As one of the leading DeFi aggregators, Odos demonstrates how to enhance the on-chain trading experience through complex algorithms and extensive liquidity integration.

Author: Odos

Compiled by: Deep Tide TechFlow

If you are trading on-chain cryptocurrency without a DeFi aggregator, you may be losing profits unnecessarily.

The emergence of decentralized finance (DeFi) has fundamentally changed cryptocurrency trading, providing users with unprecedented access to assets and financial products. However, trading directly on a single decentralized exchange (DEX) can expose users to issues such as price impact, slippage, security risks, and limited token choices, especially for large or complex trades.

At this point, DeFi aggregators come into play. These platforms solve the trading challenges of a single DEX by distributing trades across multiple liquidity sources, optimizing prices, and reducing risk exposure. As one of the leading DeFi aggregators, Odos showcases how to enhance the on-chain trading experience through complex algorithms and extensive liquidity integration.

Contents

Why Do We Need Aggregators?: Aggregators like Odos are crucial for DeFi traders as they address issues such as price impact, slippage, and access to long-tail assets while enhancing trading security.

Differences Among Aggregators: Different aggregators exhibit significant differences in routing algorithms, liquidity sources, and chain support, resulting in varying service quality.

Unique Advantages of Odos: Odos offers users the best trading pricing and efficiency through its superior routing algorithms, extensive liquidity integration, multi-token swaps, and a new "simple swap" experience.

Why Do We Need Aggregators?

Trading in the DeFi ecosystem can be very complex. Hundreds of decentralized exchanges offer different tokens, fees, and prices. Just as travel platforms like Expedia or Kayak simplify the booking process by comparing multiple airlines and routes, aggregators like Odos eliminate uncertainty in trading by finding the optimal path for your trades.

Core Advantages of Aggregators:

Better Pricing: Aggregators ensure users receive the most valuable trading prices by integrating multiple DEXs and liquidity pools.

Broader Token Selection: Users can access a wider range of tokens, including long-tail assets, without manually searching multiple platforms.

Improved User Experience: Odos simplifies the trading process with tools like "simple swap" and advanced routing, saving users time and effort.

Challenges of Trading on a Single DEX

Decentralized exchanges (DEXs) are a vital infrastructure of the decentralized finance (DeFi) ecosystem. By reserving trading pair tokens in liquidity pools and using mathematical pricing curves to determine exchange rates, DEXs ensure liquidity is always available and permissionless. However, the operational mechanisms of DEXs also present unique challenges that can impact trading.

Price Impact

When trading on a single DEX, large trades can significantly alter the asset ratios within the liquidity pool, leading to adverse price changes. This phenomenon is known as price impact.

The extent of price impact typically depends on the trade size and the depth of the liquidity pool. For large liquidity pools with deep liquidity, even large trades may only cause minor price fluctuations. Conversely, for smaller liquidity pools with shallow liquidity, even medium-sized trades can lead to significant price volatility.

