The think tank proposing the allocation of Bitcoin believes that Microsoft cannot miss the next wave of technological innovation, and Bitcoin is that wave.

Written by: Li Dan, Wall Street Insights

Even though Bitcoin has seen a significant rise since Trump's election as President of the United States, the tech giant Microsoft, which holds a prominent position in the U.S. stock market, is currently not considering allocating Bitcoin.

On Tuesday, December 10, Eastern Time, Microsoft shareholders voted against a proposal regarding the allocation of Bitcoin, stating that Microsoft's existing strategy is already evaluating various investable assets, including Bitcoin, as part of a broader investment framework.

The proposal in question, titled "Assessment of Investment in Bitcoin," was submitted by the conservative think tank National Center for Public Policy Research (NCPPR) based in Washington. This think tank advocates that Bitcoin is a "good tool for hedging against inflation, even if it is not the best."

NCPPR defines Bitcoin as a responsibility for companies to provide value to shareholders through profit diversification. The introductory video of their summarized proposal states:

"Microsoft cannot miss the next wave of technological innovation, and Bitcoin is that wave."

NCPPR believes that adopting Bitcoin could create trillions of dollars in value and eliminate risks for shareholders. The video also echoed the content of the proposal text: the adoption of Bitcoin by institutions and companies is becoming increasingly common, with Microsoft's second-largest shareholder, BlackRock, offering Bitcoin spot ETFs to its clients.

The NCPPR proposal argues that Bitcoin is "more volatile" than corporate bonds, thus suggesting not to hold "too much," but at the same time recommending not to let shareholder value suffer from "completely ignoring Bitcoin." Therefore, it suggests that Microsoft should use 1% to 5% of its profits to purchase Bitcoin. The proposal formally requests Microsoft "to assess whether including Bitcoin for corporate balance sheet diversification is in the best long-term interest of shareholders."

