By analyzing its market positioning and implementation logic, we explore the immense potential of the decentralized computing power market and the development opportunities for Spheron.

Author: Deep Tide TechFlow

In an era where AI Agents are as common as fish crossing a river and the secrets to wealth are increasingly difficult to uncover, how can one mine for gold more intelligently in the AI sector?

From Solana to Base, from Pump.fun to Virtuals, the AI sector is thriving, with hundreds or even thousands of AI Agents being born every day, far surpassing the heat of other sectors.

However, most people's attention seems to be drawn to application-layer products that are more perceptible to the public, while the underlying infrastructure projects aimed at promoting higher quality development of AI applications appear to be quietly working behind the scenes (wealth effect).

If you are already fatigued by the PvP battlefield of AI Memes, shifting your focus from applications to the underlying infrastructure may be a smart strategy for mining gold in the AI sector. After all, the demand created by the prosperity on the application side will ultimately be transmitted to the underlying layer, bringing immeasurable growth opportunities for AI infrastructure projects.

So, how will the journey of seeking Alpha from the perspective of AI infrastructure unfold?

By dissecting the three key elements of AI development—data, models, and computing power—we seek market opportunities aimed at integrating global computing power resources to create a GPU trading market, providing highly customized and low-cost computing power services for demand-side applications including AI, DeFi, and gaming, further bringing Spheron into the public eye.

What are the current supply and demand challenges facing GPUs? In a sector where AI and DePIN are strongly correlated, how does Spheron achieve efficient matching of GPU supply and demand through Providers nodes, Fizz nodes, and effective ecological incentives? In the ongoing AI boom and intensifying competition in the GPU sector, what is Spheron's unique market positioning compared to other projects?

This article aims to delve into Spheron, analyzing its market positioning and implementation logic to explore the immense potential of the decentralized computing power market and the development opportunities for Spheron.

Decentralization: A Good Solution to the Imbalance of GPU Supply and Demand

To truly understand the intricacies of the "solution," one must first clarify the essence of the problem.

Why is GPU important in the market targeted by Spheron?

Firstly, as an electronic circuit capable of executing mathematical calculations at high speed, GPUs have stronger parallel computing capabilities compared to CPUs, allowing them to process large amounts of data streams simultaneously, making them an indispensable tool in modern computing.

In fact, GPUs are ubiquitous in our lives: whether it's graphic rendering and animation production for large games, training and inference for AI, or high-frequency trading and risk modeling in large-scale finance, GPUs provide a powerful driving force for building higher quality products.

It can be said that in today's digital wave sweeping the globe, GPUs are regarded as a crucial cornerstone of the digital economy.

The importance of GPUs is self-evident, but where does the problem in the GPU market lie?

The imbalance between supply and demand.

For GPU suppliers, on one hand, the high barriers to scaling GPU production have led to an increasingly obvious trend of market monopolization; on the other hand, the issue of idle GPUs has become more prominent, with many GPUs in the market not being fully utilized, resulting in resource waste and affecting the returns for suppliers.

For GPU demanders, the cost of acquiring GPUs is not only high but often inflexible to adjust according to their actual needs, which undoubtedly compresses the space for most small and medium-sized enterprises to participate in market competition, further hindering innovation on the application side.

After clarifying the problem, what is the solution?

In the past year, as AI, which has a strong demand for GPUs, has gained favor in the decentralized Web3 market, the market trend has already provided a choice.

One significant advantage of decentralized markets is the low barrier to entry: anyone can contribute their idle computing power in a permissionless manner or obtain computing power supply that better meets their actual needs. This openness allows more long-tail participants to enter the market, further expanding the supply scale of the GPU market while enhancing flexibility and promoting more rational resource allocation.

After establishing connections between supply and demand, the greater advantage of decentralized markets lies in peer-to-peer transactions and efficient, convenient payment settlements: not only does it eliminate intermediary steps to reduce transaction costs, but it also avoids the complexities and delays of traditional payment methods, enabling efficient flow of market value for both buyers and sellers.

