With the global stimulus policies of China and other major central banks, the increasing institutional adoption rate, and the rapid advancements in blockchain technology, the outlook for 2025 appears quite bright.

Written by: Matt Hougan, Ryan Rasmussen, Bitwise

Translated by: Yuliya, PANews

The year 2024 is set to be a milestone year for the cryptocurrency market. Bitcoin soared to an all-time high of $103,992 (as of the time of writing, up 141.72% year-to-date), primarily driven by the record issuance of the U.S. spot Bitcoin ETF, which attracted $33.56 billion in assets. Other major crypto assets also saw significant gains: Solana rose 127.71%, XRP increased 285.23%, and Ethereum climbed 75.77%. Meanwhile, cryptocurrency-related stocks like MicroStrategy and Coinbase surged 525.39% and 97.57%, respectively.

Record prices are not the only noteworthy development. Cryptocurrency has clearly taken center stage in the 2024 U.S. elections, which bodes well for the regulatory outlook for cryptocurrencies in the U.S. Elected President Trump supported cryptocurrencies during his campaign, promising to establish a Bitcoin strategic reserve and restructure the SEC (which has historically been hostile towards cryptocurrencies). He also nominated Scott Bessent as Treasury Secretary, who has stated, "Cryptocurrency represents freedom, and the crypto economy will be here for the long term." As we enter 2024, Congress also appears to lean towards supporting cryptocurrencies, with pro-crypto candidates defeating opponents in several key elections. Legislative support for cryptocurrencies is expected in the coming months.

With the global stimulus policies of China and other major central banks, the increasing institutional adoption rate, and the rapid advancements in blockchain technology, the outlook for 2025 appears quite bright.

TL;DR

01: Bitcoin, Ethereum, and Solana will reach all-time highs, with Bitcoin trading above $200,000.

02: Inflows into Bitcoin ETFs in 2025 will exceed those in 2024.

03: Coinbase will surpass Charles Schwab to become the world's most valuable brokerage, with its stock price breaking $700 per share.

04: 2025 will be the "Year of Crypto IPOs," with at least five crypto unicorns going public in the U.S.

05: Tokens issued by AI agents will lead to a larger meme coin craze than in 2024.

06: The number of countries holding Bitcoin will double.

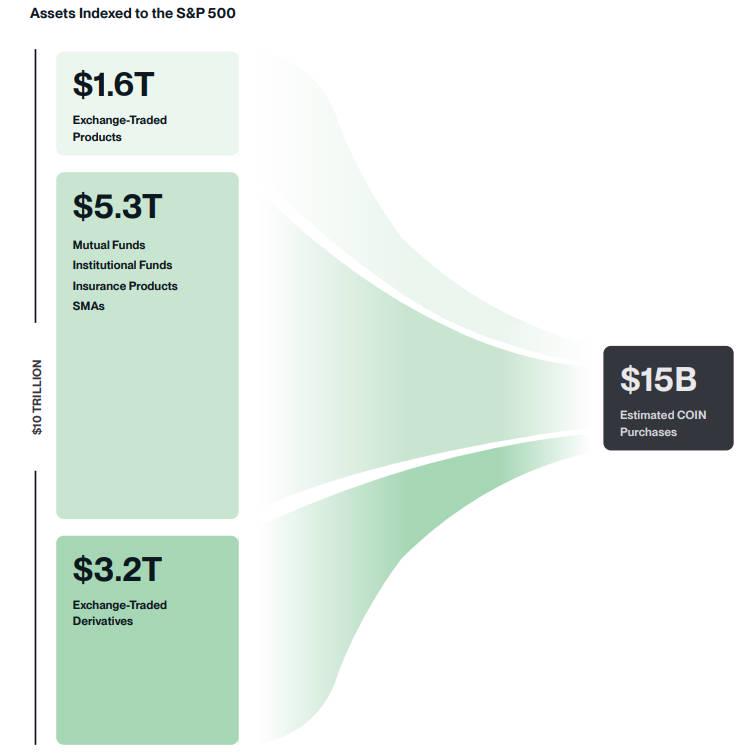

07: Coinbase will enter the S&P 500 index, and MicroStrategy will enter the Nasdaq 100 index, adding cryptocurrency exposure to (almost) every U.S. investor's portfolio.

