Tether's market share is expected to fall below 50% by 2025, challenged by yield-bearing stablecoins.

Author: Galaxy Research

Compiled by: Deep Tide TechFlow

From the 2025 cryptocurrency predictions by @glxyresearch, covering price trends of Bitcoin and Ethereum, ETHBTC ratio, Dogecoin and D.O.G.E., stablecoins, DeFi, L2 solutions, policies, venture capital, and more. Here are the predictions we just shared with @galaxyhq clients and partners:

Bitcoin price is expected to break $150,000 in the first half of 2025 and reach or exceed $185,000 in the fourth quarter.

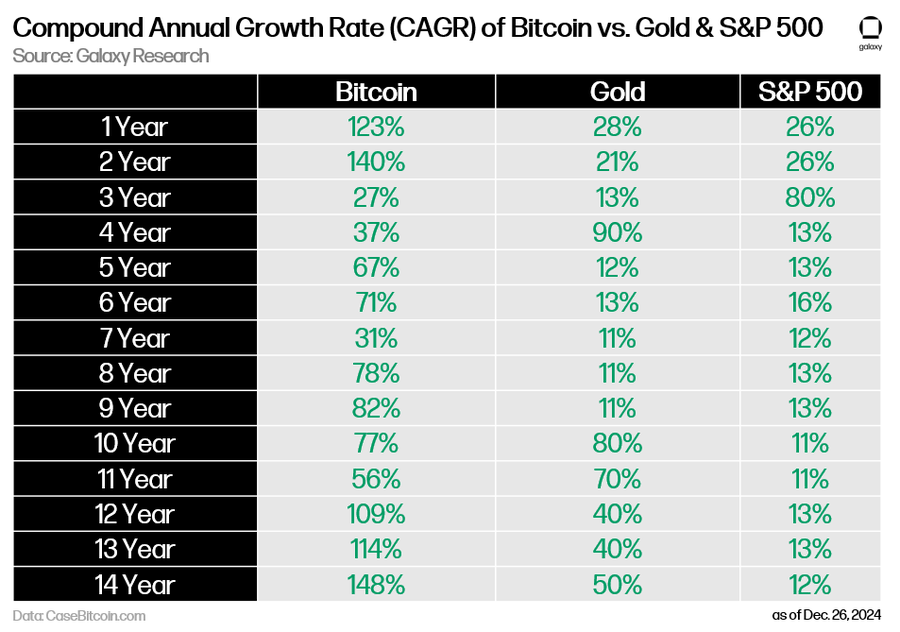

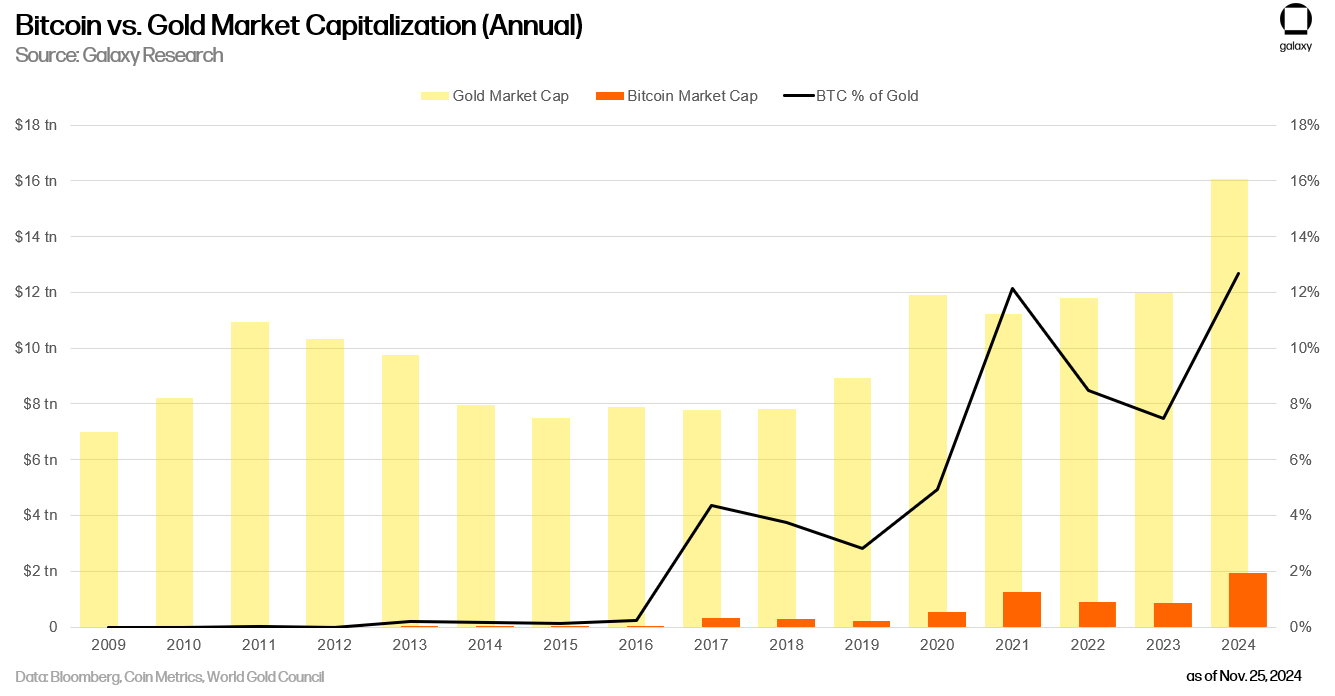

Adoption at the institutional, corporate, and national levels will be the main driving force behind Bitcoin's price reaching new highs in 2025. Since its inception, Bitcoin's appreciation rate has outpaced all other asset classes, especially the S&P 500 and gold, and this trend is expected to continue in 2025. Bitcoin's market capitalization is projected to reach 20% of the total gold market capitalization.

