Recently, the stablecoin season and Superchain narrative have emerged, offering insights into the DeFi world.

1/ Ethena and Usual Spark the Stablecoin Season

(1) Ethena launches USDtb, supported by BlackRock's BUIDL.

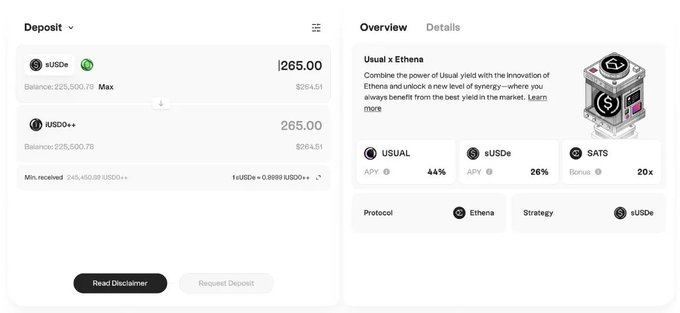

(2) Ethena collaborates with Usual to mutually boost TVL and incentives.

(3) WLFI partners with Ethena to integrate sUSDe into the lending market.

Unlike the previous Stablecoin war, this round of stablecoins shows a clear trend of collaboration, with participants being more composed and experienced than the impulsive players of the last cycle.

Usual embeds a multi-party game stablecoin mining mechanism, similar to the underlying logic of DeFi Summer's Pool 1-3, with differences in 1) RWA concept, 2) more refined game models, and 3) massive liquidity exits provided by partners like Binance.

The collaboration with Ethena is beneficial for the expansion of USD0, with early rapid TVL growth relying on token prices, which in turn boosts TVL -> enhances token staking yields. The upper limit of this perpetual motion model is when TVL growth slows down, potentially reaching an inflection point, where token prices and TVL gradually balance, forming a reasonable yield close to the market.

Another X factor is the external positive stimuli (given the unique policy dividends of RWA in this cycle) that may again stimulate token prices to drive a new round of TVL growth.

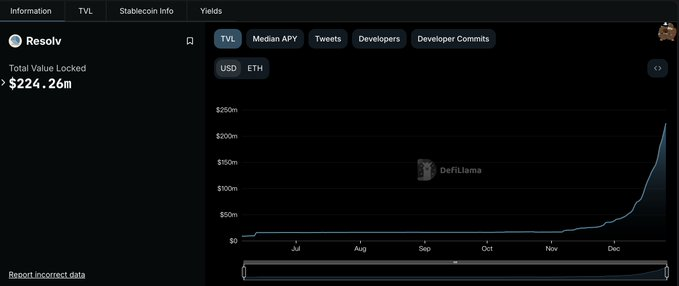

2/ Resolv TVL Grows Nearly 400% in the Last 2 Weeks

(1) Delta, a neutral stablecoin protocol similar to Ethena, introduces RLP, which serves as an insurance layer absorbing market volatility risks between USR and underlying assets.

(2) If the collateral pool incurs losses (e.g., funding rate losses or unexpected losses), these losses are first borne by RLP, without affecting USR holders.

(3) To incentivize users to mint RLP, RLP users will receive higher profit sharing as compensation for bearing market and counterparty risks.

(4) The design of RLP and USR corresponds to risk stratification for users with different risk preferences.

(5) In the future, Resolv will launch on HyperEVM.

3/ Frax Recasting

(1) Frax collaborates with Symbiotic.

(2) veFRAX multi-yield structure.

(3) Proposal to use BlackRock's BUIDL as collateral for Frax USD.

4/ Superchain Narrative

(1) Ink, developed by Kraken, goes live on the mainnet and joins the Superchain.

(2) Dinero launches the first LST on ink.

(3) Velodrome will integrate into ink in 2025; ink has already purchased and locked 2.5M veVELO to develop its own L2 on compliant exchanges. With the success of Base, market expectations for ink are also high. As the liquidity center of the Superchain, velo may no longer expand through forks like aerodrome but will strategically use velodrome to horizontally expand and capture other Superchain members.

5/ Convex and Yearn Collaborate to Launch Decentralized Stable Protocol Resupply

(1) reUSD: A stablecoin generated from the lending market as collateral, such as stablecoin receipts in Curve Lend and Frax Lend.

(2) Leverage support: Through built-in leverage cycling functionality.

A classic nesting doll from the old DeFi.

6/ GammaSwap Yield Token Nearing Completion, Sent for Audit

GammaSwap's track focuses on hedging impermanent loss, allowing LP tokens to be lent/split and reorganized while achieving a profit and loss curve similar to options. Usage among old DeFi participants is increasing, primarily observing TVL growth after the Yield Token launch.

7/ Ethena Releases New Proposal for Integrating Derive Options and Perpetual Futures on Governance Forum

(1) If approved, Derive will become the on-chain hedging and foundational trading venue for Ethena's $6 billion TVL segment.

(2) Derive is one of the few on-chain options trading products; if it can obtain better liquidity through Ethena, its competitiveness will significantly increase.

8/ Aptos Changes Leadership, Mo States No APT Has Been Sold, New CEO Will Focus More on DeFi Development

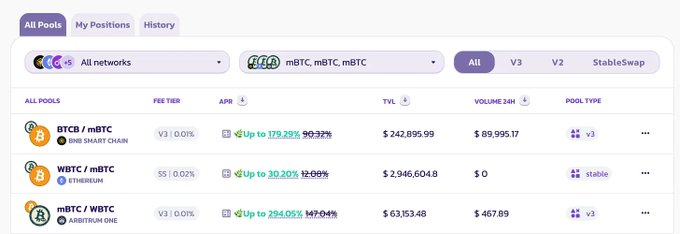

9/ Babypie Incentivizes mBTC-BTC Liquidity Across Multiple Chains and DEXs

10/ Fluid Expands to Arbitrum

- Introducing $FLUID to the Arbitrum network and implementing growth incentives.

- Currently one of the most efficient DEXs, L2 expansion will capture larger trading volumes.

11/ (1) Avalanche Foundation Launches infraBUIDL(AI) Program.

(2) LFJ Will Soon Launch DEX Aggregator on Avalanche.

(3) Morpho Labs Proposes Deploying Core Smart Contracts Across Multiple Chains.

(4) Sonic Goes Live on Mainnet, Token Conversion, Aave Integration, and Some Ecological Projects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。