The Federal Deposit Insurance Corporation (FDIC), an entity originally formed to restore trust in the American banking system, on Friday, quietly released letters it had previously sent to banks prohibiting them from engaging in any “crypto-related activity,” as part of an alleged covert effort to undermine the entire cryptocurrency industry, a project informally dubbed Operation Choke Point 2.0.

The corporation provides deposit insurance to banks and “directly supervises and examines more than 5,000 banks and savings associations for operational safety and soundness,” according to its website.

Between March 2022 and May 2023, the FDIC, in its supervisory capacity, sent at least twenty-five letters to banks asking them to “pause” all services related to digital assets, to “not implement” crypto-related products, and to “refrain from expanding” services involving crypto.

“The FDIC has not yet determined what, if any, regulatory filings will be necessary for a bank to engage in this type of activity,” the regulator wrote in one of its first letters sent to a bank in March 2022.

The FDIC did not publish the letters willingly. Rather, they were forced by a June 2024 court order filed by cryptocurrency exchange Coinbase (through its contractor History Associates), to release the letters after initially turning down the exchange’s Freedom of Information Act (FOIA) request.

“We finally got the unredacted OCP [Operation Choke Point] 2.0 letters from the FDIC,” Coinbase Chief Legal Officer Paul Grewal posted on X “It took a court order, but you can now read them for yourself below. They show a coordinated effort to stop a wide variety of crypto activity.”

Names of the various financial institutions were redacted in the public copies available on the FDIC website. It’s not clear if Coinbase received unredacted copies as per Grewal’s post.

Several themes stood out in the letters, the first and most obvious being a push by the regulator to force banks to cease any crypto-related activities with no date given to resume such activities.

The second theme was to request an unusually burdensome amount of paperwork from banks that were attempting to offer fairly straightforward crypto services to their customers.

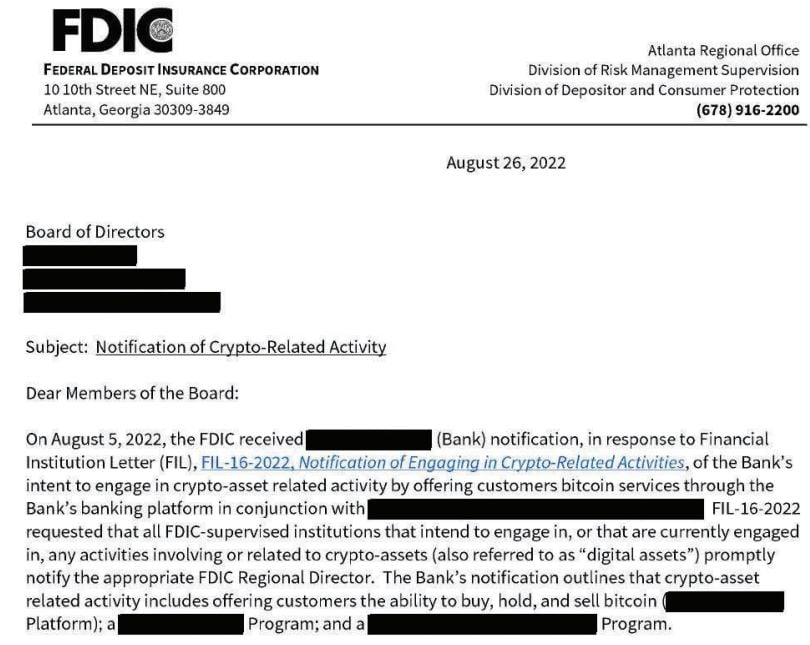

FDIC “pause letter” sample / FDIC.gov

One institution that simply wanted to allow its customers to buy bitcoin using online banking in conjunction with a third-party, was slapped with nearly three pages of thirty-six questions ranging from a request for a full strategic and marketing plan all the way to “the bank’s analysis of SEC SAB 121 and its applicability,” after receiving a letter in August 2022 (document 18).

The U.S. Securities and Exchange Commission (SEC) Staff Accounting Bulleting 121 (SAB 121) is an accounting guideline that makes it onerous for banks to service crypto clients.

Another letter from April 2022 (document 8) sent to a bank that wanted to set up a blockchain-based service, had almost four-and-a-half pages of questions about governance structure, accounting methods for digital assets, exposure to other banks, risk management and controls, and more.

One final theme that began in September 2022 (document 20) is the FDIC’s request that recipients of its letters keep the documents confidential.

“This letter is confidential and may not be disclosed or made public in any manner under part 309 of the FDIC Rules and Regulations,” the FDIC wrote.

The referenced confidentiality policy likely played a key role in keeping the public uninformed about the regulator’s questionable approach.

“It’s hard to believe in their good faith when their sweater further unravels every time we pull on the thread,” Grewal said. “The new congress should launch hearings on all this without delay.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。