Author: Web3 Farmer Frank

What does a strategic reserve asset of 1 million BTC mean?

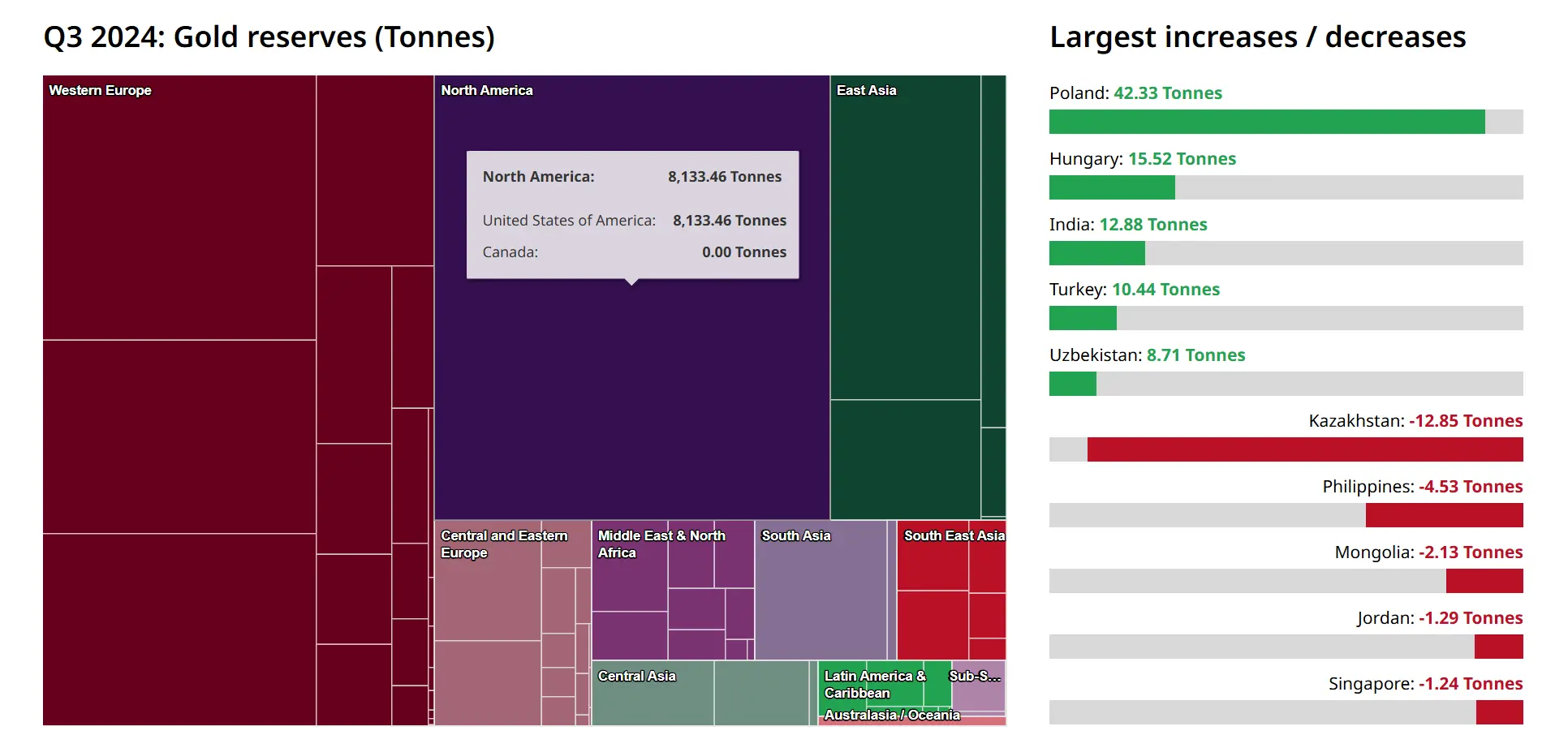

According to the World Gold Council, as of the third quarter of 2024, the Federal Reserve's gold reserves total 8,133.46 tons (approximately $530 billion), firmly holding the top position globally, while 1 million BTC is currently valued at nearly $100 billion, almost equivalent to 19% of the U.S. gold reserves!

Source: World Gold Council

Source: World Gold Council

With Trump and an increasing number of institutions/companies and sovereign nations beginning to consider establishing a "Bitcoin strategic reserve," will Bitcoin's "Fort Knox moment" arrive? Can it, like gold, become part of the global reserve asset system?