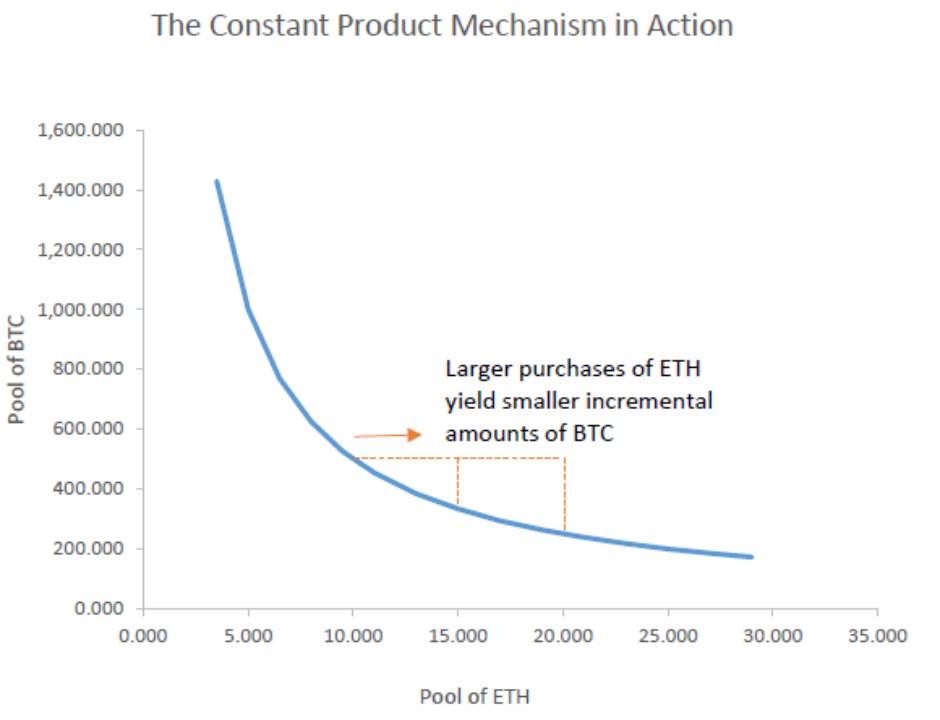

The following diagram illustrates how pricing curves operate in a typical liquidity pool (e.g., ETH/WBTC trading pair). As trades occur, the asset ratios in the pool change, affecting the price ratio.

The diagram shows a visual example of pricing curves. Under the automated market maker (AMM) model, the pricing curve of the liquidity pool dynamically adjusts based on the ratio of tokens in the pool, determining the exchange rate for trades. Source reference here.

Slippage

Slippage refers to the difference between the expected price of a trade and the actual execution price. Rapid market fluctuations or network congestion can cause trades to be executed at prices lower than expected.

Limited Token Choices

A single DEX may not support all tokens, especially some less common long-tail assets, which limits users' trading options.

Security Risks

Trading across multiple DEXs requires repeated token authorizations, increasing users' exposure to malicious contracts or potential security vulnerabilities. For example, the BadgerDAO $120 million exploit was caused by malicious token authorization requests.

Solution: DeFi Aggregators

DeFi aggregators effectively address various trading challenges by optimizing prices, expanding token choices, enhancing security, and simplifying operational processes.

Aggregators minimize price impact and slippage throughout the trading process by integrating with multiple protocols and their liquidity pools, providing users with better exchange rates than a single DEX.

Additionally, aggregators offer a unified and trustworthy interface, reducing the need for users to repeatedly authorize tokens across multiple DEXs, thereby lowering security risks and simplifying the trading process. With an aggregator, you can easily execute complex trades without manually switching between multiple platforms, saving significant time and effort.

