How long does it take to go from 0 to 80 billion in market value? The newly inaugurated U.S. President Trump provided the answer: 31 hours.

Written by: Babywhale, Techub News

How long does it take to go from 0 to 80 billion in market value? The newly inaugurated U.S. President Trump provided the answer: 31 hours. Of course, calculating market value based on token price may not be a universally accepted method, but it must be acknowledged that Trump's team has set a record in the Web3 space that may be unprecedented and hard to replicate in the future. However, this record may serve no purpose other than to prove Trump's nature as a businessman who only acts when there is profit to be made.

The story of these three days is likely already known to everyone. Trump posted a tweet on X announcing the issuance of the "official Trump Meme," which began to rise amid doubts of "possibly being hacked." However, as the tweet remained up for a long time and was confirmed by Trump's son Eric, the market ultimately recognized that this Meme token named TRUMP was indeed issued by the Trump family.

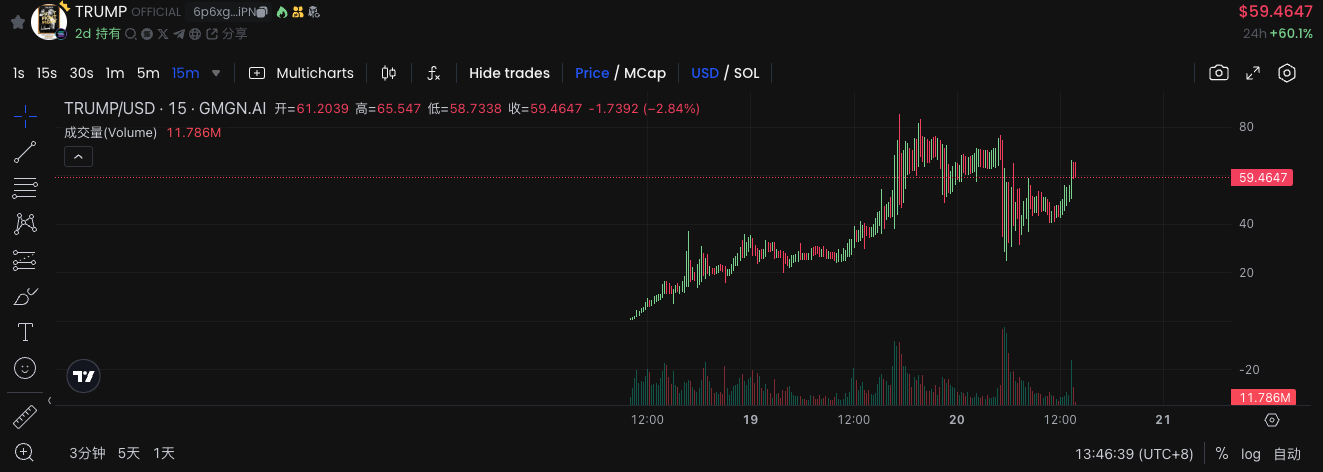

The subsequent developments may have overturned the expectations of everyone inside and outside the Web3 industry. With a total supply of 1 billion, only 20% of TRUMP was released, and the price began to soar. According to GMGN data, the token price rose from an initial $0.18 at 10:00 AM on Saturday to around $80 at approximately 5:00 PM yesterday, accomplishing an impossible task over the weekend.

"Presidential Token" Sparks Controversy

The birth of TRUMP allowed many investors to profit handsomely over the weekend, and major exchanges, including Binance, launched TRUMP spot trading last night, which may have been one of the key drivers pushing its price to at least a temporary high.

From a profit-making perspective, the issuance of a Meme by the U.S. President undoubtedly recognizes and supports the Meme itself and Web3, while also rewarding the on-chain Meme players who stay glued to their computers every day. In fact, the issuance of TRUMP clearly involved a lot of preparatory work, with projects like Meteora and Moonshot providing assistance to varying degrees. Moonshot also reported gaining 400,000 new users in just two days, and its app briefly topped the Apple Store charts.

However, from another perspective, most observers inside and outside the industry have given negative evaluations:

An article from Bitcoin Magazine offered very direct criticism, stating, "This is nothing more than a self-serving scheme to inflate and sell off, an unethical act, and the investors (or rather 'fans') involved are extremely foolish." The author of the article expressed the belief that Trump would not allow Bitcoin to compete with the dollar, which is precisely the original meaning of Bitcoin's existence, and hinted that if Trump truly supported Web3, he should not focus on viewing Web3 as a "casino."

