What impact will the addition of these new platforms have on the development of the Web3 industry in Hong Kong?

Written by: Mankun Blockchain Legal Services

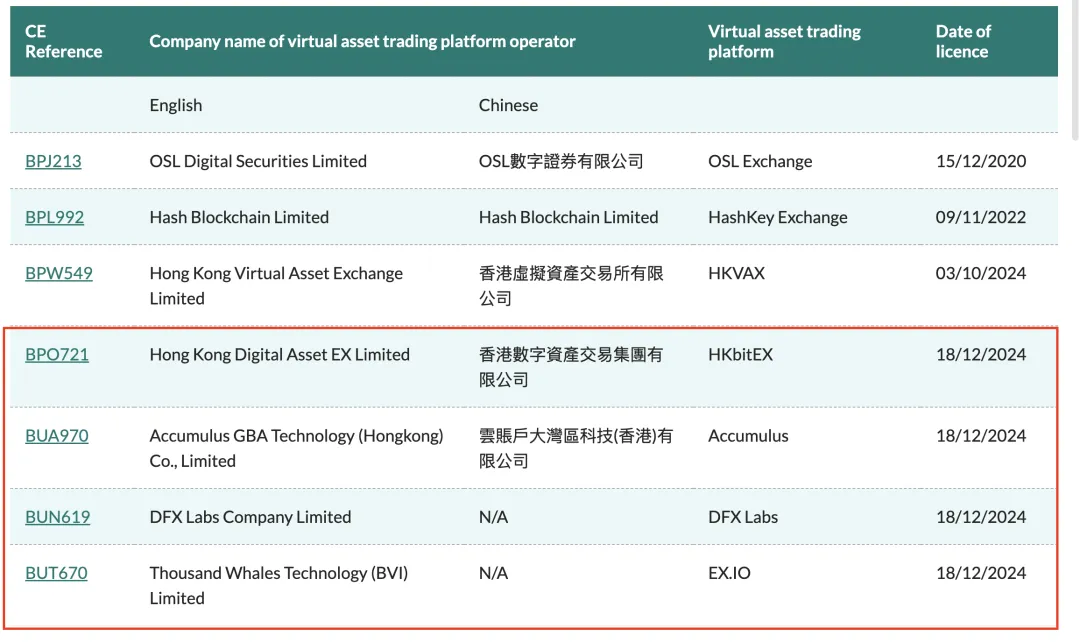

Recently, the Hong Kong Securities and Futures Commission (SFC) updated the list of licensed virtual asset trading platforms on its official website. Since 2020, Hong Kong has been issuing licenses for virtual asset trading platforms approximately every two years. However, just two months after HKVAX was licensed, four new licensed platforms were added all at once. Who are these new players? What impact will their addition have on the development of the Web3 industry in Hong Kong? Today, Mankun Lawyers will take you on a deep dive.

▲Source: SFC Official Website

What is a Virtual Asset Trading Platform Operator?

With the rapid development of global virtual assets, especially the continuous approval of Bitcoin and Ethereum ETFs, the importance of virtual asset trading platforms as the "hub" of the market has become increasingly prominent.

Virtual Asset Trading Platform Operators refer to centralized virtual asset trading platforms that operate in Hong Kong or actively promote services to Hong Kong investors. Their main characteristics include:

Centralized operation;

Operating in Hong Kong or promoting services to Hong Kong investors;

Providing virtual asset trading services.

Operators meeting the above conditions must apply for the relevant licenses from the Hong Kong SFC and accept its regulation.

According to the Securities and Futures Ordinance (Cap. 571) and the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615) (the Anti-Money Laundering Ordinance), compliant virtual asset trading platform operators typically need to hold the following licenses:

Type 1 License (Securities Trading);

Type 7 License (Providing Automated Trading Services);

AMLO License (Anti-Money Laundering Compliance).

