The macro environment is expected to provide strong support for crypto assets.

Author: Messari

Translation: Deep Tide TechFlow

Introduction

As the year comes to a close, it's time for reflection and outlook.

As a top research institution in the industry, Messari released its annual report “The Crypto Theses 2025” last week, providing a comprehensive description and forecast of the development history of the crypto industry in 2024 and trends for 2025.

The report highlights several key points, such as the expectation that BTC will mature as a global asset next year, and that the speculative nature of Memes will continue to attract users.

The report consists of two main parts. It begins with a section on the "Current State of Cryptocurrency," which includes a brief article on the state of the crypto market in 2024; the second part is "Segment Research," which reviews the narratives and forward-looking theories of major segments.

However, considering the original report is 190 pages long, a complete read can be time-consuming; Deep Tide TechFlow has distilled and summarized the key content from the original report, presenting the most important viewpoints, especially the predictions and outlooks for each subsection.

Macro Environment: Breaking the Pessimistic Expectations, Providing Strong Support for Crypto

Key Developments

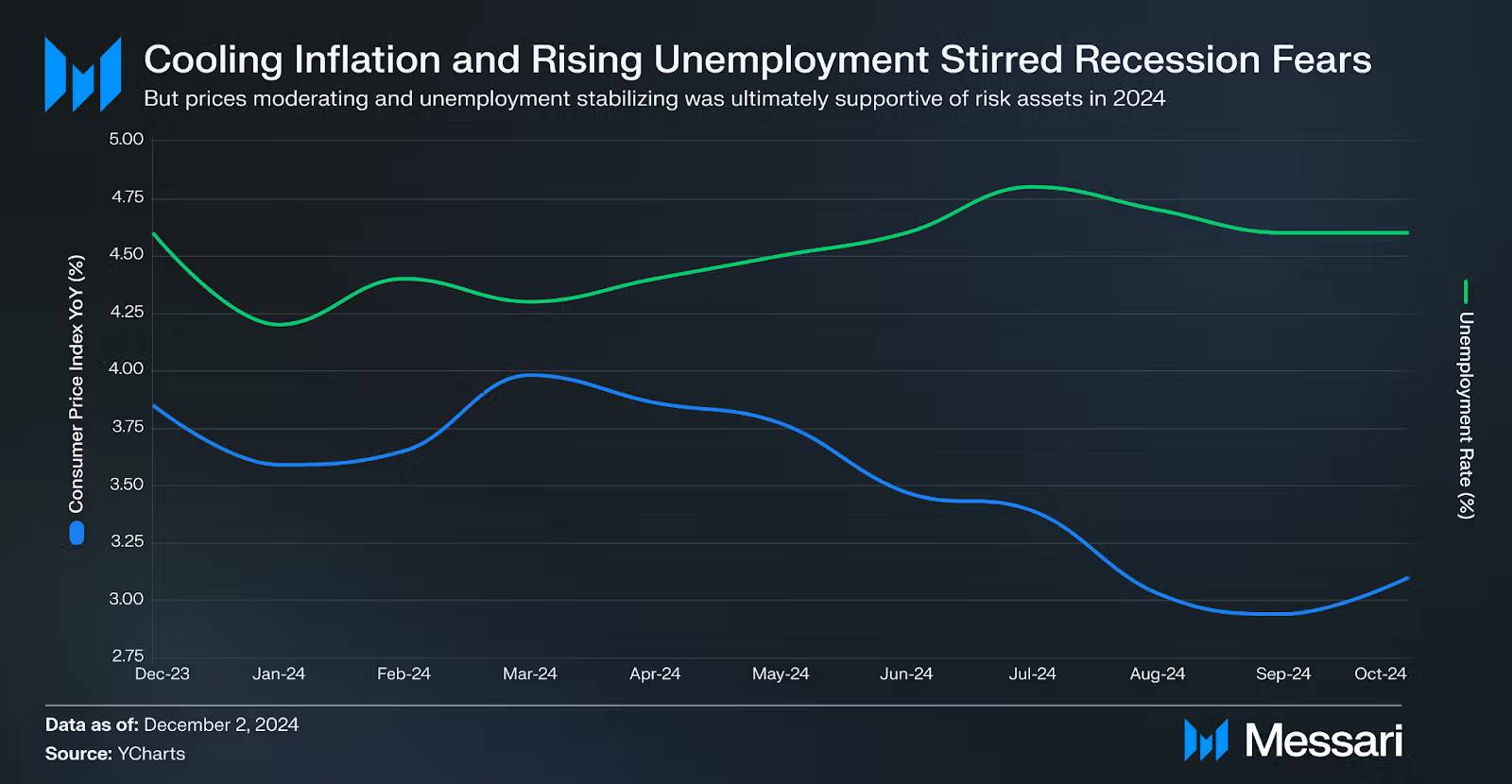

The economic trend in 2024 has broken many pessimistic expectations, with the U.S. economy showing unexpected resilience. The Federal Reserve was able to implement rate cuts of 50 and 25 basis points in September and November, respectively, achieving a relatively smooth policy shift.

The S&P 500 index rose about 27% for the year, ranking among the top 20 historical performances, fully reflecting the market's confidence in an economic soft landing. Notably, aside from the temporary fluctuations caused by the unwinding of yen carry trades and geopolitical issues, the market overall maintained a steady upward trend.

Unique Landscape of the Crypto Market

The crypto market faces dual challenges in 2024. On one hand, it must cope with various risk factors from traditional markets; on the other hand, it must overcome industry-specific challenges, including the German government's selling pressure, the token distribution from Mt. Gox, and investigations into Tether. The market experienced an 8-month consolidation period until the elections became a breakthrough catalyst.

2025 Predictions

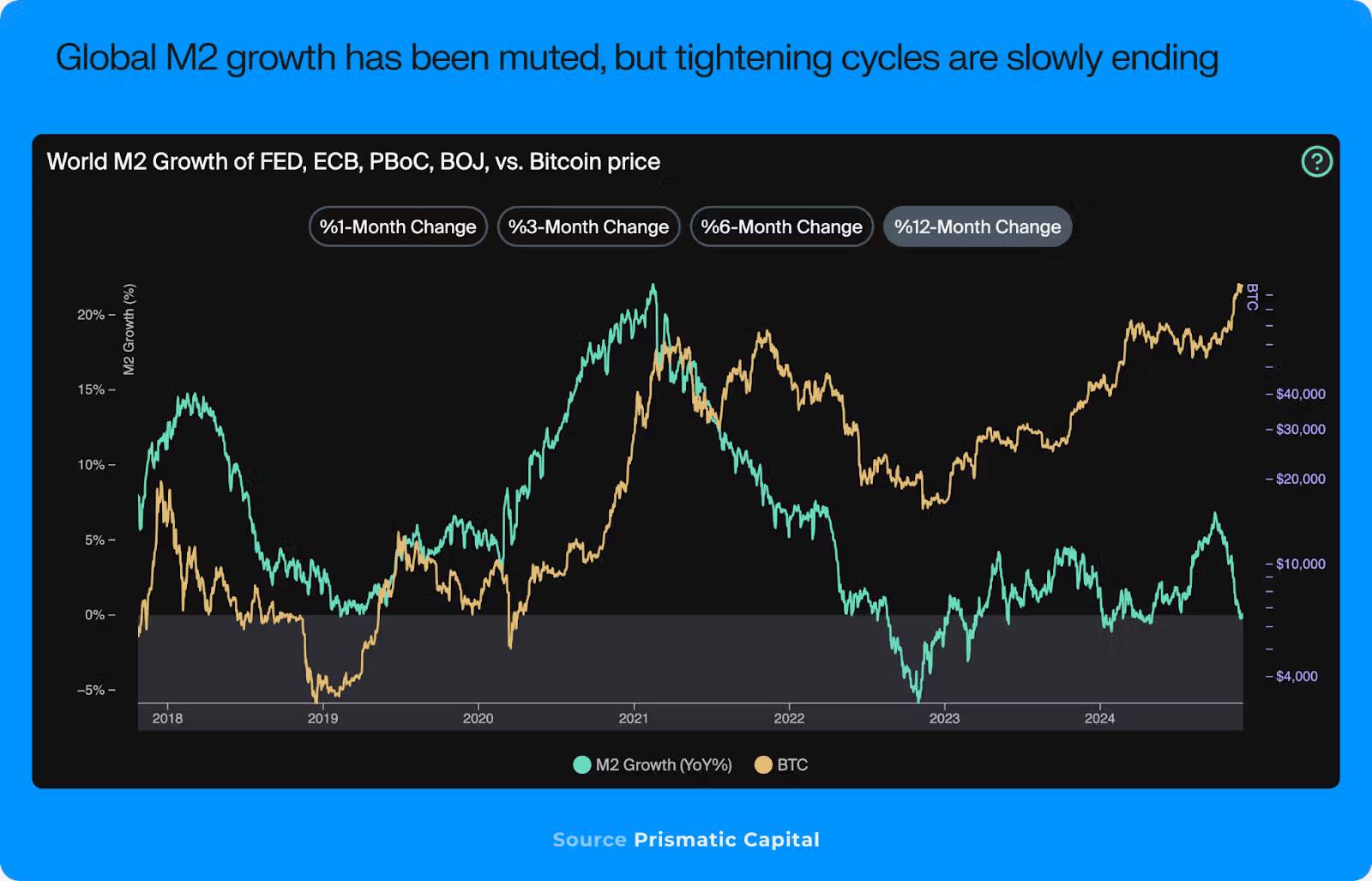

The macro environment is expected to provide strong support for crypto assets. Specifically:

