The trend of tokenization always manages to spark new waves of innovation and market adoption.

Author: 0xJeff

Compiled by: Deep Tide TechFlow

Tokenization of [] has always been a concept of great interest. While it seems simple, new things being tokenized always quickly attract people's attention.

Here are some tokenization trends we have observed, their development history, and possible future directions:

Tokenization of Assets

Asset tokenization is one of the earliest emerging trends in tokenization.

Bitcoin pioneered the first decentralized, secure, and transparent ledger system, laying the foundation for the digital representation of assets.

Subsequently, the launch of Ethereum in 2015 further propelled this trend. Ethereum introduced smart contracts, allowing assets to be programmable, enabling more efficient management and trading through tokenization, whether it be real estate, artwork, or decentralized finance (DeFi).

As of now, the fully diluted valuation (FDV) of $ETH has reached as high as $470 billion, which sufficiently demonstrates the significant impact of tokenization in the asset domain.

Tokenization of Art (NFTs)

The rise of NFTs has expanded the application of tokenization into the art field.

In 2017, projects like CryptoPunks and CryptoKitties brought NFTs into the public eye.

By 2021, the trading volume of NFTs skyrocketed to $13 billion, becoming a major form of digital art and collectibles.

Some well-known series like CryptoPunks, BAYC (Bored Ape Yacht Club), and Art Blocks saw individual pieces reaching prices of millions of dollars during the market peak in 2021.

Tokenization of Yield

Yield tokenization is another significant breakthrough in the field of tokenization.

In 2021, @pendle_fi first proposed the idea of tokenizing future yields.

Through the Pendle platform, users can trade fixed and variable yields, bringing greater flexibility and liquidity to the DeFi market.

Pendle experienced rapid growth in 2023 with the popularization of liquid staking tokens (LSTs) and the launch of the points market in early 2024.

As of now, the fully diluted valuation (FDV) of $PENDLE has reached $1.6 billion, showcasing the market potential of yield tokenization.

