This year, the global market has experienced significant volatility, undergoing macroeconomic changes, regulatory adjustments, and important developments in the digital asset ecosystem.

As we enter the final week of 2024, cryptocurrency traders are facing a critical moment, assessing the latest economic data and decisions from major central banks. The global market has seen intense fluctuations this year, with macroeconomic changes, regulatory adjustments, and significant developments in the digital asset ecosystem. Bitcoin is nearing its highest quarterly closing price of the year, while the breakthrough growth of Ethereum Layer-2 highlights the market's vitality.

Here is the information you need to understand the close of December and prepare for 2025.

Table of Contents

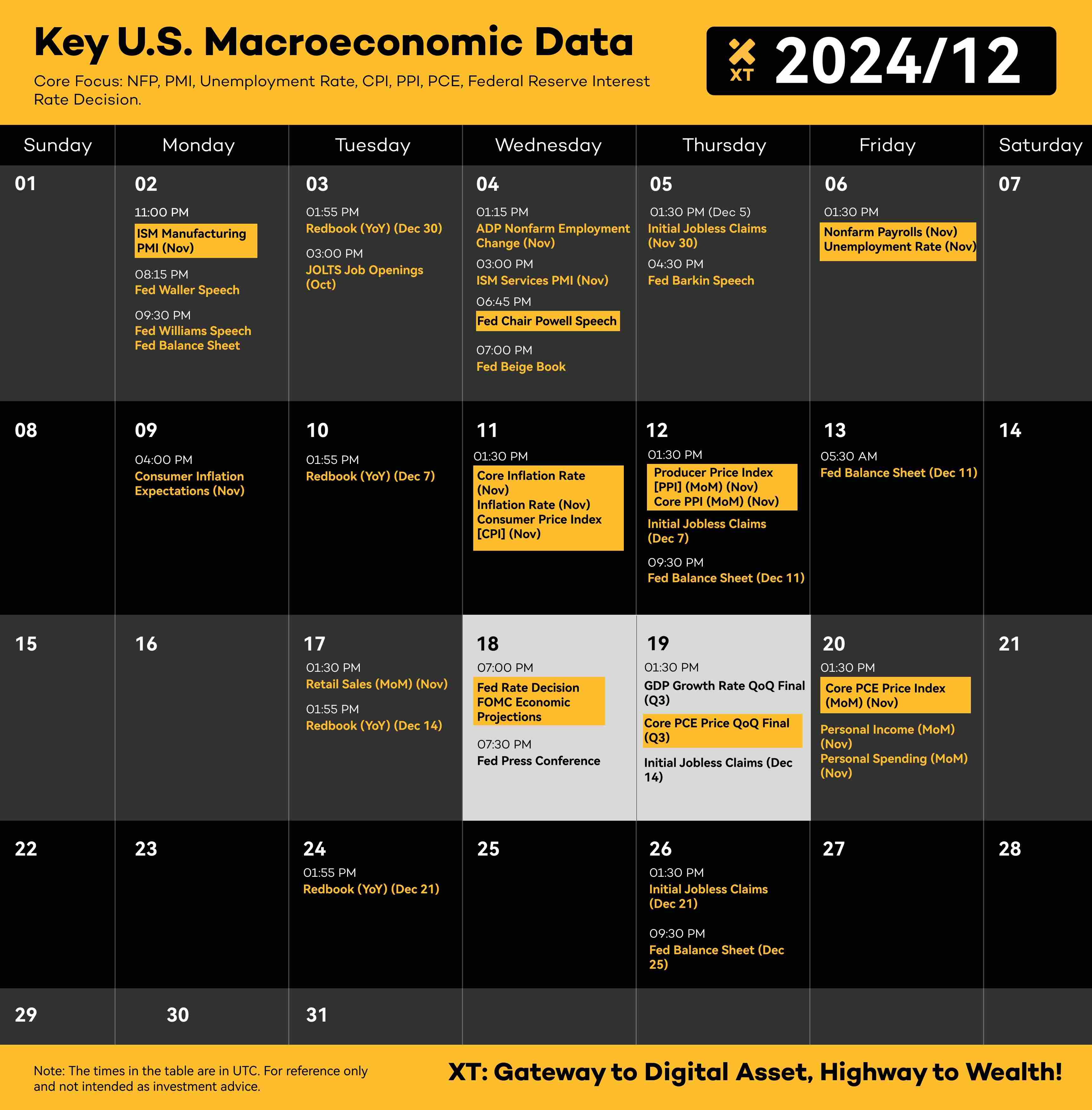

Key Economic Calendar Highlights for December 2024

Expected Focus for This Week

Best Performing Areas in Cryptocurrency for 2024