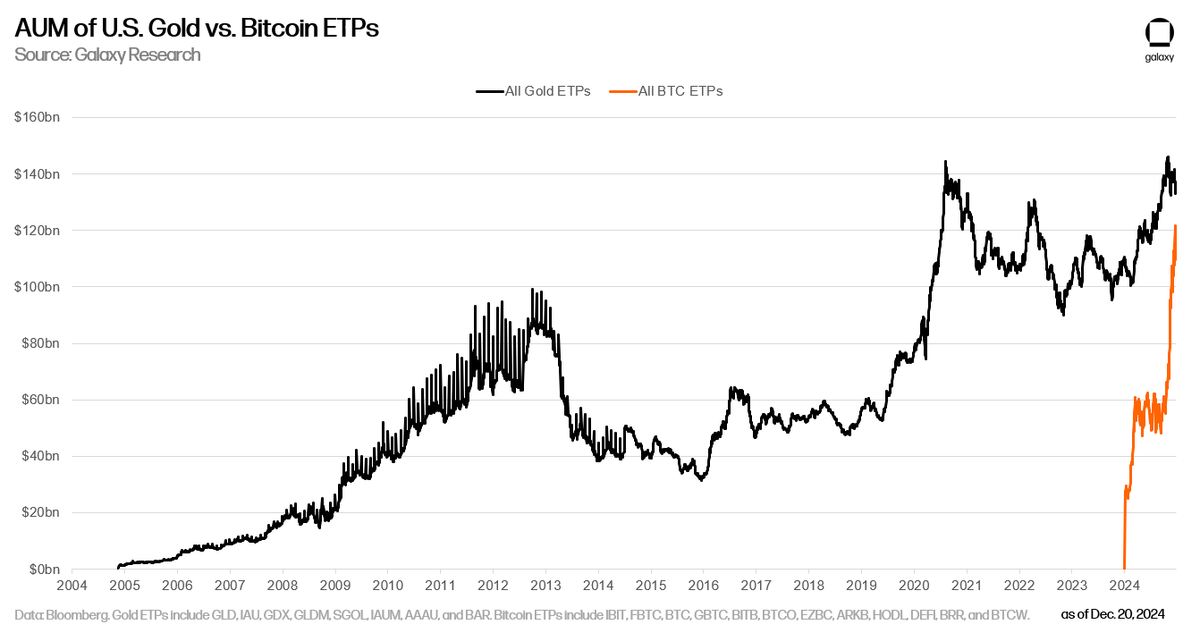

The total assets under management (AUM) of U.S. spot Bitcoin ETPs will exceed $250 billion in 2025.

In 2024, Bitcoin ETP products attracted over $36 billion in net inflows, becoming the best-performing ETP product lineup in history. Many of the world's top hedge funds (such as Millennium, Tudor, and D.E. Shaw) have chosen Bitcoin ETPs, and according to 13F filings, the State of Wisconsin Investment Board (SWIB) also holds related positions. In just one year, the AUM of Bitcoin ETPs is only $24 billion (19%) away from surpassing the total size of all U.S. physical gold ETPs.

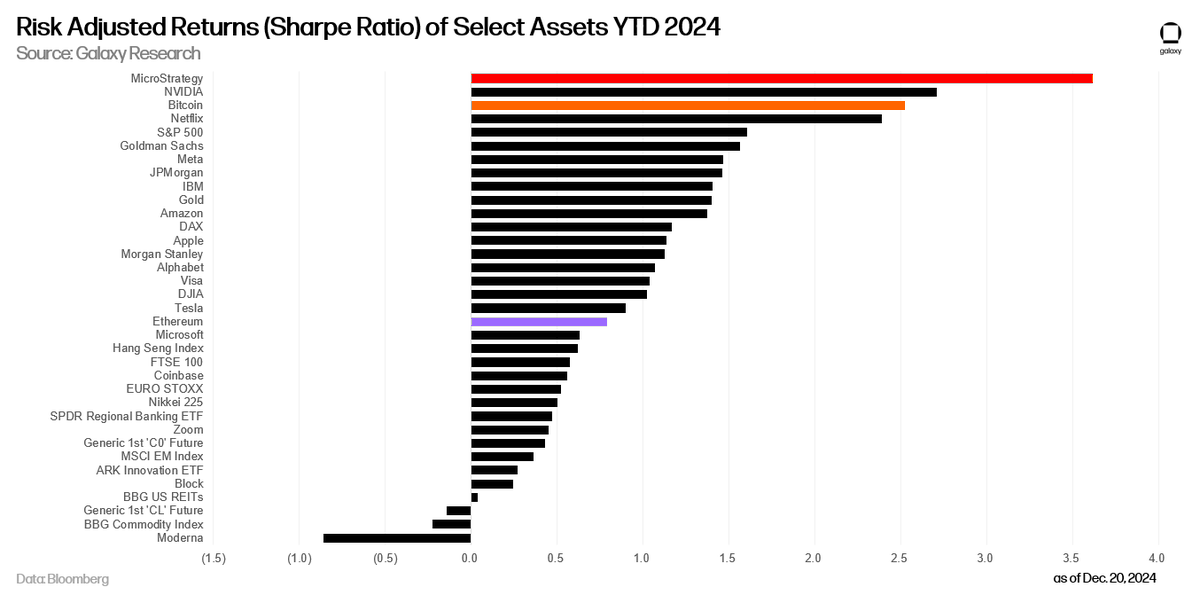

Bitcoin will again be one of the best-performing assets globally on a risk-adjusted basis in 2025.

Bitcoin's outstanding performance is not only due to record capital inflows but also driven by price increases in 2024. According to risk-adjusted return metrics, Bitcoin ranks third among global assets, behind only a few top assets. MicroStrategy, which calls itself the "Bitcoin treasury," has particularly outstanding Sharpe ratio performance.

At least one top wealth management platform will recommend clients allocate 2% or more of their portfolio to Bitcoin in 2025.

Due to factors such as investment familiarization periods, internal education, and compliance requirements, no major wealth management firm currently includes Bitcoin allocations in its investment recommendations. However, this situation is expected to change in 2025, further driving inflows and AUM growth for U.S. spot Bitcoin ETPs.

