This guide will provide you with a comprehensive overview of SOL staking, covering the most common questions and all key areas.

Written by: Lostin, Helius

Compiled by: Glendon, Techub News

If you hold SOL tokens and want to stake them but do not understand the staking mechanism of Solana, don’t worry. This guide will provide you with a comprehensive overview of SOL staking, covering the most common questions and all key areas. Let’s get started!

Why Stake SOL?

Staking SOL is not just about earning rewards—it is also crucial for the decentralization and security of Solana. By staking, SOL token holders can contribute to the stability and governance of the network. In this process, it is very important to choose a suitable validator for staking. Delegating tokens to a validator is akin to voting in a representative democracy, reflecting trust in the validator's ability to remain highly online and process blocks quickly and accurately. Other considerations include the validator's ethical behavior, response to hard forks, and contributions to the Solana ecosystem.

Reasonably distributing staking rights among reputable validators can further promote the decentralization of the network and effectively prevent any single well-funded entity from manipulating consensus decisions for personal gain.

What Happens After You Stake?

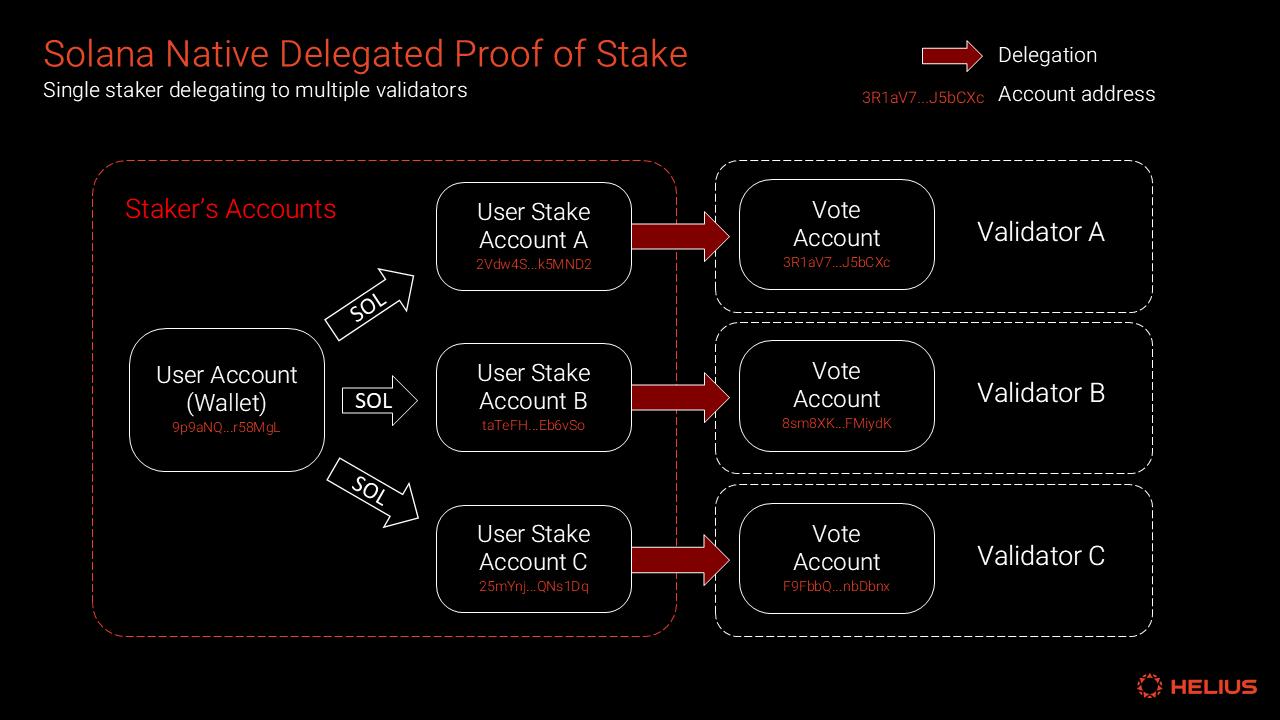

There are two forms of staking on Solana: native staking and liquid staking. Currently, 94% of staked SOL is done through native staking, so this article will focus on this form and briefly introduce liquid staking later. For native staking, users can operate through various platforms, including multi-signature fund management tools (like Squads), popular wallets, and dedicated staking websites. The process of native staking is relatively simple: users just need to deposit their tokens into a staking account and then delegate them to the validator's voting account. Individual users can create multiple staking accounts, each of which can flexibly choose to delegate to the same or different validators.

