Original article: Biraajmaan Tamuly, Cointelegraph

Translated by: Yuliya, PANews

The price of Bitcoin (BTC) fell again on January 8, forming a bearish engulfing candlestick pattern on the daily chart. This intraday decline is the second largest drop for BTC in nearly 19 weeks.

In the context of uncertain market dynamics, Bitcoin traders and commentators have shared their insights on the possibility of a correction below $90,000.

Stablecoin Supply Enters "Price Discovery" Phase

Data from the U.S. Bureau of Labor Statistics shows that job creation reached 8.1 million at the end of November, exceeding the expected 7.74 million. This data indicates that the U.S. economy is improving, leading to a weakening of the stock and cryptocurrency markets, with Bitcoin plummeting from $102,760 to $92,500.

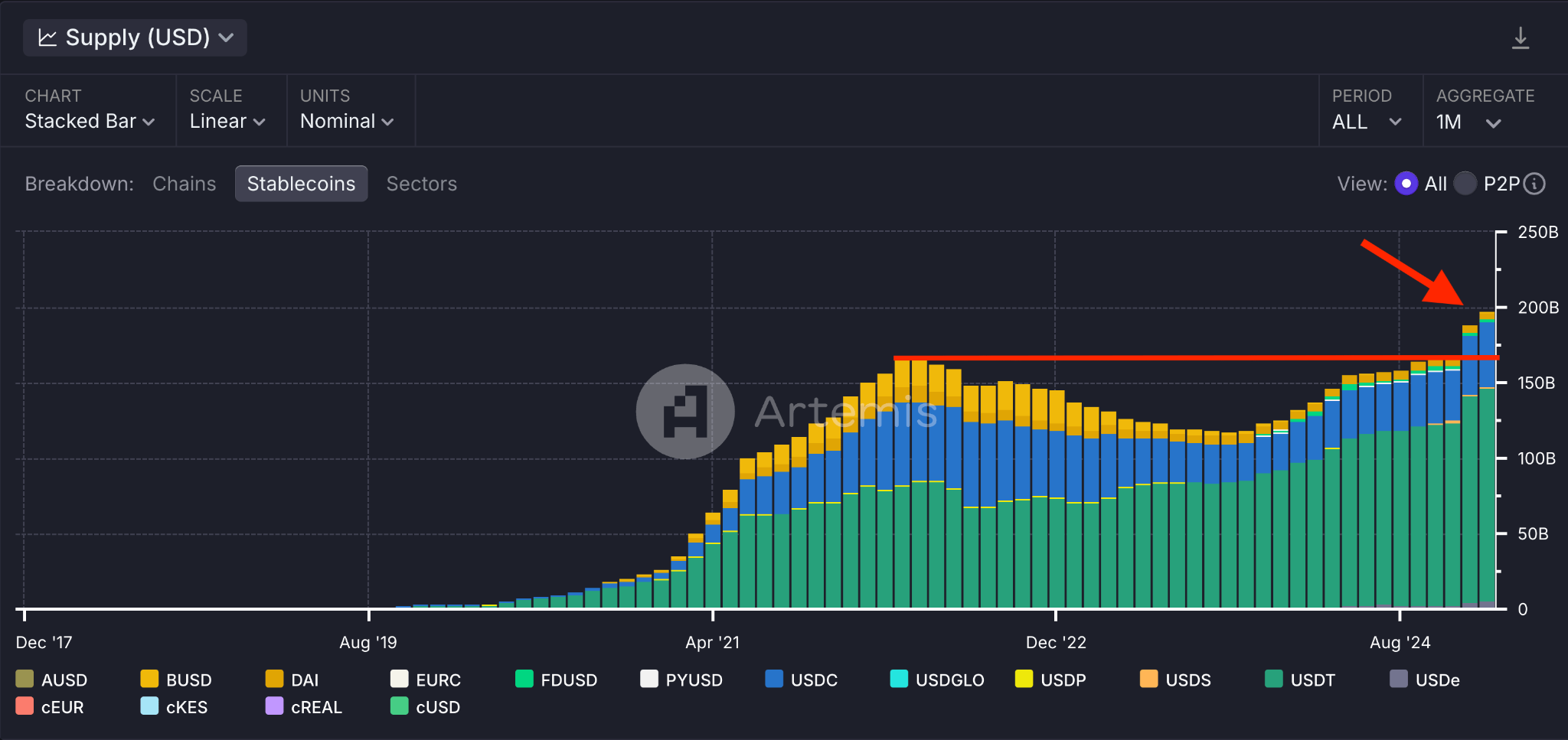

While this development has triggered broader bearish expectations, cryptocurrency analyst Miles Deutcher pointed out that the stablecoin supply has entered a "price discovery" phase, meaning there is more liquidity available in the current crypto ecosystem. The increase in stablecoin supply suggests that more funds may flow in over the coming months.

Market analyst Jamie Coutts shares a similar view, believing that more liquidity will flow in, potentially leading to a rise in BTC prices in six months. Based on the strengthening U.S. dollar, Coutts stated that Bitcoin could have dropped to $80,000, but the potential strength of buying in the BTC market indicates that market expectations remain high.

