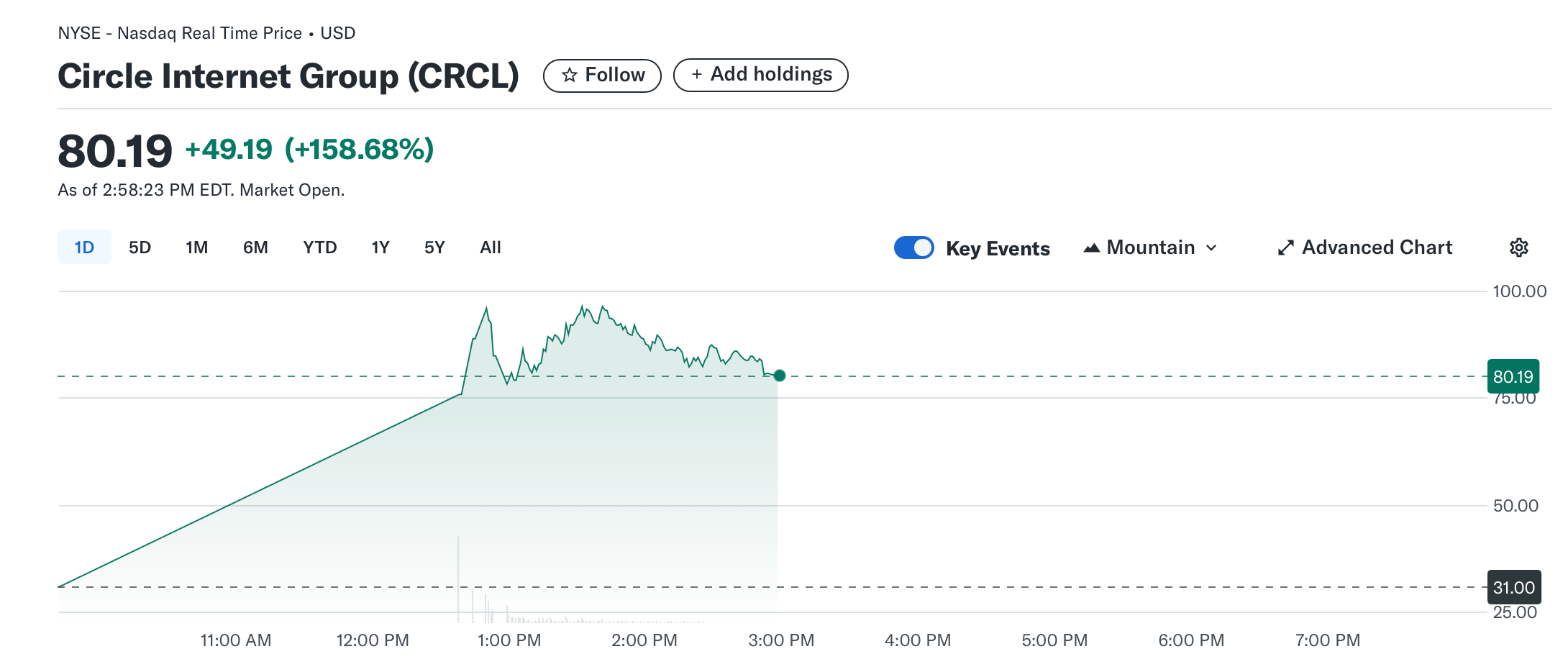

在撰写本文时,纽约证券交易所(NYSE)的上市使Circle Internet Financial(CRCL)的完全稀释市值徘徊在约167.9亿美元。周四,股票的需求很大,截至下午中段,交易量约为34,355,443美元。

周四下午3点,CRCL股票的情况。

在社交媒体上,用户们纷纷发表评论,分析Circle首次亮相的热潮。“Circle的交易价格为85美元,较31美元的IPO价格上涨,”加密倡导者Yano在X上发布。“每个投资银行和CEO现在都在盯着这个数字,心里想着‘是时候了。’准备迎接一波加密IPO的浪潮,”Yano继续说道。

其他人则采取了更轻松的语气,其中一条调侃写道:

想象一下Gensler在《华尔街日报》上阅读Circle IPO的情景,真有趣。

Galaxy Digital的研究主管Alex Thorn反思了这段旅程,他表示:“当我在2018年(在富达时)遇到Circle团队并听到他们转向‘稳定币’的故事时,我觉得他们疯了,抓住了稻草。我错了!在经历了十多年几乎尝试每种加密商业模式后,他们公开上市真是史诗般的成就。”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。