Above: A single staker delegates to multiple validators

Each staking account has two key permissions: staking permission and withdrawal permission. These two permissions are automatically set by the system at the time of account creation and are defaulted to the user's wallet address. Each permission has its own clear responsibilities. The withdrawal permission has higher control over the account, allowing it to remove tokens from the staking account and enabling users to update the allocation of staking permissions.

The most important time unit in staking is the epoch. Each epoch on Solana lasts for 432,000 slots, which is approximately two days. Whenever a new epoch begins, the system automatically distributes staking rewards to the corresponding stakers. This process does not require manual operation from the stakers; they will see their account balance increase at the end of each epoch. Additionally, users can directly harvest MEV rewards through the Jito website (which will be detailed later).

When you stake SOL natively, your tokens will be locked for the duration of the current epoch. If a user unstakes at the beginning of an epoch, they may have to go through a cooling-off period of up to two days before they can withdraw. If they withdraw at the end of the epoch, the process will be almost instantaneous, with no additional waiting.

Similarly, starting staking also requires a warm-up period, which may last two days or be almost instantaneous, depending on when the user starts the staking account. During this process, users can refer to the Solana block explorer to track the progress of the current epoch.

How Do Operators Profit?

Validator operators primarily profit in three ways:

Issuance / Inflation: Issuing new tokens

Priority Fees: Users send SOL to validators for priority processing of their transactions

MEV Rewards: Users pay Jito tips to validators to include transaction bundles

Validator income is entirely denominated in SOL, and the scale of their income is directly linked to the amount they have staked. Operating costs are mostly fixed and are priced in a mix of SOL and fiat currency.