- The Federal Reserve has begun to ease the tightening policies implemented since 2022, but has not yet entered a substantial easing phase. This gradual policy adjustment is expected to provide stable support for the market;

The volatility of various assets is expected to significantly decrease after the elections. Historical experience shows that low volatility often leads to even lower volatility, which is particularly favorable for the development of crypto assets like Bitcoin and Ethereum;

Most importantly, there will be a fundamental improvement in the regulatory environment. Even a relatively neutral regulatory stance will bring significant improvements compared to the stringent controls of the past four years. This change is expected to alleviate major concerns for institutional investors entering the market, bringing in more incremental funds;

The stablecoin sector may become a breakthrough point. The bipartisan openness towards stablecoin regulation creates favorable conditions for advancing related legislation in 2025;

Institutional Funds: Comprehensive Entry

Major Changes in Market Landscape

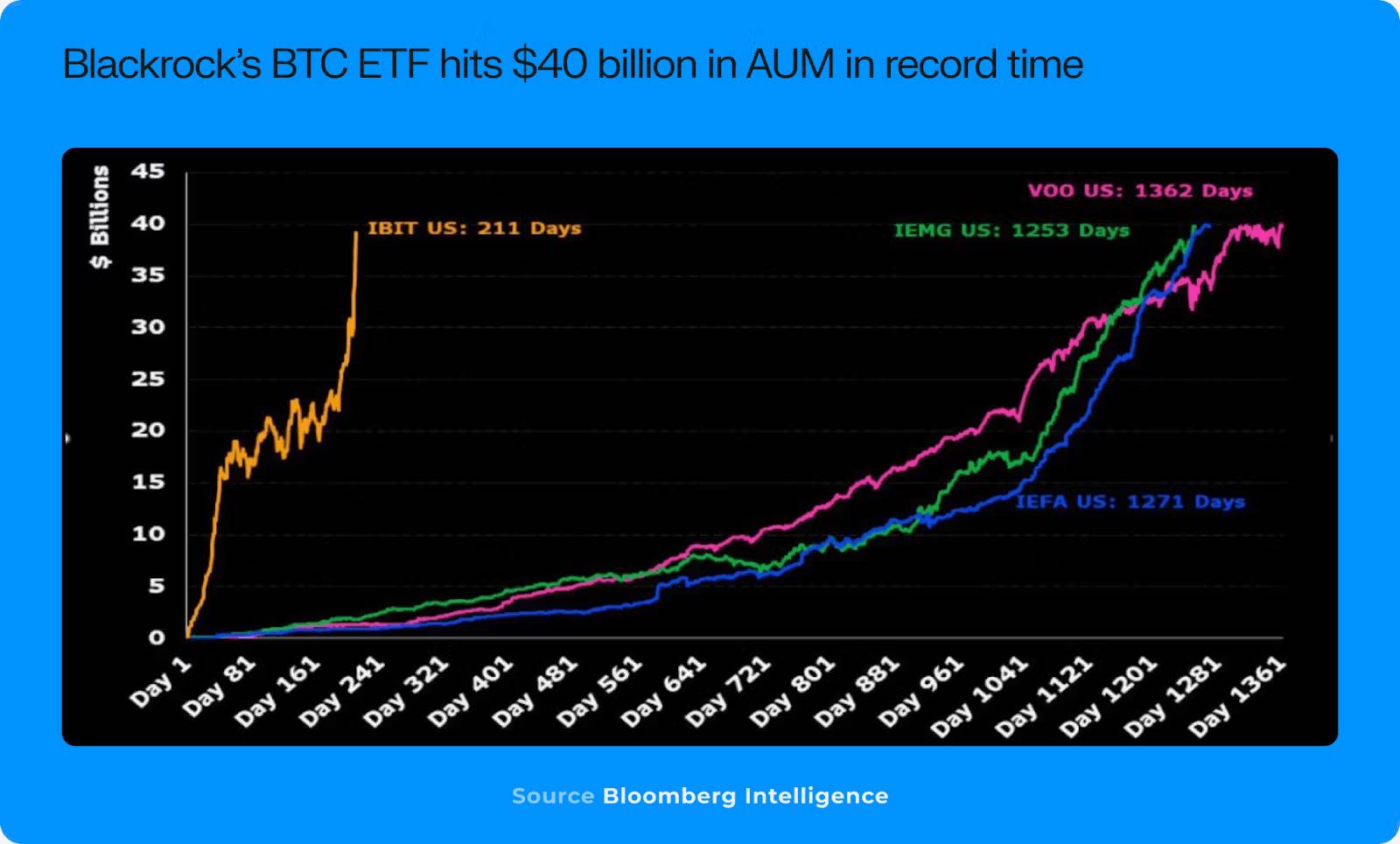

In 2024, the entry of institutional funds is no longer just talk. The approval of Bitcoin and Ethereum ETFs marks the formal recognition of the crypto asset class, providing a more convenient access channel for institutional and retail investors;

BlackRock's IBIT sets a record: the first ETF to reach $3 billion AUM within 30 days of issuance, and surpassing $40 billion in about 200 days. This demonstrates strong institutional demand for crypto derivatives;

Diversification of Institutional Participation

Institutional participation goes beyond ETF investments. Traditional financial institutions are expanding their presence in multiple areas: asset issuance, tokenization, stablecoins, and research have all seen significant progress;

Institutions like Sky (formerly MakerDAO) and BlackRock have launched on-chain money market funds. Ondo Finance's USDY (tokenized treasury fund) has reached an asset scale of approximately $440 million;

Integration of Financial Technology

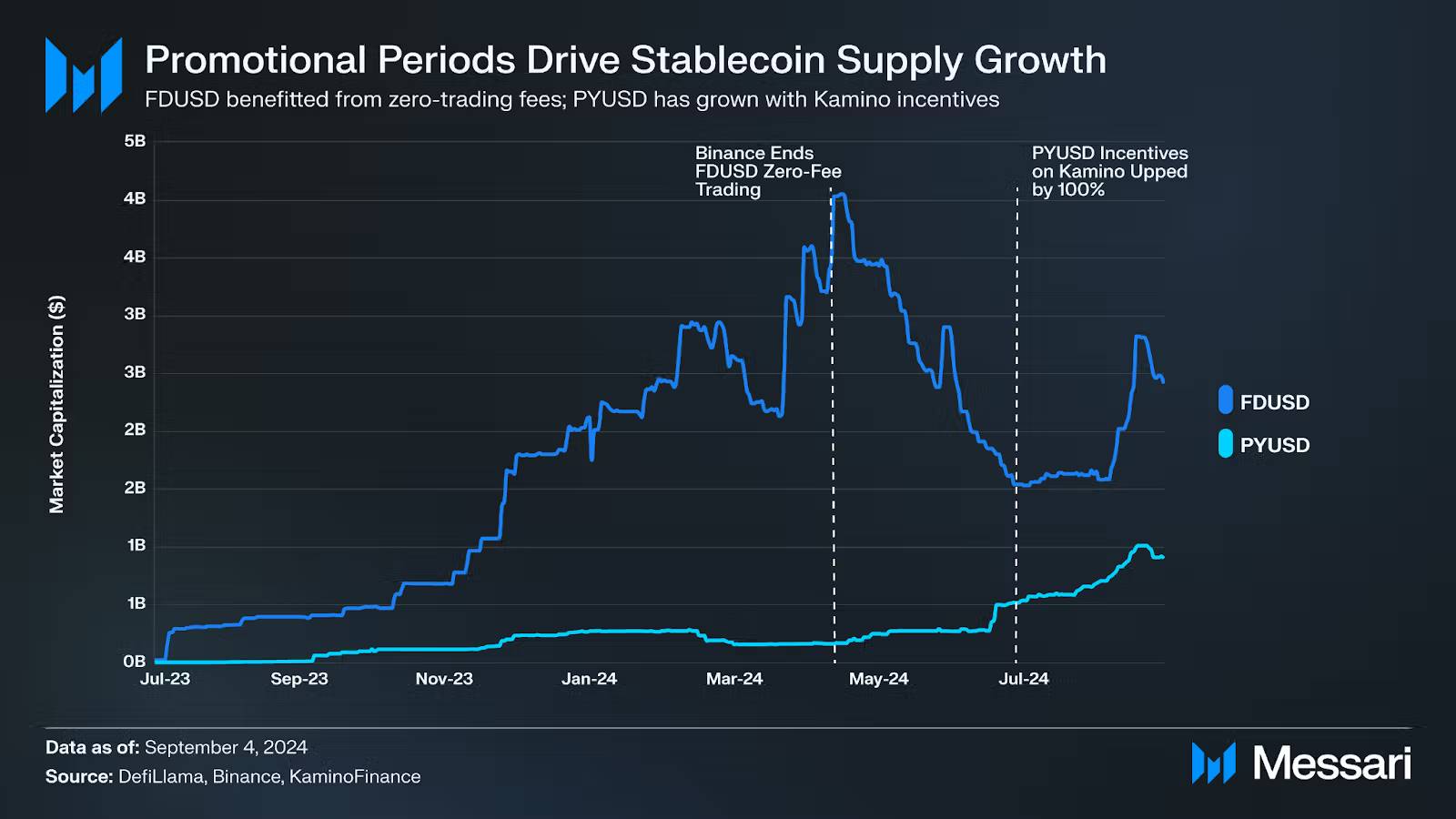

- PayPal issued its stablecoin PYUSD on Solana in May, and Agora, supported by Nick Van Eck, has also launched the stablecoin AUSD on multiple chains, which is backed by Van Eck (asset management company) and custodied by State Street;

