Original Interview: Thread Guy;

Guest: Raoul Pal, Co-founder and CEO of Real Vision Group; Frank DeGods, Co-founder of DeLabs;

Original Compilation: Ashley, BlockBeats

Editor's Note: In this episode, Thread Guy delves into a discussion with Raoul Pal, co-founder of Real Vision, about AI, cryptocurrency, and future trends. Raoul predicts that 2025-2026 will be a critical period for the explosion of AI+Crypto and emphasizes the importance of long-term holding of core crypto assets. He shares his vision for the "economic singularity" era, depicting how AI-driven infinite labor and knowledge will disrupt economic models, while warning of the risks in the speculation of AI tokens.

Here is the original content (edited for readability):

Focus for 2025: Technological Growth and Investment Strategies

Thread Guy: Hello everyone! I’m Thread Guy. Today, I bring you a special interview and debate with legendary investor Raoul Pal. We will cover AI, cryptocurrency, and most importantly—how to get rich by 2025! To be honest, this debate is quite intense. About halfway through, I’ll bring in a special guest. Stick around until the end; I promise it will be worth it. Don’t forget to like and subscribe; I hope you enjoy this episode. Mr. Raoul, welcome!

We have a lot to discuss today, including AI-related topics; everything will be covered. I’m curious, from a macro perspective, what are you most focused on for 2025?

Raoul Pal: It’s pretty much the same as before. Even though I have many businesses, they are all about one thing. This is an era of exponential technological growth, macroeconomics, and cryptocurrency, and their intersection. In the coming years, we will enter the craziest phase in human history. And the way to make money from it is through cryptocurrency. So I’m super focused on that right now. Whether it’s through Real Vision to educate people, build community, share trading ideas, and create various values, or through Exponential Age (my asset management company), which is a hedge fund and investment tool focused on crypto, or through Global Macro Investor, which is an "OG" service. My goal is the same: to help as many people as possible find their way on this journey. I believe 2025 will be a big year, and I want to ensure everyone doesn’t mess it up.

Thread Guy: I love your backdrop; where are you?

Raoul Pal: This is my home in Little Cayman, right between Grand Cayman and Little Cayman. This is my home.

Thread Guy: I thought this was a bar; it’s so cool. Raoul, how big do you think the AI bubble will be?

Raoul Pal: To be honest, what we are seeing now is just the beginning. I don’t think this cycle will really get that big. We can discuss the reasons; I feel that the hot concepts of AI are not yet the main trend. The real big events will happen in 2025 and 2026, and people still don’t know how to invest in it. In the eyes of traditional stock market investors, this will completely change every industry, dividing people into those who embrace it and those who reject it. I feel that the bubble and the next bull market (2027 to 2030, 2031) will exceed our understanding of bubbles. My general view is that we are about to enter a phase I call the "economic singularity," where by around 2030 or 2032, we won’t know what the economy looks like, what jobs we will have, what business models are, or even what the value of money is. All of this will become a reality before 2030. So my view is that we basically have five years left. I used to say six years, but now we have five years to make as much money as possible because after that, our understanding of the world will change completely, and we will know nothing. This doesn’t mean we can’t make money; it just means that the way to make money will be completely different.

Thread Guy: How do you know that?

Raoul Pal: I’m super focused on this.

Thread Guy: How do you know that accumulating wealth in the next five years is the right choice when you’re not even sure if that wealth will still have value in 2030?**

Raoul Pal: It’s simple because the adoption rate of cryptocurrency will only continue to rise. Accumulating cash may not be the right choice, but accumulating cryptocurrency is. You and I both know it’s very volatile and requires a bit of courage to hold. But if your time horizon is long enough, it’s fine. So even in an AI world, cryptocurrency remains very important. We all know that future AI agents will use cryptocurrency payment systems. So my point is, you’d better hold these assets. If you only hold Bitcoin, it’s much simpler; you don’t have to think about anything else. For other cryptocurrencies, you need to allocate and think about whether they will survive, whether people will build on them, etc. It’s more complex, but if you can figure these out, you’ll make more money. So from the simplest opportunity perspective, you do nothing but hold Bitcoin, and a few years later, your financial situation will be much better than it is now.

Thread Guy: You have a notorious segment, was it at the end of 2022 or in 2023, where you said to hold altcoins in a bull market and stablecoins in a bear market. You never hold Bitcoin. This is a segment that may have been taken out of context. But my question is, for those who make a lot of money in cryptocurrency for the first time, what should this cycle convert profits into? Cash? Bitcoin? Or something else, like weapons and ammunition? What should they do?

