Babylon has raised $96 million in three years, gathering top investment institutions such as Binance Lab, Polychain, OKX Ventures, and ABCDE Capital.

Every time the staking quota is opened, it is quickly snatched up by BTC whales, which has preliminarily verified the market's recognition of Babylon.

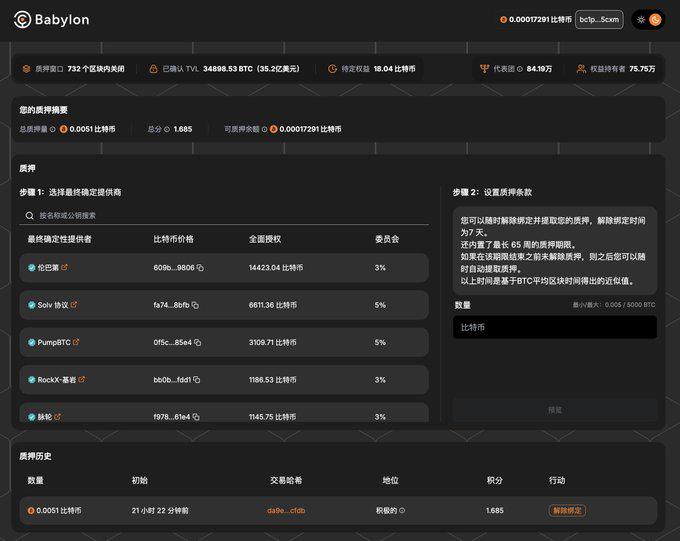

Now, Babylon has launched the third phase of staking, lasting for 1000 block times, approximately one week, with a minimum stake of 0.005 BTC, around $500.

This time, it is clearly providing an opportunity for ordinary users to participate, unlike previous rounds that only allowed institutions and whales to rush in first. Therefore, we ordinary users cannot miss this opportunity. Babylon is bound to be the largest player in the BTC ecosystem by 2025.

Why is Babylon definitely a major player?

Babylon can be compared to Eigenlayer, but Babylon's ceiling may even exceed that of Eigenlayer.

Like Eigenlayer, Babylon is focused on shared security, but Babylon combines Bitcoin's native technology, allowing Bitcoin holders to lock their Bitcoin in a self-custodial manner, without a third-party bridge.

Eigenlayer shares Ethereum's security, while Babylon shares Bitcoin's security. Currently, Ethereum's market cap is about one-third of Bitcoin's market cap, so the security that can be released may also be lower than Bitcoin's, thus presenting a very large market space.

The emergence of Babylon is timely, as it is addressing another important question: how to turn Bitcoin into an income-generating asset?

In traditional financial markets, income-generating assets account for over 90% of total assets, which highlights the importance of income-generating assets in the financial market.

For example, Ethereum transitioned from a PoW mechanism to a PoS mechanism, and due to the staking scenario, Ether can earn staking rewards, turning it into an income-generating asset. This has spurred a series of financial innovations in the Ethereum ecosystem, such as liquid staking, re-staking, and liquidity re-staking, attracting more liquidity into this ecosystem and creating a strong wealth effect.

The Bitcoin ecosystem also needs such income-generating assets as underlying assets to foster new gameplay and accelerate the revitalization of the ecosystem. The Bitcoin ecosystem is like a forgotten ancient continent, filled with untapped virgin land, with more potential waiting to be discovered.

At this moment, this ancient continent needs a Tower of Babel to unite the Bitcoin ecosystem and connect it with other ecosystems, to shine with the miracles and brilliance of the crypto world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。