Seeing the outcome to know the cause, observing the past to know the future.

Written by: 1912212.eth, Foresight News

2024 is about to pass in the blink of an eye, a year that is destined to leave behind many significant moments. In the crypto industry, filled with various uncertainties, there have been surprises, hopeful aspirations, and astonishing transformations.

At the beginning of this year, the highly anticipated Bitcoin spot ETF was officially approved. Just when the public thought the Ethereum spot ETF was progressing slowly, the SEC's attitude suddenly changed. Subsequently, as the U.S. elections drew closer, the prediction market Polymarket gained widespread attention due to its data changes and was widely cited in reports, becoming one of the few breakout crypto applications this year. Meanwhile, Binance founder and CEO Changpeng Zhao, after being convicted, served three months in prison and was officially released at the end of September.

As we entered the fourth quarter, the crypto-friendly Trump was unexpectedly elected as the next U.S. president. Under Musk's proposal, the Department of Government Efficiency (DOGE) was established, bringing the long-dormant Dogecoin back to life. The Dogecoin craze spurred explosive growth in many memes. Solana became the king of meme chains, with the total market value of meme coins on it once surpassing $15 billion. At the same time, the current SEC chairman, who has been criticized by the industry, is set to leave office when Trump officially takes office, bringing a sigh of relief to the crypto industry. Bitcoin continued to rise amid ongoing fluctuations, ultimately breaking the $100,000 mark for the first time on December 5.

1. Approval of Bitcoin and Ethereum Spot ETFs — Wall Street's New Favorite

The much-anticipated Bitcoin spot ETF has been highly awaited by the industry since the end of 2023. On January 10, the U.S. Securities and Exchange Commission (SEC) announced the official approval of the first batch of ETFs (Exchange Traded Funds) that partially use Bitcoin as underlying assets, allowing these ETFs to be publicly traded on January 11, 2024 (midnight Beijing time on January 11, 2024).

The approved Bitcoin spot ETFs are issued by 11 institutions, including Grayscale, Bitwise, Hashdex, iShares, Valkyrie, Ark 21Shares, Invesco Galaxy, VanEck, WisdomTree, Fidelity, and Franklin. This decision marks a historic step for the U.S. digital asset ecosystem and indicates that the digital asset market may be standing at a new historical starting point.

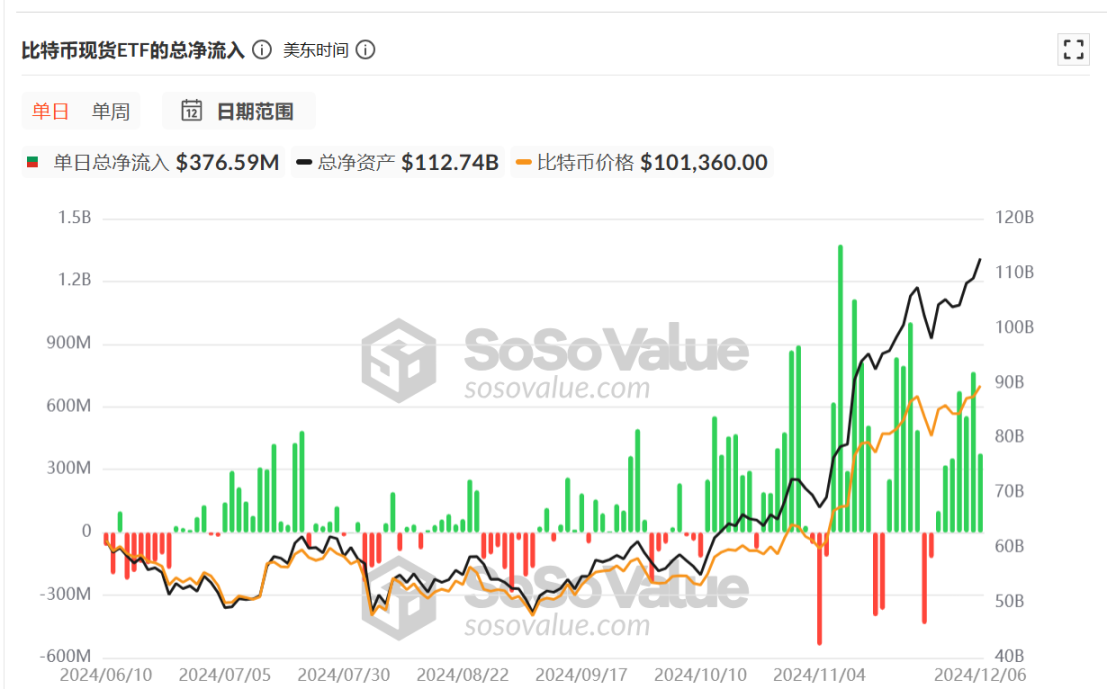

As of December 9, the total net inflow of Bitcoin has risen to $33.43 billion, with no signs of slowing down.