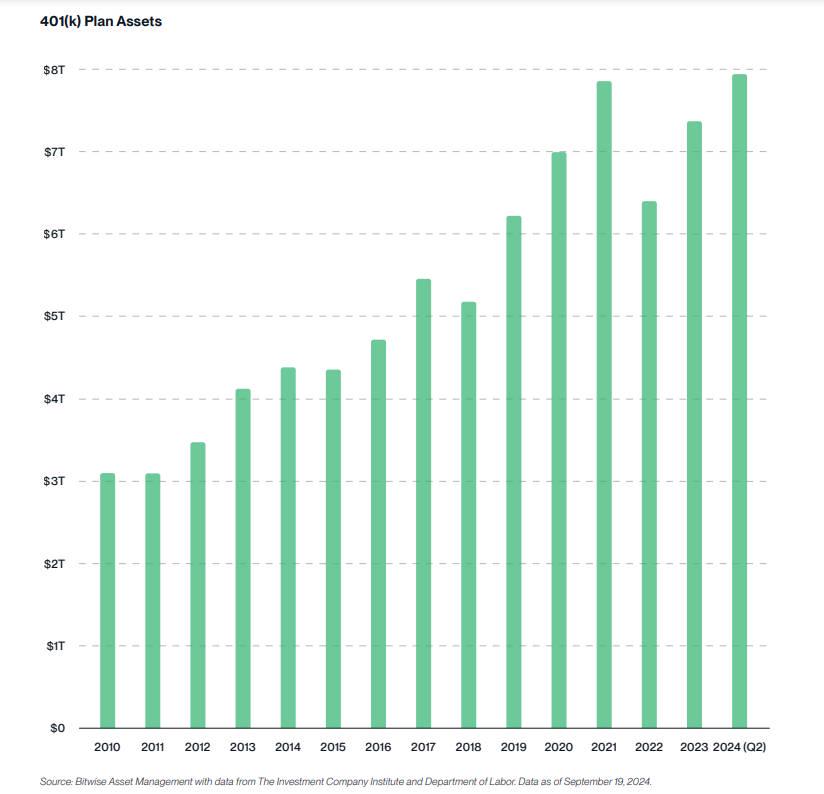

08: The U.S. Department of Labor will relax guidance on cryptocurrency in 401(k) plans, allowing hundreds of billions of dollars to flow into crypto assets.

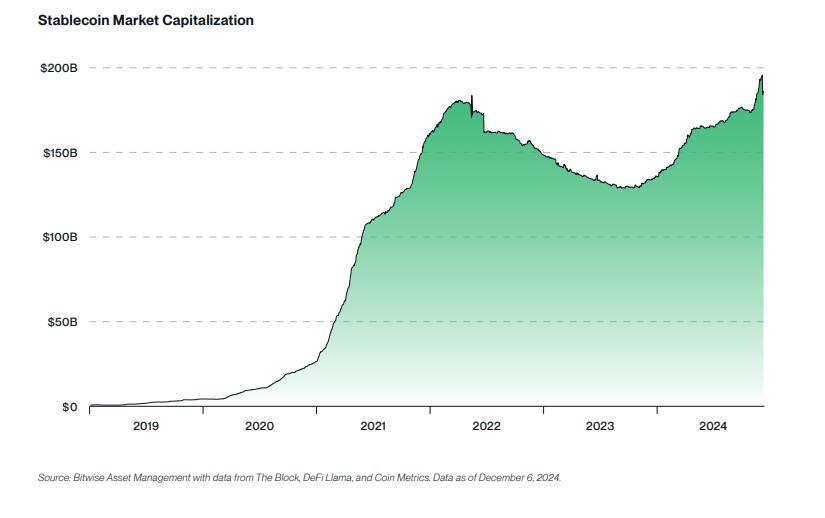

09: With the long-awaited stablecoin legislation passed in the U.S., the market cap of stablecoins will double to $40 billion.

