The continuous growth of institutional investment demand has further intensified the supply crunch of Bitcoin.

Author: SergeKazachiy

Translated by: Deep Tide TechFlow

Key Takeaways:

Market Sentiment: The stablecoin market has grown by $30 billion since the election, averaging an increase of $750 million daily, injecting significant liquidity into the market. Last week, Bitcoin's price briefly fell to $92,500, triggering panic selling, a phenomenon often seen as a positive signal for market rebounds. Meanwhile, the sustained growth in institutional investment demand has further exacerbated the supply crunch of Bitcoin. At the same time, the price of Pudgy Penguins NFTs surged by 240%, and total sales of Ethereum NFTs reached $304 million, indicating strong growth momentum in the NFT market.

Yield Opportunities: Bitwise launched a Solana-based collateralized ETP in Europe, and sBTC went live on the Stacks mainnet, offering up to 5% annual percentage yield (APY) on Bitcoin assets.

New Airdrops: Binance added two new tokens, CAT and PENGU, to its HODLer airdrop program, while Fuel Network began distributing 1 billion FUEL tokens to 200,000 users.

Upcoming Token Generation Events (TGE) and Token Sales:

Sony's Soneium (Ethereum L2, airdrop on December 26);

Azuki's Animecoin;

Kraken's Inkonchain (mainnet launch);

Uniswap's Unichain (coming soon);

ConsenSys's Linea (active after mainnet launch).

Key Developments:

Ethena launched a stablecoin backed by BlackRock's BUIDL token;

Kraken announced the mainnet launch of the Ink blockchain.

Special Attention: Recent funding rounds have received strong support from top angel investors.

This Week's Research: Exploring the cyclical effects of the "hype machine."

In-Depth Analysis: Panic or Euphoria?

Two weeks ago, driven by a surge in institutional demand and expectations of monetary easing, Bitcoin's price broke its historical high, reaching $107,000. In this process, the ample liquidity of stablecoins played a crucial role. Meanwhile, AI entities and memes have also become hot topics in the market.

Last week, liquidity driven by stablecoins and institutional demand remained key factors supporting Bitcoin's price, while the NFT market, particularly the Pudgy Penguins project, also showed strong growth momentum.

Stablecoins Driving Market Liquidity

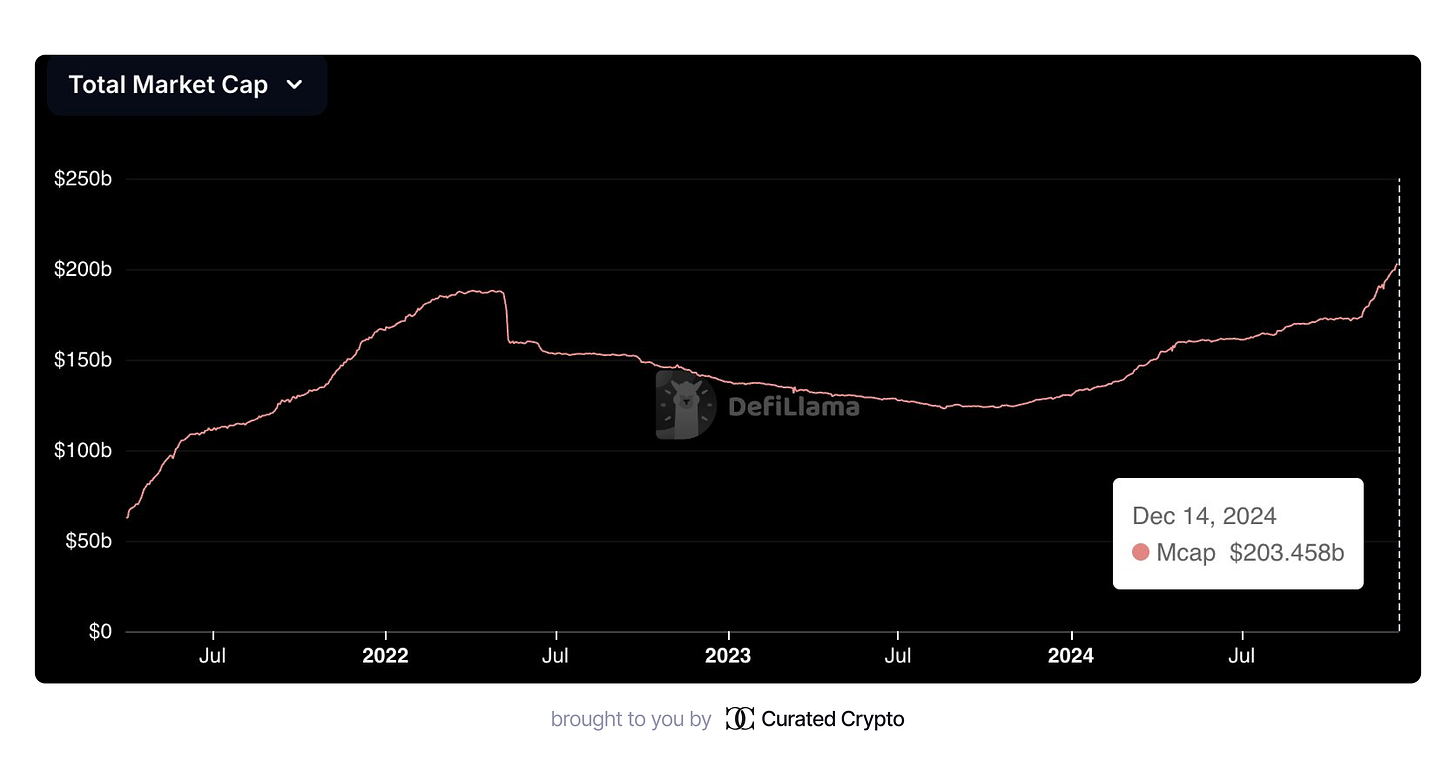

The stablecoin market is experiencing steady growth, with total supply continuously increasing. Since the election, the total market capitalization of stablecoins has surged by $30 billion, averaging an increase of $750 million daily.

Total Market Capitalization of Stablecoins

This growth is also reflected in the activity on exchanges, with an average of $40 million in USDT deposited daily over the past eight weeks. This influx of funds provides crucial liquidity support to the market, stabilizing prices and boosting market confidence. We discussed this in detail in our latest analysis on Substack.

Market Turbulence

Last week, Bitcoin's price plummeted to $92,500, triggering panic selling among short-term investors. However, this phenomenon is often seen as a positive signal for market rebounds. Meanwhile, calls for "buying the dip" in the community reached their highest level in nearly eight months, a sentiment that is often viewed as a bearish signal in the short term.