Outlook for Next Week: Week 1 of 2025

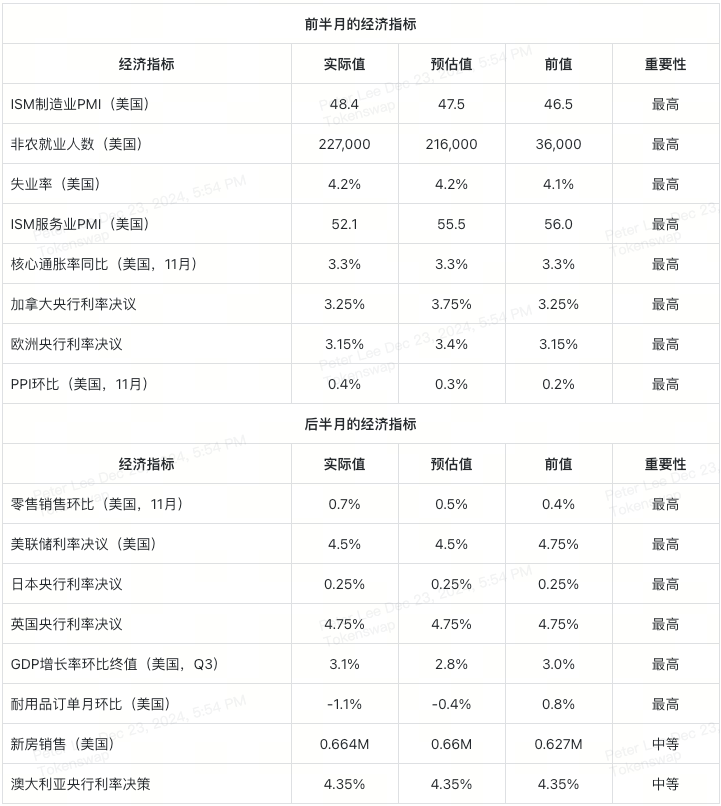

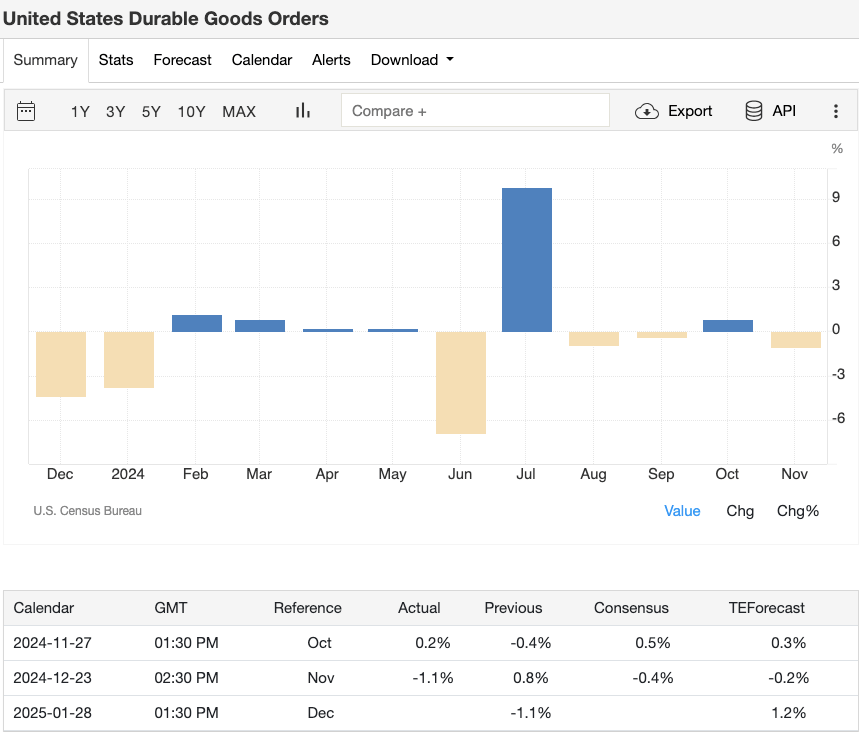

Key Economic Calendar Highlights for December 2024

Image Source: Follow @XTexchange on Twitter https://x.com/XTexchange

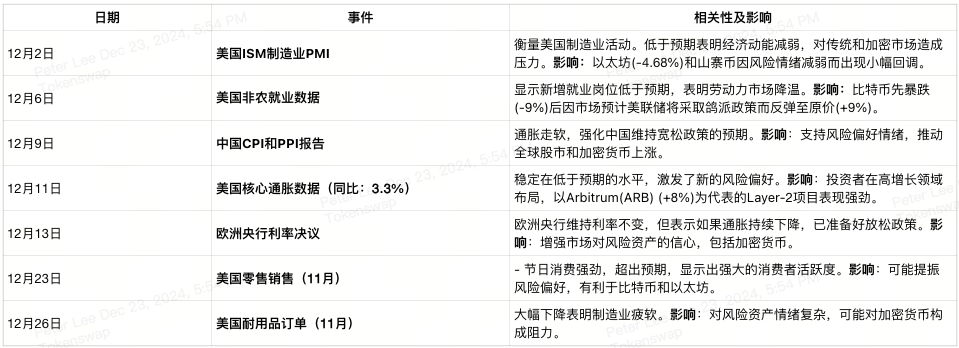

Key Dates and Impacts:

Expected Focus for This Week

From December 23 (Monday) to December 25 (Wednesday)

Focus: The market will continue to digest U.S. retail sales and GDP data while monitoring changes in durable goods orders to gain insights into overall economic trends. Strong retail data highlights consumer activity during the holiday season, while the GDP growth rate (+3.1%) further validates economic resilience. However, the significant decline in durable goods orders (-1.1%) exposes potential weaknesses in manufacturing, a key area that could become a drag on risk assets.

Analysis:

Consumer Behavior and Sentiment: Strong retail data reflects robust consumer confidence, which may translate into higher participation in risk assets, including cryptocurrencies. Particularly, strong holiday spending may attract institutional funds to capitalize on favorable macro conditions.

Manufacturing Risks: The decline in durable goods orders suggests that businesses may be cutting back on capital expenditures, which could negatively impact risk sentiment in both the stock and crypto markets. Investors may become more cautious regarding cyclical fluctuations in the economy.

Potential Impacts on the Crypto Market:

Bitcoin and Major Altcoins: If market sentiment remains optimistic, mainstream assets like Bitcoin and Ethereum may stabilize or even see slight increases.

DeFi and Layer-2 Platforms: Strong retail data may stimulate capital inflows into yield-generating decentralized platforms, such as stablecoins and lending protocols with attractive yields.

From December 26 (Thursday) to December 27 (Friday)