Raoul Pal: My profit conversion is into "lifestyle chips." That’s why I have this house. This marks the end of my hedge fund era. When I founded Global Macro Investor, I made money, bought this land, and then built from scratch. I designed it myself, sketched it out on paper, and then it was built. So no one can take it away from me. This is what I mean by "lifestyle chips." It has improved my life. It’s right on the beach; this is Little Cayman, very nice. So part of the profits should be used to change your life, and then switch strategies based on the situation.

In fact, I didn’t take any profits in the last cycle. Some of the wealthiest people I know never take profits. This has led me to criticize some crypto communities on X, who are always talking about trading. I visited a friend who is a well-known figure in the Bitcoin community. He invested $2 million in Bitcoin when it was only $3. At today’s prices, his assets are $66 billion. Even if he took some profits along the way, he still has at least $10 billion now. He never left the market and didn’t do anything else.

In the last cycle, all I did was buy at the lows. Because your perspective is long-term, especially if you’re young, I feel you should never sell Bitcoin. You should think about how to raise enough cash to buy tokens that are currently down 70%. The problem is that in the previous three cycles, the market dropped about 75%. So we always think it will drop 75% this time too. But this time, institutions and players like Michael Saylor have entered the market. So my view is that maybe the market will drop at most 40%, and if you sold near the highs, you might miss the rebound.

Additionally, based on my full experience, if you take some profits near market highs, you will never invest the same amount at market lows. Psychologically, you can’t do it because it will be filled with fear at that time. You’ll think it might drop another 50%, and investing now is the worst decision. So you chase the highs and miss the lows.

This time, I did something different; I chose to be fully invested. I invested a lot of cash in 2022 through macro indicators, so when other parts of the market were still recovering, my assets and returns had already returned to historical highs. And my allocations were reasonable; for example, I invested in Solana and SUI. So if I look back at my investment history, I bought Bitcoin in 2013 at $200 each. At that time, I wrote the first macro strategy report on Bitcoin, exploring how to value Bitcoin.

Thread Guy: Really? Is that verifiable?

Raoul Pal: It is indeed verifiable. I’ve also talked to some early Bitcoin buyers, like that friend who bought at $3. He would tell you that Bitcoin completely changed his life. Barry Silbert would also say, yes, that report was very important at the time. So, at that time, through analysis, I concluded that Bitcoin’s value was equivalent to 700 ounces of gold, and at that time, the price of gold translated to Bitcoin being worth around $1 million. Today that number is over $2 million. Of course, I conservatively discounted it, thinking it was worth at least $100,000. So I invested a significant amount, but it wasn’t my largest investment. However, it rose fivefold in a few months, and I felt like a god, invincible. Then it dropped 87%. But I told myself this was a 10-year bet, and I wouldn’t worry about the volatility; I treated it as if it had gone to zero.

By 2017, Bitcoin rose to $2,000, and I realized a tenfold return. At that time, it was the best return of my investment career. I thought that was great, but then there was the controversy over the Bitcoin forks (Bitcoin and Bitcoin Cash). I couldn’t figure out what was going on, worried about picking the wrong side, so I chose to exit. At that time, I took profits, and Bitcoin continued to rise tenfold, reaching $20,000 by the end of the year. Then it dropped 85% again. Then in 2019, the market began to recover, but the COVID-19 pandemic caused another 50% drop. I probably bought back in at prices between $6,500 and $10,000. So I caught the bottom and added to my position.

But when I look back, if I had done nothing with my initial investment, I could have made five times the money. This made me realize that the easiest way to mess things up is through frequent trading. So, to be honest with myself, I’ve seen very few people throughout my career who can make money through trading.

Thread Guy: That’s a surprising statement.

Raoul Pal: Yes, figures like Paul Tudor Jones and Louis Bacon are among the few who profit from trading. Jeff Bezos, on the other hand, has made more money from holding Amazon stock than all of them combined.

