The subtle game between the government, traditional finance, and the cryptocurrency market may be a prelude to the future fate of the crypto market.

Produced by | OKG Research

Authors | Jason Jiang, Hedy Bi

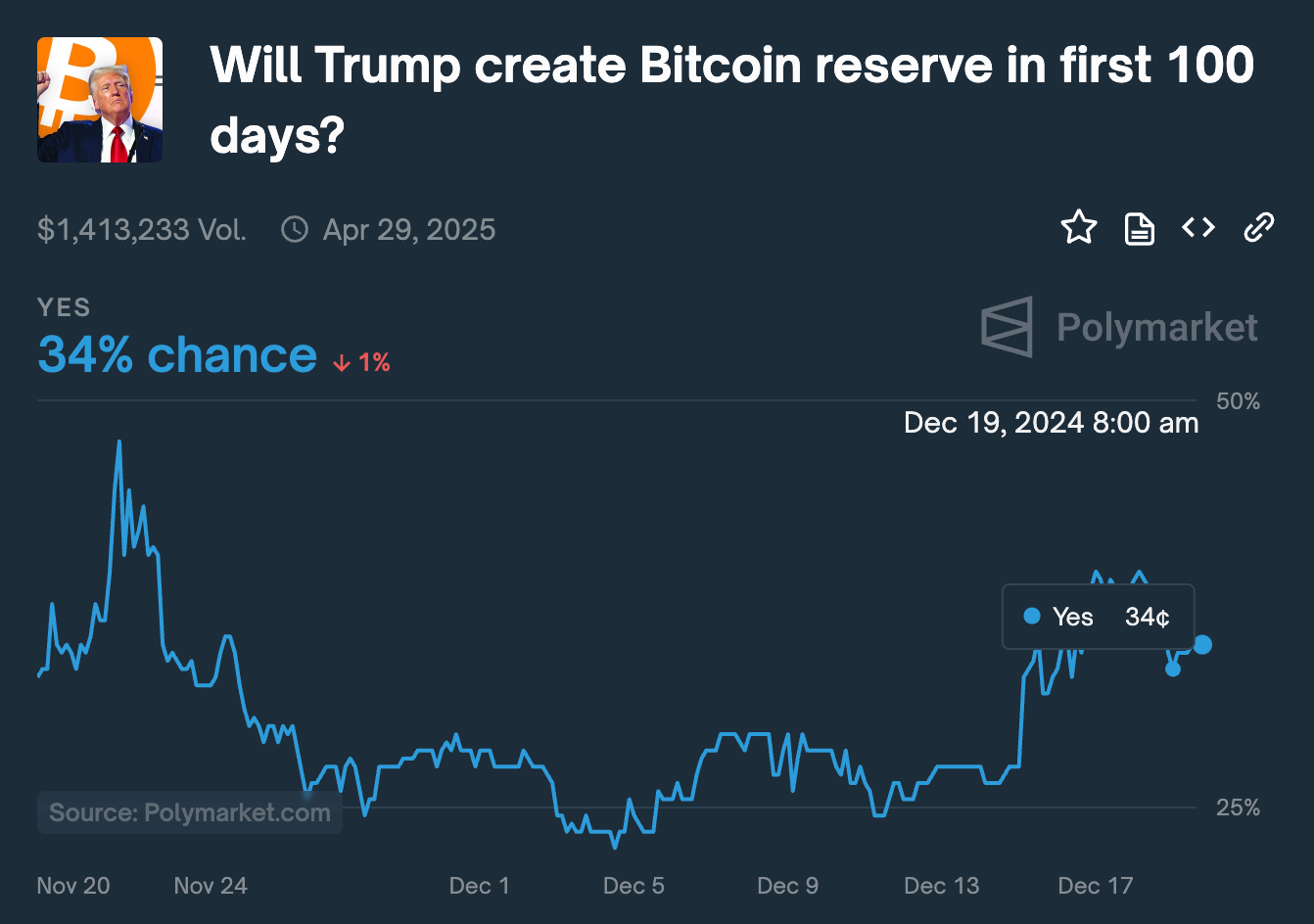

In the early hours of today, Federal Reserve Chairman Jerome Powell clearly stated at a press conference following the monetary policy meeting that the Federal Reserve has no intention of participating in any government plans to hoard Bitcoin. He emphasized that such issues fall within the purview of Congress, and the Federal Reserve is not seeking to change existing laws to allow for the holding of Bitcoin. Powell's remarks immediately triggered market turbulence, with Bitcoin's price rapidly retreating from its highs earlier in the week. According to the information prediction market Polymarket, the likelihood of a Bitcoin Strategic Reserve (BSR) dropped from a peak of 40% on the 18th to 34% after Powell's speech. The total market capitalization of the crypto market also plummeted, evaporating approximately 7.5%.

Image source: Polymarket

This statement not only left the market puzzled about the prospects of the "Bitcoin Strategic Reserve (BSR)" but also refocused attention on a deeper question: Does the Federal Reserve really have the authority to block the BSR plan?

First, it is necessary to clarify the position of the Federal Reserve within the U.S. financial system. The Federal Reserve's superior authority is the U.S. Congress: Congress is the highest power institution for all financial regulatory agencies, legislating financial regulations and policies, and authorizing other financial institutions (such as the