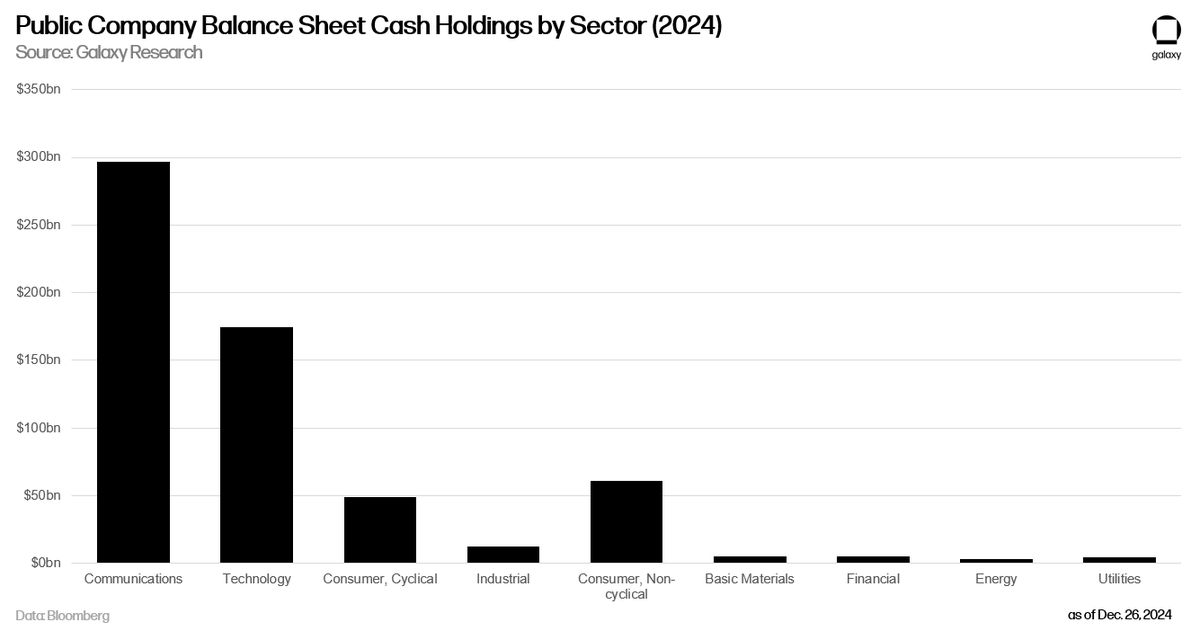

Five Nasdaq 100 companies and five countries will announce the inclusion of Bitcoin in their balance sheets or sovereign wealth funds.

Whether for strategic needs, portfolio diversification, or trade settlement considerations, Bitcoin will gradually enter the balance sheets of major corporations and national-level investors. In particular, non-aligned countries, those with large sovereign wealth funds, and even countries opposed to the U.S. will actively acquire Bitcoin through mining or other means.

- JW

Bitcoin developers will reach consensus on the next protocol upgrade in 2025.

Since 2020, Bitcoin core developers have been discussing how to enhance transaction programmability by introducing opcodes. As of the end of 2024, the most supported opcodes include OPCTV (BIP 119) and OPCAT (BIP 347). Although consensus on Bitcoin's soft forks is extremely rare and time-consuming, it is expected that an agreement will be reached in 2025 to jointly promote the introduction of OPCTV, OPCSFS, and/or OP_CAT. However, this upgrade will not activate in 2025.

More than half of the top 20 publicly listed Bitcoin mining companies by market capitalization will announce transformations or partnerships with hyperscalers, AI, or high-performance computing (HPC) companies in 2025.

With the surge in computing demand from AI, Bitcoin miners will gradually retrofit existing facilities, build new infrastructure, or jointly deploy mining farms with HPC companies. This trend will limit the annual growth rate of global computing power, which is expected to reach 1.1 zettahash by the end of 2025.

These predictions outline a possible blueprint for the cryptocurrency market in 2025, filled with opportunities and challenges.

- @intangiblecoins, @SimritDhinsa

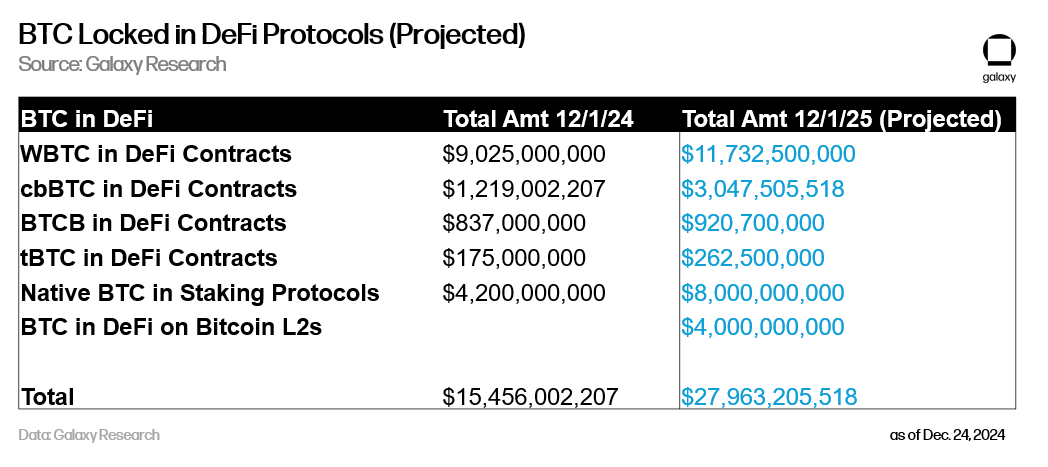

The Bitcoin DeFi market size is expected to double by 2025.

As of the end of 2024, over $11 billion of wrapped Bitcoin (such as WBTC) has been locked in DeFi smart contracts. Of this, over 70% of the locked Bitcoin is used as collateral for lending protocols. Additionally, approximately $4.2 billion is deposited through Bitcoin's largest staking protocol, Babylon. The current total valuation of the Bitcoin DeFi market is $15.4 billion, and significant growth is expected by 2025. This growth will come from multiple directions, including existing DeFi protocols on Ethereum L1/L2, new DeFi protocols on Bitcoin L2, and staking layers like Babylon. Key drivers for the market doubling include: a 150% year-on-year increase in cbBTC supply, a 30% increase in WBTC supply, Babylon's TVL reaching $8 billion, and new Bitcoin L2 networks achieving $4 billion in DeFi TVL.