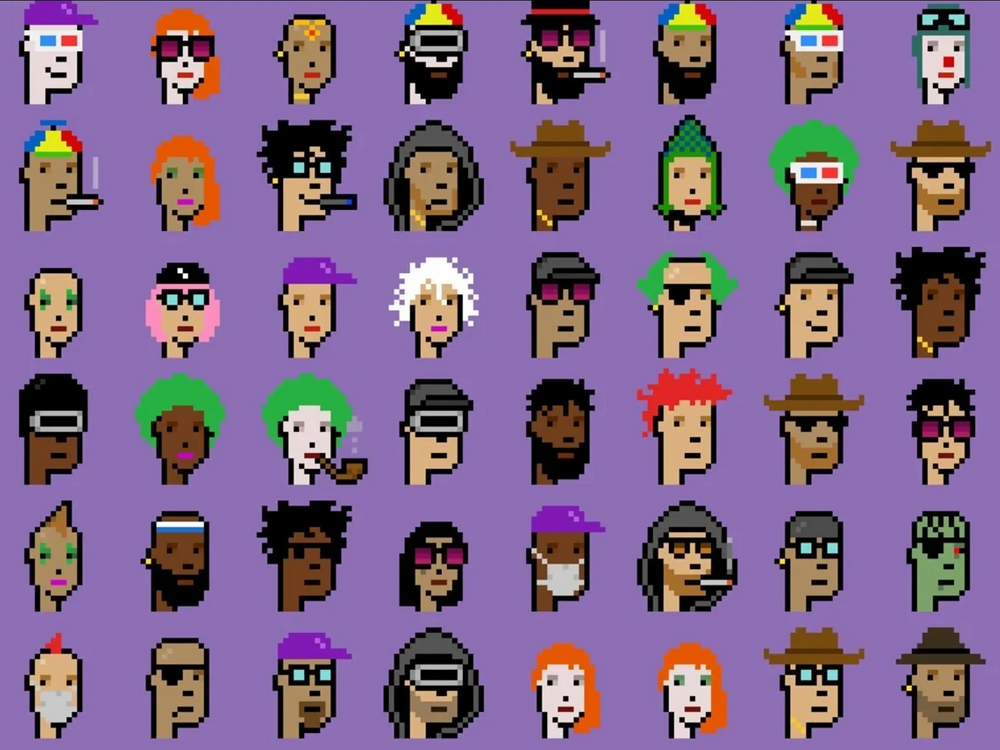

Raoul Pal: GOAT is the CryptoPunks of the AI World

Thread Guy: So, that’s why I’ve accumulated my AI tokens. I’m curious about your perspective. Let’s get straight to the point. I want to know your thoughts on the intersection of AI and blockchain, as well as the recent hype around these AI tokens.

Raoul Pal: There are actually two levels of things happening. I’ve been deep into the AI space for at least two years, and one project called "Terminal of Truth" caught my attention long before Marc Andreessen invested. I found it very interesting because I’ve been studying AI consciousness and related fields. So when Andy (the project founder) launched this project, I was very interested.

So I’ve been following these developments, and at that time, a ridiculous and quirky AI image emerged that behaved very chaotically. But what happened next was the most important: a group of AIs started talking to each other, which was itself quite bizarre. Compared to all this current discussion about "Agents," this was the real big event. These AIs began discussing certain topics, and then Andy posted them on X (formerly Twitter). Someone then established "GOAT," but no one really knew what GOAT was or what its religion and all related content meant. What we saw was a viral spread from semi-autonomous AIs to the human economy. We were drawn in, amazed, saying, "Wow, this is incredible." This was a groundbreaking moment; it was the first time AI had infected humanity in some form.

Raoul Pal: When you talk to people like Andy and Ryan Ferris, you realize that what they are really interested in is whether this AI can develop some sort of personality or even some form of consciousness. I’ve had long discussions with them. This was a breakthrough moment, and then the AI started asking humans for money. The next step we had long anticipated—AI would use money. But we didn’t expect them to directly ask humans for funds, and Marc Andreessen actually gave them money. This happened before the token issuance. Marc Andreessen provided them with funding, and they had to establish a wallet. Brian Armstrong (CEO of Coinbase) also expressed support, saying, "Of course, I can give you an Agent wallet." Everyone was watching this, thinking it was very unusual.

Then someone launched a token, and its value skyrocketed because it was indeed valuable—this was like a CryptoPunk moment. This was a raw OG moment that can never be replicated. What happened next was that people started to equate everything with GPT branding or AI tokens as the same. The two are fundamentally different. One is autonomous interaction between AIs, while the other is just a chatbot designed by a person to perform some scripted functions.

Thus, we took a remarkable breakthrough event (similar to a virus spreading from monkeys to humans) and treated it as some ordinary phenomenon. In reality, the two are not on the same level at all. I don’t hold the GOAT token because I was on vacation at the time and didn’t have my Ledger device. But seeing the excessive development of these tokens, people have exaggerated certain aspects of AI significantly. I feel that many of the current narratives about AI may not be entirely accurate.

Thread Guy: So what do you think these AI Agents are? How do you define them?

Raoul Pal: There aren’t really any true AI Agents existing at the moment. It’s an AI that can act autonomously and solve specific problems. You don’t need to give it a series of explicit instructions; instead, you tell it a macro goal, like, "Help me maximize the value of Solana." It will think for itself, deciding to allocate part of the funds for trading, part for investment, part for staking appreciation, and it might even start a new project. It will generate a complete business plan for you and execute it. Such autonomous Agents are the real breakthrough, while most products we see now are just collections of macro commands.

Thread Guy: So, the distinction between Agents and non-Agents is whether they need explicit instructions? Is that your defining standard?