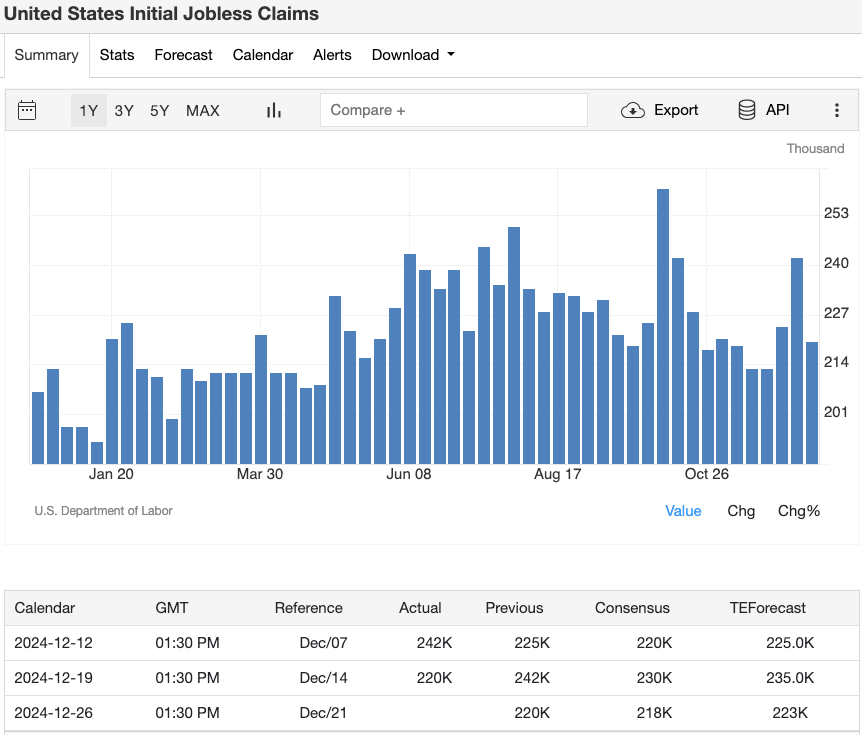

Focus: In the latter half of the week, the market will pay attention to U.S. initial jobless claims and changes in crude oil inventories. Initial jobless claims may challenge the robustness of the labor market, while crude oil inventory data will reveal changes in inflationary pressures and energy market demand.

Analysis:

Labor Market Signals: An increase in jobless claims may dampen overall market sentiment, increasing volatility in both traditional and crypto markets. Conversely, stable or declining labor market data may boost risk appetite, particularly for non-essential consumer-related assets like NFTs and gaming tokens.

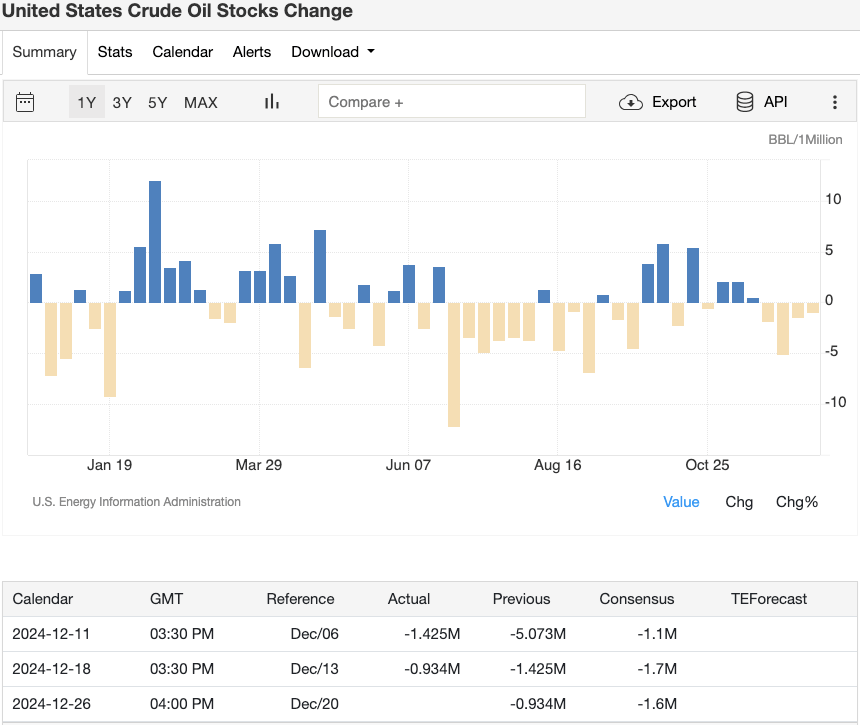

Energy Market Impact: A significant reduction in crude oil inventories may raise concerns about inflation, while an increase in inventories could alleviate some market pressures, indirectly affecting energy-related crypto assets like Bitcoin.

