1. The Rise of Strategy: The Future Spokesperson for Bitcoin

In February 2025, MicroStrategy, which had traditionally focused on software, officially rebranded as Strategy, marking the company's complete shift from the traditional IT industry to the world of Bitcoin. This move is undoubtedly a bold commitment from Michael Saylor, aimed at shaping the company into the world's first "Bitcoin treasury company." The new brand logo features orange and the Bitcoin symbol "₿," symbolizing an unwavering pursuit of cryptocurrency. Saylor stated that this renaming is the result of a "natural evolution" of the company's strategy, indicating that Bitcoin will become the core of its business.

This rebranding is not just a change of name but a profound strategic transformation. Saylor hopes to provide returns higher than Bitcoin itself by continuously increasing Bitcoin reserves, despite the significant risks and rewards associated with this strategy. In other words, Strategy aims to not only use Bitcoin as an investment tool but also to further solidify its position in the cryptocurrency field through financial and capital innovations involving Bitcoin.

2. Q4 Financial Report Revealed: The Gamble and Risks of Bitcoin Investment

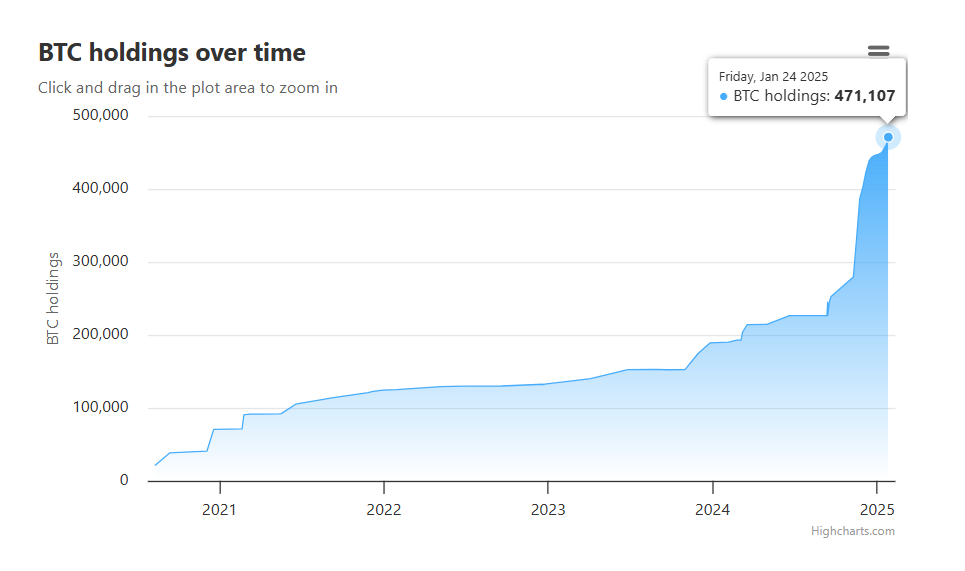

Continuous Accumulation of Bitcoin: The Company Holds Nearly 470,000 BTC — As of the end of 2024, Strategy's Bitcoin holdings have reached 471,107 BTC, valued at approximately $44 billion, accounting for 2% of the total global Bitcoin supply. In the fourth quarter, the company's actions in the Bitcoin market amounted to $20.5 billion, purchasing 218,887 BTC, marking the largest single-quarter increase to date. This investment indicates that Strategy is not only gradually "withdrawing" from traditional software business but is also fully attacking the cryptocurrency sector.

Financial Losses and Concerns: The "Bet" of Bitcoin Investment — Despite the significant returns from the Bitcoin market, Strategy's financial report is less than stellar. In the fourth quarter, the company reported a net loss of $670.8 million, primarily due to impairment losses on digital assets. Although Bitcoin itself performed well, accounting standards require Strategy to account for its assets at the lower of cost or market price, leading to a significant increase in asset impairment.

In addition to the impairment losses on Bitcoin, the company's operating expenses were also exceptionally high. The operating expenses for the fourth quarter reached $1.103 billion, a staggering 693% increase year-on-year, indicating that Strategy's expenditures have not yielded corresponding revenue returns. Although subscription service revenue in the software business saw some growth, overall revenue performance was relatively weak, with software revenue declining by 3% year-on-year. Furthermore, the decline in product support and other service revenues further exacerbated the instability of the company's performance.