SEC and the Federal Reserve) to exercise their functions. In the U.S. financial market, monetary policy and fiscal policy serve as the two core tools of government economic management, respectively managed by the Federal Reserve and the Treasury Department. These institutions maintain independence through mutual checks and balances to ensure the smooth operation of the U.S. economy and finance.

The Federal Reserve enjoys a high degree of independence in monetary policy and national economic stability, but in the decision-making process for establishing a BSR, the Federal Reserve cannot "veto" it.

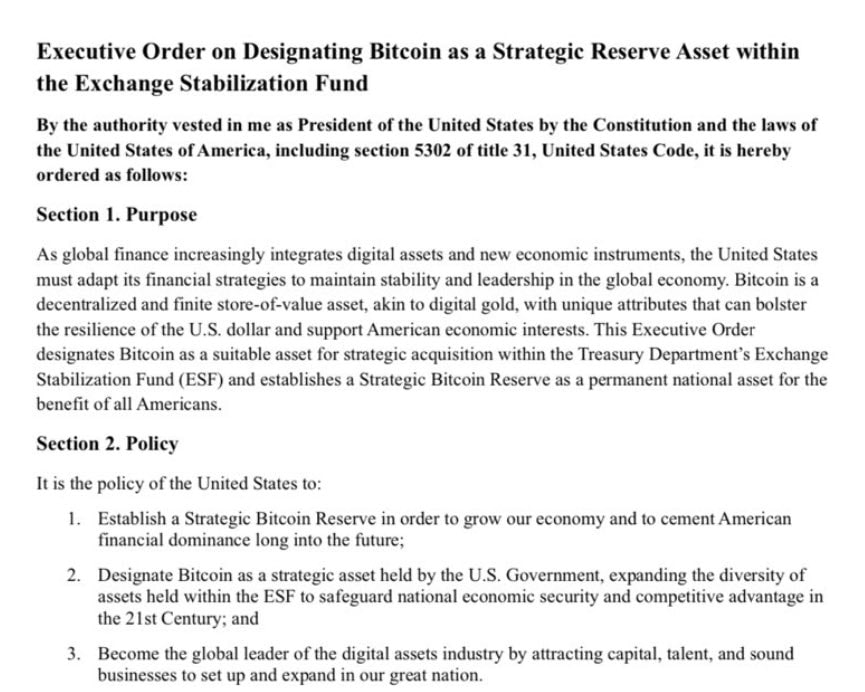

If the Trump administration wants to quickly establish a BSR, the most direct way would be to sign an executive order after officially taking office, directing the U.S. Treasury to use the Exchange Stabilization Fund (ESF) to directly purchase Bitcoin. The ESF is a special fund managed by the U.S. Treasury, primarily used for foreign exchange market intervention, supporting dollar stability, and responding to international financial crises, currently including assets such as dollars, Special Drawing Rights (SDR), and gold. The operation of this fund is not subject to control by the U.S. Congress, and the President and Treasury have significant autonomy in its use. The President can theoretically issue an executive order to directly instruct the Treasury to adjust the allocation of ESF funds for the purchase or reserve of specific assets, bypassing Congress's direct appropriation approval and reducing political resistance. The executive order recently drafted by the Bitcoin Policy Institute aims to establish the BSR in this manner.

