RWA and stablecoin sectors are expected to achieve broader applications and deeper impacts globally.

"Stablecoins are a trillion dollar opportunity."

According to a research report published by Pantera Capital partners Ryan Barney and Mason Nystrom, the statement that stablecoins represent a trillion dollar opportunity is not an exaggeration. As a type of cryptocurrency pegged 1:1 to fiat currency and maintained in value through algorithms or reserves, stablecoins have seen their share in blockchain transactions rise from 3% in 2020 to over 50% currently, thanks to their non-speculative nature.

Development of the Stablecoin Market in the Past Two Years

2024: A Year of Breakthroughs

This year has seen significant breakthroughs for stablecoins, with total annual transaction volume reaching $5 trillion and nearly 200 million accounts generating over 1 billion transactions. Unlike the previous bull market, the application of stablecoins has transcended the limits of the DeFi ecosystem, demonstrating strong potential in the cross-border payment sector, especially in emerging markets with high demand for US dollars. Currently, the supply and transaction volume of on-chain stablecoins have reached all-time highs.

Traditional Financial Technology Giants are Actively Engaging:

• Stripe acquired Bridge platform for $1.1 billion, calling stablecoins the "superconductor of financial services."

• PayPal launched its own stablecoin, PYUSD, in 2023.

• Robinhood announced a partnership with a cryptocurrency company to prepare for a global stablecoin network.

• The market size of US Treasury RWA has approached $3 billion, growing 30 times since the beginning of 2023, including:

• USYC, in collaboration with Hashnote and Copper, reached $880 million.

• BlackRock's BUIDL reached $560 million.

2025: Further Expansion Expected

In its "Top 10 Predictions for the Crypto Market in 2025," asset management giant Bitwise stated that with the passage of US stablecoin legislation and the entry of institutional funds, the market value of stablecoins is expected to double to $400 billion, while the market size for tokenized real-world assets (RWA) is projected to reach $50 billion. ParaFi predicts that the tokenized RWA market could reach $2 trillion by the 2030s, and the Global Financial Markets Association even forecasts it could exceed $16 trillion.

Global Financial Giants are Actively Engaging:

• Goldman Sachs: Launched a digital asset platform, assisting the European Investment Bank in issuing €100 million in digital bonds, and plans to build a private chain.

• Siemens: First to issue €60 million in on-chain digital bonds.

• HSBC, JPMorgan, Citigroup: Exploring the tokenization of government bonds.

Next, let's take a look at some important segments of RWA projects:

RWA Sector

Ondo Finance (ONDO)

ONDO Finance is an RWA project focused on bringing traditional financial instruments into DeFi by collaborating with traditional financial institutions to acquire US Treasury assets. It then issues tokenized securities through smart contracts, splitting ownership of these Treasuries into smaller shares that investors can purchase, thereby indirectly holding US Treasuries. The value of its tokens is closely tied to the value of the US Treasuries they represent. Due to the significant position and stability of US Treasuries in the global financial market, ONDO has attracted many investors seeking stable returns and hedging opportunities. During periods of high market volatility, its token price remains relatively stable, and trading volume shows a steady growth trend. As more investors seek the digitization of traditional financial assets, ONDO is expected to further expand its market share, particularly among institutional and high-net-worth individual investors.

Market Cap: $2,407,391,199

Rank: #51

Synthetix (SNX)

Synthetix is a protocol for creating synthetic assets, allowing users to generate various synthetic assets pegged to real-world assets by collateralizing SNX tokens. The value of these assets is linked to stocks, commodities, currencies, etc., in the real world. For example, users can create synthetic assets tied to the stock price of Apple Inc. The platform uses oracle services to obtain external asset price information, and the price fluctuations will reflect the performance of Apple stock in traditional markets. SNX provides investors with a convenient way to invest in traditional market assets without directly holding them, broadening investment channels. However, the transparency, liquidity of synthetic assets, and regulatory policies are crucial for their long-term development, while also facing risks from oracle feeding mechanisms and market manipulation.

Market Cap: $760,095,061

Rank: #117

Plume Network

Plume Network is an emerging platform focused on the financialization of real-world assets (RWAfi), aiming to simplify the issuance, trading, and management of real-world assets through blockchain technology. It provides an infrastructure that allows businesses and asset management institutions to easily bring traditional assets on-chain. The platform features various functionalities, including asset tokenization, trade matching, and liquidity provision. Its strength lies in its robust compatibility, supporting various types of traditional assets such as real estate, bonds, equities, etc. This offers businesses more efficient financing channels, but effectively connecting with traditional financial institutions and ensuring regulatory compliance are its main challenges.

