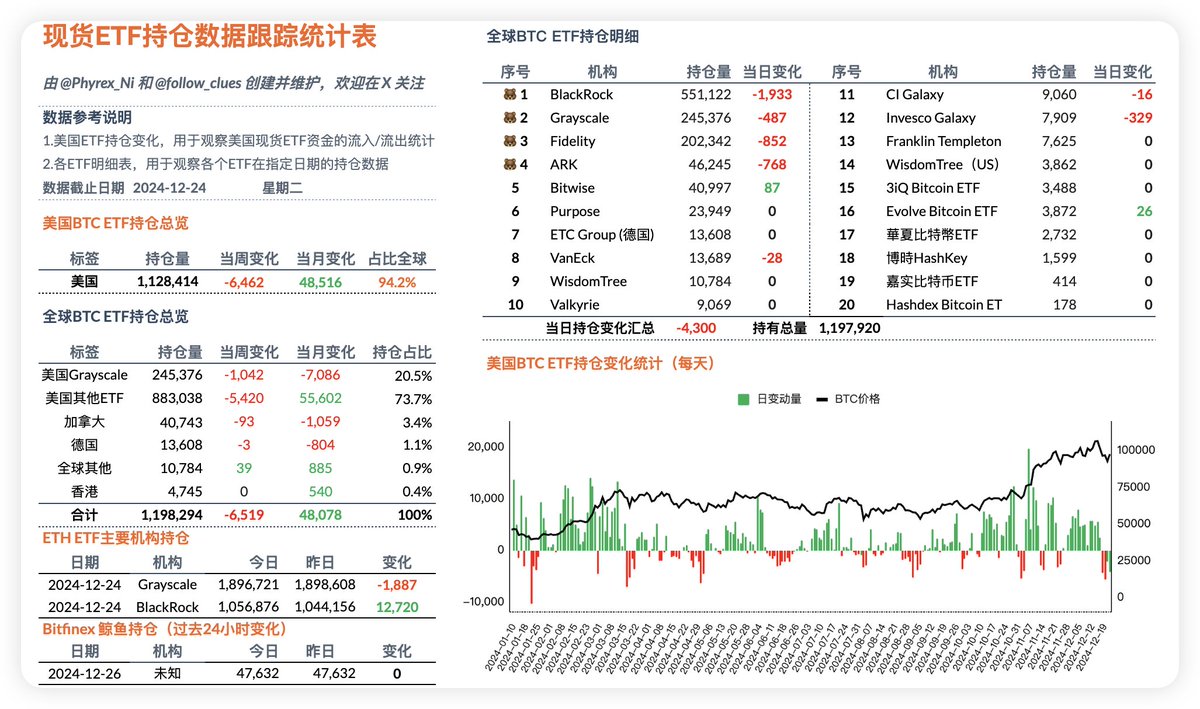

It has been the third consecutive working day that the BTC spot ETF is in a state of net outflow, and the outflow amount has not only not shown a significant slowdown but has actually increased, especially with BlackRock still on the list of reductions, ranking first in the reduction list, having reduced nearly 2,000 #BTC. This is the largest single-day reduction by BlackRock in the history of the BTC spot ETF.

Fidelity, ARK, Grayscale, and Invesco have also reduced hundreds of BTC. On Christmas Eve, apart from Bitwise, which had an increase of 87 BTC, the other seven firms all had reductions, with the rest being zero. Although the price of BTC has rebounded nicely during the Christmas holiday, the panic sentiment among U.S. ETF investors can still be seen, and it has not ended before Christmas.

Tomorrow, when looking at today's data, we will be able to see if investor sentiment has improved. However, based on the current price fluctuations of BTC, it is estimated that the outlook is not very optimistic.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。