New Forces Join the Stablecoin Race: How Does Perena Participate?

Written by: shaofaye123, Foresight News

Stablecoins, as one of the core infrastructures of decentralized finance (DeFi), have always attracted significant attention.

On December 11, Binance Labs announced its investment in Perena's core development team, Quine Co., supporting the establishment of the first stablecoin infrastructure protocol on Solana.

As a core player in the stablecoin space, Tether made a profit of up to $5.2 billion in the first half of this year, with daily earnings exceeding $30 million. Despite the previous collapse of Luna, many projects continue to build in the stablecoin sector.

Recently, ENA returned to 1 U, Usual saw a weekly increase of nearly 60%, and ANZ surged threefold in a single day. Stablecoins across various chains are continuously evolving. This article will give you a quick overview of Perena, a project that has been favored by major VCs since its early days.

What is Perena

The current stablecoin market has a funding scale of $200 billion, and the number of new stablecoins is increasing. Issues such as stablecoin fragmentation, isolated liquidity pools, and user experience problems are becoming increasingly apparent. Perena aims to address these issues, serving as the infrastructure for the stablecoin sector. It does not compete with USDC, PYUSD, etc., but rather provides more efficient and convenient trading for them.

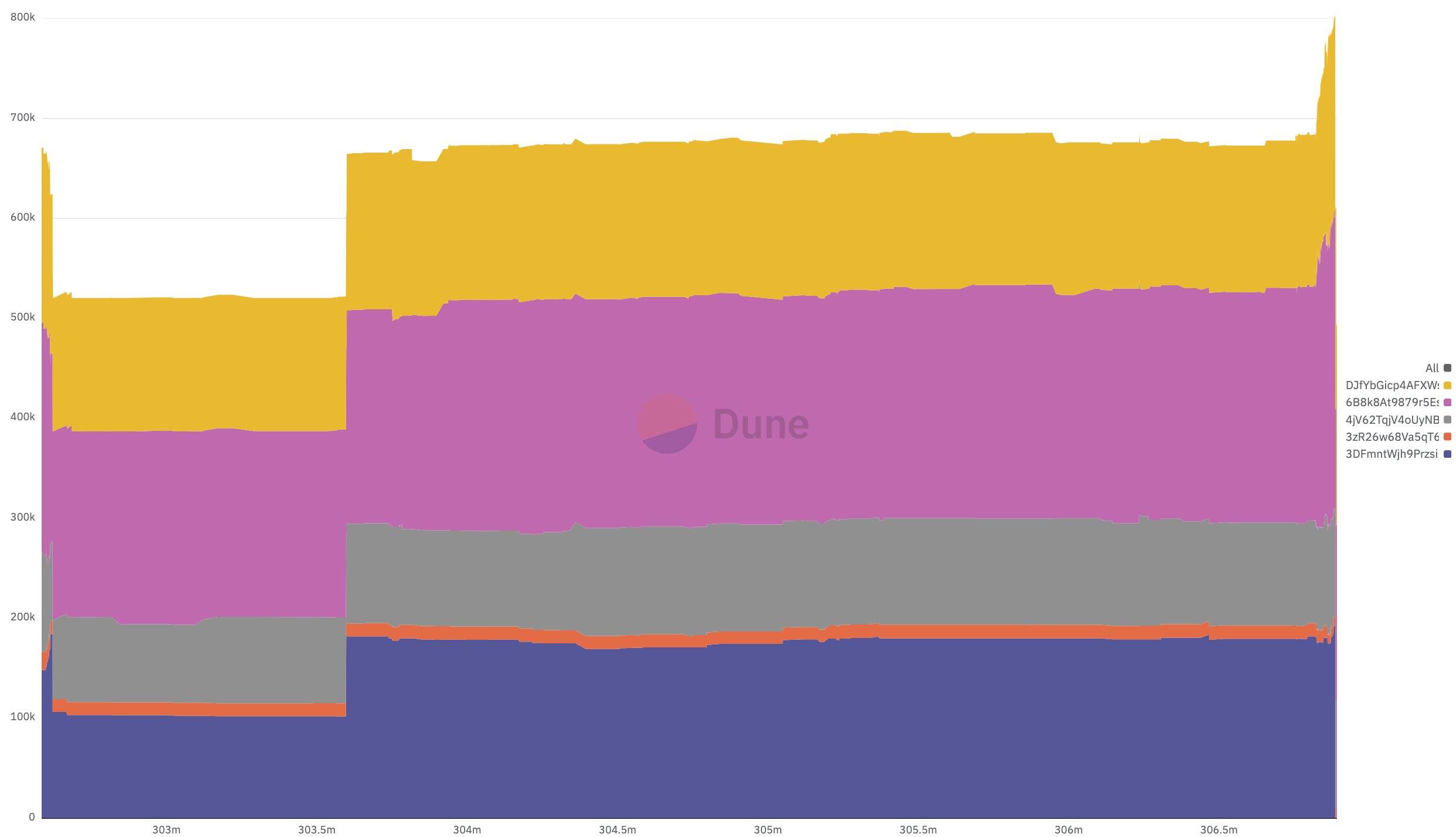

Perena primarily offers an efficient and flexible multi-asset stablecoin exchange platform for the Solana ecosystem, aiming to create a borderless monetary infrastructure. Since Binance announced its investment, the Total Value Locked (TVL) has rapidly increased to nearly $1 million.