Most importantly, well-designed token economics will provide a transparent benefit distribution mechanism for the decentralized GPU market, encouraging broader market participation through token incentives, where each participant's contributions will be honestly recorded and rewarded accordingly, leading to a positive pull for the continuous expansion of the ecosystem.

Having explored the background of the sector, let us shift our focus to the specific logic of the solution:

Based on decentralized power, how does Spheron create a GPU market that allows everyone to participate with low barriers and benefit fairly?

Global Supercomputing Network: How does Spheron achieve efficient matching of GPU supply and demand?

In simple terms, Spheron's core architecture revolves around a matching engine aimed at integrating global GPU resources and achieving efficient matching between the supply side and the demand side.

Supply Side of Computing Power:

Providers Nodes: Enterprise-level GPU providers, the core pillar of Spheron's global supercomputing network.

Fizz Nodes: Integrating long-idle home computing power, allowing ordinary users to contribute GPUs.

Demand Side of Computing Power:

- Dominated by various applications that require computing power.

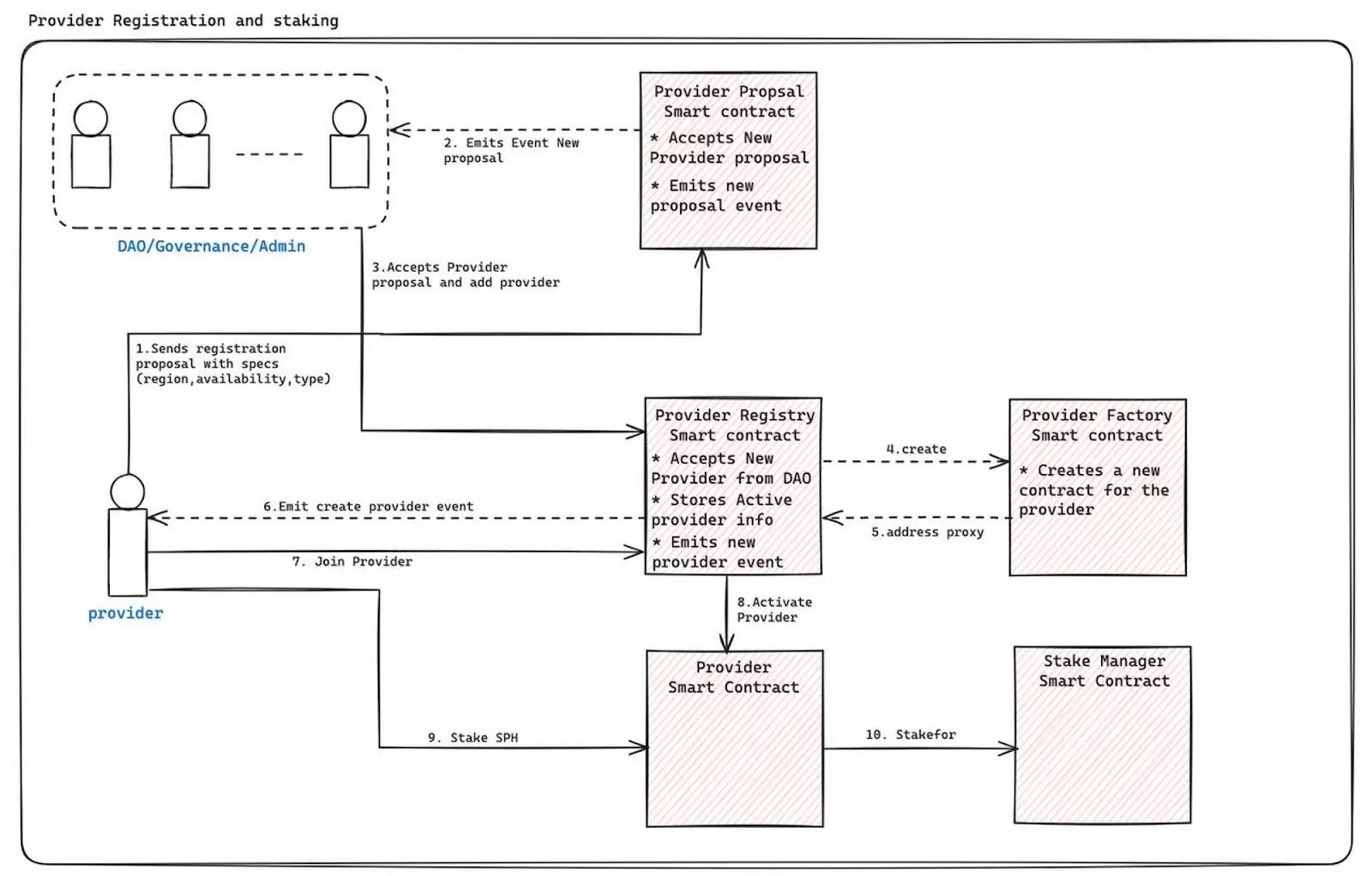

The robustness and reliability of Providers nodes are closely related, thus they have a high registration threshold and strict review process:

Applicants must first submit a registration proposal, which serves as a self-description of their GPU capabilities, including specifications such as computing power, tier, and types of computation;

Subsequently, the Spheron governance body will be responsible for verifying the proposal and deciding whether to approve it (during the initial operational phase of the network, all submitted proposals will be approved after verification). Additionally, Spheron has established multiple verification methods such as random verification and challenge mechanisms to continuously monitor the status of Providers nodes and protect the network from fraudulent activities.

Introducing a staking mechanism for Providers nodes is an important measure for Spheron to further maintain ecological rights: becoming a Providers node requires staking SPON tokens, and if improper behavior occurs, their staked funds and earnings will be reduced or even confiscated, aiming to further constrain and incentivize GPU providers to maintain good behavioral standards.

Fizz nodes target ordinary users' laptops and other hardware devices, aiming to integrate the global long-tail computing power market with the lowest barriers, while further optimizing resource allocation, increasing broad participation, and enhancing decentralization.

As an important component of the Spheron network, Fizz nodes set minimal requirements for CPU, RAM, storage capacity, and GPU support, allowing ordinary laptops to easily participate in contributing computing power resources and earning additional income.

Participants first need to fill out relevant questions to register Fizz nodes on the Spheron network, a process that requires a small amount of ETH on the Spheron chain as Gas (currently, during the testnet phase, it can be obtained through the Spheron faucet or Arbitrum Sepolia).

