BenFen Chain is the world's first stablecoin payment public chain, positioned as the Web3 version of the Swift system, specifically designed for stablecoin payment scenarios.

Author: Bixin Ventures

BenFen is an ecosystem based on stablecoins, consisting of the high-performance underlying public chain BenFen Chain (underlying infrastructure), the native stablecoin BUSD, BenPay, BenPay DEX, merchant services, and more.

As countries introduce stablecoin regulatory policies, we believe that the external environment for cross-border payments based on stablecoins is gradually maturing, which may partially replace traditional payment systems. BenFen is positioned as the Web3 version of the Swift system, focusing on stablecoin application scenarios and reshaping the future of cross-border payments through its own high-performance public chain.

TL; DR

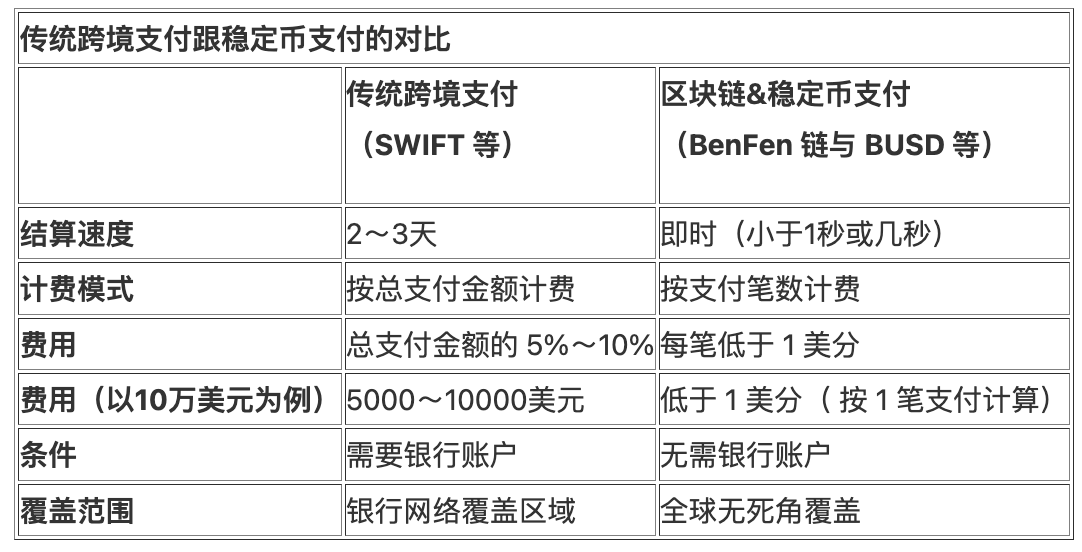

The settlement time for cross-border payment systems based on interbank communication networks is long and costs are high; blockchain-based payment systems can solve this problem.

BenFen Chain is the world's first stablecoin payment public chain, positioned as the Web3 version of the Swift system, specifically designed for stablecoin payment scenarios.

Emphasizing high security, high throughput & low Gas fees: BenFen Chain uses the Move programming language and an enhanced consensus based on DAG, achieving tens of thousands of transactions throughput, latency of less than 0.5 seconds, and Gas fees below 0.1 cents, ranking among the top in all public chains.

Innovative stablecoin issuance and stabilization mechanisms: BenFen permanently places 50% of the governance token BFC in the treasury to issue the native stablecoin BUSD, while designing various stabilization mechanisms such as elastic currency supply mechanisms and exchange rate reversion mechanisms to ensure price stability.

BenPay: A super application that integrates deposit and withdrawal, exchange, staking and lending, offline consumption, and on-chain red packet transfers. Unlike Ethereum and Solana, which treat governance tokens ETH and SOL as first-class citizens, BenFen treats BUSD as the first-class citizen within the ecosystem, used for Gas fee payments and various scenarios such as on-chain staking.

Smooth user experience: Supports zkLogin login, allowing users to log in directly with Google/Apple accounts without cumbersome mnemonic phrases.

High-value governance token BFC: The governance token BFC essentially captures the value of the entire BenFen ecosystem, including BenFen Chain, various stablecoins (BUSD, BINR, BJPY, BEUR, etc.), BenPay DEX, BenPay, BenPay Card, and merchant services. From a valuation perspective, the value of the governance token BFC should be the sum of the values of all these projects.

Compared to other stablecoin solutions (infrastructure + stablecoin mechanisms), BenFen's high-performance underlying public chain + native stablecoin BUSD solution leads in security, throughput, latency, Gas fees, and user entry experience.

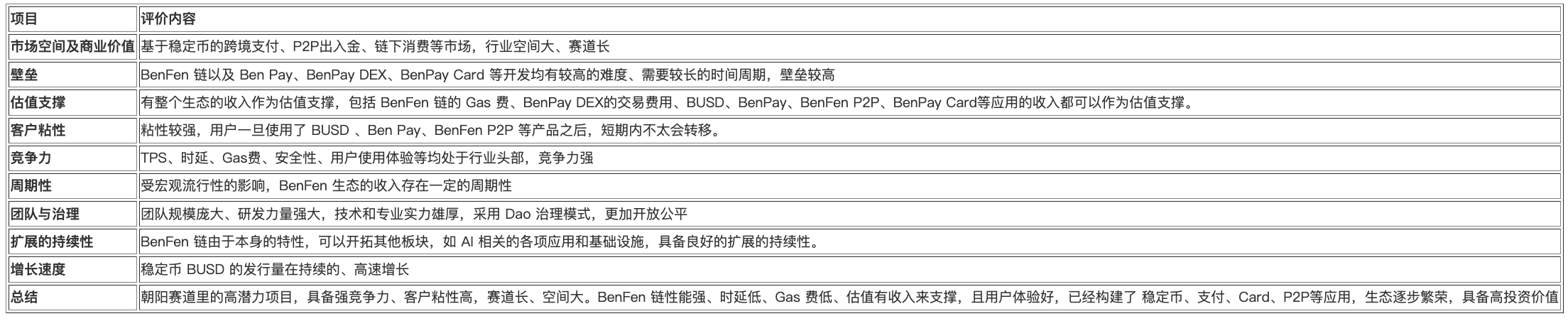

BenFen is a high-potential project in a sunrise industry, with strong competitiveness, high customer stickiness, long industry cycle, and large space. BenFen Chain has strong performance, low latency, low Gas fees, and valuation supported by revenue, along with a good user experience. It has already built applications such as stablecoins, payments, Cards, P2P, and merchant services, with the ecosystem gradually thriving and possessing high investment value.

Introduction to BenFen

Using Stablecoins to Solve the Problems of Cross-Border Payments: High Costs and Long Settlement Periods

According to data from the Society for Worldwide Interbank Financial Telecommunication (SWIFT), traditional cross-border payments take 2 to 3 business days and require payment fees of 5% to 10% of the total amount. This model is costly and inefficient, severely hindering the development of global finance and trade.

At the same time, traditional cross-border payments rely on bank networks, and in some impoverished areas of the world, banks do not operate in those regions due to lack of profitability, resulting in approximately 2 billion people without bank accounts, depriving them of their rightful rights.

Blockchain and stablecoin-based payment solutions can precisely address these issues. This solution typically consists of underlying infrastructure (public chain) and on-chain issued stablecoins, where the underlying public chain is similar to the SWIFT system, and stablecoins are akin to the US dollar in SWIFT. The combination of blockchain and stablecoins can achieve instant settlement (less than 1 second or a few seconds) and costs at the cent level, while also eliminating the need for bank accounts, meaning global coverage 24/7 without dead ends.

BenFen Chain: The Web3 Version of the SWIFT System, Specifically Designed for Stablecoin Payment Scenarios

The creation of a cross-border payment system first requires a secure, reliable, high-performance, and low-cost infrastructure, namely the underlying public chain. Existing public chains face issues of low security, high costs, or weak performance. For example, the application development languages of Ethereum, Arbitrum, and Base chains are Solidity, which has lower security than the Move language, and Ethereum has delays exceeding 10 seconds and Gas fees over $20.

To thoroughly solve these problems, BenFen chose to abandon building applications based on existing public chains and instead decided to develop a new underlying public chain based on the Move language from scratch, along with developing upper-layer applications. BenFen assembled a team of nearly 100 people and, after more than two years of relentless development, achieved transaction throughput of tens of thousands and latency of less than 0.5 seconds. It also developed components such as the native stablecoin BUSD, BenPay, BenPay DEX, and BenFen Oracle. As the Web3 version of the SWIFT system, BenFen Chain promotes the development of cross-border payments, specifically designed for stablecoin payment scenarios!

Achieving Higher Security with the Move Programming Language

The Move language was initially used in Facebook's Diem project. In terms of code, due to its strict type system, many common errors can be caught at compile time. Additionally, its unique resource concept ensures that resources can only be used for their intended purposes, preventing issues such as reentrancy attacks and resource leaks. Furthermore, different control permissions can be set for different user groups, prohibiting unauthorized access.

The Move language advocates for the use of immutable data structures and functional programming paradigms, which reduces code complexity. It also provides formal verification tools for static analysis and verification of code, allowing for the discovery and fixing of potential security issues.

Move also defines a language called Move Specification Language (MSL), which ensures that programs can run correctly, reducing on-chain computation overhead and enhancing security. When a program is described by MSL and its specifications are defined, the Move to Boogie compiler converts these programs into an intermediate verification language Boogie with formal semantics. Finally, an automated theorem proving solver is used to verify whether the program meets the specifications.

The Move language also relies on modular design, advanced abstraction capabilities, custom data structures, flexible permission control, and cross-platform compatibility, making BenFen Chain flexible and capable of meeting the development needs of different applications. BenFen also provides a standard library containing over 40 commonly used functional modules, including accounts, transfers, and transactions.

Improving Consensus Mechanisms and Multiple Fee Optimizations to Achieve Higher Performance & Lower Gas Fees

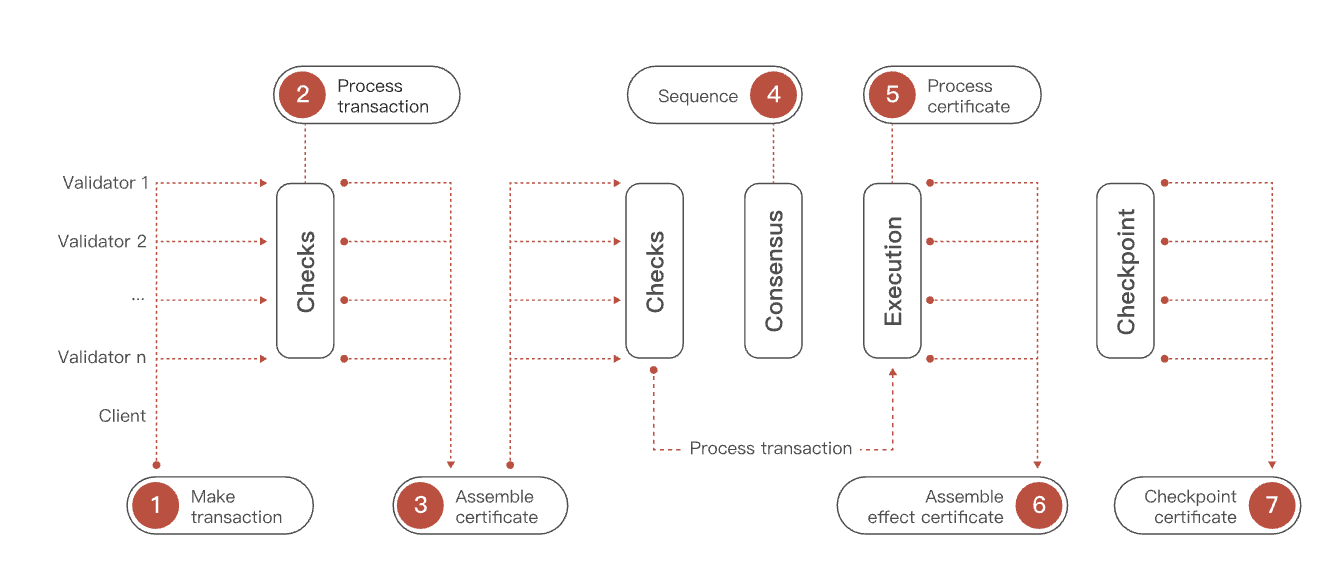

To achieve higher performance and lower Gas fees, BenFen Chain combines DAG-based consensus with non-consensus. When users create and sign transactions using their private keys, the transactions are sent to each validator of the local chain. The validators then perform a series of validity checks and return the signed transactions to the client, which collects responses from the majority of validators to form a transaction certificate.