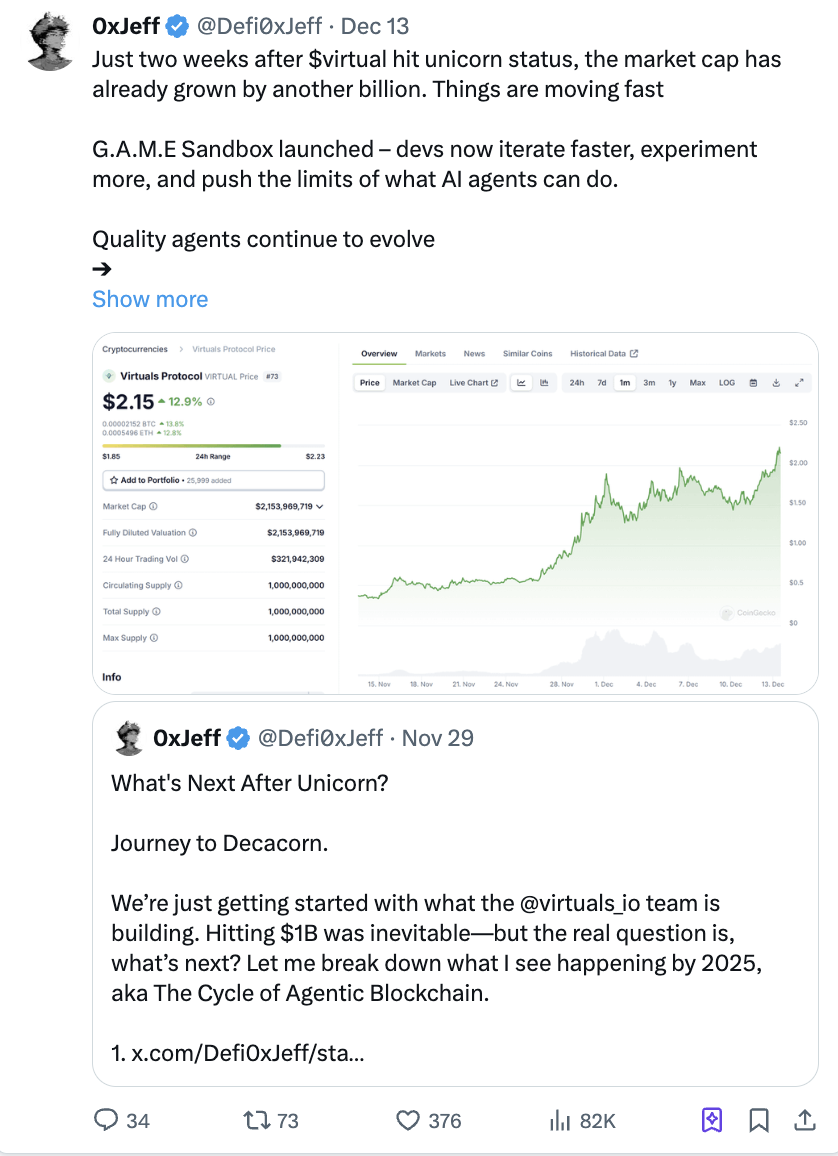

Tokenization of AI Agents

Today, the tokenization of AI agents is becoming a new trend.

@virtuals_io launched a platform where users can create AI agents and tokenize them. This approach not only makes the development of AI agents more flexible but also effectively reduces development costs.

The concept of tokenizing AI agents began in October 2024, when Virtuals first built a market focused on agent ownership, allowing users to hold and trade rights to AI agents in token form.

To date, the fully diluted valuation (FDV) of $VIRTUAL has reached $2.5 billion.

Identifying Trends

In all these categories of assets, art, yield, and AI agents, we can clearly see that pioneers in each field are often quickly accepted by the market, leading to significant price changes.

So, what will be the next direction for tokenization?

Here are some trends and ideas I am currently watching:

Tokenization of Data

@withvana is actively exploring the possibilities of Data DAOs and Data Liquidity Pools (DLPs).

Users can contribute data to these pools while retaining ownership of the data and receive corresponding rewards based on the quality of the contributed data.

Essentially, this model transforms data into a highly liquid and tradable asset.

$VANA will officially launch on December 16 (listed on Binance). However, it is important to note that its fully diluted valuation (FDV) has not yet been clarified, but the concept of data tokenization ownership could have far-reaching impacts.

Tokenization of Attention

@_kaitoai is attempting to tokenize attention, introducing it into the world of Web3. They demonstrate the ability to generate and attract more attention through platforms, a mindshare dashboard, and the recently launched Yap-to-Earn feature (though I haven't been able to log in successfully due to Twitter's rate limit issues; can anyone help me with this?).

Their Yapper Leaderboard encourages thought leaders to "Yap" more to earn Yap points, ultimately leading to an airdrop of the $KAITO token.

In simple terms, Yap equals attention, and attention translates to $KAITO.

This is an interesting attempt at how Web3 can redefine user engagement.

Tokenization of AI Applications

This trend seems to be a natural extension of the tokenization of AI agents.

With the popularity of tools like @Replit and the rapid development of the agent ecosystem, we are gradually approaching the creation of personalized software.

Tokenized AI applications can allow users to participate in the initial stages of development and own a portion of the future revenue generated by the applications.

Key competitors in this field:

@alchemistAIapp and @myshell_ai are two leading platforms in this area.

Both platforms provide creators with the ability to build revenue-generating AI applications, offering practical and scalable solutions.

Myshell goes a step further by allowing investors to directly invest in these AI applications and receive a share of the revenue they generate in the future. This model not only supports development but also establishes a synergy of interests between creators and investors.

Final Thoughts

The trend of tokenization always manages to spark new waves of innovation and market adoption. But their allure lies not only in the technology itself but also in how they bring people together and shift attention towards new opportunities.

What will be the next big trend in tokenization? I cannot be certain, but these ideas are undoubtedly worth paying attention to.

Disclaimer

This article is for informational and entertainment purposes only. The views expressed herein are not investment advice or recommendations. Investors should conduct thorough due diligence before investing and make decisions based on their financial situation, investment goals, and risk tolerance (which this article does not consider). This article does not constitute an offer or invitation to offer to buy or sell the assets mentioned.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。