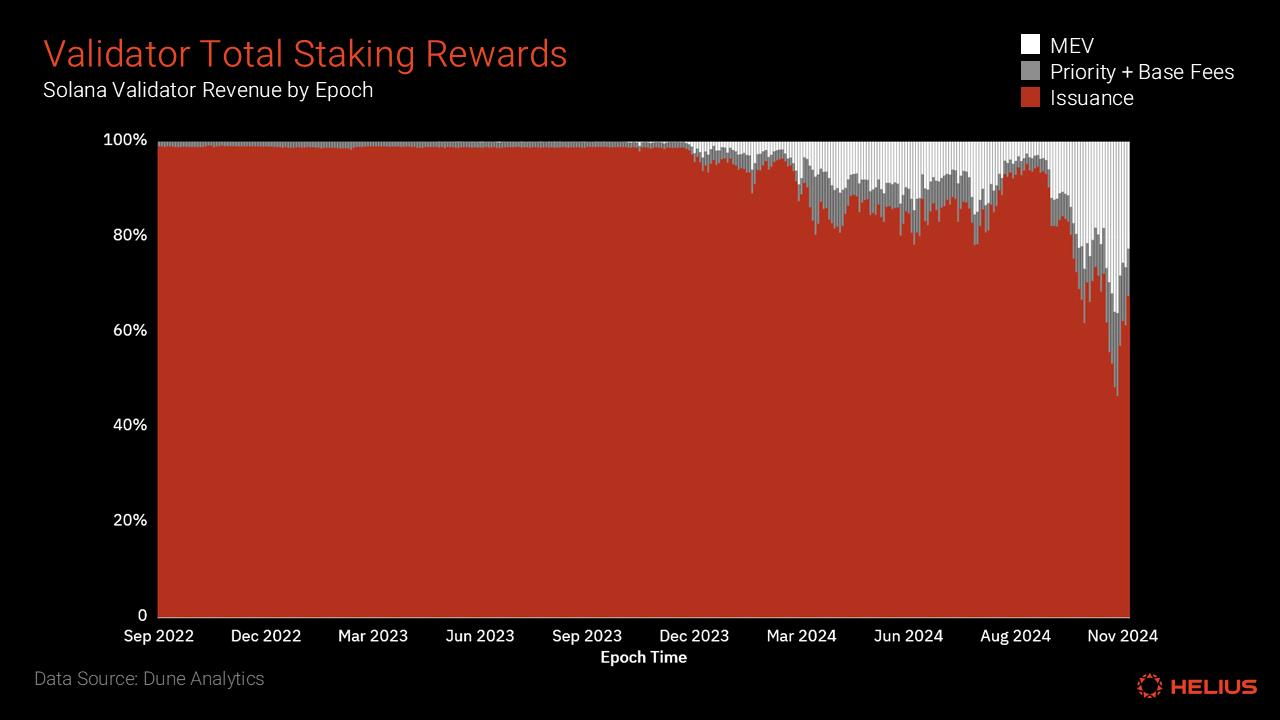

Above: Total staking rewards for Solana validators (Data source: Dune Analytics, 21.co)

Token Issuance

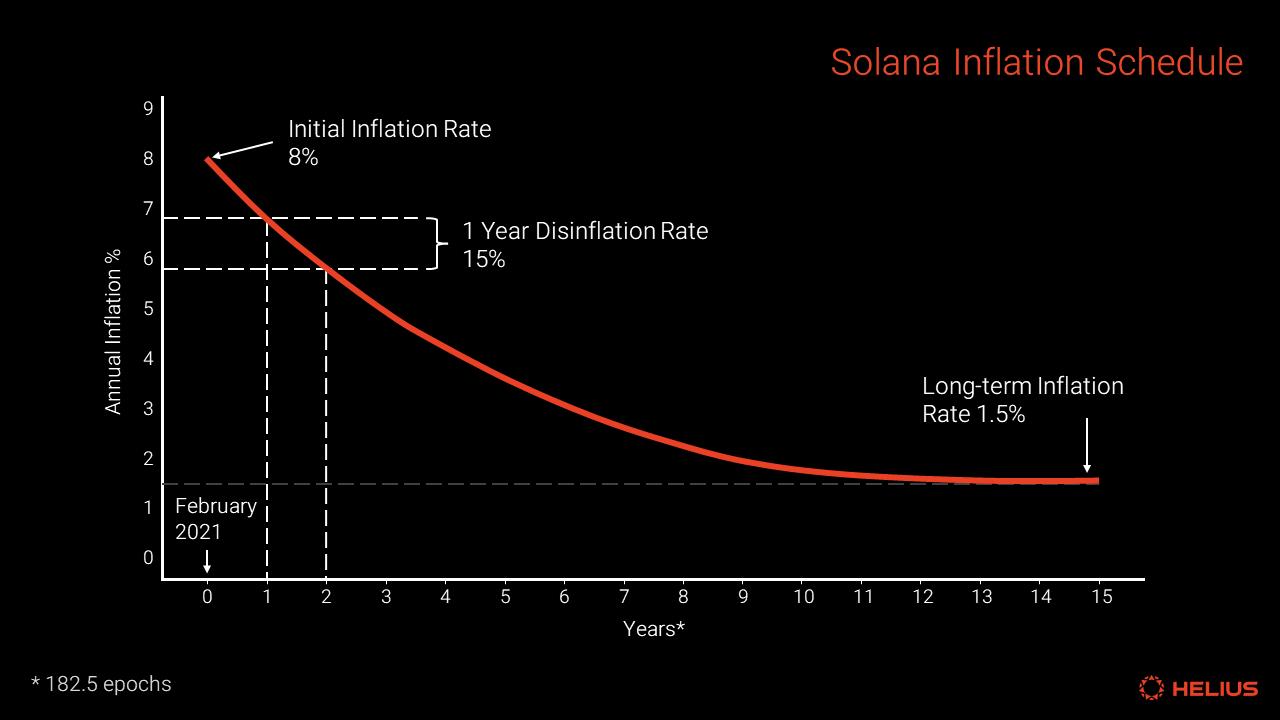

Solana regularly issues new SOL tokens according to its inflation plan and distributes these tokens as staking rewards to validators at the end of each epoch. Currently, Solana's inflation rate is 4.9%, which will decrease by 15% each year until it stabilizes at a long-term inflation rate of 1.5%.

