Key events in 2024, such as institutional adoption, regulatory progress, and the launch of Bitcoin ETFs, have laid the groundwork for innovation and growth in 2025, driving the widespread development of decentralized finance, blockchain infrastructure, and real-world assets.

Author: everstake

Translation: Blockchain in Plain Language

The blockchain world is heating up as we approach 2025! Institutional adoption is thriving, innovation is booming, and regulation is finally catching up. Meanwhile, the launch of spot Bitcoin ETFs has become a game changer, restoring market liquidity and confidence.

Our R&D team has analyzed the most influential developments of 2024, providing a comprehensive overview that reveals how these trends are shaping the industry. From the rise of liquid staking and layer two solutions to the evolution of stablecoins and their increasingly important role in global finance, we will detail the key events that are paving the way for 2025.

TL;DR

2024 is a transformative year for blockchain, laying the foundation for further growth in 2025. Institutional adoption is soaring, regulation is becoming clearer, and groundbreaking innovations are reshaping the crypto space. What trends will the blockchain world present in 2025?

Bitcoin ETFs Lead the Charge: Spot Bitcoin ETFs have become major holders of Bitcoin, attracting institutional interest and redefining narratives in the financial sector.

Ethereum Scaling Upgrade: Layer two solutions and the Dencun upgrade are significantly reducing costs, with over 200 projects exploring zero-knowledge (ZK) rollups.

Liquid Staking Boom: Protocols like EigenLayer and Babylon are redefining network security and efficiency, with the restaking ecosystem expected to grow rapidly.

Real Assets on the Blockchain: The tokenization of real estate, bonds, and commodities is accelerating, narrowing the gap between traditional finance and cryptocurrency.

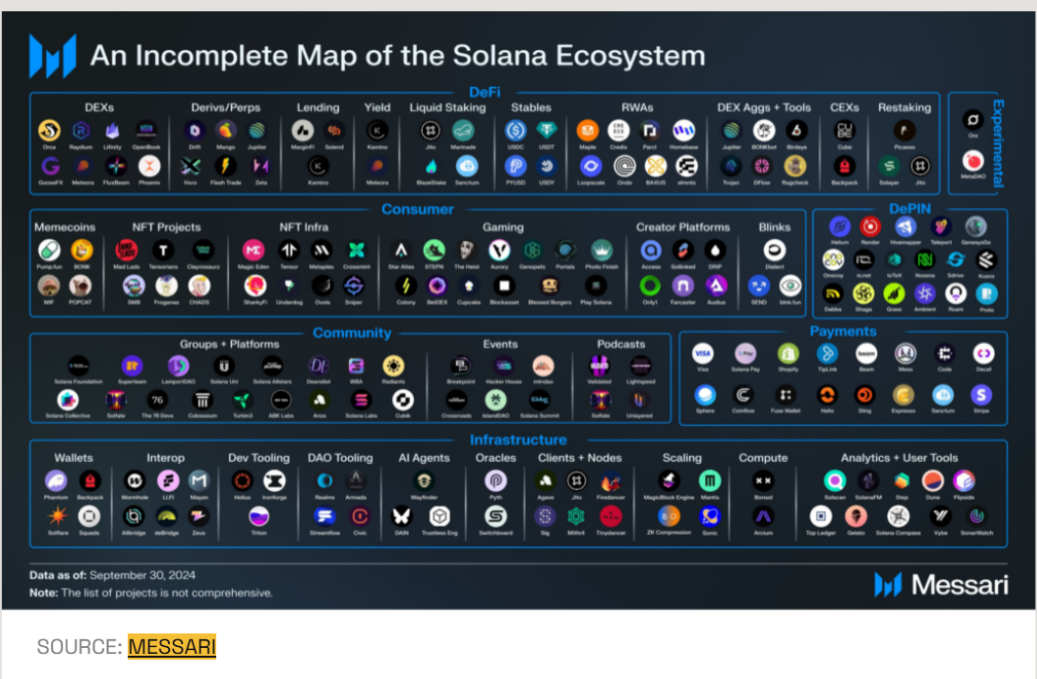

Solana's Revival: Private financing has reached new heights, user activity has surged, and the Solana network has solidified its market position through memecoin trading and NFT innovations.

AI and Blockchain Convergence: The combination of AI and blockchain is revolutionizing user experiences in data integrity, decentralized computing, finance, and beyond.

Decentralized Physical Infrastructure and Storage: Infrastructure solutions are addressing real-world needs, enhancing efficiency, security, and energy optimization.

Seamless Cross-Chain Integration: Cross-chain interoperability has become the norm, with innovations like Particle Network simplifying blockchain interactions.

Decentralized Finance Renaissance: With lower Ethereum fees and enhanced financial products, DeFi is becoming more accessible, ushering in the next wave of decentralized finance.

Global Regulatory Progress: The EU, UK, and Asia-Pacific are developing crypto-friendly regulatory policies, while the US anticipates potential positive changes under new leadership.

2025 will be a year of transformation, but before looking ahead to future trends, we first want to showcase how this year has brought us to new heights.

1. The Journey of 2024: From Recovery to Innovation

2024 is a pivotal year for the crypto industry, laying the groundwork for new growth and innovation. Following the mid-2023 bull market, the approval of spot Bitcoin ETFs in January 2024 marked a watershed moment, restoring institutional confidence and market liquidity.

Let’s delve into the key highlights that defined this transformative year.

1) The Impact of Bitcoin ETFs

The launch and rapid adoption of spot Bitcoin ETFs became a game changer in 2024. These financial products have made ETFs one of the largest holders of Bitcoin, collectively holding about 4.5% of the circulating supply. This surge in institutional interest further solidified Bitcoin's reputation as a valuable and viable financial asset.

Notably, Bitcoin's growth has even sparked political discussions in the US, with some arguing that Bitcoin could help address the $35 trillion national debt issue. While the practical feasibility of this proposal remains questionable due to the rapid accumulation of debt, it highlights Bitcoin's increasing influence in mainstream economic discourse.

2) Progress and Challenges

In 2024, regulation received substantial upgrades, paving the way for institutional entry.

