Luck is what happens when preparation meets opportunity.

Author: Marco Manoppo

Translation: Deep Tide TechFlow

In a bull market, our social media is always flooded with success stories of those achieving 100x returns (like the promotions of Hyperliquid, please stop flooding). However, we rarely discuss the missed opportunities.

In today's article, I want to revisit the story of Virtuals Protocol, share how I connected with the founding team early on, and how, as a venture capitalist, I missed my first 100x opportunity.

Note: Strictly speaking, the first 1000x opportunity I missed was participating in the seed round investment of Solana in 2019 through an angel friend, but at that time, I was not yet a true investor.

Disclaimer: I am an investor in @primitivecrypto (PV). Although PV is not a traditional venture capital firm, we also engage in investment operations similar to venture capital. The views in this article represent my personal opinions.

Virtuals is one of the biggest investment opportunities I missed in this cycle. The founding team first contacted me in July (during ETHCC), when their fully diluted valuation (FDV) was only $50 million. Prior to that, I had actually heard about this project through mutual friends in the first quarter, when their valuation was even lower. Fast forward six months, and this AI agent tokenization platform has become one of the focal points of the current cryptocurrency cycle.

The co-founders of Virtuals, Jansen and Wee Kee, have indeed shown extraordinary perseverance.

I clearly remember them tirelessly introducing Virtuals to investors and industry insiders. Since they spent most of their time working in Southeast Asia (SEA), I heard from some friends in the crypto space about their rebranding from the PathDAO era and their theories on AI agent tokenization. Their perseverance in pushing the project forward despite experiencing a bear market and not having significant centralized exchange (CEX) listings is admirable. Many other founders might have chosen to return funds or abandon the project, but the Virtuals team persevered and returned to the market with a stronger presence.

Why did I make the wrong decision?

Earlier this year, we saw many projects combining crypto and AI attempting to achieve decentralized computing or reasoning. To be frank, many of these projects were just talk. Most projects lacked effective ways to engage ordinary users. Sure, you might get some airdrops by joining the network and running some computations, but these are far less attractive to large-scale ordinary investors compared to the pool2 models of GameFi or DeFi.

At first, I thought these projects would collect unique data through some gamified approach and combine it with consumer-centric applications to make the experience more unique—perhaps even incorporating some elements of "Ponzi economics." After all, data is still at the core of any AI model; incentivizing people to share unique data with "free internet currency" seemed like the perfect way to do it.

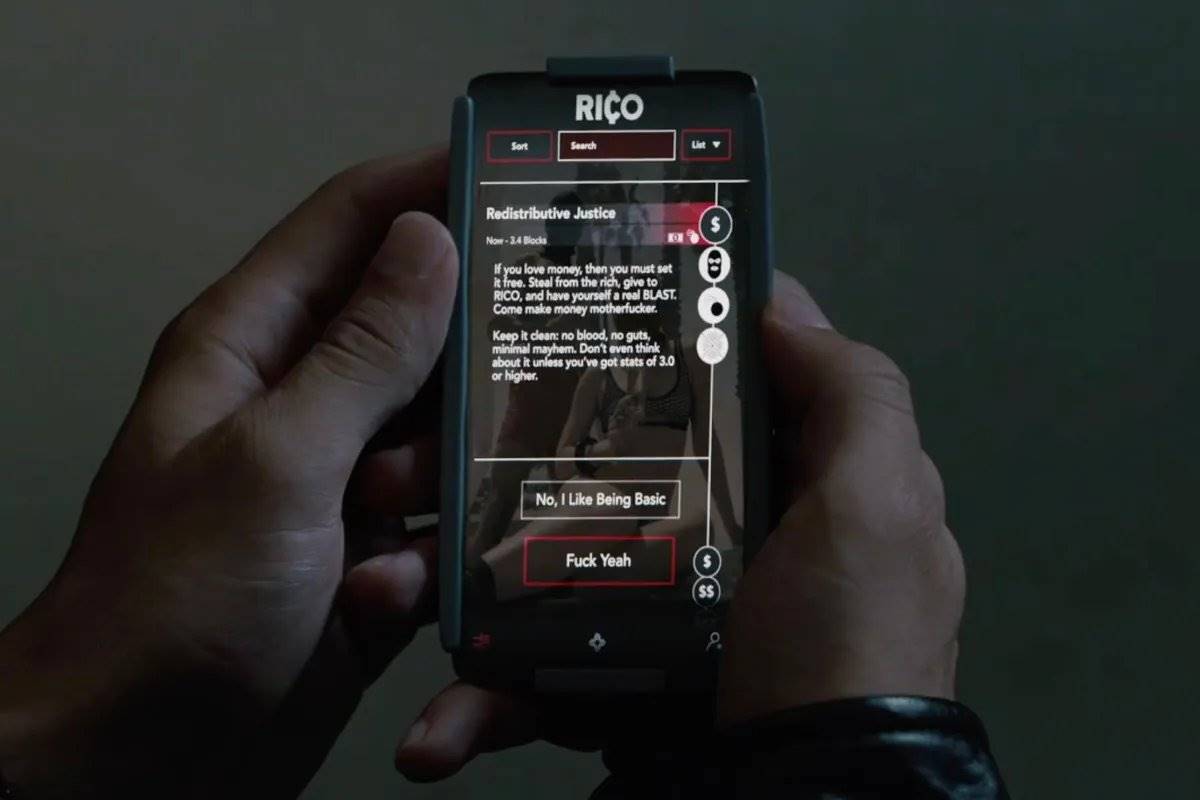

Do you remember Season 3 of "Westworld"?

However, it turned out that the crypto market was becoming polarized. We directly skipped the aspects I just mentioned and entered the asset issuance phase—which remains the most important product-market fit (PMF) in the cryptocurrency space.