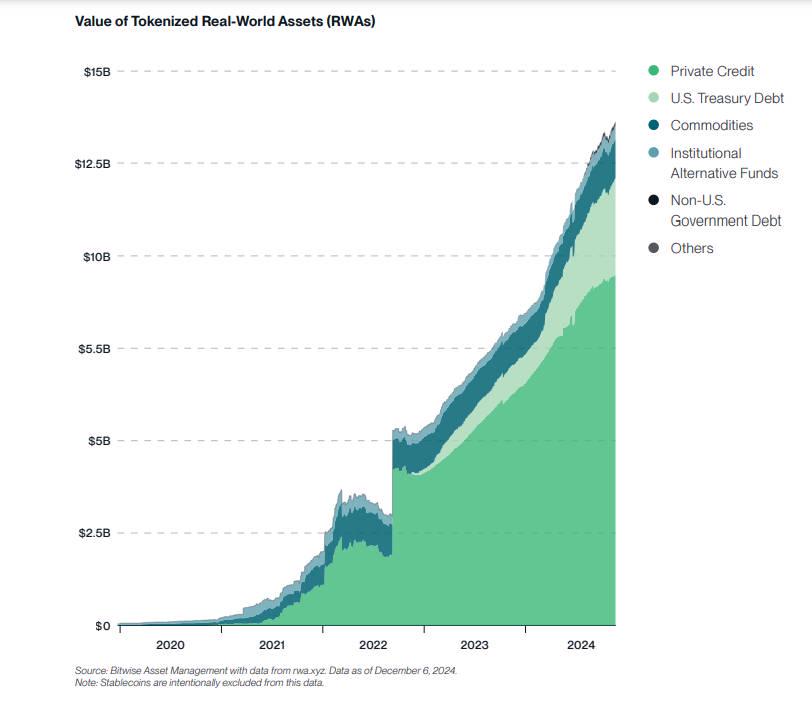

10: As Wall Street's acceptance of cryptocurrencies deepens, the value of tokenized real-world assets (RWA) will exceed $50 billion.

Additional Prediction: By 2029, Bitcoin will surpass the $18 trillion gold market, trading above $1 million per coin.

Prediction 1: Bitcoin, Ethereum, and Solana will reach all-time highs, with Bitcoin breaking $200,000

The three giants of cryptocurrency—Bitcoin, Ethereum, and Solana—outperformed all major asset classes in 2024, rising 141.72%, 75.77%, and 127.71%, respectively. In contrast, the S&P 500 index rose 28.07%, gold increased 27.65%, and bonds rose 3.40%.

This momentum is expected to carry into 2025, with Bitcoin, Ethereum, and Solana all reaching new historical highs. Specific target prices are as follows:

Bitcoin: $200,000

Record ETF inflows drove Bitcoin to a new high in 2024

This trend is expected to continue

The April 2024 halving will reduce new supply

New buying demand from corporations and governments

If the U.S. government implements the proposal to establish a strategic reserve of 1 million Bitcoins, prices could reach $500,000 or higher

Ethereum: $7,000

Despite a 75.77% increase in 2024, Ethereum's attention among investors has waned

A narrative shift is expected in 2025

Driving factors include:

Accelerated activity on Layer 2 blockchains (such as Base and Starknet)

Spot Ethereum ETFs attracting billions in inflows

Massive growth of stablecoin and tokenization projects on Ethereum

Solana: $750

Strong recovery in 2024 driven by meme coin frenzy

Momentum is expected to continue strengthening

Catalysts for 2025 will include the migration of "serious" projects to the network

There are early cases, such as the migration of the Render project

This trend is expected to accelerate in the coming year

Catalysts

Increased institutional investment

Continued corporate buying

Investment banks approving cryptocurrency operations

U.S. strategic Bitcoin reserve plan

Better regulatory and political environment

Bitcoin halving leading to tighter supply

Layer-2 scaling solutions

Macro tailwinds (interest rate cuts, China's stimulus policies)

Increased allocation ratios (3% becoming the new 1% standard)