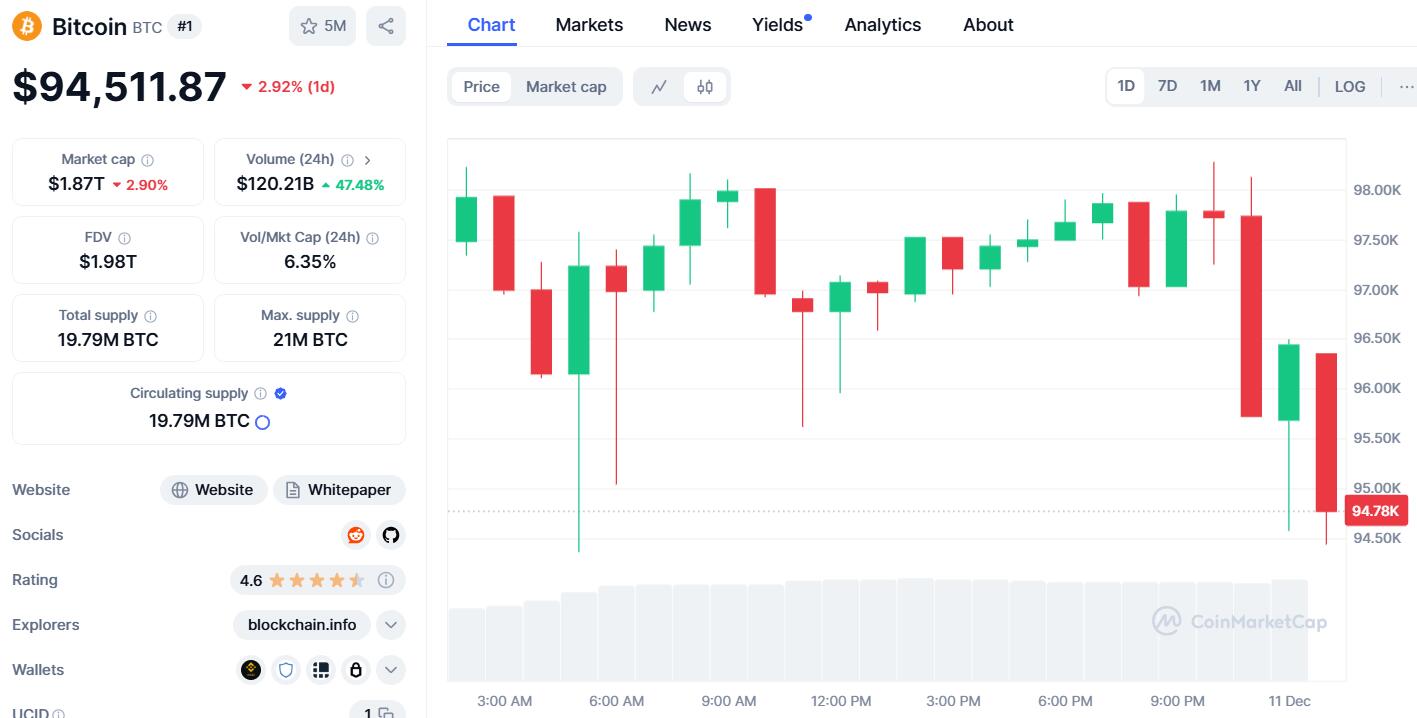

After Microsoft shareholders voted down the proposal to hold Bitcoin, Bitcoin fell back below $95,000 during Tuesday's U.S. stock market session. Data from CoinMarketCap shows that Bitcoin's trading price dipped below $94,500 during the U.S. midday session, approaching the day's low refreshed in the Asian market on Tuesday, dropping over $3,800 from the day's high of above $98,200 in the early U.S. market, a decline of nearly 4%.

