The Art and Science of Market Making Plays a Key Role in Ensuring Market Liquidity and Smooth Trading.

Written by: arnaud710

Translated by: Block unicorn

Market Makers: The Illusion of Unsung Heroes

Market makers are the unsung heroes behind smooth trading, acting like stage managers on the trading floor, maintaining market liquidity and seamless transactions while balancing countless factors to ensure stability. Building an efficient market-making system is akin to creating a high-performance car—every component needs to work perfectly to deliver top performance.

What is Market Making?

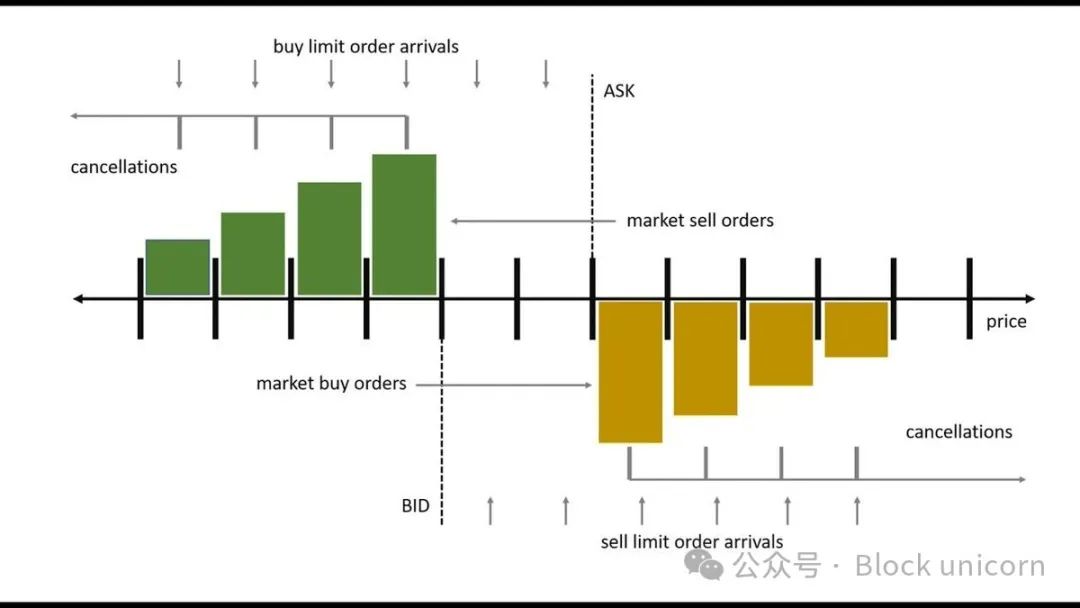

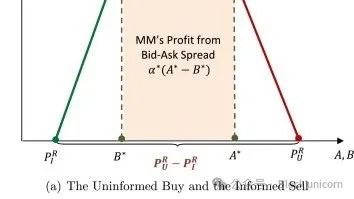

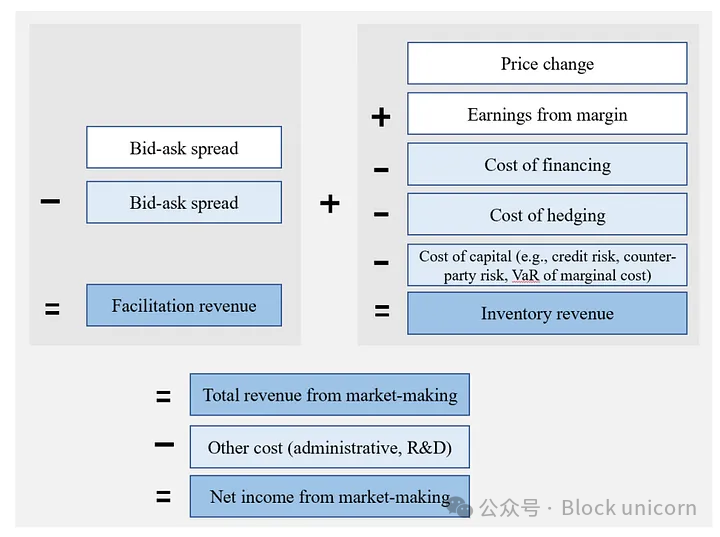

At its core, market making provides liquidity to financial markets by continuously quoting buy (Bid) and sell (Ask) prices, offering trading opportunities for securities. Market makers profit from the bid-ask spread—the difference between the buy and sell prices. You can think of them as friendly local shopkeepers who always have goods to sell and are willing to buy back products, ensuring that buyers and sellers leave with something.

Bid-Ask Spread: The Heart of Market Making

The bid-ask spread is key to a market maker's profitability; it must cover the risks and costs of holding inventory and facilitating trades, while also determining whether market makers can attract traders.

Wider spread: While it can yield higher profits, it may scare off traders seeking tighter prices.

Narrower spread: Can attract more trades, but with lower profit margins.

The key is to find a "sweet spot"—if the spread is too wide, your inventory may become unsellable; if it's too narrow, your earnings will be minimal. A well-adjusted spread can help market makers cover costs while remaining competitive.

