Author: @dittochu_

Compiled by: @GodotSancho

If you notice that $griffain continues to decline and want to know when it will stabilize, you can analyze the "Wintermute Model."

Wintermute is a crypto asset market maker, and one of their important businesses is helping small projects (Alts) get listed on major platforms (like Binance).

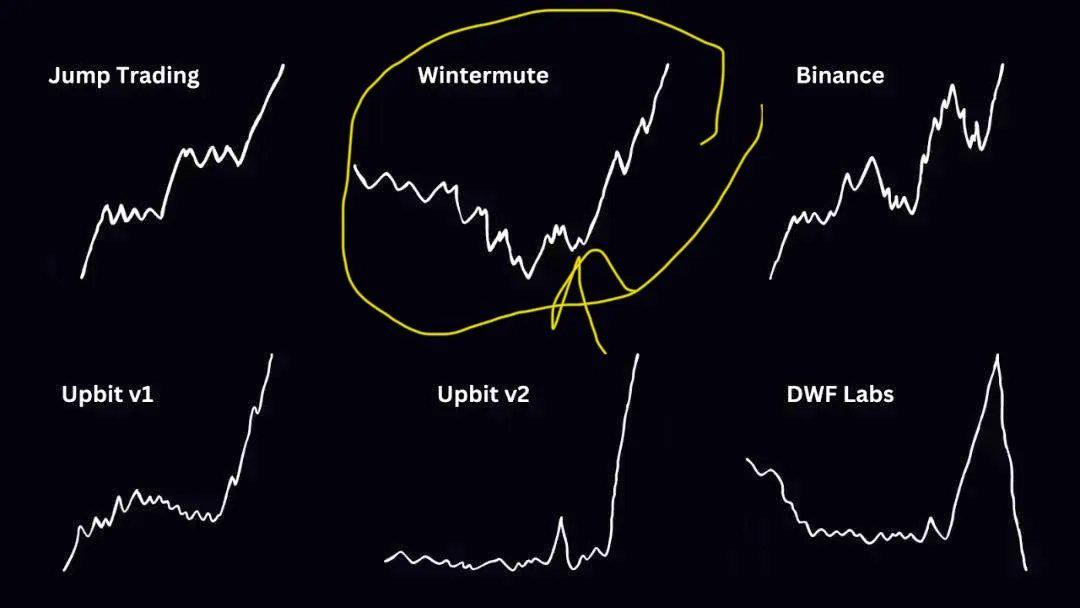

Some investors have found that when Wintermute participates in market making for a project, the token price often exhibits a specific trend known as the "Wintermute Model."

Why do projects that Wintermute market make usually drop first before rising? To answer this question, we need to understand their trading strategy.

Wintermute employs a Delta Neutral strategy (which refers to eliminating token volatility risk through hedging), avoiding directional trading.

During the market-making process, they often reach agreements with existing token holders to borrow tokens from project parties or whales while simultaneously buying call options to profit when the price rises.

Taking $griffain as an example, suppose they borrow 40 million tokens, which is equivalent to 4% of the total token supply. They would then sell a portion of $griffain, exchanging it for SOL or stablecoins to provide liquidity. Essentially, this is a short-selling operation, profiting by borrowing tokens and selling them.

The token sale causes the price to drop. Wintermute will repurchase $griffain at a lower price because they need to return the borrowed tokens, effectively closing their short position. At the same time, they avoid triggering significant price fluctuations during the repurchase transaction. Thus, they make money during the price decline.

