Interest rate cuts have landed, yet the three major U.S. stock indices and the cryptocurrency market have all seen a pullback.

Written by: Liu Jiaolian

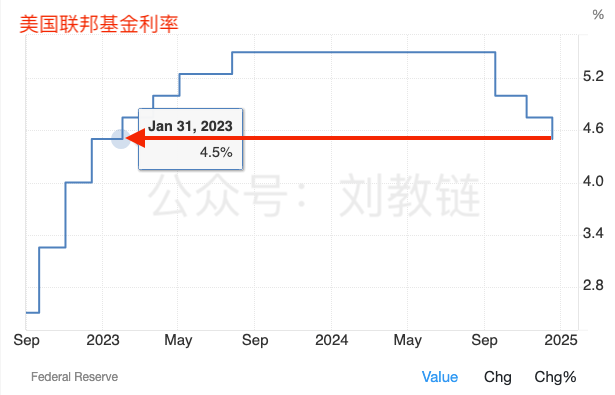

Overnight this morning, the Federal Reserve's December interest rate meeting concluded as expected, resulting in a continued rate cut of 25 basis points. This outcome exceeded the expectations of some who speculated that the rate cuts would stop. Since the second half of 2024, the Federal Reserve has cut rates a total of three times, with a total reduction of 100 basis points, or 1%, bringing the U.S. federal funds rate down from 5.5% to 4.5%.

This brings the rate back to the level at the beginning of 2023.

With the interest rate cut in place, the three major U.S. stock indices and the cryptocurrency market have all pulled back. Why? Because the anticipated rate cut had already been priced in by the market. This has turned a favorable outcome into a negative one; the mountains remain, but the sunset has faded.

Of course, the pullback is also related to the Federal Reserve Chairman's statement that policy adjustments may need to be more cautious next year, which contrasts with the aggressive expectations of some in the market for continued rapid rate cuts next year.

After all, in this global wave of radicalism during the Kondratiev winter, being slightly less radical can lead to accusations of conservatism. A rate cut that is not thorough is essentially no rate cut at all.

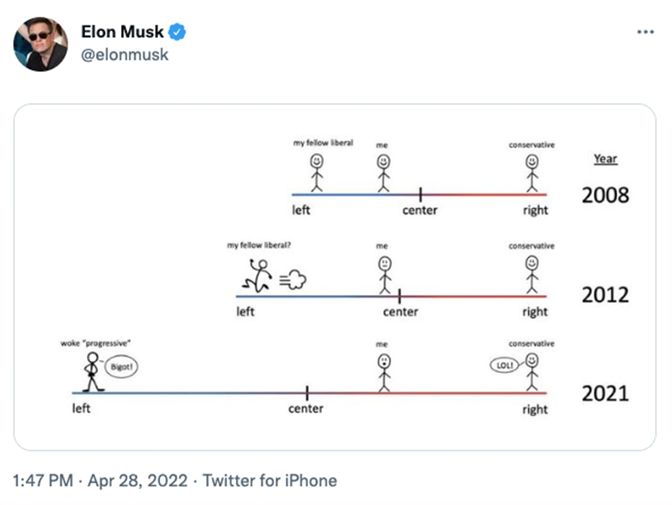

As a moderate standing in the middle, you will be criticized by those on your right for being too left and by those on your left for being too right. This is what it means to be caught in the middle.

Why does Chinese philosophy emphasize the doctrine of the mean? This is called "supplementing what is lacking." The ancient sages of China saw through this: society easily evolves into an "M-shaped" structure, and those who stand in the middle are the bravest. Without courage, one cannot stand in the middle. Without enough strength, standing in the middle will lead to being torn apart.

It's either black or white, either left or right; it's either heaven or hell, a thought can lead to enlightenment or to damnation. Today is the blockchain revolution, tomorrow could be the tulip mania.

It's easy to play tricks and act mysteriously. It's hard to be a person of great stature, standing tall between heaven and earth. It's easy to blindly cater to the emotions of the masses, either by praising or criticizing. It's hard to view new things objectively and without bias, and to seize historical opportunities.

