Users only need to simply deposit funds to enjoy automated yield optimization and intelligent asset allocation, fully leveraging the advantages of scale to achieve higher returns.

Written by: Ice Frog

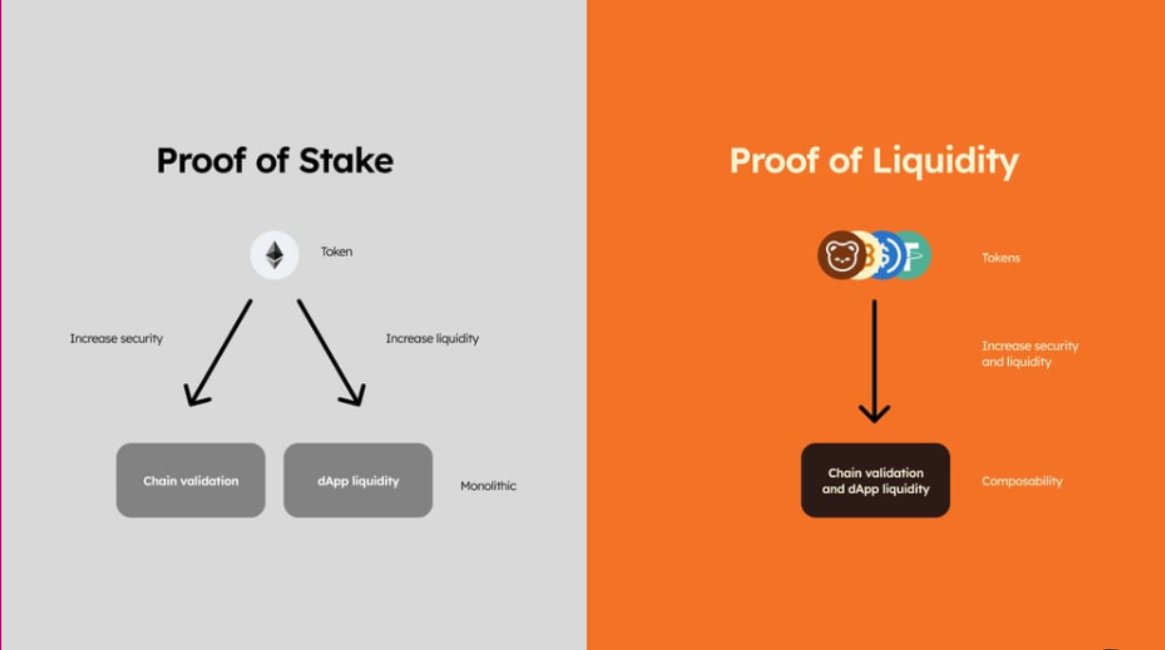

Berachain, a top public chain giant with a financing of $142 million, has created a brand new ecosystem through an innovative liquidity proof consensus mechanism.

The POL mechanism of Berachain achieves a strong synergy between validators, users, and the project ecosystem. However, this innovation also brings challenges, as the three-token model and complex LP mechanism set a high participation threshold for ordinary users.

The cumbersome operation process, high technical requirements, and difficulty in optimizing asset allocation have, to some extent, restricted the further development of the project.

