First, let's talk about the situation of investment return analysis in China.

Historically, the investment return rate in China has been relatively low, so let's analyze this issue. Why analyze this problem?

1 - First, let's see if it's true:

We look at Figure 1: the difference in 10-year government bond yields between China and the U.S. vs. the USD/CNY exchange rate. Before 2022, the yield on Chinese government bonds was higher than that of U.S. bonds, with a yield difference of about 1%-1.5%. During the same period, the USD/CNY exchange rate fluctuated but did not change significantly.

This 1% yield difference can be understood as compensation for the exchange rate fluctuations and changes between China and the U.S. After all, the major capital in the world is U.S. dollar capital, so we calculate based on the dollar.

After 2022, the U.S. began to raise interest rates, and the yield difference between China and the U.S. turned negative, but at the same time, the exchange rate also started to rise (the renminbi depreciated). This means that from 2022 to now, holding Chinese government bonds is not profitable, resulting in a double hit: a hit to the yield and a hit to the exchange rate.

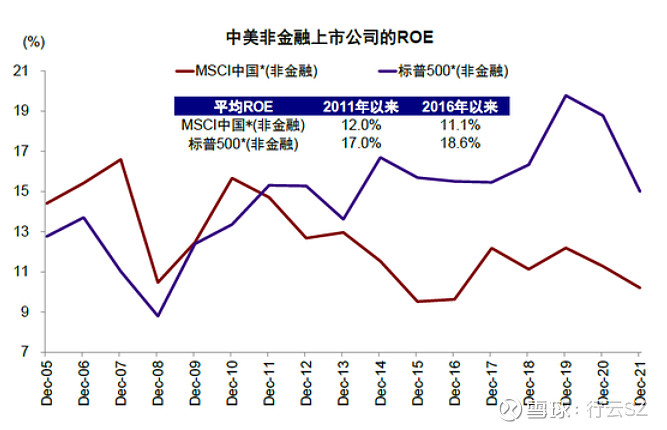

Next, let's look at corporate return rates, using ROE as an indicator. In Figure 2, we can see that before 2011, the ROE of non-financial enterprises in China and the U.S. was basically the same, but after 2011, a divergence occurred, stabilizing around 2015 with a difference of about 6%.

So it is clear that the investment return rate in China is lower than that in the U.S., which is a factual statement.

2 - Why is this the case?

From a corporate analysis perspective, there are many reasons. For example, this article from CICC summarizes a few points:

https://finance.sina.com.cn/stock/marketresearch/2022-09-15/doc-imqmmtha7443963.shtml

One reason is the cost of capital; Chinese enterprises tend to borrow from state-owned enterprises.

Then there are tax differences: the corporate income tax rate in China is 25% vs. 15% in the U.S.

Finally, the positioning of industries is different; Chinese enterprises are often in the middle of the smile curve, while the U.S. is at both ends.

But I want to look at it from a different angle, specifically from the perspective of capital abundance.

The logic is simple: in any industry, even if the profit margin is low, if there are few competitors, high profits can still occur. Conversely, in high-margin industries, like real estate, if there are many competing enterprises, it can turn into a low-profit or even loss-making industry (Evergrande, who are you referring to?).

The impression is that there are many funds and entrepreneurs in China, but the industries available for them to engage in are limited, leading to a situation where there are too many wolves and too little meat. For example, in the past, the e-cigarette industry saw a surge of companies, but in the end, very few made real profits. In simple terms, there is just too much money.

Let's make a hypothesis: one reason for the excess money is the high savings rate.

Reason one is the high savings rate.

From the 1980s to 2023, the savings rate of Chinese residents (the savings rate refers to the percentage of disposable income that is saved) has remained between 36% and 45%. In the same period, developed countries averaged around 20%, Germany, Japan, and South Korea around 30%, while among developing countries, Brazil is about 17.4% and India about 30.2%; the global average savings rate is around 25%-27%.

So, it is accurate to say that China's savings rate is high.

What impact does a high savings rate have? Savings are the money kept in banks. When there is more money saved in banks, it means there is more money available for investment, which leads to "too many wolves"… Additionally, saving means less consumption, which in turn means lower overall demand in society, resulting in "too little meat." Therefore, a high savings rate can be considered an important reason for "too many wolves and too little meat, leading to low investment returns."

Let's assume there is a Chinese person named 9527 and an American named Jack. Both earn 10,000 yuan each month, but Jack can spend 8,000 yuan, while 9527, with grand ambitions, only spends 6,000 yuan, saving the remaining 4,000 yuan.

