Author: Deep Tide TechFlow

As Bitcoin declines and altcoins turn red, the memes on the first-level chain market have temporarily become a "safe haven" for the market. Although some high-market-cap memes listed on exchanges are inevitably affected by the overall market and continue to decline, for new popular assets (or more appropriately, fast-moving assets), the panic in the market can at most cause some superficial wounds.

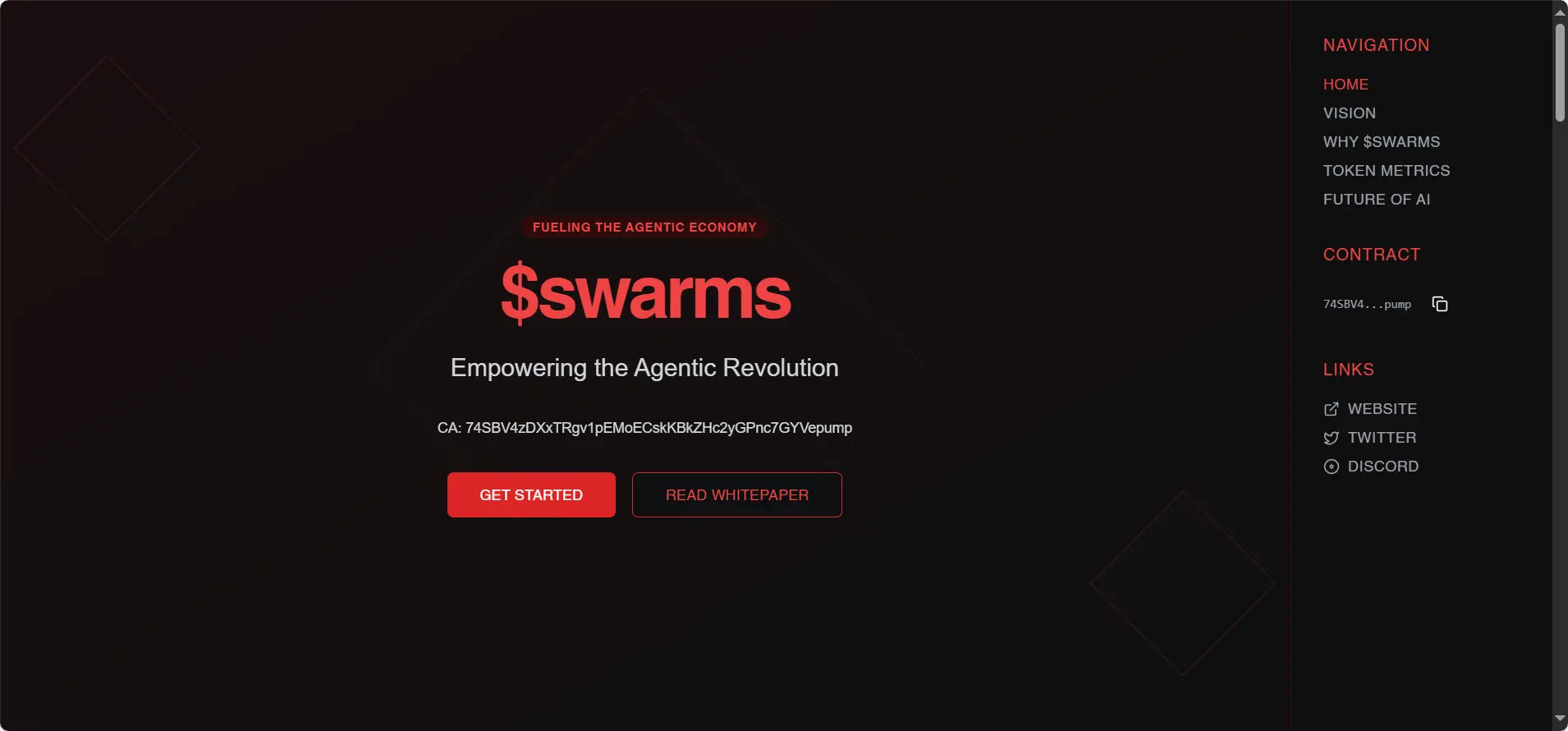

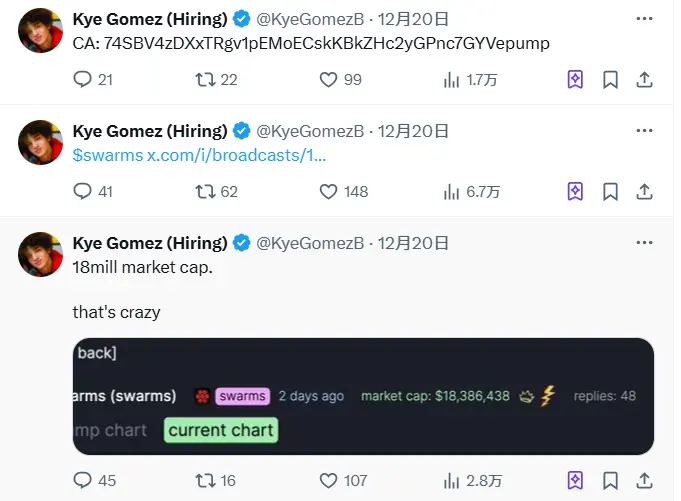

Last Friday, the enterprise-level multi-agent collaboration framework Swarms announced on Twitter that it had "claimed" the token $swarms issued through Pump.Fun. The reason it is termed "claimed" is that $swarms did not launch on the official announcement day but had existed two days prior. At that time, the unendorsed $swarms may have been regarded by the market as an ordinary "scam," with its market cap once languishing at a low of $6,000, unnoticed.

