Author: Frank, PANews

From the once-celebrated public chain Fantom to the current Sonic Labs, 2024 is set to be a transformative year for this Layer 1 chain: a rebranding of the foundation, a mainnet upgrade, and a token swap. Fantom is attempting to achieve a "second startup" through a series of actions. However, with TVL dropping to less than $100 million, ongoing controversies over token issuance, and lingering shadows of cross-chain security issues, Sonic still faces numerous doubts and challenges. Can the new chain's high performance deliver? Will the token swap and airdrop save the ecosystem?

Telling the Performance Story: Returning to the Market with Sub-Second Public Chain

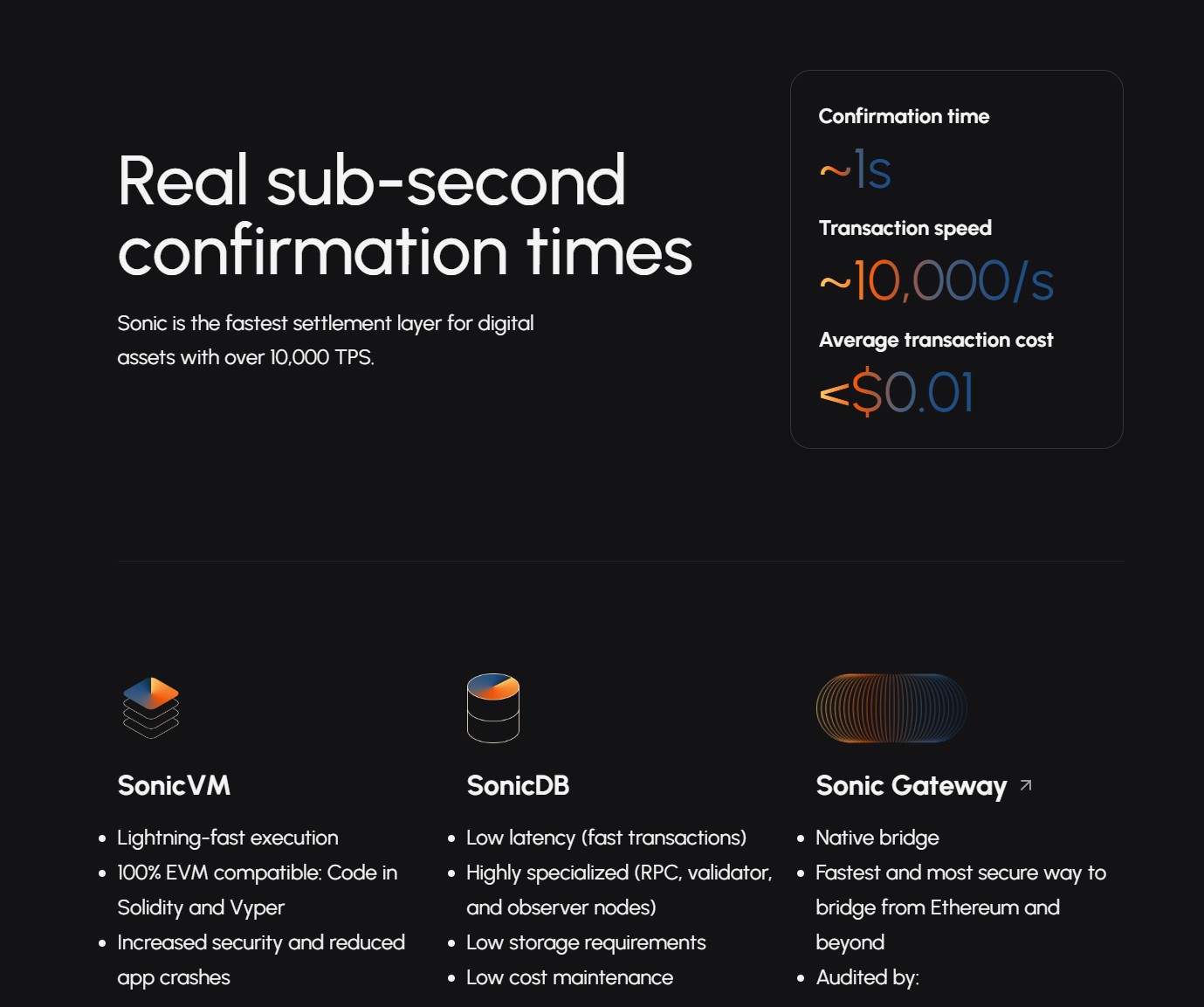

On December 18, 2024, the Fantom Foundation officially rebranded as Sonic Labs and announced the launch of the Sonic mainnet. As a new public chain known for its sub-second transaction speeds, performance has naturally become Fantom's most important technical narrative. Just three days after its launch on December 21, official data showed that the Sonic chain had already produced 1 million blocks.