For transactions involving user-owned objects, transaction certificates can be processed directly without waiting for the consensus engine's intervention. All certificates are processed using the DAG consensus protocol executed by the validators of the local chain. Each consensus submission forms a checkpoint, ensuring the long-term stability of the network. Through these process optimizations, BenFen Chain can achieve transaction delays of less than 0.5 seconds and throughput of tens of thousands of transactions per second.

Local Chain Flowchart Source: BenFen White Paper

In terms of Gas fees, the Move language used by BenFen Chain itself significantly reduces costs, and the object-based storage types and consensus mechanisms also help lower Gas fees. Generally, Gas fees consist of computation fees and storage fees. The storage mechanism of the local chain provides storage fee refunds when previous stored objects are deleted. The local chain supports Gas fee payments in BFC, as well as BUSD and BJPY. After these optimizations, the Gas fees of the local chain will be less than 1 cent.

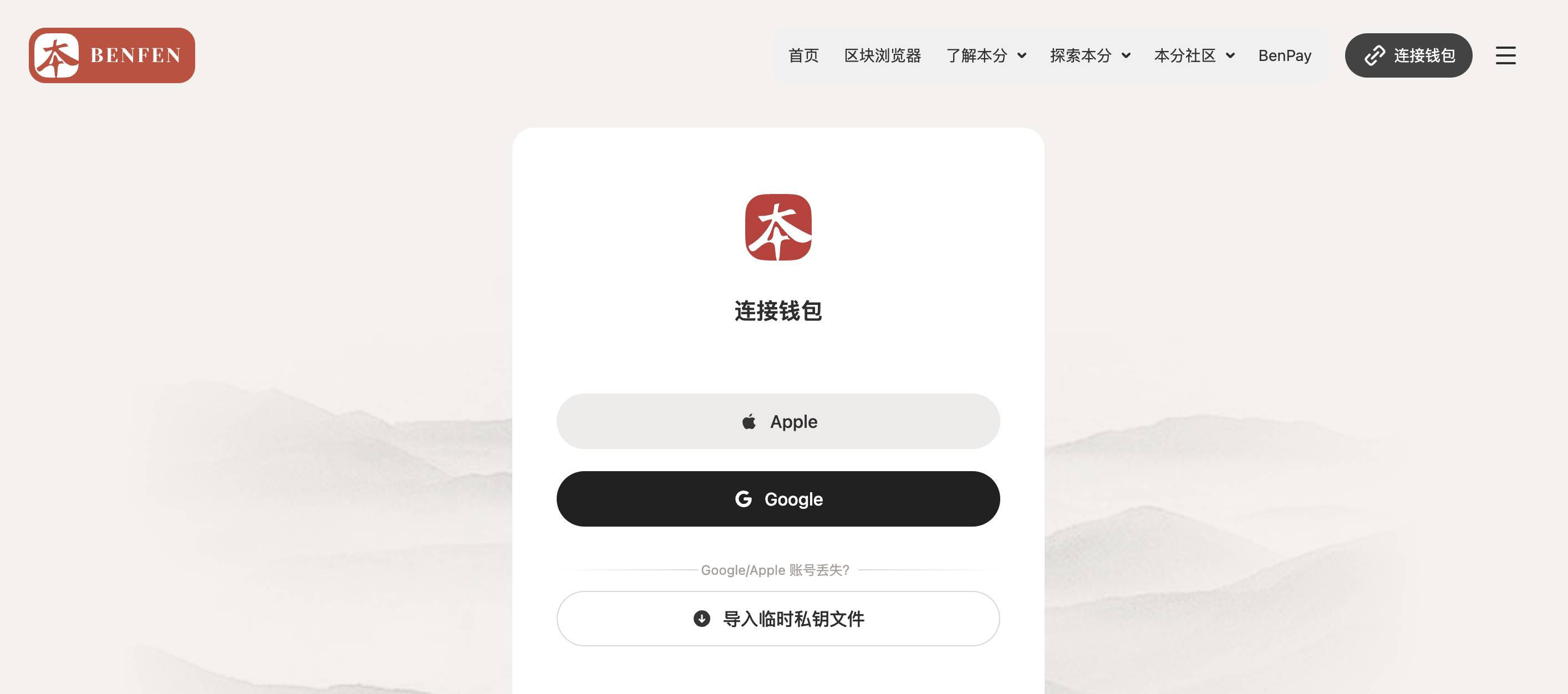

No Need for Mnemonic Phrases: Supports zk-Login, Users Can Log in with Google/Apple Accounts

Traditional users often need to record mnemonic phrases when entering Web3, a cumbersome process that hinders user adoption. BenFen Chain supports zk-Login, allowing users to log in directly with Google/Apple accounts without the need for mnemonic phrases, significantly lowering the entry barrier for Web2 users.

zk-Login allows users to generate local addresses using third-party login via OAuth, and the OAuth provider cannot access the user's temporary private keys.

zk-Login login interface Source: Official website

Native Stablecoin Supporting Gas Fee Payments and On-Chain Staking

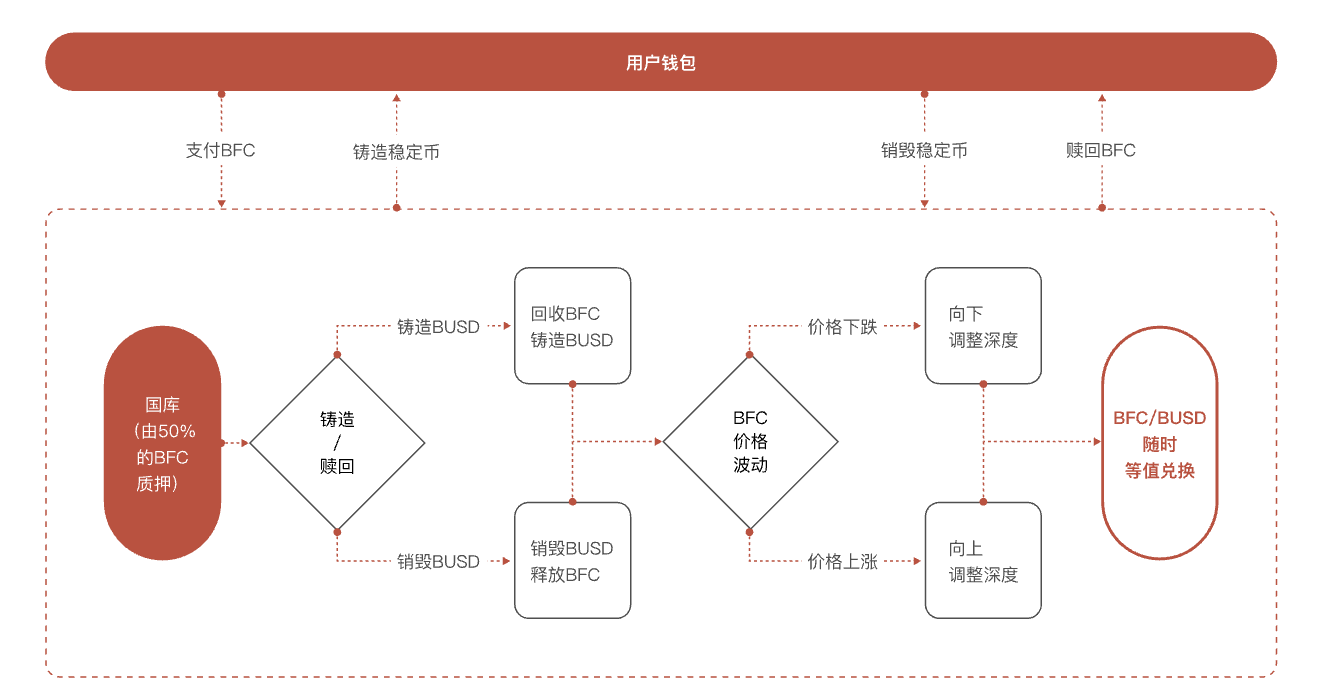

BenFen will launch multiple stablecoins, among which BUSD is issued by staking 50% of BFC in the treasury, achieving elastic supply through BenPay DEX, and ensuring relative stability of the exchange rate through a dynamic liquidity mechanism.

When minting BUSD, BenPay DEX will recycle BFC; when destroying BUSD, BenPay DEX will release BFC. During this process, the price of BFC will inevitably fluctuate; when the price drops, the system will adjust the depth downwards; when the price rises, the system will adjust the depth upwards. In terms of user experience, users pay BFC to obtain stablecoins; when users redeem BFC, the system destroys the stablecoins.

Process of Minting and Redeeming BUSD Source: BenFen White Paper

In terms of depth adjustment, if the trading volume of BUSD increases, the system will automatically increase liquidity to reduce trading friction. Conversely, if trading volume decreases, the system will reduce liquidity.

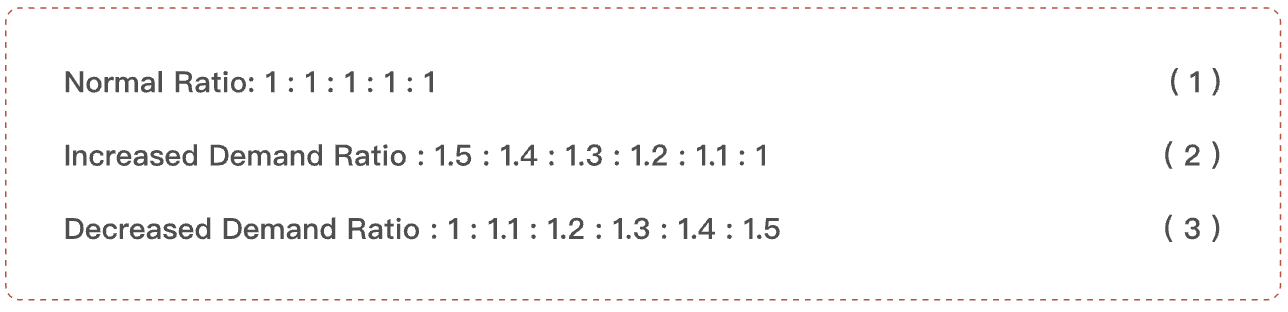

By dynamically managing the liquidity of BenFen, the stablecoin protocol can guide price trends to some extent. For example, when prices rise, the system can provide more liquidity to suppress the increase. Conversely, when prices fall, the system will reduce liquidity to prevent excessive declines. The specific liquidity adjustment ratios are shown in the figure below.

Liquidity Adjustment Ratios

For other stablecoins, BenFen issues stablecoins for other currencies based on its native exchange rate oracle. Taking BJPY as an example, users can mint or cross-chain exchange it using BFC, and then mint BJPY based on the price from the exchange rate oracle. When users no longer need BJPY, they can redeem it for BUSD at the current oracle price, which will reduce the liquidity of BJPY in the market.

BenPay: A Super Application Integrating Deposit and Withdrawal, Exchange, Staking and Lending, Offline Consumption, and Red Packet Transfers

BenPay is the core application of the BenFen ecosystem, centered around payment scenarios. To facilitate user adoption, BenFen has developed a comprehensive service. Users can use BenPay's P2P service for deposits and withdrawals, exchange other tokens via BenPay DEX, and make purchases and payments using BenPay Card. BenPay DEX obtains prices through oracles to facilitate spot and perpetual contract trading. For merchants, BenPay has also developed a crypto payment channel, BenPay Merchant, to help merchants with payment collection and refunds.