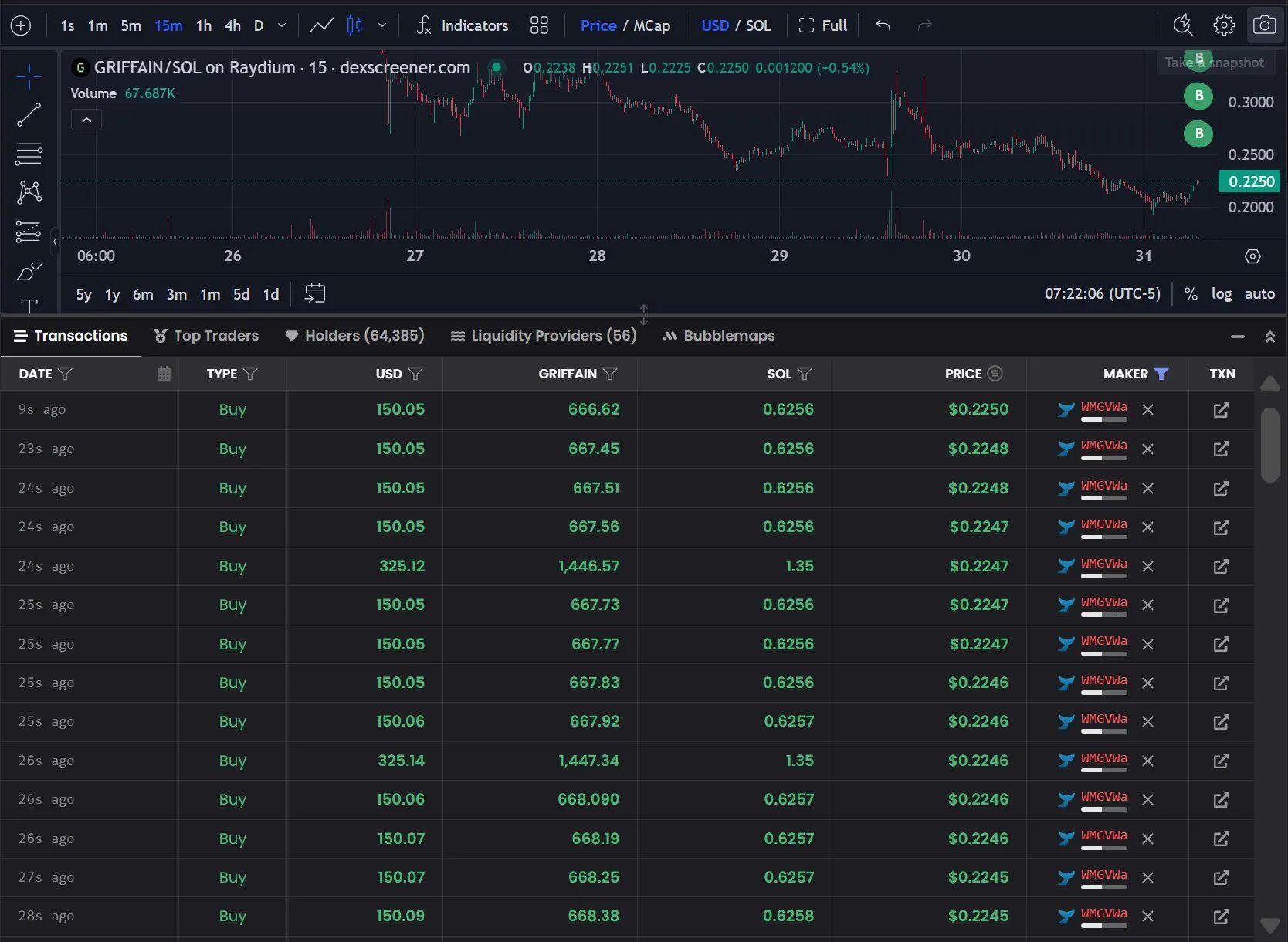

After the price drops, over the past few days, they have been repurchasing $griffain in small amounts of $150, executing dozens of orders per minute.

Eventually, Wintermute repurchases all the $griffain they previously borrowed. Once the repurchase is complete, the price will rebound. They profit from shorting, and this portion of the earnings may also be used to pay for exchange listing fees. At this stage, the trading volume of $griffain will also significantly increase, which helps persuade exchanges to list it.

When $griffain gets listed on major platforms like Binance, the price will skyrocket. Returning to the previously mentioned call options, the strike prices of these options are usually 25% to 50% higher than the market borrowing price. However, recently, due to market maker operations, the strike prices have been pushed up to 60% to 70% above the borrowing price.

Now let's take a look at on-chain data. First, we need to try to determine which stage Wintermute is in within the so-called "Wintermute Model."