United States: With expectations for a new government in 2025, market optimism for more crypto-friendly policies is gradually rising, but 2024 itself laid an important foundation for this shift. Discussions have focused on strategic Bitcoin reserves and stablecoin regulation, with stablecoin issuers becoming key players in the US financial system. Holding $125 billion in government bonds, they have become the 18th largest holder of US debt, underscoring the trend of digital assets increasingly merging with traditional financial systems.

EU and UK: The EU and UK are leading the way in regulatory frameworks for stablecoins and staking services. These initiatives emphasize their commitment to maintaining financial stability while promoting innovation. This progress solidifies their leadership in providing a structured, business-friendly environment for the crypto market.

Despite significant progress, the industry still faces serious challenges, including scalability issues, liquidity exits from institutions, and global policy fragmentation.

3) The Rise of Liquid Staking and Restaking

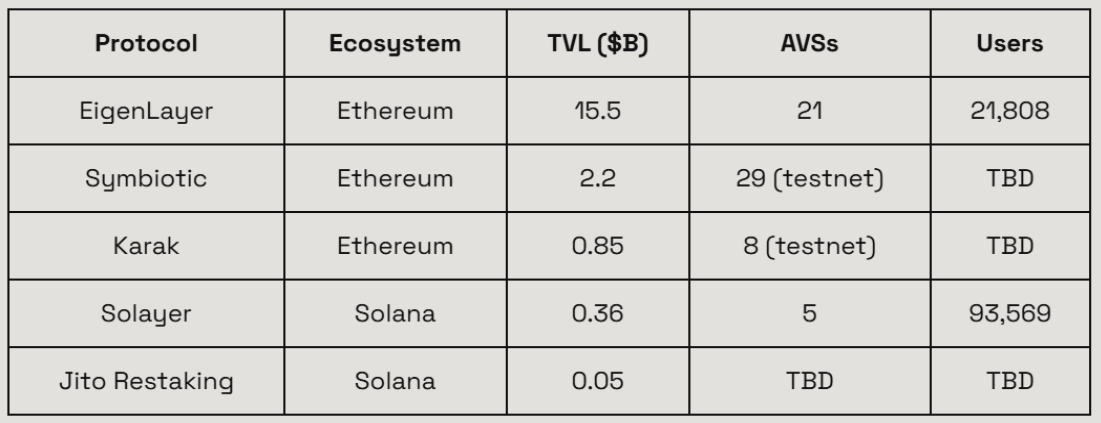

In 2024, liquid staking and restaking experienced unprecedented growth. Protocols like EigenLayer, Symbiotic, Karak, and Babylon enable validators to secure multiple networks simultaneously, enhancing efficiency and security.

The restaking ecosystem is rapidly expanding, with up to 400 active validation services (AVS) expected by the end of 2025. However, many of these protocols are still in development and face key issues such as effective validator coordination and actual user benefits that need further resolution.

4) Layer Two Solutions

Layer two (L2) solutions continue to thrive, providing scalable and efficient transaction processing for Ethereum. The Dencun upgrade has significantly reduced transaction costs, driving L2 adoption.

However, the high costs associated with generating zero-knowledge proofs (ZK) have become a bottleneck, necessitating innovative solutions to drive broader application. Currently, over 200 projects are actively developing ZK technology, emphasizing its critical role in blockchain scalability.

5) Ethereum: Staking Goes Mainstream

Since Ethereum's transition to proof of stake (PoS), staking has seen rapid growth:

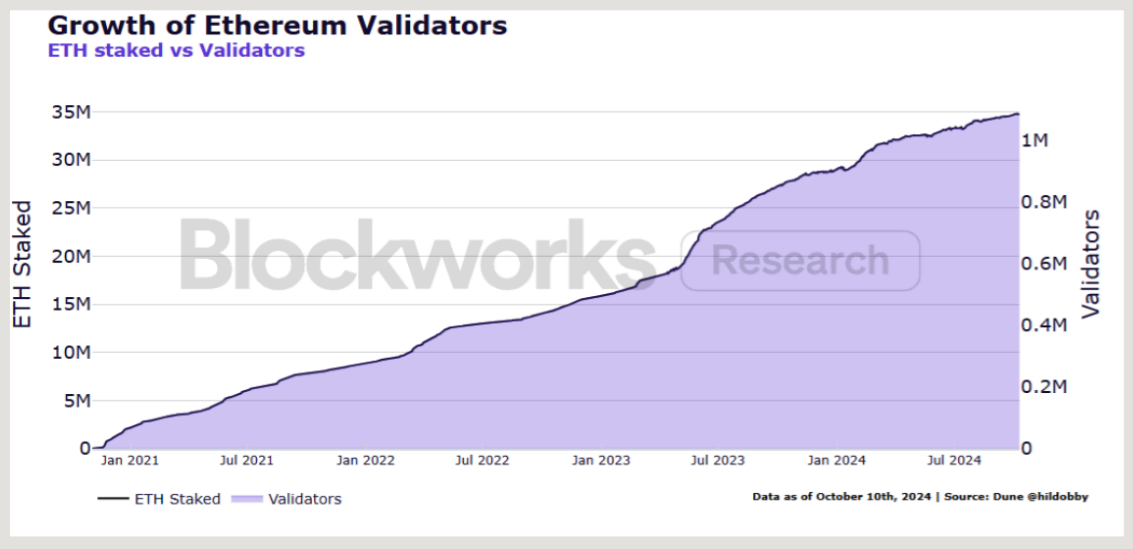

Staked ETH: Increased from 14 million to 35 million, a 2.5-fold increase.

Validators: Grew from 400,000 to 1.1 million, an increase of over 2.5 times.