So, what is the secret to its "speed"? According to official sources, Sonic has deeply optimized both the consensus layer and the storage layer, introducing technologies such as live pruning, node synchronization acceleration, and database optimization, allowing nodes to confirm and record transactions with a lighter load. The official claims that compared to the old Opera chain, node synchronization speed has increased tenfold, and the cost of large-scale RPC nodes can be reduced by 96%, laying the foundation for a truly high-performance network.

It is worth noting that while "high TPS" is no longer a novel concept in the public chain competition, it remains one of the core metrics for attracting users and project parties. A fast and smooth interaction experience can typically lower the barrier to entry for users into blockchain technology and provide possibilities for complex contracts, high-frequency trading, and metaverse gaming applications.

Beyond "high performance," Sonic claims to fully support EVM and is compatible with mainstream smart contract languages such as Solidity and Vyper. On the surface, the choice between "self-developed virtual machine vs. EVM compatibility" was once a watershed moment for new public chains; however, Sonic opted for the latter. The advantage of this choice is that the migration barrier for developers is low—any smart contract originally written on Ethereum or other EVM chains can be deployed directly to Sonic without major modifications, saving a significant amount of adaptation costs.

In the fiercely competitive public chain market, abandoning EVM often means having to re-cultivate developers and users. Clearly, Sonic hopes to "smoothly" inherit the Ethereum ecosystem based on strong performance, allowing projects to land as quickly as possible. From the official Q&A, it appears that the Sonic team also considered other routes, but based on their judgment of industry inertia, EVM remains the most "common denominator" choice, helping to rapidly accumulate application numbers and user bases in the early stages.

Additionally, Fantom had previously stumbled in the Multichain incident, so Sonic's cross-chain strategy is also under close scrutiny. The official technical documentation lists the cross-chain Sonic Gateway as a key technology and specifically introduces its security mechanisms. The Sonic Gateway employs validators running clients on both Sonic and Ethereum, providing decentralized and tamper-proof "Fail-Safe" protection. The design of the "Fail-Safe" mechanism is quite special: if the bridge does not report a "heartbeat" for 14 days, the original assets can be automatically unlocked on the Ethereum side, ensuring user funds are protected; by default, cross-chain packaging occurs every 10 minutes (ETH→Sonic) and every hour (Sonic→ETH), but can also be triggered instantly for a fee; Sonic's own validator network operates the gateway by running clients on both Sonic and Ethereum. This ensures that the Sonic Gateway is as decentralized as the Sonic chain itself, eliminating the risk of centralized manipulation.

From a design perspective, Sonic's main updates aim to attract a new round of developers and funds through high TPS, sub-second settlement, and EVM compatibility, allowing this veteran public chain to return to the market spotlight with a new image and performance.

Token Economics: Left Hand Issuance, Right Hand Destruction

In fact, the most discussed topic in the community right now is Sonic's new token economics. On one hand, the 1:1 exchange model for FTM seems to be a straightforward shift. On the other hand, the airdrop plan six months later, which amounts to an additional issuance of 6% of tokens (approximately 19 million), is seen by the community as a dilution of token value.

When Sonic first launched, it set an initial supply of 3.175 billion tokens (the same as FTM), ensuring that old holders could receive S on a 1:1 basis. However, a closer examination reveals that the issuance may only be part of Sonic's strategy, as the token economics also contains several practices aimed at balancing the total supply.

According to the official documentation, starting six months after the mainnet launch, 1.5% (approximately 4.7625 million S) will be issued annually for network operations, marketing, DeFi promotion, and other purposes, continuing for six years. However, if this portion of tokens is not fully utilized in a given year, it will be 100% burned, ensuring that only the issued portion is actually put into construction rather than hoarded by the foundation.

In the initial four years, the 3.5% annual validator rewards for the Sonic mainnet primarily come from the unused FTM "block reward share" from Opera, thus avoiding a large minting of new S at the start, which could lead to severe inflation. After four years, the issuance of new tokens will resume at a rate of 1.75% for block rewards.

To counteract the inflationary pressure from this issuance, Sonic has designed three destruction mechanisms:

Fee Monetization Burn: If a DApp does not participate in FeeM, 50% of the Gas fees generated from transactions in that application will be directly burned; this acts as a higher "deflation tax" on applications that do not join the revenue-sharing model, encouraging DApps to actively participate in FeeM.