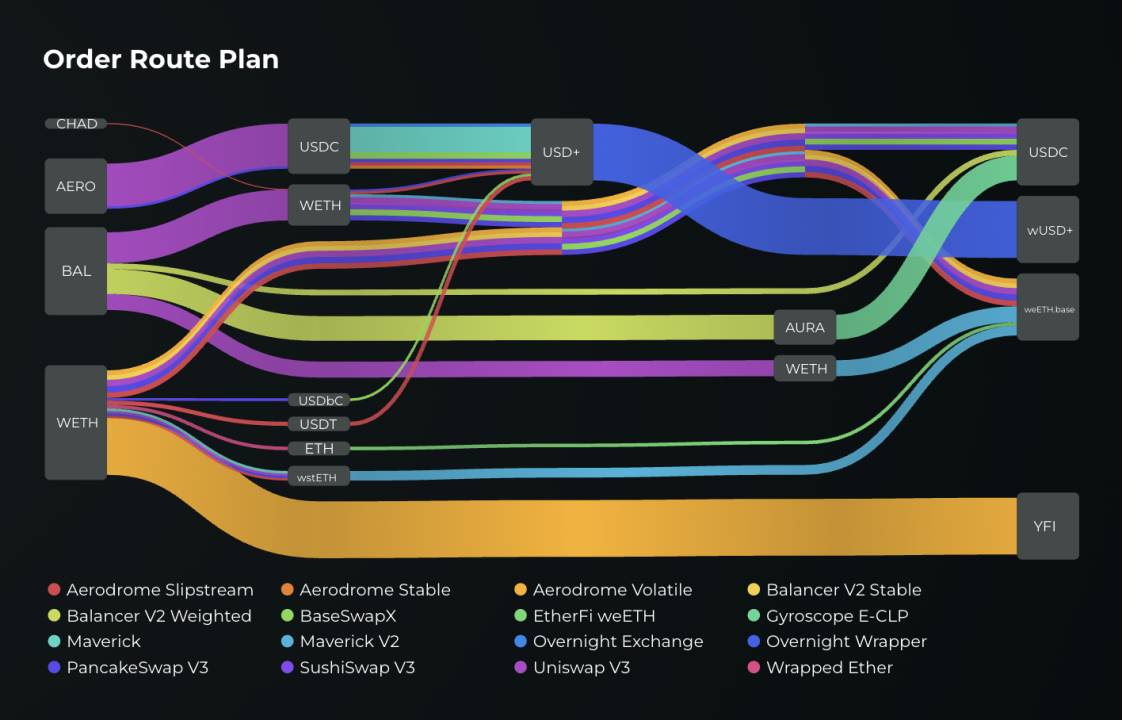

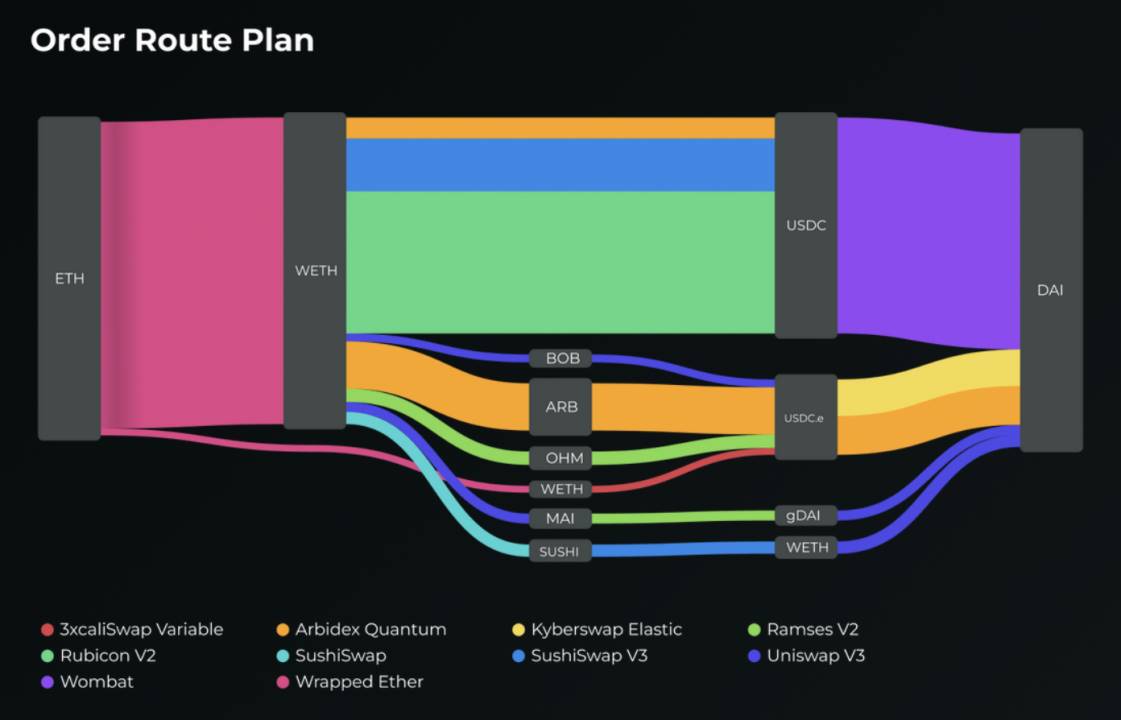

Here is an example of an ETH-to-DAI trade routed through Odos:

Aggregators automatically find the best trading path. Source: Odos dApp.