During a bull market, many users do not want to sell their BTC but wish to have liquid funds. In this case, users can utilize the staking and lending feature in BenPay to stake BTC and borrow USDT. Users can obtain bBTC on the BenFen chain, stake it on the BenFen chain, borrow BUSD, and then convert BUSD to USDT through BenFen Bridge and transfer it to their address on an EVM chain.

Illustration of BenPay's Staking and Lending Function

BenPay has also developed a transfer function between users, similar to the transfer and red packet functions in WeChat. When sending a red packet, users can choose between a regular red packet or a lucky red packet. The user sending the red packet sets a password for the red packet and pays the Gas fee to distribute the red packet to other users.

Illustration of BenPay Red Packet

High-Value Governance Token BFC, Fully Capturing the Value of the Entire Ecosystem

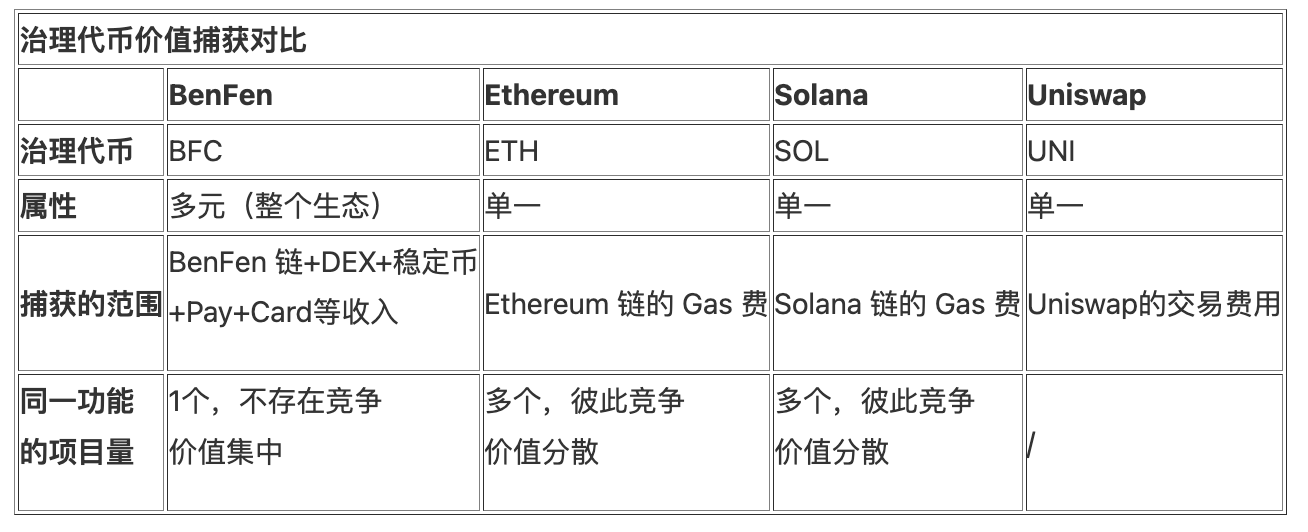

From a valuation perspective, the value of the chain is the discounted sum of future Gas fees received, the value of the DEX is the discounted sum of future transaction fees received, and the same applies to stablecoins, payments, and other projects.

Compared to governance tokens of other chains that only capture the value of the chain, BenFen's governance token BFC captures the value of the entire BenFen ecosystem, including the chain, stablecoins (BUSD, BINR, BJPY, BEUR, etc.), BenPay DEX, BenPay, BenPay Card, merchant services, and more. Therefore, the value of BFC is the sum of the values of all these projects.

Additionally, on a single chain, there are usually multiple projects with the same functionality. For example, in the DEX space, besides Uniswap, there are Balancer, Sushi, and others, leading to significant value loss due to competition among multiple projects. Given that existing models in the market are relatively mature, such as CLMM model DEXs, generally speaking, the BenFen ecosystem only develops one product for the same function, avoiding internal competition and achieving higher value capture efficiency.

Diverse Ecosystem: From Deposits and Withdrawals, Asset Cross-Chain Transfers, Exchanges to Offline Consumption Payments

BenFen has a diverse ecosystem, including:

BenPay DEX: A swap application within the BenFen ecosystem that provides trading for various tokens.

BenFen Bridge: A decentralized cross-chain bridge that serves as a medium for users to transfer assets into the BenFen system.

BenPay Card: Users can use the BenPay Card for offline consumption, paying with cryptocurrencies. Users can top up BUSD and spend it offline. BenPay Card also supports other cryptocurrencies and payments in multiple fiat currencies.

BenPay Merchant: A crypto payment channel that provides users with more functionalities, such as purchasing BUSD with fiat, instant transfers between users, merchant payment solutions, refunds, and more.

BenFen KYC: An on-chain identity authentication and verification system that aggregates the certification results of major KYC providers, enabling one-click queries for multi-platform KYC and peer-to-peer identity verification.

BenFen P2P: An escrow trading platform that addresses the lack of channels for user deposits and withdrawals.

Token Function and Distribution

BenFen plans to issue 1 billion tokens (BFC), of which:

5% (50 million BFC) is for staking rewards.

5% (50 million BFC) is for community incentives and the BenFen Foundation, to support and reward contributors to the community and for the operation and development of the BenFen Foundation.

37.84% (378 million BFC) is for node rewards, generated through node mining.

2.16% (21.59 million BFC) belongs to the development team to encourage and support the contributions of core developers and teams in the ongoing development of the project.

50% (500 million BFC) is for the stablecoin treasury, to maintain the price stability and liquidity of BenFen's stablecoins.

Investment Logic and Business Analysis

Scale and Potential: By 2030, the Total Amount of Stablecoin Transfers May Reach $38 Trillion/Year