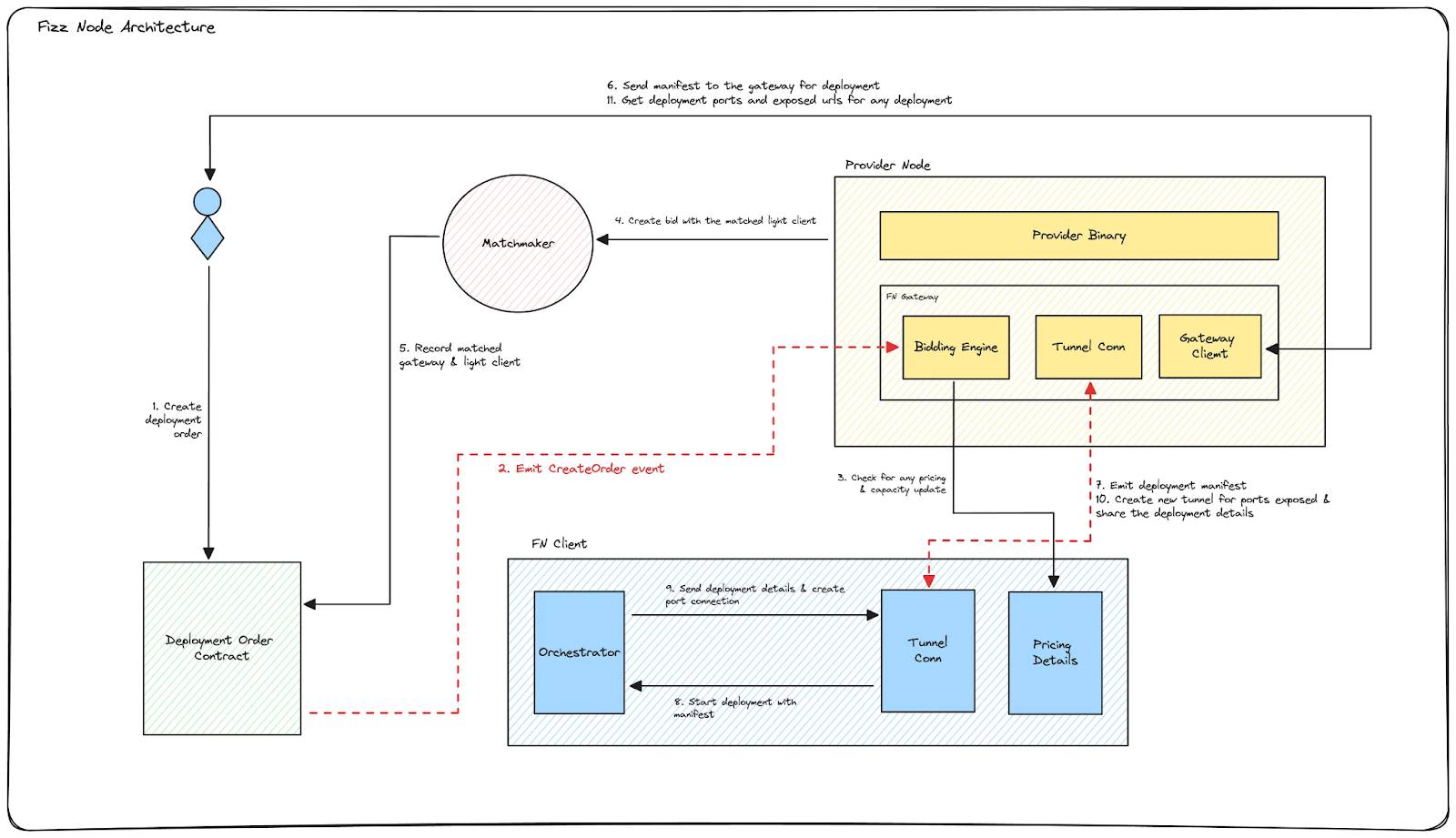

After completing the registration, participants can run the system by downloading the terminal and completing simple settings: the key components of the Fizz client include pricing configuration, orchestrator, and service tunnel, enabling the contribution of underutilized computing resources to the network.

The gateway service is another core aspect of Fizz nodes, managed by Providers nodes or individual gateway runners, aimed at facilitating user interaction with the Fizz node client and handling most communications.