Inventory Holding Cost (IHCi): The Art of Balance

Market makers hold a certain amount of securities in inventory to facilitate trading.

The cost of holding inventory comes from two main aspects:

- Opportunity cost of capital

Holding inventory ties up capital that could be used for other investments. If the price of securities rises, the required spread will also increase to compensate for this cost. This can be seen as high-end products requiring higher pricing because producing them demands more resources.

- Risk of price volatility

The securities market is highly volatile, and price changes can lead to losses. If market prices move unfavorably, market makers may incur losses. To mitigate this risk, market makers typically widen the spread to provide a buffer against adverse price changes.

This approach explains the interaction between security prices, volatility, and holding duration, ensuring that the premium adjusts with market conditions.

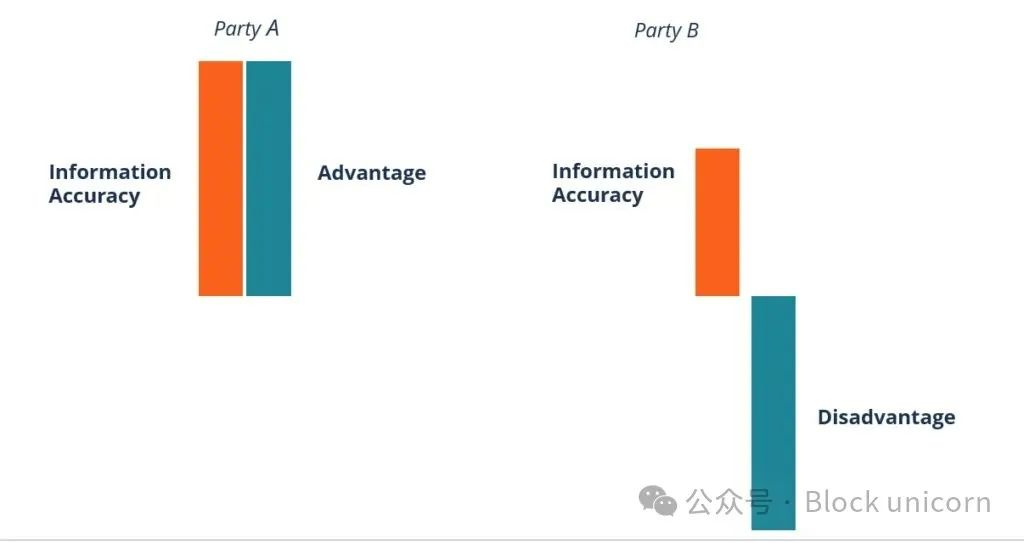

Adverse Selection Cost (ASCi): Protecting Against Information-Advantaged Traders

Adverse selection refers to traders possessing superior information about the future movements of securities that market makers do not have. To prevent potential losses from these information-advantaged traders, market makers need to adjust the spread for protection.

For example: If someone knows a stock is about to surge, they might buy at the sell price, and if the stock price does not rise as expected, the market maker could suffer significant losses. By incorporating ASCi into the spread, market makers can mitigate risks arising from information asymmetry.

Probability of Information Trading (P_I): Assessing Risk

Evaluating the likelihood of facing information-advantaged traders is a complex task that requires analyzing patterns and market data to determine if trades are based on insider information. Factors such as trading frequency, volume, and historical price trends all influence this assessment.

Higher P_I: Indicates a greater risk of adverse selection, prompting market makers to widen the spread.

Lower P_I: Suggests lower risk, allowing the spread to narrow and encourage more trading activity.

Competitive Agents (H′): Measuring Market Competition

Competition among market makers affects the width of the spread; the more intense the competition, the narrower the spread typically becomes, as market makers need to attract traders. H′ can be calculated based on the concentration of market makers for specific securities:

Formula: H′=ViXH′ = \frac{V_i}{X}H′=XVi

ViV_iVi: The trading volume contributed by a specific market maker.

XXX: Total trading volume.

A higher H′ value indicates less competition and higher concentration, which may lead to a wider spread; conversely, in a competitive environment, the spread tends to narrow.

Understanding the Core Principles of Market Making Through Vivid Analogies

Opportunity Cost: Imagine your capital as your best salespeople; if you keep them busy making cold calls all day instead of closing high-value deals, you miss out on significant profits. By allocating capital wisely and ensuring your "money-making experts" focus on the right tasks, you can widen the spread and increase earnings.

Volatility: Think of volatility as a person bouncing on a trampoline; you can never predict the height or direction of the next jump. Market makers must stay steady and not get thrown off by these fluctuating market conditions.

Adverse Selection: Adverse selection is like watching a football game where some spectators secretly know the outcome. Market makers need to set the spread accurately to avoid being led by these cunning "insider spectators" and falling into their traps.

Building a Complete Market Making System is Much More Complex

In summary, the art and science of market making play a crucial role in ensuring market liquidity and smooth trading. Constructing an efficient market-making system is a technical endeavor that combines both art and science. It requires deep technical knowledge, precise strategic adjustments, and the ability to quickly adapt to rapidly changing market dynamics.

Through careful operation, market makers ensure that financial markets remain liquid and efficient, providing essential support for the stable development of the entire market ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。