The Perena team is quite strong. Perena's founder, Anna Yuan, was the head of stablecoins at the Solana Foundation, where she made significant contributions to the increase in stablecoin issuance on Solana and the launch of non-USD stablecoins, doubling the stablecoin issuance to $3.6 billion. The team also includes professionals from institutions like Jump Trading. Additionally, the team has collaborated with central bank governors and regulatory agencies on stablecoin regulation.

In terms of financing, Perena has not only received support from well-known investors such as Solana co-founders Anatoly Yakovenko and Raj Gokal but has also attracted numerous institutions. It has completed a Pre-Seed round of financing led by Borderless, with investors including Binance Labs, Primitive Crypto, Anagram, Temporal, ABCDE Labs, SevenX Ventures, etc., raising approximately $3 million. Furthermore, Perena has established partnerships with several DeFi protocols.

How Numéraire Operates

Perena has already launched its first product—Numéraire. Numéraire is a multi-asset stablecoin exchange system that introduces the concept of USD*. It utilizes an Automated Market Maker (AMM) mechanism to enable seamless creation and exchange of stablecoins while optimizing liquidity and efficiency across various markets. It addresses the fragmentation issue in the stablecoin ecosystem and reduces the capital requirements for issuing new stablecoins. Users can mint stablecoins through the protocol, earn tokenized real-world asset returns, and utilize a layered collateral debt position system for customized risk-return configurations. However, although Numéraire claims to offer a cheaper and more efficient stablecoin exchange, it currently suffers from higher slippage compared to platforms like Raydium due to liquidity issues.