The next decade may be a critical time window for this answer to be revealed.

What does "strategic reserve asset" mean?

At the Bitcoin2024 conference held in July 2024, Trump publicly promised in his speech to "never sell" the Bitcoin held by the government and any future acquisitions, insisting on the concept of a "strategic Bitcoin reserve."

Now, with Trump's election and the recent appointments of crypto-friendly individuals to key positions, including the U.S. Secretary of the Treasury, the SEC Chair, and the White House crypto czar, it undoubtedly brings the idea of incorporating Bitcoin into the U.S. strategic reserve closer to reality.

Source: Bloomberg

Source: Bloomberg

So, what exactly is a "strategic reserve asset"?

Simply put, a "strategic reserve asset" is a key asset held by a government or regional authority, aimed at responding to economic fluctuations, financial crises, or geopolitical risks, maintaining national financial stability, economic security, and international competitiveness. They typically possess characteristics such as high value and universal acceptance, security and stability, and liquidity.

At the corporate level, "strategic reserve assets" also help companies/institutions achieve financial stability, enhance risk resistance, and support their long-term growth strategies, especially during economic fluctuations, where strategic reserve assets often serve as the first line of defense against risks.

Traditional strategic reserve assets mainly include:

- Gold: Widely regarded as a stable store of value due to its scarcity and anti-inflation properties;

- Foreign exchange reserves: Primarily U.S. dollar-denominated reserve currencies, essential for supporting international trade and payments;

- Special Drawing Rights (SDR): Allocated by the International Monetary Fund (IMF) to supplement member countries' official reserves;

This also means that assets that can become "strategic reserves" must simultaneously possess comprehensive advantages such as value stability, global recognition, and convenient circulation, and Bitcoin, as an emerging digital asset, is gradually meeting these conditions and starting to be viewed as a potential alternative to gold.

Notably, in addition to Trump's "commitment," on July 31, 2024, U.S. Senator Cynthia Lummis also submitted the "Bitcoin Strategic Reserve Act of 2024" to the U.S. Congress, which details the requirement that "the U.S. Treasury must purchase 1 million BTC within five years and must hold it for at least 20 years, unless used to repay outstanding federal debt," and even plans to require the Federal Reserve to "use a certain amount of net income each year to purchase Bitcoin."

The goal of this plan is to ensure that the U.S. government can hold a significant amount of Bitcoin over the next twenty years, providing the nation with a long-term financial hedging tool. The bill has been submitted to the U.S. Senate Committee on Banking, Housing, and Urban Affairs for discussion and voting, and will then be sent to Trump for signing into law after passing both houses.

Source: congress.gov

Source: congress.gov

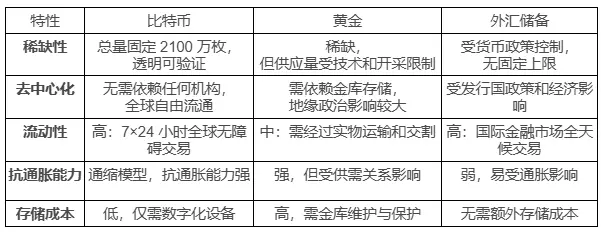

Why Bitcoin, beyond gold and foreign exchange?

To some extent, more gold reserves are not necessarily better in an absolute sense.

Firstly, gold, as a physical asset, does not generate interest or returns and lacks liquidity benefits, which is a primary reason for Buffett's negative stance on it—"Gold cannot pay you interest, so there is no compounding effect."

More importantly, holding gold reserves incurs high storage and maintenance costs, especially for the vast majority of countries, where effectively managing and protecting gold reserves becomes a significant financial burden. For example, the world-renowned Federal Reserve's main gold storage facility, "Fort Knox," has invested enormous resources to ensure the security of gold storage:

Not only is it located deep in the strategic heartland of Kentucky, but it is also buried underground, surrounded by thick reinforced concrete walls and all-weather security equipment, with thousands of soldiers stationed year-round. This makes the storage of gold reserves not just a security requirement but a long-term and costly financial investment.

Source: U.S. Mint

In contrast, the storage cost of Bitcoin is almost negligible; it does not require physical storage space or expensive protective facilities. It only relies on secure wallets, multi-signature technology, and a decentralized network verification system to achieve efficient storage and management.