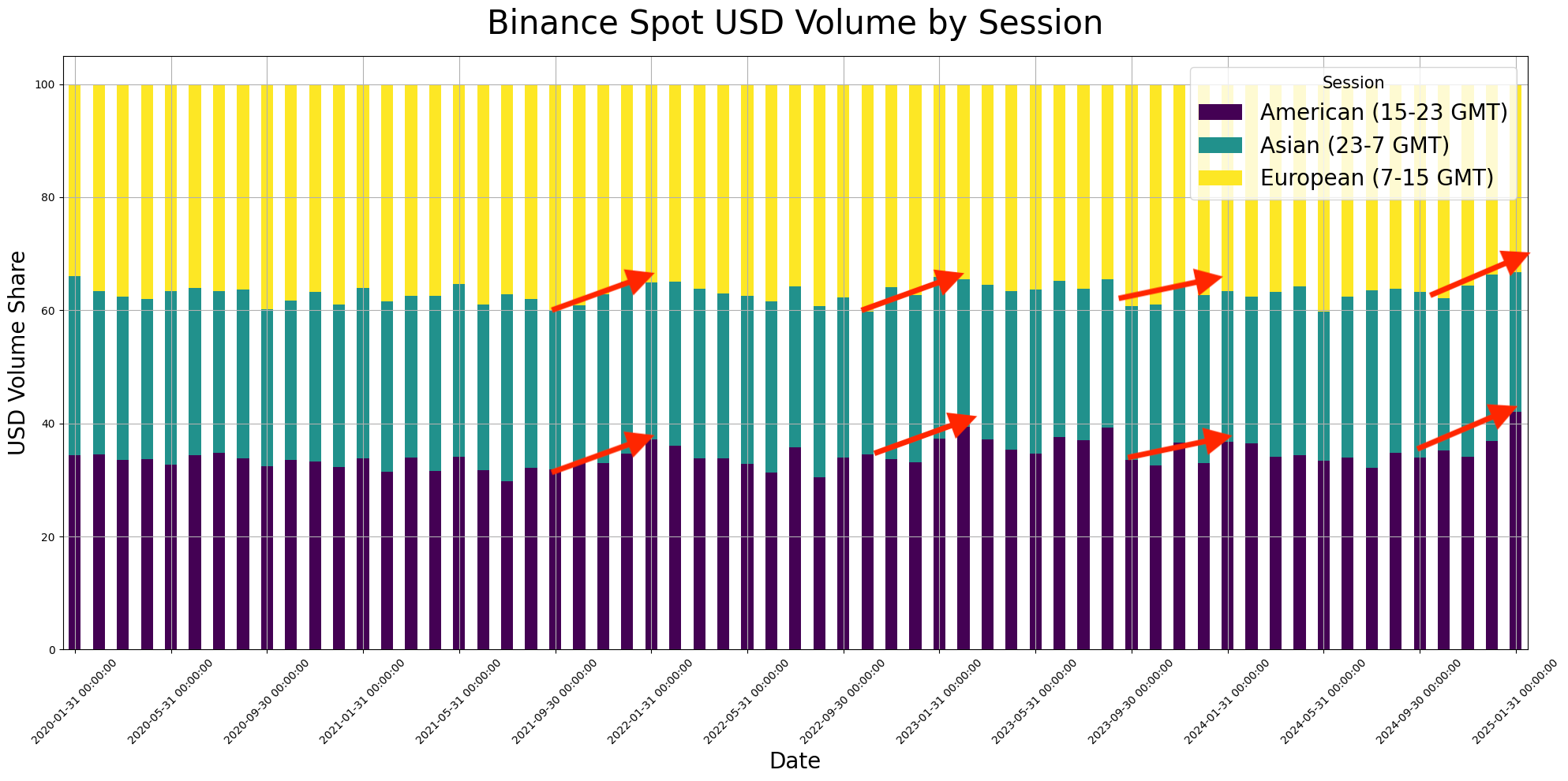

Compared to previous bull markets, the current bull market has shown more liquidity. Data analyst Roman Zinovyev recently emphasized that the dollar trading volume on the Binance spot market has gradually increased since 2020. As shown in the chart, the market share in the Americas reached a historic high of 42% during the 2024-2025 period.

Do On-Chain Data Indicate a Bitcoin Rebound?

Strong on-chain developments do not negate the fact that Bitcoin's 5.15% drop erased the gains made in the previous four days. The probability of an immediate rebound after a drop of 5% or more is also not optimistic.

As shown in the chart, since January 2024, Bitcoin has experienced 15 pullbacks of 5% or more. Of these 15 instances, BTC only rebounded immediately 3 times, indicating a mere 20% probability. Therefore, from a probabilistic perspective, BTC is unlikely to experience a strong upward movement immediately.

Cryptocurrency trader Krillin mentioned that Bitcoin may accumulate between $92,000 and $90,000 in January, followed by a market rally in the coming month.

Cryptocurrency and stock investor Jelle also expressed a similar view after market buying failed to maintain BTC above $100,000. This investor expects a low point around $90,000 to be reached and stated, "Back to the original plan; wait for the low point to be reached before making new highs."

If the daily close falls below $90,000, a deeper Bitcoin crash may occur. Such a level would confirm a reverse head and shoulders pattern, potentially leading to severe consequences. For example, BTC could further decline by 20%, with a price target of $71,500.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。