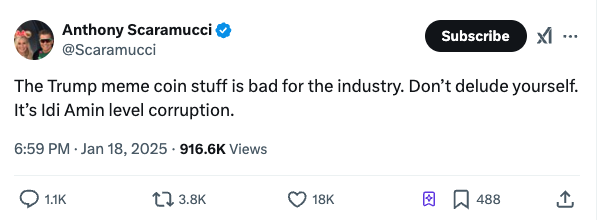

SkyBridge's founder argued that Trump's actions are not beneficial to the industry and supported calling it "corrupt behavior."

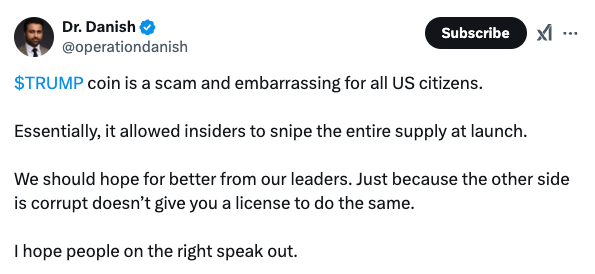

Even a doctor with 1.5 million followers on YouTube spoke out, stating: "Another president's corruption does not mean you can do the same."

Technology Should Be Free, But Not Chaotic

Musk once joked on a show that the Animal Protection Association approached him, asking SpaceX to assess the potential impact of rocket debris on whales, sharks, and other marine life that might fall into the ocean. To refute the Animal Protection Association's belief that the noise from rocket launches would affect seals, they even caught a seal and put headphones on it to let it listen to the noise to prove there was no actual impact.

Silicon Valley tech giants have long expressed their grievances about excessive regulation, which may also be the main reason Musk decided to establish a government efficiency department called "D.O.G.E." American tech giants have always advocated for loosening regulations on technology to enhance innovation capabilities, which is understandable, but weak regulation does not mean a lack of rules; otherwise, "freedom" would turn into "chaos."

In my understanding of the current round of numerous altcoins showing no signs of improvement, a crucial point is that the U.S. regulatory authorities have never clearly defined what these project-issued tokens actually are. If they are a form of security, such as representing equity in the project, then what is the equity of the project operating company? If there is no way to define the actual significance of these tokens, it is challenging for large funds to genuinely invest based on the project's inherent value.

On the other hand, should the project parties regularly disclose the number of tokens they hold? Should the foundation's financial status be disclosed like a financial report? Should project parties disclose when they sell their held tokens? Should the potential market manipulation by exchanges, market makers, and certain so-called whales be regulated?

These are some very basic questions, but it seems they either find this an unsolvable issue or are unwilling to address it. After all, a market with no regulation other than pure fraud is the best tool for capital plunder, much like the early financial markets.

In the current market, the actual definition of altcoins is unclear, and their prices are completely unlinked to the inherent value of the projects. Since this is the case, it is not unreasonable for retail investors to choose to engage in on-chain PvP.

The act of Trump issuing a token itself is not problematic. If it can set an example, clarify many ambiguous issues currently in the crypto space, or make everything transparent, then issuing a token is also justifiable, as there is no law in the U.S. prohibiting the act of issuing tokens itself. However, the problem lies in this seemingly "casual" issuance of a Meme token, which appears to tell everyone: you can issue tokens at will.

No need for any rules, no need for any transparency, simply state your plan, and you can even note in the disclaimer that collective lawsuits cannot be filed. Thus, using IP to issue tokens and then rug-pulling seems to pose no issues, and there are no legal prohibitions against the token issuer selling the tokens they hold.

It is worth noting that this was considered illegal behavior by the previous SEC, such as misleading investors, but was broken by Trump's "leading by example" behavior.

Of course, it is too early to draw conclusions about the next four years based solely on the issuance of a Meme token. Web3 should not be overly restricted by stringent regulations, but it should also define some basic concepts to lay a foundation for more funds to invest based on the inherent value of projects. Meme culture is one of the unique aspects of Web3, but it is not all of Web3, nor is it the most important part.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。