Potential Downsides

Disappointing Washington policies

Leverage liquidation risks

Government sell-offs

Meme coin craze failures

Interest rate cuts falling short of expectations

Prediction 2: Inflows into Bitcoin ETFs in 2025 will exceed those in 2024

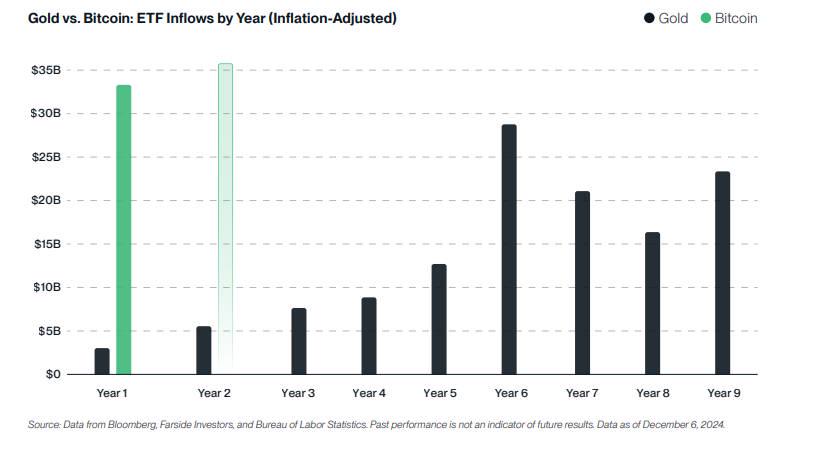

When the U.S. spot Bitcoin ETF launched in January 2024, ETF experts predicted that the product group would attract $5 billion to $15 billion in inflows in its first year. In reality, it exceeded the upper end of that range within the first six months. Since its launch, these record ETFs have attracted $33.6 billion in inflows. Inflows in 2025 are expected to exceed this figure. Three supporting reasons for this prediction:

1. The first year is usually the slowest for ETFs

The best historical analogy for Bitcoin ETFs is the launch of gold ETFs in 2004

That year, gold ETFs attracted $2.6 billion in inflows, which was exciting

But the following years (numbers adjusted for inflation) were as follows:

Year 2: $5.5 billion

Year 3: $7.6 billion

Year 4: $8.7 billion

Year 5: $16.8 billion

Year 6: $28.9 billion

The key point: inflows in the second year exceeding those in the first year aligns with the development pattern of gold ETFs, while a decrease in inflows would be unusual.

2. Major investment banks are joining in

The world's largest investment banks (including Morgan Stanley, Merrill Lynch, Bank of America, and Wells Fargo) have yet to unleash the power of their wealth management teams

These financial advisors currently have virtually no access to these products

This situation is expected to change in 2025

Trillions of dollars managed by these firms will begin to flow into Bitcoin ETFs

3. Investors are gradually increasing allocations—1% becoming 3% is the new trend

Bitwise has observed a clear pattern over the past seven years while helping investment professionals enter the cryptocurrency market:

Most investors start with small allocations and gradually increase over time

It is expected that most investors who purchase Bitcoin ETFs in 2024 will double their investments in 2025

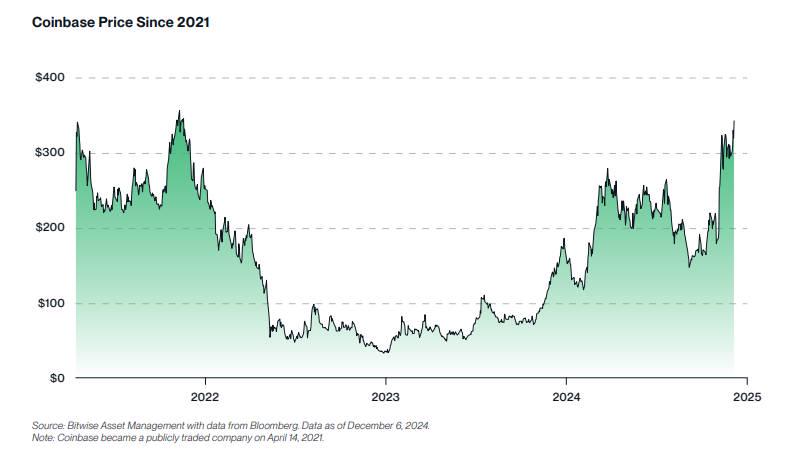

Prediction 3: Coinbase will surpass Charles Schwab to become the world's most valuable brokerage, with its stock price breaking $700

At the beginning of 2023, investors could purchase Coinbase stock for $35. Today, its stock price has reached $344, nearly a tenfold increase. Predictions indicate that this price may continue to rise significantly.