2025 Predictions

The depth and breadth of institutional participation are expected to further expand. As BlackRock continues to position digital assets as a non-correlated asset class worthy of a small allocation, stable inflows into ETFs may continue. More importantly, institutions are seeking innovative opportunities across multiple verticals to reduce costs, improve transparency, or accelerate payment efficiency;

Notably, traditional financial giants like JPMorgan and Goldman Sachs are accelerating their layouts. They are not only expanding their own blockchain platforms but also exploring a broader range of product offerings;

This trend indicates that institutions no longer view crypto merely as an investment asset, but are beginning to take its potential as financial infrastructure seriously;

Meme: The Heat Will Continue

2024 Market Landscape

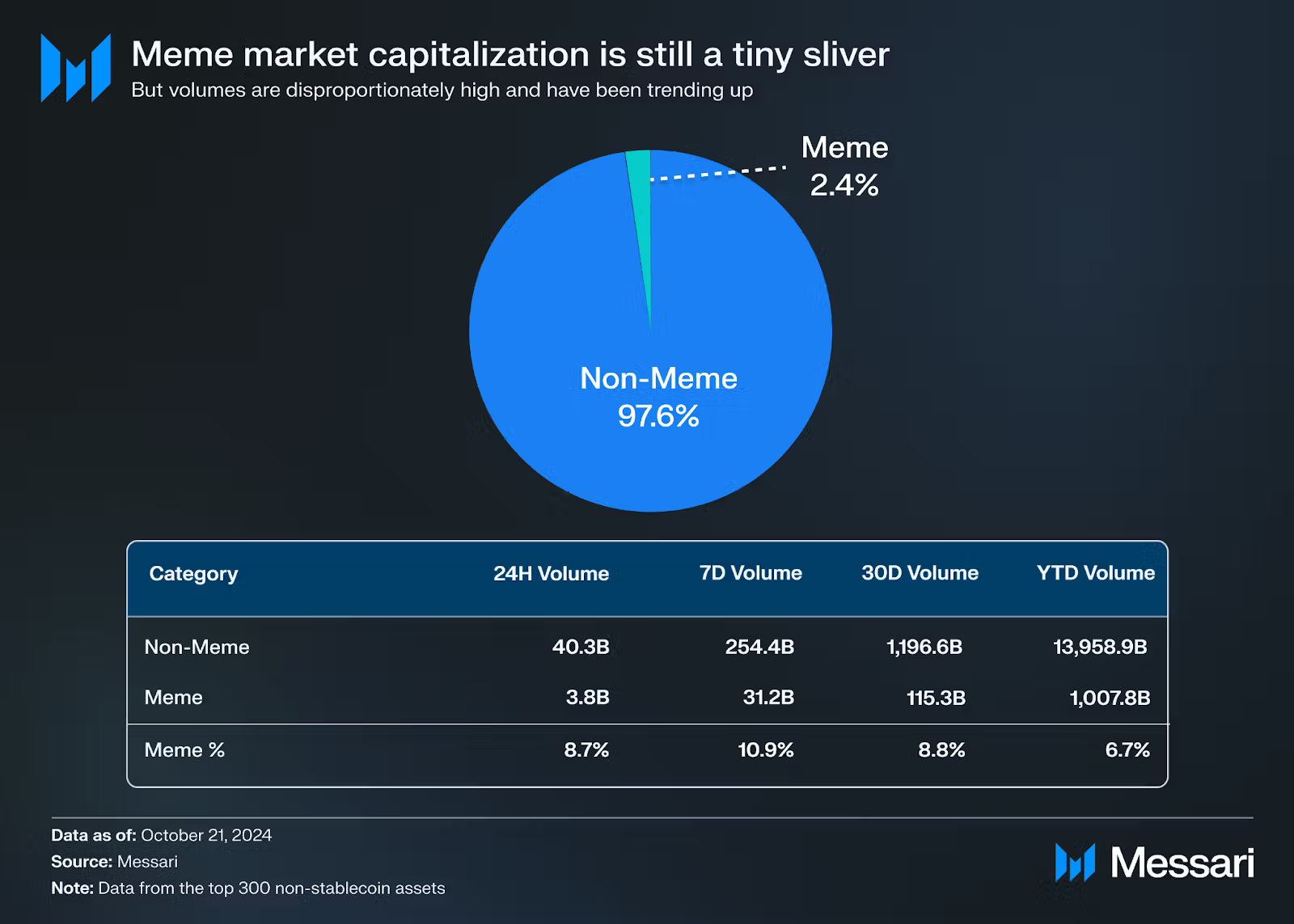

- Although meme coins account for only 3% of the market capitalization of the top 300 cryptocurrencies (excluding stablecoins), their trading volume continues to occupy 6-7% of the share, recently even climbing to 11%;

- The rise driven by politically themed meme coins like Jeo Boden in the first quarter was followed by TikTok meme coins (such as Moodeng and Chill Guy) and AI agent concepts (like Truth Terminal's GOAT) continuing to drive this momentum;

Market Drivers

The prosperity of meme coins is not only due to trends or user-friendly interfaces but also relies on two key conditions:

Excess Capital: As the overall crypto market appreciates, many traders have accumulated significant capital but lack quality investment opportunities;

Ample Block Space: High-throughput networks like Solana and Base provide a low-cost, efficient trading environment;

This environment is particularly evident on Solana. The strong market performance at the end of 2023 and the beginning of 2024 has allowed Solana users to accumulate significant capital.

Evolution of Trading Infrastructure

User-friendly trading platforms have significantly boosted the popularity of meme coins. Applications like Pump.fun, Moonshot, and Telegram bots have simplified the operational processes for retail traders;

In particular, Moonshot has bypassed traditional cryptocurrency deposit channels by supporting payments via ApplePay, PayPal, or USDC on Solana, attracting a large number of new retail investors with its intuitive interface and simple registration process;

2025 Predictions

For 2025, meme coins are expected to continue growing, primarily due to several key factors:

Infrastructure support: High-throughput chains like Solana, Base, Injective, Sei, and TON provide ample block space, allowing meme coin trading without incurring high costs;

User experience optimization: Applications like Moonshot and Pump.fun continue to lower the entry barriers and simplify trading processes, likely attracting more retail participants;

Macroeconomic alignment: The speculative nature of meme coins, akin to gambling, may continue to attract users seeking entertainment and profit in the current macro environment;

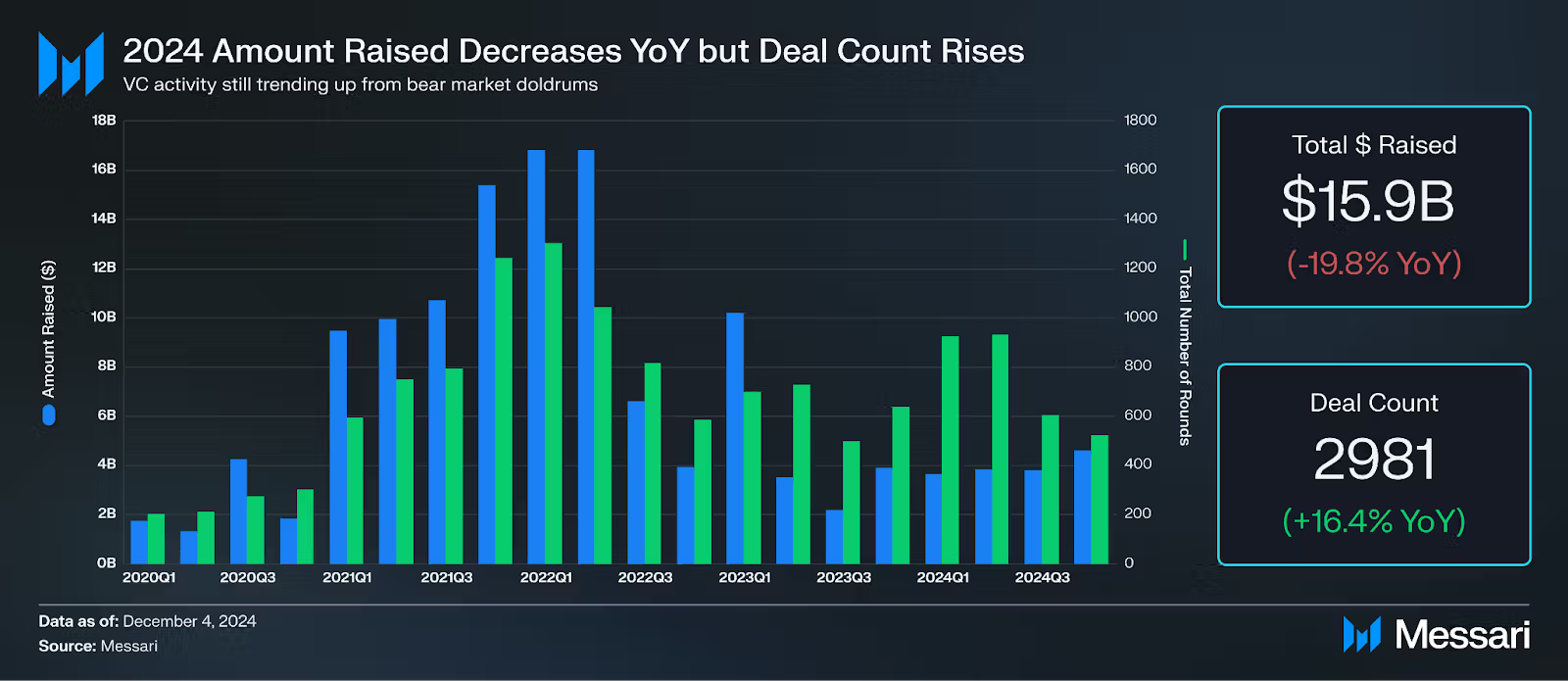

Financing Landscape: AI Leading Emerging Investment Themes

Market Overview

- Crypto project financing has shown an upward trend compared to 2023. Although the total financing for startups and protocols has decreased by about 20% year-on-year (mainly affected by an anomaly in Q1 2023), the market still saw several large financing rounds;

