The news has been tumultuous, and after experiencing a series of spikes and corrections, Bitcoin has finally returned above $100,000. As the year-end market focuses again on the actions of the Federal Reserve, the market is eagerly awaiting developments. However, at this moment, Alipay has brought a bit of shock to the industry.

On December 12, according to reports from Wu Shuo Blockchain, community users reported that some users in mainland China recently received promotional advertisements for cryptocurrency funds on the Alipay fund homepage, stating "Global investment, cryptocurrency soaring, invest from 10 yuan, get on board immediately." Upon verification, the fund in question is the Hua Bao Overseas Technology C (QDII-FOF-LOF), which has a limited purchase mechanism, allowing each person to buy only 1,000 yuan per day.

After receiving this news, I also checked Alipay, but the recommendation mechanism was unclear; I did not see this promotional page, but another colleague found the advertisement for the crypto fund in the "Global Investment" section of the Alipay fund area. Additionally, Hua Bao's products are being sold normally on various fund distribution platforms outside of Ant Wealth, with related displays also appearing on platforms like Licai Tong and China Merchants Bank. Moreover, it seems that the crypto fund is not limited to Hua Bao Overseas Technology C, as the interface also recommends Guofu Global Technology Internet Mixed (QDII).

This move quickly sparked heated discussions in the industry. Does this mean that the mainland is opening up?

Further analysis of Hua Bao and Guofu reveals that both belong to QDII, or Qualified Domestic Institutional Investor. QDII is a system implemented in China since 2006, which allows domestic institutions to invest in overseas capital markets under controlled conditions, despite the non-convertibility of the RMB capital account and the lack of an open capital market.

In other words, due to China's strict foreign exchange management system, domestic investors cannot directly invest in overseas capital markets, but through the establishment of QDII, they can use it as a medium to invest in overseas markets. The two major crypto funds can allocate overseas assets precisely because they have been granted this qualification.

In addition to QDII, Hua Bao Overseas Technology C also has FOF-LOF in its name. FOF refers to funds that primarily invest in other funds, while LOF refers to listed open-end funds, meaning that investors can trade at market prices on the stock exchange in addition to purchasing and redeeming through fund sales institutions. Thus, Hua Bao Overseas Technology C is an open-end fund that can be traded on the exchange and invests in overseas funds.

The structure is quite nested, and in reality, it is also quite nested, merely shifting from retail investors to a higher shell. In summary, domestic retail investors can indirectly participate in overseas asset investment by investing in the aforementioned QDII funds and then using those funds as the main body for overseas allocation. To put it simply, users invest their funds into the fund, and the fund manager then uses that capital to purchase overseas assets, which may include crypto assets, thus completing the purchase of regulated crypto assets in a compliant manner.

Disclosure reports also confirm this point. According to the QDII-LOF report for the Hua Bao Overseas Technology Equity Securities Investment Fund for the third quarter of 2024, the investment strategy section states, "This fund primarily invests in overseas technology-themed related funds (including ETFs), ultimately investing in stocks that support long-term corporate development through technology."

In terms of asset allocation, the fund invests 87.5% in funds, 8.9% in bank deposits and clearing reserves, and the remaining 3.6% in other asset combinations. The question arises: since crypto is the selling point, what is the investment proportion of crypto assets in the fund?

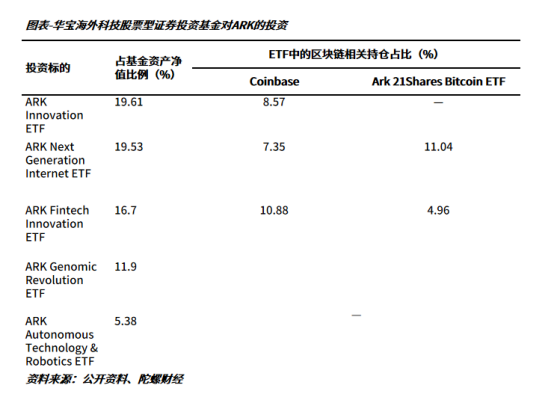

In the core fund investment business segment, more detailed investment specifics provide an answer. Among the top ten funds sorted by fair value as a proportion of the fund's net asset value, five are ARK ETFs under Cathie Wood, accounting for 73.11%. If we delve deeper, the ARK ETF holdings include Coinbase and its own Bitcoin spot ETF, Ark 21Shares Bitcoin ETF. Thus, Hua Bao achieves indirect investment in crypto through layers of nesting. In total, Hua Bao Overseas Technology's investments include approximately 4.93% in Coinbase stock and 2.98% in Ark 21Shares Bitcoin ETF, totaling 7.92%.

The latest scale of Hua Bao Overseas Technology C is only 406 million yuan, and the actual investment proportion in crypto assets is even more insufficient, resembling a case of "hanging a sheep's head while selling dog meat." Alipay has also imposed a purchase limit on this fund, allowing each person to buy only 1,000 yuan per day. Unlike Hua Bao, Guofu mainly focuses on stocks, and there is no mention of blockchain in its top ten disclosures for the quarter. Even in the mid-term report's 36 equity holdings, there are no blockchain companies, indicating a very low actual investment proportion in crypto. It can be seen that, in terms of both amount and proportion, crypto assets do not hold an advantage; rather, the fund itself uses crypto assets as a hot promotional gimmick.