Not understanding her goodness is because you haven't been with her yet. Once you've been with her for a while, you'll come to know her goodness.

At the early morning press conference, a statement from Powell during a Q&A session became popular.

A reporter asked about the U.S. national BTC strategic reserve.

Powell responded: The Federal Reserve is not allowed to own Bitcoin. We are not seeking any legal changes regarding this.

What he said indeed reflects the "current" situation.

However, this statement is somewhat general, vague, and abstract. We need to break it down carefully.

First, what is Powell's perception of the nature of BTC?

Looking back at the article by Jiaolian on December 5, 2024, titled "The Bitcoin Wind Rises Again, Breaking $100,000 for the First Time", Powell had previously stated that, in his view, BTC is more like gold. He said, "It is not a competitor to the dollar, but a competitor to gold."

In other words, he believes BTC is a physical asset.

So, can the Federal Reserve directly "own" physical assets? Clearly, it cannot.

For example, gold. The U.S. gold reserves are actually owned by the U.S. Treasury. The actual storage and custody are dispersed across various reserve vaults in the U.S. (such as the New York Federal Reserve Bank). According to the Gold Reserve Act of 1934, the Treasury issues gold certificates to record the value of the gold it owns. These gold certificates issued by the U.S. Treasury are the legal proof of the gold reserves.

Can the Federal Reserve own gold as a physical asset? No, it cannot. The Federal Reserve can only own gold certificates as financial assets.

However, even to own gold certificates, it must act in accordance with the law. The key here is to legally account for the value of financial assets on the Federal Reserve's balance sheet.

According to the Federal Reserve Act of 1913, the Federal Reserve can include gold certificates on its balance sheet as part of its reserve assets. Gold certificates are recorded on the Federal Reserve's balance sheet at nominal value, representing the value of gold promised by the Treasury.

In accounting, the price of gold reserves is set by the International Monetary Fund Agreement Act of 1973, which fixes the price of gold at $42.22 per ounce, rather than the market price. Regarding this pricing, Jiaolian discussed it in detail in the article on November 14, 2023, titled "How Much Gold Does the U.S. Actually Hold?", and will not elaborate further here.

However, this pricing is not set in stone. For instance, our central bank adjusts the pricing based on market prices. For specific reference, see Jiaolian's article on October 31, 2023, titled "The 'Secret' of the Central Bank".

Now, having understood all this, we need to examine two questions in sequence:

First, can the new U.S. president authorize the Treasury to reserve BTC (Bitcoin) and issue "Bitcoin certificates" solely based on presidential power?

Second, can the Federal Reserve, without amending the Federal Reserve Act of 1913, urgently include "Bitcoin certificates" on its balance sheet?

Regarding the first question, the 35th President of the United States, John F. Kennedy, has already set a precedent.

On June 4, 1963, President Kennedy signed an executive order, Executive Order 11110. This executive order authorized the U.S. Treasury to issue "Silver Certificates" based on the silver reserves owned by the Treasury under the Silver Purchase Act of 1920.

Essentially, silver certificates are a form of U.S. currency that can be exchanged for an equivalent amount of physical silver.

On November 22, 1963, President Kennedy was assassinated. For details, see Jiaolian's article on November 8, 2024, titled "The Federal Reserve Cuts Rates as Expected, Powell Refuses to Resign".

It seems as if the voice of a female singer is coming from the radio:

"I want to ask if you dare / To love me like you said you would /

I want to ask if you dare / To be as crazy in love as I am

I want to ask if you dare / To love me like you said you would /

Like I am crazy in love / What do you really think?"

Regarding the second question, the Federal Reserve has already set an example.

During the 2008 financial crisis, the Federal Reserve implemented a series of unconventional monetary policies, including purchasing MBS and other financial assets to provide liquidity and support the U.S. economy. This policy is known as Quantitative Easing (QE).

Section 14, Clause 2 of the Federal Reserve Act of 1913 states that the Federal Reserve can purchase government bonds (such as U.S. Treasury bonds) to manage the money supply and stabilize the economy, but the act does not explicitly authorize the Federal Reserve to purchase private assets unrelated to the government, such as mortgage-backed securities (MBS).