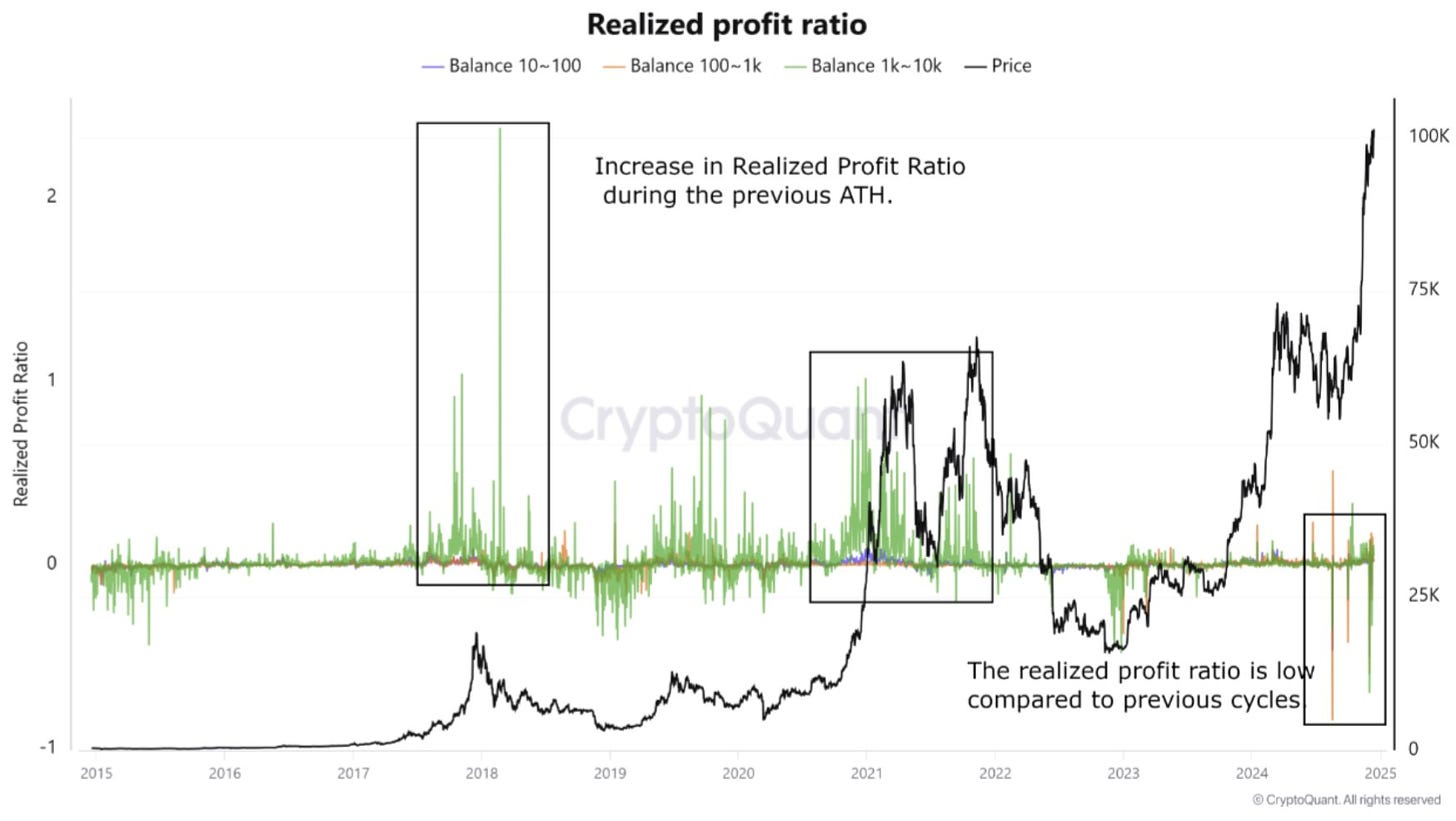

Key indicators show a subtle market sentiment: the current realized profit ratio remains below previous cycles, indicating that large holders have not yet begun to take profits on a large scale. Additionally, analysis based on the 30-day exponential moving average (EMA) shows that Bitcoin's funding rate does not exhibit signs of overheating typical of the end of a cycle.

The market has also seen what analysts are calling the "third Bitcoin supply shock." Bitcoin balances on exchanges continue to decline significantly, while demand from institutional giants like BlackRock and Microstrategy has surged. This supply-demand dynamic could significantly impact Bitcoin's price trajectory in the coming months.

NFT Resurgence: Hype or Signal?

This month, both Bitcoin and Pudgy Penguins NFTs have surpassed the $100,000 mark, indicating strong momentum in the cryptocurrency and NFT markets.

Source: Pudgy Penguins NFT floor price exceeds Bitcoin price

Bitcoin's price has risen from about $88,000 to over $100,000 in the past 30 days, an increase of approximately 14%.

The price of Pudgy Penguins surged from 9.45 ETH (about $30,000) to 26.15 ETH (about $103,000), a staggering increase of 240%.

The rise of Pudgy Penguins is attributed to the hype surrounding its upcoming $PENGU token launch, which will expand the ecosystem to Solana. Additionally, the rise in Ethereum's price and strong community support have also fueled this growth.

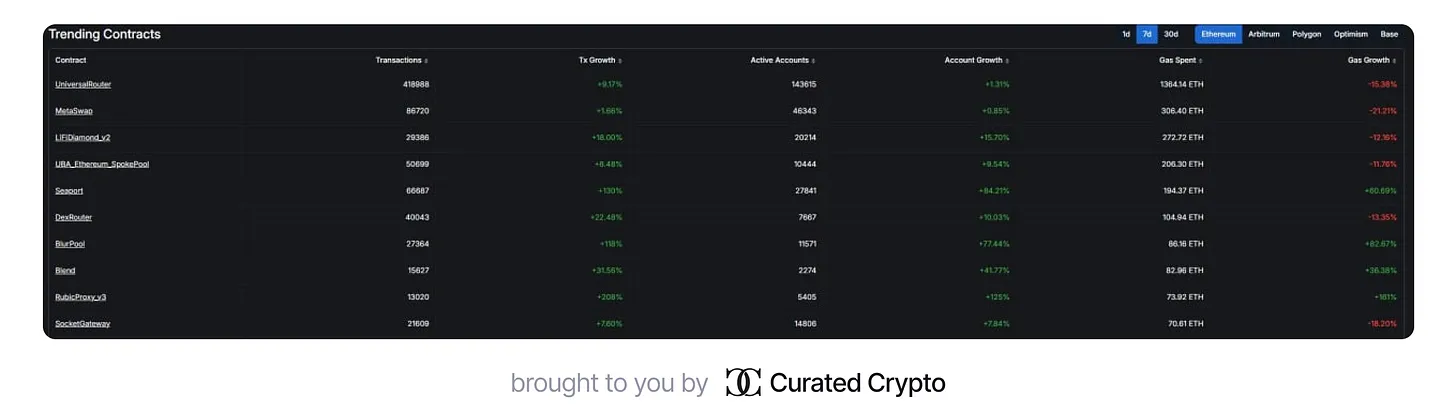

In the past seven days, NFT activity on Ethereum has significantly increased.

While it is currently difficult to determine whether this surge in activity is a signal of market recovery, it is certain that the NFT market is attracting increasing attention.

