The Christmas season's market, although cold, is filled with warmth. There are only a few hours left until Christmas is over, but the Christmas market trend will not dissipate just because the holiday ends; it is likely to continue until around January 6. Even though the U.S. stock market will open tomorrow, liquidity and trading volume are expected to be much lower than on a typical working day. In this context, #BTC has broken through to $99,000. How many people could have imagined that just two days ago, many were saying we would see BTC starting with an 8 or a 7?

If I insist that this is the effect of the trend, many might scoff. So let me rephrase: it is very likely that some investors have already accepted the outcome that the Federal Reserve will only cut interest rates twice in 2025. After all, from the conclusion, BTC's price has managed to stay above $100,000 after Powell's speech, indicating that investors are beginning to accept this outcome.

The core PCE before Christmas is also a tool to salvage sentiment. So, will the market just oscillate like this until liquidity recovers? My view is a bit conservative; let's first observe the trend after tomorrow's opening. Although many institutions and investors will still be off tomorrow, the liquidity after the U.S. stock market opens will be better than during the holiday. Now, facing U.S. investors who have already surpassed $99,000, will they start to face reality and muster the courage again, or will they sell off to hedge? We will know soon.

After these two working days, there will be another two working days until the New Year, so the sentiment on the first trading day will be even more important. Predicting prices has little significance; it’s just about being right or wrong. If right, it’s just a bit more unrealized profit; if wrong, it’s just a temporary paper loss. As long as one is still confident that the trend hasn’t ended, holding on is fine.

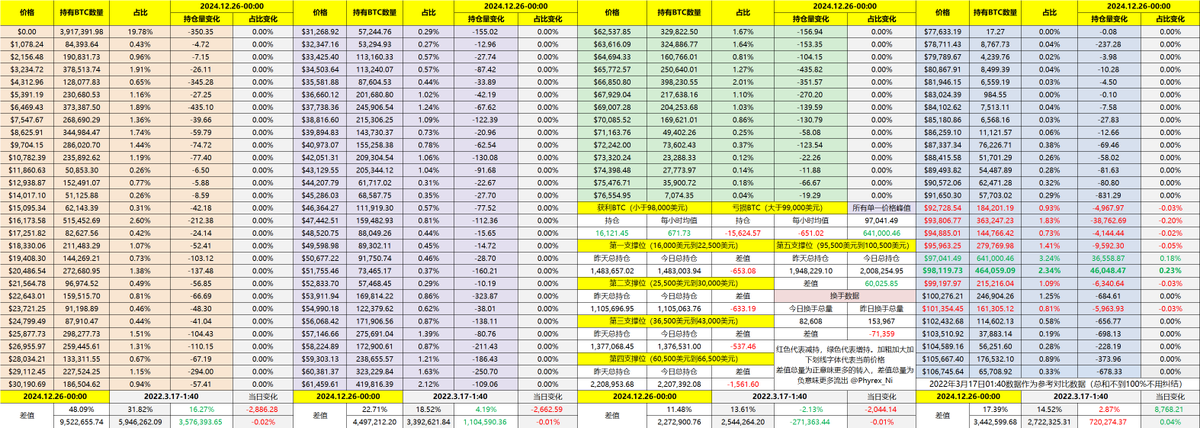

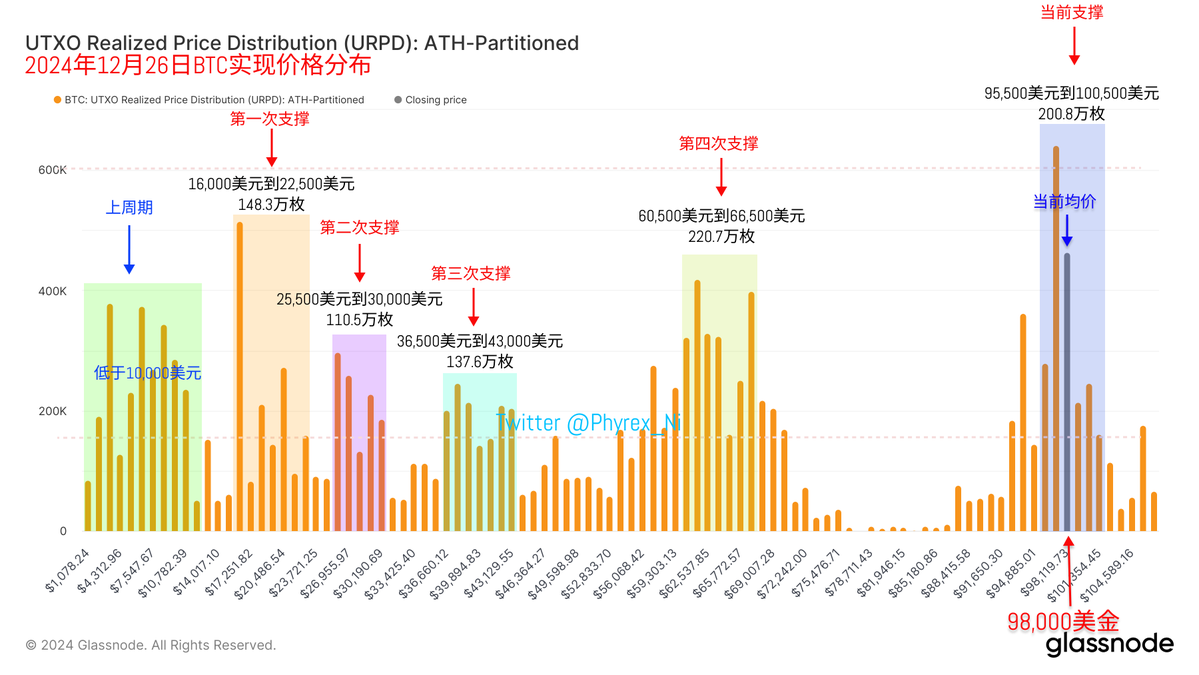

From today’s BTC data, the turnover rate has decreased by nearly half compared to Christmas Eve, which is within our expectations. The drop in liquidity clearly shows that earlier investors are not continuing to participate in trading, as they still have enough space and time. Instead, recent investors who started bottom-fishing at $92,000 continue to trend towards exiting.

The support level has not changed; the support between $95,000 and $100,000 remains very solid. In the short term, unless there is a significant negative factor, I still do not recommend shorting. Although there are many spikes in a bull market, the recovery is also very quick. No one should doubt that we are in a bull market now, even if it is just BTC's bull market.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。