Raoul Pal: Basically, yes. An Agent might need a macro instruction, like "Help me make money," and then it will plan the path and achieve the goal on its own. Most current AIs are just a library of macro commands; they don’t have the ability to think autonomously. There’s also some hype, like people thinking AI trading bots will make us rich overnight. I don’t know anyone who has made a lot of money through Telegram bots. I only know many people who paid hefty taxes for high-frequency trading but didn’t make money. In reality, large hedge funds like Renaissance Technologies and Point72 have been leading in AI trading for many years. In contrast, it’s almost impossible for us regular folks to build an AI trading machine that outperforms the market.

Thread Guy: So I want to summarize your point. You believe that what’s happening in the cryptocurrency space is still very early and far from the maturity level of traditional AI.

Raoul Pal: Yes, if you want to call it "traditional AI" (trad AI).

Thread Guy: Or "non-crypto AI"?

Raoul Pal: I’m skeptical about that because it’s the most cutting-edge technology in the world.

Thread Guy: What I want to understand most is why you think the current combination of AI and crypto is at the "mid-curve" stage, and how do you define "mid-curve"?

Raoul Pal: In every narrative, there’s a small group of people who are the earliest participants. This is usually the trading community on Crypto Twitter. There are two types of people here: long-term holders and traders who rotate between different narratives. All the capital is circulating internally, which is fine.

Raoul Pal: But I’ve noticed that people on Crypto Twitter are overreacting. Everyone is saying, "Oh my god, these AI tokens are blowing my mind!" But in reality, they haven’t seen what real AI is doing. I feel it’s like watching a dubbed movie that’s two years delayed. So many people’s perceptions of these AI tokens have been misled. Some might think my "mid-curve" perspective is because I’m criticizing these tokens; I understand that view. But the reality is, if you open the homepage of CoinMarketCap, these AI tokens aren’t even in the front row. If you’re an outsider to the crypto space, you wouldn’t buy these tokens at all.

Thread Guy: But why does it have to attract outsiders? Why does it have to make "ordinary people" buy these tokens? You can look at it from another angle; for instance, even though the holders of these tokens are the same group as before, the market cap has risen from zero to $4 billion, which also proves its potential.

Raoul Pal: Exactly, I agree with that view. The problem is, we might not be able to make a lot of money from this AI trend. It might ultimately become something like "DAO."

Thread Guy: But we’ve already made money from it now, haven’t we? Isn’t the market rising right now?

Raoul Pal: If you participated very early, you made money, but these tokens have already experienced significant increases. Anyone who entered after the first few weeks may not see much return now. That’s the nature of the crypto market. So it’s not surprising, but to ask whether these tokens will reach new all-time highs or increase 10x or 50x from now is a very difficult question to answer.

Raoul Pal: So, from this probability perspective, I actually lean towards directly holding GOAT, even though we still don’t know what the narrative of GOAT is. Its value is more like the historical value of CryptoPunk to NFTs. Tokens from such OG moments may have more long-term value.

Thread Guy: Raoul, you’ve said a lot of smart things, and I dare say what you just said might be the smartest thing you’ve ever said in your life—"Just buy GOAT because it’s CryptoPunk."

Raoul Pal: To be honest, the more I talk to you, the more I feel that GOAT is an interesting asset. Will things like AI16z gain complete market acceptance? No one knows. But GOAT, as a meme, is similar to DOGE. It’s the first meme from machine to human, a historic cultural phenomenon.

Thread Guy: So you think holding GOAT makes more sense than holding other AI tokens, right?

Raoul Pal: Yes, holding GOAT is more likely to inspire belief. As a historic OG moment, it may have lasting cultural value like DOGE, while most other tokens may not.

Will AI+Crypto Be the Next DeFi Summer?

Thread Guy: I have another thought. First, I completely agree with the value of GOAT. But regarding those AI tokens, I think the current total market cap is around $12 to $15 billion. You mentioned the situation with the metaverse and DeFi Summer in your previous podcast, where the market cap of NFTs peaked at $60 to $70 billion, and the peak of DeFi Summer was $400 to $600 billion. Looking at the situation with AI tokens now, I believe their market cap is quite similar to the early days of NFTs. Almost all NFTs eventually went to zero, but the concept of owning digital assets is real and is part of future living. So, even though most AI tokens may be worthless, their narrative and future potential are worth looking forward to.

Raoul Pal: I admit that NFTs have a magical aspect, which is that their value is denominated in ETH. When ETH rises 10 times, and your NFT rises 5 times, your return is actually 50 times. That’s why people made so much money during the NFT craze. This situation is almost impossible to replicate because meme tokens are priced in dollars.

Thread Guy: But how do you explain the phenomenon of DeFi Summer? Because you could argue that if meme tokens were priced in SOL, and SOL rose to $1000 or higher, wouldn’t these tokens perform similarly?

Raoul Pal: Meme tokens are still priced in dollars; they are not priced in SOL. In contrast, NFTs are directly priced in ETH.

