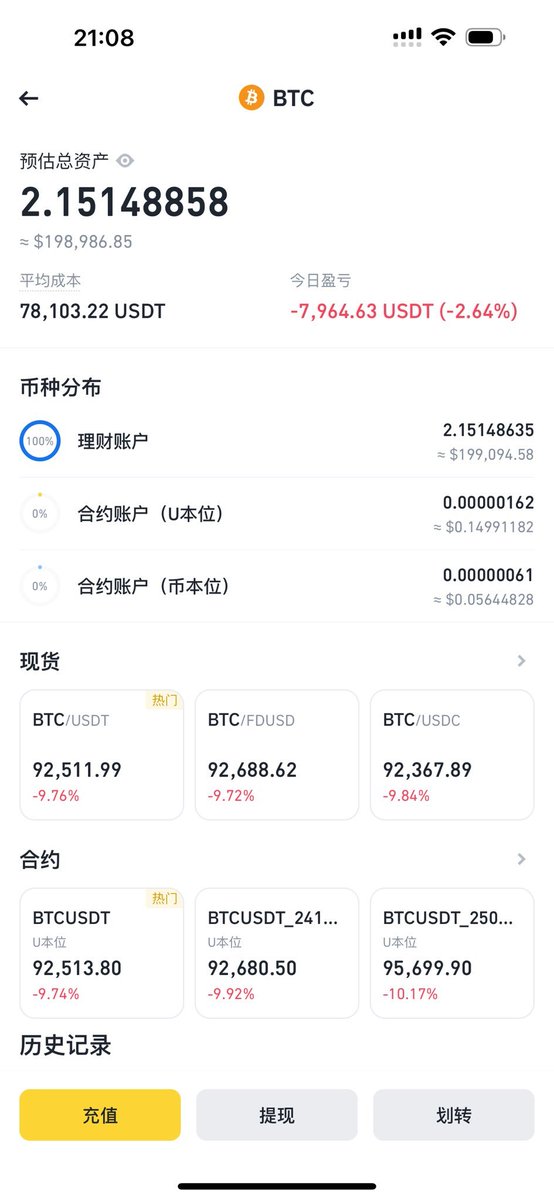

I bought two #BTC in two days, with an average price of $98,000. It's still a bit high; the third one should be at $89,000. I don't know if I can buy it, but it's already arranged. If I can buy it, the average price will be $95,000, which is about the same as my previous expectation.

Let me explain why I made this arrangement. It's not that I can't see any bearish signals, right? Why did it drop from $100,000 to $89,000 (hypothetically)? Isn't the consensus around $100,000 very strong? How did it break down to $92,000? Isn't there strong support between $95,000 and $100,000? How did it break through?

I know my friends have many questions, so after coming out of the hot spring, I started typing without changing my clothes. First, let me talk about my judgment on the bearish signals. After the Federal Reserve's meeting, I really felt there was nothing bearish left. Even today's PCE data doesn't seem significant to me because it's highly likely that there won't be any rate cuts in January, and the Federal Reserve has also anticipated the rise in inflation. Therefore, the rising PCE data itself is normal; the market has already anticipated it. The final outcome has prepared for no rate cuts in January and March next year, so how much impact can the current inflation data have?

That's the first point. The second point is that before Christmas, there are no other important data releases. From Christmas until January 20, before the power transition, there is the non-farm payroll data on January 11 and the CPI data on January 15. Let's talk about CPI first; it is not much different from this PCE. Even if it has an impact, it's not a big deal. On the contrary, the non-farm data is somewhat useful, but there is almost no bearish signal, only bullish ones. Why do I say that?

Because the current definition of the economy by the Federal Reserve is very strong, and they also hope to cool down the job market. So a decrease in the unemployment rate indicates that the market is still good, which aligns with expectations for continued pauses. If the unemployment rate rises, it indicates some turbulence in the economy, but it's not a big issue; it might prompt the Federal Reserve to consider cutting rates a few more times. Therefore, as long as there is no economic recession or black swan event, there really aren't any bearish data to see before January 20.

Now, my friends might ask, if everything is fine, why is it dropping? We rationally analyze that the core PCE's actual impact is already very low, but the market itself is irrational. Many investors are still worried that if inflation continues to rise, will the Federal Reserve choose to raise rates or reduce the extent of rate cuts, leading to risk-averse sentiment before important data is released?

We talked about risk aversion before the Federal Reserve's meeting, so my expectation for buying the second #Bitcoin was actually quite simple, looking at today's BTC performance in the Asian time zone, still hovering around $98,000, it shows that Asian investors feel the current price is about right. Only when it reached European time did risk-averse sentiment gradually start to appear, peaking in the U.S. time zone.

So my personal judgment is that this is now a release of risk-averse sentiment, and Buy The Dip is a normal behavior. Why aim for $89,000? It's because the last day of each workweek is usually the day with the lowest capital volume, and then it reaches the lowest liquidity during the weekend. This time is very likely to see panic selling, especially in the main trading time zone in Asia. So what I did was to set a trap; of course, if it continues to drop, I will keep buying.

Then there's the consensus around $100,000, which I explained quite clearly in yesterday's analysis. Even after Powell's speech, whether in the U.S. time zone or the Asian time zone, BTC's price hovered around $99,000. It only started to drop today due to risk aversion from the PCE. I don't know when it will correct, but I believe that even if the power transition on January 20 doesn't reach a new high, returning to the consensus point of $100,000 shouldn't be a big issue.

As for the support between $95,000 and $100,000, I just looked at the data and still believe there is no problem. This support has not been broken and remains the largest concentration area of chips currently. We have mentioned this many times when it was at $66,000. As long as the support is not broken, no matter how many times it drops, it will rebound.

So my approach is to strictly adhere to my trading logic. I buy when I need to buy. I say this and I also do this.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。