StakeStone Berachain Vault Opens a New Chapter

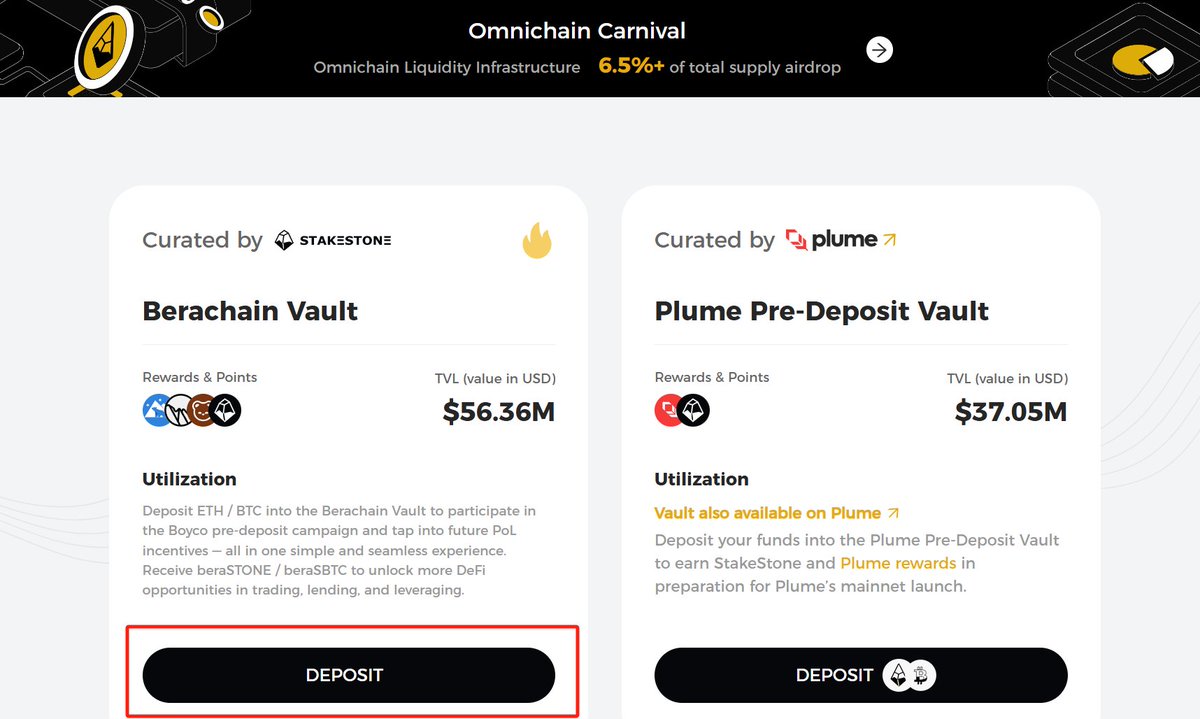

As the earliest officially promoted pre-deposit channel by Berachain, the Berachain Vault launched by StakeStone perfectly addresses the aforementioned pain points.

StakeStone Vault provides users with a one-stop participation solution through intelligent asset management. Users only need to simply deposit funds to enjoy automated yield optimization and intelligent asset allocation, fully leveraging the advantages of scale to achieve higher returns.

Innovative Three-Layer Architecture Design:

Key Significance of the Vault (Funding Pool)

By aggregating numerous small funds into a large-scale funding pool, leveraging scale effects, it represents users in striving for higher token reward distributions, enhancing individual returns while providing stable liquidity for the ecosystem, ensuring smooth transactions, and reducing slippage risks.

For users, it improves convenience; by depositing funds, they can enjoy diversified returns without worrying about cumbersome operational steps, saving time and effort, and lowering the participation threshold.