According to data from Galaxy Research, the NFT market is gradually recovering, with trading volume showing a rapid growth trend. Data from DefiLlama indicates that in just one week, NFT sales on Ethereum reached $304 million, demonstrating explosive growth in this market.

Passive Income Opportunities: This Week's Highlights

This week, DeFi and other sectors have provided investors with various attractive passive income opportunities. Here are some key points to watch:

Trends in Restaking for 2024

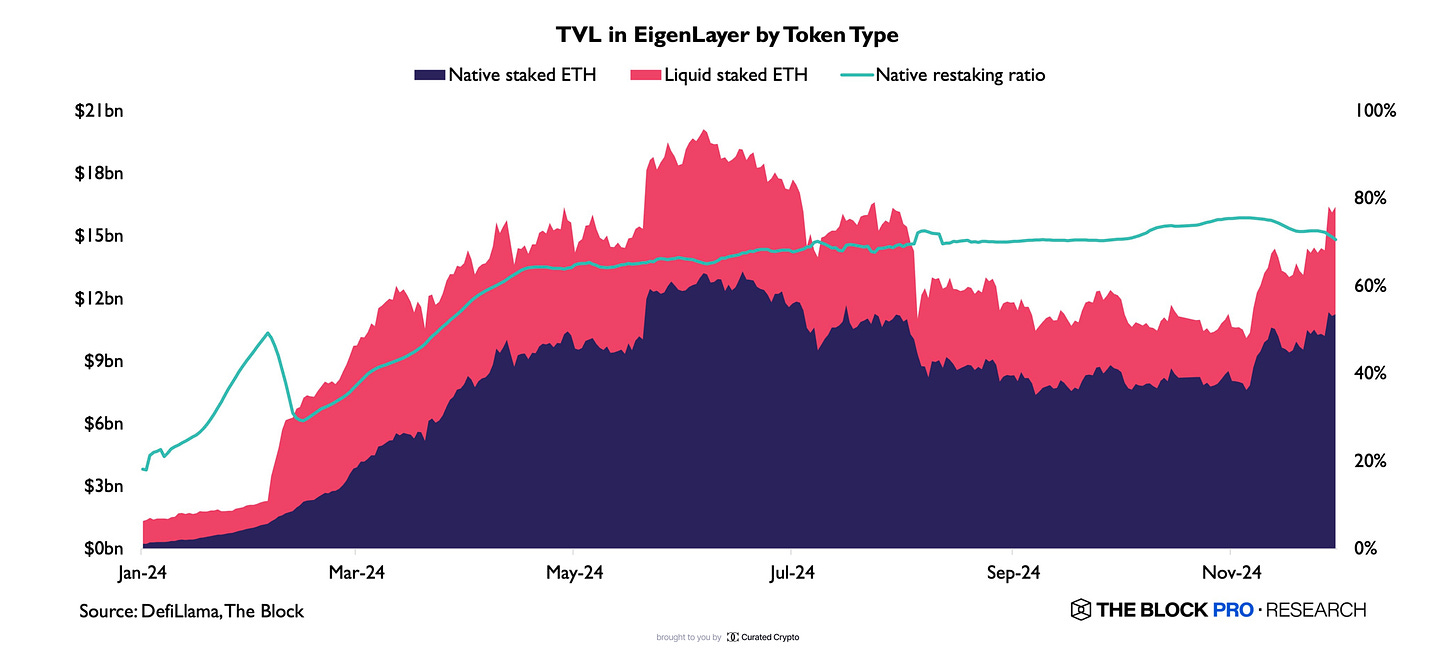

Total Value Locked (TVL) by Token Type on EigenLayer

The Rapid Rise of EigenLayer: As a leader in the Restaking space, EigenLayer had a total value locked (TVL) of $1.3 billion at the beginning of the year and peaked at $20 billion in June. Although there was a decline in the third quarter, it currently remains stable at $16 billion.

The Emergence of New Protocols: Protocols such as Babylon (focusing on Bitcoin, with a TVL of $2.3 billion) and Symbiotic (focusing on Ethereum, with a TVL of $2.4 billion) are attracting more and more users and attention.

Ether.fi's Dominance: As the top liquidity Restaking protocol for 2024, Ether.fi has accumulated a TVL of $7.3 billion, making it the fourth largest DeFi application globally.

In-Depth Insights: For a more detailed analysis, refer to “Restaking Trends in 2024”.

Latest Developments in Crypto Staking ETPs

Bitwise's Expansion in Europe: Bitwise has launched a Solana staking exchange-traded product (ETP) in Europe, providing European investors with access to Solana while enjoying staking rewards.

Hedera HBAR Joins Euronext: The new ETP for Hedera HBAR has been launched on Euronext, offering more staking options for both institutional and retail investors.

sBTC Launches on Stacks Mainnet

sBTC Officially Launched: The highly anticipated sBTC has been launched on the Stacks mainnet, becoming one of the most decentralized Bitcoin derivatives in the Layer 2 network.

Decentralized Governance: sBTC is secured by a network of signers that includes well-known institutions, ensuring transparency and security in its management.

Attractive Yields: Holders can earn up to 5% annual percentage yield (APY) by staking sBTC. This launch marks a significant advancement in Bitcoin cross-chain interoperability and the Stacks ecosystem in the decentralized finance (DeFi) space.

Latest Updates for Airdrop Hunters

If you are looking for airdrop opportunities, this week has brought many exciting updates in the crypto space:

Pudgy Penguins Launches PENGU Token on Solana

PENGU Token Launch: The Pudgy Penguins project has officially launched the PENGU token on the Solana blockchain, providing its community with a new way to interact.

Claim Time Limit: Token holders must claim their PENGU tokens within 88 days; unclaimed tokens will be permanently burned. This initiative not only expands the Pudgy Penguins ecosystem but also further solidifies its influence on Solana while rewarding loyal supporters.

Binance Adds CAT and PENGU Airdrop Programs

New Token Airdrops: Binance has included Simon's Cat (CAT) and Pudgy Penguins (PENGU) in its HODLer airdrop program, providing more incentives for token holders.

Reward Mechanism: Eligible users holding CAT or PENGU can participate in the airdrop activities, further enhancing the market appeal of these tokens.

Fuel Network Announces 1 Billion FUEL Genesis Airdrop

Mass Distribution: Fuel Network will airdrop 1 billion FUEL tokens to 200,000 users to reward early supporters and promote the adoption of its modular blockchain.

Event Timing: The airdrop officially began on December 19, providing users with an opportunity to interact with the Fuel Network ecosystem.

Want to try Sui airdrops? If you have time this weekend, consider exploring the following six noteworthy projects:

For more airdrop opportunities and the latest updates, stay tuned for our weekly series!