With the success of $arc as a precedent, the narrative framework of $swarms led the market to buy in without hesitation. On the "Black Friday" when altcoins plummeted, $swarms merely consolidated sideways for a short while during the market's most panicked hours, before directly breaking through a market cap of $70 million.

By synthesizing information provided by Swarms' official website and technical documentation, we have a preliminary understanding of what the Swarms framework does.

Note: Meme token prices are highly volatile and carry significant risks. Investors should fully assess risks and participate cautiously. This article merely shares information based on market trends, and the author and platform do not guarantee the completeness or accuracy of the content. This article does not constitute any investment advice.

Is it another entry by the tech crowd?

In addition to the clear token address on the Swarms official homepage, the developer of the Swarms framework @KyeGomezB continued to discuss token news on the same day.

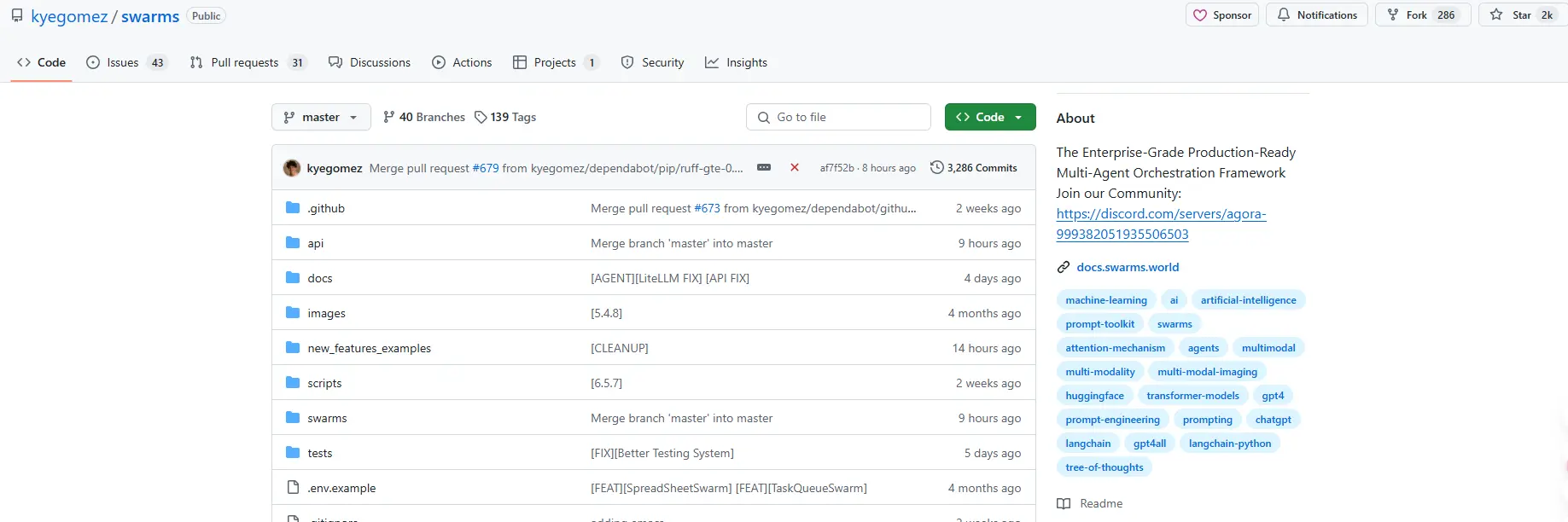

According to Kye Gomes' GitHub page, the Swarms framework has already received over 2,000 stars (the $arc rig framework currently has 1,300 stars).