Why is Jack so willing to spend, while 9527 is not? There are a few reasons:

Characteristics of an agrarian civilization, delayed gratification; this is a good thing, saving money for future expenses like retirement and children's education.

Insufficient social welfare; people are reluctant to spend because once the money is spent, they cannot afford retirement…

Limited places to spend, for example, on gambling or drugs, which are available in Thailand but not in China 😂.

Reason two is capital controls:

Let me share a little story. In 2017, I joined a private enterprise as one of the first employees. This company collaborated with an American firm to develop cloud services in China. A few of us early employees went to the U.S. for training and technical negotiations. One day, during a dinner, we heard the news that our service company was explicitly prohibited by the government from continuing overseas mergers and acquisitions and other "capital outflow" activities… 😂 At that moment, I genuinely felt like I had stepped in something unpleasant.

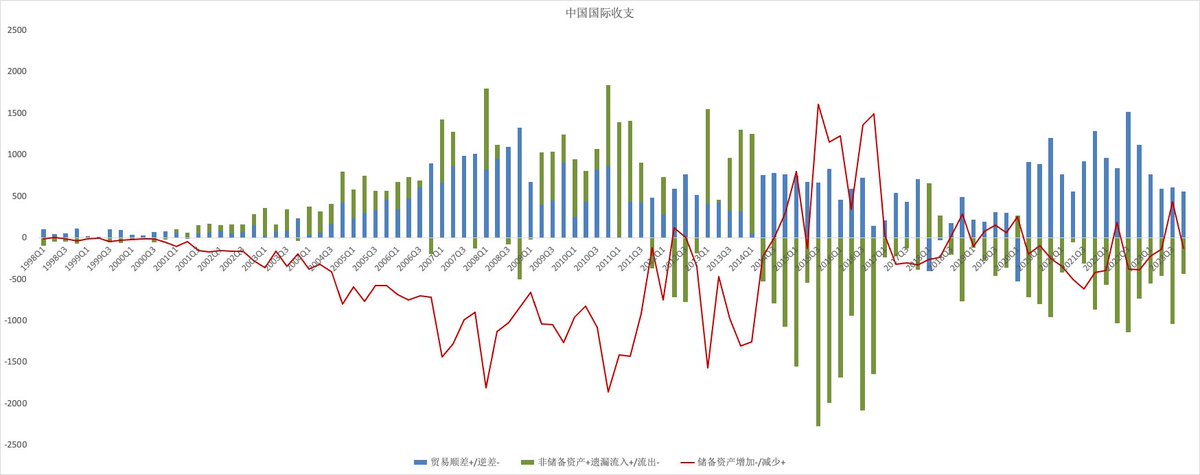

So, from 2014 to 2017, there was significant "capital outflow" (the green bar in Figure 3), but in 2017, the government blocked this outflow, meaning that the abundant domestic capital could not be globally allocated… Imagine China's capital pool as a lake connected to the sea by a river, but this outlet is blocked, causing the lake's surface to be higher than the sea level.

What would happen if capital outflow were allowed? The result would be a decrease in available domestic capital (fewer wolves), which would alleviate the issue of insufficient returns. Of course, there are other related problems, such as exchange rate fluctuations, but we won't analyze those here.

In summary, the two reasons boil down to the fact that Chinese people love to save, there is a lot of money, but this money cannot participate in global investments and can only "rot in the pot," circulating in this relatively small domestic market, leading to a decline in investment returns.

3 - How to solve it?

Capital controls are a long-term national policy due to security concerns. Just look at how the Southeast Asian financial crisis abruptly halted the development momentum of those countries. Overall, in today's context where U.S. financial capital and methods are clearly superior, implementing some controls is reasonable and not a big issue. I believe the overall trend is towards openness.

Now, regarding the savings rate issue, here are three strategies:

The first strategy is for the government to spend on behalf of individuals. For example, increase spending on welfare and public services. Where does the money come from? Either through taxation or by increasing the money supply; it's all the same. To some extent, past infrastructure projects were equivalent to the government spending money for the people, improving urban construction, and now even second-tier cities have subways, which the public can also benefit from.

The second strategy is to learn from the U.S. and create a narrative. How to create a narrative? By enticing and convincing people 😂 that tomorrow will be better and there will be more money. But this is a cognitive battle, and like finance, it is not a constant.

The third strategy, I believe, is to open up the service industry: try to reduce some taboos and promote more openness. Of course, it is still necessary to distinguish from the West; for example, drugs cannot be legalized, but cultural industries and financial services can be cautiously opened and managed. However, the opening of these sectors and other service industries requires a high level of management; as always, safety must be ensured alongside openness.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。