Upcoming Token Generation Events (TGE), Listings, and Product Releases

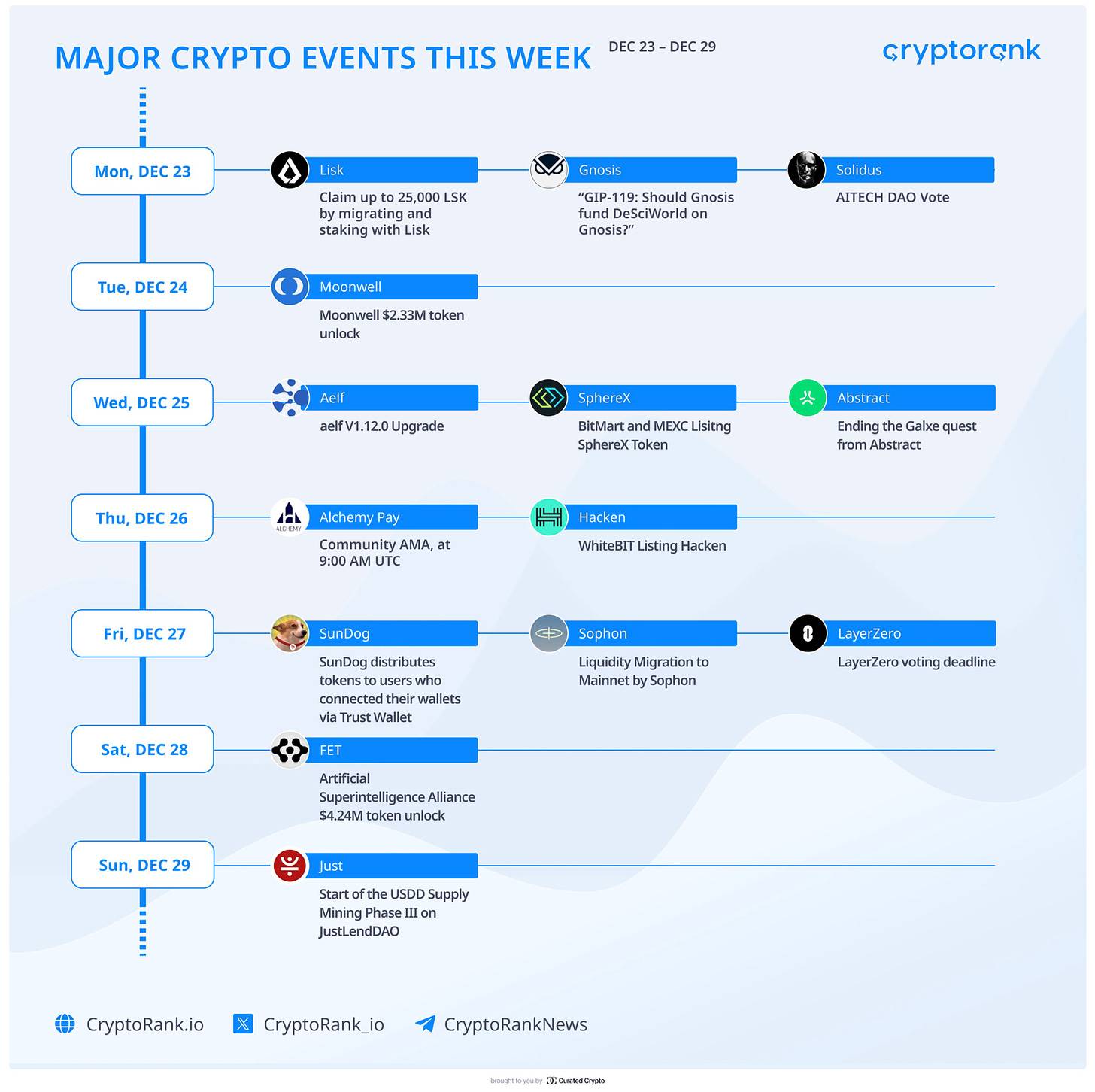

Major Crypto Events from December 23 to 29

Highlights in the Crypto Space This Week

Here are the important events in the crypto space this week:

December 23:

Migrate and stake Lisk to claim up to 25,000 $LSK

GIP-119 Proposal: Should we support funding for the DeSciWorld project on Gnosis Chain?

AITECH DAO voting opens

December 24:

- WELL $2.33 million token unlock

December 25:

aelf blockchain will undergo V1.12.0 upgrade

Spherex Tech Token will be listed on BitMart and MEXC exchanges

Abstract's Galxe task activity ends

December 26:

AlchemyPay community will hold an AMA at 9 AM UTC

Hacken token will be listed on WhiteBIT exchange

December 27:

SunDog will distribute tokens to users connected via Trust Wallet

Sophon will conduct liquidity migration on the mainnet

LayerZero proposal voting deadline

December 28:

- $FET $4.24 million token unlock

December 29:

- JustLendDAO will launch the third phase of $USDD supply mining

Top Blockchains Supporting Upcoming Token Generation Events

Top Blockchains Hosting TGE Events Supported by Major Companies

Here are some notable blockchain projects and their upcoming token generation events, supported by well-known companies:

Soneium by Sony Group: Sony Group has announced the launch of Soneium, an Ethereum-based Layer-2 blockchain. Although the mainnet launch date has not been announced, it has been confirmed that an airdrop will take place on December 26, 2024.

Animecoin by Azuki: Azuki hints at the upcoming launch of the Animecoin token. The official Azuki account retweeted a video about Animecoin on December 22, suggesting that the project is about to make new progress.

Inkonchain by Kraken: Kraken has announced that its Ink Layer 2 blockchain has officially launched its mainnet, ahead of the originally planned early 2025. The network offers a 1-second block time, designed for high-speed transactions.

Unichain by Uniswap: Uniswap has announced its Layer-2 network Unichain, designed for DeFi. The mainnet is expected to launch early next year, and the Sepolia testnet is currently open for use.

LineaBuild by ConsenSys: ConsenSys has launched Linea, a Layer-2 blockchain solution. The mainnet went live at the EthCC event in Paris, and on-chain activity has been active since its launch.

Significant Events & Progress of Observed Protocols

Crypto Watchlist for This Week

This week, several projects in the crypto and tech sectors made significant progress:

$BTC – MicroStrategy Joins Nasdaq 100 Index

Event Date: December 23

MicroStrategy becomes the first company focused on Bitcoin to be included in the Nasdaq 100 index.

$HYPE – Strong Performance of Hyperliquid Token

Update Status: Ongoing

The Hyperliquid token has shown strong resilience during the decline in Bitcoin prices, demonstrating its market strength.

$FTM – Sonic Gateway Launching Soon

Event Date: Next week

The native bridging tool Sonic Gateway between Sonic and Ethereum L1 is set to launch soon.

$PENDLE – Airdrop Snapshot Coming Soon

Event Date: December 31

A PENDLE airdrop snapshot for stakers is about to take place.

FLUID (formerly INST) – Fluid DEX Proposal

Update Status: Now live

The proposal for deploying Fluid DEX on Arbitrum L2 is now open for voting.

$ZRO – LayerZero Fee Switch Proposal

Event Date: December 27

Voting on LayerZero's fee switch proposal is about to end. If passed, it will activate the buyback and burn mechanism for ZRO.