The amount of staking rewards a validator receives mainly depends on the number of points they earn by correctly voting to become on-chain block nodes. If a validator experiences downtime or fails to vote in a timely manner, their earned points will decrease. Under average point conditions, a validator with 1% of the total staked amount is expected to receive rewards that account for about 1% of the total inflation.

Additionally, the staking rewards received by validators are further subdivided and allocated based on the size of their delegators' stakes. In this process, validators can charge a certain percentage of commission on the total inflation rewards earned by their stakers. This commission rate is usually a single-digit percentage but can be any number between 0% and 100%.

Above: Solana Inflation Timeline

Priority Fees

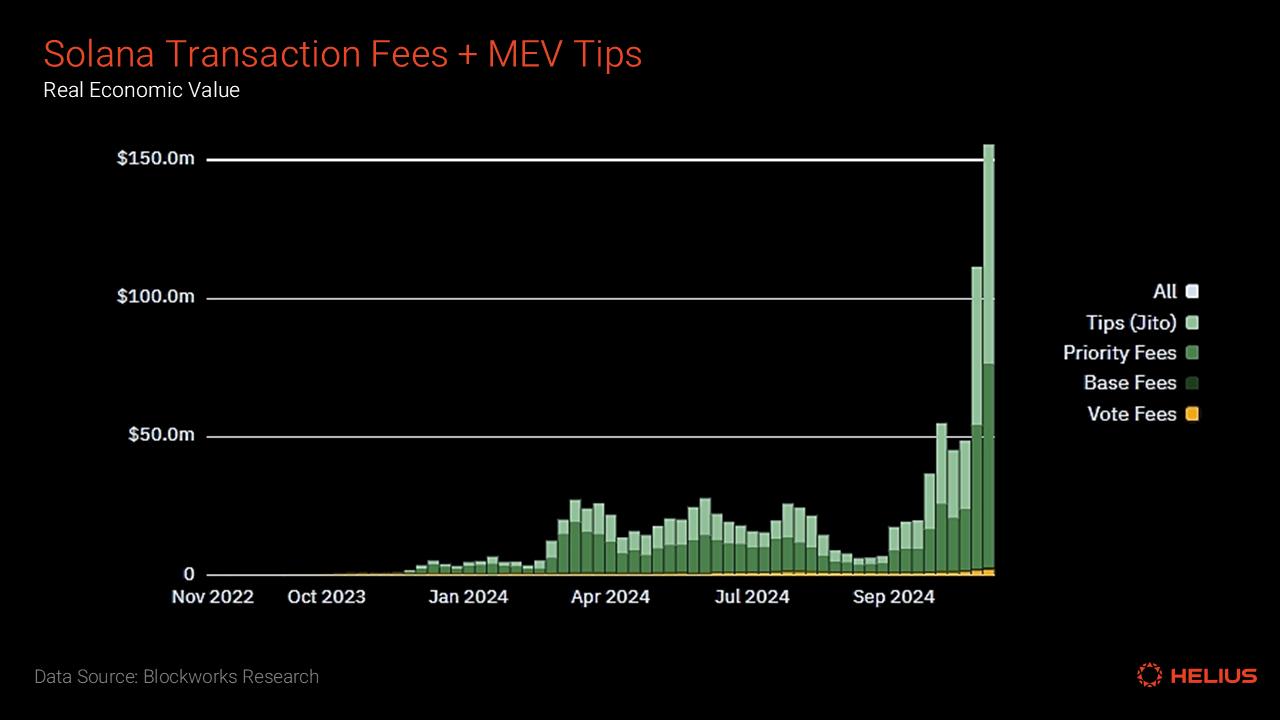

In the Solana network, validators selected as the current block builders collect fees from each transaction they process, which are divided into two types: base fees and priority fees. These fees are immediately credited to the validator's identity account. Prior to this, validators could earn 50% of both the base fees and priority fees as rewards, while the remaining portion is burned. With the passing of SIMD-96, this fee structure is about to change, allowing block producers to receive 100% of the priority fees.