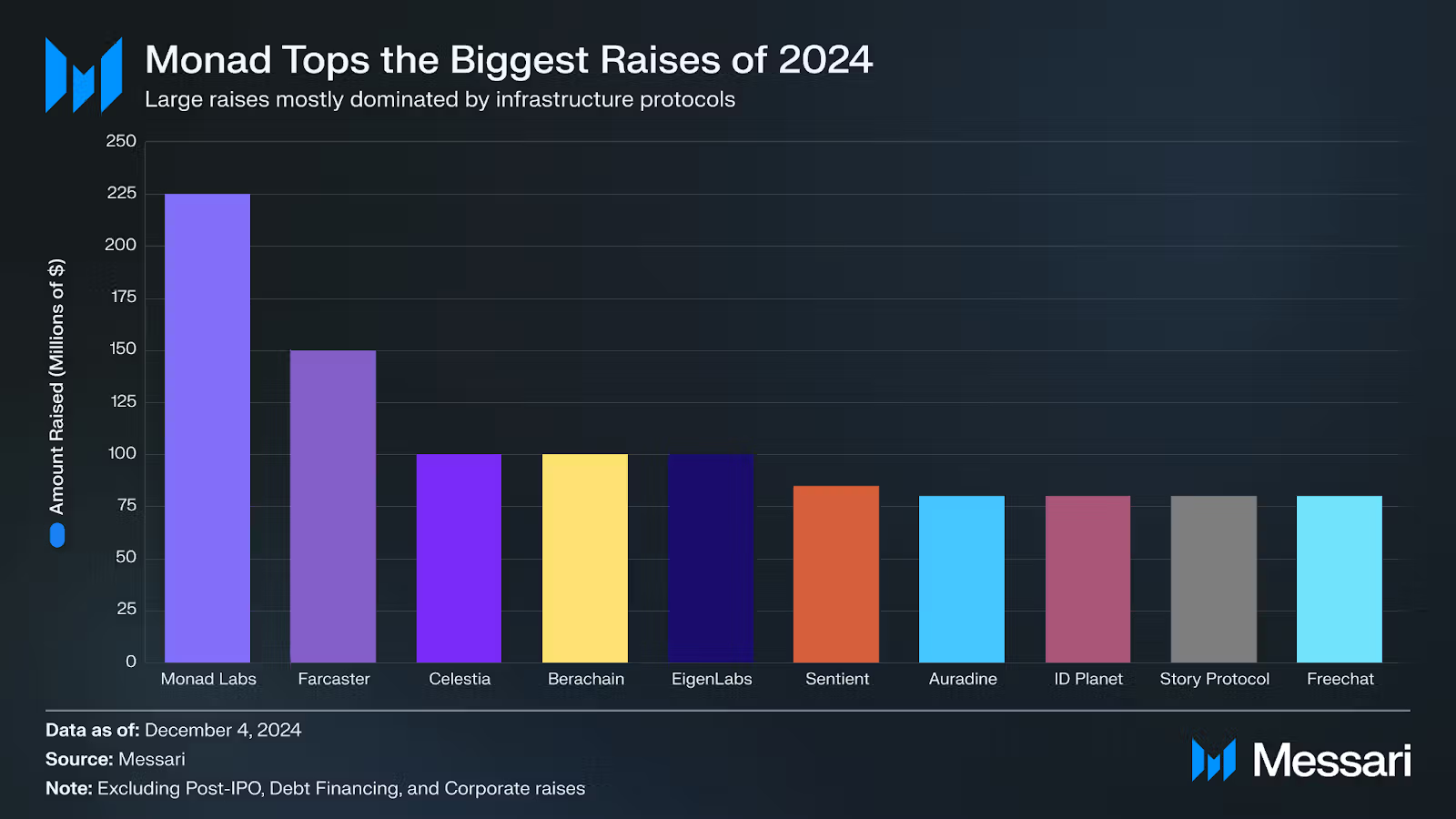

Important Financing Cases

Monad Labs: Raised $225 million in April, indicating that infrastructure and L1 projects remain key investment areas for VCs;

Story Protocol: Completed $80 million in Series B financing, led by a16z, aimed at transforming intellectual property into programmable assets;

Sentient: Secured $85 million in funding, led by Thiel's Founders Fund, focusing on an open AGI development platform;

Farcaster and Freechat: Raised $150 million and $80 million, respectively, indicating continued capital interest in the social sector;

The Rise of AI and DePIN

AI project financing has increased by about 100% year-on-year, with financing rounds growing by 138%;

DePIN project financing has surged by about 300% year-on-year, with financing rounds increasing by 197%;

AI rounds are particularly popular in accelerator projects like CSX and Beacon. Investors are showing strong interest in the intersection of crypto and AI.

Emerging Investment Themes

In addition to AI and DePIN, several noteworthy financing trends have emerged in 2024:

The decentralized science sector is beginning to attract attention, with projects like BIO Protocol and AMINOChain receiving funding;

VCs in the Asia-Pacific region are more inclined to invest in gaming protocols, especially projects launched on the TON blockchain;

The share of financing for NFT and metaverse projects has significantly decreased compared to 2021 and 2022;

The social sector continues to experiment, with projects like Farcaster, DeSo, and BlueSky receiving funding support, despite limited past success cases;

Crypto Users, New Evidence of Growth

Market Size Breakthrough

- According to a16z's report, the number of active monthly addresses in cryptocurrency reached a historical high of 220 million, with a growth trend similar to early internet adoption. Although this number may include duplicates (as many users utilize multiple wallets), it is estimated that there are still 30-60 million real monthly active users after filtering;

Key Cases of User Growth in 2024

Phantom Wallet's Breakthrough, becoming the most popular wallet in the Solana ecosystem, ranking in the top ten in the iOS App Store, surpassing WhatsApp and Instagram;

The Use of Stablecoins in Emerging Markets: Sub-Saharan Africa, Latin America, and Eastern Europe are beginning to bypass traditional banking systems and directly adopt stablecoins; platforms like Yellow Card, Bitso, and Kuna are promoting adoption by providing stablecoin exchange and payment API services;

The Explosion of Telegram Mini-Apps: Notcoin has over 2.5 million holders, Hamster Kombat attracted 200 million users, and has 35 million YouTube subscribers;

Practical Applications of Polymarket: Rapid growth during the election period, adding nearly 1 million accounts, briefly becoming the second most downloaded news app on iOS;

Base and Hyperliquid Driving CEX Users On-Chain: Base L2 provides a free transfer channel from Coinbase to Base, while Hyperliquid offers a CEX-like high-performance trading experience for perpetual contract traders;

2025 Predictions

The crypto ecosystem is no longer just preparing for mass adoption but has already begun to realize it;

User growth is shifting from sporadic, noise-driven entry patterns to a more natural discovery and sustained growth model through various applications. Meme coins, consumer applications (like Phantom and Telegram), prediction market platforms, and the growing on-chain utility will continue to drive compound growth;

The next key step is to make blockchain navigation more retail-friendly, which will be greatly improved through innovations like chain abstraction and aggregated frontends;