In terms of performance, Hua Bao Overseas Technology C has generally outperformed the market, achieving a net value growth of 25.02% this year, compared to 16.25% for the CSI 300, exceeding it by 9 percentage points. The growth performance has been best in the last three months, with a net value increase of 29.23%. Of course, when compared to directly holding Bitcoin, the difference is significant, and this fund also has a management fee of 1% and a custody fee of 0.2%, making the holding costs relatively higher.

However, for the clearly regulated mainland, this indeed opens a door for investors, providing them with a legal and compliant channel to indirectly hold cryptocurrencies. The direct advertising promotion by Alipay also allows more investors to access such assets. For the industry, even if it is just fund promotion, it has a positive significance.

On the other hand, given Alipay's important position in China's industry, some speculate whether this is a precursor to the mainland's opening up.

Such speculation is not unfounded, as multiple countries have noticed crypto assets and even adopted BTC as national reserves amid the accelerating mainstreaming of Bitcoin. In fact, since Hong Kong issued its virtual asset declaration, rumors about China lifting the ban on virtual currencies have been rampant. Just this July, Galaxy Digital's CEO Mike Novogratz mentioned that China would lift the ban in the fourth quarter.

Recently, Zhao Changpeng reiterated at the Bitcoin MENA conference in Abu Dhabi that although China's stance on cryptocurrencies is somewhat ambiguous and uncertain, the trend of establishing Bitcoin reserves is "inevitable." When the U.S. begins to truly establish Bitcoin reserves, it may prompt other countries to follow suit. At some point, China must also do this because Bitcoin is the only "hard asset." He also believes that, based on China's national conditions, if it were to implement this, it would likely first secretly accumulate Bitcoin on a large scale and then formally announce its strategic plan to the outside world at an appropriate time.

From the perspective of Bitcoin's global recognition and the regulatory trends of major countries, it seems that there may be an opportunity for relaxation regarding cryptocurrencies. However, based on China's current regulatory framework, it is still too early to discuss any opening up.

This year, China's regulatory policies on virtual currencies have remained consistent, merely refining the regulatory framework around this issue. For example, "virtual asset" trading has been included as a method of money laundering, and there has been in-depth research to improve the disposal process and case handling of virtual currencies. If one pays attention, during the recovery of the crypto market this year, many regions have reiterated the 2021 notice issued by ten departments, including the People's Bank of China, the Cyberspace Administration, the Supreme People's Court, and the Supreme People's Procuratorate, regarding further prevention and handling of risks associated with virtual currency trading speculation. For instance, the Shenzhen Municipal Financial Management Bureau issued a notice in February and again in June regarding the risks of virtual currency trading speculation.

Interestingly, the notice explicitly states that "Internet companies must not provide network operating venues, commercial displays, marketing promotions, paid traffic diversion, and other services for virtual currency-related business activities. Any discovered illegal or irregular issues should be reported to the relevant departments in a timely manner, and technical support and assistance should be provided for related investigations and inquiries." Although the legal risks can be largely mitigated through layers of nesting, the cautious Alipay's promotional behavior for this fund may still carry a certain degree of public opinion risk.

In mainstream media, there seems to be no indication of a relaxation regarding virtual currencies. Mainstream media still presents a relatively negative attitude towards cryptocurrencies like Bitcoin. Even when Bitcoin's price exceeds $100,000, the Xinhua News Agency's article "The Financial Ecology and Risks Behind the 'Bitcoin Surge'" still uses terms like "greedy capital and blind investors" to warn of risks.

In fact, even without considering the energy consumption, security risks, market fairness, and other issues of cryptocurrencies, under China's current strict foreign exchange control background, considering the impact of digital currencies on sovereign currencies and the unique anti-censorship nature of decentralized currencies, a comprehensive relaxation of virtual currencies can only be described as a pipe dream.

The current attitude of the central bank governor, Pan Gongsheng, also makes this goal more difficult. As early as 2017, he was a well-known opponent of cryptocurrencies, stating at the time, "As Keynes told us, the time of market irrationality can be long enough to bankrupt you. Therefore, there is only one thing to do: sit by the river and watch; one day, the corpse of Bitcoin will float past you."

In fact, from a regulatory perspective, there are currently no strong supporters of crypto in the political arena. Even Yao Qian, previously praised as "the most knowledgeable government official about blockchain" and "the person who understands digital currency the most in China," was expelled from the party and public office last month, with the announcement directly pointing to his use of virtual currencies for power-for-money transactions.

To some extent, at this stage in China, banning virtual currencies may be a form of political correctness. Of course, a comprehensive opening is difficult, but partial relaxation is not hard to operate. And time is still long; if the U.S. truly lists Bitcoin as a strategic reserve, whether the top-level attitude will change remains to be seen.

However, from the current perspective, indirect investment, for investors who are relatively lacking in knowledge about virtual currencies, is at least a form of investment. In the context of the broader environment in Hong Kong, it can be anticipated that more flexible investment channels suitable for Chinese investors will emerge in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。