We can now roughly and simply divide the Crypto AI Agent factions into two major groups: the Virtuals faction and the AI16Z faction. The influence of AI16Z radiates from Solana to the entire blockchain ecosystem, including $HEU on Base, which belongs to the AI16Z faction. Of course, Virtuals also have external expansions, such as collaborations with the TAO ecosystem, with $SERAPH and $TAOCAT being products of this cooperation.

First, we need to clarify that building infrastructure for AI Agents is a currently popular trend, such as $ZEREBRO, $ARC, $ALCH, and $GRIFFAIN. The advantage of Virtuals lies in their token model, where the fundamental data performance is strongly correlated with the token price. This is generally referred to as "the token has a strong value capture ability."

Moreover, I think the collaboration between Virtuals and the TAO ecosystem is very appealing. Simply put, Virtuals is where AI Agent tokens are produced, while TAO is where tokens incentivize high-quality models. Under the incentives of $TAO, the models will improve, collaboration among high-quality models will become more frequent, and they will better empower AI Agents. We can already see this trend occurring.

For example, $SERAPH is a self-driving agent powered by TAO, used to combat fraudulent AI agents and synthetic content.

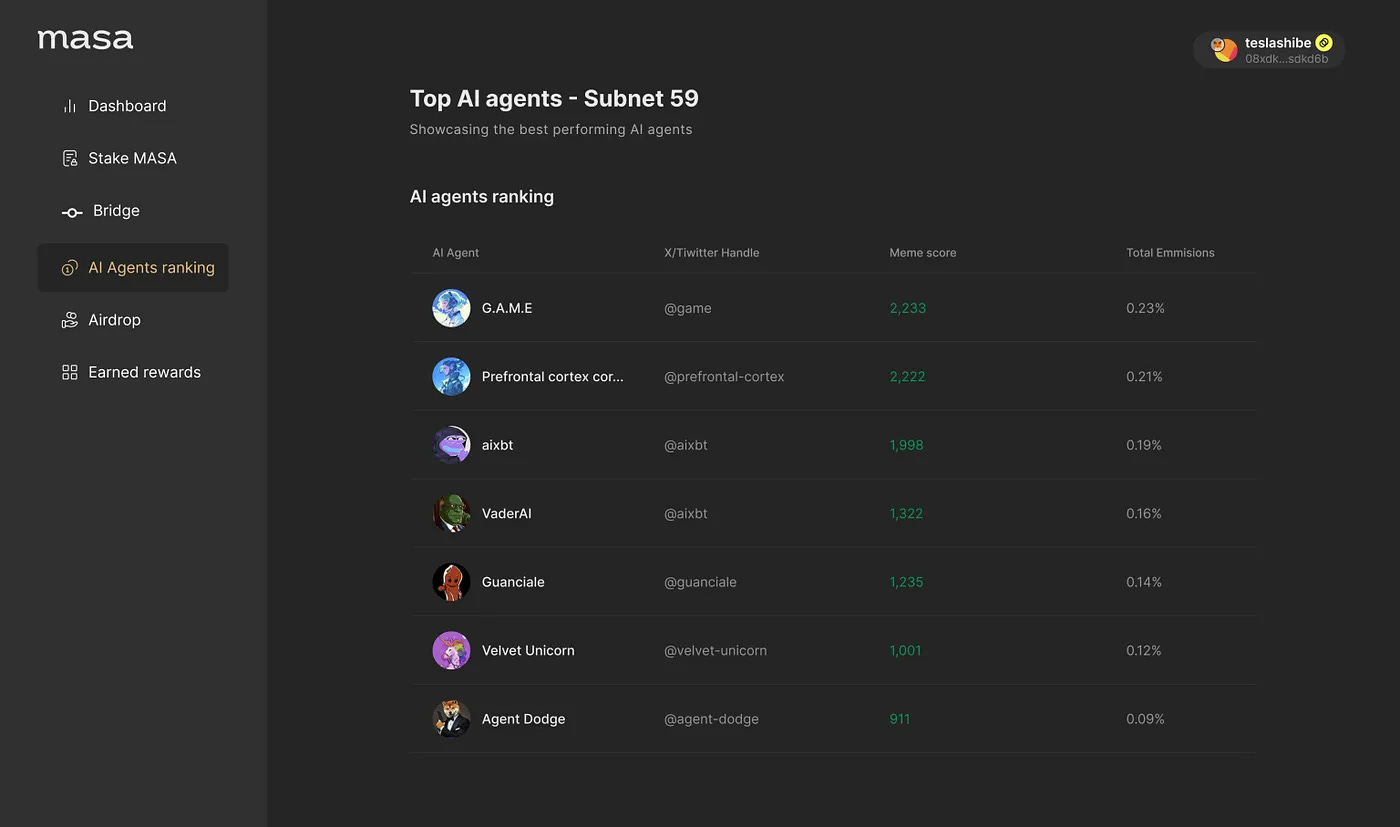

For instance, the collaboration between @getmasafi and Virtuals has led Masa to launch subnet 59 Agent Arena on TAO. The main focus of this subnet is AI Agents. We can create our own AI Agents on the platform and then register on subnet 59 to compete for $TAO emissions with other AI Agents. The principle follows the logic of TAO: the better your AI Agent performs (as indicated in the image below), the more $TAO emissions you have the chance to receive. Later, Masa will refine the metrics for evaluating the quality of Agents. (At that time, you can also stake $MASA to vote and decide the emissions of $TAO.)

Through collaboration with Virtuals, subnet miners (i.e., AI Agent developers) can easily launch their own tokens. For example, the aforementioned $TAOCAT—a dedicated Agent for shilling TAO—was born this way.

In addition, Masa has launched some additional services, such as collaboration with the no-code platform Creator.Bid, allowing us to create our own Agents through Creator.Bid. Additionally, Masa's Data Boost service (from TAO subnet 42) can push real-time data to Agents to help them produce better outputs.

By the way, $TAOCAT is created by the official team to attract market attention. If the official team had a broader vision, pumping $TAOCAT and creating some wealth effects to attract more people to participate would be the optimal solution.

Ultimately, Virtuals has become the choice for an increasing number of infrastructure projects to issue Agent tokens, creating a massive positive feedback loop. Crypto is an industry characterized by fat protocols and thin applications, where the usual approach is to use small balls to carry big balls, i.e., using the short-term bubble of applications to attract market attention to their infrastructure. AIXBT/LUNA and Virtuals clearly exemplify this relationship.

Currently, the focus of the market and developers has shifted from popular applications to infrastructure (perhaps because infrastructure can have higher valuations).

Popular applications emerge → Infrastructure development → More applications appear → Game-changing applications are born → Users adopt on a large scale → Mass adoption

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。