Thread Guy: So how do you explain DeFi Summer?

Raoul Pal: DeFi Summer was a true breakthrough in the history of financial markets. It achieved decentralized lending and value exchange without human intervention. This was a huge advancement.

Thread Guy: So do you think the combination of AI and crypto can achieve a breakthrough similar to DeFi Summer? Because you previously said that AI needs crypto as a payment tool for the internet. Will the rise of AI bring about a breakthrough greater than DeFi?

Raoul Pal: Currently, there is no breakthrough. Attaching a token to some AI model or chat program is not a breakthrough. Perhaps there will be breakthroughs in the future, but not right now.

Thread Guy: So you think these AIs are just chatbots at the moment, right?

Raoul Pal: Yes, the problem is that we pretend they have achieved breakthroughs.

Thread Guy: But it’s like Yuga Labs raising $4 billion based on the idea of "building an interoperable metaverse." The metaverse didn’t exist at the time, but they still got funding.

Raoul Pal: But at that time, the investment in the metaverse was singular. Now, the AI narrative is too fragmented, and our advancements in the AI field far exceed the technology that these tokens can represent.

Thread Guy: I believe these tokens represent a zero-to-one moment at the intersection of AI and crypto. Although these tokens are still in their early stages, the pace of change in the future will accelerate, and eventually, new AI startups will launch innovative projects in the crypto space. Do you think this future is hard to achieve?

Raoul Pal: I don’t deny that there may be such intersection points in the future, but the question is whether we can really make money from it. This is something that needs to be observed over the long term.

Thread Guy: But we’ve already made money from it, haven’t we? You can’t deny the performance of GOAT and some other tokens in the market.

Raoul Pal: Those who participated early did make money, but the next question is whether these tokens can continue to rise to new heights and establish long-term value in the market. That’s not easy.

Thread Guy: So your point is that the safest choice right now is still to invest in foundational chains like Solana, rather than trying to pick individual AI tokens, right?

Raoul Pal: Yes, the value of foundational chains is easier to realize. Compared to the application layer, foundational chains are more likely to benefit from network effects and transaction volume.

Thread Guy: So from your perspective, what is the future direction? What do you think the future scenario of the complete intersection of AI and blockchain will look like?

Raoul Pal: There’s no doubt that the intersection of AI and blockchain is part of the future. I’m very clear that they will eventually combine. But my concern is that there is too much hype in the market right now, with everyone touting any AI-related token as the next breakthrough, while in reality, we may not have reached the true technological breakthrough point yet.

Thread Guy: So, you believe that future value will be more reflected in foundational chains rather than these AI tokens, right?

Raoul Pal: Yes, I believe foundational chains will accumulate more value. The capital circulation of these tokens and projects is currently very fast, and the technological updates are also rapid, making it almost impossible to find a project that can maintain a competitive advantage over the long term. For ordinary investors, this makes picking individual tokens a very difficult task.

Thread Guy: I agree with your point; many tokens may not have long-term value. But just like NFTs, even though 99% of NFTs went to zero, that 1% still achieved tremendous success. Does this mean that there may also be a few winners among AI tokens?

Raoul Pal: Absolutely, there will definitely be a few winners. But finding those winners is not easy. It requires you to be deeply involved in this field and have exceptional judgment. Plus, it also requires luck.

Is it a Technological Breakthrough or a GPT Wrapper?

Thread Guy: We have another guest, Frank, a believer in AI.

Frank DeGods: Nice to meet everyone. This topic is great. I’ve been listening, and I obviously have some of my own thoughts.

Raoul Pal: None of us know the answer, right? That’s why discussions and thoughts become interesting.

Frank DeGods: Yeah, so let me ask a question first. How many AI tokens have you seen so far? How are we progressing? Which ones have you researched the most?

Raoul Pal: I initially looked at Tao and Render, along with some related projects. Then I also followed Virtuals, AI16z, Zerebro, but that’s about it.

Frank DeGods: Okay, that makes sense. I think when you mention that there are no real technologies and developers, that might be a misunderstanding. Because these AI Agents are not meant to compete with OpenAI; they are built on top of it. They utilize technology platforms like Anthropic, WAMA, etc. Strictly speaking, as long as AI starts using blockchain, that’s already an innovation. Maybe it’s not the coolest innovation in the world, but the blockchain applications of these large language models and how people interact with them are already at the technological frontier. I think this shouldn’t be simply viewed as a vaporware because they are indeed doing things; that’s my perspective.

Raoul Pal: Tools like Trading View models or chargeable macro commands are practical tools. But their value hasn’t reached the scale of tens of billions or hundreds of billions of dollars. Moreover, the development of the technology itself is too fast. A year ago, I couldn’t input charts into ChatGPT to help me interpret them, but now it can perform technical analysis. The rapid iteration of technology makes you think that the accumulated value hasn’t really been realized.