Stablecoin Sector

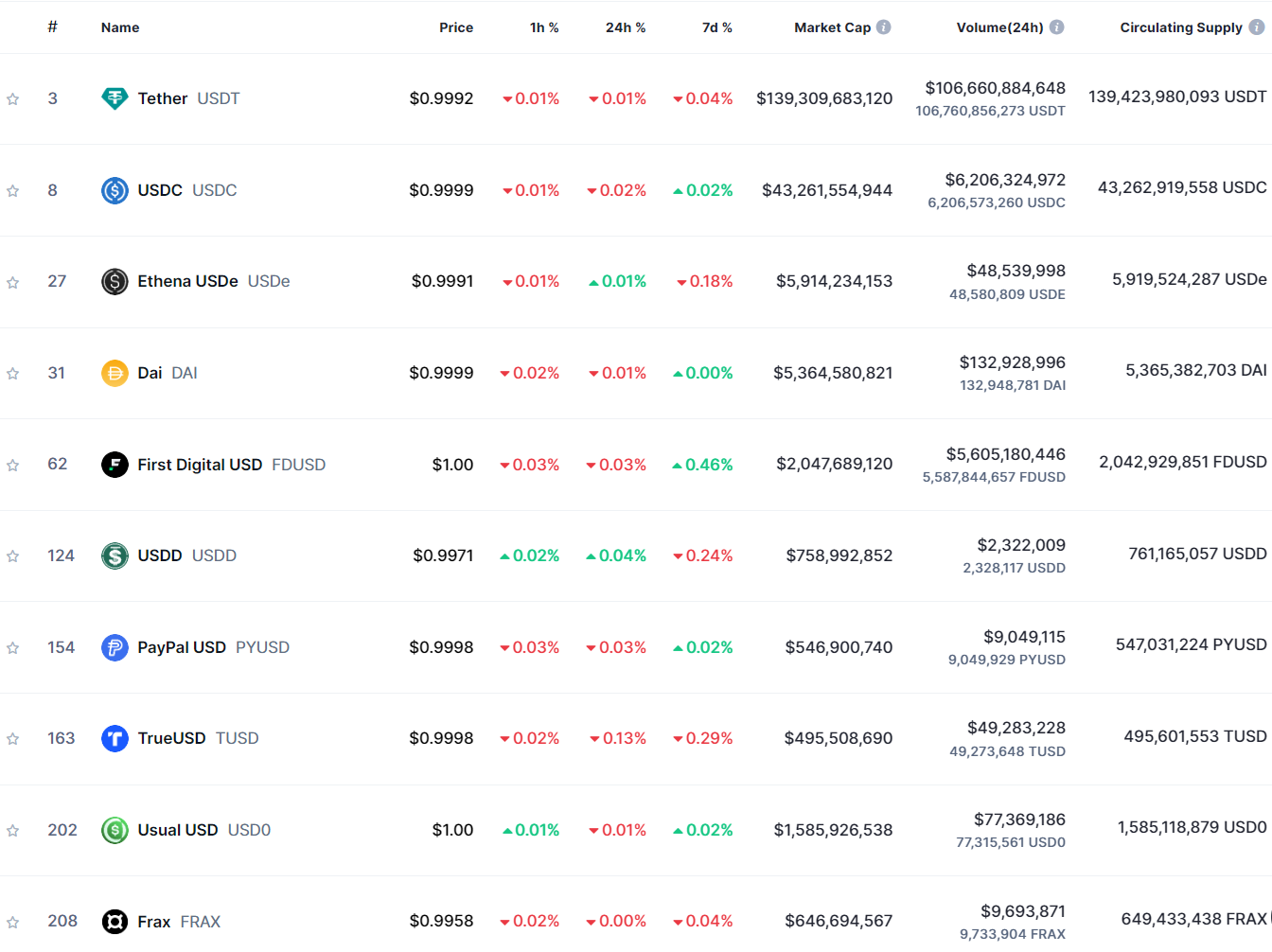

Currently, among the top 10 stablecoins by market cap, USDT leads with a total market cap of $142.7 billion, far surpassing the supply of other stablecoins. USDC ranks second with a current market cap of $41.9 billion, but on-chain trading data shows that USDC's usage rate actually exceeds that of USDT, with total trading volume in the past month being nearly double that of USDT. This month, USDe's market cap reached $6 billion, surpassing DAI ($4.5 billion) to become the third-largest stablecoin by market cap.

According to CMC market cap rankings, we observe that USD0's market cap has also reached $1.5 billion, growing 77.17% in the past 7 days, and its rank has jumped to 9th place. It is an innovative stablecoin protocol launched by the project Usual on Binance Launchpool, integrating BlackRock, Ondo, Mountain Protocol, M0, and Hashnote, transforming them into permissionless, on-chain verifiable, and composable stablecoins. Recently, it provided users with a very generous airdrop, and its platform token USUAL has also performed strongly. The following sections will share some stablecoin projects worth participating in.

