Every flow brings considerable value.

Written by: Pzai, Foresight News

Recently, as many deposit pledge projects begin their TGE, finding the next residence for existing stablecoin liquidity has become a pressing issue.

The wealth effect after the TGE of deposit projects is also quite significant. For example, the recently popular Usual deposit has brought users about 50% returns on their deposit amounts, while Ethena previously provided first-phase users with a 70% return rate. Several projects have delivered considerable returns to users within just a few months of the deposit cycle, thus attracting more and more on-chain liquidity to bet on these deposit projects. This article aims to outline the existing potential deposit airdrops, striving to unfold the potential stablecoin deposit airdrop landscape for readers.

Reddio

Reddio is a Layer 2 solution that employs a parallel EVM technology architecture, characterized by the use of parallel execution and GPU acceleration technology to enhance blockchain network throughput and computational efficiency. Additionally, it utilizes zero-knowledge proof technology to ensure security comparable to Ethereum. The project secured seed round financing led by Paradigm and Arena in August this year and is about to announce its new round of Series A financing.

In Reddio's points program, users can cross-chain stake ETH, USDT, or STONE from the Ethereum mainnet, with the withdrawal function to be opened later. According to its website, since the launch of the public testnet, Reddio's total staking scale has been approximately $2.77 million, indicating a relatively large opportunity space. Users can also earn points by participating in various tasks and check-ins on Reddio's social platforms. During the early bird phase, users can receive a 10% bonus on points.

Perena

The Solana stablecoin protocol Perena builds liquidity for multiple stablecoins on Solana through a stablecoin pool design. The project received $3 million in Pre-seed round financing with participation from Binance Labs on December 11 and has launched a trading Beta version. Users can access its TG group to obtain an invitation code.

In terms of rules, users can participate in the following operations to earn related Petals points:

Daily trading: Up to 10 transactions per day can earn Petals

Invitations: Each invitation earns 100 Petals and a 5% points rebate

Daily check-ins and liquidity pools: Holding LP tokens (USD) earns corresponding Petals, and addresses that earn 700 Petals can access the growth pool feature. Holding 100 USD grants a 25% bonus on the growth pool LP portion of points.

Astrol

Eclipse, as one of the new public chains that has not yet undergone TGE, is an Ethereum SVM L2 that recently launched its public mainnet. The main lending protocol Astrol has also opened Epoch 0 deposits, quickly reaching the deposit hard cap for ETH and SOL. Expected deposits in Astrol will also receive corresponding incentives in Eclipse Turbo Taps (currently only open to OGs), making it worth a try for Degen users seeking early incentives in the new ecosystem.