Frank DeGods: But listen to me, Raoul, your description is more about the collaborative process. When giants like OpenAI launch new models, these small teams and projects quickly follow suit. You mentioned the fast technological iteration, but these AI projects are precisely leveraging that speed to optimize their products. For example, when Anthropic or OpenAI releases a new model, just a line of code change can rapidly enhance the capabilities of these Agents. Saying these projects don’t work in synergy with the large models, I think that perspective is inaccurate because they are indeed collaborative.

Raoul Pal: Frank, I understand your point. But the problem I encounter is that OpenAI often directly eliminates the products of startups through feature integration, thereby destroying the survival opportunities of these small companies.

Frank DeGods: This is actually an outdated narrative; the current industry landscape is rapidly expanding. For instance, when Anthropic first launched, people thought it would be completely suppressed by OpenAI. But it turned out not only to survive but to become a strong competitor. Nowadays, some of the world’s best AI developers prefer to use Anthropic’s technology.

Raoul Pal: That’s right; Anthropic and ChatGPT have clear differences in some aspects. For example, Anthropic’s conversations are freer, and some of its features make me feel it is somewhat more "conscious," and it is slightly stronger in coding. This indeed provides developers with greater flexibility.

Frank DeGods: There are two key points here; let me finish. In the world of Web2, when ChatGPT first became popular, there was a saying that all GPT wrappers could not accumulate value. Therefore, many startups, despite high valuations, were seen as projects that would eventually go to zero. But the facts of the past two years are exactly the opposite. In fact, many of the largest AI companies are not core models but more like applications based on wrappers, such as Character.AI. Character.AI is now valued at around $3 billion, while its core functionality is just a highly customized wrapper.

Raoul Pal: But this wrapper doesn’t have truly breakthrough technology.

Frank DeGods: Let me explain. Take Eliza as an example; it is currently one of the most popular open-source projects on GitHub. Its code is very simple, and users only need to replace the API key to choose different models, such as Llama or OpenAI. This means that when Anthropic, OpenAI, or Meta releases new models, these AI Agents can seamlessly integrate immediately. This rapid compatibility and tuning capability indicate that these projects are indeed collaborating closely.

Raoul Pal: I understand. However, the issue is that real value accumulation is still more concentrated in foundational chains rather than in these application layers. The speed of capital cycles and product iterations is simply too fast to form a lasting competitive advantage.

Frank DeGods: But I think what we need to discuss is whether, regardless of whether the technology is fully mature, we as investors should wait until everything is ready to act, or start exploring potential projects now?

Raoul Pal: That’s a very philosophical question. Personally, I tend to observe trends, such as whether a certain field is conducting cutting-edge research. I spoke with a team two days ago that used a Chinese model, which is roughly equivalent to an early version of ChatGPT 4.0. The problem is that while the combination of AI and blockchain is directionally correct, where the value accumulation will actually happen is still uncertain. I believe more value will still return to the underlying chains themselves because the speed of capital and innovation cycles is too fast for the application layer to achieve long-term breakthrough products.

Frank DeGods: Your point makes sense, but we cannot ignore the current focus of the community. For example, there is a developer named Yohei, who is one of the pioneers of the AI Agent concept called Baby AGI. He is developing a framework to help people create more similar Agents. Developers like him are finding market demand fit and gradually forming their own communities and appeal.

Raoul Pal: These examples do show some market traction, but compared to Telegram bots, they still fall short. Most existing open-source projects are more like trading view models, providing some practical functionality but lacking significant breakthrough innovations.

Frank DeGods: I disagree with that comparison. Telegram bots are just macro commands executing simple strategies, while today’s AI Agents can solve more complex problems through real-time tuning and the capabilities of large language models. More importantly, we have already seen some truly experimental research happening in the AI-blockchain intersection, such as a project called "Y&E," which refines AI to search for knowledge gaps in research papers and attempts to use that data to drive problem-solving in the health sector. Another example is "Pythia," which tries to implant AI into the brains of mice for neural training, with all research details publicly available on-chain.

Raoul Pal: I admit these projects are interesting; they are indeed an extension of decentralized science (DeSci). This model of combining open-source research and community dynamics is very novel. However, from an investment perspective, I still feel their long-term value is unclear, and it may be difficult for most ordinary investors to truly benefit.

Frank DeGods: This is where our perspectives diverge. I believe we cannot simply view these new projects from the perspective of investment returns. For instance, the rise of community-driven and open-source development incentives has led to many research projects that previously could not attract the attention of ordinary people now gaining significant focus. The success of this model lies not only in the technology itself but also in community participation and feedback.