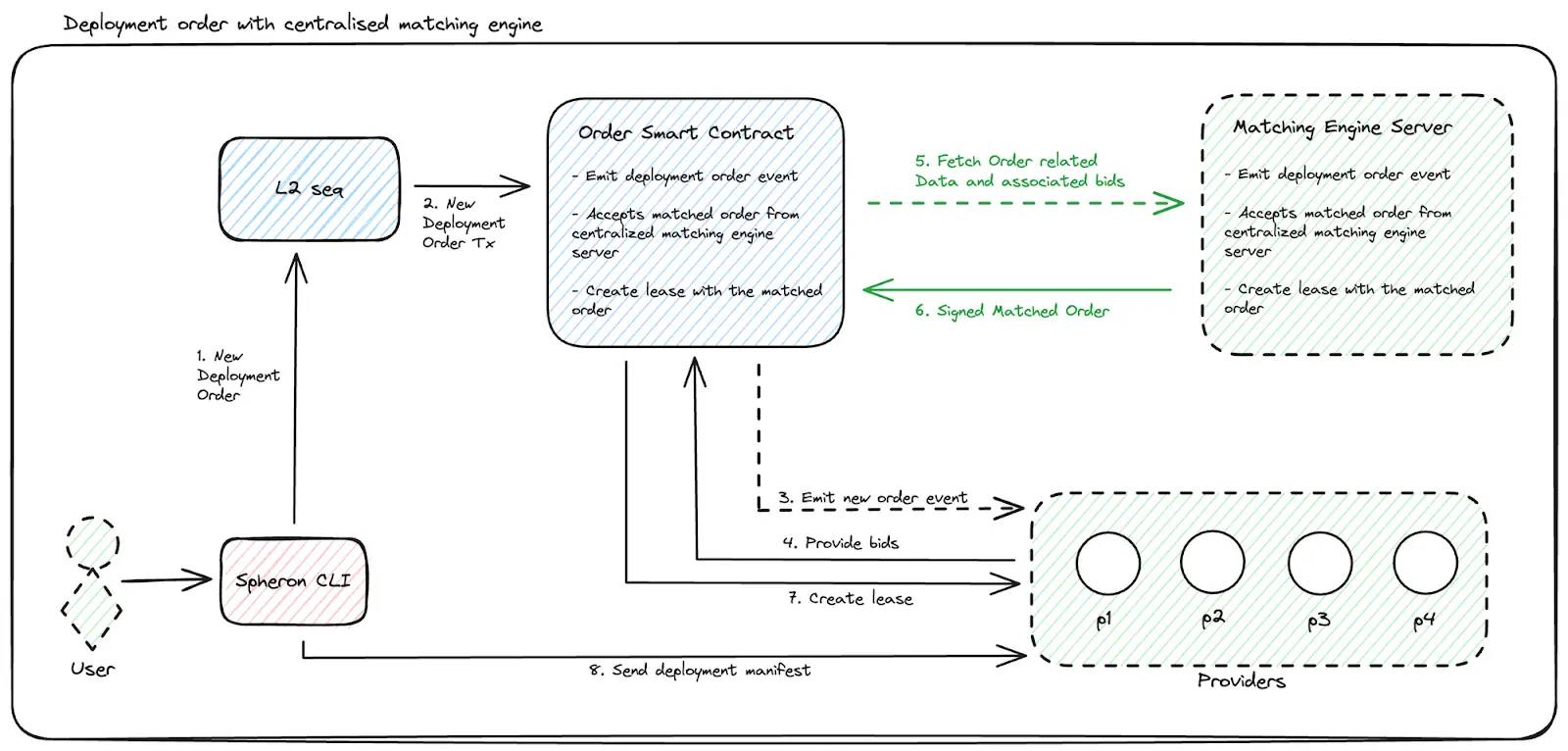

Based on the dual-node design of Providers and Fizz, Spheron has established a basic framework for the supercomputing network. After aggregating resources, the larger challenge lies in how to efficiently utilize them. The powerful matching engine built on the AVS architecture by Spheron plays a crucial role: this engine, built on Arbitrum, can quickly find the most suitable GPU resources for both supply and demand sides based on location, hardware, and network speed, allowing users to transmit deployment lists via MTLS connections to initiate workload deployment on designated providers.

Firstly, Spheron adopts a tiered mechanism for GPU suppliers, categorizing them based on their capabilities and trust levels to achieve more precise demand management and matching;

Spheron has a matching engine built on Arbitrum that can quickly find the most suitable GPU resources for both supply and demand sides based on location, hardware, and network speed, allowing users to transmit deployment lists via MTLS connections to initiate workload deployment on designated providers.

When a GPU demander initiates a new deployment request, the supplier will listen for the demand and submit bids to the smart contract;

After collecting all bids, the matching engine will select the proposal that best meets the demand side's requirements based on predetermined parameters, after which the demander will verify the proposal and send the deployment list to the matched supplier;

Finally, the GPU supplier confirms the list and deploys the service, completing a more efficient, lower-cost, and better-matched demand matching process.