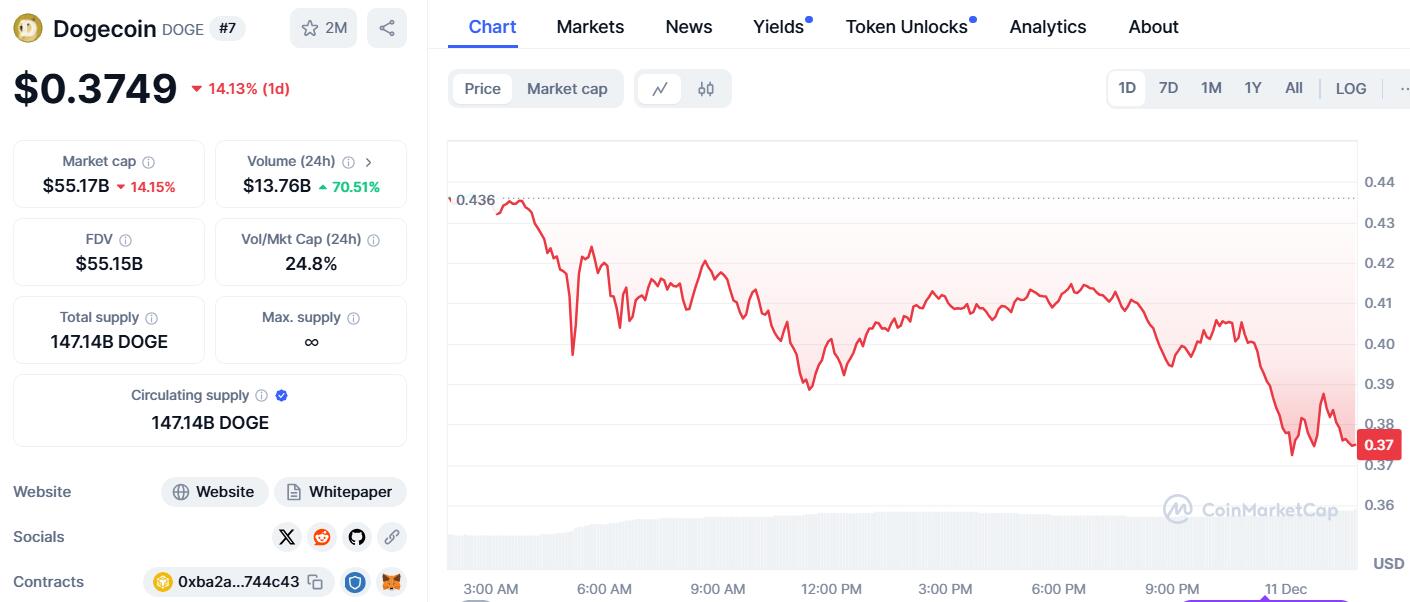

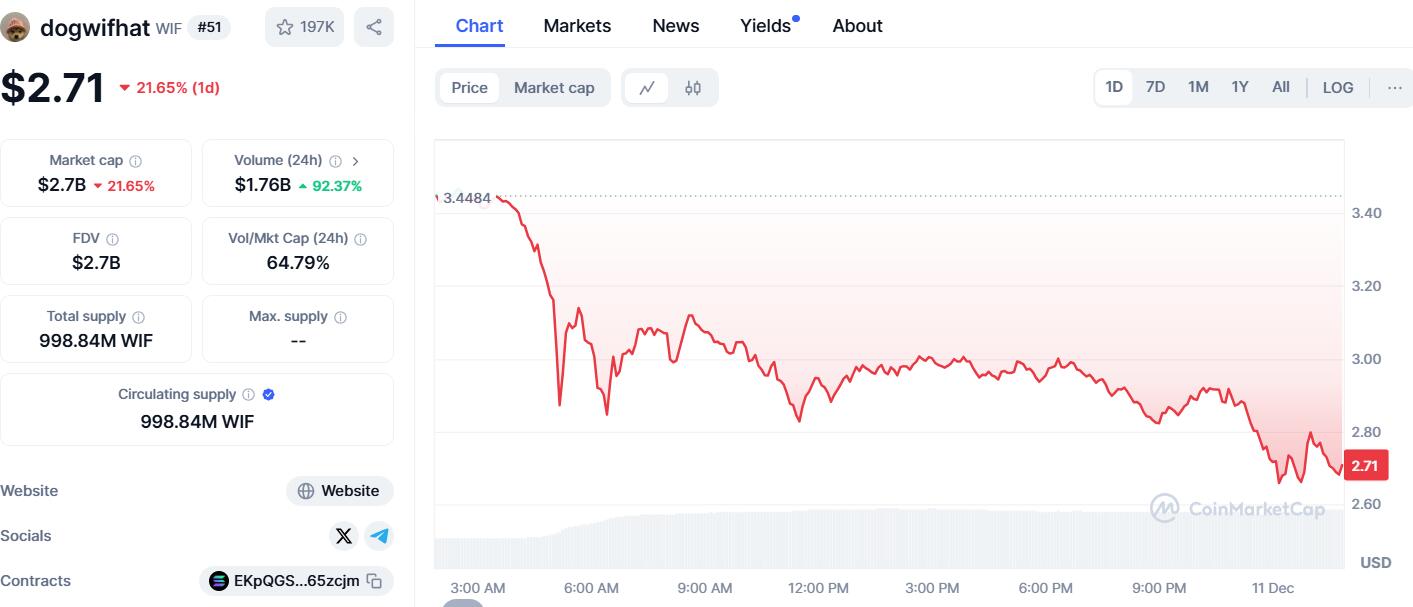

At the same time, the decline in meme coins expanded, with CoinMarketCap data showing that Dogecoin (DOGE), ranked seventh in global cryptocurrency market capitalization, recently fell over 14% in the last 24 hours, while dogwifhat (WIF), ranked 51st by market cap, dropped over 20% during the day.

Microsoft shareholders reject proposal to reduce AI risks related to misinformation and data privacy breaches

On Tuesday, Microsoft shareholders also rejected a proposal concerning AI risks. This proposal called for Microsoft to reduce AI risks ranging from misinformation to data privacy breaches and to disclose such risks.

The proposal was submitted by the conservative nonprofit organization National Legal and Policy Center (NLPC), which believes that shareholders "should be concerned about Microsoft's record on data ethics" and mentioned that OpenAI, the AI unicorn heavily invested in by Microsoft, has been accused of stealing users' personal information without notice or permission.

The AI proposal presented on Tuesday reflects concerns that Microsoft developers might use data from unethical or illegal sources to train generative AI, such as personal information, copyrighted works, or proprietary business information provided by users.

Commentators believe that this proposal faced by Microsoft shareholders reflects that, in the face of rapidly evolving AI technology, investors are demanding that companies consider developing new transparency and ethical policies for the development and use of AI, including generative AI.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。