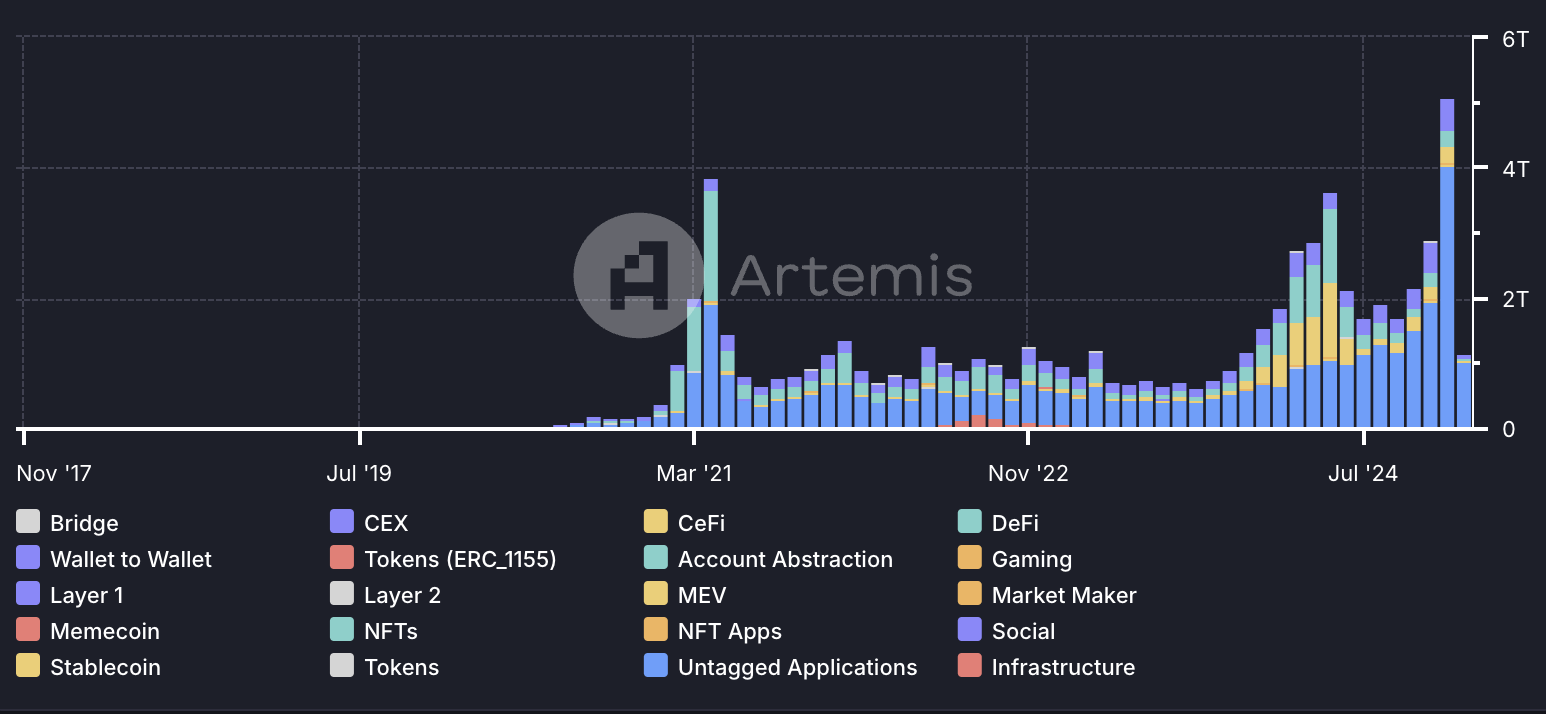

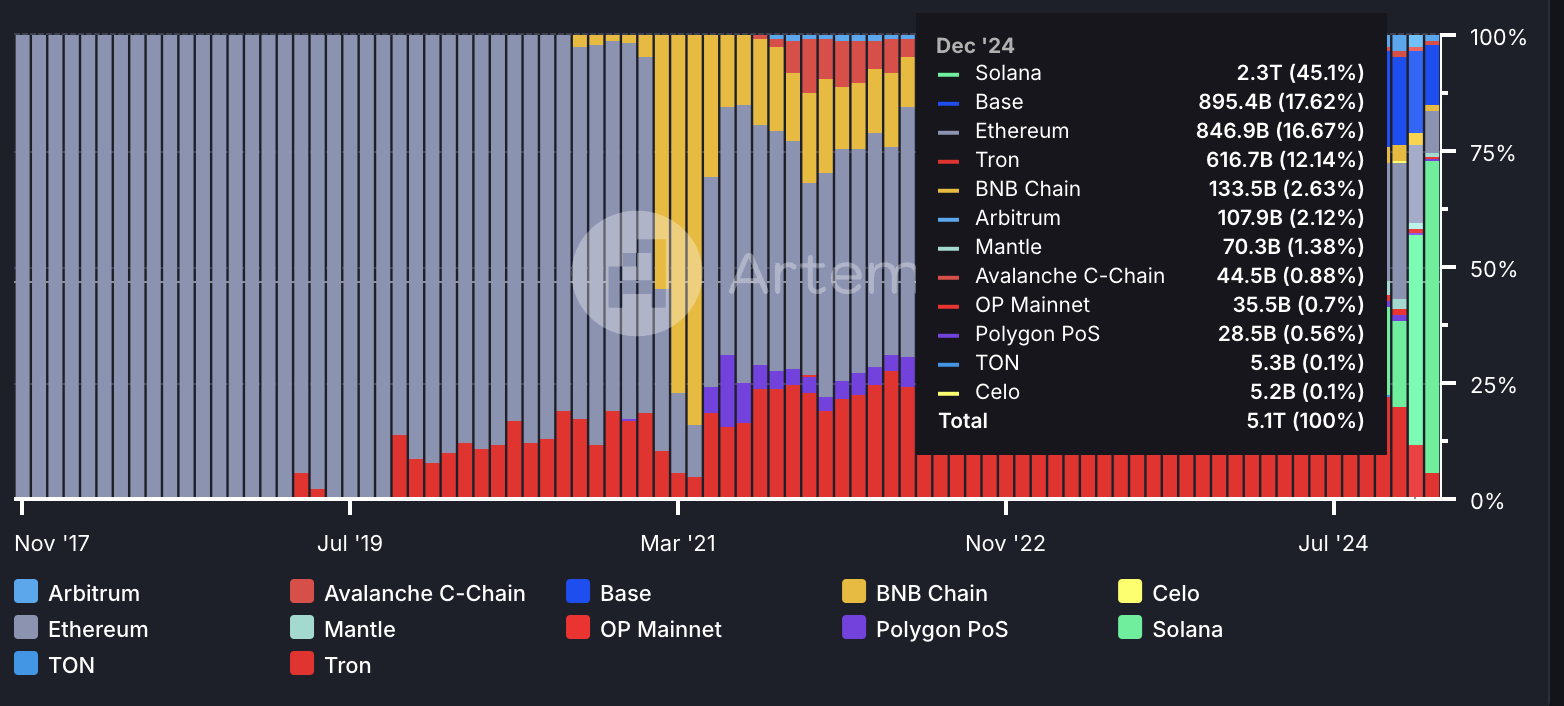

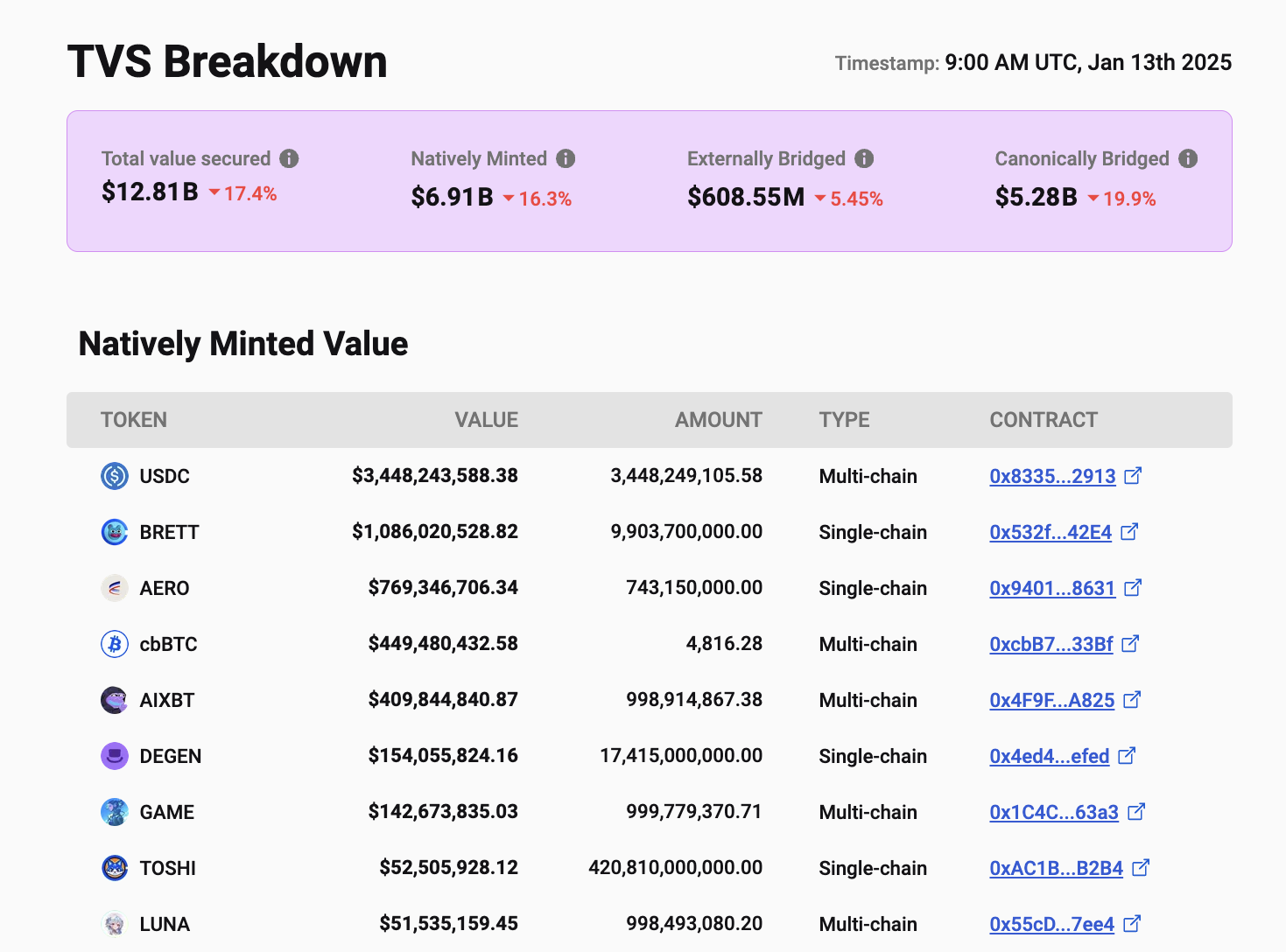

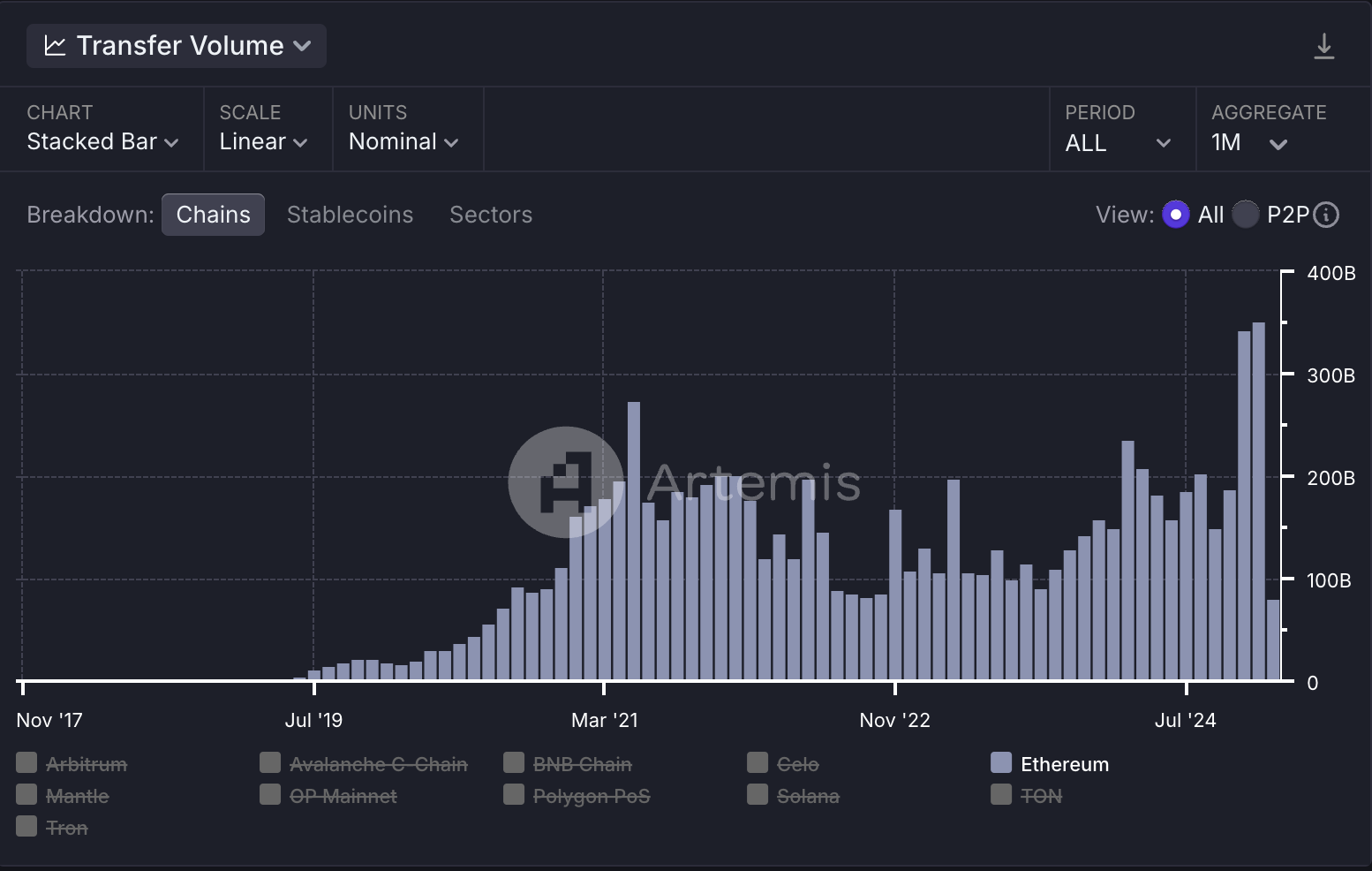

From historical performance, according to data from Artemis, by December 2024, the monthly settlement amount of stablecoins is expected to reach $5.1 trillion (equivalent to an average daily transaction amount of about $170 billion), which is more than a threefold increase compared to $1.2 trillion in December 2023. The monthly settlement amount in December 2021 was only $218.2 billion, representing a growth of over 22 times in three years.

Additionally, referring to VanEck's prediction for 2025, the global daily settlement amount of stablecoins is expected to reach an astonishing $300 billion, with the main growth coming from the adoption by tech giants and payment networks (Visa, Mastercard, etc.). The cross-border remittance market is also expected to explode, with stablecoin transfers between the US and Mexico potentially increasing fivefold.

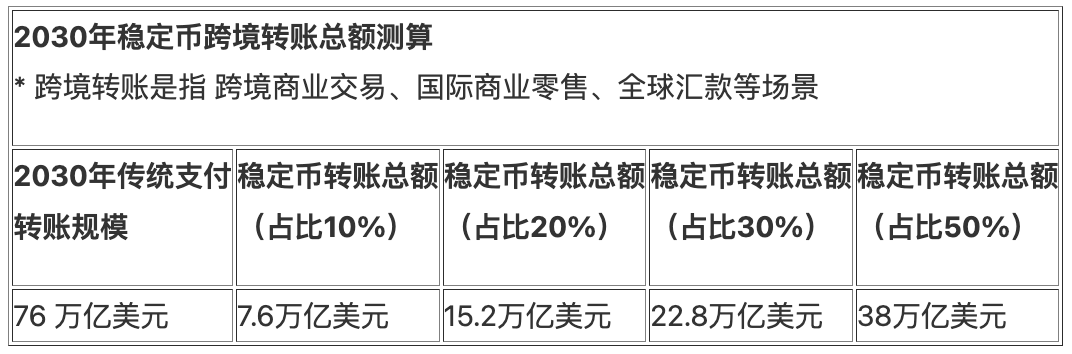

Monthly Stablecoin Settlement Amount Source: Artemis

From a longer-term perspective, according to statistics from the International Fund for Agricultural Development, FXC Intelligence, and Statista, the capital flow involved in cross-border commercial transactions, international retail, and global remittances reached $45 trillion in 2023, and this amount could rise to $76 trillion by 2030. Due to the instant settlement, low costs, 24/7 service, and transparency of stablecoins, they will partially replace existing payment methods. We assume that by 2030, stablecoins could account for 10%, 20%, 30%, or 50% of the total, estimating that the total amount of transfers based on stablecoins could reach $38 trillion by 2030.