Behind the continuously breaking historical highs is the reflection of Bitcoin increasingly becoming a mainstream asset. The purchasing power of funds from both institutional and retail investors has been released due to the spot ETF, laying the groundwork for the rise in Bitcoin prices.

After the approval of the Bitcoin spot ETF, market investors naturally shifted their focus to Ethereum. However, due to the lack of news, some were not very hopeful. On May 14, Bloomberg senior ETF analyst Eric Balchunas stated that he did not expect the ETF to be approved before the end of 2025. Meanwhile, bettors on the on-chain prediction market Polymarket estimated the likelihood of the SEC approving the ETF before May 31 to be 14%.

The approval of the Ethereum spot ETF came faster than expected. Just 10 days later, on May 24, the Ethereum spot ETF was officially approved by the SEC. The SEC approved the plans for listing spot Ethereum ETFs on the New York Stock Exchange, Cboe, and Nasdaq, including applications from eight Ethereum spot ETFs, such as those from BlackRock and Fidelity.

Unlike the Bitcoin spot ETF, the launch of the Ethereum spot ETF coincided with a sluggish market, with data showing poor performance and even daily net outflows exceeding net inflows for an extended period. It wasn't until early November that its net inflow significantly exceeded net outflow, and market funds began to flood in.

As of December 9, the total cumulative net inflow of the Ethereum spot ETF has risen to $1.41 billion.

2. Polymarket Breaks Out — The Most Accurate Polling Platform

With the hot market and the excitement of the U.S. elections, Polymarket successfully rose to prominence as the hottest breakout crypto application by betting on event outcomes. In June of this year, its trading volume reached $109 million, setting a historical high, with monthly active users reaching 29,200, also a historical high.

As the U.S. presidential election date approached in July, August, September, and October, Polymarket set historical highs in trading volume each month. Questions about whether Biden would withdraw from the race and the comparison of Trump and Harris's winning probabilities pushed the platform's data to new heights. Figures like Musk and CNN frequently cited its data when discussing the election.

In October, Trump's winning probability exceeded 60%, and by November 6, it soared above 88%. After the official announcement of the election results, the accuracy of its data predictions was praised by market participants, stating, "Real money bets often reflect market views better."

Prediction markets are more accurate than public opinion polls, media, and expert predictions. Besides Trump, who won the election, a French whale betting on Trump's victory made a profit of $47.8 million on Polymarket. This "whale" is a French billionaire who previously worked as a trader at several banks and began using his mathematical expertise to analyze U.S. opinion polls this summer, ultimately gaining fame through this bet.

In November, Polymarket's trading volume reached $2.577 billion, setting a historical high, with active users reaching 293,705 and new account registrations hitting 339,531, also a historical high.

3. Changpeng Zhao Sentenced to Four Months in Prison — 161 Letters of Support Changed the Verdict

Binance founder Changpeng Zhao was officially released from prison on September 29 this year. Since the end of 2023, Zhao has not been allowed to hold any positions and appeared in Seattle court on November 22. On the same day, Reuters cited insiders stating that Binance's fine was $4.368 billion, setting a record for the highest fine paid in the crypto industry. Court records show that Binance faced three criminal charges, including conducting unauthorized fund transfer operations, conspiracy charges, and violations of the International Emergency Economic Powers Act.

As the founder of Binance, Zhao could not escape legal sanctions either. He pleaded guilty to money laundering charges and paid a $50 million fine. He was then allowed to be released on a $175 million bail and was briefly permitted to return to the UAE during the bail period. However, as the case progressed, U.S. courts repeatedly overturned previous decisions, prohibiting him from traveling abroad.

In April 2024, U.S. prosecutors formally filed criminal charges against Zhao, recommending a 36-month prison sentence. Prosecutors pointed out that Zhao's Binance platform had serious compliance issues, failing to report suspicious transactions related to terrorist organizations and supporting the sale of child sexual abuse materials and receiving ransomware payments. They argued that these actions severely violated U.S. anti-money laundering regulations and must be punished severely.