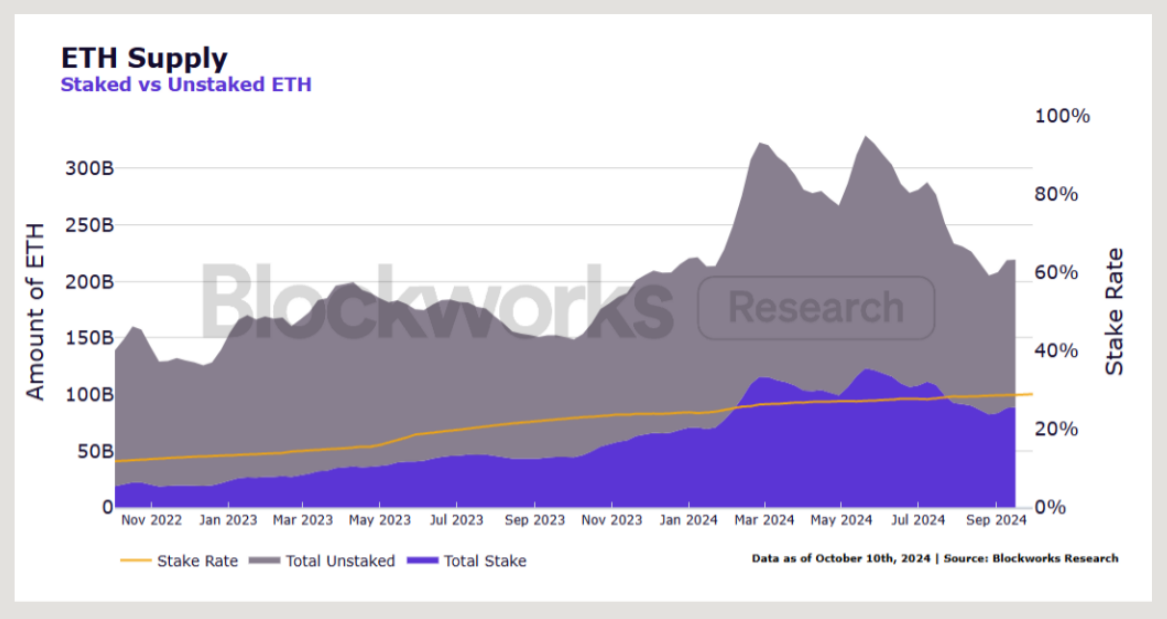

As the crypto industry matures, staking has become a key strategy for institutional investors. Currently, about 28.38% of Ethereum's total supply (34.2 million ETH) has been staked through 1.1 million on-chain validators.

Institutional staking participation reached new heights in 2024, with 70% of Ethereum-holding institutions staking. Notably, over half of them opted for liquid staking solutions, reflecting a growing demand for flexible and yield-generating opportunities.

6) Solana: A Year of Growth

Solana performed exceptionally well in 2024! Private financing reached $173 million in the third quarter, with $103 million attracted in September alone. Major players like Hamilton Lane, Franklin Templeton, and BlackRock have all participated in Solana's tokenized assets.

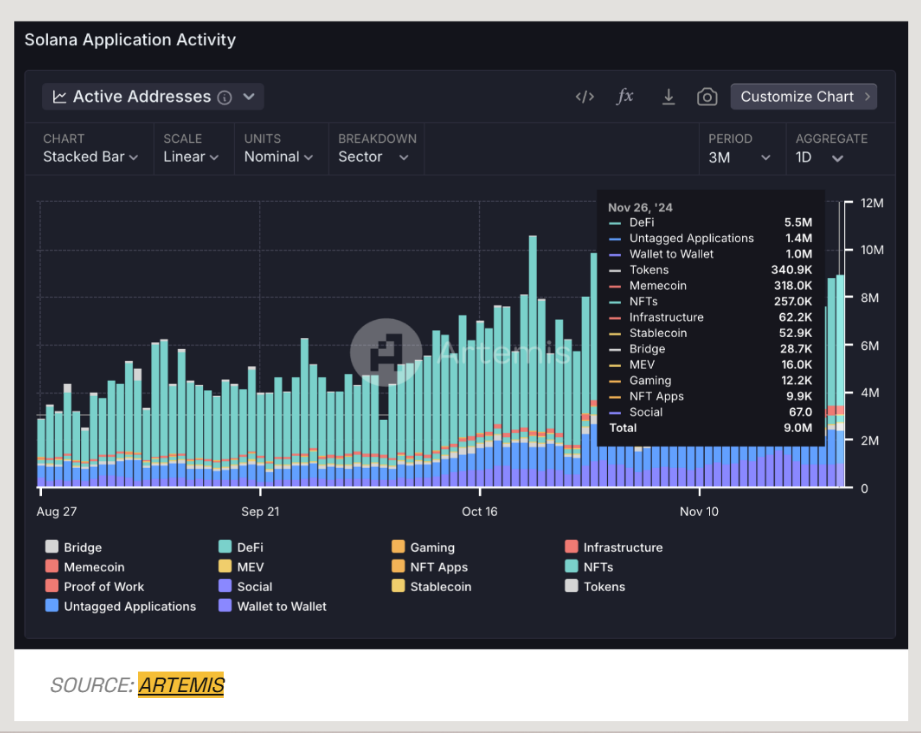

Active Addresses: Reached 7 million in November 2024, driven by the memecoin and NFT craze.