Potential Impacts on the Crypto Market:

NFTs and Metaverse Tokens: These tokens are sensitive to changes in consumer spending. Stability in the job market may support continued growth in this sector, while positive consumer confidence data may stimulate investor interest.

Privacy Coins: In the absence of significant changes in macro conditions, privacy coins may remain range-bound. If new regulatory or geopolitical risks arise, privacy coins may serve as a hedge.

In-Depth Analysis of This Week's Economic Data

- U.S. Durable Goods Orders (Monday):

Image Source: Trading Economics

Durable goods orders are a key indicator of manufacturing activity. A significant decline in data may indicate a slowdown in economic momentum, putting pressure on risk assets, including cryptocurrencies. Conversely, an unexpected rise in data could provide a boost to growth sectors, driving performance in both traditional and digital assets.

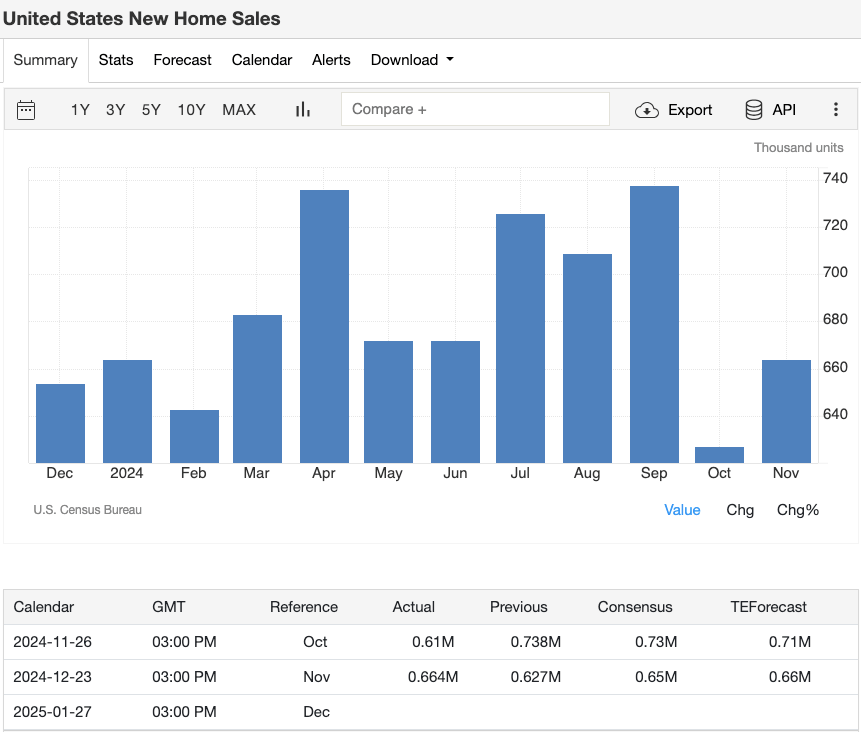

- U.S. New Home Sales (Tuesday):

Image Source: Trading Economics

New home sales reflect consumer confidence and broader economic health. Strong sales data may reinforce risk appetite, benefiting sectors such as high-growth cryptocurrencies like DeFi and NFTs. Conversely, weak data may trigger cautious sentiment in the market.