Competitive Landscape: USDT and USDC Dominate, with Solana, Base, and Ethereum in the Top Three

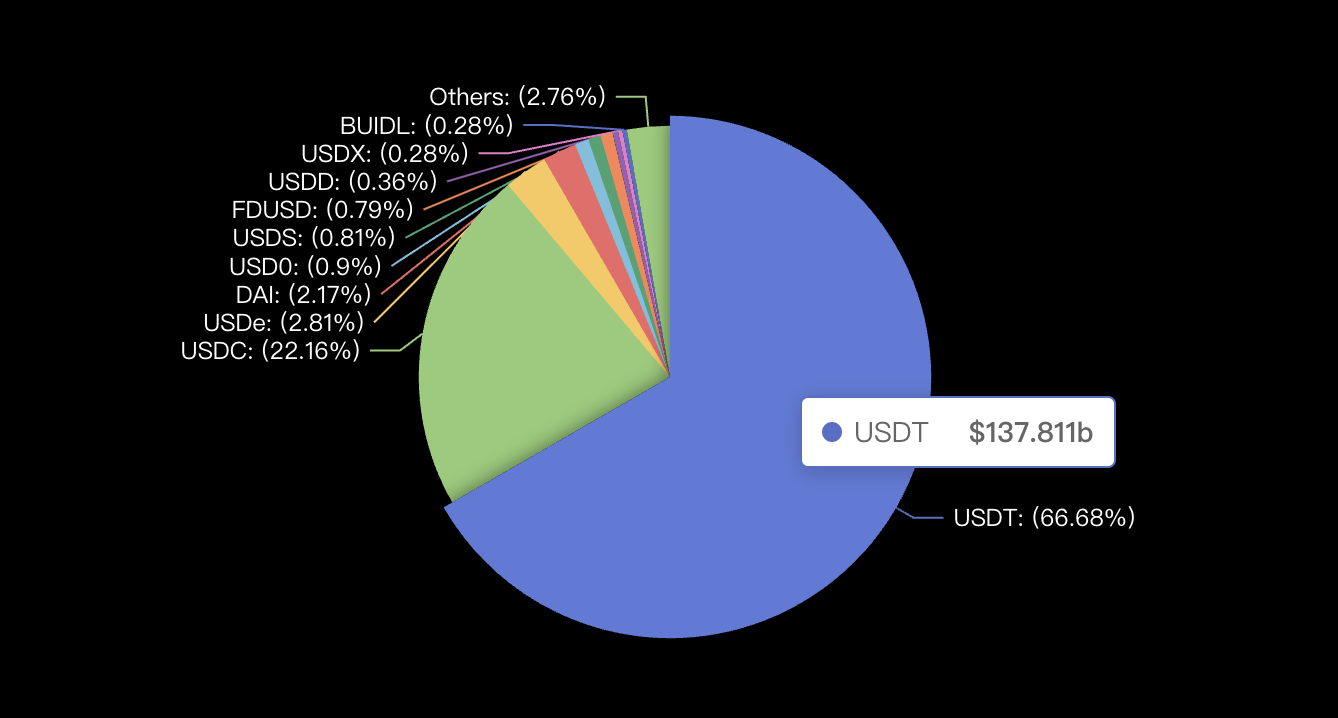

In terms of issuance scale, according to DeFillama data, as of January 2025, USDT ranks first with 137.8 billion USD, accounting for 66.7%; USDC ranks second with an issuance scale of 45.8 billion USD, accounting for 22.16%; USDe ranks third with 5.81 billion USD, accounting for 2.81%; and DAI ranks fourth with 4.48 billion USD, accounting for 2.17%.

Stablecoin Competitive Landscape by Issuance Scale Source: DeFillama

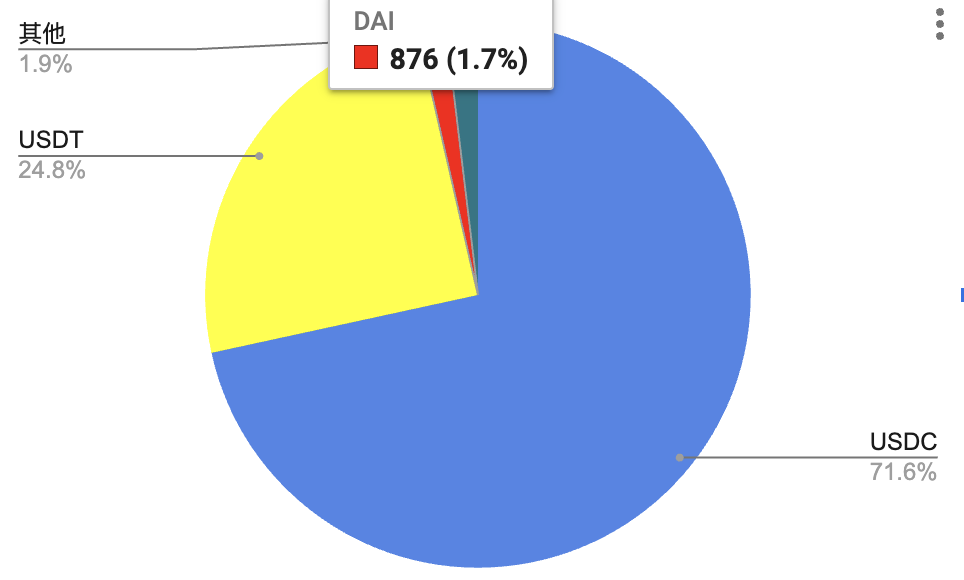

In terms of settlement volume, according to Artemis data from December 2024, USDC has a monthly settlement amount of $3.6 trillion, accounting for 71.6%, ranking first; USDT has a settlement amount of $1.3 trillion, accounting for 24.8%, ranking second; and DAI has a monthly settlement amount of $87.6 billion, accounting for 1.7%, ranking third.

Stablecoin Competitive Landscape by Total Settlement Amount Source: Artemis

In terms of infrastructure, according to Artemis data, in December 2024, Solana has a monthly settlement amount of $2.3 trillion, accounting for 45.1%, ranking first; Base has $895.4 billion, accounting for 17.62%, ranking second; and Ethereum has $846.9 billion, accounting for 16.67%, ranking third.

Stablecoin Infrastructure (Underlying Public Chain) Competitive Landscape Source: Artemis

Comparison of Data with Competitors

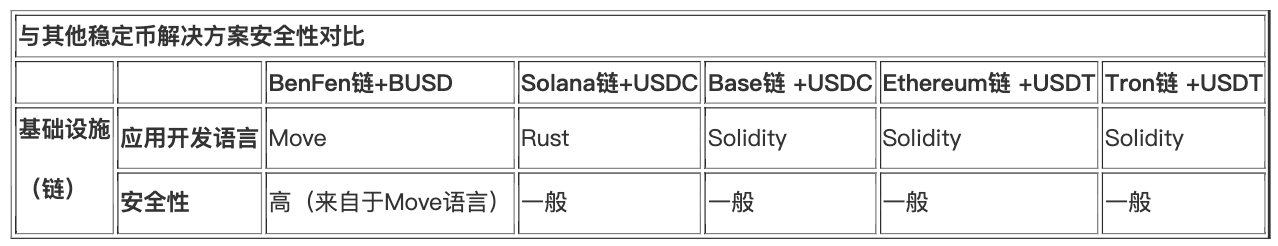

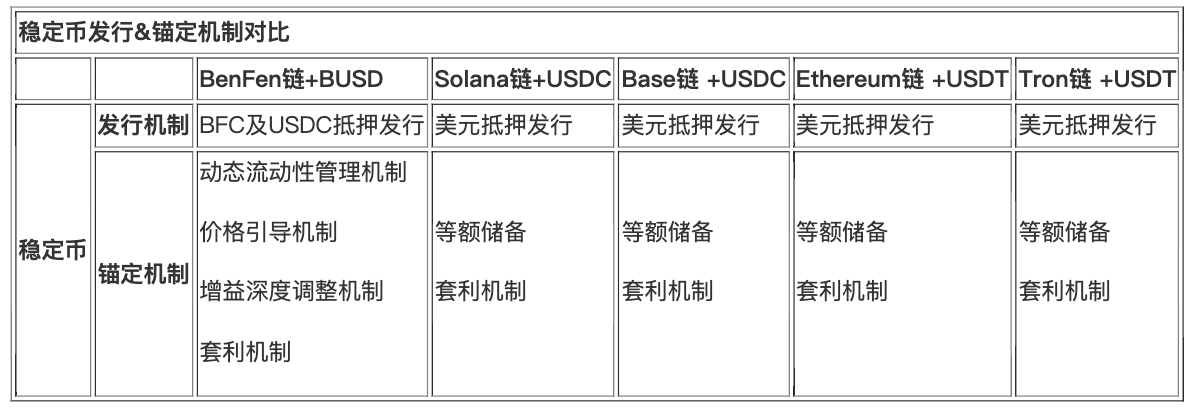

Due to the applications based on stablecoins, they are closely related to the underlying infrastructure (public chains) in addition to the stablecoins themselves. Therefore, we selected several stablecoin solutions with high settlement volumes in the current market as competitors to the BenFen chain and BUSD for comparison across multiple dimensions. These competitors include Solana chain + USDC, Base chain + USDC, Ethereum chain + USDT, and Tron chain + USDT.

Infrastructure

The infrastructure of stablecoins mainly consists of underlying public chains, and their characteristics such as security, performance, and costs will affect the development of stablecoin applications.

In terms of security, compared to other solutions, the BenFen chain uses the Move language as its application development language. Due to the properties of the language itself, its security is higher than that of Ethereum and Solana, which use Solidity and Rust.