Upcoming Token Unlocks

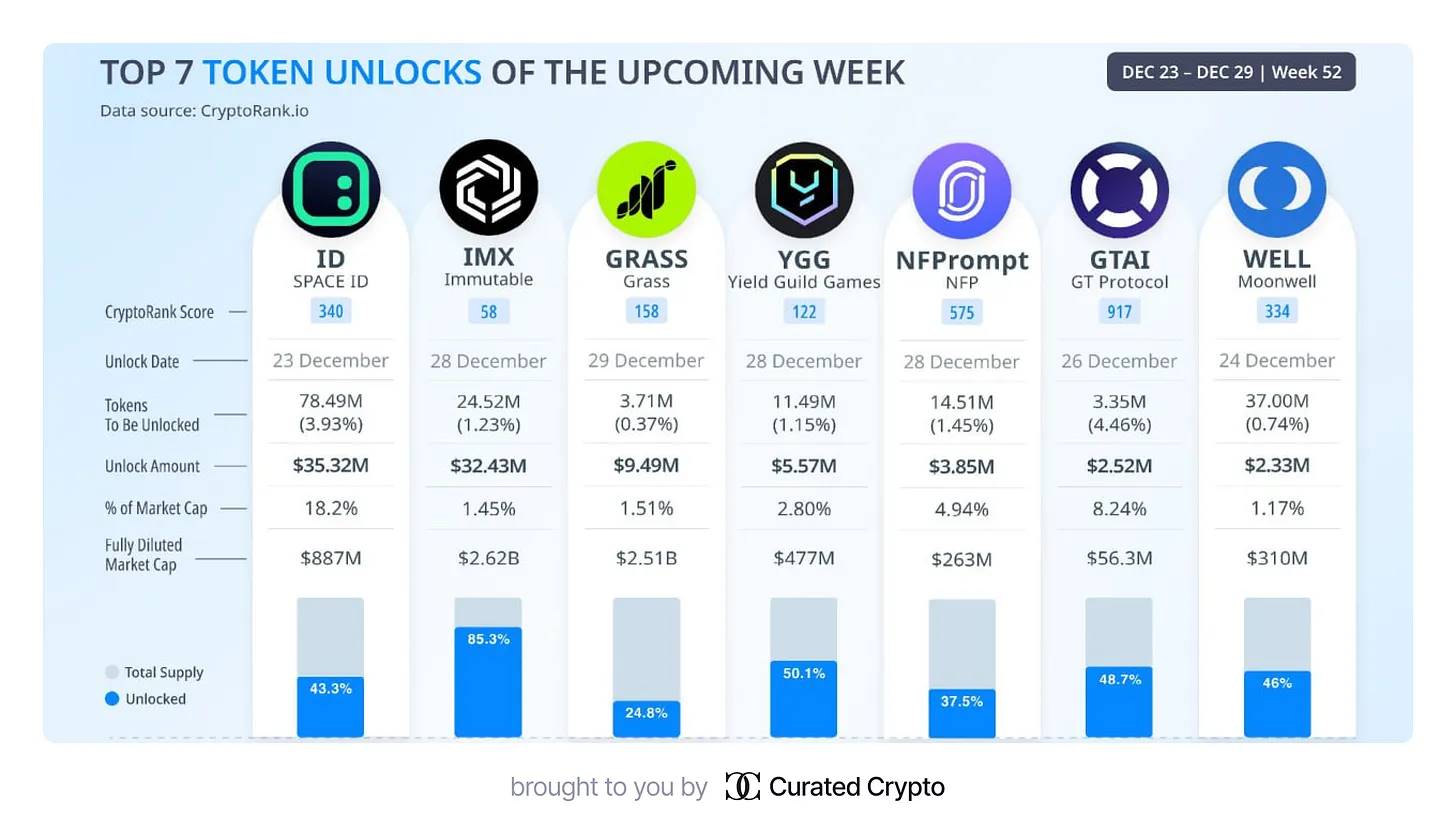

Top 7 Token Unlock Events from December 23 to 29

Seven Major Token Unlocks Next Week

Here are the tokens with the largest unlock amounts next week:

IDEX (ID) ◦ Unlock Amount: $35.32 million

Immutable X (IMX) ◦ Unlock Amount: $32.43 million

Grass (GRASS) ◦ Unlock Amount: $9.49 million

Yield Guild Games (YGG) ◦ Unlock Amount: $55.57 million

NFPrompt (NFP) ◦ Unlock Amount: $3.85 million

GT Protocol (GTAI) ◦ Unlock Amount: $2.52 million

Moonwell (WELL) ◦ Unlock Amount: $2.33 million

Protocols to Watch

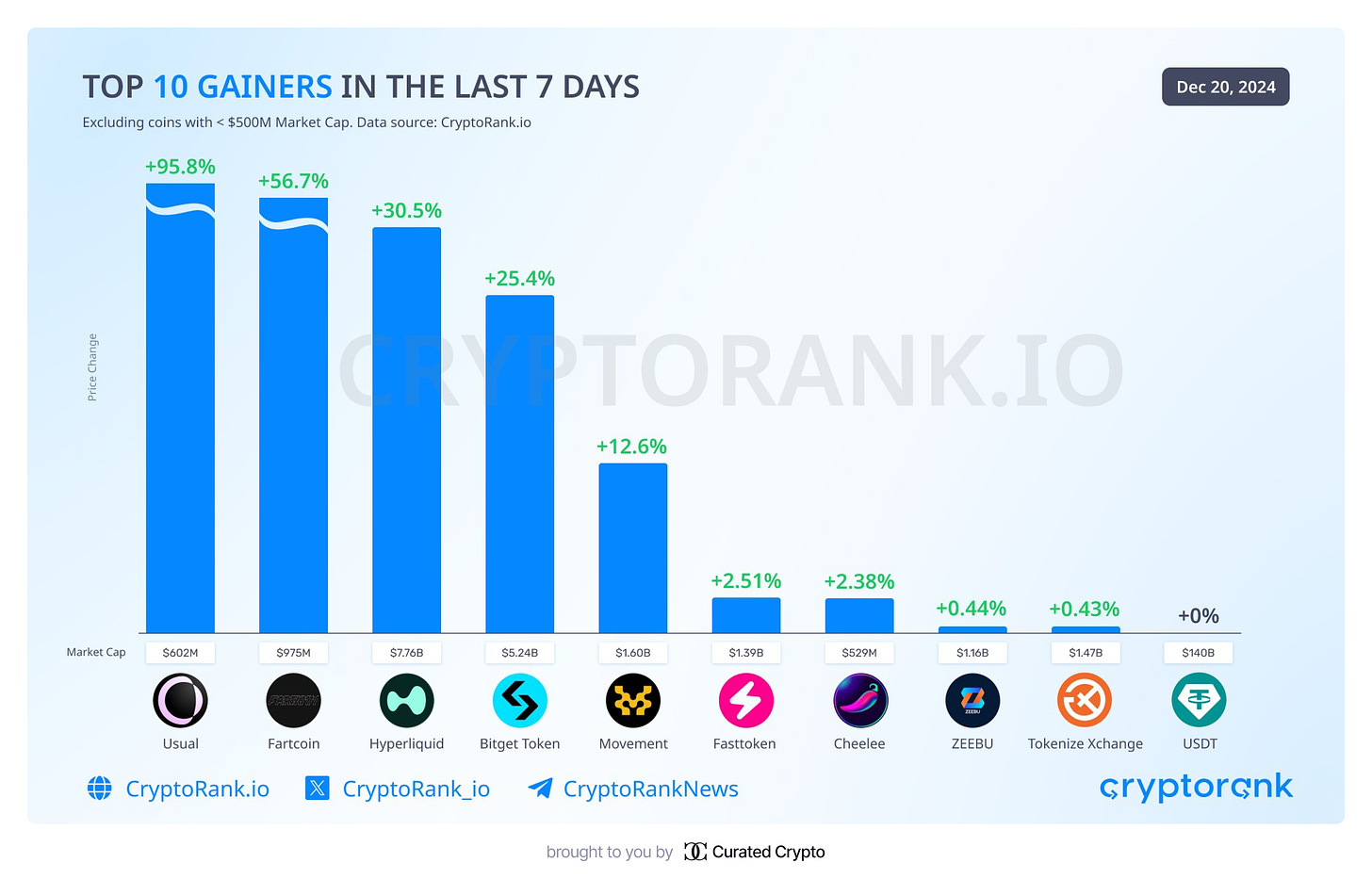

Top Gainers in the Past 7 Days

Top 10 Gainers in the Past 7 Days

Despite the overall weak market performance, some newly launched tokens like $USUAL, $MOVE, and $HYPE have maintained a strong upward trend. Additionally, stablecoins have shown high resilience during market fluctuations. Tokens like $Fartcoin and $BGB have also risen against the trend, contrasting sharply with the overall market direction.

Latest Updates from the Hyperliquid Ecosystem

The Hyperliquid platform, powered by the HYPE token, is rapidly emerging in the DeFi space.

Its airdrop event is one of the largest in the crypto market, attracting widespread attention and driving user growth.

Hyperliquid focuses on decentralized liquidity and is expected to continue innovating and achieving further growth in the DeFi sector.

World Liberty Financial Partners with Ethena to Launch sUSDe

Background: World Liberty Financial, supported by Donald Trump, is collaborating with Ethena, with the first outcome being the launch of sUSDe.

Impact: This collaboration could have far-reaching effects on both traditional finance and decentralized finance (DeFi).

Innovation: Through sUSDe, Ethena is redefining the concept of "internet bonds," attempting to challenge traditional government bonds in terms of usage and acceptance.

Exploring Blockchain Solutions from XProtocol

Technical Highlights: XProtocol is a cutting-edge blockchain protocol focused on solving scalability and interoperability issues.

Goal: The platform aims to connect different blockchain ecosystems, laying the foundation for a more interconnected decentralized future.

Positioning: By optimizing blockchain infrastructure, XProtocol is becoming an important component of the future of decentralized technology.

Chainbase: Revolutionizing Blockchain Data Analysis

Innovative Technology: Chainbase enhances on-chain data processing efficiency by integrating AI-driven tools, transforming the way blockchain data is analyzed.

Practical Use: This technology helps decentralized applications (DApps) make smarter, data-driven decisions.

Future Vision: Chainbase focuses on providing high-quality on-chain data for the emerging AI economy, gradually becoming an essential tool for DeFi applications and the broader blockchain ecosystem.

Product Updates This Week

Several important developments related to stablecoins occurred this week:

Ethena Launches Stablecoin Supported by BlackRock's BUIDL Token

Ethena has launched a stablecoin supported by BlackRock's BUIDL token, further enhancing its DeFi capabilities.

This move combines traditional finance with blockchain technology, expected to boost the project's credibility and long-term potential.

Kraken Announces Launch of Ink Blockchain Mainnet

Kraken has launched the Ink blockchain, further expanding its services beyond traditional crypto exchanges.

This release strengthens Kraken's decentralized services and paves the way for new blockchain solutions.

This move indicates Kraken's commitment to achieving sustained growth in the Web3 space.

Solana Network Hits Record Trading Volume

Solana has set a new record for daily trading volume, further solidifying its position as a leading blockchain.

In November, 55% of global crypto users were active on the Solana network.

This growth indicates that Solana's adoption and market influence are continuing to expand.

Nexus Attracts 1.5 Million Nodes in Testnet Phase

Nexus's decentralized supercomputer testnet has attracted 1.5 million nodes, showing signs of potential success.

The project aims to redefine the decentralized computing space and enhance blockchain scalability.

Key Venture Capital Financing This Week

Here are the projects that raised over $100 million this week:

0G Labs

Total Financing: $250 million in token purchase commitments.

Additional Financing: $40 million for the development of a decentralized AI operating system, having raised $35 million earlier this year.

Focus: Preventing large entities from controlling massive datasets through decentralized technology, especially in the rapidly growing AI sector.

Monad

Total Financing: $225 million led by Paradigm.

Goal: To build a Layer 1 blockchain that competes with Ethereum and Solana, launching a new type of Ethereum Virtual Machine (EVM) for parallel processing and instant block finality.

EVM Compatibility: Facilitating Ethereum developers to migrate existing applications.

Celestia

Total Financing: $100 million led by Bain Capital Crypto.

Goal: Achieve higher throughput with 1GB blocks, with processing capabilities comparable to Visa.

Competitors: Ethereum (50 TPS), Solana (up to 65,000 TPS but averaging around 400 TPS).

Berachain

Total Financing: $100 million in Series B funding.

Co-leads: Framework Ventures and Brevan Howard Digital.

Use of Funds: Focused on economic growth, global expansion, and enhancing engineering resources.

Target Regions: Hong Kong, Singapore, Southeast Asia, and Latin America.

Recent Financing Dynamics Supported by Top Angel Investors

This week, several projects in the crypto and tech sectors received significant venture capital:

Yei Finance

Financing Amount: $2 million

Project Overview: Yei Finance is a non-custodial money market protocol dedicated to providing users with secure and decentralized financial services.

Significance: This round of financing reflects strong market demand for innovative DeFi tools that help users better control their assets.

Uranium Digital

Financing Amount: $1.7 million

Project Overview: A blockchain project focused on modernizing uranium trading, optimizing the commodity market by streamlining processes and enhancing transparency.

Significance: This project indicates that blockchain technology is gradually being applied to niche but critical industries like energy trading.

Lens Protocol

Financing Amount: $31 million

Project Overview: A blockchain-based social network protocol aimed at supporting decentralized social platforms, building a user-driven social ecosystem without intermediaries.

Significance: The financing for Lens Protocol indicates a rapidly growing market interest in decentralized social platforms, which have the potential to challenge the dominance of traditional social media.