Not All Aggregators Are the Same

Aggregators are highly efficient in saving trading costs for users, with over 50 aggregators currently in the market, achieving a total daily trading volume of 1-3 billion USD. However, there are significant performance differences among different aggregators.

Routing Algorithms

The core of an aggregator is its routing algorithm. Advanced algorithms can split trades across multiple liquidity pools to minimize price impact; they can also identify arbitrage opportunities in the market to optimize trading prices; at the same time, they can efficiently handle complex multi-token swaps. One could say that advanced algorithms act like experienced traders, seeking the best trading opportunities in the market.

Liquidity Sources

The more liquidity sources an aggregator integrates, and the higher their quality, the better its trading pricing and asset availability. More liquidity sources mean a higher likelihood of finding the best prices, while deep liquidity pools effectively reduce price impact and slippage.

Network Support

Aggregators that support multiple blockchains can provide broader asset coverage, allowing users to access more tokens and trading pairs. Additionally, these aggregators can directly meet the needs of users on their respective chains, eliminating the need for users to spend time transferring assets between different chains. Choosing an aggregator that supports the chain where your assets are located and can meet your trading needs is crucial.

Odos's Leading Position

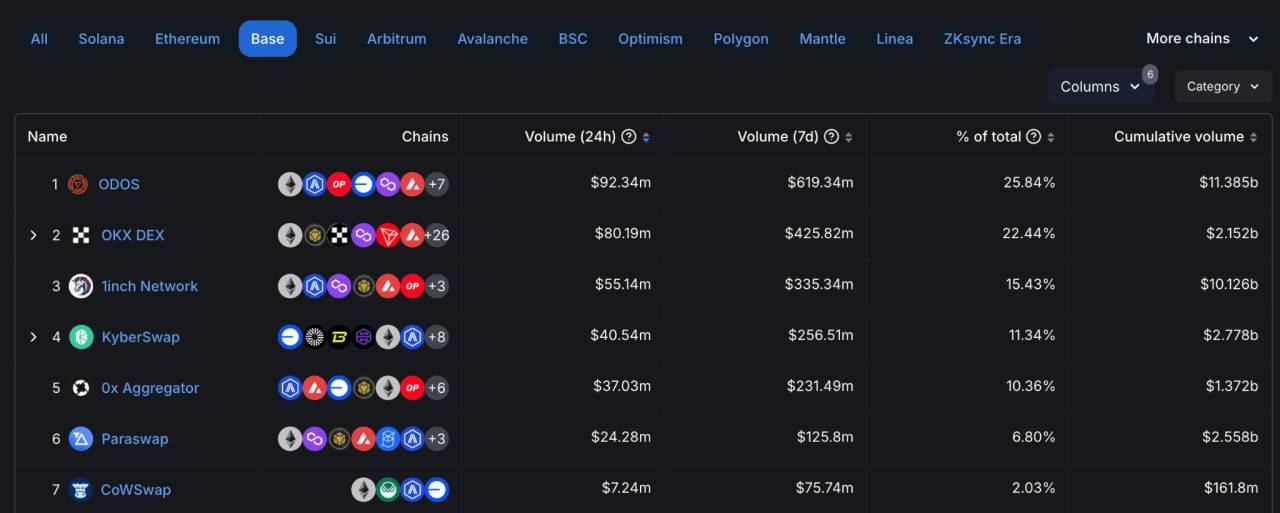

Odos is a leader among most Layer 2 networks (such as Base, Optimism, Arbitrum, zkSync Era, and Mantle) as well as other major networks like Avalanche and Fantom. For instance, on the Base network, Odos's weekly trading volume reaches up to $619 million, nearly double that of the second-largest aggregator on Base.