Bitcoin: This Year is Good, Next Year Will Be More Mature

Key Developments in 2024

Price and Institutional Adoption

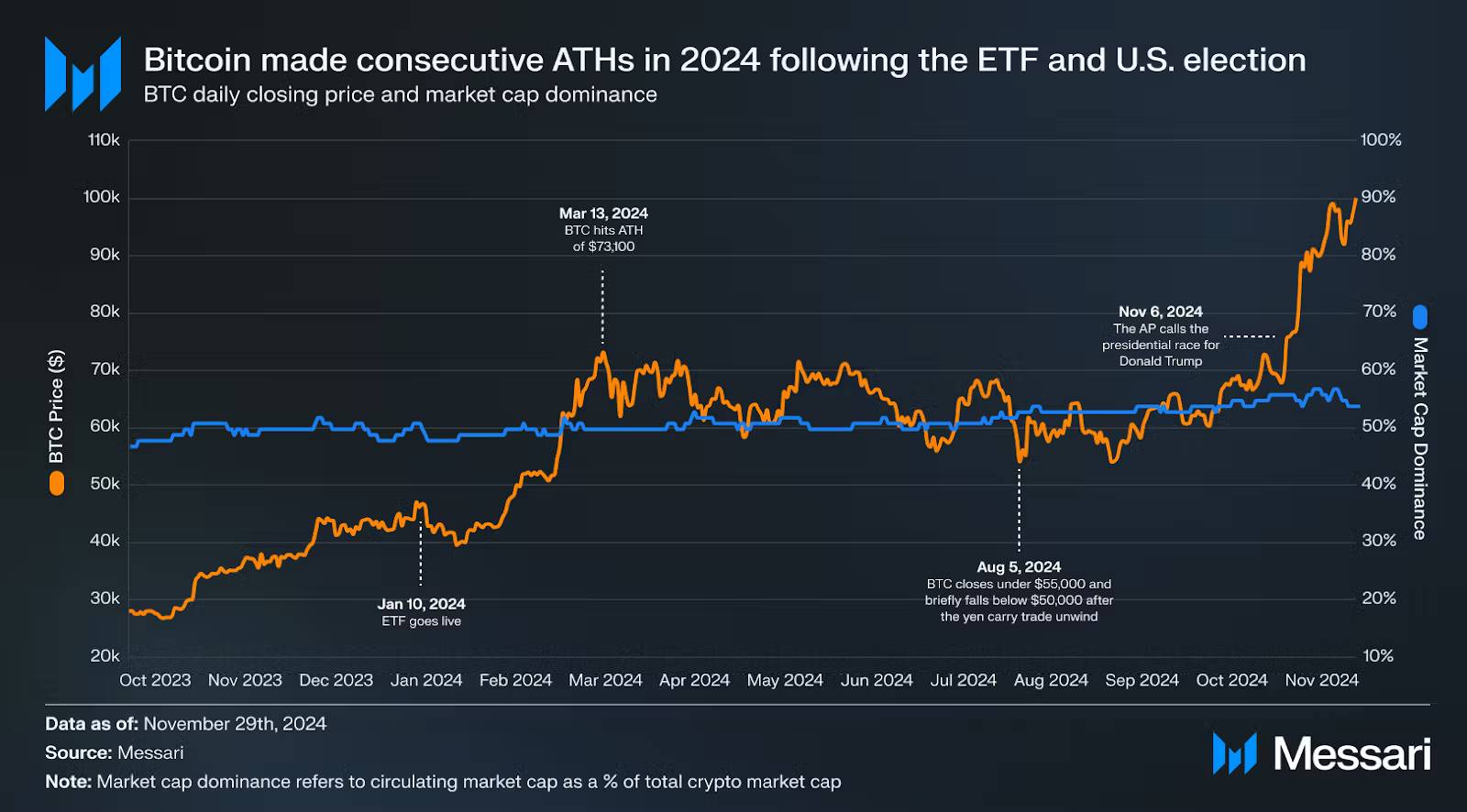

- Starting at $40,000, Bitcoin reached a new high of $75,000 in Q1 after ETF approval, and broke the important $100,000 mark after Trump's victory;

Bitcoin's market capitalization dominance rose to about 55%;

ETF issuers hold over 1.1 million Bitcoins, with BlackRock and Grayscale accounting for 45% and 19%, respectively;

After ETF approval, there was only one month of net outflow in April; BlackRock's IBIT continued to be the largest net buyer, with approximately $8 billion inflow in November alone;

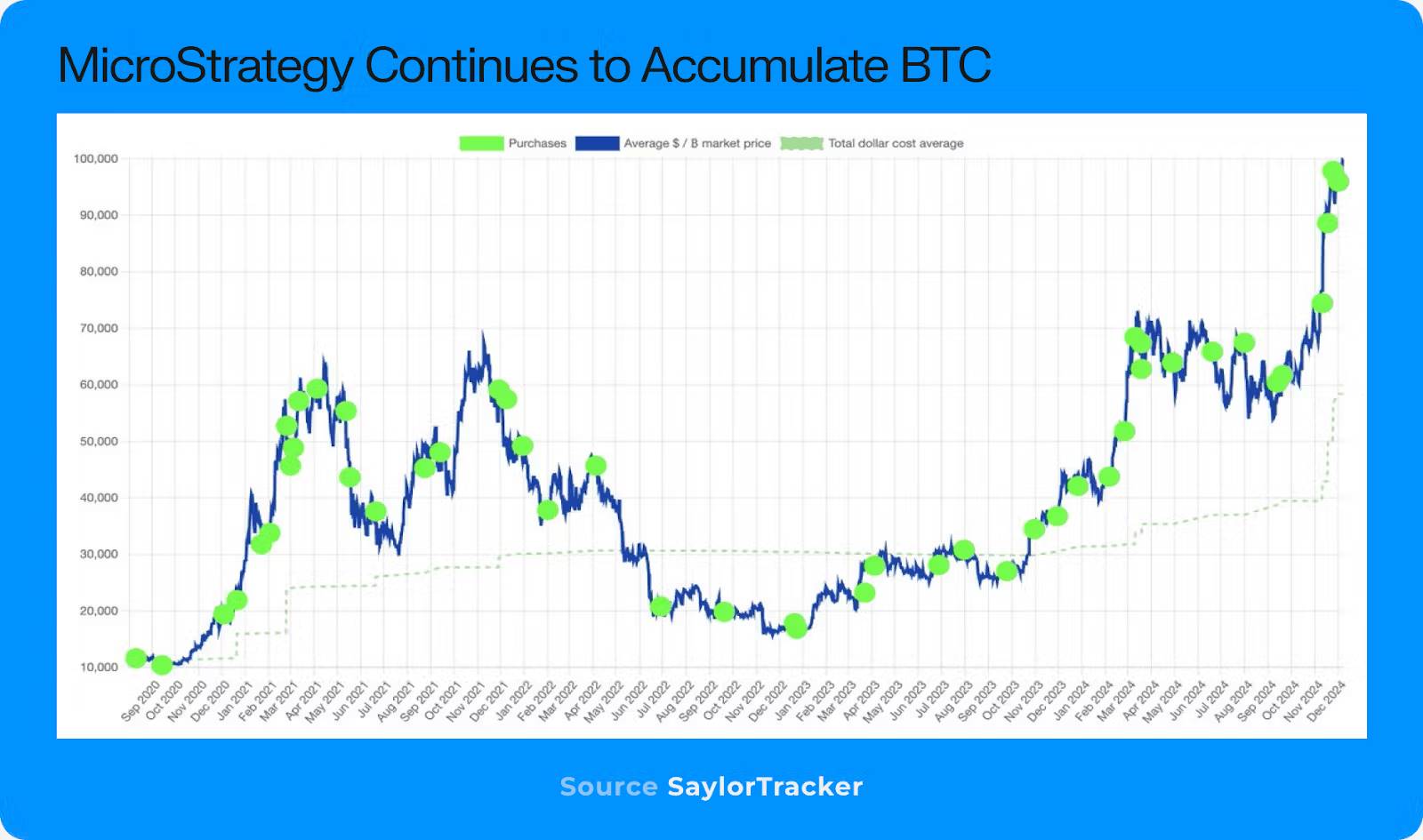

MicroStrategy continues to make large-scale purchases, with the latest acquisition of $2.1 billion in Bitcoin between December 2 and 8, holding approximately 420,000 Bitcoins, second only to Binance, Satoshi Nakamoto, and ETF issuers;

Michael Saylor and MicroStrategy (MSTR) continue to dollar-cost average, with a BTC-centered strategy incentivizing other publicly traded companies like Marathon Digital Holdings (MARA), Riot Platforms, and Semler Scientific to start accumulating BTC reserves;

2024 is also a BTC halving year, and the number of natural sellers of Bitcoin will decrease over time;

Network Innovations

The Rise of Ordinals and Runes

Ordinals bring NFT functionality to Bitcoin, while Runes are introduced as a new token standard, similar to Ethereum's ERC-20;

Some Runes projects have reached nine-figure valuations, indicating market recognition of the expansion of the Bitcoin ecosystem;

Breakthroughs in Bitcoin Programmability and Staking Innovations

The emergence of BitVM brings the possibility of arbitrary computation to Bitcoin, with over 40 Layer-2 projects launched on testnets or mainnets;

CORE, Bitlayer, Rootstock, and Merlin Chain lead in terms of TVL;

Babylon, as the first staking protocol for Bitcoin, launched in Q3, with the first round of 1,000 BTC staking capacity reaching its limit within 6 blocks;

Liquid staking tokens like LBTC from Lombard are beginning to appear;

2025 Predictions

Inflows into Bitcoin ETFs have significantly exceeded expectations, and over time, institutions are likely to gradually become the main drivers of daily BTC price movements;

ETFs can purchase spot Bitcoin without using leverage. The inflow of spot funds from institutions is smoother and more consistent, which should reduce reflexive, leverage-driven volatility, thus helping Bitcoin mature as an asset;

The approval of Bitcoin ETFs may place BTC in the early to mid-stage of becoming a leading global store of value. In November, Bitcoin surpassed silver to become the eighth most valuable asset globally, partly due to ETF inflows throughout the year. Year-end trends indicate that ETF inflows will continue to increase in 2025, especially as Grayscale's GBTC shifts to positive net flows;

On the regulatory front, the new Trump administration has shown a positive attitude towards cryptocurrencies and Bitcoin, making commitments related to Bitcoin during the campaign. Although Bitcoin quickly repriced after Trump's victory, the government will ultimately need to fulfill some of its promises;

While we predict that the likelihood of this happening is low, a federal strategic Bitcoin reserve would be particularly influential. The market seems to approach the Trump administration with cautious optimism, and if the president can achieve some high-probability action items, it may build enough goodwill to sustain positive sentiment around Bitcoin;

After the 2024 elections, the impact of clear and positive cryptocurrency reforms will become a major issue for all government departments, and we believe that cryptocurrency is on the verge of gaining bipartisan support. Its impact is significant and will help eliminate regulatory uncertainties surrounding Bitcoin in the foreseeable future;

Regarding Runes and Ordinals, we believe the dust has largely settled, and opportunities will be enticing by 2025;

Magic Eden is a driving force for improving Bitcoin's UI/UX, and if the Bitcoin ecosystem takes off, we expect them to be clear winners;

Bitcoin's programmability and BTC staking are still in their infancy, and early TVL growth is not yet sufficient to indicate actual demand; consumers largely favor the performance capabilities of networks like Solana and Base, and if this trend continues, Bitcoin builders will face a tough battle;