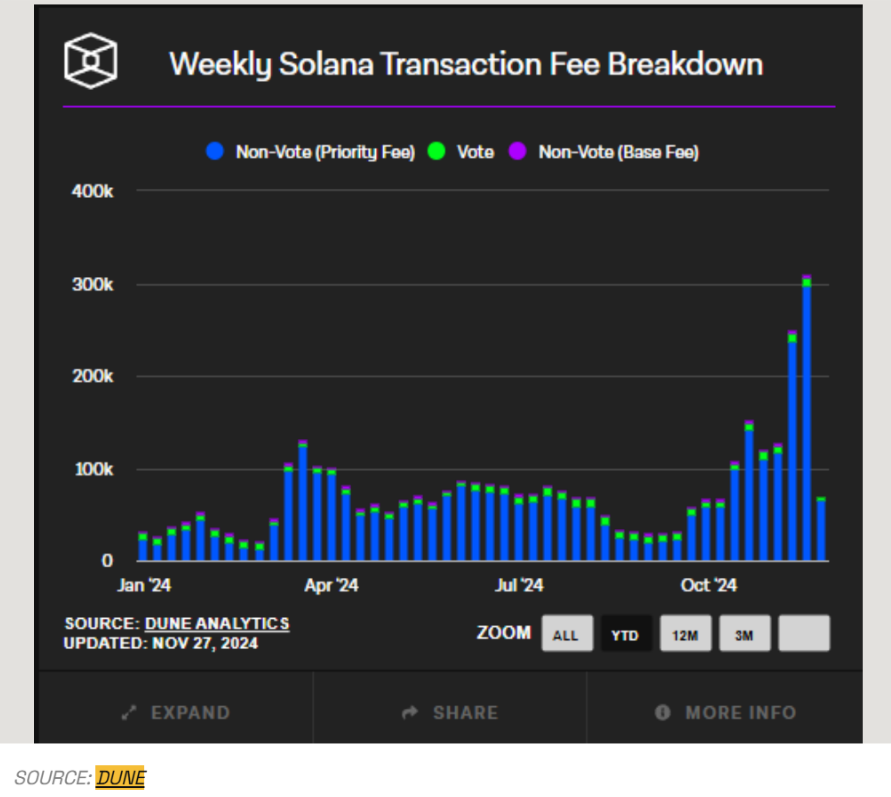

Low Fees, High Transaction Volume: Transaction fees reached $260 million over six months, with an average fee of just $0.02 per transaction.

In 2024, decentralized exchange (DEX) activity surged, primarily driven by memecoin trading:

Q1 2024: Trading activity peaked.

Q4 2024: Activity rebounded.

Solana's Stablecoin Market Cap: Reached $3.8 billion, ranking fifth among all blockchain networks.

Restaking gained attention in the Solana ecosystem:

Jito is set to launch its restaking platform, with a current total value locked (TVL) of $50 million, covering three LRT protocols.

Solayer has launched, with a TVL of approximately $390 million.

7) The Rise of Asia-Pacific

The Asia-Pacific region is becoming a cornerstone for crypto development, thanks to a strong community of developers and investors. The region's blockchain adoption rate has surged, with Solana alone accounting for 100 million active addresses out of 220 million global blockchain addresses as of September 2024.

Projects in the region are often tailored to local preferences, making flexibility and market research key to success.

2. Investment Landscape in 2024

In 2024, global investment activity in the crypto market significantly increased. The approval of spot Bitcoin and Ethereum ETFs provided much-needed liquidity to the market and restored market confidence. This fostered a close connection between the primary and secondary markets, driving investor participation.

In the first three quarters of 2024, funding trends reflected this revitalized optimism:

Q1 2024: Fundraising amounted to $2.545 billion, a year-on-year increase of 0.76%.

Q2 2024: Investment rose to $2.75 billion, an 8.05% increase from Q1.

Q3 2024: Funding slightly decreased to $2.406 billion, down 13% from Q2.

Despite these fluctuations, the market demonstrated resilience, achieving a year-on-year growth rate of 26.05%. This indicates that while short-term volatility remains, long-term confidence is still strong.

1) Top Venture Capital Firms

Leading venture capital firms in the crypto industry have played a crucial role in supporting innovation. Heavyweights like a16z, BN Labs, and Polychain are at the forefront of the industry by backing projects in emerging areas such as real-world assets (RWA), decentralized finance (DeFi), privacy protocols, and cross-chain interoperability.

These firms not only provide financial support to projects but also actively drive innovation and influence industry direction. Their strategic investments have the potential to shape the trends we will see in 2025 as they continue to identify and support the most promising technologies.

2) The Fourth Wave of Web3 Innovation

The crypto industry is experiencing what is referred to as the fourth wave of Web3 innovation. The rise of non-EVM memecoins, BRC20, AIGC, and RWA assets marks the arrival of this wave.

The broad adoption of applications has progressed slowly, preventing the primary market from reaching the heights of Bitcoin's performance. The key to growth lies in identifying assets that can attract both investors and retail users, with retail users being the main drivers of capital inflow.

The trading structure of the crypto investment market reveals several key trends:

Over 54.9% of institutions remain inactive, indicating a cautious approach amid market uncertainty.

Only 12% of projects successfully secured two or more rounds of funding, highlighting the challenges of obtaining sustained financial support.

The average amount raised per round of funding increased slightly by 0.62% ($53,139) compared to 2023, reflecting stagnation in capital inflow growth.

Despite these challenges, the primary market exhibits a clear "head effect," with most institutional investors choosing to remain on the sidelines, waiting for clearer market signals or the emergence of more innovative projects before making significant investments.

3) Key Investment Highlights

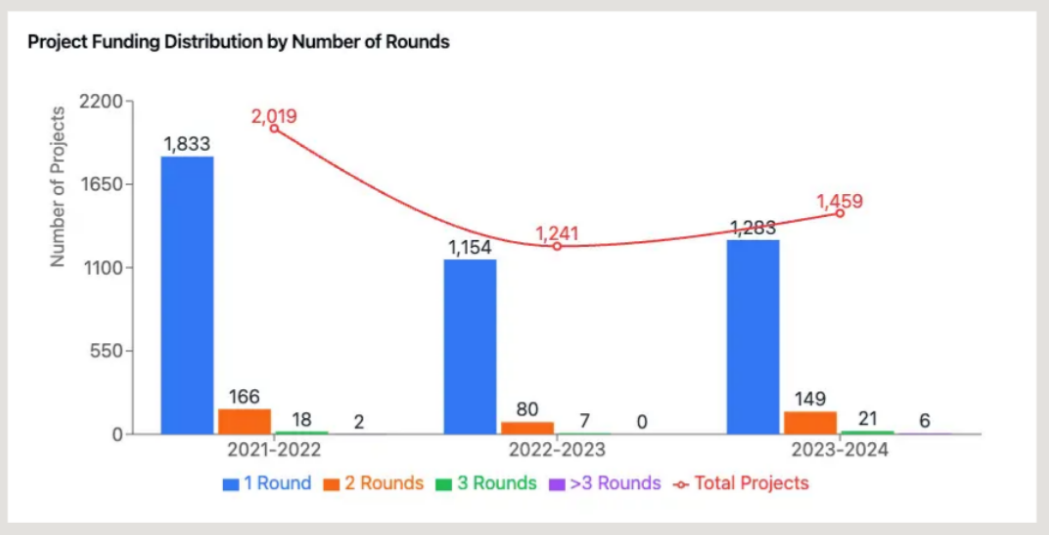

In 2024, the crypto industry saw a total of 1,459 funding events:

Round 1: 1,283 projects.