Ethereum price is expected to break $5,500 in 2025.

As regulatory pressure eases in the DeFi and staking sectors, Ethereum will reach a historic high in 2025. Collaboration between DeFi and traditional finance may unfold in a new regulatory sandbox environment, allowing traditional capital markets to explore public blockchains more deeply, with Ethereum and its ecosystem being the main beneficiaries. At the same time, enterprises will gradually attempt Layer 2 networks based on Ethereum technology. Some public blockchain-based games may find product-market fit, and NFT trading volume will also see a significant rebound.

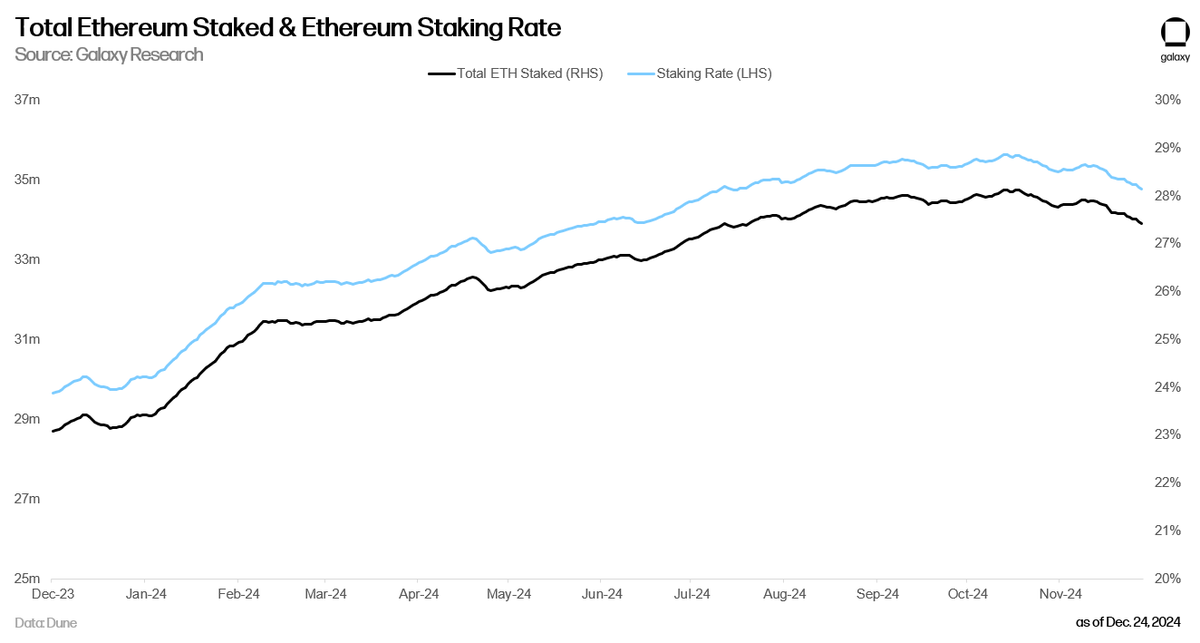

Ethereum staking rate is expected to exceed 50% in 2025.

The U.S. government may provide clearer regulatory guidance for the crypto industry, such as allowing spot ETH ETPs to stake a portion of their held ETH. Demand for staking will continue to grow next year, and by the end of 2025, the amount of staked Ethereum may exceed half of its circulating supply. This will prompt Ethereum developers to seriously consider adjusting the network's monetary policy. At the same time, the rising staking rate will further drive demand and value inflows into staking pools (such as Lido and Coinbase) and re-staking protocols (such as EigenLayer and Symbiotic).

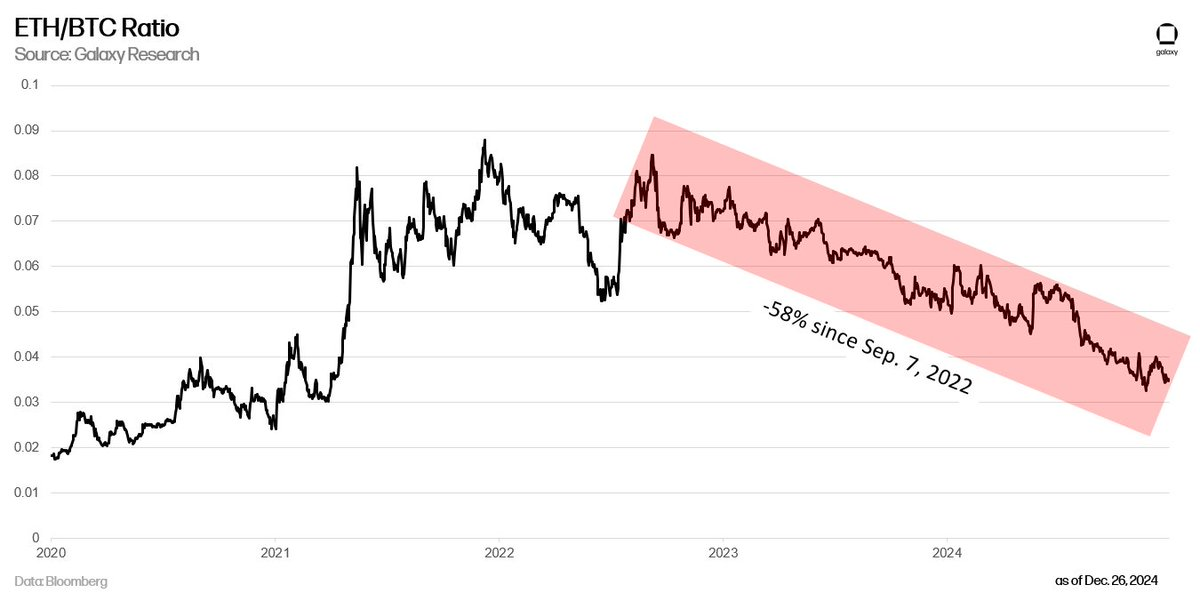

The ETH/BTC ratio is expected to fall below 0.03 in 2025 but will rebound to above 0.06 by the end of the year.