With GitHub as proof, at least the hardcore technical identity of the $swarms token is established.

Enterprise-level multi-agent collaboration framework

The Swarms framework was not originally designed specifically for Web3 or Crypto Native; its core positioning, as the term "Swarms" suggests, is a multi-agent collaboration framework for enterprises. It is not just a simple AI development tool but a complete solution focused on addressing the practical problems enterprises face during the implementation of AI.

In practical applications, Swarms provides a complete toolchain that enables enterprises to easily build and manage collaboration among multiple AI agents. These AI agents can be different language models, specialized tools, or custom intelligent agents, which can seamlessly cooperate under the scheduling of Swarms to complete complex business tasks.

From a technical architecture perspective, the Swarms framework includes the following core components:

Task scheduling system: responsible for breaking down complex tasks and assigning them to suitable AI agents

Agent management module: manages the lifecycle and status of each AI agent

Communication middleware: ensures accurate and efficient information transfer between agents

Monitoring and logging system: tracks the operational status of the entire system in real-time

At the enterprise application level, Swarms provides:

High availability assurance: automatic fault tolerance and recovery mechanisms

Complete monitoring system: real-time tracking of AI agent performance and status

Flexible scalability: easy addition of new AI capabilities and business logic

Security considerations: comprehensive permission management and data protection mechanisms

To understand how Swarms works, we can use a symphony orchestra as an analogy:

Imagine a large orchestra performing a symphony. Traditional AI solutions are like a jack-of-all-trades trying to play all instruments at once. In contrast, Swarms allows each "musician" (AI agent) to focus on their expertise, collaborating under the direction of a "conductor" (the Swarms framework). The sheet music represents the standardized task flow of the entire system, while rehearsals are the ongoing optimization process of the system.

For example, in an e-commerce scenario, when a user needs personalized shopping recommendations, the system automatically coordinates multiple specialized agents. The user profiling agent deeply understands user needs, the product recommendation agent filters the most suitable products accordingly, the feedback analysis agent organizes user feedback, and finally, the conversational assistant agent integrates this information into friendly suggestions for the user. These agents perform their roles while seamlessly cooperating, ultimately providing precise services to the user.

How does it differ from other projects in the same field?

As a product in the AI framework space, whether it is $ai16z & $ELIZA with the ELIZA framework or $arc based on the rig framework, their prices reflect the market's recognition of the underlying infrastructure concept.

So, is the Swarms framework in competition with the other two projects? Or can they leverage each other's strengths for collaboration?

**Twitter user *@tmel0211* summarized the potential connections between the three frameworks:**

The evolution logic of standards and frameworks from ELIZA to RIG (ARC) to Swarms makes sense. ELIZA focuses on lightweight rapid deployment to create AI agents, ARC aims to enhance resource optimization and performance of AI agent systems using Rust, while Swarms seeks to build a complex task decomposition and coordination framework for multi-AI agent collaboration. Its multi-agent mixed orchestration mechanism, flexible combination of serial and parallel mechanisms, and multi-layer memory processing architecture all make sense in terms of the necessity and development direction of technical evolution.

Theoretically, Swarms can integrate ARC, and ARC can optimize ELIZA. All three frameworks share a modular design philosophy, and their technical visions are becoming increasingly ambitious. This could be a concern of being overly "conceptual." The current standard frameworks are far from a point of evaluating superiority or inferiority. We should observe the completeness of the framework codebase and the implementation of single AI applications based on these frameworks. If early technical advantages are hard to gauge, focus on the application implementation; technology may float in the air, but the interactive experience will certainly land on the ground.

Clearly, whether it is ELIZA, RIG, or Swarms, their feasibility and expansion space are still in the early stages. Different language frameworks aim to solve different problems in the large-scale adoption of AI, and "collaboration" will be an unavoidable theme among the frameworks in the future.