Compared to entities that only need to hold a Type 9 License (Asset Management) to engage in virtual asset investment activities, the compliance threshold for virtual asset trading platforms is significantly higher. This difference mainly stems from the SFC's greater focus on market integrity, trading security, and investor protection for VATPs, while the Type 9 License emphasizes compliance in asset management and fund operations.

If you are interested in further understanding the differences between VASP (Virtual Asset Service Provider) and VATP (Virtual Asset Trading Platform) licenses, you can refer to Mankun Lawyers' previous research article (Hong Kong Virtual Currency License Application, What is the Difference Between VASP and VATP? | Mankun Web3 Legal). We conducted an in-depth comparison of the two in that article.

Overview of New Licensed Platforms

HKbitEX

Background: Hong Kong Digital Asset Trading Group (HKbitEX) is a subsidiary of Taiji Capital Group Limited, holding Type 1, Type 7, and AMLO licenses issued by the SFC.

Business Scope: Headquartered in Hong Kong, with operations covering multiple regions in Asia.

Parent Company Overview: Taiji Capital was established in 2018, focusing on developing a digital financial ecosystem that combines blockchain and compliant Web3 technology to support the development of the real economy. It includes four wholly-owned subsidiaries: HKbitEX, Pioneer, O’Hash, and ON1ON Limited.

Accumulus

Background: Accumulus is operated by Cloud Account Greater Bay Area Technology (Hong Kong) Limited, the overseas business headquarters of the Chinese Fortune 500 company Cloud Account Technology (Tianjin) Co., Ltd.

Platform Positioning: Focused on providing long-term stable cryptocurrency trading services for Hong Kong users.

Parent Company Overview: Cloud Account is the largest online human resources service company in China, with a revenue of 108.4 billion RMB in 2023 and a tax payment of 7 billion RMB, with an expected revenue of 120 billion RMB in 2024. The company is headquartered in Tianjin, China.

DFX Labs

Background: DFX Labs is a subsidiary of the Hong Kong-listed company Lianlian Digital (02598), holding Type 1, Type 7, and AMLO licenses issued by the SFC.

Core Business: Focused on providing compliant virtual asset trading services.

Parent Company Overview: Since its establishment in 2009, Lianlian Digital has achieved a total payment volume (TPV) of 2 trillion RMB, covering over 100 countries and regions worldwide. The company is headquartered in Hangzhou, Zhejiang, China.

EX.IO

Background: EX.IO is operated by Thousand Whales Technology (BVI) Limited, with major investors including Huasheng Capital, a subsidiary of Sina.

Platform Features: EX.IO claims to be the first licensed institution in Hong Kong with a securities brokerage background.

Investor Overview: Backed by investors including Sina Group, Longling Capital, and Weixin Jinke (HKG:2003). Sina Group strategically invested in Huasheng Capital in 2017, which is headquartered in Hong Kong.

Why is Hong Kong Accelerating the Licensing Process?

This move by Hong Kong demonstrates its commitment to building a Web3 hub in Asia. The four new virtual asset trading platforms were licensed under a "fast-track licensing procedure." Dr. Ye Zhiheng, Executive Director of the Intermediaries Division of the Hong Kong SFC, stated that they will "accelerate the licensing process for virtual asset trading platforms." This indicates that in the future, whether for virtual asset trading platforms or other licenses related to virtual assets, the application process may be further simplified, and the timeline may be shortened.

Why has the Hong Kong SFC suddenly accelerated the licensing process? The reasons are as follows:

1. Rapid Development of the Global Virtual Asset Market

Recently, the global virtual asset market has shown rapid growth, especially with the continuous approval of Bitcoin spot ETFs and the increasing entry of traditional financial institutions into the crypto space, driving enthusiasm across the industry. This necessitates Hong Kong to expedite the issuance of licenses to seize market opportunities and attract more investors and businesses to operate in the region.

2. Regional Competitive Pressure

In recent years, places like Singapore and Dubai have frequently updated their regulatory frameworks in the virtual asset and Web3 sectors, competing to attract global blockchain companies and investors. As one of Asia's financial centers, Hong Kong needs to demonstrate its support for innovative finance through accelerated licensing to maintain its competitiveness.