The ETH/BTC ratio is one of the most closely watched trading pairs in the crypto market. Since Ethereum completed its "Merge" upgrade and transitioned to proof of stake in 2022, the ratio has been on a downward trend. However, changes in the regulatory environment are expected to particularly support Ethereum and its application layer, especially DeFi, reigniting investor interest in the world's second-largest blockchain.

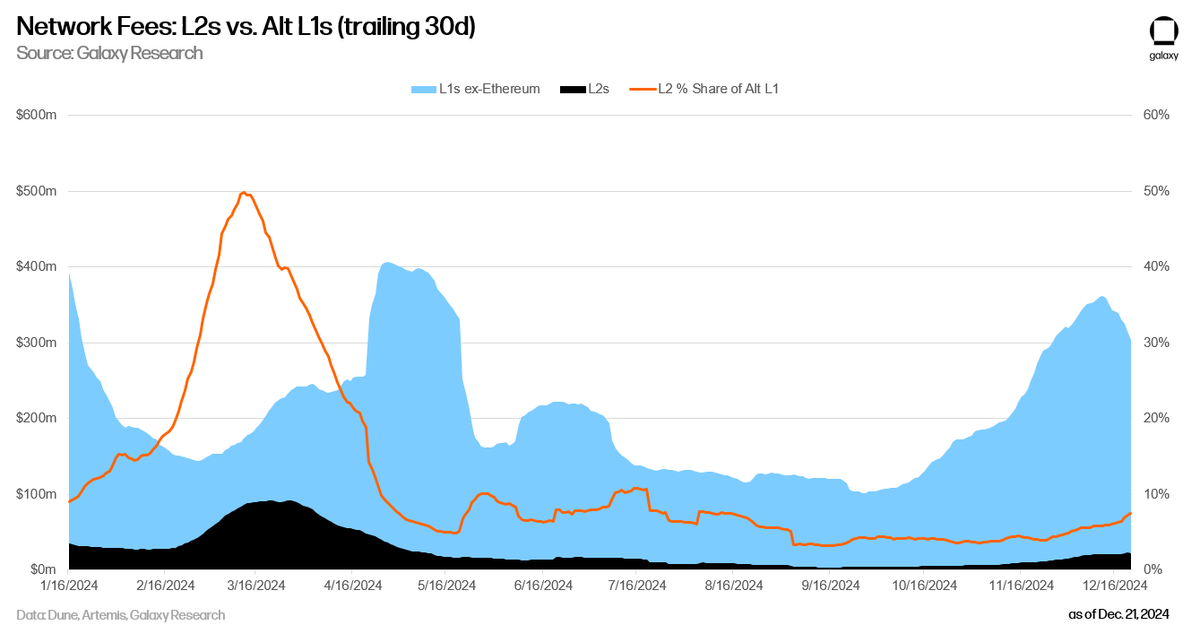

L2 economic activity is expected to surpass other Alt L1 networks in 2025.

The fee share of L2 networks (currently in the mid-single digits) is expected to exceed 25% of the total fees of Alt L1 by the end of the year. As L2 networks approach their scaling limits at the beginning of the year, transaction fees may frequently spike, forcing networks to adjust gas limits and blob market parameters. However, technical solutions (such as the Reth client or alternative virtual machines like Arbitrum Stylus) will enhance the efficiency of Rollups, keeping transaction costs within acceptable ranges.

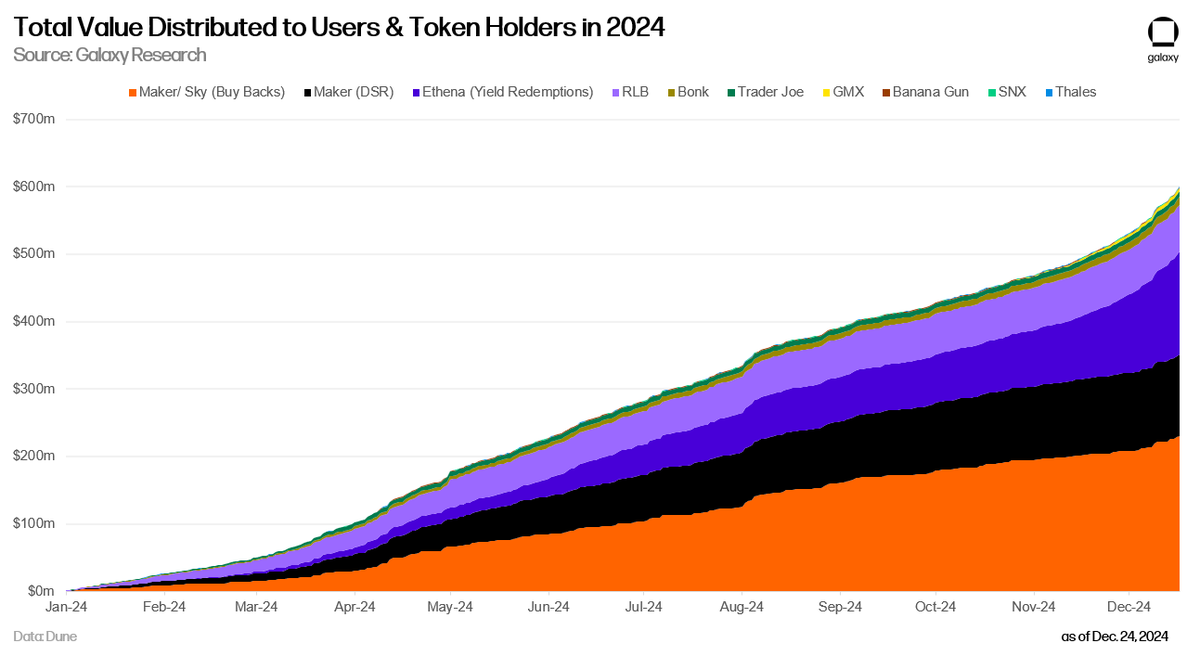

DeFi may enter a "dividend era" in 2025, with on-chain applications expected to distribute at least $1 billion in value to users and token holders.