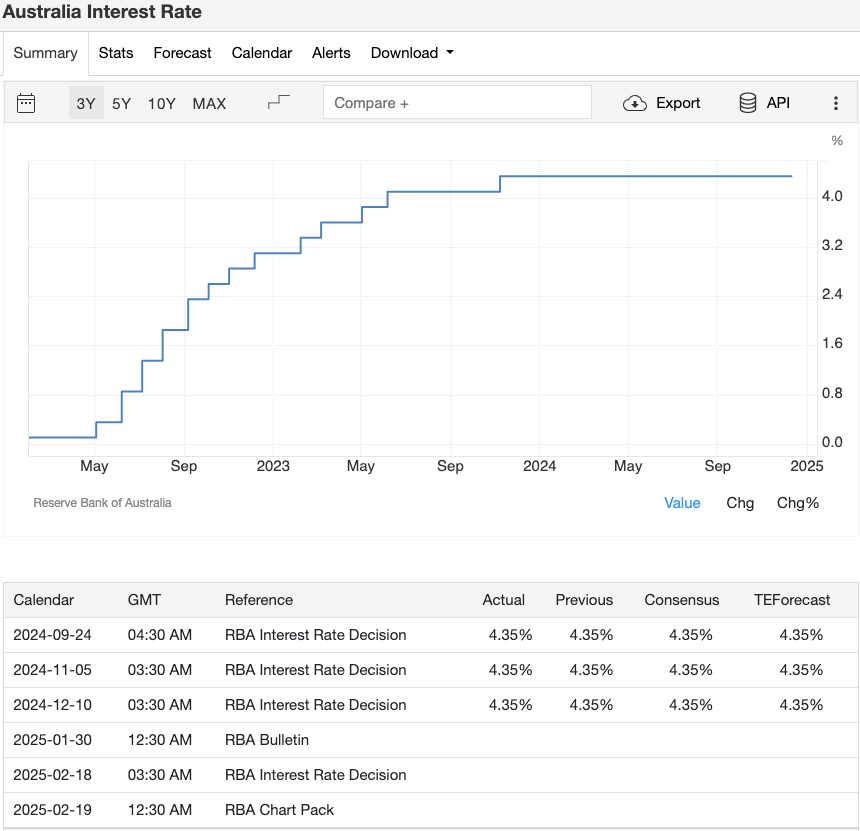

- Australia Interest Rate Outlook (Tuesday):

Image Source: Trading Economics

The Reserve Bank of Australia's (RBA) robust stance on interest rate policy reflects a balance between inflation and economic growth. A dovish policy inclination may encourage capital inflows into risk assets, but ongoing caution regarding inflation may limit optimism in the crypto market.

- U.S. Initial Jobless Claims (Thursday):

Image Source: Trading Economics

Weekly initial jobless claims data is a timely indicator of labor market health. An increase in jobless claims may weaken risk appetite, while stable or declining data may support market resilience, indirectly boosting the crypto market.

- U.S. Crude Oil Inventory Changes (Thursday):

Image Source: Trading Economics

Changes in crude oil inventories have significant implications for inflation expectations and broader market sentiment. A substantial reduction in inventories may heighten inflation concerns, while an oversupply may alleviate some market pressures, impacting energy-related crypto assets (like Bitcoin).

Market Sentiment:

Early comments indicate that institutional investors are cautiously optimistic about the market, with major central banks maintaining a steady policy path. Durable goods orders and new home sales data will provide important economic context, while dynamics in the labor market and energy inventories will offer further insights into economic stability.

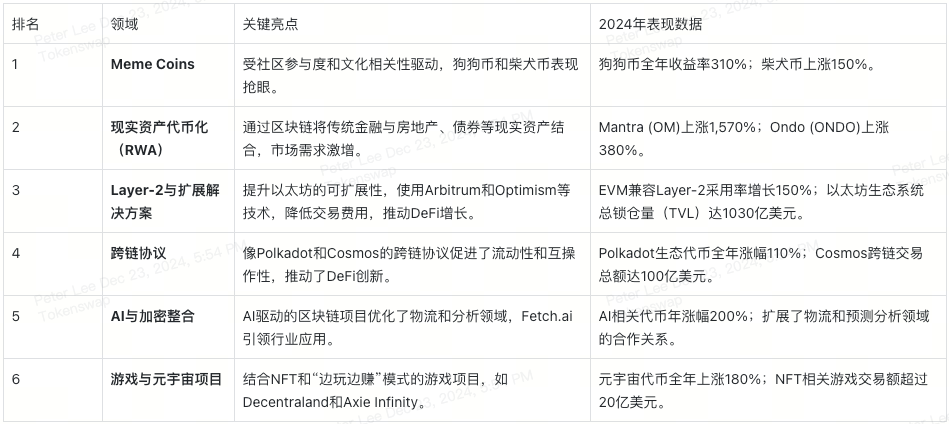

Best Performing Areas in Cryptocurrency for 2024

In 2024, the crypto market achieved significant growth across multiple sectors. From the community-driven surge led by Meme Coins to the tokenization of real assets and infrastructure improvements in Layer-2 solutions, the rise of these areas has invigorated the market. Additionally, the introduction of AI technology and the popularity of metaverse projects have created more possibilities for the future.

