Regarding the RWA document, I feel it is positive, and the meaning is clear:

RWA is no longer in a regulatory gray area; the essence of the asset determines the regulatory jurisdiction. Going on-chain does not equal innovation; compliance is the threshold. As for what constitutes compliance, the document also explains it quite clearly:

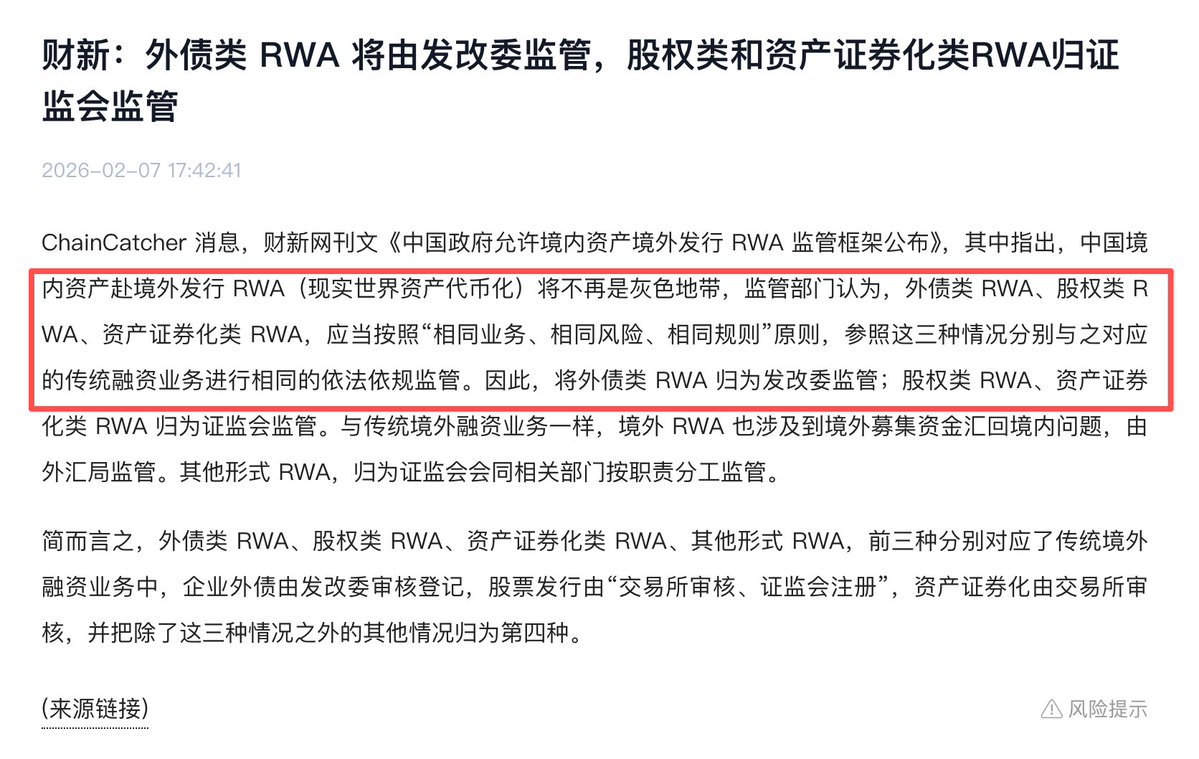

Foreign debt RWA falls under the regulation of the National Development and Reform Commission; equity RWA and asset securitization RWA fall under the regulation of the China Securities Regulatory Commission.

In other words, in China, RWA is not for retail investors; it has nothing to do with us retail investors, but is meant for the financial system:

The future is: financial institutions leading + strict regulation + non-retail-oriented.

Essentially, from a regulatory perspective, it has completely shut down the fantasy of "using RWA for implicit foreign capital introduction / fund repatriation."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。