As DeFi regulation gradually clarifies, the value-sharing mechanisms of on-chain applications will expand. Projects like Ethena and Aave have already begun discussing or implementing fee mechanisms through proposals that will allow users to benefit directly. Other protocols that previously opposed such mechanisms (like Uniswap and Lido) may reassess their positions due to regulatory clarity and competitive pressure. A more lenient regulatory environment and increased on-chain activity suggest that protocols may engage in buybacks and direct income distribution more frequently.

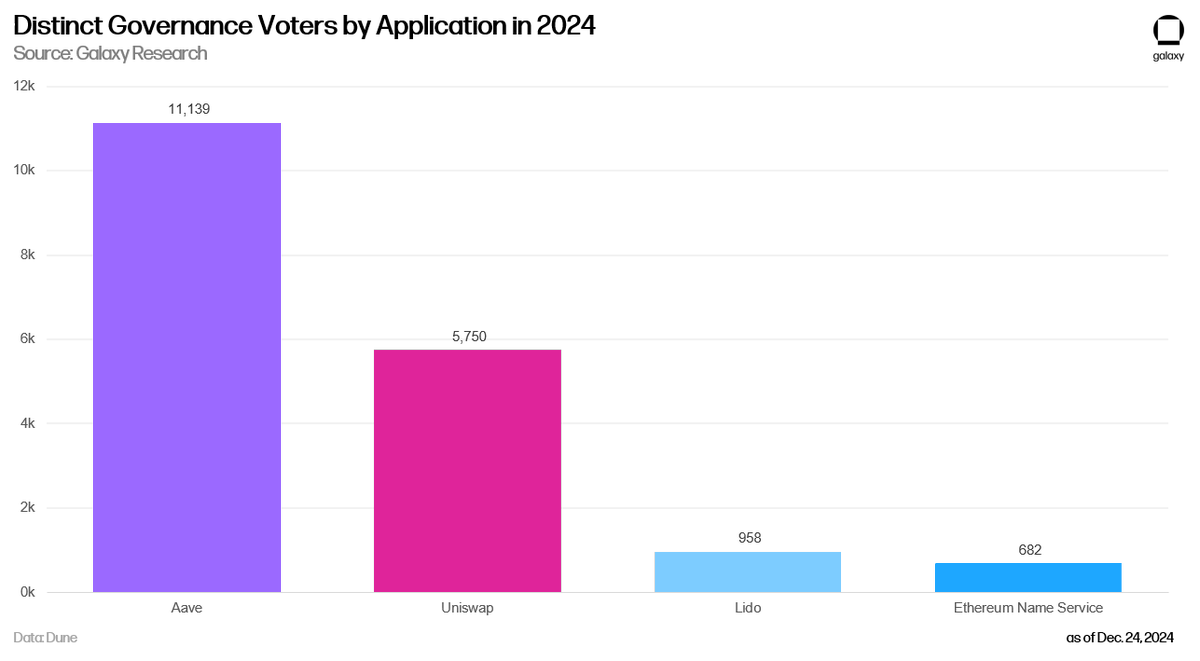

On-chain governance may see a revival in 2025, with applications attempting governance models based on futurism.

The total number of active voters in on-chain governance is expected to grow by at least 20%. On-chain governance has long faced two main issues: low participation rates and a lack of diversity in voting (most proposals pass with overwhelming majorities). However, with regulatory pressure easing and the success of Polymarket, these two issues are expected to improve in 2025. At that time, more applications will shift from traditional governance models to futurism-based governance models, enhancing voting diversity and optimizing governance outcomes.

The world's four major custodians are expected to begin offering digital asset custody services in 2025.

The Office of the Comptroller of the Currency (OCC) plans to provide a policy path for national banks to custody digital assets, which will drive the world's four major custodians—BNY Mellon, State Street, JPMorgan Chase, and Citibank—to launch digital asset custody services in 2025.

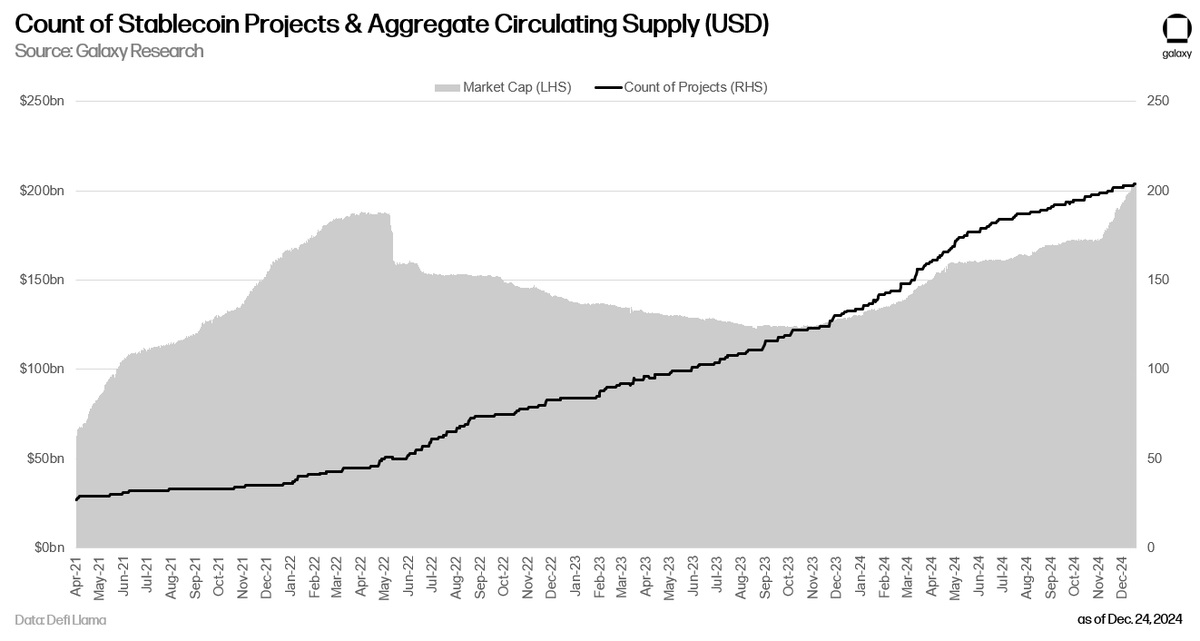

At least ten stablecoins supported by traditional finance are expected to launch in 2025.