Ethereum: Identity Crisis and Future Opportunities

2024 Performance Overview

Ethereum has experienced an extraordinary year. As the "second brother" of the crypto market, it competes with Bitcoin, the "big brother," for the hard currency narrative while also facing challenges from new public chains like Solana. Key performances include:

Significantly underperformed relative to other major crypto assets, especially compared to Bitcoin and Solana;

The Layer-2 ecosystem continues to grow, but mainnet activity has noticeably declined; ETH has experienced sustained inflation for the first time, rather than the expected deflation;

Initial fund inflows after ETF approval were limited, only recently beginning to accelerate;

L2 scaling capacity has increased 15-fold, with cumulative throughput reaching approximately 200 TPS;

The rapid growth of Base has sparked discussions about "the future of Ethereum is Coinbase," but the decentralization of the L2 ecosystem has led to a compromised user and developer experience;

2025 Key Outlook

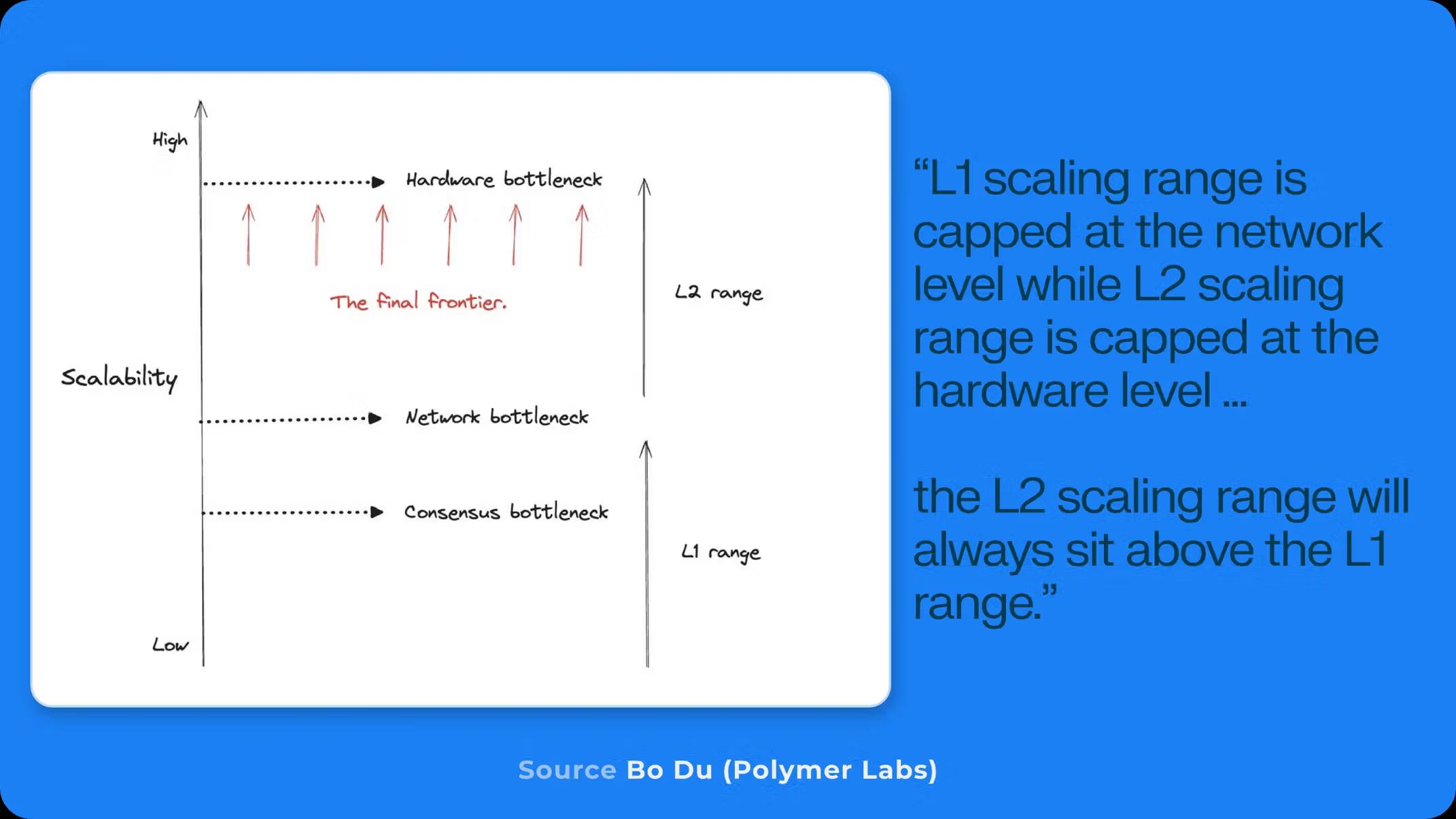

L2 Better than L1

Layer-2 designs allow for a more flexible execution environment, superior to native Layer-1; high-throughput L2s (like MegaETH) theoretically have far greater capacity than fast L1s;

Application chains can achieve better trade-offs, such as customized transaction prioritization;

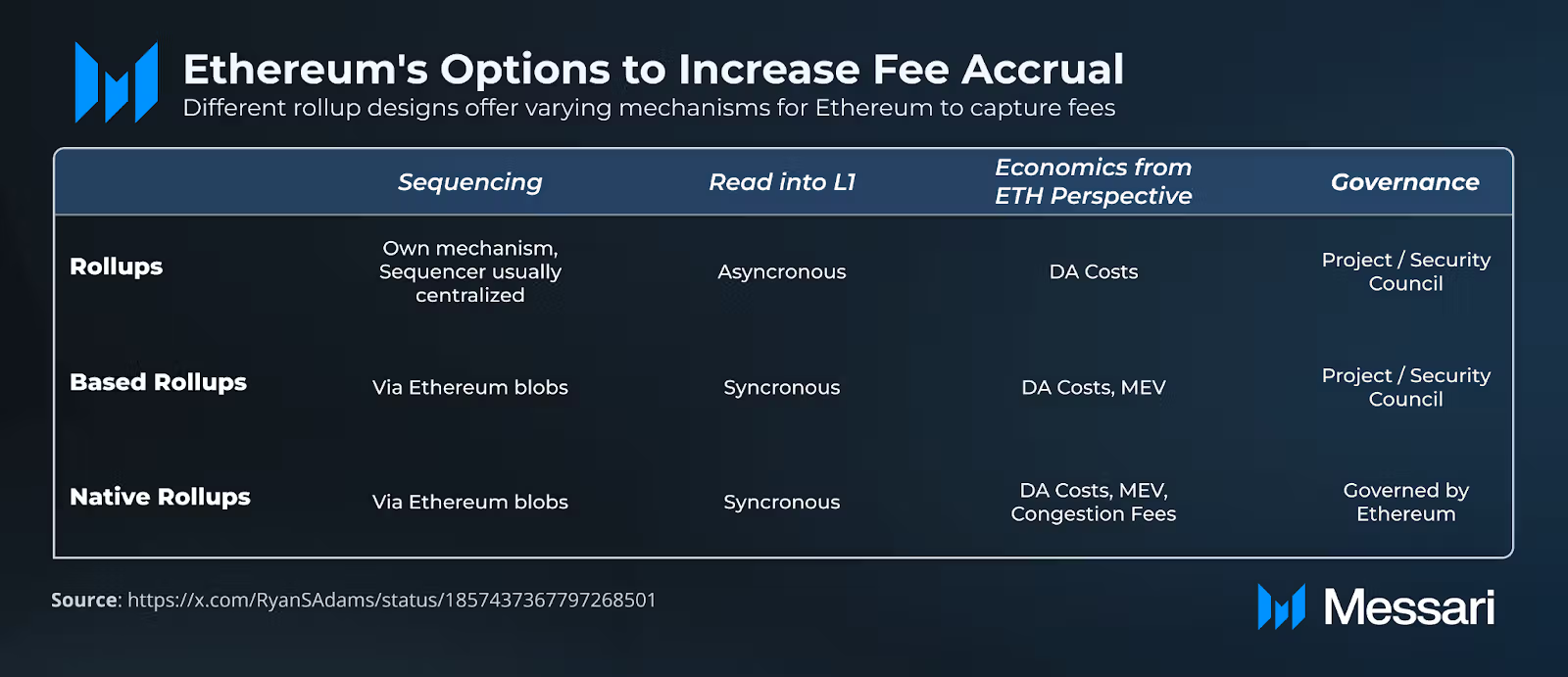

Two Viable Models for Increasing Value Capture

Ethereum faces two paths for value capture:

Fee-Insensitive Route

Current fees primarily stem from speculative activities, with sustainability in question;

Token valuations should be based on "security demand" rather than fees; maximum applications create the highest security demand, driving the value of native assets;

Enhanced Fee Capture Route

Native rollups can improve mainnet value capture and increase data availability fees;

Expand the base layer to compete with ordinary EVM Layer-2s;

New Opportunities for the Ecosystem as a Whole

A super rollup, interconnected based-rollup network, or high-fee burning could all become successful paths;

Regaining market share in the crypto-native speculative market will drive institutional interest;

The decentralized nature of the ecosystem allows any participant to potentially facilitate this shift;