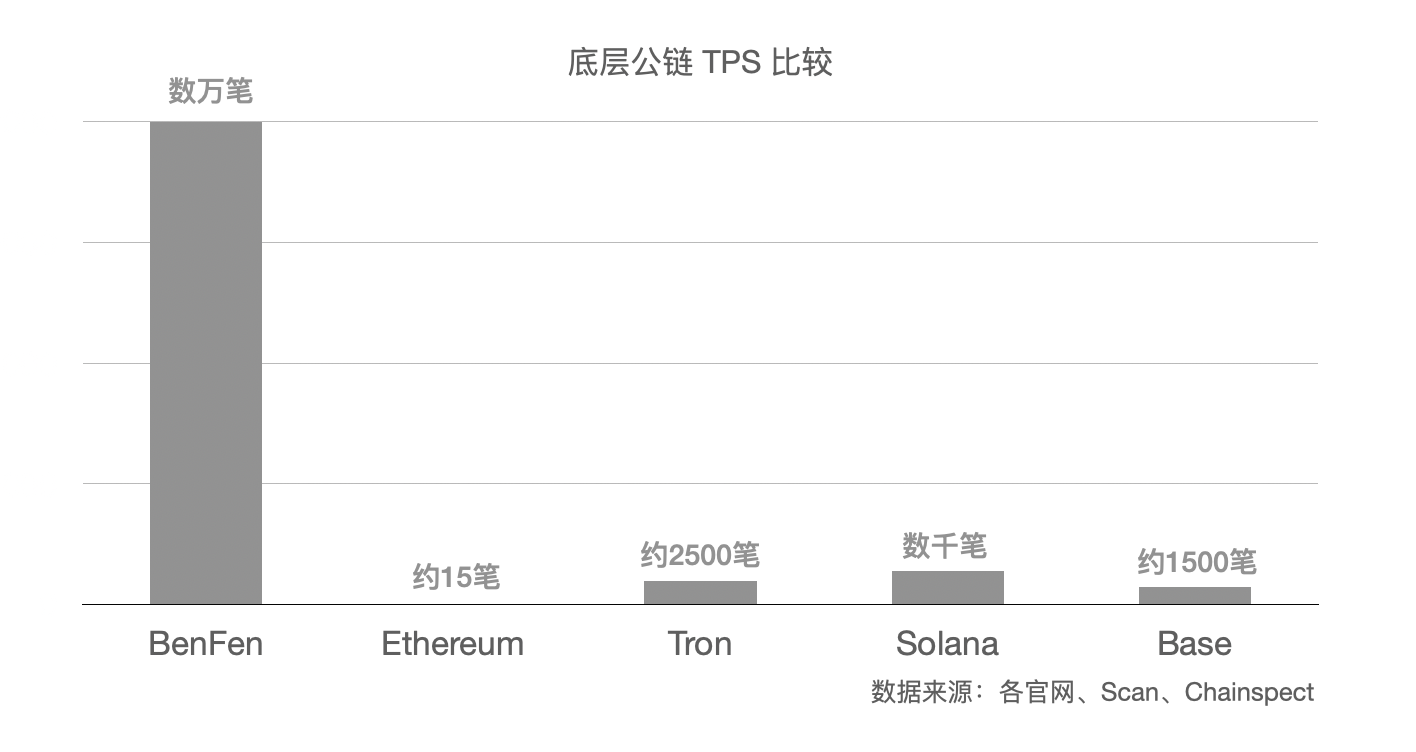

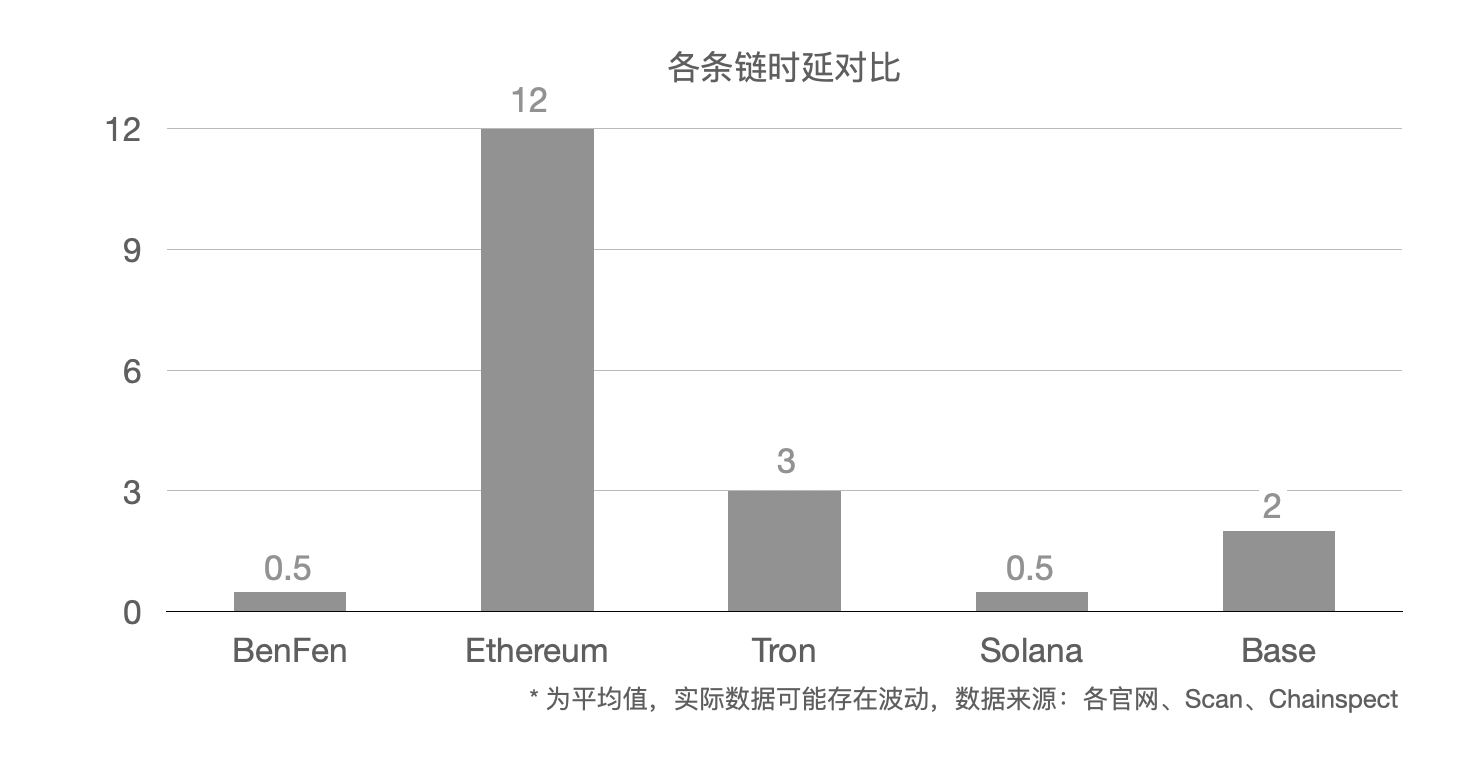

In terms of TPS, the BenFen chain has a transaction volume of tens of thousands per second, which is higher than other chains. The higher the TPS, the greater the settlement volume it can support, enabling larger-scale payment and transfer operations.

In terms of latency, the BenFen chain has a latency of 0.5 seconds, placing it in the top tier of the industry. The lower the latency, the faster and smoother the payment experience for users, eliminating the need to wait for extended periods.

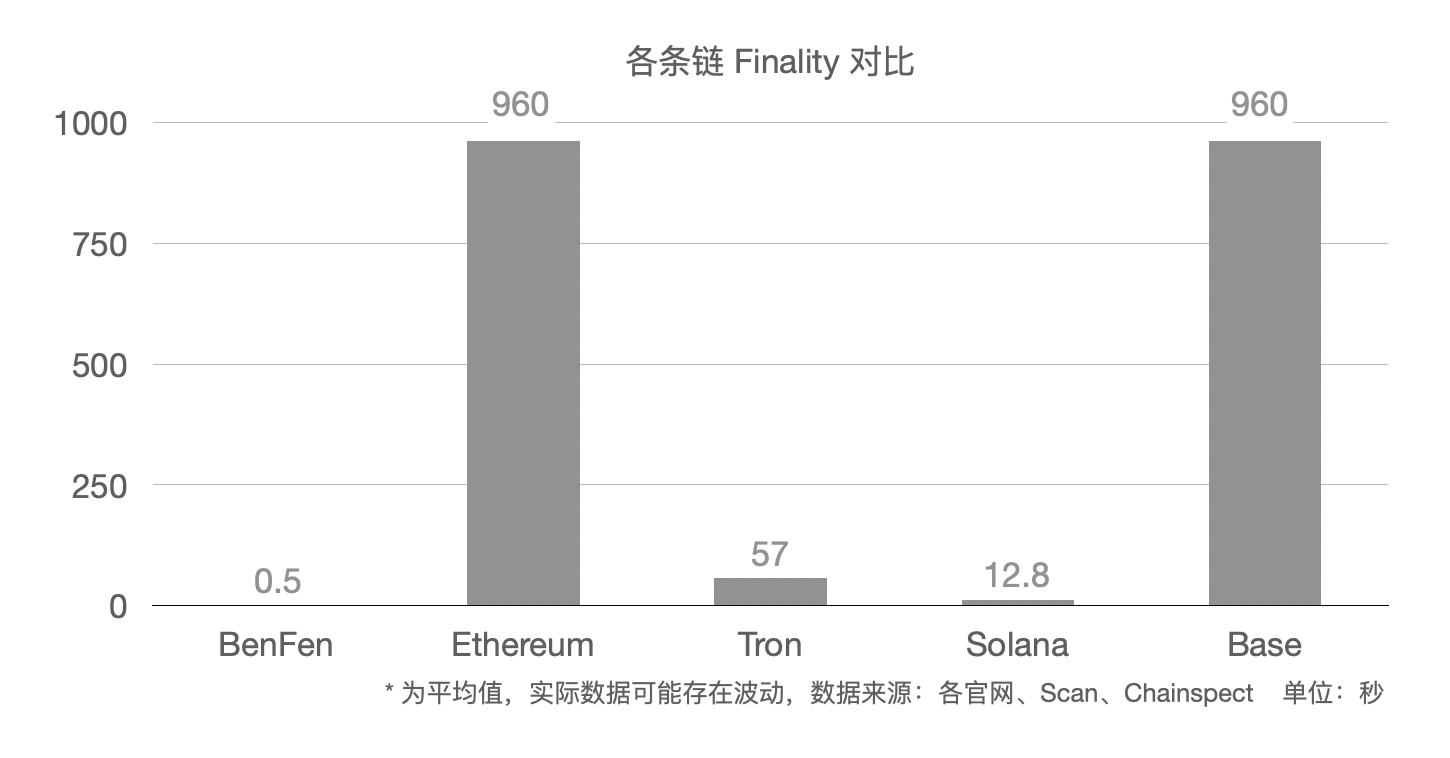

In terms of finality, the BenFen chain, being a single-chain structure, has finality that is almost consistent with latency, giving it an advantage. Finality refers to the time a transaction is truly recorded on the blockchain; shorter finality means a shorter time from transaction to settlement (on-chain), which increases security and reliability, enhancing user experience.

In contrast, L2 solutions like Base need to relay transactions to Ethereum for final settlement (on-chain), resulting in a finality time consistent with Ethereum, requiring over 15 minutes for settlement.

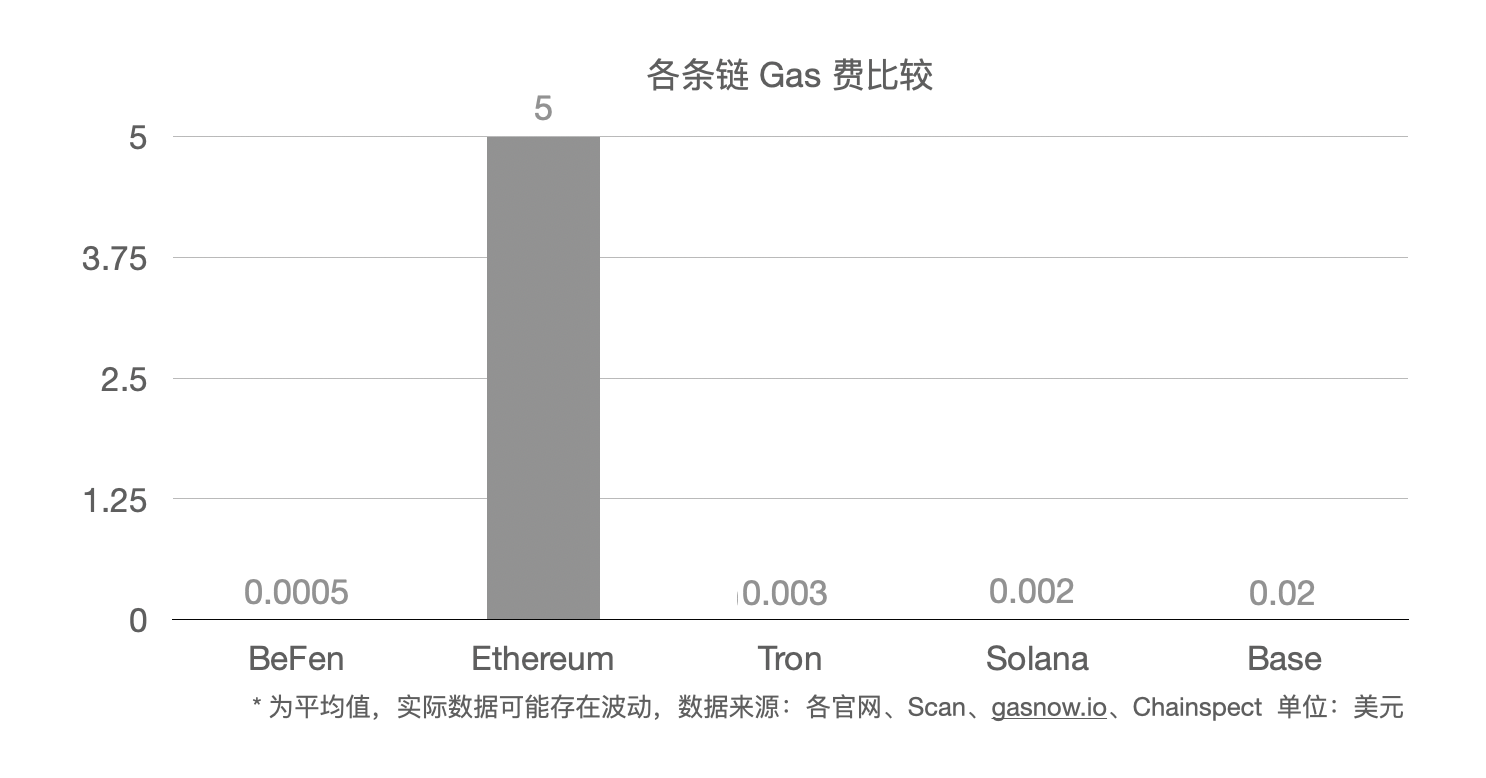

In terms of gas fees, the BenFen chain has extremely low fees, which is beneficial for adoption in real payment scenarios. The BenFen chain can achieve gas fees below $0.001 per transaction, while Ethereum's gas fees are around $5.