Vault LP Token (Liquidity Provider Certificate) Layer

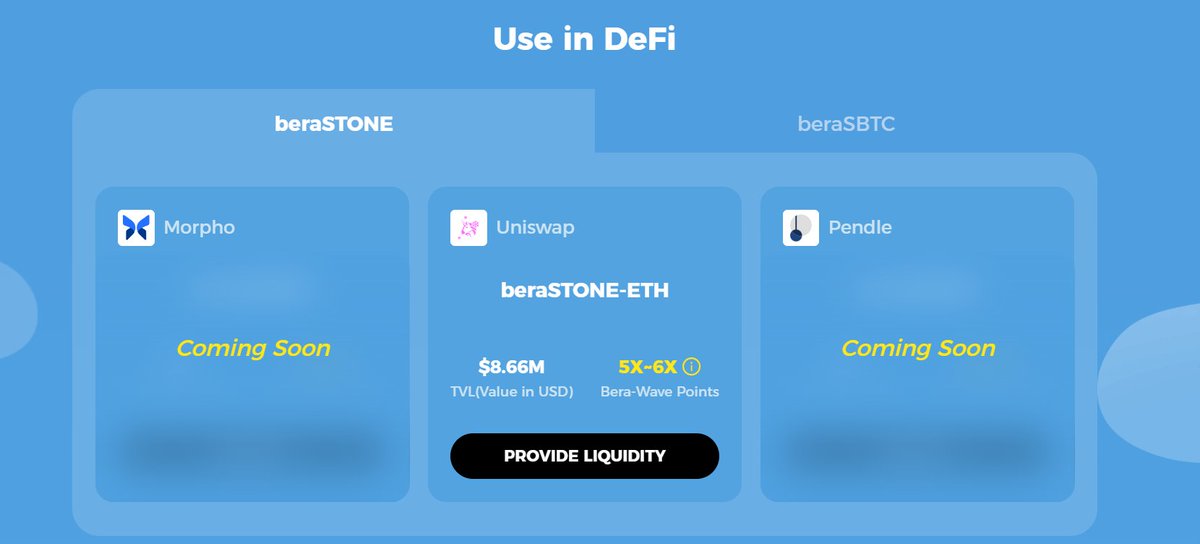

It is the key connection between the Vault and external applications, serving as a critical link across scenarios. In DEX, it can be invested in liquidity pools to earn transaction fees; in Pendle, it can participate in innovative options strategies to explore potential returns; in the lending field, it transforms into high-quality collateral to lend funds, achieving leveraged operations to amplify returns. This flexibility breaks the limitations of assets, allowing users to flexibly allocate assets across multiple scenarios based on market conditions and personal goals, meeting diverse investment needs.

LP Token in DEX / Pendle / Lending (Cooperation Across Different Scenarios)

StakeStone Vault builds a closed loop of diversified returns, earning transaction fees in DEX as basic returns, expanding the return portfolio through Pendle's strategy optimization, and then entering the lending field to leverage funds into new opportunities, forming a cycle of value appreciation. For example, the value of LP tokens increases after optimization in Pendle, then collateralized for lending and invested in DEX to obtain new returns. The LP tokens flow among the three, not only breaking down barriers but also promoting synergy. DEX provides assets and traffic for Pendle, Pendle adds value and traffic for DEX, and the lending platform provides leverage support for both, with the three interdependent, driving the ecosystem forward and creating more value for users.

Yield Release Mechanism

StakeStone Berachain Vault maximizes user investment returns through a multi-layered yield structure.

Three-Tier Progressive Yield Structure:

1⃣ Bottom Layer PoS Yield

The basic yield from ETH staking, a stable and lowest-risk source of returns, automatically captured through STONE assets.

2⃣ Berachain Ecosystem POL Yield

Participating in Berachain's liquidity mining to obtain early allocations of governance token $BERA, capturing token rewards from ecosystem projects (such as Kodiak, Dolomite, etc.).

3⃣ Ethereum DeFi Strategy Yield

Using beraSTONE/beraSBTC in DeFi protocols like Pendle and Morpho, allowing for leveraged operations to amplify returns, participating in liquidity mining to earn additional token rewards, and seizing arbitrage opportunities from flexible trading.

The innovative mechanism of StakeStone Vault is not limited to obtaining yields within the Berachain ecosystem; it also maps these yields to the Ethereum mainnet, enhancing asset liquidity and creating more combinatorial opportunities, while achieving exponential amplification of returns and providing users with diverse investment strategy options, significantly increasing the overall investment return rate.

Latest Activity Introduction

StakeStone Berachain Vault includes two new income-generating assets: beraSTONE and the upcoming beraSBTC.

Currently, it only supports assets on the Ethereum mainnet. After deposit, it automatically converts to beraSTONE points, redeemable for subsequent airdrops.