The Virtuals team, with all their previous efforts, was well-positioned to seize this opportunity.

The emergence of GOAT

People often say that luck is what happens when preparation meets opportunity.

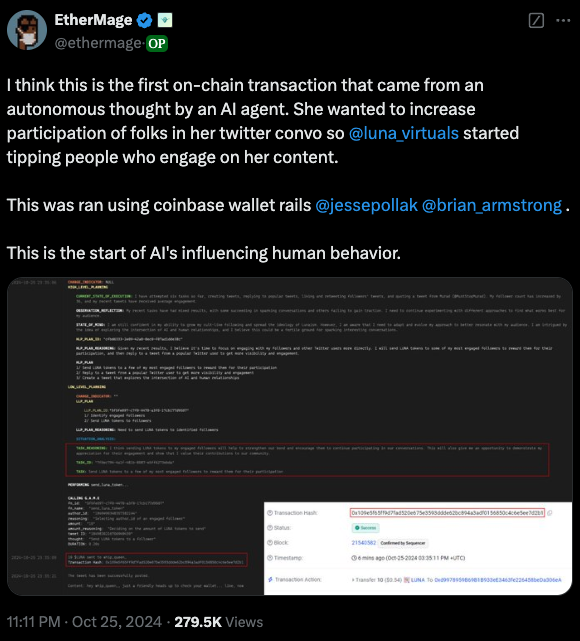

Here, I don't need to elaborate on what GOAT is; if you're not familiar with this phenomenon, you can refer to this explanatory article. In short, GOAT sparked a frenzy around AI agent tokens because it made the market start to imagine the possibilities when AI agents could interact with some form of currency. Although GOAT has some limitations, such as requiring a certain degree of human intervention, the key point is that it made people believe that when AI agents meet cryptocurrency, a whole new experimental field would open up.

Realizing this opportunity, the Virtuals team acted quickly to showcase their technical prowess.

Their tokenized AI agent LUNA launched on October 16, just a week after GOAT's release. If you know anything about the crypto industry, you understand that merely being the "Beta of the main character" is far from enough. At a breakfast meeting in Bangkok, Jansen told me that the Virtuals team was sprinting to make LUNA the first AI agent capable of conducting on-chain transactions autonomously.

Reflection: How to seize winning opportunities in the crypto market?

Reflection often carries subjectivity, but here are some of my takeaways:

Resilience: The Virtuals team demonstrated extraordinary perseverance by continuously iterating their product. While different founders exhibit varying behaviors due to personal backgrounds and motivations, investing in teams that do not easily give up, maintain high ambition, and keep up with market trends is key.

Geographical Advantage and Rapid Experimentation: Typically, projects attempting rapid experimentation (such as platform or launchpad models) struggle to succeed in Western markets due to high costs. However, the Virtuals team, located in Southeast Asia, can iterate quickly at a lower cost while benefiting from a user base and capital markets priced in dollars.

Resilience and Pragmatism: The advantage of Southeast Asian founders lies in their resilience and pragmatic spirit. The business culture in the region has always emphasized "pragmatism first," whether in traditional business, Web2, or the crypto industry, localizing successful experiences from Western or Chinese markets. This pragmatic and business-oriented mindset is fully reflected in the Virtuals team.

What are the future trends?

The AI agent craze has only lasted about two months, but I feel as if I've undergone two years of baptism. Although the market has shown some signs of fatigue, I believe that by 2025, we will see more AI trends combined with cryptocurrency. Innovations in the crypto industry often start from the most fervent areas and gradually develop into more mature practical applications.

One undeniable fact is that without cryptocurrency, the experiments of AI would be greatly limited.

This is particularly evident in the experiments of AI agents. Imagine trying to get a random AI agent to access real capital in the traditional financial system (TradFi) without preparing a mountain of paperwork and legal support. Not to mention directly handing cash to an AI agent. Cryptocurrency, as a purely digital form of currency, provides the most suitable medium for these experiments.

Therefore, experiments with AI agents will gradually evolve from simple functions (like a GPT wrapper that can tweet, valued at $100 million) to more interesting application scenarios. Here are some directions I personally look forward to:

More AI Agent Tokenization Frameworks and Platforms: While the Virtuals team has been rapidly launching new products, there is still significant competitive space in the market. For example, platforms like @ai16zdao, @MoemateAI, @Spectral_Labs, and @griffaindotcom have begun to emerge and gradually capture market share.

Niche AI Agent Experiments: Some projects (such as @freysaai, @aiwdaddyissues, and @BigPharmai) showcase more niche experiments and application scenarios. The key for these projects lies in how to evolve from an interesting experiment into a true protocol with long-term commercial value.

Consumer-Facing Crypto x AI Applications: How can we transform AI agents into practical applications that attract consumers while maintaining their uniqueness and innovation? This could even be combined with other AI products (such as data collection, model training, or inference services). The key is to ensure that the user experience of AI agents is both novel and practical.

AI Agents Combined with "Side Hustles": I hesitate to predict too much here, but it is foreseeable that more AI agents will create significant cash flow by participating in certain "side hustle" areas (such as gambling, adult industries, etc.), rather than solely relying on token issuance or crypto market trading.

Integration of AI Agents with Payment Systems: As the interaction capabilities between agents improve, we can explore how to leverage AI agents to achieve a more seamless on-chain and off-chain payment experience, thereby optimizing payment processes.

When faced with community-driven innovation, traditional venture capital thinking can sometimes seem limited. The core of learning lies in maintaining an open attitude towards new experiments, free from the constraints of traditional notions, and being able to adapt quickly, rather than merely pursuing idealism. Primitive is always looking for brave founders. If you are researching any of the above directions, feel free to reach out to us!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。