BlackRock's BTC ETF (IBIT) has experienced its largest outflow since its launch in January of this year.

Written by: bitcoinist

Translated by: Blockchain Knight

As a major player in the crypto asset market, BlackRock has undergone some changes after experiencing the largest capital outflow in months.

On December 20, BlackRock recorded a capital outflow of $72.7 million, ending the consecutive inflows of its BTC ETF.

Data shows that BlackRock's BTC ETF (IBIT) has seen its largest outflow since its launch in January.

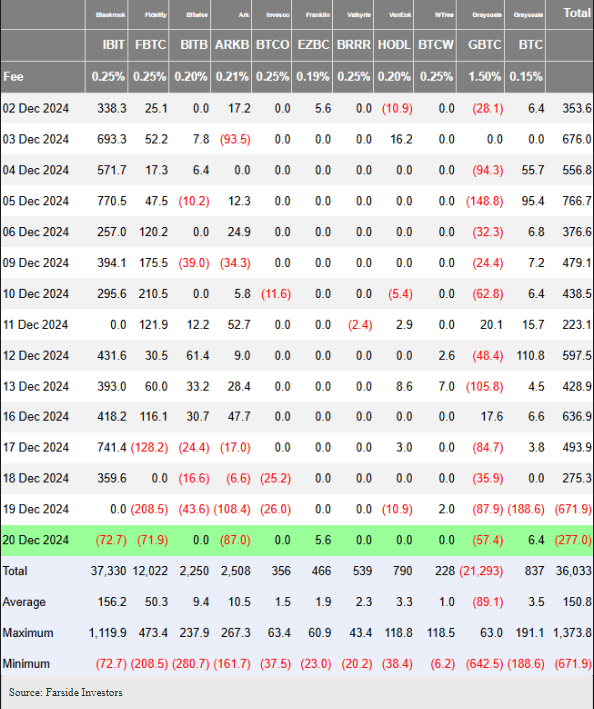

Farside Investors stated that the global asset management company's BTC ETF saw an outflow of $72.7 million in December, setting a record for IBIT.

Farside Investors added, "This occurred on the second day after IBIT registered zero inflow, which has made investors anxious about the ETF."

Just a day before IBIT faced the same predicament, Fidelity's BTC Fund (FBTC), also an ETF issuer, recorded a historic outflow of $208.5 million on December 19.

Analysts noted that on December 20, FBTC again recorded an outflow of approximately $71.9 million, marking two consecutive days of outflows for the ETF.

IBIT and FBTC are among the best-performing ETFs in the U.S.

One month after their listing, these two ETF issuers ranked 1st and 2nd among the top 25 ETFs by assets.

Market observers indicated that the consecutive outflows from the U.S. spot BTC ETF market set a historical high, with the outflows from BlackRock and Fidelity contributing to this trend.

Data shows that the ETF market lost $671.9 million on December 19, followed by an outflow of $277 million the next day.

The massive outflows experienced by the two largest ETF issuers in the U.S. have raised concerns among crypto asset investors about the outlook for ETFs in the coming months.

However, analysts believe that the challenges faced by BlackRock and Fidelity should not come as a surprise to traders, as these two international asset management companies have largely been the reason for significant capital inflows.

Some investors are worried that the recent developments regarding ETFs could mark a turning point, leading to a substantial decline in institutional investors' interest in BTC exposure.

Market observers believe that the outflows may not be sustained and added that after BTC earlier plummeted to $92,710, this alpha crypto asset has rebounded and is rising again.

Trading analysts noted that BTC's market trading volume has dropped to $59.5 billion, with total trading volume down 52%, which contrasts with the bullish trend of crypto assets following Trump's victory in the U.S. election last month.

During the crypto asset bull market, BTC reached an all-time high of $108,000 per coin in November.

In the same month, the U.S. spot BTC ETF also benefited from the crypto asset bull market, with net inflows setting a historical high of $6.2 billion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。