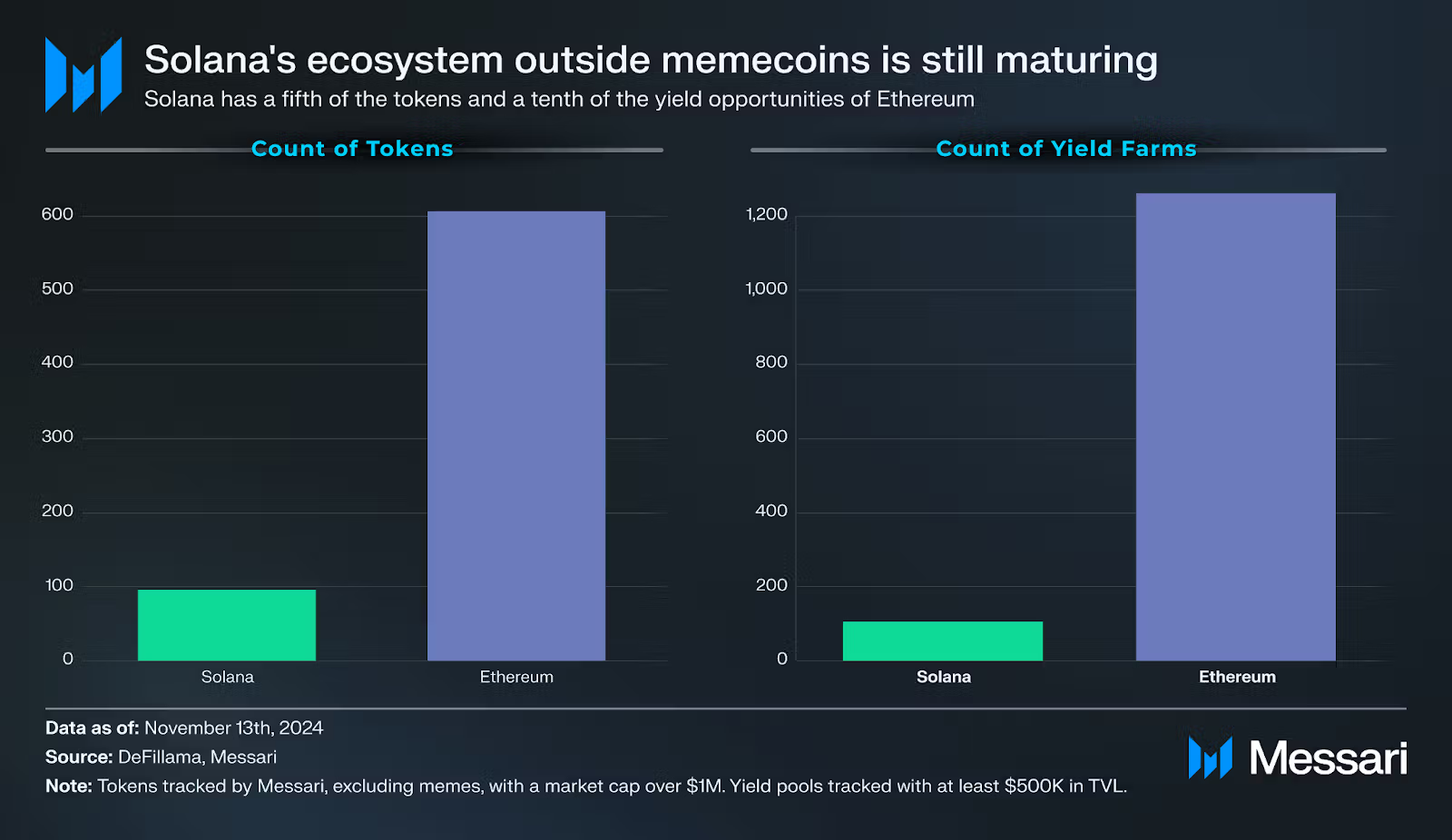

Solana: From Challenger to Mainstream Ecosystem

2024 Key Performance

Solana has transformed from "recovery after the FTX collapse" to a definitive breakthrough. Major achievements include:

- Transitioning from a "duopoly competition" between Bitcoin and Ethereum to a "triple alliance" structure;

Network stability has significantly improved, with only one 5-hour outage throughout the year; total locked value (TVL) in DeFi has grown from $1.5 billion to over $9 billion; stablecoin issuance has increased from $1.8 billion to nearly $5 billion;

Positioning itself as a speculative venue, particularly through Memecoin trading. The seamless user experience of ecosystem wallets, along with platforms like Pump.fun and Moonshot, has made token issuance and trading easier than ever;

This series of on-chain activities has even led to Solana's on-chain fees occasionally surpassing Ethereum's, highlighting the network's accelerating momentum and retail appeal;

2025 Key Outlook

Ecosystem Expansion

Expecting applications beyond speculation: We are particularly excited about the prediction market of MetaDAO, and the emerging Solana L2 ecosystem is worth watching to see if they can effectively compete with their Ethereum counterparts;

AI Trend Pioneering: ai16z has become one of the most trend-value repositories across all domains on GitHub. The Solana ecosystem not only embraces AI x Crypto but also leads this trend;

Traditional Financial Interest

Under the ETF trend, investors may seek to invest in "tech stocks" in this field, with Solana becoming the fastest horse;

A spot Solana ETF seems inevitable in the next year or two, creating a perfect storm for the explosive second phase of the Solana story;

Intensifying Competition

A new batch of Layer 1 blockchains (such as Monad, Berachain, and Sonic) is expected to emerge next year;

A revival of DeFi, AI agents, and consumer applications led by platforms like Base and numerous new L2s;

Other L1 + Infrastructure 2025 Outlook

Deep Tide Note: Due to space limitations, this chapter will focus on interpreting the sections regarding the 2025 outlook predictions. The summary for 2024 can be found in the original report, which includes more publicly available objective information.

Next year, we will see Monad and Sonic launch as two general-purpose, high-throughput, "holistic" L1s;

Both projects have accumulated significant funding (Monad with $225 million, Sonic with approximately $250 million in FTM tokens) to attract developers;

Berachain is one of the most interesting experiments in L1, having raised $142 million in Series A and B funding, with over 270 projects committed to supporting the network, showing great interest from developers and application teams;

Celestia's Lazybridging proposal and Avail's Nexus ZK proof verification layer have the potential to establish meaningful network effects for modular L1s in the second half of 2025;

If Unichain succeeds, it could trigger a wave of protocols—bypassing L1 and building application-specific or domain-specific L2s to increase value accumulation and create more revenue for token holders;

Alternative virtual machines (primarily Solana and Move VM) will continue to attract attention;

Avalanche9000 will leverage Avalanche's strengths in institutional and gaming sectors, making this year another strong one;

The outlook for Cosmos remains uncertain in 2025;

Initia will launch as an L1, supporting 5 to 10 application-specific, interoperable L2 solutions. This strategic setup positions Initia to potentially lead the next wave of application chain advancements;

In the interoperability track, focus on Across, Espresso, Omni Network;

In the ZK track, pay attention to Polygon's Agglayer. In 2025, it is expected that nearly all infrastructure protocols will adopt ZK technology;

The boundaries between applications and infrastructure are becoming increasingly blurred, and modular projects like Celestia, EigenDA, Avail may benefit from this;

DeFi 2025 Outlook

Base and Solana - Valuable Real Estate: We continue to see the growing prospects of Solana and Base DEX gaining market share relative to DEXs on other chains;

Vertical Integration and Composability: Protocols like Hyperliquid and Uniswap have shifted to owning their own infrastructure to configure network features that benefit their applications;

Prediction Markets: We predict that trading volumes may decline compared to previous election-driven trading months. To succeed, other protocols must provide relevant markets for bettors to speculate on continuously while incentivizing market makers;

RWA: As interest rates decline, tokenized government bonds are expected to face resistance; idle on-chain funds may gain more favor, shifting the focus from purely importing traditional financial assets to exporting on-chain opportunities. Even if macroeconomic conditions change, RWA has the potential to maintain growth and diversify on-chain assets;

Point Systems: We expect points to remain central to protocols designed to guide user adoption through token distribution, powering market and yield trading protocols. Entering 2025, protocols may refine their point systems while nurturing early adopter communities;

Driven by new opportunities in yield farming and the speculative appeal of point-based incentives, yield trading protocols like Pendle are expected to grow further;

AI X Crypto 2025 Outlook

Bittensor and Dynamic TAO: A New Type of AI Coin Casino

Each existing subnet (and future subnets) will have its own token, which will essentially be linked to Bittensor's native TAO token;

The AI race is a talent race, and Bittensor has a unique angle to attract talent—subnets show early signs of producing high-quality research;

If Bittensor unexpectedly becomes the center of cutting-edge AI research in the cryptocurrency field next year, do not be surprised;

Bittensor is not just a speculative "AI coin casino," but a platform capable of attracting serious AI developers;

Decentralized Model Training: A Stumbling Block and a Lever

Decentralized networks will not attempt to compete with giants like OpenAI and Google by training large foundational models but may instead focus on fine-tuning smaller specialized models;

More experiments are expected next year in the realm of small and specialized models. These models may be designed to perform specific tasks;

AI Agents and Meme Coins: Ongoing Experiments

Most AI agents may prefer to operate on-chain;

The growing token valuations can fund the continuous development of AI Agents and promote social media engagement;

We believe that as more engineers focus on this area, talent density will continue to increase;

As AI agent KOLs actively compete for attention on social media, this category will outperform "static" meme coins;

With ongoing discussions around the openness and closure of AI, we expect cryptocurrencies to occupy an increasingly significant portion of the conversation;