Round 2: 149 projects.

3 Rounds and Above: 27 projects.

Compared to the period from 2021 to 2022, these numbers have decreased by 27.7% to 30%. However, compared to 2022 to 2023, this trend shows positive growth, with increases ranging from 7.6% to 86.3%.

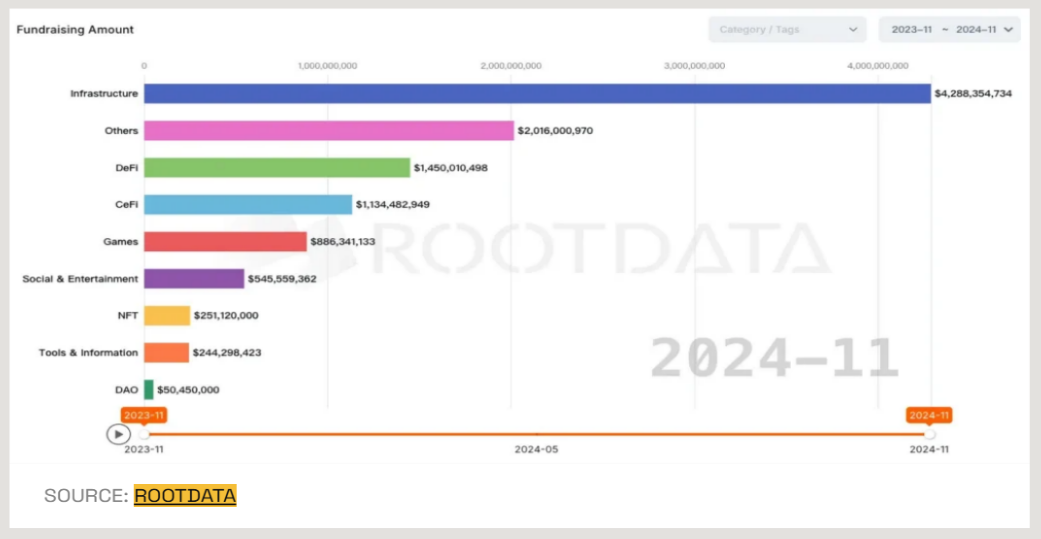

The sectors that received the most funding are:

Infrastructure Solutions: Raised over $4.2 billion.

- Decentralized Finance (DeFi): Attracted over $1.4 billion in investment.

4) Leading Ecosystems and Projects

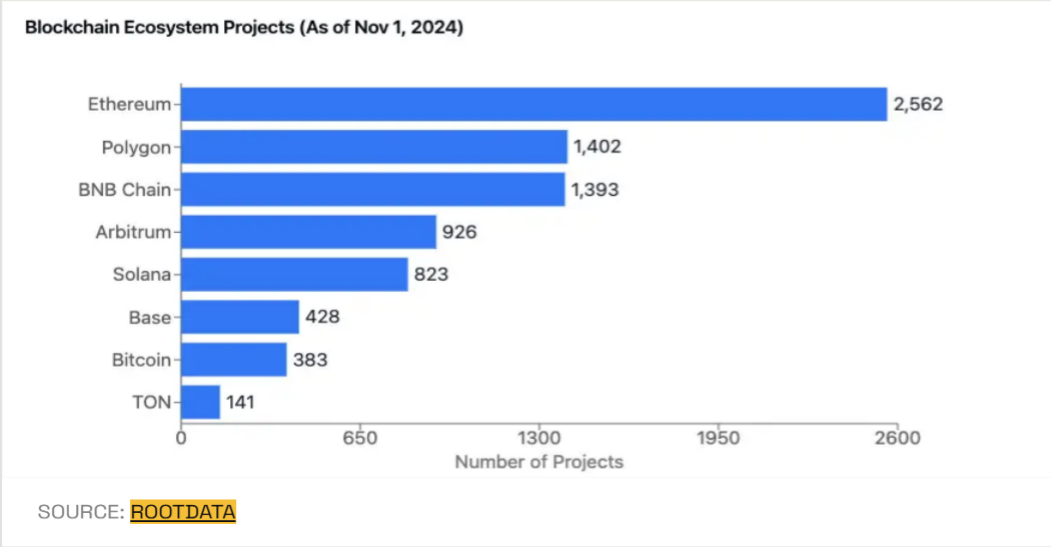

Several blockchain ecosystems performed outstandingly in 2024:

Ethereum: Continues to dominate the market with 2,562 active projects.

Solana: Strongly recovered from the FTX collapse, hosting 823 projects.

Bitcoin Ecosystem: Gained momentum with the emergence of 383 projects.

TON (Telegram Open Network): Showed growth with 141 projects.

Base: As the fastest-growing layer two solution, launched 428 projects with a TVL of $3.6 billion.

These ecosystems reflect the diversity and ever-evolving nature of blockchain development, each with its unique strengths and growth trajectories.