Prediction: Coinbase stock will break $700 in 2025 (more than doubling from the current price). This will make Coinbase the world's most valuable brokerage, surpassing Charles Schwab.

The reason is that Coinbase is more than just a brokerage.

Three main catalysts driving its growth:

1. Stablecoin business

Thanks to an agreement with USDC issuer Circle, Coinbase's stablecoin business is thriving

Year-to-date, stablecoin revenue has grown by $162 million (+31%)

If the trajectory of stablecoins continues as expected, this trend will persist

2. Base Network

Last year, Coinbase launched Base, a new Layer 2 network based on Ethereum

It currently ranks first in both trading volume and total value locked among L2 networks

With growth comes substantial revenue

Base now generates tens of millions of dollars in revenue each quarter

As more developers, users, and capital flow into the ecosystem, this revenue is expected to grow further

3. Staking and custody services

As of the third quarter, these two businesses generated $589 million in revenue

This is an increase of $304 million (+106%) compared to the same period last year

Both businesses are driven by asset balances and net new asset inflows

Both metrics are expected to increase significantly in 2025

Annual revenue from these business lines is expected to exceed $1 billion

Prediction 4: 2025 will be the "Year of Crypto IPOs," with at least five crypto unicorns going public in the U.S.

In recent years, the IPO landscape in the cryptocurrency sector has been relatively quiet. However, 2025 is expected to usher in a wave of IPOs from crypto unicorns.

Why Now?

The current backdrop for publicly listed cryptocurrency companies is significantly different from previous years:

Rising cryptocurrency prices

Increased investor demand

Surge in institutional adoption

Blockchain technology has become mainstream

Favorable macro environment

Most importantly, the political climate has warmed up

These factors collectively create favorable conditions for industry giants to go public.

Top Five Candidates for IPOs in 2025:

- Circle

Issuer of USDC (one of the largest stablecoins)

Actively preparing for an IPO

Holds a strong position in the stablecoin market

Expanding into new financial services

- Figure

Known for leveraging blockchain technology to provide various financial services

Offers mortgage, personal loan, and asset tokenization services

Has been exploring IPO possibilities since 2023

With Wall Street's increasing focus on tokenization, the timing may be ripe

- Kraken

One of the largest cryptocurrency exchanges in the U.S.

Has been considering an IPO since 2021

Plans delayed due to market conditions

May regain momentum in 2025

- Anchorage Digital

Provides digital asset infrastructure services

Diverse client base, including investment advisors, asset managers, and venture capital firms

Holds federal charter bank status

Comprehensive crypto services may prompt it to seek an IPO

- Chainalysis

Market leader in blockchain compliance and intelligence services

Unique service offerings

Strong growth trajectory

With the increasing emphasis on compliance in the crypto industry, it is highly likely to enter the public market