Founder faces scrutiny, token price fluctuates

Although the market initially recognized the narrative of $swarms, things did not run smoothly.

On the day the $swarms token exploded, the founder of $ai16z, Shaw @shawmakesmagic, publicly criticized the developer of the Swarms framework @KyeGomezB on Twitter, stating, "I really don't like publicly pointing out others' problems. Doing so poses a huge risk to our project, makes many people nervous, and I don't want to discourage those hardworking developers. But some people will steal others' work and try to take credit for it." He referenced a 2023 Reddit post to argue Kye's plagiarism. The article pointed out that a GitHub repo might show signs of stealing others' work, and that repo belongs to Swarms developer Kye.

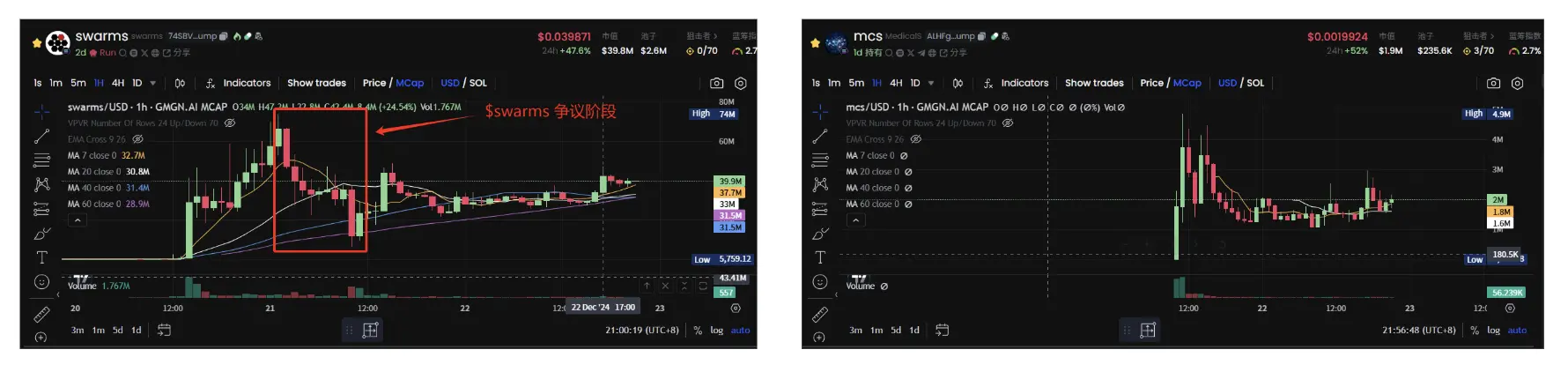

Shaw's FUD nearly halved the price of $swarms. However, in response to this FUD, Swarms' founder Kye was also unyielding, countering on Twitter while launching a new token $mcs based on the Swarms framework application Medicalswarm to prove that his framework is not useless but indeed "has something to offer."

Kye may not be familiar with the gameplay of AI memes. When the consensus around $swarms was not yet solidified and the token price was still on a downward trend, the launch of a new token was directly interpreted by many confused players as a sign that the $swarms dev no longer wanted to manage this project, making $swarms seem unworthy of further investment. Therefore, the launch of $mcs initially did not help save $swarms; instead, it caused $swarms to drop even further, with its market cap plummeting from a high of $74 million to as low as $6 million, dragging the new token $mcs down with it.

However, the inexperienced Kye realized that his handling of the situation might have been incorrect upon seeing the market's reaction. He quickly started a live stream to announce that he was indeed serious about building the project and locked up his $swarms tokens for a year during the live broadcast. Perhaps the founder genuinely wanted to prove himself in the face of various FUD, or maybe he received guidance from someone knowledgeable, using this unstable consensus period to gather more tokens. In any case, this series of actions did wash away many early investors, and the market, regaining its composure, began to buy back $swarms, gradually increasing its market cap to stabilize around $30 million.

Summary

As of the time of writing, the price trend of $swarms has gradually stabilized, with a market cap still around $40 million.

The "fast-track script" of $swarms is somewhat similar to $arc. As a token with a technical background, it saw a frenzy of buying once it gained traction, quickly reaching a market cap of tens of millions. However, as profit-taking occurs and market understanding and community consensus take time to solidify, such tokens will inevitably experience volatility in their early stages.

Whether this project truly has substance, as the founder claims, will ultimately be determined by the market's choices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。