At the national level, the storage cost of Bitcoin mainly focuses on technology and network maintenance, which is far lower than the physical protection costs of gold. This also means that even if Bitcoin does not generate direct returns, its holding costs are still significantly lower than gold, leaving more room for net asset growth.

Meanwhile, trading physical gold often involves complex processes such as physical delivery, storage, and transportation, which can take days or even weeks. The gold market is usually restricted by the trading hours and geographical limitations of the traditional financial system, while Bitcoin can be traded 24/7 through exchanges, covering the global market.

In addition to gold, foreign exchange reserves (such as euros, yen, etc.), as fiat currencies issued by other countries, depend not only on the economic conditions of the issuing country but can also be affected by geopolitical risks. In contrast, Bitcoin's scarcity is not influenced by monetary policy interventions, avoiding the devaluation risks caused by excessive issuance, and allowing any holder (whether individual, institution, or sovereign nation) to freely store, transfer, and trade globally.

This decentralized characteristic ensures that Bitcoin is not subject to political and economic interference, and even during global turmoil, its value storage function can still operate stably.

Enterprises/institutions and sovereign nations are becoming BTC "Pi Xiu"

For this reason, Bitcoin, with a total market value now reaching $2 trillion, is gradually being viewed as a potential reserve tool due to its lack of physical storage, global circulation, high transparency, and anti-inflation characteristics. More and more companies/institutions, and even sovereign nations, are beginning to explore incorporating Bitcoin into their strategic reserve asset systems.

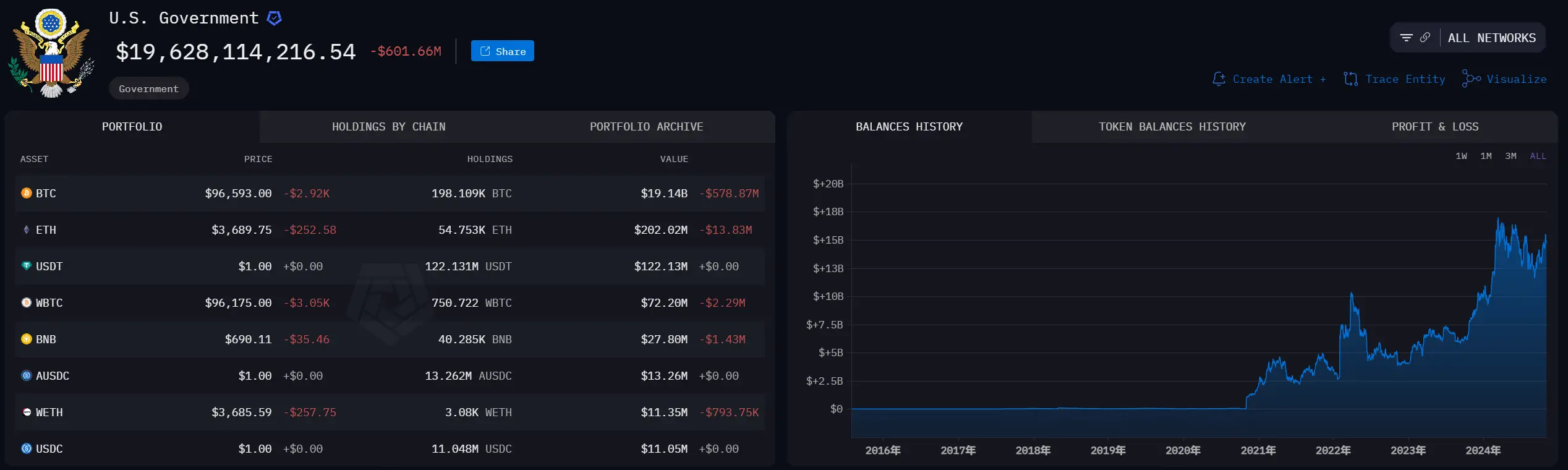

U.S. Government: One of the largest Bitcoin holders in the world

Surprisingly to many, the U.S. government is actually one of the largest Bitcoin holders in the world, having seized a large amount of Bitcoin over the years through law enforcement actions against cybercriminals, money laundering organizations, and dark web markets, and currently holds about 200,000 BTC, valued at nearly $20 billion at the time of writing.

As the "most crypto-friendly president in U.S. history" (at least in public statements), it remains uncertain whether Bitcoin will be incorporated into the federal reserve asset system during Trump's next four years. However, it is certain that the Bitcoin held by the U.S. government may not be sold as frequently as before, but rather may gradually explore its longer-term strategic significance.