Based on this, the framework for efficiently matching GPU demand and supply has already taken shape, and the effective ecological incentives brought by the ecological token SPON are key to Spheron's stable and sustainable growth, continuously expanding its ecosystem.

SPON Token: The Finishing Touch for Spheron to Achieve Ecological Positive Flywheel

We all know that the economic model is one of the core designs of blockchain networks. It not only determines the function and use of tokens within the network but also directly impacts the long-term sustainability of the network, user incentive mechanisms, and the development direction of the ecosystem.

As the native token of Spheron, SPON has multiple utilities aimed at promoting the sustainable development of the ecosystem while providing diverse rights and benefits to token holders.

Firstly, the Spheron network uses SPON tokens as Gas fees, which injects fundamental demand into the token.

Secondly, the SPON token serves as the core value exchange medium in Spheron's payment system, providing users with efficient payment methods. Although the network supports other tokens as payment tools to enhance user flexibility and convenience, any payment method using non-SPON tokens must be approved through a governance process to ensure the security and consistency of the network. In contrast, payments made with SPON tokens are completely free, while payments with other tokens incur an additional 2% fee.

Additionally, Spheron has introduced a staking mechanism for its tokens: on one hand, Providers nodes must stake SPON tokens to increase trust; if a node fails to fulfill its commitments, its staked tokens may face confiscation risks. On the other hand, token holders can also stake their SPON tokens to Providers nodes, thereby supporting the secure and stable operation of the network while earning staking rewards.

One of the core functions of the token is ecological incentives, and Spheron is no exception: both Providers nodes and Fizz nodes can earn SPON token rewards by deploying nodes. In addition to earning rewards through staking, token holders can also receive additional incentives by participating in ecological activities and supporting network development. This multi-layered reward system ensures the enthusiasm of ecosystem participants.

Besides being a payment tool and incentive medium, the SPON token is also an important vehicle for ecological governance. Users holding SPON tokens can vote on significant governance decisions within the ecosystem, further ensuring ecological fairness and promoting the network's development in line with community wishes.

Based on the SPON token incentive system, a rare positive flywheel is clearly visible in the Spheron ecosystem:

With effective ecological incentives, more Providers nodes, Fizz nodes, and demand-side participants are attracted to join the ecosystem, which not only further enhances the decentralization of the network but also brings more active on-chain activities and revenue, enabling the network to empower its token holders and generate more substantial returns. This will also drive the ecosystem into a spiral of growth, becoming increasingly robust over time.

In fact, in the more than a year since Spheron's inception, the expanding ecological landscape and the achievement of several groundbreaking milestones have already proven that this positive flywheel has brought Spheron a compounding growth effect.

The mainnet is coming soon, and the token will soon be launched: Spheron's future growth expectations are promising.

The year 2024 is particularly significant for Spheron, as it has achieved remarkable ecological development during this year.

Spheron's ecological landscape has welcomed many heavyweight members over the past year: Spheron has established partnerships with Arbitrum, Caldera, Ora Protocol, Sentient, Witness, Genlayer, Heurist, DeNet, Akaave, Filecoin, and several other top AI projects, becoming one of the important driving forces behind the rapid development of Web3 AI.

This year, Spheron also launched its public test network. According to the public test data, the GPU utilization rate of the Spheron network reached 80%, showcasing the efficient utilization of GPU resources under its powerful supply-demand matching engine.

On the node front, after the successful launch of Providers nodes, the community-focused Fizz nodes have also officially launched, allowing more individuals to easily participate in computing power contributions through devices like laptops, turning idle computing power into additional income.

In addition, Spheron has released more ecosystem features, including a console app that supports seamless GPU access, and launched CLI and SDK to further lower the barriers for developers to help with easy integration.

The achievement of a series of milestones has also led to rapid growth in the community scale for Spheron: according to Spheron's data dashboard, the total number of addresses has exceeded 36,000, with over 13,000 connected nodes, making it one of the largest DePIN computing networks currently.