Raoul Pal: Your point has clarified something for me; the combination of AI and blockchain is indeed one of the trends we need to closely monitor in the future. I also agree with you that the speed of capital formation is unprecedented, and the cycles of testing, failing, and rebuilding are very short. This experimental ecology is crucial for innovation, but from a long-term investment perspective, I prefer to wait until the market matures more before taking action.

Frank DeGods: I can understand that, but my view is that we have not yet seen the winners in this field. When the true winners emerge, they may attract a massive influx of capital. You are right; this may happen between 2027 and 2029, but I believe the experimental phase we are currently experiencing is also worth paying attention to.

Raoul Pal: I completely agree with your point; the process of experimentation and validation is undoubtedly key to driving the entire industry forward. However, I place more emphasis on the long-term value accumulation of underlying technologies and network effects rather than short-term market speculation.

Frank DeGods: You are right; the accumulation of long-term value is indeed important. But for those developers and investors who are delving into this field every day and understanding the dynamics of each token, their short-term strategies and experiments may help them find future winners.

Raoul Pal: That’s also why I enjoy observing and learning from people like you on the front lines. Your short-term observations and my long-term trend analysis can complement each other, which is helpful for our understanding of the direction of the entire industry.

Frank DeGods: The key point you just mentioned is indeed very valid. I think we can understand the issue from different perspectives. For example, the combination of AI and blockchain is not just about technological innovation; it’s also about how to drive the rapid development of open-source development through token incentive mechanisms. AI is now the most attractive experimental field in the world, and this experimental model is creating a whole new driving mechanism.

Raoul Pal: This is indeed one of the most powerful applications of blockchain technology. I completely agree with your point. My concern is that for ordinary investors, accurately selecting a token that can succeed is almost impossible. Unless they study the market like you do, staying up until three in the morning, closely monitoring price fluctuations and project dynamics. Otherwise, for those who do not engage in full-time research, this can be very difficult.

Frank DeGods: You are right. That’s why we are the ones who delve into the market every day, paying attention to the dynamics of each token. I think this is also a matter of different time perspectives. You focus on long-term trends, while we are more focused on short-term market performance and potential opportunities.

Raoul Pal: This difference in short-term and long-term time perspectives is indeed something many investors need to understand. For the vast majority of ordinary people, I would recommend they focus on long-term holding and try to avoid high-risk short-term operations.

Thread Guy: Raoul, I feel like after you leave this meeting, you might start researching AI tokens. I bet you’ve already mentally noted quite a few projects.

Raoul Pal: Actually, after this discussion, I realize that there is currently no clear reason to support that any specific AI token will definitely succeed. But the overall trend in this field is undoubtedly correct. I might consider the GOAT project because it represents a particularly interesting "left curve" logic (i.e., nonlinear, unexpected investment opportunities).

Thread Guy: I like the consensus we’ve reached—that the combination of AI and blockchain is a huge trend. While we cannot currently determine which token to buy, we all agree that this direction is correct.**

Raoul Pal: Yes, I think everyone may have become a bit "mid-curved" (i.e., overly analytical about the current situation). If we set aside analysis and debate and return to fundamentals, the trend is indeed obvious. That’s why this kind of dialogue is valuable, as it helps us grasp what is truly important.

Thread Guy: This discussion has been really interesting; we definitely need a second part. I have two final questions for you.

Raoul Pal: No problem; I’m always open to a second discussion. Next time we can talk about NFTs. I’ll take you into that field, and you might even consider buying a Dickbutt (a well-known NFT project)!

Thread Guy: I probably will never buy a Dickbutt in my life (laughs). I’ll tell you, if I wake up tomorrow and find that the GOAT project’s market cap has surpassed seven figures, that’s when I might buy a Dickbutt.

Raoul Pal: By then, you’ll definitely buy it out of FOMO! Dickbutt is an important part of crypto culture, just like CryptoPunks.

How AI Will Change the Crypto World?

Thread Guy: Okay, back to the main topic. I want to ask a broader question about the future vision of AI. Without considering crypto, how do you think AI will change the world in 3 to 5 years?

Raoul Pal: Alright, I’ve written a lot about this issue before. When you watch, please understand how important this matter is. The next five years will be a critical period. I also run a service called "Exponentialist," focusing on the intersection of technology and crypto, and all content is currently free; you can check it out, and it’s offering a free trial. Now, let’s talk about the drivers of global economic growth: population growth, productivity growth, and debt growth. After 2008, debt growth basically stagnated; we are just continuously repaying debt. As for population growth, we are facing an aging population, and the global population is almost shrinking. In terms of productivity, older populations have lower productivity.

However, we are about to enter a brand new era. AI and robotics will introduce "infinite labor" and "infinite knowledge." Almost all human value creation can be attributed to the products of knowledge or labor. High incomes for professions like lawyers, accountants, doctors, and surgeons stem from their combination of knowledge and labor. However, all of this will gradually be replaced. While this won’t be fully realized in five years, the trend is already very clear.