As we enter 2025, these standout areas are likely to continue shaping the landscape of the cryptocurrency market. Innovations in DeFi, scalability solutions, and further developments in tokenization will be key drivers of market adoption. Investors should closely monitor dynamics in these areas to seize potential growth opportunities.

Outlook for Next Week: Week 1 of 2025

Emerging Themes

As 2024 transitions into 2025, the upcoming week will present a series of key economic indicators that will significantly impact market sentiment and trading strategies. Here are the areas to focus on:

China Manufacturing Data:

NBS Manufacturing PMI (December 31): Expected to remain stable, with a forecast value of 51, reflecting moderate growth in factory activity.

Caixin Manufacturing PMI (January 2): Expected to rise to 51.5, indicating the strongest expansion since mid-2024, driven by external demand and export growth.

Germany Unemployment Change (January 3):

- A slight increase of 7K in unemployment is expected, showing that despite facing global economic headwinds, the German labor market remains resilient.

U.S. ISM Manufacturing PMI (January 3):

- The December reading is forecasted at 48.4, indicating that the trend of contraction in manufacturing is stabilizing, with improvements in the orders and employment indices.

Australia Interest Rate Outlook:

- The Reserve Bank of Australia's meeting minutes (December 24) indicate that despite potential inflationary pressures, its policy stance remains stable. Economic activity and consumer spending are mixed, with ongoing geopolitical risks.

Transitioning to 2025

Improved manufacturing data from China and stable unemployment figures from Germany may boost market risk appetite. Conversely, if the U.S. ISM Manufacturing PMI data is weaker than expected, it could dampen investor sentiment and impact the cryptocurrency market. Cryptocurrency traders should remain vigilant and adjust strategies based on changing macroeconomic signals.

Strategies and Risks

Short-term Strategies:

Position Adjustment: Anticipate volatility from manufacturing and labor market data in the first week of 2025, and use stop-loss orders to protect profits and reduce risk.

Seize Opportunities: Focus on areas that may respond quickly, such as Layer-2 solutions and DeFi lending platforms, especially after strong performance in China’s manufacturing PMI data.

Long-term Positioning:

Focus on Layer-2 and Tokenization: Continue to increase attention on Layer-2 projects and the tokenization of real assets, which have shown strong fundamentals.

Portfolio Balancing: Utilize stablecoins to diversify investments to cope with rapid market fluctuations, avoiding over-reliance on high-risk assets like Meme Coins and speculative altcoins.

Risk Management:

Macroeconomic Data Monitoring: Closely watch the U.S. ISM Manufacturing PMI and Germany's unemployment changes for economic trend signals that may affect cryptocurrency adoption and market sentiment.

Global Policy Impact: Pay attention to unexpected statements from major central banks, particularly the Reserve Bank of Australia, to adjust investments in Australian-related digital assets and global markets.

Summary

Economic indicators in the first week of 2025 will provide key signals for market direction. The recovery of China’s manufacturing sector, stability in Germany’s labor market, and improvements in U.S. manufacturing trends will all influence global investors' risk appetite. These macro trends suggest a cautiously optimistic start to the year and potential benefits for well-positioned cryptocurrency assets.

Key Focus Points:

China Manufacturing PMI Data: This data is a key driver of global market sentiment and may impact supply chain-related tokens and overall market confidence.

U.S. ISM Manufacturing PMI: This will provide important insights into the health of the U.S. economy, with results directly affecting the attractiveness of risk assets.

Germany Unemployment Trends: As a pillar of the European economy, the stability of the German labor market will strengthen confidence in the European market and related cryptocurrency assets.

By closely monitoring these global trends and macroeconomic data, traders can capitalize on volatility for short-term opportunities while establishing a robust long-term investment framework.

Disclaimer: Economic data and forecasts are subject to change at any time. This content is for reference only and does not constitute investment advice.

Wishing you smooth trading and solid investments as you start 2025!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。