Airdrop Burn: 75% of the airdrop shares require a 270-day vesting period to be fully obtained; if users choose to unlock early, they will lose a portion of their airdrop shares, and these "withheld" shares will be directly burned, thereby reducing the circulation of S in the market.

Ongoing Funding Burn: The 1.5% annual issuance for network development will also be 100% burned if not fully utilized in that year; this prevents the foundation from hoarding tokens and limits certain members' long-term occupation of the tokens.

Overall, Sonic attempts to ensure ecological development funding through "controllable issuance" in one hand while employing multiple "burning" strategies to suppress inflation. The most noteworthy aspect is the "burning" under the FeeM mechanism, as it is directly linked to the participation level and transaction volume of DApps, meaning that the more applications that do not participate in FeeM, the greater the deflationary effect on-chain; conversely, as more FeeM applications emerge, the "deflation tax" decreases, but developer shares increase, creating a dynamic balance between profit-sharing and deflation.

TVL Only 1% of Peak Period: Can Refunds + Airdrops Regain DeFi Momentum?

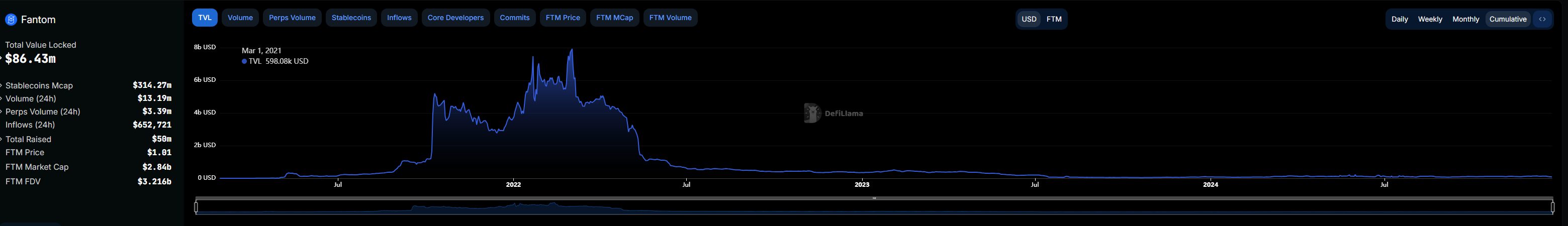

The Fantom team once enjoyed a moment of glory during the 2021-2022 bull market, but over the past year, Fantom's on-chain performance has not been ideal. Currently, Fantom's TVL is only about $90 million, ranking 49th among DeFi public chains, while its TVL once peaked at around $7 billion. The current data is only about 1% of its peak.

Perhaps in an effort to revitalize the DeFi ecosystem, Sonic has introduced the Fee Monetization (FeeM) mechanism, claiming it can refund up to 90% of network Gas fees to project parties, allowing them to achieve sustainable revenue based on actual on-chain usage without overly relying on external financing. This model draws on the Web2 platform's "revenue-sharing based on traffic" approach, hoping to encourage more DeFi, NFT, and GameFi developers to come to Sonic and stay.

Additionally, the official has set up a 200 million S token airdrop pool and launched two gameplay options: Sonic Points, which encourage ordinary users to actively interact, hold, or accumulate a certain historical activity on Sonic; and Sonic Gems, aimed at incentivizing developers to launch attractive and genuinely usable DApps on the Sonic chain. The S tokens used for the airdrop also incorporate mechanisms such as "linear vesting + NFT locking + early unlock burning," attempting to find a balance between airdrops and medium to long-term stickiness.

The mainnet launch, the milestone of 1 million blocks, and the announcement of the cross-chain bridge have indeed increased Sonic's visibility in the short term. However, the current reality is that the ecosystem's prosperity is far from its peak era. The full competition from Layer 2, Solana, Aptos, Sui, and other public chains has already ushered the market into an era of multi-chain diversity. High TPS is no longer the only selling point. If Sonic cannot spark one or two "flagship projects" within its ecosystem, it may struggle to compete with other popular chains.

Nevertheless, Sonic's launch has garnered support from some industry star projects. In December, the AAVE community proposed a plan to deploy Aave v3 on Sonic, and Uniswap announced that it has completed its deployment on Sonic. Furthermore, Sonic can directly inherit 333 staking protocols from Fantom as its ecological foundation. These are advantages compared to a completely new public chain.

Can performance and high incentives bring back funds and developers? The answer may depend on whether Sonic can deliver convincing results in specific application deployment, governance transparency, and cross-chain security by 2025. If all goes well, Sonic may hope to recreate the glory of Fantom's past. However, if it remains merely a concept without addressing internal conflicts and security concerns, this "second startup" may fade into obscurity amidst the multi-chain melee.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。