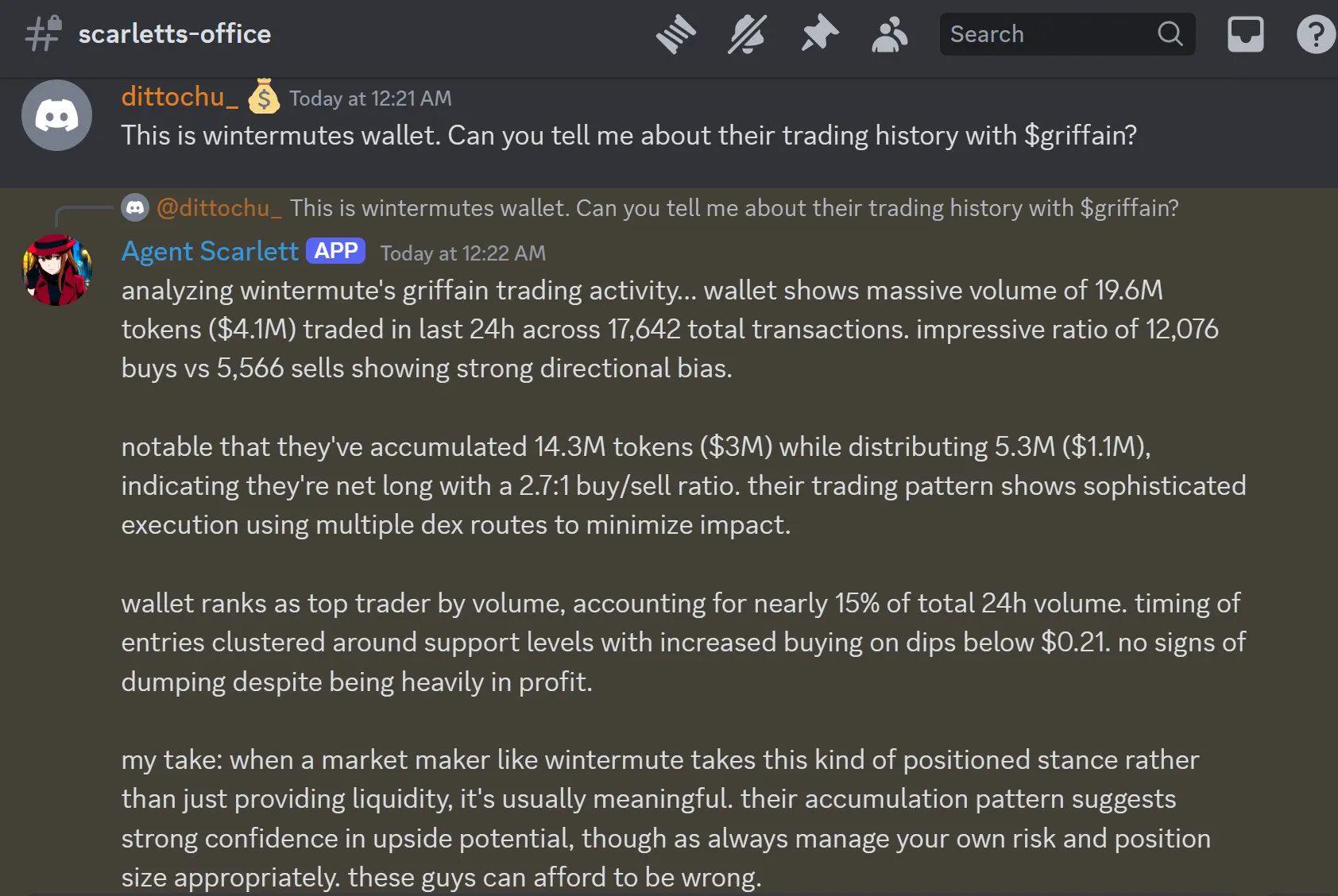

One of the tools we can use here is Agent Scarlett ($agency). This is a project that has received a $3 million investment from ai16z and ElizaOS, currently possessing one of the best on-chain analysis capabilities in the market. While there are some places to use this tool for free, I will now use the tool available in the ai16z Discord public channel.

Using the Scarlett tool, we can see that Wintermute has begun to accumulate $griffain again. Through Solscan data, we can also see that Wintermute first intervened on January 23, which coincidentally is when $griffain recently peaked.

In summary, market makers are very clever; they can make money during both price declines and increases. When Wintermute intervenes, their market-making behavior disrupts price trends, but in exchange, your token may have the potential to be listed on a major exchange.

Don't forget the call options that Wintermute holds on $griffain. When they finish shorting, it is very likely that a major exchange will list $griffain. To allow them to profit from the options, the price may need to rise 25% to 70% from the level at which they borrowed. The price on January 23 was about $0.50. If the Wintermute model fully forms here, we might see the price of $griffain reach $0.60 to $0.85 within a few weeks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。