Image source: Bitcoin Policy Institute

This method is the easiest to implement, and the use of ESF funds does not require prior approval from Congress, but Congress can investigate or legislate to restrict its operations. During the COVID-19 pandemic in 2020, Congress imposed strict limitations on some fund operations of the Treasury. Additionally, the sustainability of a BSR established through an executive order is questionable, as executive orders are essentially an extension of executive power, and successors may revoke or modify previous decisions through new executive orders.

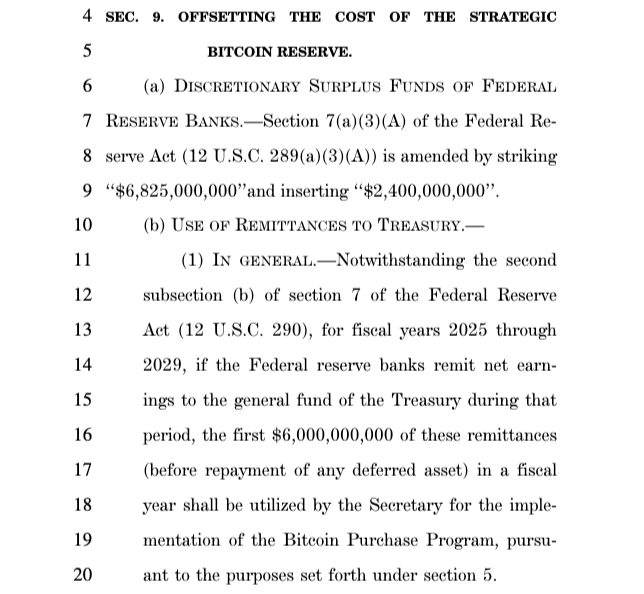

To establish and maintain a long-term stable BSR, another path must be chosen, namely through congressional legislation to include Bitcoin in the Strategic Reserve Act or similar laws, clearly defining Bitcoin's status as a national strategic reserve asset. This method has stronger legitimacy and can establish a long-term framework for Bitcoin reserves. The "U.S. Bitcoin Strategic Reserve Act" previously proposed by Republican Senator Cynthia Lummis has chosen this path. The bill has now been formally submitted to Congress and is under review by the Senate Banking Committee, and it will subsequently go through the Senate, the House of Representatives, and presidential review and approval before it can be officially enacted. Therefore, establishing a strategic Bitcoin reserve through this path will take longer and may encounter various obstacles along the way.

Whether establishing a strategic Bitcoin reserve through presidential executive orders or congressional legislation, the currently revealed plans ultimately require the Treasury to lead the implementation, rather than the Federal Reserve.

Image source: Congress.gov

In addition to the above options, the Federal Reserve and the Treasury could theoretically also choose a middle path for Bitcoin allocation. The Federal Reserve could purchase Bitcoin through open market operations and include it on its balance sheet. Due to its relative independence, the Federal Reserve's actions do not require congressional approval, but there needs to be a clear policy framework supporting its purchase of Bitcoin. Given the recent statements from the Federal Reserve, the likelihood of this option being realized in the short term seems low. The Treasury could invest in Bitcoin through a dedicated fund as part of its fiscal investment plan, which would not change the existing legal framework, but the related financing would require congressional approval.

Regardless of the path taken, "the Federal Reserve says no" does not outright deny the proposal for a BSR, and the pragmatic actions of Trump have shown support. According to on-chain data, just two minutes into Powell's speech, the Trump family's crypto project, World Liberty, quietly began buying altcoins. This scene undoubtedly reveals a deeper game: on one hand, the Federal Reserve's lukewarm response to the Bitcoin strategic reserve plan reflects the government's cautious attitude towards emerging assets; on the other hand, the actions of the Trump family's crypto project reveal the subtle struggle between traditional power and market innovation. The delicate game between the government, traditional finance, and the crypto market may indeed be a prelude to the future fate of the crypto market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。