On May 1, Zhao's criminal trial was confirmed, and it was evident that the 161 letters of support played a significant role in the outcome, as he was ultimately sentenced to four months in prison.

Since Zhao's release, he has stated in interviews that he spends at least half of his time on the digital education platform Giggle Academy, believing that the project is very interesting and impactful.

4. Trump's Victory — The First "Crypto" President

A photo of Trump raising his fist after being shot during the campaign went viral worldwide. Perhaps surviving a near-death experience brings good fortune; on November 6 at noon Beijing time, Trump defeated Harris to officially win the U.S. presidential election. Trump presented himself as crypto-friendly during the campaign, expressing a series of views, such as firing the current SEC chairman and establishing a national Bitcoin reserve.

After his successful campaign, Trump continued to take action, nominating five cryptocurrency players as candidates for new government ministers. Additionally, he plans to expand the CFTC's regulatory powers and clarify the responsibilities and boundaries with the SEC. The selection of the new SEC chairman is still being finalized.

For a long time, U.S. regulatory policies have been criticized by the market for their severity. The multiple enforcement actions by the CFTC and SEC over the past few years have also undermined market confidence. Trump's official inauguration and the nomination of new government ministers have made the market eagerly anticipate changes.

Bitcoin has been on the rise since Trump's election, breaking the $100,000 mark for the first time in early December. The new cabinet selections and expectations of relaxed regulations have also spurred a revival in DeFi, with various U.S.-based public chains, DeFi, and RWA also rising in response.

Bitwise CEO Hunter Horsley stated in early December, "In the past 30 days, Coinbase's market value has increased by about $30 billion, and XRP's market value has increased by about $100 billion. The shift from regulatory resistance to regulatory favor in the U.S. is one of the biggest and most important structural catalysts we see in the crypto space. Its impact is just beginning."

5. Establishment of the Department of Government Efficiency (DOGE) — A Victory for Dogecoin

Musk's plan for the Department of Government Efficiency had been brewing even before Trump's election. This initiative was co-launched by him and former President Donald Trump, aiming to conduct a comprehensive financial audit of the federal government and propose suggestions to reduce waste, fraud, and unnecessary spending.

In September of this year, during a speech at the New York Economic Club, Trump officially stated that if elected president, he would create the Department of Government Efficiency in collaboration with Musk. Therefore, this document declaration was merely a formal announcement that followed naturally.

Trump has high expectations for it, stating that it could become the "Manhattan Project" of our time. Republican politicians have long dreamed of the goals of "DOGE." To drive this radical transformation, the Department of Government Efficiency will provide advice and guidance from outside the government and collaborate with the White House and the Office of Management and Budget to promote large-scale structural reforms, creating an unprecedented entrepreneurial government.

The final statement also indicated that "their work will be completed no later than July 4, 2026, bringing a smaller, more efficient, and less bureaucratic government, which will be a perfect gift to America on the 250th anniversary of the Declaration of Independence."

The English abbreviation for the Department of Government Efficiency is D.O.G.E, which is no coincidence. Its inspiration comes from the Dogecoin community, and in August of this year, Musk referred to the name as perfect during a Twitter interaction.

Dogecoin has also surged under the wave of the Department of Government Efficiency, climbing to a peak of around $0.48 since September, an increase of nearly six times.

6. HBO Documentary "Money Electric: The Bitcoin Mystery" Released — Who is Satoshi Nakamoto

The HBO documentary "Money Electric: The Bitcoin Mystery" premiered on October 8. This video reveals the true identity of Satoshi Nakamoto. Prior to this, the real identity of Satoshi Nakamoto could have included Len Sassaman, Nick Szabo, and Adam Back.

The documentary identifies Satoshi Nakamoto as Bitcoin developer Peter Todd, who stated, "Wrongly publicly announcing that an ordinary person is actually extraordinarily wealthy can expose them to threats like robbery and kidnapping. This issue is not only foolish but also dangerous. Satoshi clearly does not want to be found, and there is a reason for that; everyone should not help those trying to find Satoshi."

Although the identity of Satoshi Nakamoto identified in the documentary was denied by Todd himself, it still sparked considerable discussion.

On December 16, after Bitcoin broke $106,000, Satoshi Nakamoto became the 16th richest person, with a personal wealth exceeding $100 billion.

7. SEC Chairman Gary Gensler Resigns — Dawn is Approaching

On November 22, according to a statement from the U.S. Securities and Exchange Commission, SEC Chairman Gary Gensler, whose term was originally set to end in June 2026, will leave office early on January 20, 2025.

