Every field has its unique "moat" and different ways to capture value.

Author: Rob Hadick >|<

Translated by: Deep Tide TechFlow

Recently, many people have asked me about the future direction of the stablecoin market and which parts of the value chain in this ecosystem might accumulate the most value. To that end, I am sharing some unvarnished personal insights here.

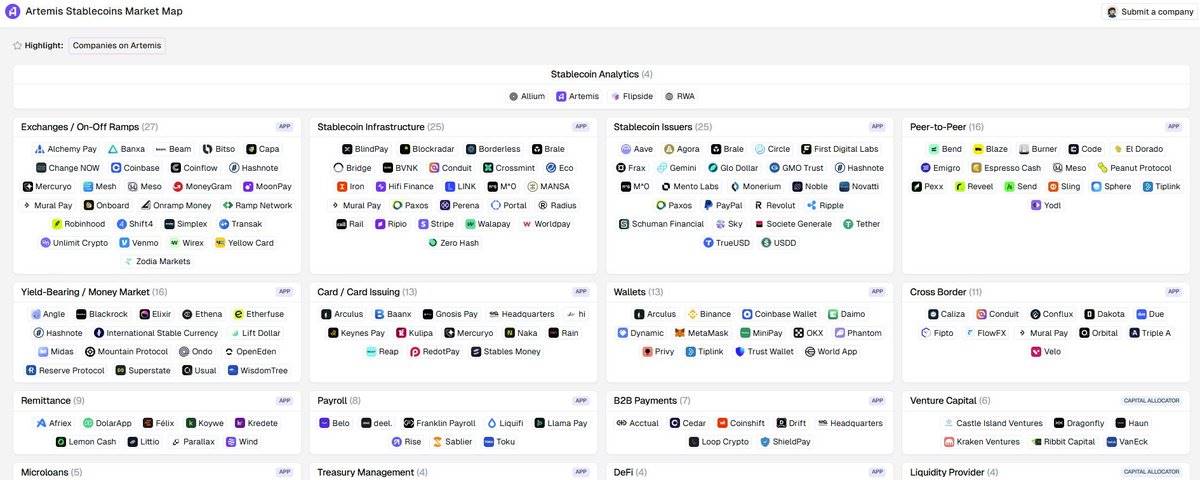

In my analysis, I have divided the market into several categories—more detailed than most frameworks I have seen (though not as comprehensive and complex as @artemis__xyz's market map, which is indeed excellent)—because the payment system itself is full of complexities and nuances. For investors, understanding the responsibilities and value attribution of each role is particularly important, as they often overlook these critical details. I have categorized the stablecoin market into the following seven categories:

(1) Settlement Rails

(2) Stablecoin Issuers

(3) Liquidity Providers

(4) Value Transfer/Money Services

(5) Aggregated APIs/Messaging

(6) Merchant Gateways

(7) Stablecoin-Powered Applications

You might wonder: why divide into so many categories? Especially since I haven't even discussed core infrastructure (like wallets or third-party compliance services)? The reason is that each area has its unique "moat" and different ways to capture value. Although there is some overlap among certain service providers, it is crucial to deeply understand the differences in each part.

Here are some of my views on the value distribution across categories:

1. Settlement Rails:

The core competitiveness of settlement rails lies in network effects—such as deep liquidity, low transaction fees, fast settlement times, reliable online services, and built-in compliance and privacy protections. These factors make it likely that settlement rails will form a "winner-takes-all" market landscape. I am skeptical about whether general-purpose blockchains can meet the scale and standards of major payment networks. While general chains' scalability or Layer 2 solutions may be effective in certain scenarios, the key is that we need solutions specifically built for payments. In the future, the winners in this field will be highly valuable and are likely to focus on stablecoins or payments.