Source: Arkham

Source: Arkham

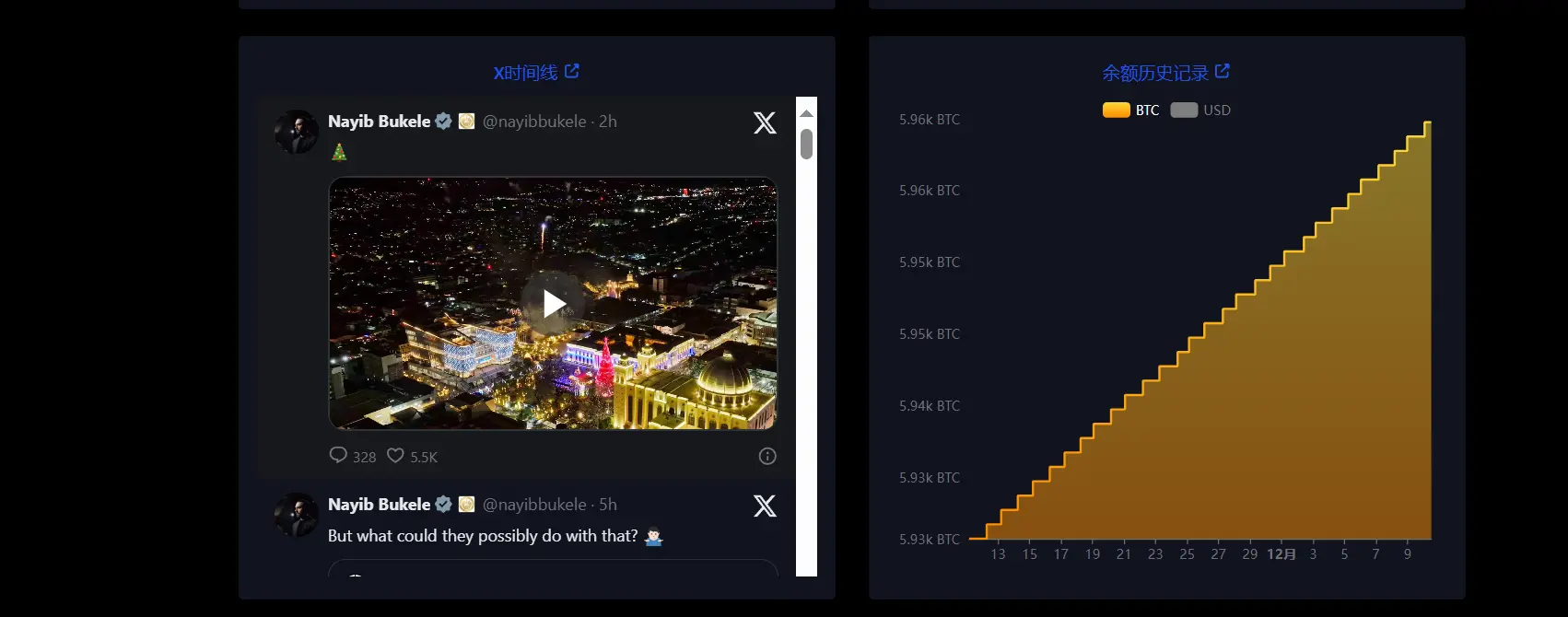

El Salvador: Daily investment of 1 BTC

El Salvador is the first country in the world to establish Bitcoin as legal tender, having enacted relevant legislation on September 7, 2021. It subsequently launched the electronic wallet Chivo and preloaded $30 worth of Bitcoin for every resident who downloaded the wallet, integrating Bitcoin into the national economic system and demonstrating its firm "Bitcoinization" path.

Moreover, whenever the crypto market experiences significant volatility, El Salvador's President Nayib Bukele often promptly announces Bitcoin purchases via social media, injecting confidence into the market. Currently, El Salvador continues to buy 1 BTC daily, and with rounds of "bottom-fishing," as of December 10, its BTC holdings have reached 5,959.77 BTC, with a holding value of approximately $577 million.

This holding, while not large on a global scale, is remarkable for a small economy, providing a unique experimental case for other countries.