Usual (USUAL)

Usual is a secure and decentralized fiat stablecoin issuer that ensures its stablecoin USUAL can be exchanged for US dollars at a 1:1 ratio by holding dollar reserves. At the same time, Usual distributes ownership and governance rights of the platform through its platform token USUAL. As a multi-chain infrastructure, Usual integrates the growing tokenized real-world assets (RWA) from institutions like BlackRock, Ondo, Mountain Protocol, M0, and Hashnote, transforming them into permissionless, on-chain verifiable, and composable stablecoin USD0. USD0 is its first liquid deposit token (LDT), supported by real-world assets at a 1:1 ultra-short term ratio, offering high stability and security. Users can conveniently and diversely mint USD0 by directly depositing RWA or indirectly through USDC/USDT.

Market Cap: $634,268,673

Rank: #133

Ethena (ENA)

Ethena is often regarded as a decentralized stablecoin USDe project and an Ethereum synthetic dollar protocol, providing a crypto-native currency solution and "internet bonds," aiming to address the issues of autonomous currency issuance and basic pricing in the web3 world, returning the right to issue currency to the web3 world. In 2023, on-chain transaction settlements for stablecoins exceeded $12 trillion, and AllianceBernstein predicts that by 2028, the stablecoin market size could reach $2.8 trillion. If ENA gains market recognition, its value potential is enormous. However, ENA also faces various risks. In terms of financing risk, while it can benefit from financing, it may incur costs; however, negative returns are not persistent and are backed by reserve funds to protect users. Regarding liquidation risk, the leverage in derivatives trading is not high, and there are various ways to ensure risk control. Custodial risk relies on "over-the-counter settlement" providers, reducing risk through bankruptcy-isolated trusts and multiple partners. The risk of exchange bankruptcy can be mitigated and reduced through cooperation with multiple exchanges and retaining asset control. Although collateral risk supports assets that differ from the underlying assets, the low leverage and small collateral discounts minimize its impact. Overall, the ENA project presents both opportunities and challenges, making it worthy of attention for its future development.

Market Cap: $3,030,206,926

Rank: #42

Frax (FXS)

FRAX is the first partially collateralized and partially algorithmic stablecoin protocol, combining the advantages of traditional fiat collateral and algorithmic regulation. Through smart contracts, FRAX achieves a dynamic balance between stablecoin supply and market demand. The innovation of FRAX lies in its elastic collateral mechanism, allowing users to mint FRAX stablecoins by depositing US dollars or other cryptocurrencies. The protocol also introduces FRAX Share (FXS) as a governance token, enabling holders to participate in platform governance and share in profits. The protocol has three applications. Fraxswap is an automated market maker with built-in TWAMM, capable of executing long-cycle bulk trades. Fraxlend is a lending platform that can create ERC-20 token lending markets, supporting various functions, and can also create over-the-counter debt markets with customized terms. Fraxferry is a cross-chain bridge that can securely transfer locally issued Frax protocol tokens without the need for bridging or third-party applications, with funds arriving within 24-48 hours. Frax Finance builds a feature-rich DeFi ecosystem through stablecoins and applications, providing users with diverse services and options in different scenarios.

Market Cap: $355,706,115

Rank: #194

Lista DAO (LISTA)

Lista DAO is a liquidity staking and LSDFi project based on the BNB Chain, formerly known as Helio Protocol. After receiving investment from Binance Labs, it merged with Synclub to establish itself. Its aim is to provide yields for staked crypto assets and support the decentralized stablecoin LISUSD. The core mechanisms include stablecoin lending, liquidity staking, and innovative collateral. Stablecoin lending operates through an over-collateralization model, with LISUSD being a decentralized stablecoin that does not fully rely on being pegged to fiat currency and supports various collateral assets, introducing new staking assets in the innovative zone. In terms of liquidity staking, users stake crypto assets to receive liquidity tokens, such as staking BNB to get sLISBNB, which can be operated across multiple platforms while earning staking rewards. Users can also use sLISBNB as collateral to borrow LISUSD, with the current borrowing interest rate at 0%. Overall, Lista DAO has great potential in the DeFi space and is expected to establish a foothold through its services and innovations.

Market Cap: $85,255,603

Rank: #475

Summary

In summary, the RWA and stablecoin sectors demonstrate the immense potential of combining blockchain technology with traditional finance. As technology advances and regulations gradually clarify, these sectors are expected to mature further and become an important bridge connecting traditional finance with the blockchain world. These projects lower the barriers to financial participation through innovative mechanisms, enhancing asset liquidity and transparency, and are attracting an increasing number of institutional and individual investors. For investors, gaining a deep understanding of the operational models and potential risks of these projects will help seize opportunities in this field. However, the rapid development of this sector also comes with risks, including market volatility, regulatory policy uncertainties, and technical security issues.

It is also particularly important to note that while RWA and stablecoin projects offer unprecedented opportunities for investors, there are potential pitfalls related to compliance and lack of transparency. Therefore, investors should fully understand the associated risks and carefully assess investment returns and their own risk tolerance when participating in such projects. This report is for informational purposes only and does not constitute any investment advice. In the future, as regulatory policies become clearer and technology continues to optimize, the RWA and stablecoin sectors are expected to achieve broader applications and deeper impacts globally.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。