Stablecoin Mechanism

Compared to other stablecoins that use a dollar-collateralized issuance model, BenFen allows users to stake USDC 1:1 to mint BUSD and also provides a model for issuing BUSD through BFC staking.

In terms of anchoring mechanism, BUSD has designed a dynamic liquidity management mechanism, price guidance mechanism, depth adjustment mechanism, and arbitrage mechanism to stabilize the price of BUSD.

User Adoption

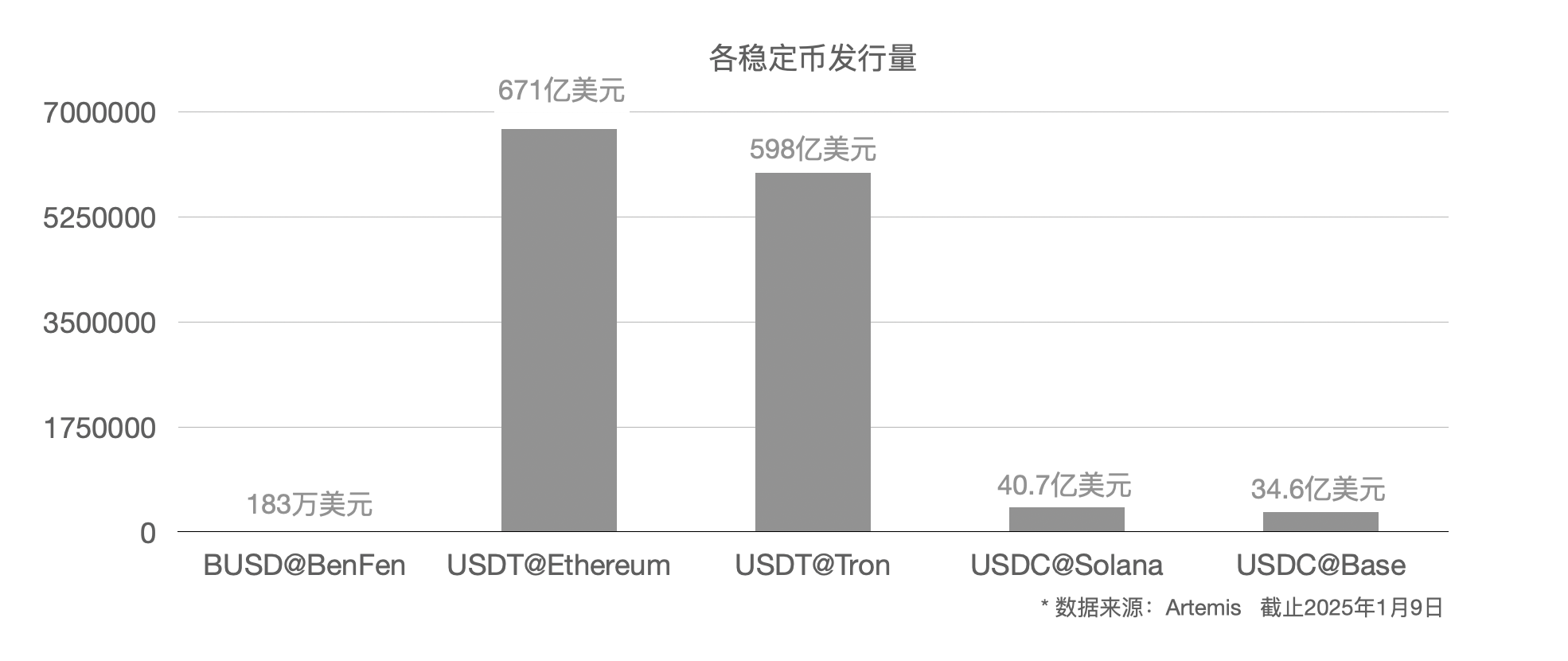

In terms of issuance volume, currently, since BenFen has just launched, the total issuance volume is $1.83 million. USDT has an issuance volume of $67.1 billion on Ethereum, ranking first, and $59.8 billion on Tron, ranking second. USDC has an issuance volume of $4.07 billion and $3.46 billion on Solana and Base, ranking third and fourth, respectively.

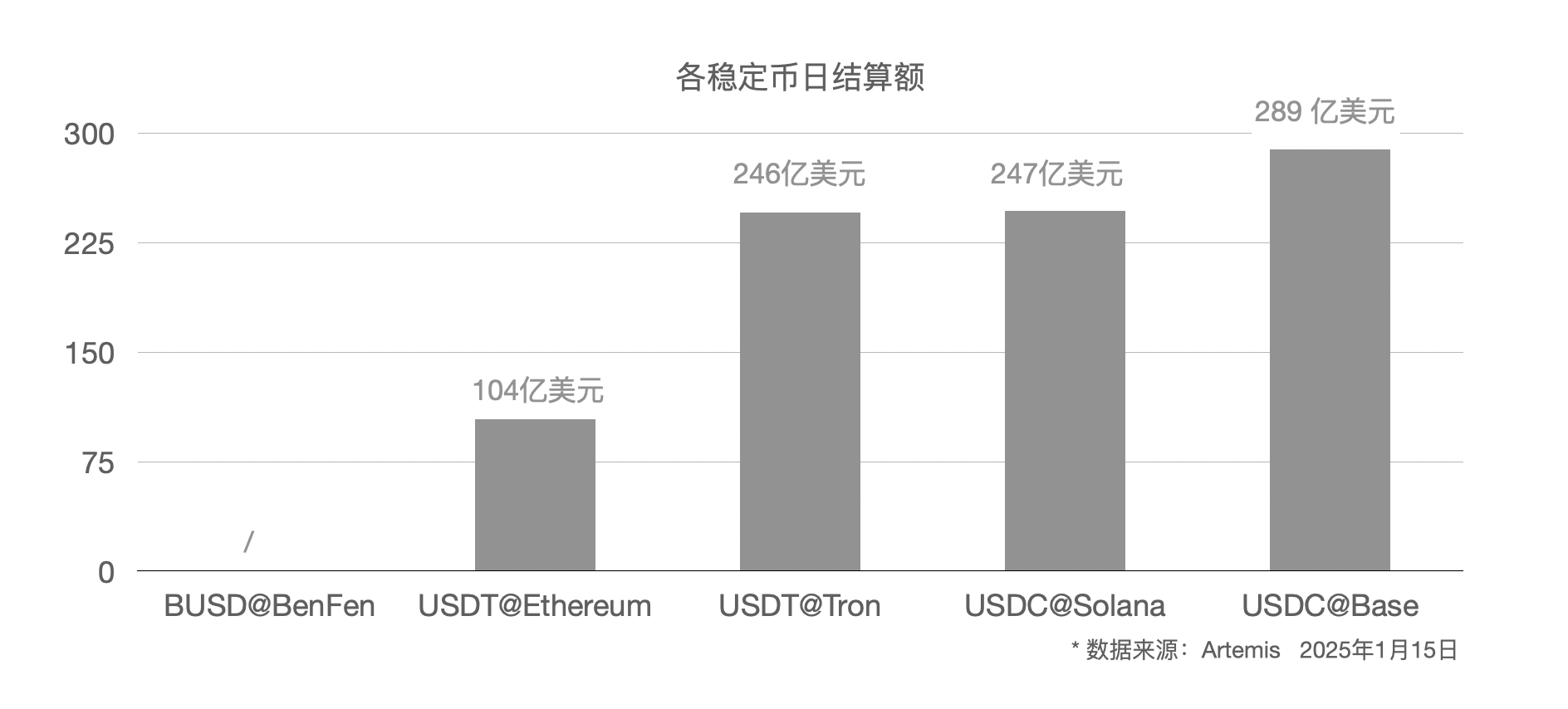

In terms of settlement volume, since BUSD from BenFen has just launched, its settlement volume is negligible. USDC on Base performs excellently, with a daily settlement amount of $28.9 billion, ranking first, while USDC on Solana has a settlement amount of $24.7 billion, ranking second. USDT on Tron and Ethereum has settlement amounts of $24.6 billion and $10.4 billion, ranking third and fourth, respectively.

Main Competitor Situation

Solana Chain + USDC

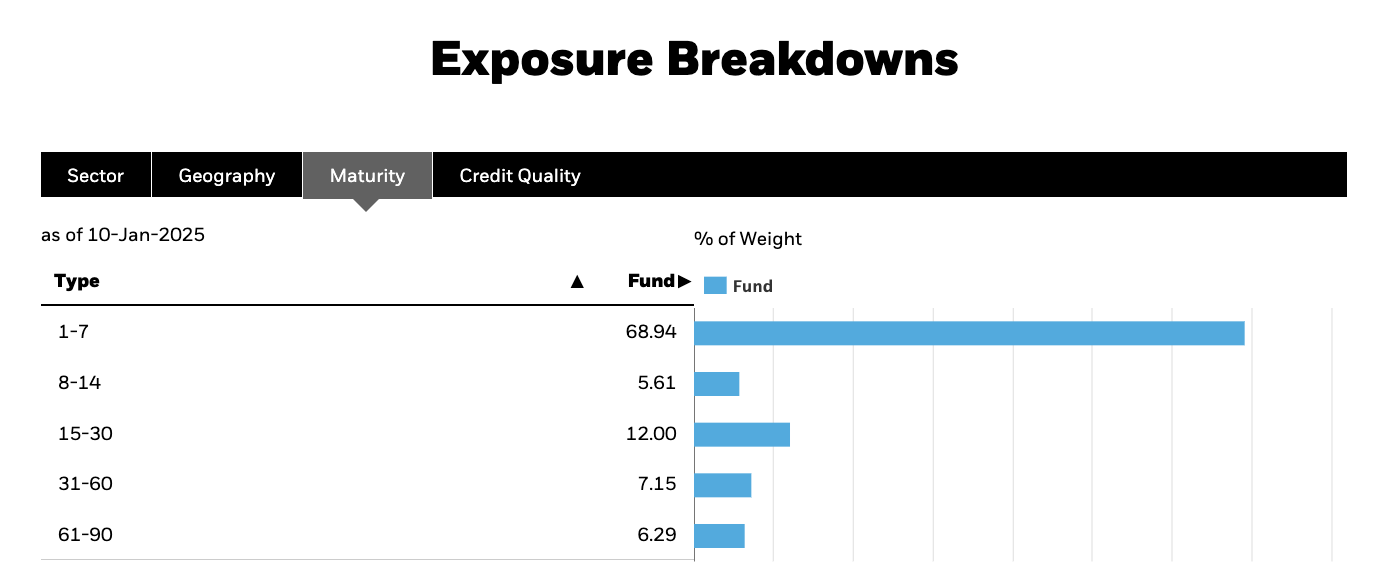

On Solana, although the issuance of USDC is only $4.37 billion, its daily settlement volume has reached 247 billion USD. The stablecoin solution of the Solana chain and USDC has achieved such excellent performance primarily because Solana, as the underlying infrastructure, provides high TPS and low gas fees, laying the foundation for the application of stablecoins. Additionally, Circle regularly discloses reserve details, with audits conducted by Deloitte presenting detailed reports, and most of the funds are managed by Blackrock to generate returns. In terms of risk control, funds maturing in 1-7 days account for 68.94%. Users can check the relevant earnings on their website. Therefore, USDC possesses high transparency and compliance.

Blackrock's liquidity management of USDC reserves Source: Blackrock Official Website

Moreover, the collaboration between Circle and the Solana Foundation, especially regarding the incentive policies for USDC, such as some DeFi projects directly subsidizing USDC to fund developers to build applications on the Solana chain, has contributed to this success. Additionally, the launch of the Cross-Chain Transfer Protocol (CCTP) has enhanced the liquidity and availability of USDC. At the same time, Circle has simplified the development of smart contracts, making it easier for developers to adopt USDC.

However, Solana uses Rust as its application development language, which is relatively less secure than the Move language.