3. The Trend of Mainland Chinese Capital Entering Web3

From the background of the newly licensed institutions, many parent companies or major investors come from mainland China. This indicates that mainland enterprises are laying out Web3 through Hong Kong. By rapidly issuing licenses, Hong Kong aligns with this trend, reinforcing its role as a bridgehead for mainland capital to extend outward.

In summary, the acceleration of licensing by the Hong Kong SFC is driven not only by market demand but also as a proactive strategic choice aimed at laying a more solid foundation for the development of Hong Kong's virtual asset industry while strengthening its position as a global virtual asset center.

Impact of Accelerated Licensing in Hong Kong on Various Parties

1. For the Industry as a Whole

The increase in licensed virtual asset trading platforms is undoubtedly good news for both the development of Hong Kong's Web3 industry and the global virtual asset market. Firstly, the addition of licensed institutions will increase market competition, forcing platforms to reduce costs and improve efficiency, thereby optimizing service quality. Secondly, more platforms being included in the regulatory framework will help enhance industry transparency and market confidence. Finally, by introducing more licensed platforms, Hong Kong solidifies its position as an international hub for virtual assets.

2. For Licensed Institutions

The addition of new licenses may weaken the advantages of existing licensed institutions. On one hand, licenses serve as an official endorsement of virtual asset trading platforms, while on the other hand, they create barriers and restrictions for unlicensed institutions.

In the absence of an expansion of licensed platforms, virtual asset trading platforms that obtained licenses earlier can achieve near-monopolistic market positions and gain absolute competitive advantages. However, as the number of licensed platforms increases, in the short term, this may weaken the advantages of early licensed platforms. In the long run, whether for early or late licensed institutions, a fully competitive market environment will compel all major platforms to reduce costs and improve efficiency, lower trading fees, and enhance service quality, benefiting the international competitiveness of Hong Kong's virtual asset trading platforms.

3. For Traders

For a wide range of virtual asset traders, the increase in licensed exchanges is undoubtedly a positive development, as it means that trading fees may further decrease, trading efficiency may improve, and traders will have more options for trading platforms. This allows for diversified trading or investment, effectively hedging against the internal and external risks associated with centralized virtual asset platforms.

4. For Web3 Practitioners

Firstly, the Hong Kong government has demonstrated its commitment to supporting the development of the Web3 industry through concrete actions, boosting practitioners' confidence. Secondly, with the increase in licensed institutions and the improvement of the market ecosystem, more innovative projects and business models will have the opportunity to be implemented in Hong Kong.

Overall, this licensing initiative will have a short-term impact on the market landscape, but in the long run, it will enhance Hong Kong's attractiveness and position in the global virtual asset market through strengthened competition and improved regulation, creating more opportunities and value for all parties involved.

Mankun Lawyers' Summary

The rapid issuance of virtual asset trading platform licenses by the Hong Kong SFC not only demonstrates its determination to build an Asian Web3 hub but also injects new momentum into the market. The newly licensed institutions will promote cost reduction and efficiency improvement in the industry through intense market competition, drive service optimization, provide more choices for investors, and enhance the international influence of Hong Kong's virtual asset industry.

In this context, we also observe that mainland Chinese enterprises are gradually turning their attention to the Web3 field, using Hong Kong as a bridgehead for global expansion. This not only reflects the recognition of mainland capital for Web3 but also showcases Hong Kong's strategic position as a key player in the development of virtual assets.

As a professional legal service provider in the Web3 field, Mankun Lawyers will continue to dedicate itself to providing comprehensive support for virtual asset trading platforms and Web3 entrepreneurs.

The wave of Web3 has already arrived, and Hong Kong is ushering in a new round of industry opportunities. Mankun Lawyers looks forward to collaborating with more industry partners to jointly promote the prosperous development of the Web3 ecosystem and help clients gain a competitive edge in compliance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。