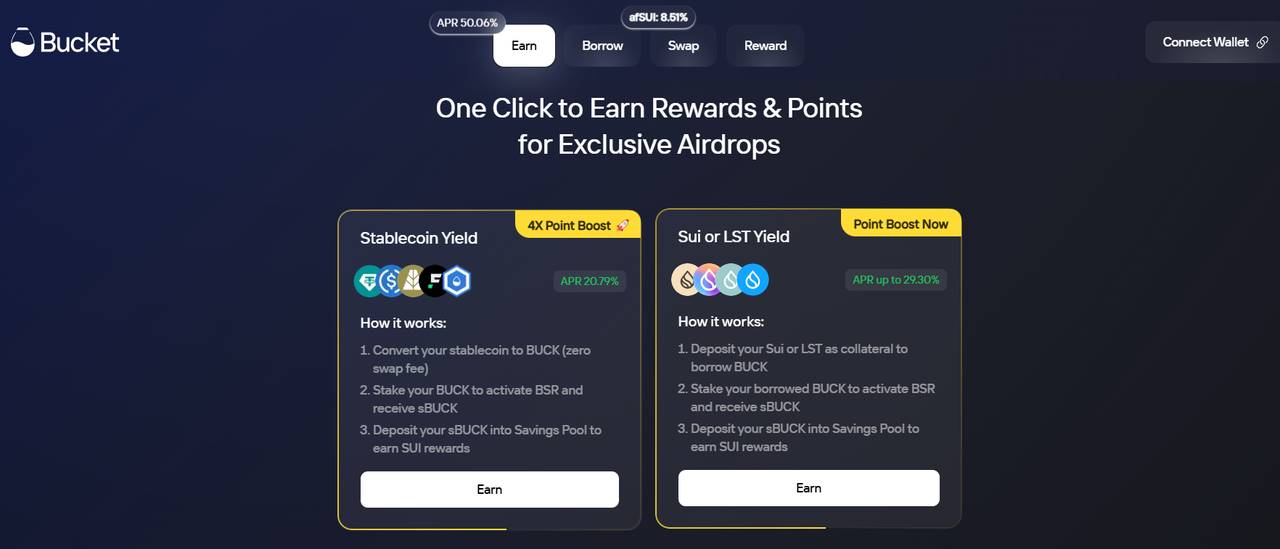

Bucket Protocol

Bucket Protocol, as a synthetic stablecoin protocol in the SUI ecosystem, provides one-click yield strategies for various stablecoins and SUI holders, offering users high APY, Bucket points, and SUI incentives. As a relatively strong player in the SUI ecosystem, its ecological opportunities naturally deserve attention, and airdrops from ecosystem projects like Deepbook have significantly enhanced user expectations for airdrops. For stablecoin holders, Bucket's "one fish, multiple meals" return rate is also quite considerable.

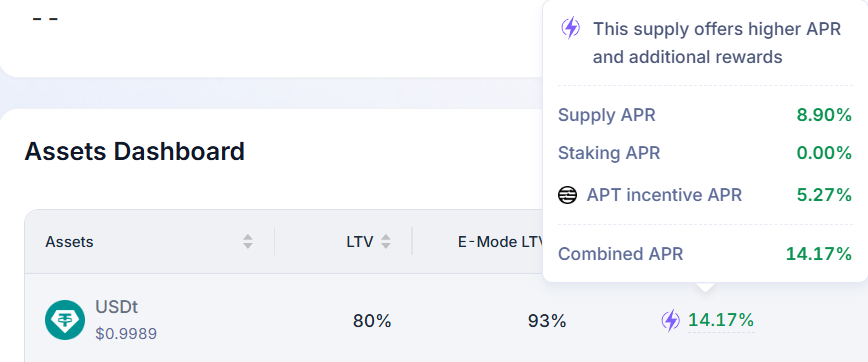

Aptos Lending Protocol

The Aptos lending protocols Echelon, Superposition, Meso, etc., provide users with considerable stablecoin yield options. In addition to the general lending market returns, deposits in these protocols also benefit from ecological APT subsidies provided by Aptos, offering a certain APY advantage compared to other ecosystems. Many projects in the Move ecosystem are also actively preparing for their TGE, making these unlaunched protocols increasingly attractive to users.

Meson Finance USDT Deposit Yield Distribution

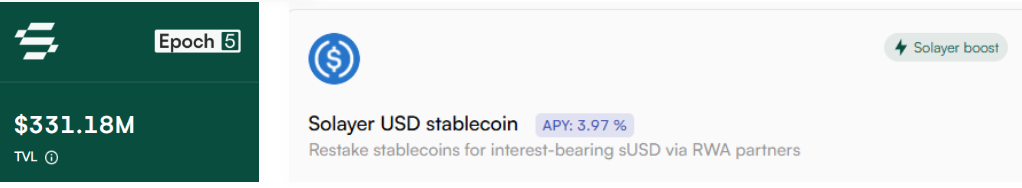

Solayer sUSD

The Solana ecosystem's re-staking protocol Solayer has launched a USDC staking option within the ecosystem, enjoying the protocol's Boost feature to accumulate incentives. To date, Solayer's staking scale is approximately $330 million. As a re-staking protocol for mainstream assets, Solayer could be the next place to provide more potential returns for stablecoin holders, and this staking can exist in a safer form, suitable for users who wish to avoid the price volatility risks of crypto assets while not wanting to miss out on DeFi yield opportunities.

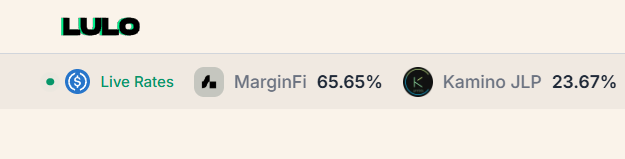

Lulo

The aggregation protocol Lulo on Solana offers users the best stablecoin yield opportunities across various protocols, with the highest yield rate reaching 65.65%. The real-time adjusted yield strategy provides users with more convenient and flexible options. For stablecoin users, not only can they obtain high APY returns within the protocol, but they can also prepare early for future airdrop expectations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。