Base Chain + USDC

The Base chain and USDC, as another stablecoin solution, have achieved rapid growth in daily settlement volume over the past few months, reaching 289 billion USD, ranking first, based on an issuance volume of $34.7 billion.

In the second quarter of 2024, Coinbase's trading revenue fell by 50% year-on-year, USDC's issuance shrank by 41% over five months, and ETH staking faced regulatory pressure. Under SEC accusations, Coinbase found itself in a difficult position and had to make a decisive move under regulatory pressure, focusing on infrastructure like the Base chain for a breakthrough.

As Coinbase continues to strengthen the Base chain, the total value of assets on the Base chain has reached $12.8 billion, with USDC being the most valuable at $3.448 billion.

Asset distribution on the Base chain Source: L2Beat

Overall, the Base chain + USDC stablecoin solution has many advantages. First, the resource advantage of Coinbase, which will provide unwavering support for the Base chain. Second, the compliance barriers due to the backing of Coinbase, which has higher compliance requirements, making USDC more suitable for adoption on the Base chain due to its higher compliance, thus establishing barriers for other stablecoins. Third, as an infrastructure, the Base chain's high TPS and low gas fees are suitable for various applications of stablecoins.

However, since the Base chain is developed using OP Stack and the application development language is Solidity, its security is somewhat lower compared to the Move language. Additionally, since transactions must be submitted to L1 for final settlement, the finality will be consistent with the Ethereum chain, exceeding 10 minutes, which will reduce the overall stability and reliability of the system.

Ethereum Chain + USDT

The Ethereum chain + USDT solution is one of the earlier stablecoin solutions. Although the total issuance has reached $67.2 billion, the daily settlement volume is $10.4 billion, approximately 15.4% of the total issuance. In contrast, the daily settlement volume of the Solana chain + USDC solution is 5.6 times its issuance, while the Base chain + USDC solution's daily settlement volume is 8.3 times its issuance.

Although USDT's monthly settlement amount shows a growth trend, its growth rate is significantly lower compared to USDC on the Solana and Base chains.

USDT's settlement amount on the Ethereum chain (monthly) Source: Artemis

The main reason is that the Ethereum chain itself has low throughput, high gas fees, long latency, and long finality, which creates significant friction for users using USDT, leading to a substantial reduction in adoption frequency. Due to these issues, the Ethereum chain will lag behind other high-performance, low gas fee public chains in capturing the growth of stablecoins.

Tron Chain + USDT

Due to the significantly lower transfer fees for stablecoins on Tron compared to other chains, Tron has seized this major application scenario for stablecoin transfers. As a result, the issuance of USDT on the Tron chain has reached $59.7 billion, second only to the Ethereum chain, with a daily settlement amount of $24.6 billion, accounting for 41% of its issuance. While stablecoin transfers on Ethereum are driven by on-chain application demand, those on Tron are primarily motivated by low fees, making it the preferred method for many users transferring from exchanges to the chain. In the second half of 2024, Justin Sun proposed a gas-free stablecoin transfer solution to meet the needs of the financial and payment sectors. Driven by the demand for stablecoin transfers, the number of on-chain users on Tron has surpassed 200 million.

For the Tron chain, its revenue mainly comes from two parts: first, stablecoin transfers, and second, meme coin trading. Stablecoin transfers are a core revenue source for Tron and hold indispensable strategic value within the Tron ecosystem. Tron will undoubtedly focus on consolidating this business.

For USDT, transfers on Tron represent its largest application scenario, which is of great importance. In the competition with USDC, USDC holds a clear advantage on the Solana and Base chains.

Competitive Advantages of BenFen Chain + BUSD

Focus on Stablecoin Application Scenarios

The BenFen chain + BUSD solution focuses on stablecoin application scenarios, including PayFi, Card, gas fee payments, P2P, etc., while other chains and stablecoins target a broader range of ecosystem applications, including DeFi, GameFi, Social, Meme, AI, etc., lacking sufficient focus.

Integrated Super Application BenPay: Inbound and Outbound Payments, Exchange, Staking and Lending, Offline Consumption, Red Packet Transfers

BenFen has built a complete and feature-rich super application, BenPay, where users can perform various functions such as inbound and outbound payments, exchanges, staking and lending, offline consumption, and red packet transfers, all within one application to meet multiple user needs.

Security Advantages of Move Language

BenFen uses the Move language as its application development language, which has special security requirements compared to Solidity and Rust, such as a strict type system and the concept of resources, greatly enhancing overall security. Stablecoin applications are high-value applications, and security is paramount.

Improvements in Consensus Mechanism and Cost Optimization Leading to High Performance and Low Gas Fees

The application scenarios for stablecoins require a high-performance and low gas fee underlying public chain. BenFen achieves tens of thousands of transactions per second, 0.5 seconds of latency, and gas fees below $0.001 through improvements in the consensus mechanism and cost optimization, far outperforming the Ethereum chain. An excellent underlying public chain lays the foundation for the application of stablecoins.

High-Value Governance Token BFC

Compared to other chains and applications with dispersed value capture mechanisms, such as ETH capturing Ethereum chain gas fees and UNI capturing Uniswap trading fees, BenFen's governance token BFC can fully capture the value of the entire ecosystem, including the BenFen chain, BenPay DEX, BenPay, BenPay Card, merchant services, and more. Therefore, its value is the sum of all ecosystem project values, making it more valuable.

Smooth User Login Experience: Supports zk-Login, No Seed Phrase Required

Cumbersome seed phrases have always been a barrier for users entering Web3 applications. The BenFen chain supports zk-Login, allowing users to log in to the BenFen chain and its applications using only their Google/Apple accounts, without needing a seed phrase. In contrast, other chains and stablecoin-related applications require users to remember seed phrases, making the process complicated and significantly hindering user adoption.

Driving Factors and Trends: Advantages of Blockchain & Stablecoins Themselves and Support from Policies

The advantages of blockchain & stablecoin solutions over traditional payments are becoming more prominent

Since the emergence of Bitcoin and Ethereum, blockchain has been operating stably for many years, with various applications of stablecoins such as USDT, USDC, and DAI (Lending, DEX, Staking, etc.) continuously emerging, which has basically proven the stability and reliability of this system. In contrast, traditional payment systems like Swift have been criticized by users for their slow settlement and high fees.

Therefore, based on the advantages of blockchain and stablecoins themselves, they will form an alternative to traditional cross-border payment solutions.

Support from Policies: Support from the US, Europe, Japan, and Others

With the conclusion of the US elections, more than half of the members of Trump's team support crypto assets. It can be anticipated that as team members take office, more favorable policies for the crypto market will be formulated and issued. At the same time, Europe has also enacted the Markets in Crypto-Assets Regulation (MiCA). Additionally, Hong Kong, Japan, Singapore, and the UK have introduced stablecoin legislation.

The introduction of these policies and regulations indicates that countries hope to regulate the development of the stablecoin market, guiding it towards a more compliant direction.

Main Risks

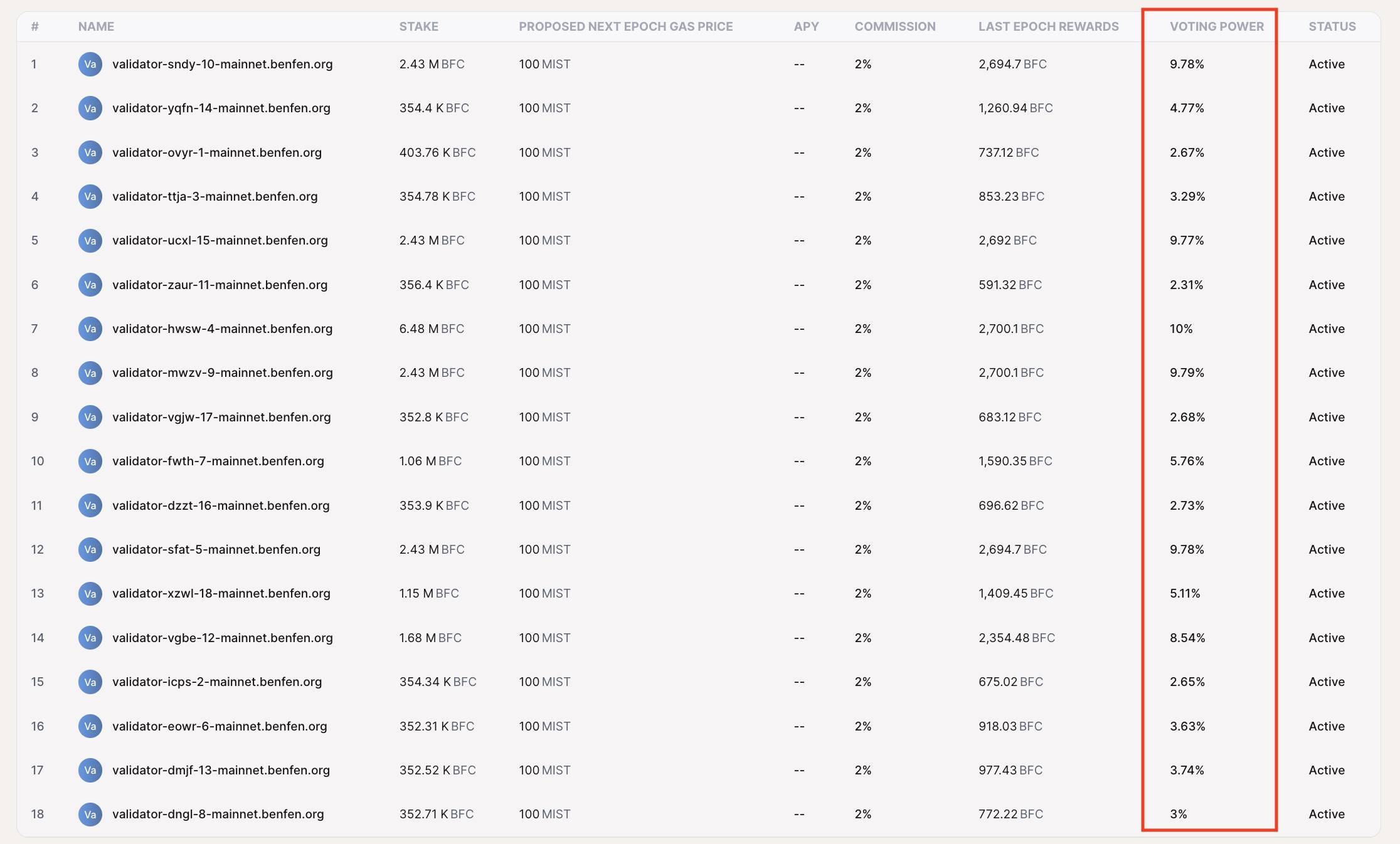

Centralization Risk of Validators

Currently, there are only 18 Active Validators, which is relatively few compared to other public chains, posing a certain risk of validator centralization. However, the Voting Power is relatively evenly distributed, ranging from 2% to 10%, which somewhat reduces the risk of centralization.

Distribution of Voting Power Source: BenFen Explorer

Security Risks of Smart Contracts

The security risks of smart contracts are common challenges faced by all public chains and DApps. Relatively speaking, since BenFen uses the Move language as its application development language, the security of smart contracts has been significantly enhanced. However, due to the inherent complexity of smart contracts, there may still be certain security risks in specific areas.

Value Assessment

Logical Support for Investment

a) The application scenarios based on stablecoins, including cross-border payments, P2P deposits and withdrawals, and offline consumption, represent a rigid demand, and this demand is vast and full of potential.

b) Policies have already been or will be relaxed, and the formulation of policies and regulations has laid the necessary groundwork for the prosperous development of the industry, especially with the appointment of Trump's pro-crypto team, where policy advantages are gradually becoming apparent.

c) The high-performance underlying public chain created by BenFen, combined with a multi-national anchored stablecoin payment solution, precisely meets the core needs of stablecoin application scenarios, namely security, fast settlement, low fees, and smooth entry.

High Investment Value Compliance Assessment

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。