By paying priority fees, users can ensure that their transactions are processed with priority in the block. This mechanism is particularly important in various scenarios, including arbitrage, liquidation, and NFT minting, where transaction speed is often of utmost importance. Since complex transactions require more computational power, they typically need to pay higher priority fees. Generally, accounts for popular tokens with high demand require higher priority fees.

In contrast to priority fees, while base fees contribute relatively less to income, they play an indispensable role in preventing spam. To maintain the security and stability of the network, the Solana system has fixed the base fee at 0.000005 SOL (5000 lamports) per signature to reduce the risk of malicious transactions and network congestion.

MEV (Jito) Rewards

Currently, validators operating the Jito validator client account for over 90% of the total staked SOL. Jito introduces an off-chain block space auction mechanism, allowing seekers and applications to submit groups of transactions called bundles. These bundles often contain time-sensitive transactions, such as arbitrage or liquidation. To incentivize block builders to prioritize these transactions, each bundle comes with a "tip." This provides validators with an additional source of income beyond priority fees and base fees.

In 2024, Jito's MEV income has grown from negligible to a major source of income for validators. For validators, they can set and collect their MEV commissions using a mechanism similar to that of inflation rewards. Stakers also receive a share of the remaining fees based on the relative size of their delegation to the block builders.

Above: Data on the growth of quantified priority fees and Jito tips. Data source: Blockworks Research

Where Does APY Come From?

Annual Percentage Yield (APY) is an important metric that measures the annualized compound percentage yield that stakers can earn by staking at the current rate for a full year. This yield is influenced by a variety of complex factors, including but not limited to the current issuance rate of the network, the performance and uptime of validators, the tips given to validators by users, and the current staking rate (i.e., the proportion of staked SOL to the total supply). Currently, several websites provide lists of validators ranked by APY, with StakeWiz being one of the most comprehensive.

Specifically, the sources of APY can be divided into two main components: issuance rewards and MEV rewards.

Issuance Rewards

In the Solana network, validators allocate staking rewards based on the size of their stakers' delegations. When distributing rewards, validators charge a certain percentage as a service commission, which can range from 0% to 100%. Additionally, the rewards a validator receives depend not only on the size of their stakers' delegations but also on their voting performance. Each successful vote earns points for the validator, which are a crucial basis for them to obtain rewards.

Well-managed validators tend to generate higher rewards based on the following factors:

Shortest Downtime: Validators do not earn points during downtime because they cannot participate in voting.

Timely Voting: If validators consistently lag in consensus participation, they may earn fewer points.

Accurate Voting: Points are only earned when voting on blocks that are subsequently confirmed.

MEV (Jito) Rewards

MEV rewards play an increasingly important role in the composition of staking rewards. The growing on-chain transaction volume and the resulting arbitrage opportunities drive this growth. Recently, Jito MEV tips accounted for about 20-30% of total rewards, significantly enhancing the earnings of stakers. Similar to issuance rewards, the commission charged by validators on MEV tips ranges from 0% to 100%. Additionally, Jito charges a 5% commission on all MEV-related income as a platform service fee.

Other Considerations

However, when choosing a validator, stakers do not only focus on the commission rate. Although low-commission validators may offer higher direct returns, many still prefer to choose high-commission validators like Coinbase, driven by factors such as vendor lock-in and regulatory arbitrage. For example, funds using Coinbase Custody are often required to stake exclusively on Coinbase's validators. On the other hand, centralized exchanges also benefit from retail users prioritizing convenience over yield optimization. For off-chain users, they may not be sensitive to below-standard returns, which gives exchanges greater flexibility in the rewards they offer.

Finally, new protocol mechanisms (such as SIMD-123) aim to allow validators to share block rewards directly with stakers. If successfully implemented, this will provide stakers with an additional source of income.