Source: Bitcoin Office

Source: Bitcoin Office

MicroStrategy's All-in Bitcoin Strategy

In addition to sovereign nations, publicly traded company MicroStrategy is undoubtedly the absolute representative in the field of Bitcoin "hoarding"—its strategy of "buying, buying, buying" Bitcoin has long been a clear and bold approach, with its holdings surpassing those of any sovereign nation in the public domain.

The news of MicroStrategy's public Bitcoin purchases can be traced back to August 11, 2020, when it spent $250 million to acquire 21,454 BTC, with an initial purchase cost of approximately $11,652 per Bitcoin. It then embarked on an unstoppable path of accumulation, with the most recent publicly disclosed purchase occurring on December 9, when it bought 21,550 BTC for about $2.1 billion, averaging $98,783 per Bitcoin.

As of December 8, 2024, MicroStrategy has acquired 423,650 BTC at an approximate cost of $25.6 billion, averaging about $60,324 per Bitcoin. Based on the current price of $97,000, the holding has an unrealized loss of about $15.5 billion.

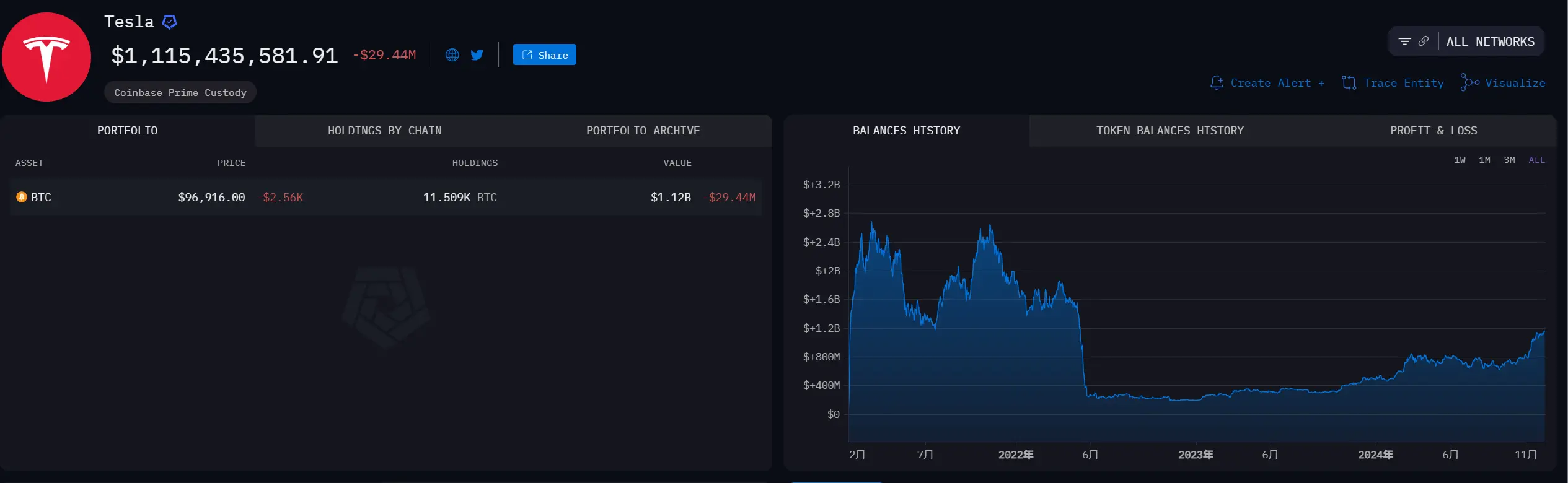

Tesla's "Hodl" Bitcoin Strategy

On December 20, 2020, after MicroStrategy's Michael Saylor encouraged other CEOs to follow his lead, Elon Musk expressed interest in purchasing Bitcoin for the first time. Shortly thereafter, in late January 2021, Musk changed his Twitter bio to #Bitcoin, and Tesla ultimately announced the purchase of $1.5 billion in Bitcoin in February 2021.

Subsequently, Tesla reduced its Bitcoin holdings by 10% in the first quarter of 2021. According to Musk, this was to "test liquidity and prove that Bitcoin's liquidity is sufficient to serve as a cash alternative on the balance sheet."

According to Arkham data, as of the time of writing, Tesla's Bitcoin holdings amount to 11,509 BTC, with a holding value of approximately $1.1 billion.