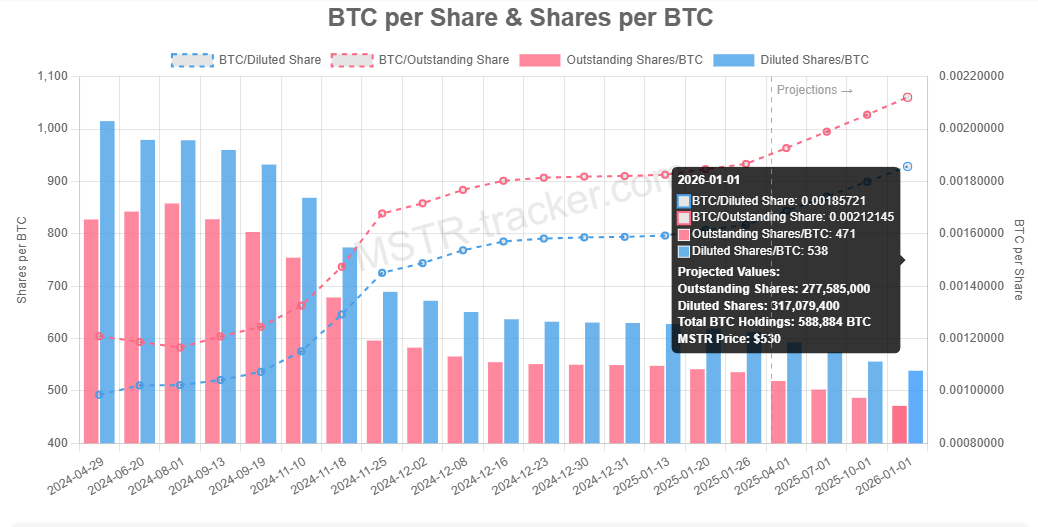

Bitcoin Investment Returns: Visible Returns, Hidden Concerns — Despite the red flags in the financial report, Bitcoin's performance remains impressive. In 2024, Strategy's Bitcoin investment return reached 74.3%, and this figure is expected to adjust to an annualized rate of over 15% in 2025. This indicates that despite ongoing short-term losses, the potential for long-term investment returns remains worthy of attention.

3. Capital Operations and Future Financing: A Double-Edged Sword in the Market

Fundraising and Capital Plans: Company Movements and Market Expectations

To continue supporting its aggressive Bitcoin investment plan, Strategy is undertaking a massive fundraising initiative. The company plans to raise $42 billion through stock issuance and convertible bonds, of which $20 billion has already been completed. This fundraising plan not only demonstrates Strategy's strong appeal in the capital market but also reminds investors that excessive reliance on financing may exacerbate the company's financial pressure.

Additionally, Strategy has issued 7.3 million perpetual preferred shares (STRK), each with a liquidation preference of $100, aimed at providing funding support for its Bitcoin investments. Whether this move can successfully attract more investors will depend on the market's long-term trust in its Bitcoin strategy.

Stock Split: Shareholder Returns and Capital Restructuring

To further enhance shareholder value, Strategy announced a stock split in January 2025, adjusting the ratio of Class A and Class B common stock to 10 to 1. This operation will allow the company to significantly increase the number of authorized shares and provide greater space for future capital operations and issuance. Although the stock price may be affected in the short term, this adjustment in capital structure undoubtedly paves the way for large-scale financing and strategic acquisitions in the future.

4. Market Outlook and Investment Strategy: Opportunities and Challenges Coexist

Market Sentiment: The Double-Edged Sword of Bitcoin Investment

Strategy's actions not only inject new vitality into the Bitcoin market but may also influence the direction of the entire cryptocurrency ecosystem. The company's continuous increase in Bitcoin reserves may encourage more enterprises to adopt Bitcoin as a reserve asset, thereby driving up market demand. However, this also brings a potential risk, as excessive reliance on Bitcoin's volatility may lead to market instability.

From an investor's perspective, Strategy's large-scale accumulation of Bitcoin may also become a significant driver of market sentiment. The sustained rise in Bitcoin prices may attract more institutions to follow suit, but if prices correct, these new investors may collectively withdraw, leading to increased market price volatility.

Investor Choices: Balancing Long and Short-Term Strategies

For long-term investors, Strategy's "treasury" strategy offers a noteworthy perspective. Considering Bitcoin's attributes as digital gold, holding Bitcoin may become an effective hedge against inflation. However, short-term market volatility cannot be ignored, and investors need to closely monitor Bitcoin prices, the company's financial health, and changes in external regulatory factors.

Short-term investors should proceed with caution, especially in light of the company's reported losses and high operating expenses, as market sentiment fluctuations may intensify. It is recommended that traders combine technical analysis and market trends to flexibly adjust their positions, avoiding being affected by short-term market fluctuations.

Disclaimer: The above content does not constitute investment advice.

If you have any questions, you can contact us through the following official channels:

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。