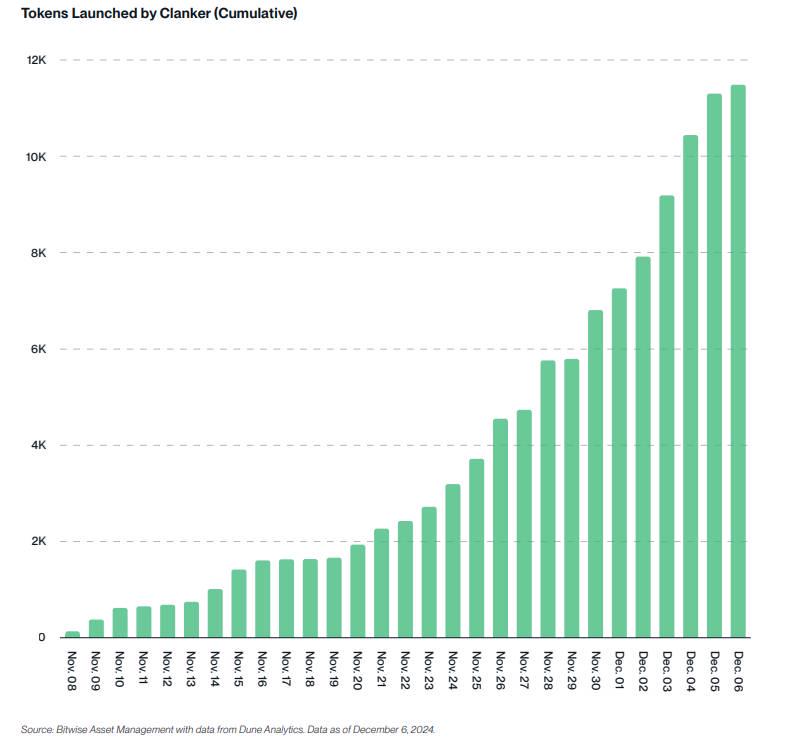

Prediction 5: Tokens Issued by AI Agents Will Lead to a Larger Meme Coin Craze than in 2024

A larger meme coin craze than in 2024 is expected in 2025, with tokens issued by AI agents becoming the leaders of this wave.

GOAT Case: The First Collision of AI and Meme Coins

A striking case comes from Marc Andreessen of a16z and his interaction with the autonomous chatbot Truth Terminal. The AI agent promoted a niche meme coin called GOAT, which started as an experimental project and ultimately surpassed a market cap of $1.3 billion, showcasing the immense potential of the combination of AI and meme coins.

Clanker: A Pioneering AI Token Issuance Platform

Clanker serves as an innovative platform that enables autonomous token deployment on Coinbase's Layer 2 scaling solution, Base.

Users simply need to tag Clanker on Farcaster and provide the token name and image, and the AI agent can automatically complete the token deployment.

In just one month after its launch, Clanker has issued over 11,000 tokens, generating over $10.3 million in fee revenue.

Future Outlook

AI-issued tokens are expected to drive a new wave of meme coins in 2025. Although these tokens may lack practical application value and most may ultimately go to zero, they represent the fusion of two groundbreaking technologies: AI and cryptocurrency, a trend that will continue to attract market attention.

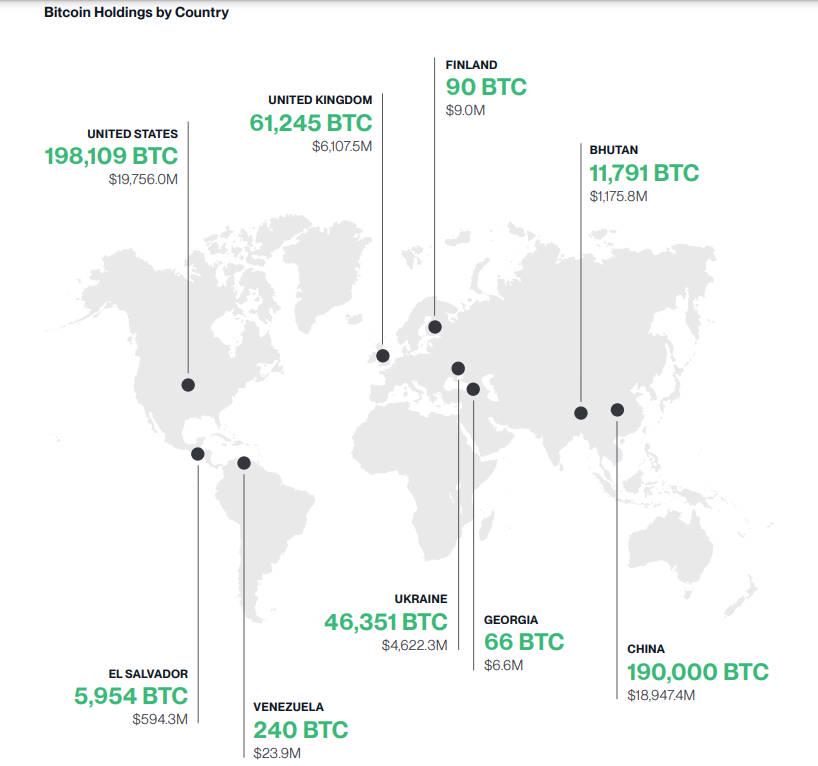

Prediction 6: The Number of Countries Holding Bitcoin Will Double

Prospects for U.S. Strategic Reserves

There remains uncertainty about whether the U.S. will establish a Bitcoin strategic reserve in 2025. While there are positive signals:

Wyoming Republican Senator Cynthia Lummis has proposed a bill suggesting the U.S. purchase 1 million Bitcoins within five years

Incoming President Trump has expressed support for this proposal

However, according to Polymarket predictions, the likelihood is below 30%

Global Competitive Landscape

The U.S. consideration of establishing a Bitcoin strategic reserve has already triggered a chain reaction globally:

Legislators from Poland to Brazil are proposing bills to establish their own Bitcoin strategic reserves

Governments are accelerating their plans to avoid missing the opportunity

Current Status and Future Outlook

According to data from BitcoinTreasuries.net:

Currently, nine countries hold Bitcoin, with the U.S. leading the way

This number is expected to double by 2025

Prediction 7: Coinbase Will Enter the S&P 500, MicroStrategy Will Enter the Nasdaq 100

Coinbase and MicroStrategy, two major publicly listed companies in the cryptocurrency sector, will be included in mainstream stock indices, meaning that nearly all U.S. investors' portfolios will gain exposure to the cryptocurrency space.

Market Status

Ordinary U.S. investors currently have no exposure to cryptocurrencies.

As an emerging asset class, many investors either do not understand it or actively choose to avoid it.

However, almost every investor holds funds that track the S&P 500 or Nasdaq 100.

Many investors hold both types of index funds simultaneously.

Potential Impact

Once these two companies are included in the indices, it will have a massive market impact:

Approximately $10 trillion in assets directly track the S&P 500 index

An additional $6 trillion in assets benchmark against this index

Expected inflows into Coinbase after inclusion in the index:

Index funds will need to buy about $15 billion worth of stock

Benchmark funds may bring an additional $9 billion in buying demand

Although MicroStrategy will have a relatively smaller impact due to the smaller tracking fund size of the Nasdaq 100, it will still have a significant effect.

Prediction 8: The U.S. Department of Labor Will Relax Guidance on Cryptocurrency in 401(k) Plans

In March 2022, the U.S. Department of Labor issued guidance warning 401(k) plan fiduciaries to be aware of the significant risks associated with cryptocurrency investment options, announcing the initiation of an investigation project to protect plan participants from these risks.

With the arrival of a new government in Washington, it is expected that the Department of Labor will relax this strict guidance. The significance of this policy change can be seen in the data:

U.S. 401(k) plans currently manage $8 trillion in assets.

These funds continue to receive weekly inflows.

If the allocation ratio for cryptocurrencies reaches:

1%: It will bring $80 billion in new funds to the cryptocurrency sector.

3%: It will bring $240 billion in new funds.

Prediction 9: The Market Cap of Stablecoins Will Double to $40 Billion, and the U.S. Will Pass Long-Awaited Stablecoin Legislation

The stablecoin market is expected to thrive in 2025, with a market cap reaching $40 billion or higher. This growth will be driven by several key factors:

Stablecoin Legislation

Pro-cryptocurrency policymakers in Washington are most likely to achieve comprehensive stablecoin legislation. This will address important questions, including who will regulate and what the appropriate reserve requirements are. Clear regulations will spark immense interest from issuers, consumers, and businesses. Major traditional banks like JPMorgan are expected to enter this space.

Fintech Integration

Stripe's $1.1 billion acquisition of the stablecoin platform Bridge has stated that stablecoins, with their speed, accessibility, and low cost, have become the "superconductor of financial services." PayPal launched its own stablecoin (PYUSD) in 2023, and Robinhood recently announced plans to collaborate with several cryptocurrency companies to launch a global stablecoin network. As stablecoins become integrated into popular fintech applications, the asset management and transaction volume of stablecoins will significantly increase.