Plume Network

Financing Amount: $20 million

Project Overview: An L1 blockchain platform focused on bringing real-world assets (RWAs) into the blockchain ecosystem, connecting the traditional economy with the digital economy.

Significance: This project will redefine the tokenization and trading of RWAs, promoting broader accessibility in global markets.

Hexagate

Financing Type: Acquisition round led by Chainalysis.

Project Overview: A technology platform focused on Web3 security, dedicated to addressing security vulnerabilities in decentralized applications and blockchain systems.

Significance: This round of financing highlights the importance of security in the development of the Web3 ecosystem, which is key to ensuring user trust and platform stability.

These financing cases showcase the diverse investment directions in the crypto and tech industries, as well as the strategic layout driving the future development of the industry.

Crypto News This Week: Long-Term Market Impact

Federal Reserve Interest Rate Cuts and Their Impact

The Federal Reserve recently announced a 25 basis point reduction in the benchmark interest rate to 4.25%-4.5%. In the statement, Fed Chairman Jerome Powell indicated that the Fed currently does not hold Bitcoin and has no plans to promote legislation related to purchasing Bitcoin, further underscoring its traditional conservative stance on cryptocurrencies.

Economic Forecast and Market Impact

According to the Fed's latest forecast, the economy is expected to undergo a mild adjustment by 2025:

Unemployment Rate: Expected to slightly decrease from 4.4% to 4.3%.

PCE Inflation: Expected to be 2.5%, a slight increase from the previous forecast of 2.1%.

GDP Growth: Expected to be revised up from 2.0% to 2.1%, with a long-term growth rate stabilizing at 1.8%.

Despite an overall market pullback last week, with ETFs recording the highest outflow in history, global crypto investment products still saw a net inflow of $308 million this week, continuing an upward trend for 11 consecutive weeks. However, the Fed's decision to cut rates led to nearly $1 billion in outflows from crypto funds, indicating that investors remain highly sensitive to macro policy changes.

This complex situation reflects the increasingly close relationship between monetary policy and the digital asset market.

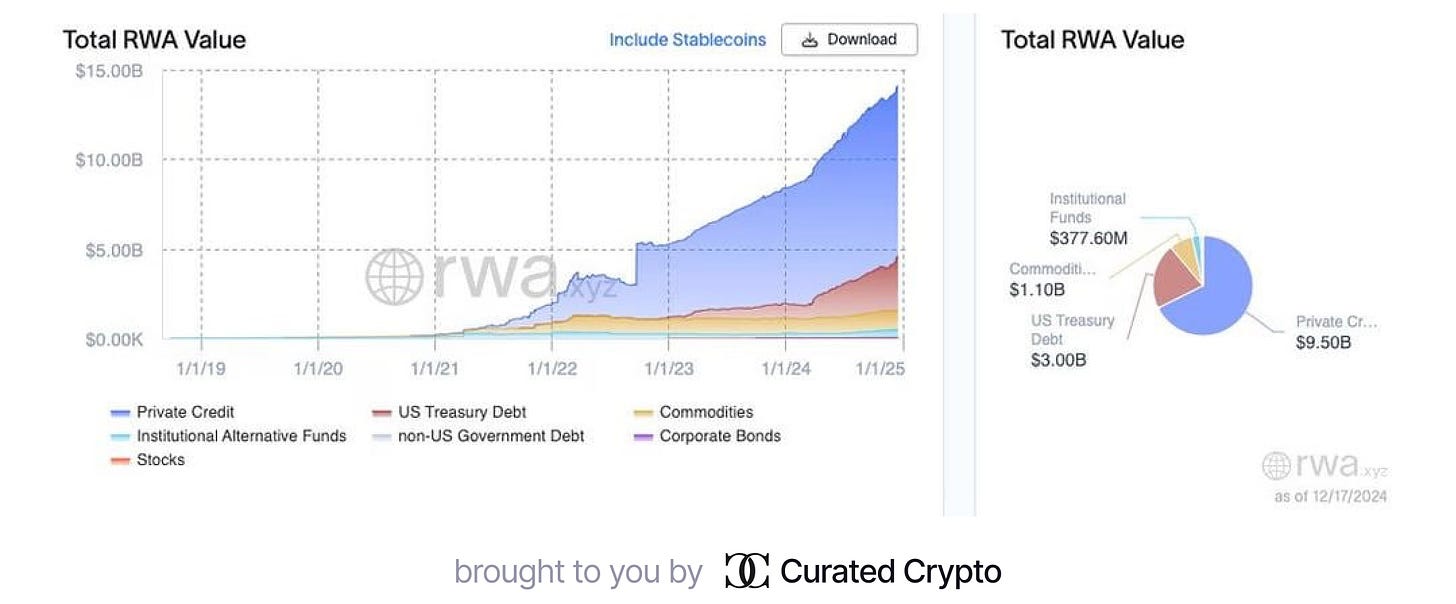

RWA Market Surpasses $14 Billion

The total value of the global tokenized real-world assets market has surpassed $14 billion, marking a significant year-on-year growth of 66%. This milestone indicates that blockchain-based tokenization technology is gaining broader market recognition and application.

Total Value of the Global RWA Market

According to Bitwise's forecast, the RWA (real-world assets) market is expected to expand rapidly in the coming years, potentially reaching $50 billion by 2025. This growth highlights the transformative potential of this sector in connecting traditional finance with blockchain technology, providing greater liquidity and accessibility for various real-world assets.