5) Notable Funding Rounds and Trends

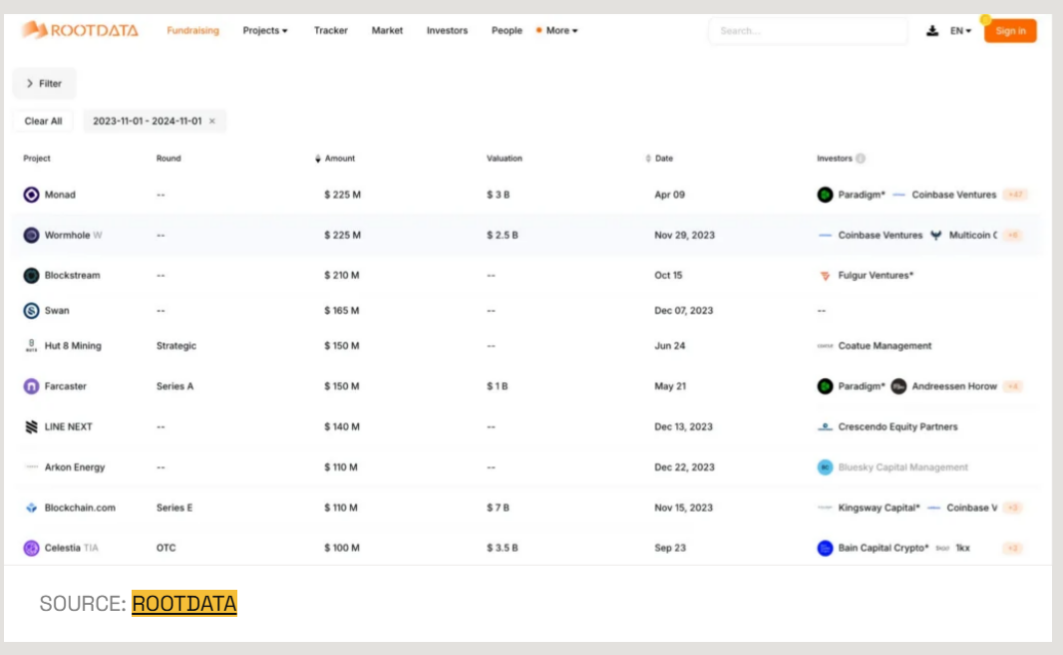

In 2024, several significant funding deals highlighted investor confidence in the crypto industry:

Monad: Raised $225 million in April 2024, with a project valuation of $3 billion.

- Celestia: Secured $100 million in September 2024 through over-the-counter (OTC) transactions.

These large-scale investments underscore a trend: infrastructure projects and innovative blockchain solutions continue to attract substantial capital.

3. Looking Ahead to 2025

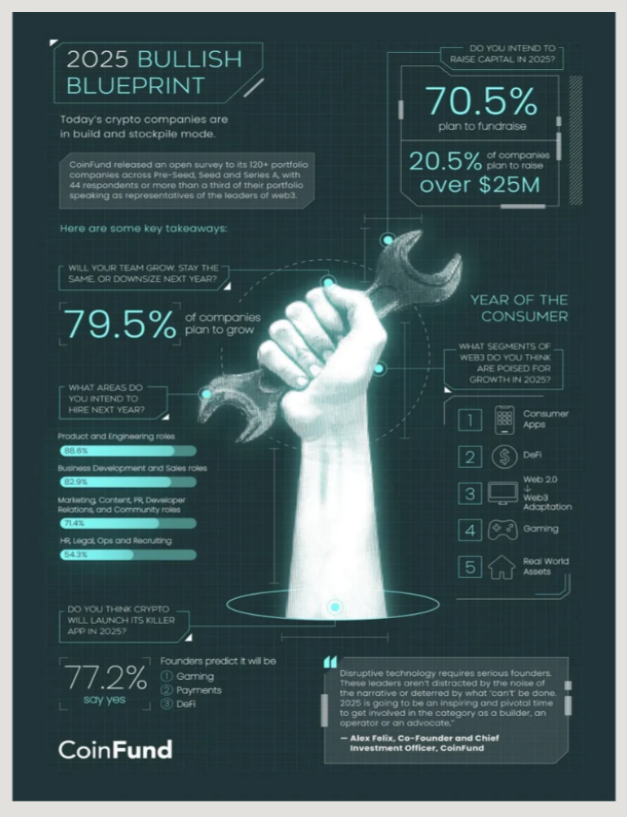

A survey conducted by CoinFund provides insight into the ambitious plans of crypto companies for 2025. The survey shows that 70.5% of companies plan to raise funds, with 20.5% targeting over $25 million, indicating that the industry is entering a phase of building and expansion.

Key Highlights:

Nearly 79.5% of companies plan to expand their teams, focusing on hiring for product and engineering roles (88.6%), followed by business development and sales roles (82.9%).

Consumer applications, decentralized finance (DeFi), Web 3.0 adaptation, and real-world assets (RWA) are expected to lead the expansion of Web3 in 2025.

Up to 77.2% of founders believe that a groundbreaking application will be launched in the crypto industry in 2025, with the most anticipated areas including gaming, payments, and decentralized finance (DeFi).

This optimistic outlook highlights the upcoming year for the Web3 industry, which may redefine the industry landscape through disruptive innovation and strategic expansion.

4. 12 Crypto Trends to Watch in 2025

The crypto world is evolving rapidly, and keeping up with the latest trends is crucial for staying ahead. As we approach 2025, our expert R&D team, led by Anna Petrenko, has identified several exciting trends to watch.

While areas like layer two solutions, GameFi, and NFTs may face challenges due to stagnation, other sectors are poised for bright prospects. Let’s explore the key areas that will shape next year's trends!

1) Bitcoin Ecosystem: The Rise of Staking and Liquid Staking

Bitcoin remains the cornerstone of the crypto market, and its ecosystem is continuously expanding through groundbreaking advancements:

Bitcoin Staking: The launch of the Babylon mainnet introduces Bitcoin staking, allowing BTC holders to earn additional rewards. Although still in its early stages, the first Babylon rewards are expected in Q1 2025.

- Liquid Staking: Emerging protocols enable BTC holders to participate in decentralized finance (DeFi) and connect with other blockchain networks.

While the Bitcoin staking space shows promising growth potential, many projects are still in development, indicating that there is still significant potential in this area for 2025.

2) The Convergence of Crypto and Traditional Finance: Integration and Consolidation

The lines between traditional finance (TradFi) and decentralized finance (DeFi) are becoming increasingly blurred. In 2025, more financial institutions are expected to incorporate crypto services, such as:

Crypto Custody: Banks providing secure storage for digital assets.