Global Trade and Remittances

In 2024, stablecoin transaction volume reached $8.3 trillion, close to Visa's $9.9 trillion payment volume during the same period. Stablecoin giant Tether recently provided financing for a $45 million crude oil transaction through its USDT stablecoin. As the digital dollar continues to disrupt these massive markets, demand for stablecoins will continue to grow.

Bull Market Growth

As the most obvious catalyst, the overall expansion of the cryptocurrency market will drive the growth of stablecoin assets under management. The cryptocurrency market is bullish in 2025, and the stablecoin market will grow alongside it.

Prediction 10: As Wall Street Accelerates Its Entry, the Scale of RWA Tokenization Will Exceed $50 Billion

Three years ago, the cryptocurrency industry had tokenized less than $2 billion of real-world assets (RWAs), including private credit, U.S. debt, commodities, and stocks. Today, this market size has reached $13.7 billion.

The significant growth in tokenization can be attributed to its clear advantages: it offers instant settlement, costs far below traditional securitization, and 24/7 liquidity, while bringing transparency and accessibility to almost all asset classes.

Larry Fink, CEO of BlackRock, has transformed from a former Bitcoin skeptic to a staunch supporter of tokenization, stating that "securities tokenization will become the next generation of the market." This statement from the head of the world's largest asset management company carries significant weight.

Wall Street has only just begun to recognize this, which means that a large influx of institutional capital may soon flow into the tokenized RWA space.

By 2025, the market size for tokenized RWAs is expected to reach $50 billion, with the potential for exponential growth thereafter.

Venture capital firm ParaFi recently predicted that by 2030, the market size for tokenized RWAs could grow to $2 trillion, while the Global Financial Markets Association forecasts it could reach $16 trillion.

Additional Prediction: By 2029, Bitcoin Will Surpass the $18 Trillion Gold Market, with a Price Exceeding $1 Million

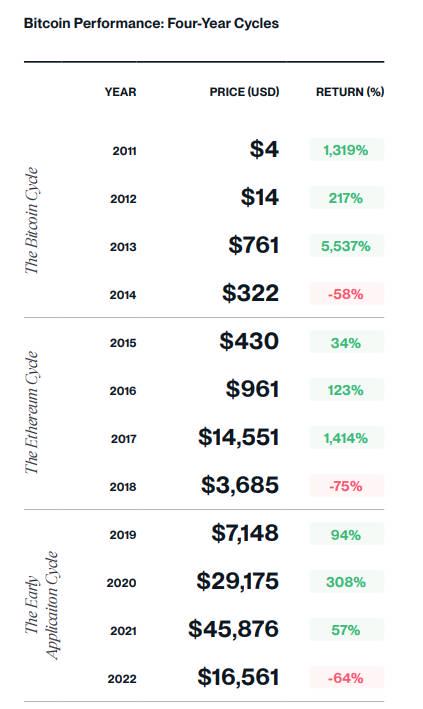

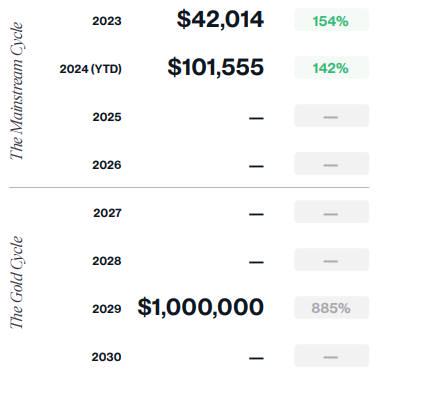

While people often tend to make one-year predictions, the long-term outlook for Bitcoin is even more striking.

It is expected that by 2029, Bitcoin's market capitalization will surpass that of the gold market. Based on gold's current market cap, this means the price of each Bitcoin will exceed $1 million.

There is a reason for choosing the year 2029: Bitcoin has historically operated on a four-year cycle. Although this pattern may not necessarily continue, 2029 will mark the peak of the next cycle (and also the 20th anniversary of Bitcoin's inception). Surpassing the gold market within 20 years of its inception would undoubtedly be a significant achievement, and Bitcoin is poised to achieve this goal.

Notably, if the U.S. announces the purchase of 1 million Bitcoins to establish a strategic reserve, the timeline for Bitcoin's price to exceed $1 million could be significantly accelerated.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。