Since the FTX incident, the SEC has tightened its regulation of the crypto industry again and initiated a series of high-profile lawsuits. Gary Gensler believes that most cryptocurrencies are securities and aims to promote compliance through a series of enforcement actions.

He has repeatedly pointed out in public that cryptocurrencies are rife with fraud, scams, bankruptcies, and money laundering. On the other hand, during his tenure, the spot ETFs for Bitcoin and Ethereum were successively approved.

Most industry practitioners have often criticized Gary, and after Trump took office, the trust in the SEC chairman's personnel has also attracted market attention. In early December, Trump nominated Paul Atkins as the new SEC chairman, but he was unwilling to accept the position. Although Coinbase CEO commented that Paul is an excellent candidate for the SEC, the position remains unfilled.

8. Bitcoin Breaks $100,000 for the First Time — Setting a New Record

On December 5, after consolidating above $90,000, Bitcoin finally broke through the $100,000 mark. This is the first time in Bitcoin's history since its inception in 2009 that it has surpassed $100,000, with a total market capitalization exceeding $2 trillion, making it one of the top seven assets globally. Throughout past bull and bear cycles, Bitcoin has remained resilient, ranking first in the market capitalization of crypto assets.

As crypto assets continue to spread globally driven by the blockchain wave, and as more financial institutions, sovereign nations, and regions recognize their value, Bitcoin's price and market capitalization are also expanding. Galaxy Digital CEO Mike Novogratz commented on Bitcoin's price breaking $100,000, stating that a global buying frenzy for Bitcoin is underway, making it one of the first global assets.

With record net inflows into Bitcoin spot ETFs and the crypto-friendly Trump set to take office, Bitcoin is likely to continue leading the upward trend in the crypto market.

9. MicroStrategy Added to Nasdaq 100 Index — The Crypto Version of Nvidia

On December 14, Nasdaq (Nasdaq: NDAQ) announced the results of the annual reorganization of the Nasdaq 100 Index® (Nasdaq: NDX®), which will take effect before the market opens on December 23, 2024. MicroStrategy Incorporated (Nasdaq: MSTR) will be included in the Nasdaq 100 Index.

The Nasdaq 100 Index is a stock index launched by the Nasdaq Stock Exchange, consisting of the 100 largest non-financial companies listed on the Nasdaq. This index reflects the overall market performance of these companies and is one of the important indices for global investors. In addition to the above, there are requirements for market capitalization, stock liquidity, visibility, and company financial profitability to be included in the Nasdaq 100 Index.

Since 2020, MicroStrategy has been using BTC as its primary reserve asset. With MicroStrategy's aggressive buying, its stock price has soared in the new cycle, driven by the strong rise of Bitcoin. In January 2023, the MSTR stock price was only $150, while in March 2024, it surged to a peak of $1999.99, with a market capitalization of several hundred billion dollars, achieving a stock price return of over 1000% in just over a year.

As of December 8 this year, data shows that MicroStrategy holds a total of 423,650 Bitcoins (accounting for 2.017% of the total Bitcoin supply), with a total purchase cost of approximately $25.6 billion and an average purchase price of about $60,324.

For the crypto industry, the influence of being included in the Nasdaq 100 may also inspire more companies to follow MicroStrategy and join the ranks of Bitcoin investors. As more institutional investors enter the cryptocurrency market, the market demand for Bitcoin may further increase, driving up BTC prices.

10. Stablecoin Market Capitalization Hits All-Time High — Mass Adoption

On December 9, the total market capitalization of stablecoins exceeded $200 billion, setting a new all-time high. The market capitalization of stablecoins had declined since reaching a peak of around $186 billion in May 2022, but began to rise steadily after the start of 2024, with funds continuously flowing into the crypto market.

In the crypto industry, stablecoins represented by USDT, USDC, and USDE provide fuel for the market price increase. Currently, USDT accounts for nearly 70%, with a market capitalization exceeding $140.57 billion, while USDC has a market capitalization exceeding $42.11 billion. The emerging stablecoin USDE has also surpassed $5.87 billion in market capitalization in just a few months.

Stablecoins offer lower fees, more competition among payment service providers, and broader accessibility. By reducing transaction costs to nearly zero, they can help businesses overcome the friction caused by existing payment methods. The adoption of stablecoins will begin with those businesses most affected by current payment methods, and this process will disrupt the entire payment industry. Currently, giants like Visa, Mastercard, and PayPal have all laid out plans for stablecoin payments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。