From 2021 to 2024, the stablecoin market has grown rapidly, with 202 projects currently in existence, some of which have established close ties with traditional finance (TradFi). Not only is the number of projects increasing, but their trading volume is also growing at a pace far exceeding that of traditional payment networks, such as ACH (approximately 1% annual growth) and Visa (approximately 7% annual growth). In 2024, stablecoins are gradually integrating into the global financial system. For example, the U.S.-licensed FV Bank has supported direct stablecoin deposits, while Japan's three major banks are collaborating with SWIFT through the Pax project to enable faster and lower-cost cross-border fund transfers. Payment platforms are also actively building stablecoin infrastructure, such as PayPal launching the PYUSD stablecoin on the Solana blockchain, and Stripe acquiring Bridge to natively support stablecoins. Additionally, asset management giants like VanEck and BlackRock are collaborating with stablecoin projects, actively positioning themselves in this field. As the regulatory environment gradually clarifies, traditional financial institutions will further integrate stablecoins into their businesses to seize market opportunities and lay the groundwork for future development.

- JW

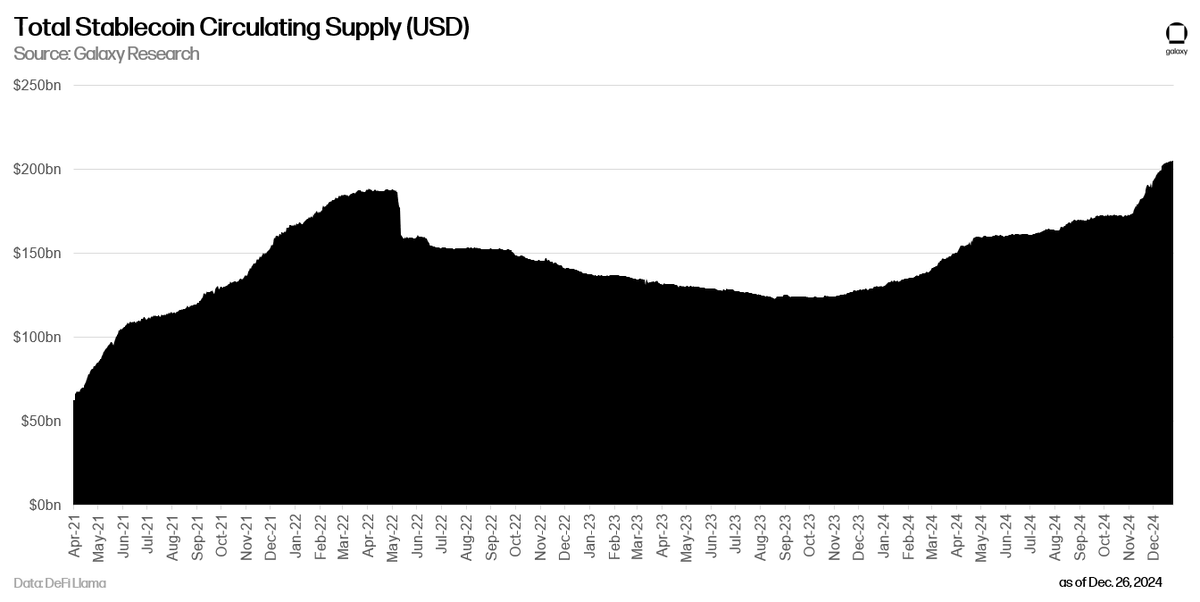

The total supply of stablecoins is expected to double by 2025, exceeding $400 billion.

The application of stablecoins in payments, remittances, and settlements is rapidly growing. With increasing clarity in the regulation of existing stablecoin issuers and traditional banks, trusts, and custodians, the supply of stablecoins is expected to experience explosive growth in 2025.

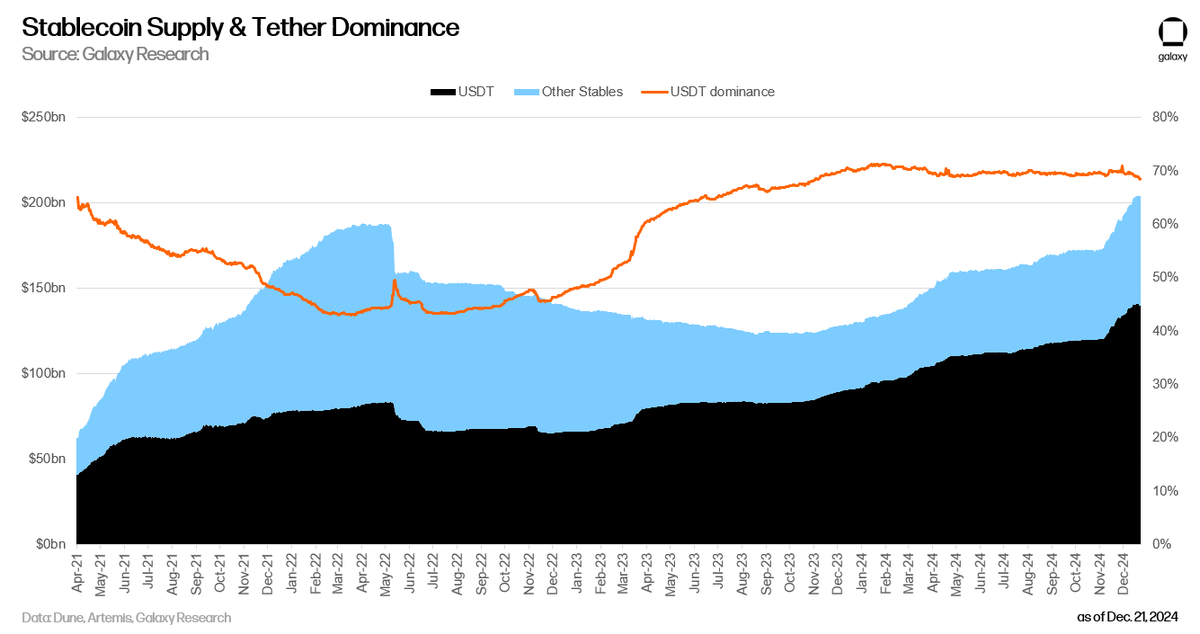

Tether's market share is expected to fall below 50% by 2025, challenged by yield-bearing stablecoins.