Source: Arkham

Other Countries and Mainstream Enterprises/Institutions: Bitcoin Reserves are Becoming Mainstream

It is noteworthy that the strategic value of Bitcoin is gradually being transmitted from the national level to enterprises and institutions. Although national reserve layouts directly influence the policy environment, enterprises are the main practitioners of adoption. Therefore, Bitcoin is not only a hedging tool but is also gradually becoming a strategic component of corporate balance sheets.

Recently, tech giants like Microsoft and Amazon have also faced active advocacy from investors urging them to incorporate Bitcoin into their balance sheets. MicroStrategy's founder Michael Saylor even directly suggested to Microsoft's board to invest in Bitcoin, believing that this move could significantly enhance corporate value and create long-term returns for shareholders.

At the same time, the American conservative think tank National Center for Public Policy Research has proposed that Amazon should invest 1% of its total assets in Bitcoin, aiming to enhance shareholder value through this approach and hedge against the risks of traditional currency devaluation.

From an objective perspective, incorporating Bitcoin into the balance sheets of mainstream institutions and traditional enterprises can indeed bring multiple advantages:

- Anti-Inflation Capability: The fixed scarcity of Bitcoin's total supply of 21 million endows it with strong anti-inflation properties, helping enterprises stabilize asset value in an environment of global monetary easing and fiat currency devaluation;

- Diversified Investment Portfolio: As an emerging asset class, Bitcoin provides enterprises with rich asset allocation opportunities, reducing reliance on a single asset class while enhancing overall financial robustness;

- Enhanced Corporate Brand and Market Image: Holding Bitcoin not only reflects a company's support for innovative technologies and future economic models but also enhances its competitiveness in the market, shaping a more forward-looking brand image;

However, in the process of incorporating BTC into their balance sheets, enterprises need to address two key issues: how to securely custody large assets and how to efficiently complete OTC (over-the-counter) transactions to avoid market impact.

This makes professional custody and OTC service providers an indispensable part of the equation. For example, OSL, Hong Kong's first licensed exchange, offers custody services that include independent wallet designs for each client, protected by a bankruptcy-isolated trust structure, ensuring the absolute security of enterprises' BTC.

Additionally, OSL has partnered with leading insurance giants like Canopius to expand its insurance coverage to $1 billion, covering various risk scenarios that could lead to asset loss, including cyberattacks, fraud, and technical failures.

In terms of OTC, as a regulated licensed compliance platform, OSL benefits from close cooperation with major banks in Hong Kong, enabling near-instant fiat settlements, with strict mechanisms governing deposits and withdrawals, significantly reducing the risk of bank account freezes.

The Future of Bitcoin in the Next Decade: Speculative Asset or Global Strategic Reserve?

Today, Bitcoin has grown from a marginalized asset to an emerging candidate for global strategic reserves. From sovereign nations to mainstream institutions/traditional enterprises, an increasing number of forces are redefining its role. Its scarcity, decentralized nature, and high transparency have led it to be widely regarded as "digital gold."

Although its price volatility remains a focal point of debate, Bitcoin's adoption is advancing at an undeniable pace. If Trump's proposed "strategic reserve asset" concept comes to fruition, BTC's status will undoubtedly rival that of gold, and its strategic significance may even surpass that of gold:

While gold possesses physical scarcity, its distribution and trading rely on complex logistics and regulatory systems. In contrast, Bitcoin, based on blockchain technology, does not require physical storage or transportation, allowing for borderless rapid circulation. This characteristic makes it more suitable as a reserve asset for nations and institutions within the global financial system, taking on greater strategic responsibilities.

Against this backdrop, in the next decade, Bitcoin's potential as a global strategic reserve asset will be fully unleashed, and its application scenarios may further expand.

Whether it is a national-level "long-term hoarding" plan or a corporate/institutional "buy-and-hold" strategy, Bitcoin's global influence is expanding at an undeniable pace. Global leaders and well-known companies like MicroStrategy, Microsoft, and Amazon have even become the best advocates for Bitcoin, greatly promoting global market recognition of cryptocurrencies.

From this perspective, whether providers like OSL, which offer "key bridge" digital asset financial services, can help enterprises and institutions overcome the full-process challenges from custody to trading is undoubtedly crucial. As more enterprises/institutions and countries/regions position themselves with Bitcoin, the infrastructure development in this field will undoubtedly play a more important role in the future.

"The light boat has passed through ten thousand mountains." Whether Bitcoin can become a strategic reserve asset for the U.S. or other countries in the next four years, it has already won an important victory on the road to adoption.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。