Key Participants in the Solana Staking Ecosystem

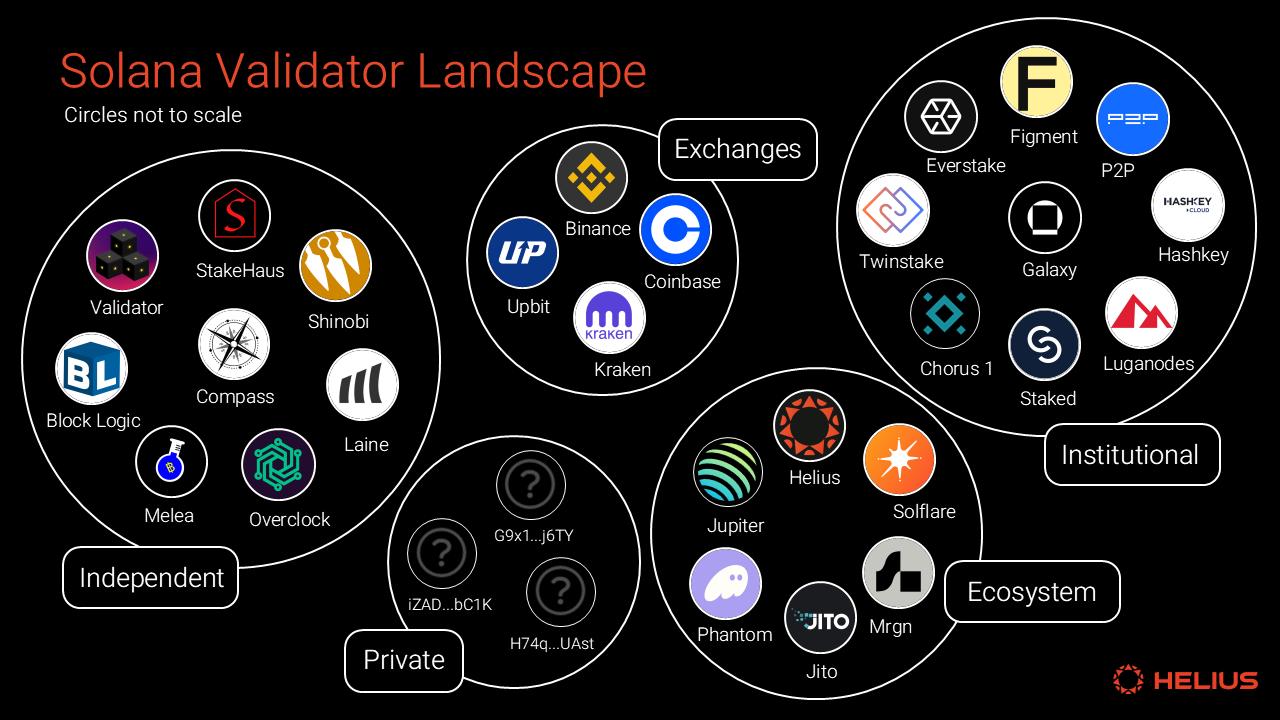

Solana validators can be categorized into several groups.

Ecosystem Teams

Many well-known Solana applications and infrastructure teams operate validators that complement their core business. For example, Helius runs a validator to support its RPC services.

Examples:

Helius

Mrgn

Jupiter

Drift

Phantom

Centralized Exchanges

Centralized exchanges are among the highest staking rate validators on Solana, providing one-click staking solutions for off-chain exchange customers.

Examples:

Kraken

Coinbase

Binance

Upbit

Institutional Solution Providers

These companies specialize in providing customized staking services for institutional clients. They support multiple blockchains to meet a broader range of customer needs.

Examples:

Figment

Kiln

Twinstake

Chorus One

Independent Teams

The Solana validator ecosystem includes many independently operated medium and long-tail validators. Some validators have been active since the network's genesis and contribute to the ecosystem through education, research, governance, and tool development.

Examples:

Laine

Overclock

Solana Compass

Shinobi

Private Validators

The network also has over 200 private validators. Their staking is self-delegated and may be controlled by operating entities. These validators are characterized by a commission rate of 100% and no publicly available identity information on block explorers and dashboards.

What is Liquid Staking?

Liquid staking allows users to diversify their staking exposure across multiple operators through staking pools, which can issue liquid staking tokens (LSTs) that represent users' ownership shares in the underlying staking accounts.

LSTs

LSTs are yield-bearing assets that accumulate rewards based on the annual percentage yield (APY) of the underlying staking account. In native staking, rewards for each epoch directly increase the staked SOL balance. In contrast to native staking, in liquid staking, the number of LSTs remains constant, but their value relative to SOL tokens appreciates over time.