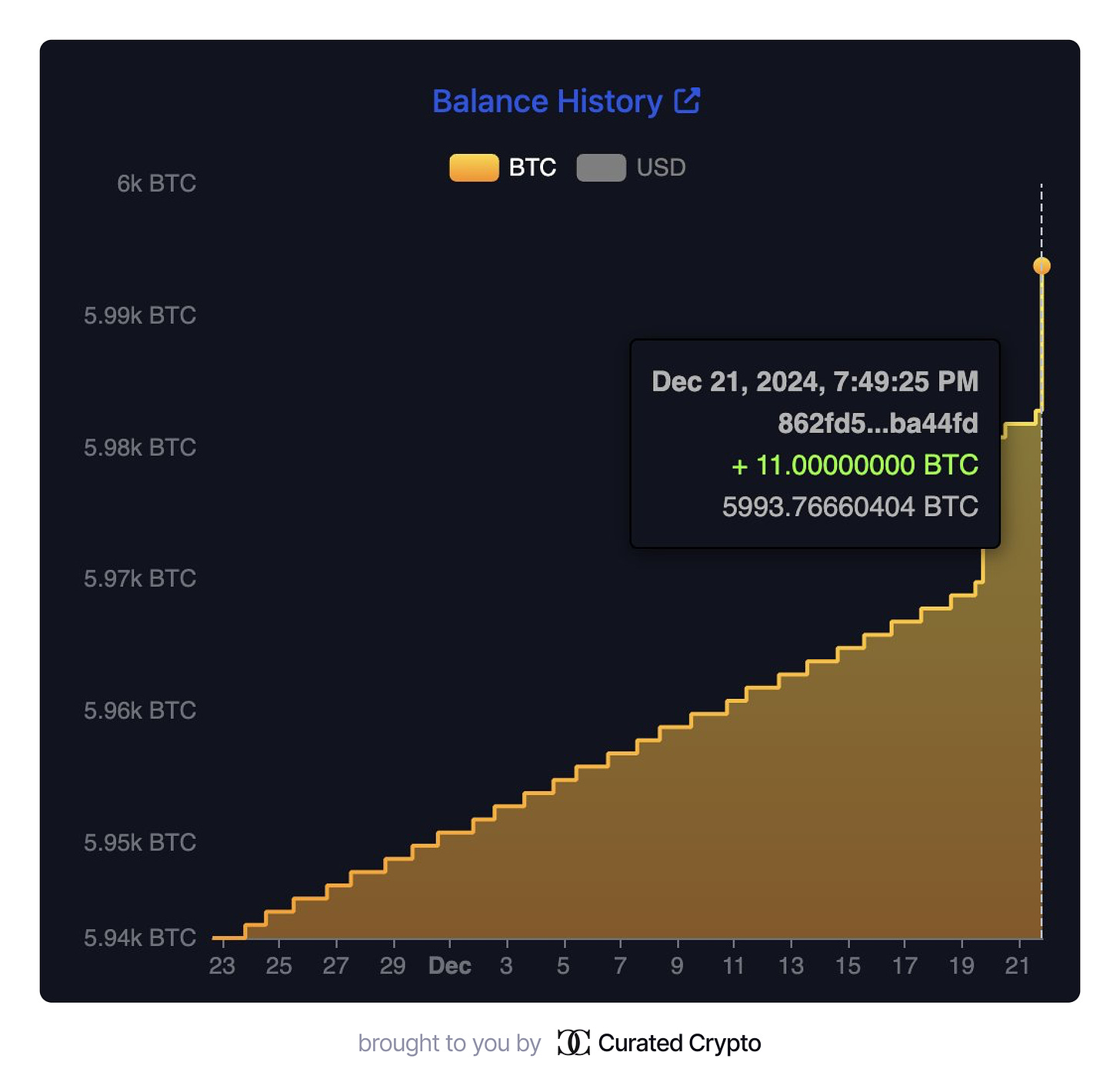

El Salvador Reaches Agreement with IMF: Bitcoin Policy Adjustment

El Salvador's Bitcoin Wallet Balance

El Salvador has reached a historic agreement with the International Monetary Fund (IMF) to secure a $1.4 billion loan to support its economic development. As part of the agreement, El Salvador will implement significant policy adjustments, including the removal of the mandatory requirement for businesses to accept Bitcoin as a means of payment.

Additionally, the IMF has imposed restrictions on Bitcoin-related activities in the public sector, prohibiting government entities from purchasing or using Bitcoin for transactions. However, the government retains the ability to purchase one Bitcoin daily, a policy that attracted widespread attention last week when the government acquired 22 Bitcoins during a market downturn.

These changes signify a major shift in El Salvador's pioneering strategy regarding Bitcoin adoption, while also reflecting its efforts to balance fiscal policy and international cooperation.

Binance Survey Reveals Crypto Trends for 2024

A recent survey by Binance revealed key trends in the crypto market for 2024:

23.89% of respondents believe AI tokens have the greatest growth potential.

19% of respondents are optimistic about Meme tokens, considering them the second most promising area.

12% of respondents prioritize DeFi projects.

Notably, 45% of respondents are entering the crypto market for the first time in 2024, indicating a surge in new participants. This data reflects growing investor interest in AI and Meme-driven markets.

For more details, please check the full survey results [link].

Research Focus

Your Bullish Expectations for Stablecoins Are Not High Enough

The article "Your Bullish Expectations for Stablecoins Are Not High Enough" discusses the increasingly important role of stablecoins in the cryptocurrency market. The article argues that these price-stable digital assets are crucial to the global financial ecosystem, especially in the context of the expanding decentralized finance (DeFi) landscape. The author points out that as the adoption of stablecoins broadens, they will bring significant growth opportunities to the market and challenge the dominance of more volatile cryptocurrencies.

2025 Market Outlook: Key Predictions

The article "2025 Market Outlook: Key Predictions," published by Delphi Digital, outlines predictions for the cryptocurrency market in 2025, covering key trends that may shape the industry. The article emphasizes factors such as regulation, market adoption, and emerging technologies, predicting that these elements will drive innovation and market growth. Experts believe these changes will bring new opportunities and challenges, laying the groundwork for the industry's future.

Delphi Digital's report "2025 DeFi Outlook" predicts the development prospects of decentralized finance (DeFi) in 2025. The report explores potential trends in DeFi protocols, the evolving regulatory framework, and technological advancements. It also highlights the increasing popularity of DeFi platforms and new solutions that may address scalability, security, and user experience issues. Investors and industry participants should pay attention to significant changes that could reshape the DeFi ecosystem.

Tokenized AI Agents: New Foundation or Fancy Packaging?

The article "Tokenized AI Agents: New Foundation or Fancy Packaging?" analyzes the rise of AI-driven tokens and their potential impact on decentralized networks. The article discusses whether these AI agents represent a revolutionary integration of blockchain and artificial intelligence or merely another marketing gimmick. The report delves into the potential effects of tokenized AI agents across various fields, from decentralized finance to governance.

The article "2025 AI + DePIN Outlook" discusses the anticipated important role of decentralized physical infrastructure networks (DePIN) in the AI sector in 2025. The article explores how the combination of AI and blockchain technology is expected to transform the industry and accelerate the adoption of decentralized solutions. The article predicts that the evolution of AI applications will drive the future development of blockchain networks and decentralized finance.

The Role of DePIN in the Next Wave of Crypto

The article "The Role of DePIN in the Next Wave of Crypto" explores the impact of decentralized physical infrastructure networks (DePIN) on the future of blockchain and cryptocurrency. As these networks evolve, they are expected to bring significant innovations in the management and access of physical assets and data. DePIN represents the next stage of development in the crypto industry, promising exciting breakthroughs in technology and economics.

The Flywheel Effect of Hype Machines

The article "The Flywheel Effect of Hype Machines" discusses how the cycles of hype and speculation in the cryptocurrency and tech sectors drive rapid adoption and market volatility. The article analyzes the psychological mechanisms behind this phenomenon and its impact on investors and the industry as a whole. By understanding the dynamics of this "hype machine," market participants can better navigate volatility in emerging markets.

Mastering Airdrops: How to Leverage Psychology to Create and Identify Winners

The article "Mastering Airdrops: How to Leverage Psychology to Create and Identify Winners" explores strategies for effectively launching and identifying successful airdrops. The article emphasizes the importance of understanding the psychological triggers of investor behavior and how to leverage these insights to maximize the impact of airdrops. By applying principles of behavioral psychology, businesses and crypto projects can create more engaging airdrop campaigns and attract more user participation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。