Odos's trading volume on Layer 2 networks is far ahead, indicating its significant advantages in price optimization. Source reference here.

Why Choose Odos

Odos stands out as a top DeFi aggregator due to its complex smart order routing algorithm. Through this algorithm, Odos can provide users with the best trading paths, ensuring optimal trading pricing and efficiency.

Superior Routing Algorithm

Odos employs a proprietary algorithm that intelligently seeks the optimal trading path for users. It can split trades across multiple liquidity pools to reduce price impact and leverage price differences between different liquidity pools to save costs for users. Additionally, Odos can explore a large number of intermediary tokens to discover arbitrage opportunities between tokens that users do not trade directly.

Notably, Odos supports multi-token atomic swaps, allowing users to exchange multiple tokens in a single transaction. This feature not only showcases Odos's flexibility but also enhances trading efficiency. Atomic swaps are a technology that ensures both parties in a trade execute simultaneously, avoiding the risk of unilateral default, thus providing users with higher trading security.

Extensive Liquidity Integration

Odos integrates over 900 liquidity sources, covering a vast network of decentralized exchanges (DEXs). Its support for 14 EVM-compatible blockchains, including Ethereum, Arbitrum, and Base, provides users with unparalleled broad coverage.

In addition, Odos supports trading of over 100,000 tokens, covering almost all mainstream and long-tail assets, allowing users to easily find the trading pairs they need.

More Than Just DEX

The strength of Odos lies in its consideration of not only DEXs but also multiple DeFi protocols in its routing optimization. For example, Odos can convert stETH to ETH through the Lido protocol, providing users with a more cost-effective trading path. It can also leverage private liquidity sources to unlock more hidden value for users. This support for complex scenarios allows Odos's routing capabilities to far exceed those of traditional aggregators.

User-Friendly Experience

Odos offers a friendly interface that caters to both novice and experienced traders. For new users, the Simple Swap feature launched by Odos greatly simplifies the DeFi trading process. It allows trades to be completed without the need for users to hold native Gas tokens, completely avoiding slippage issues through fixed pricing, making trading simpler and more reliable.

For experienced users, Odos provides Advanced Swaps and Limit Orders features. Advanced Swaps allow users to comprehensively configure parameters such as liquidity sources and slippage tolerance. At the same time, innovative visualization tools (such as Sankey diagrams) intuitively display the trading path, allowing users to clearly understand the execution details of each step of the trade. Whether you are a novice or an experienced trader, Odos provides powerful tools to optimize your trading.

Ready to Change Your Trading Experience?

In the fast-evolving DeFi world, using an aggregator like Odos is not just an advantage but an essential choice. Odos helps users fully unlock the potential of their crypto assets by providing better prices, simplifying complex operational processes, and enhancing trading security.

Don't miss out on profits any longer. Start using Odos today and unlock a new trading experience!

Visit app.odos.xyz, connect your wallet, and embark on a smarter trading journey. Explore the infinite possibilities of the DeFi world through optimized trading paths. Make every trade worthwhile and achieve more with Odos.

Join the Odos Community

Become a core member shaping the future of DeFi:

Participate in the Odos Loyalty Program: Earn $ODOS rewards through trading. For details, visit https://app.odos.xyz/rewards

Get the Latest Updates: Follow Odos on Twitter to stay updated.

Engage and Learn: Join Odos's Discord to exchange experiences with community members.

Experience Optimized Trading: Visit app.odos.xyz to personally experience how Odos enhances your trading efficiency.

If you are interested in integrating our API, please refer to our documentation.

Note: This article is for informational purposes only and does not constitute financial advice. Please do your own research before engaging in cryptocurrency trading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。