Crypto-Backed Loans: Offering loans secured by crypto assets.

Staking Services: Providing institutional-grade staking services for institutional clients.

Visa and Mastercard have begun integrating crypto solutions, and this trend is expected to accelerate. This convergence will make cryptocurrencies more accessible and seamlessly integrate them into everyday financial activities.

3) Real World Assets: Unlocking Real-World Value

The tokenization of RWAs is expected to become a dominant theme in 2025. Key drivers include:

Increased Adoption: Traditional financial institutions are exploring blockchain solutions to tokenize real estate, bonds, and commodities.

- Regulatory Clarity: More robust regulations in major markets will attract institutional capital and enhance trust in RWAs.

As interest from institutional investors grows and aligns with DeFi, RWAs are poised to change the way real-world value is accessed and managed in the digital economy.

4) Fully Homomorphic Encryption (FHE): The Future of Confidential Computing

FHE is gaining attention as a groundbreaking trend in confidential computing. This technology allows computations to be performed directly on encrypted data, ensuring:

Privacy: Data remains encrypted throughout the process.

- Security: Sensitive information is never exposed.

While similar to zero-knowledge proofs (zk), FHE offers unique capabilities that are crucial for the widespread adoption of encryption. In 2025, more FHE-based blockchain projects are expected to address real-world application scenarios and enhance privacy workflows.

5) Artificial Intelligence and Crypto: A Perfect Combination

Artificial intelligence became a focal point in 2024, accounting for 35% of U.S. startup investments (Crunchbase). The combination of AI and blockchain is addressing significant challenges. Here’s how blockchain is facilitating AI development:

Data Integrity: Ensuring the authenticity and tamper-proof nature of data used for AI training.

Decentralized Storage: Providing a secure, low-cost alternative to centralized storage.

Decentralized AI Computing: Reducing costs by leveraging idle computing power.

As AI deeply integrates with DeFi, cybersecurity, and data privacy, the combination of AI and crypto will drive new opportunities and address existing challenges.

2025 will be a pivotal year for transformation in the crypto industry. From the expansion of the Bitcoin ecosystem and the tokenization of real-world assets to the fusion of AI and blockchain, these trends will reshape the market landscape.