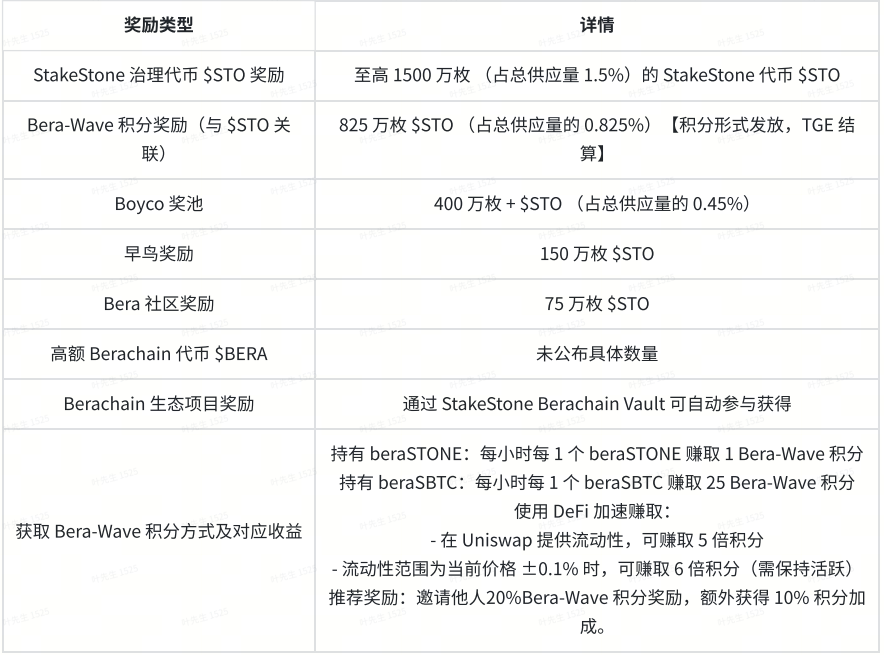

Rewards include rewards from Berachain and ecosystem protocols on Boyco, StakeStone's airdrop rewards, staking and re-staking incentives, as well as future yields from Berachain PoL, with a multi-layered reward mechanism that allows users to enjoy benefits upon deposit.

The first ten thousand participants can also receive early bird rewards (users depositing ≥0.042 ETH or 0.0015 BTC will each receive 150 STO).