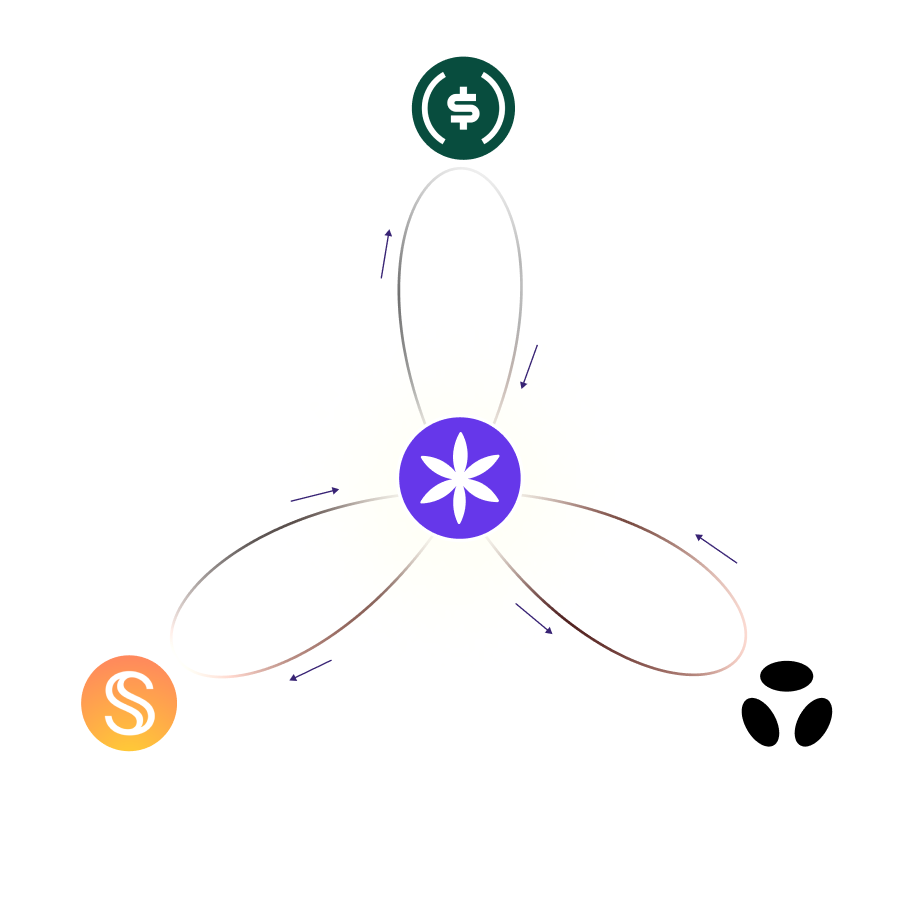

USD* is the core element of the Numéraire system; it is a holdable LP (Liquidity Provider) token that is already tradable and offers potential returns to holders. Through the concept of USD*, Numéraire not only achieves higher capital efficiency but also provides greater flexibility. All stablecoins share the same liquidity pool, reducing capital fragmentation. The lending feature will allow excess stablecoins to be lent out, further improving capital utilization. Additionally, adding stablecoins only requires establishing a relationship with USD*, enabling exchanges with all other stablecoins in the system. USD* serves as an intermediary unit, facilitating more accurate price discovery and reflecting real-time market valuations of various stablecoins.

Numéraire provides an efficient and flexible multi-asset stablecoin exchange platform for the Solana ecosystem through USD*. It not only simplifies the user experience but also offers a more efficient liquidity management solution for the DeFi ecosystem, with advantages including:

Integration of dispersed liquidity among different stablecoins

Efficient price discovery and settlement mechanisms

Opportunities for risk-return configurations

Scalability to meet institutional adoption and real-world needs

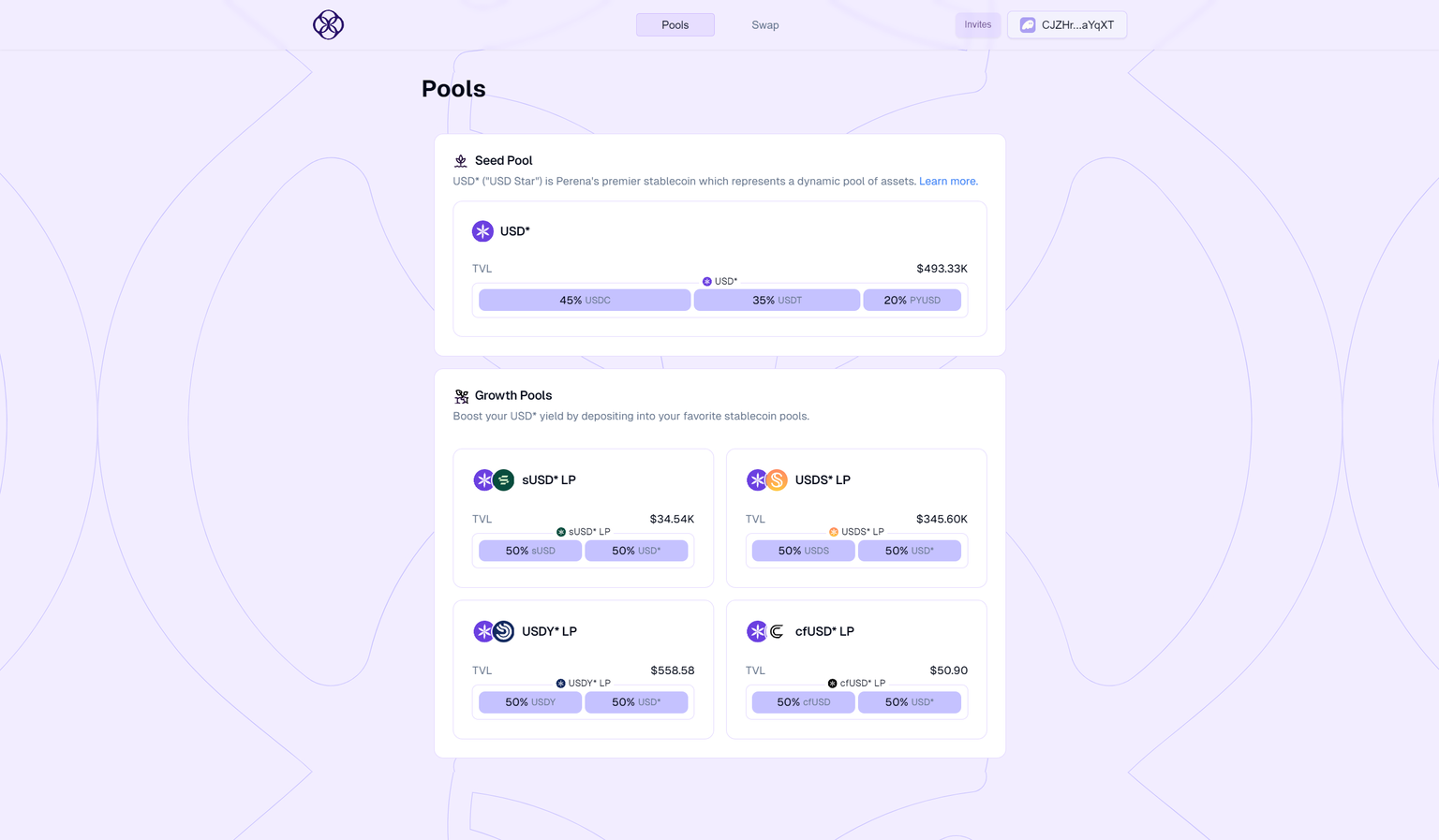

How to Participate

Currently, the project is still in its early stages, with only the Swap and Pool functions available. By trading between stablecoins and forming LPs, users can earn petal points. The Swap pool is accessible without an invitation code, while the Pool requires a referral code or reaching 700 points to unlock. Referrers can earn 5% of the points earned by referred users. Upon reaching 700 points, users can generate 4 invitation codes, and for every additional 1000 points, they can earn 2 more invitation codes. Using a referral code during registration will grant both the user and the referrer 100 petal points. The Pool function remains permanently open once accessed. Currently, trading supports 7 stablecoins, including USDC, PYUSD, and sUSD.

Daily Point Earning Methods:

Swap:

- Users can earn up to 500 points per day through trading. A maximum of 10 trades per day is allowed, with $1 worth equating to 0.1 points, and a maximum of 50 points can be earned per trade (a maximum of 500 U in trading volume is required to earn the maximum points).

Pool: (Currently no point cap; the larger the amount, the more petal points earned)

Seed Pool: 10 petal/$/day

Growth Pool: 20 petal/$/day

USD*: 100 petal/day (balance greater than $100)

Other LP tokens: 100 petal/day (balance greater than $100), e.g., sUSD-USD* LP, USDS-USD* LP

Perena has a promising vision and a luxurious investment background. However, as an on-chain stablecoin exchange platform, whether there is a real demand for it remains in question. Currently, trading stablecoins on centralized exchanges is still fee-free, which may require it to compete more with centralized exchanges than with on-chain trading platforms like Raydium. Perhaps only when on-chain funds continue to flow in, on-chain applications flourish, or when it truly integrates with real assets (such as wage issuance) can Perena play a more significant role.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。