Tether uses the income from its USDT reserves to fund its portfolio, but other stablecoin issuers and protocols are attracting users through revenue sharing, which will lead existing users to shift from Tether to yield-bearing solutions. For example, the USDC rewards paid on Coinbase's exchange and wallet balances will become a strong attraction, driving the entire DeFi sector and potentially being integrated by fintech companies to enable new business models. In response, Tether may begin distributing the income from collateralized assets to USDT holders and may even launch competitive yield-bearing products, such as a market-neutral stablecoin.

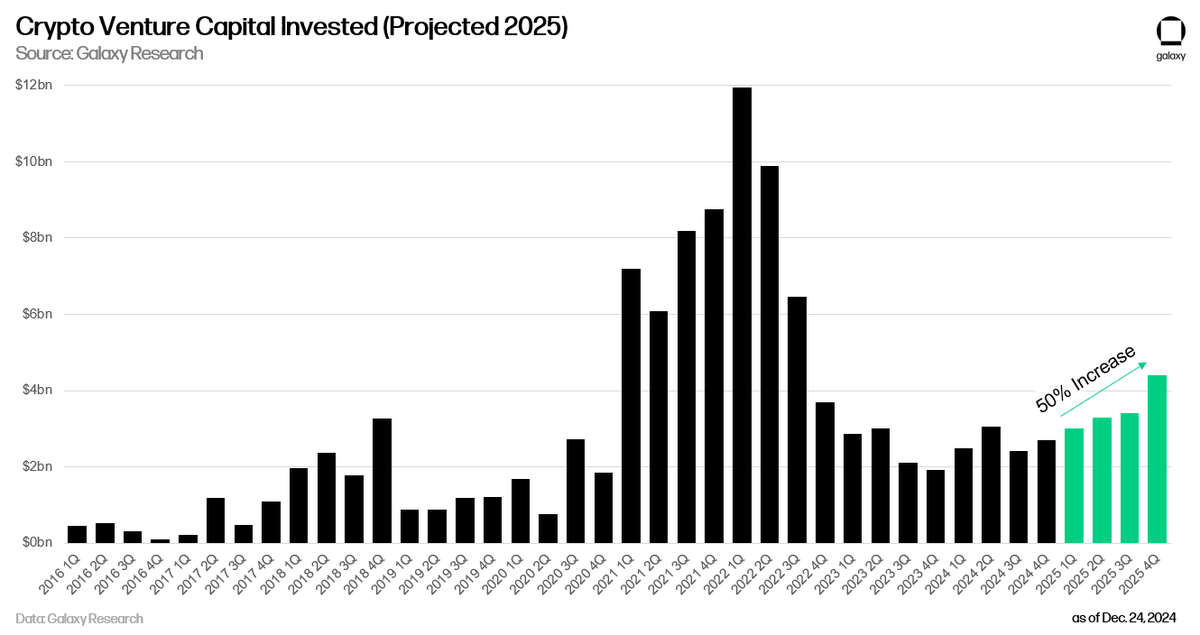

Total capital investment in crypto venture capital (VC) is expected to exceed $150 billion in 2025, with a year-on-year increase of over 50%.

As interest rates decline and the regulatory environment for crypto improves, investor interest in venture capital will significantly increase, driving a surge in venture capital activity. Historically, fundraising in crypto venture capital has lagged behind broader crypto market trends, and a "catch-up" phenomenon may occur in the next four quarters.

- @hiroto_btc, @intangiblecoins

Stablecoin legislation is expected to pass both houses of Congress in 2025 and be signed by President Trump, but market structure legislation may not pass.

Legislation establishing a registration and regulatory framework for stablecoin issuers is expected to pass with bipartisan support and be signed into law by the end of 2025. The growth of the supply of dollar-backed stablecoins will solidify the dollar's global dominance and further promote the development of the U.S. Treasury market. Combined with the easing of restrictions on banks, trusts, and custodians, the adoption of stablecoins is expected to grow significantly. However, market structure legislation (such as establishing registration, disclosure, and regulatory requirements for token issuers and exchanges, or adjusting existing SEC and CFTC rules to cover these entities) is expected to be more complex and will likely not be completed and signed into law by 2025.

The U.S. government is not expected to purchase Bitcoin in 2025, but it may utilize existing reserves to build inventory and promote discussions on expanding Bitcoin reserve policies among government departments and agencies.

- @intangiblecoins

The U.S. Securities and Exchange Commission (SEC) is expected to investigate Prometheum, the first "special purpose broker-dealer."

Prometheum, a previously unknown broker-dealer, suddenly obtained a new broker-dealer license in 2023 and publicly supported SEC Chairman Gensler's views on the securities status of digital assets, raising widespread skepticism. Its CEO faced questioning from Republican lawmakers during a congressional hearing, and according to FINRA records, Prometheum's alternative trading system (ATS) has not conducted any trades. Republicans have called for the Department of Justice and SEC to investigate whether Prometheum has "ties to China," while also pointing out irregularities in its fundraising and financial reporting. Regardless of whether an investigation is launched, the "special purpose broker-dealer" license is expected to be abolished in 2025.

Dogecoin may break $1 for the first time in 2025, with a market cap expected to reach $100 billion.

As the most well-known and historically significant memecoin in the world, Dogecoin's market performance is expected to reach new heights in 2025. However, its market cap peak may be surpassed by the budget cuts identified and successfully implemented by the "government efficiency department." This department is expected to identify and implement cuts exceeding Dogecoin's market cap peak in 2025.

Disclaimer:

Members of Galaxy and/or Galaxy Research hold Bitcoin, Ethereum, and Dogecoin. Many predictions have not been shared, and more predictions can be made. These predictions are not investment advice and do not constitute an offer, recommendation, or invitation to buy or sell any securities (including Galaxy securities). These predictions represent the views of the Galaxy Research team as of December 2024 and do not necessarily reflect the positions of Galaxy or any of its affiliates. These predictions will not be updated.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。