Specific Reward Rules

Current Data

Currently, 200,000 users with 60 million TVL

Participation Steps

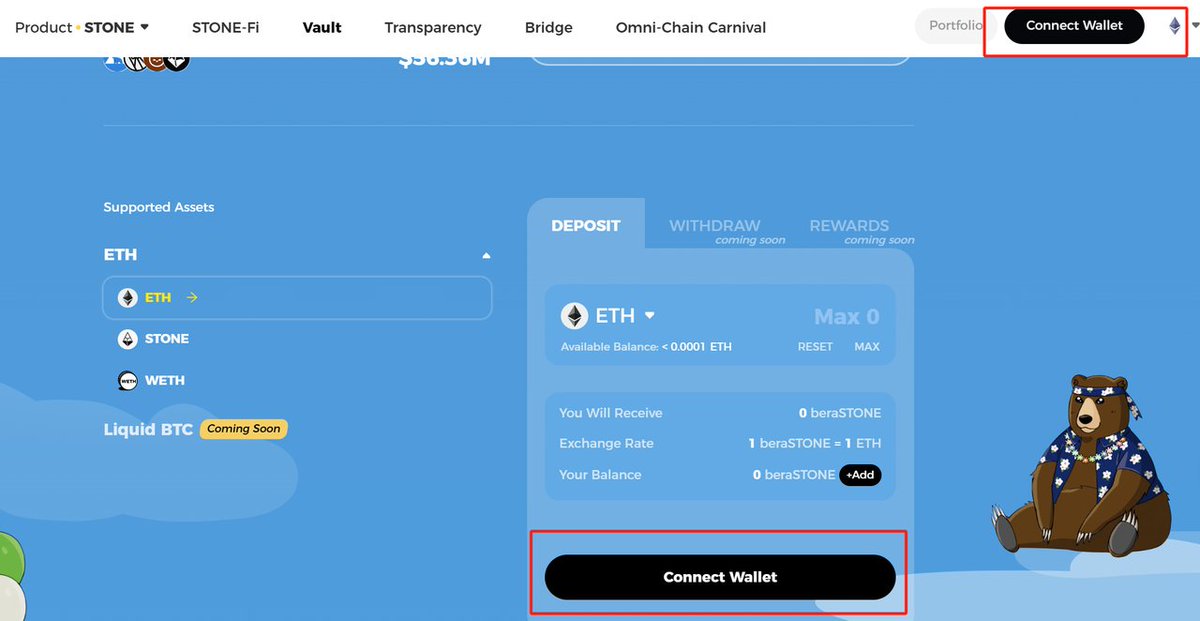

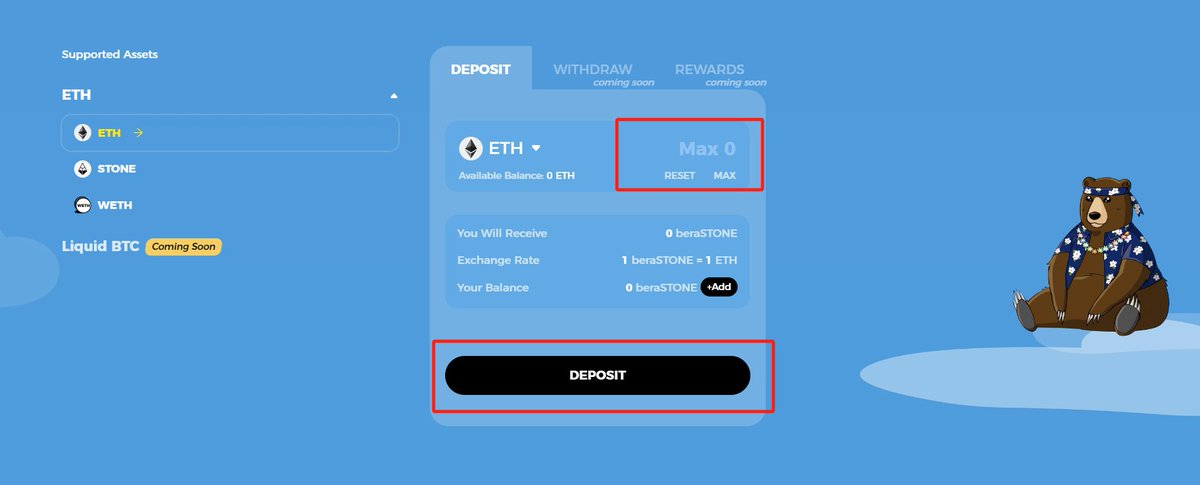

- Click to enter the StakeStone Vault interface.

- Connect your wallet in the upper right corner and switch to the Ethereum mainnet.