DePIN 2025 Outlook

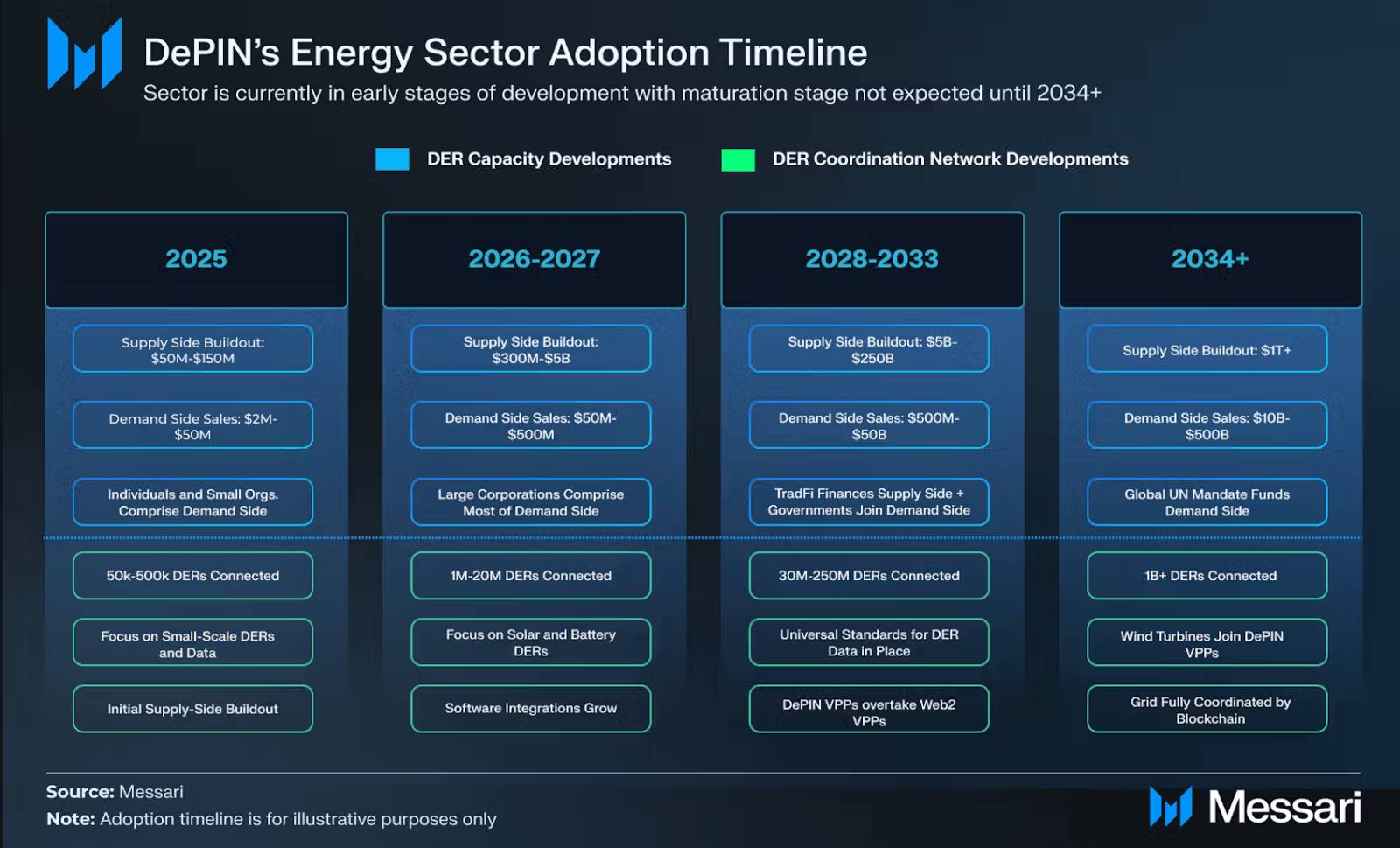

- By 2025, we expect energy DePIN to build supply-side infrastructure worth $50-150 million while generating up to $50 million in demand-side sales;

With Helium Mobile preparing for further growth and DAWN launching its mainnet in 2025, the wireless sector will solidify its position as a breakthrough use case in DePIN;

Revenue Forecast: The industry is expected to achieve eight to nine-figure revenues by 2025;

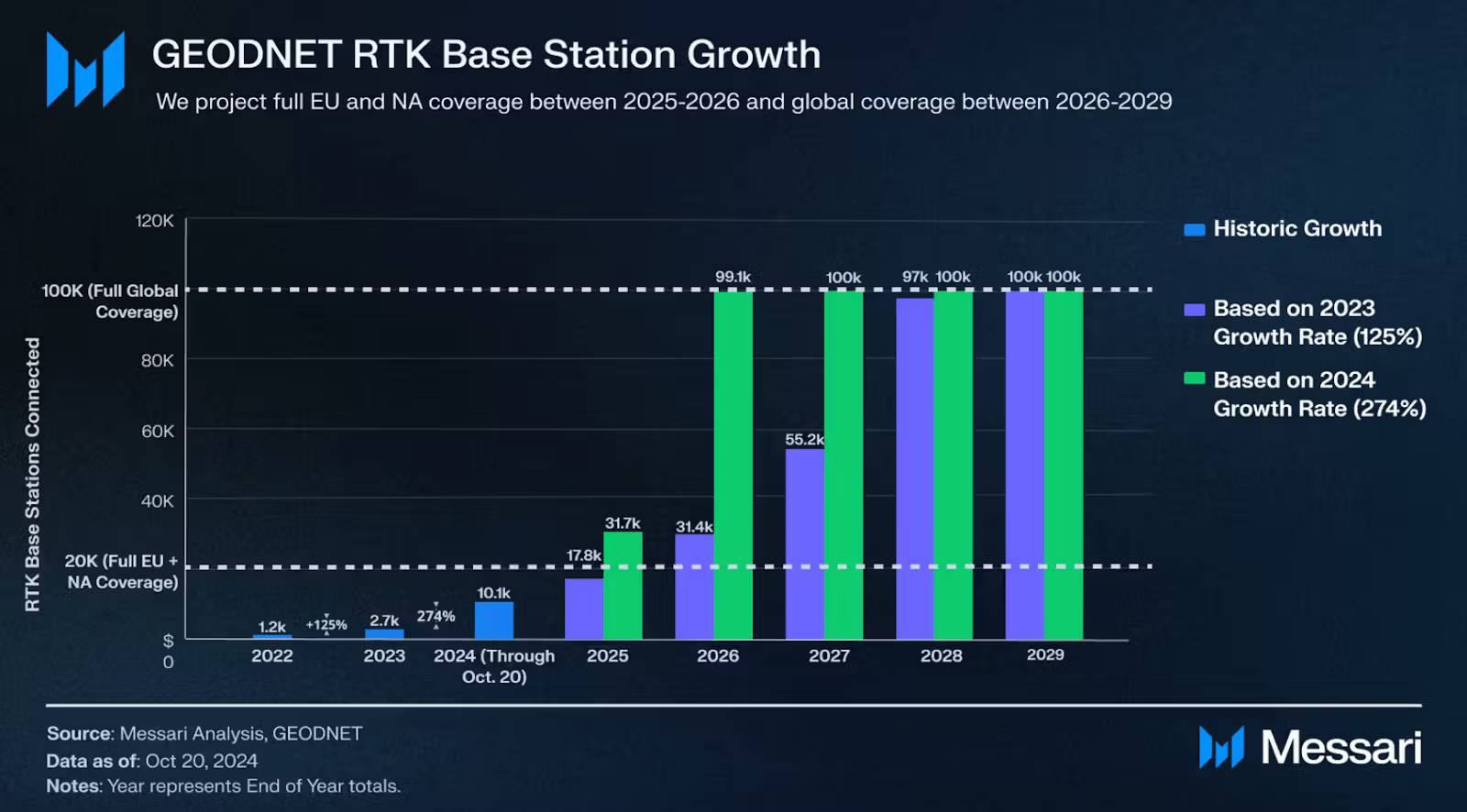

RTK networks like GEODNET are expected to expand supply-side coverage, providing 90%-100% coverage in high-value areas of the EU and North America by the end of 2025. Additionally, annual revenue may grow to over $10 million;

The weather collection network in this vertical is expected to make significant progress by 2025;

Integration and partnerships between energy and mobility DePIN are expected to further enhance grid integration and energy collection data for electric vehicle batteries;

In 2025, document storage DePIN is expected to generate $1.5-50 million in revenue across the entire sub-industry;

With the successful push of projects like Grass, data collection DePIN is expected to increase in 2025;

Consumer Applications 2025 Outlook

Play-to-earn airdrops will continue to be a primary method for attracting players into games. The "paid airdrop" strategy may become the new standard in 2025;

Mobile applications will be a decisive trend in 2025;

In 2025, we expect Solana to continue to hold the largest share of memecoin trading activity;

Ordinals are expected to become a category that continues to attract attention. Upcoming catalysts, such as potential CEX listings, airdrop-driven wealth effects, and the increasing popularity in Asian markets, will drive sustained growth and broader appeal throughout the year;

CeFi 2025 Outlook

With the ongoing bull market and rising financing rates, Ethena's supply may continue to expand;

Yield-bearing stablecoins may not quickly capture significant market share from Tether;

Trump's appointed Secretary of Commerce Howard Lutnick managing Tether's assets means the U.S. may completely change its hostile stance towards Tether;

Real innovation is likely to occur behind the scenes at orchestration companies like Bridge. Stablecoin APIs (such as those provided by Yellow Card) will enhance the ability of small businesses to accept stablecoins as payment globally;

In terms of exchanges, we will continue to see the integration of on-chain and off-chain services. Coinbase and Kraken aim to onboard as many users as possible onto their L2s in 2025, potentially offering incentives for this;

The new government will allow exchanges to be more lenient with the assets they choose to list. As Binance, Bybit, and Coinbase compete to list the most popular crypto assets, this trend may reach a fever pitch in 2025;

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。