Researching Spheron's project social media and the announced roadmap reveals that more important project events are on the horizon, injecting good expectations for continued growth in 2025.

In terms of ecological cooperation, Spheron recently announced a partnership with Mira, where both will collaborate to develop trustless and scalable AI, further enhancing the accuracy, impartiality, and reliability of AI outputs. Mira will also open 1,000 whitelist spots specifically for the Spheron community, where users can apply using the code "SPHRN."

Additionally, several major collaborations, including those with Witness, Genlayer, and Heuristic, are in the works.

In terms of ecological functionality, Spheron is about to launch its first service layer DePIN node, Supernoderz, and will introduce a model store to achieve seamless deployment of models.

More importantly, as community engagement continues to rise, the highly anticipated Spheron mainnet is on the way, and the token will be officially launched at that time.

As a key time node before the mainnet launch, users have various efficient ways to participate in the Spheron ecosystem to acquire and accumulate future revenue chips. The most direct way is to deploy Fizz nodes. Meanwhile, the second phase of the Lunar Fizzer activity has been launched, where 25,000 node operators will have the opportunity to obtain Lunar Fizzer identities and exclusive rights. Specific benefits include Lunar Fizzer identity, airdrop priority, exclusive community events, active rewards, and rental rewards, which have received widespread enthusiasm from the community.

The impressive ecological performance has also attracted the attention of industry institutions: in August 2022, Spheron revealed it had secured $7 million in funding, with investors including Alphawave Ventures, NexusVP, Zee Prime Capital, Protocol Labs, ConsenSys Mesh, Paradigm Shift Capital, Matrix Partners India, and Tykhe Ventures, along with notable figures like Sandeep Nailwal, Aniket Jindal, and Julian Traversa. According to community discussions, a new round of financing for Spheron is expected to be officially announced soon.

Conclusion

In the dividend period brought by the AI boom, the computing power market is undoubtedly one of the most promising and in-demand markets.

The GPU market targeted by Spheron is hailed as the oil of the new era, and its sophisticated product design, effective ecological incentives, and a supply-demand matching mechanism that balances security, efficiency, cost, and flexibility will empower various AI, gaming, and DeFi products that rely on GPUs, bringing a wave of decentralized innovation.

However, the AI boom has also intensified competition in the GPU computing power sector, with competitors including Aethir, Akash Network, Gensyn, Render Network, and io.net. Since the project logic essentially revolves around using token incentives to encourage computing power holders to participate in the network and provide computing power services, it aims to increase the utilization of idle computing power while meeting customer computing power needs at a lower cost, achieving a win-win situation for both buyers and sellers. Consequently, the phenomenon of homogeneity and internal competition in the sector has become increasingly evident.

In this somewhat crowded sector, we can see that Spheron is emerging due to its integration of the global computing power market and its powerful supply-demand matching engine, characterized by efficiency and flexibility:

In terms of specific business, Render primarily serves 3D artists; io.net focuses more on AI and gaming; Aethir and Netmind specialize in AI/ML engineers and enterprises.

Additionally, since io.net's service model mainly concentrates on leasing computing resources from nodes, it has advantages in GPU resource leasing but falls short in terms of flexibility and adequacy in meeting customer needs. Render Network faces a similar issue; although it has improved rendering efficiency through its off-chain rendering capabilities, it still lacks flexibility and adaptability to different customer needs due to its reliance on off-chain rendering.

Spheron aims to achieve more practical computing power matching through Providers nodes, Fizz nodes, a tiered mechanism, and a powerful matching engine, providing more flexible GPU services that can meet diverse user needs, thereby empowering various AI, gaming, and DeFi products that rely on GPUs to bring a wave of decentralized innovation.

With the launch of Fizz nodes and the arrival of the mainnet and token, for investors focusing on the GPU computing power market, participating in node deployment to experience product details may provide clearer judgment than mere text.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。