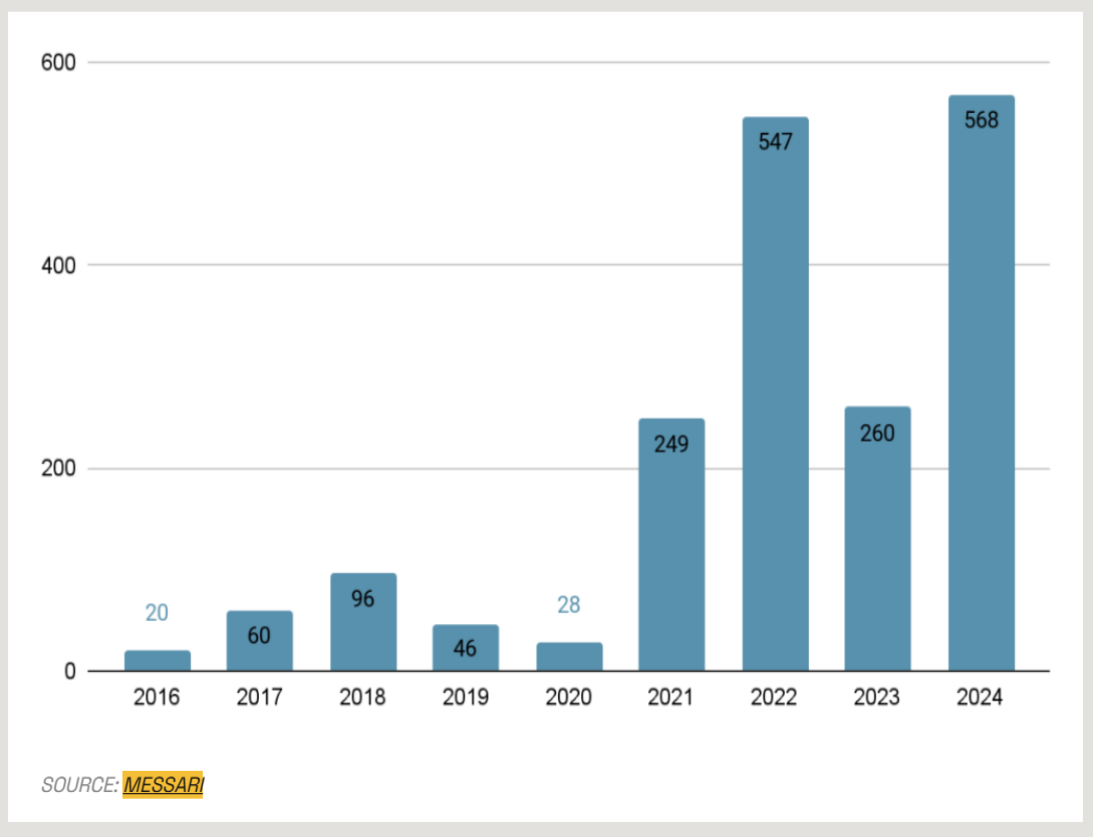

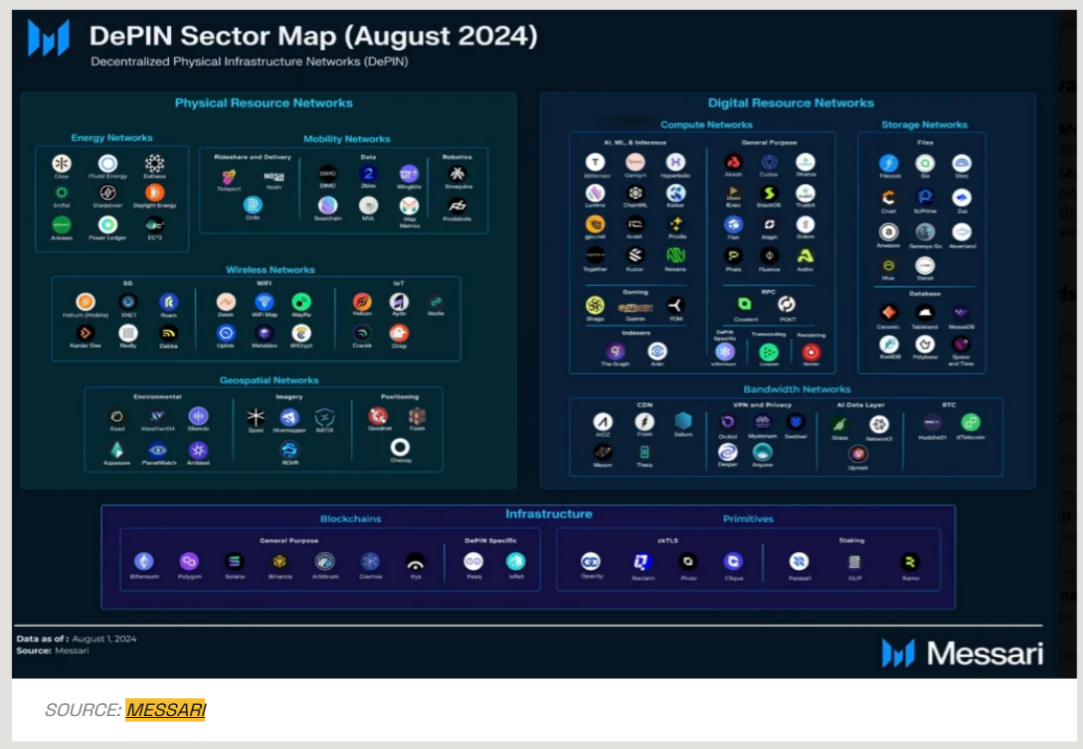

6) DePIN: Physical and Digital Infrastructure

Decentralized Physical Infrastructure Networks (DePIN) leverage blockchain technology to create decentralized solutions for real-world applications. Despite facing regulatory hurdles and competition from Web2 companies, DePIN is gaining momentum:

In 2024, it secured $568 million in funding, with over 1,500 projects surpassing a market cap of $50 billion.

A. AI-Driven Projects:

In 2024, nearly half of the top-funded DePIN projects focused on artificial intelligence.

B. Global Hubs:

The U.S. leads DePIN innovation, followed by Singapore and the UK.

C. DePIN: Addressing Growing Infrastructure Needs and Providing Robust Solutions for the Digital Economy

- Decentralized Storage: Secure, Efficient, and Resilient

Centralized storage faces increasingly severe threats, with over 1 billion records leaked in 2024 alone. Decentralized storage offers a resilient alternative:

No Single Point of Failure: Data is replicated across nodes, reducing the risk of network attacks.

Energy Efficiency: Distributed storage consumes less energy compared to centralized data centers.

Advanced Security: Technologies like Multi-Party Computation (MPC) and Zero-Knowledge Proofs (ZKP) enhance data protection.

Innovative Dynamic Sharding: Optimizes performance by adjusting data distribution in real-time, reducing the risk of data loss.

- PayFi: Instant, Programmable Finance

PayFi, launched by Solana, enables instant settlements and automated payments through smart contracts. By leveraging RWAs and DeFi, PayFi allows users to:

Pay for daily expenses using income from borrowing protocols.

- Optimize capital usage while protecting their primary assets. PayFi has the potential to revolutionize cross-border payments, DeFi applications, and financial flows in the real world.

- SocialFi: Monetizing Social Interactions

SocialFi combines social media with DeFi, allowing users to earn rewards through online activities. With a Web2-like interface, SocialFi platforms provide a smooth transition to Web3 experiences.

Challenges include creating sustainable economic models and handling high transaction volumes, but advancements in decentralized infrastructure may drive its adoption.

- Privacy and Verification: The Rise of ZKP

Privacy tools, such as Zero-Knowledge Proofs (ZKP), are becoming increasingly important in blockchain applications like payments, authentication, and governance.

ZKP can verify data without exposing sensitive information, balancing transparency and confidentiality.

- Cross-Chain Interoperability and Chain Abstraction

Seamless blockchain interactions are becoming increasingly important. Projects like Particle Network provide account-level chain abstraction, allowing users to unify account balances across multiple chains without bridging. This innovation simplifies user experience and supports the development of cross-chain applications.

- DeFi Renaissance and Pre-Confirmation

As Ethereum transaction fees decline and market conditions change, DeFi is expected to regain momentum. Greater accessibility and emerging use cases will drive the next wave of decentralized financial services.

Pre-confirmation protocols, such as Primev, Luban, and Bolt, provide guarantees for transaction inclusion and MEV protection. This innovation enhances transaction speed and security for traders and decentralized applications (dApps) while achieving decentralization in block production.

5. Summary: Outlook for 2025

2025 will be a key year for blockchain technology, driven by technological innovation, regulatory clarity, and institutional adoption. Analysis shows that 2024 saw many significant developments, such as the rapid proliferation of Bitcoin ETFs, the expansion of Layer 2 solutions, and the increasingly central role of stablecoins in the global financial system.

New frontier areas, such as Decentralized Physical Infrastructure Networks (DePIN), tokenization of real-world assets (RWA), and DeAI, are expected to revolutionize the field. The fusion of artificial intelligence and blockchain is likely to enhance scalability, security, and user experience, paving the way for mass adoption.

The EU, UK, and Asia-Pacific region are leading the way in promoting regulatory frameworks, boosting investor confidence. Meanwhile, the U.S. is expected to introduce crypto-friendly legislation under new government leadership.

The competitive landscape is vibrant, with Solana, Ethereum, and Bitcoin revitalizing their respective ecosystems. Success in 2025 will depend on real-world applications, security, and user-centric solutions.

In short, 2025 is filled with exciting opportunities and challenges.

Article link: https://www.hellobtc.com/kp/du/12/5603.html

Source: https://everstake.one/blog/blockchain-beyond-2024-trends-insights-and-predictions-for-2025

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。