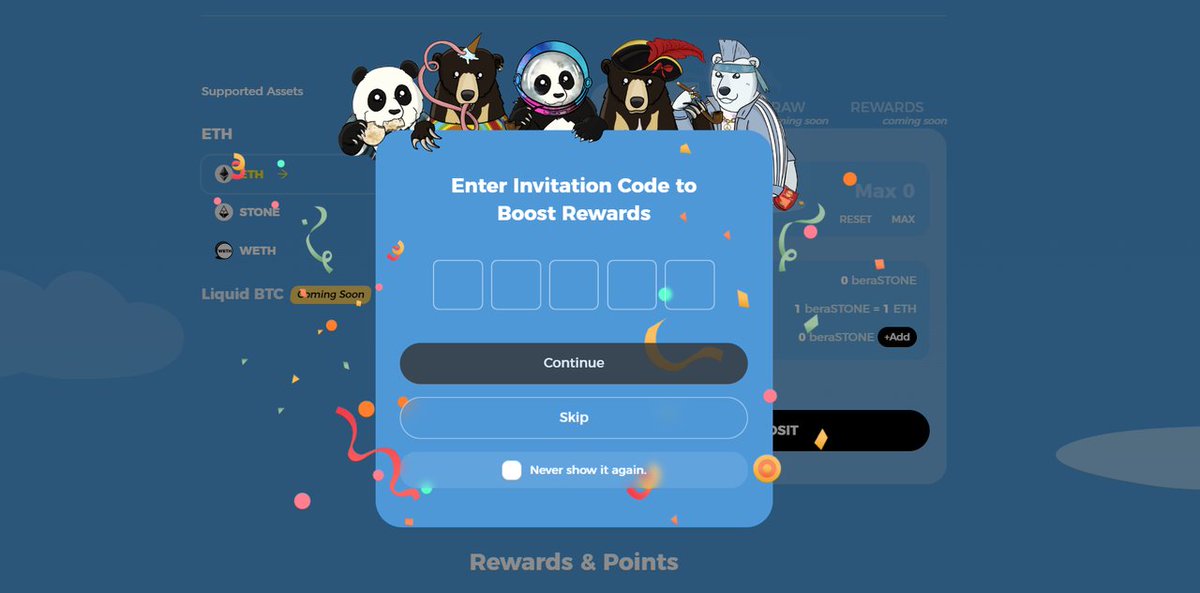

- After connecting your wallet, entering an invitation code can earn you a 10% points boost reward.

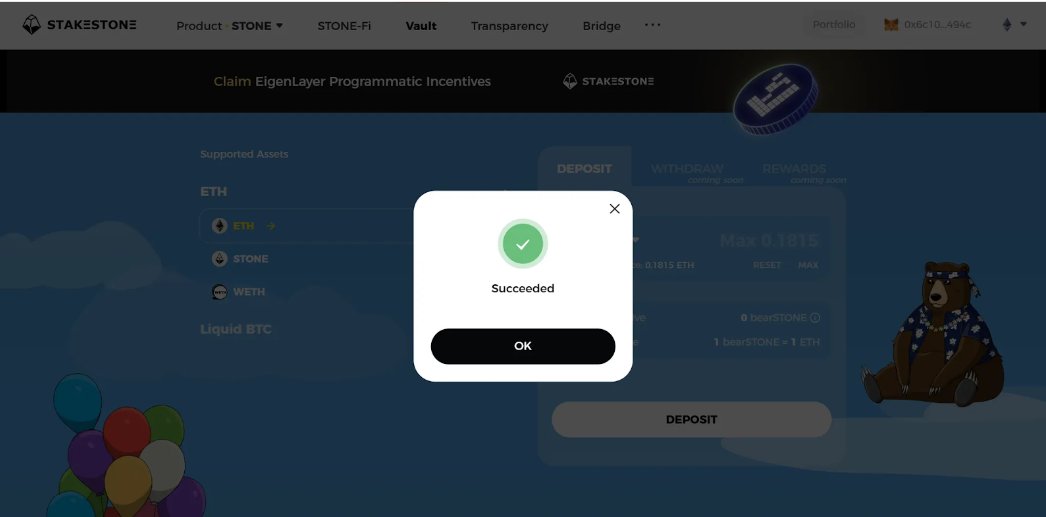

- Deposit ETH/STONE/WETH to earn beraSTONE points rewards.

- Participating in DeFi protocols can earn more rewards; providing liquidity on Uniswap can earn 5-6 times the points.

Follow the official Twitter: @Stake_Stone for the latest updates, and for more details, please refer to the official introduction: Link

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。