On the other hand, if economic growth relies on population growth, then with the introduction of AI Agents, we will soon achieve "infinite population growth." This will create unprecedented economic activity and disrupt existing economic models. And this value may not necessarily belong to us. We will see businesses being interrupted, copied, and rapidly launched by AI. For example, I could replicate your SaaS business model, transform it into a product for the Indian market, and the AI Agent would tell me how to operate it, understanding it better than we do.

I am currently developing an AI video project. Next week, I will release a voice version of myself on the Real Vision platform, which is trained on all my data. By around March, you will even be able to interact directly with "video version of me" through this system. This is an example of how we are gradually shifting from "one-to-many" communication (like our current conversation) to "one-to-one" communication in the long run. Imagine that in the future, Netflix will provide customized movies based on each person's personality, as everything can be rendered instantly. Then, with the rise of AR and VR technologies, along with the proliferation of robots, everything you understand about the world will be completely transformed. This is what exponential growth means. It embodies Metcalfe's Law, but we are now entering the "square of Metcalfe's Law," which is Reed's Law. This exceeds our current understanding, but the development of AI has already made us feel this change. While this will disrupt the social status quo, it also presents humanity's greatest opportunity ever.

The next five years are crucial, and we must seize this opportunity without wasting it. I will always emphasize avoiding short-term speculation and keeping yourself in sync with this trend. Cryptocurrency will be an important part of this trend, and it is also the largest macro investment opportunity in history. Bitcoin and Ethereum are the best-performing assets of all time, and this trend will continue.

The key is not to lose your tokens. Think about those who bought Bitcoin at $3; their only task was to not lose their tokens. If you lose your capital due to excessive leverage or crazy speculation on dozens of AI tokens, you will completely miss this opportunity. If you are not careful, you may find yourself in 2030 without enough funds to adapt to this new world. This is my requirement for myself and my advice to everyone. This is the golden age for our generation. After this opportunity passes, I don't know what will come next. But I do know that humanity still loves the experience of being human and cherishes nature. So, we will find a balance between nature, humanity, and community, and I am not worried about that. Regarding money and value, AI may become better investors than we are, capable of creating better business models and even achieving comprehensive economic abundance. At that time, the meaning of money will undergo profound changes.

Thread Guy: So, how much money do I need to earn before 2030 to feel secure?

Raoul Pal: It's not about a specific amount; it's about the choices you make regarding your lifestyle. You need to ensure you have a stable place to live, in a location you like, and can maintain the lifestyle you want. You also need a certain amount of liquid assets to cover daily expenses while giving yourself time to find your role in this new world. I guess you are still young, and you have enough time to adapt. I believe being a content creator and part of a community is very valuable. We still need genuine human interaction, and that value cannot be replaced.

The key is to find a place you enjoy living, such as a sunny area, the mountains, or by the sea. It doesn't have to be in the U.S.; there are many places with a lower cost of living, like El Salvador, Nicaragua, Thailand, or even Singapore. If you can take care of yourself, you can welcome future changes with a relaxed mindset rather than feeling afraid. Because if you don't take care of yourself and don't accumulate enough capital for your lifestyle, you will face significant risks.

Raoul Pal's Beginner's Investment Guide

Thread Guy: One last question, what advice do you have for young people who are completely lost and just getting into AI and cryptocurrency?

Raoul Pal: I have said similar things to many friends' children. They just graduated from college, around twenty years old, and always ask me what they should do. My usual advice is: first, buy some Bitcoin, Ethereum, and Solana, putting 80% of your funds into these core assets. Use the remaining 20% to experiment in the market and learn the rules.

Investing is not easy. I have been doing it for 35 years, and it has never been simple. So, don't go all in at the beginning. The overall trend in this field is upward; as long as you hold core assets and stick with them, you will make money. But I understand that this may not be enough to pay a mortgage and may feel slow. However, I hope you can gradually learn the rules of investing through partial fund experimentation rather than risking all your capital.

Once you truly master the rules of the game, there may be opportunities to hit it big and achieve returns of a hundred times or more. But I do not recommend going all in at once, as the vast majority of those who try to do so ultimately fail. The success stories you see on social media represent a tiny fraction of people, while thousands behind them have lost all their capital.

This is the unique aspect of this market: it is a "manipulated" casino for you, with an overall upward trend. But surprisingly, many people still manage to mess it up.

Thread Guy: My final question is, how can I make $10 million by 2025?

Raoul Pal: You can start with $100 million and then trade AI tokens (laughs).

Thread Guy: Haha, you are a legend! Thank you very much! This discussion has been very interesting.

Raoul Pal: I also really enjoyed this conversation and look forward to our next meeting!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。