LSTs enhance the capital efficiency of staking by unlocking DeFi opportunities. A typical example is using LSTs as collateral in lending platforms, allowing users to borrow while maintaining their holdings and still earning staking rewards.

Current State of Liquid Staking

Currently, although only 7.8% of SOL staking is done through liquid staking, this segment is growing rapidly. Data shows that liquid staking has accumulated 32 million SOL, up from 17 million at the beginning of 2024, with an annual growth rate of 88%. Among them, JitoSOL has become the most popular liquid staking token in Solana LSTs with a 36% market share, while other notable options include Marinade (mSOL) and JupiterSOL (jupSOL), which account for 17.5% and 11% of the market, respectively.

Tax Advantages

In fact, liquid staking also offers users tax advantages. In many jurisdictions, staking rewards issued in token form are considered taxable events (similar to stock dividends) and are taxed as income upon receipt. However, because the mechanism of LSTs keeps users' wallet balances unchanged, only the value increases, users do not trigger taxable events each time rewards are issued.

Is Staking SOL Safe?

Native staking provides stakers with a direct and secure way to participate in the network validation process. In this method, stakers always control and hold their SOL. If a validator goes offline or performs poorly, non-custodial stakers have the right to unstake at any time and freely switch to other better-performing validators. In the event of a network interruption, native stakers' positions are also unaffected, and once network activity resumes, their positions will remain unchanged.

Similarly, liquid staking, as another option, also provides security guarantees in its unique way. Currently, five reputable companies have conducted nine audits on staking pool programs to ensure their robustness. Nevertheless, investors should remain aware of market volatility and potential risks when using liquid staking. During unfavorable market conditions or "black swan events," the trading price of LSTs may temporarily fall below their underlying value. Although these deviations are usually short-lived, investors should consider tail risks, especially when using LSTs as collateral.

Penalty Mechanism

Slashing is a penalty mechanism that curtails delegated staking to deter malicious or harmful behavior. Although Solana has not yet implemented a slashing mechanism, network developers are actively considering this option and may introduce it in the future.

Finally, stakers should adhere to best practices and securely manage their private keys to prevent loss or theft.

How Does Staking SOL Differ from Staking ETH?

Solana and Ethereum differ in their staking methods. Solana integrates delegated proof of stake (dPoS) directly into its core protocol, allowing for delegation without relying on external solutions. This design enables Solana's staking participation rate to reach 67.7%, representing a significant proportion of the total supply, far exceeding Ethereum's 28%. In contrast, Ethereum has relied more on third-party platforms like Lido and Rocket Pool to provide delegation and liquid staking services during its transition from proof of work to proof of stake.

On the other hand, on Ethereum, home staking is the only native staking option, requiring validators to have a high level of technical proficiency and dedicated hardware. Validators must stake at least 32 ETH and ensure their hardware is always online and well-maintained. This self-custody approach has earned Ethereum a reputation as a highly decentralized blockchain, with thousands of home stakers forming the foundation of the network.

Although home staking plays a significant role on Ethereum, liquid staking has also gained widespread adoption through some major platforms. Among them, Lido holds a leading position, controlling over 28% of the staked ETH supply. Lido issues yield tokens stETH, allowing investors to earn staking rewards while maintaining their ETH holdings. However, like all liquid staking tokens, stETH faces risks, including smart contract vulnerabilities and price deviations from ETH. More importantly, Ethereum's inflationary returns are relatively low, with the annual interest rate for staking ETH using Lido being only 2.9%, significantly lower than the yield for staking SOL. Additionally, Lido charges a 10% fee on staking rewards, further reducing investors' actual returns.

Finally, it is worth noting that Ethereum includes a slashing mechanism to penalize validator misconduct, but slashing events are rare.

Conclusion

This article provides a comprehensive exploration of the concepts, mechanisms, and importance of Solana staking. Understanding staking is crucial for both experienced participants and newcomers to the Solana ecosystem. Staking not only offers a way for long-term holders of SOL to earn competitive yields but is also a core element supporting the security and decentralization of the Solana network.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。