The core question is: Does the Federal Reserve's power belong to public authority or private rights?

After all, public authority cannot act without legal authorization. If the law does not explicitly state that the Federal Reserve can personally purchase MBS, then its direct purchase of MBS would be considered illegal.

However, the Federal Reserve, as the central bank of the U.S. and even the world, is a bug-like existence. The Federal Reserve is, in fact, a private institution rather than a public sector entity. And private rights can act as long as they are not prohibited by law.

Thus, this can be flexibly interpreted.

The usual explanation is as follows:

On one hand, the Federal Reserve Act of 1913 does not explicitly prohibit the Federal Reserve from purchasing specific types of assets.

On the other hand, the Federal Reserve found other laws to back its "urgent action," including the Emergency Banking Act of 1932 and the Financial Stability Act of 2008. These laws authorize the Federal Reserve to take more unconventional monetary policies in specific emergency situations, which are considered to provide legal grounds for the Federal Reserve's purchase of MBS during a crisis.

In summary, the Federal Reserve explains that purchasing MBS is necessary for monetary policy and financial stability, and it is an emergency measure taken in response to the financial crisis. Therefore, although these actions do not conform to the literal provisions of the Federal Reserve Act of 1913, the government provided a legal basis for these measures through new authorizations.

In fact, courts at various levels in the U.S. have not explicitly ruled that these actions violate the Federal Reserve Act of 1913, but rather viewed them as emergency response measures.

Therefore, the conclusion is that despite the existence of legal gray areas, this action has not been seen as a direct violation of the Federal Reserve Act of 1913.

In 2024, "5.5 Jiaolian Insider: Accidentally Lost 1155 Bitcoins" and "7.1 Jiaolian Insider: The Uncontainable Rebound" have repeatedly mentioned that the Federal Reserve has been quietly replacing its "gray" MBS positions with legitimate U.S. Treasury positions since 2008.

This mess has been cleaned up since 2008.

Therefore, even without seeking legal changes, the Federal Reserve can find legal grounds for what it does or does not do by flexibly interpreting the nature of its powers.

Finally, it should be noted that global central banks have an international coordinating organization called the BIS (Bank for International Settlements). This is part of the post-World War II international financial order.

The BIS is primarily composed of central banks from around the world, with about 60 members currently. These members include the central banks of major global economies, such as the Federal Reserve of the United States, the European Central Bank, and the People's Bank of China. It was established in 1930 and is headquartered in Basel, Switzerland, often referred to as the "bank for central banks."

In 1974, the BIS established the Basel Committee on Banking Supervision (BCBS) to develop international regulatory standards and guidelines for the banking industry.

The main function of the Basel Committee is to establish international standards related to bank capital adequacy, risk management, and banking supervision, particularly regarding capital adequacy ratios, liquidity requirements, and risk-weighted assets. It typically issues a series of regulatory standards and recommendations for financial regulatory agencies around the world to reference and adopt, ensuring the health and stability of the banking system.

In 1988, the Basel Committee introduced Basel I, which was the first standardized requirement for global bank capital adequacy.

In 2004, the Basel Committee released Basel II, which further improved and expanded upon Basel I.

In 2010, following the global financial crisis, the Basel Committee introduced Basel III, aimed at improving the quality of bank capital and enhancing the banking system's resilience in times of crisis.

It is evident that the BIS and the Basel Committee play a crucial role in global banking regulation. The Basel Committee, established through the BIS, is responsible for formulating regulatory standards for the global banking industry, while the Basel Accords (I, II, III) are the specific manifestations of these standards.

Central banks around the world, including the Federal Reserve, typically need to establish standards through the BIS within the Basel framework if they want to include any assets on their balance sheets, i.e., to expose themselves to certain assets.

The Basel Accords are called accords rather than laws because they rely on self-discipline among members for compliance, rather than being enforced by coercive means like laws.

Coincidentally, back in December 2022, the BIS released a report stating that "BIS: Central Banks Will Be Allowed to Allocate Up to 2% of Bitcoin Starting in 2025" (as mentioned in Jiaolian's article on December 17, 2023).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。