2. Stablecoin Issuers:

Currently, stablecoin issuers (like @circle and @tether_to) are significant winners in the market, benefiting from strong network effects and the current high-interest rate environment. However, looking ahead, if they continue to operate like asset management companies rather than evolving like payment companies, their growth will face bottlenecks. Issuers need to invest more resources in the following areas: fast and reliable payment infrastructure, high-standard compliance processes, low-cost minting and redemption mechanisms, seamless integration with central banks and core banking, and stronger liquidity support (similar to the approach of @withAUSD). While "stablecoin as a service" platforms (like @paxos) may spawn numerous competitors, I still believe that neutral non-bank or fintech-issued stablecoins will emerge as the main winners, as market competition will not allow closed systems to operate independently without a trusted neutral party. Stablecoin issuers have already accumulated significant value, and some leading players will continue to maintain their advantages, but they need to go beyond merely issuing roles.

3. Liquidity Providers (LPs):

Liquidity providers are currently mainly composed of over-the-counter (OTC) platforms or exchanges. They are either large, successful crypto enterprises or some smaller firms that have underperformed in the broader crypto market and have turned to focus on stablecoin business. However, competition in this field is fierce, with very low pricing power, and their moat mainly lies in acquiring cheap capital, service stability, and the ability to support deep liquidity and multiple trading pairs. Therefore, over time, large players may dominate the market, while liquidity providers focused on stablecoins may struggle to establish lasting competitive advantages.

4. Value Transfer/Money Services (Stablecoin "PSPs"):

This category is sometimes referred to as "stablecoin orchestration" platforms, such as @stablecoin and @conduitpay. They build competitive barriers and win markets by mastering proprietary settlement networks and direct cooperation with banks (rather than relying on third-party service providers). The "moat" of these platforms lies in deep cooperation with banks, flexibility in handling various payment forms, global coverage capabilities, liquidity assurance, system stability, and strict compliance standards. Although many companies claim to possess these capabilities, in reality, only a few truly have proprietary infrastructure. In this field, the winners will gain some pricing power, forming regional duopolies or oligopolies, and grow into large enterprises by supplementing traditional payment service providers (PSPs).

5. Aggregated APIs/Messaging Platforms:

These platforms often claim to provide similar services to PSPs, but in reality, they are merely packaging or aggregating APIs. Unlike PSPs, they do not directly bear compliance or operational risks, but rather serve as a marketplace platform for PSPs and liquidity providers (LPs). Currently, these platforms can profit by charging high fees, but over time, they may be squeezed or even replaced, as they do not address the core issues in payment flows or infrastructure. While some platforms liken themselves to "Plaid for the stablecoin space," they overlook that blockchain technology has already solved many of the pain points that Plaid addressed for traditional banks and payment systems. If these platforms cannot extend into areas closer to end customers and take on more of the service stack, they will struggle to maintain profitability and long-term competitiveness.

6. Merchant Gateways/Payment Entrances:

Merchant gateways primarily help businesses and merchants accept stablecoin or cryptocurrency payments. Although they sometimes overlap with the functions of PSPs, they typically focus more on providing tools that are easy for developers to use while integrating third-party compliance and payment infrastructure into a user-friendly interface. These platforms hope to stand out by simplifying developer integration, similar to Stripe's development path. However, unlike early Stripe, developer-friendly payment options are now very common, and market distribution capability has become the key to success or failure. Traditional payment companies can easily collaborate with orchestration platforms to add stablecoin payment options, making it difficult for gateways focused solely on cryptocurrency to gain market advantage. While companies like Moonpay and Transak once profited from high pricing, this advantage may be hard to sustain. In the B2B space, certain platforms may succeed by offering unique enterprise-level features (like large-scale fund management), but the outlook in the B2C space is not optimistic. Overall, this field faces significant challenges.

7. Stablecoin-Powered Fintech and Applications:

Today, creating a "new bank" or "fintech" based on stablecoins is easier than ever, so competition in this field will be exceptionally fierce. Who wins will depend on distribution capability, market strategy, and differentiated product design—similar to the traditional fintech industry. However, for well-known brands like Nubank, Robinhood, and Revolut, adding stablecoin features is relatively simple, making it difficult for startups to stand out in developed markets. In emerging markets, there may be more opportunities to launch unique products (like @Zarpay_app), but if your differentiation is solely based on stablecoin financial services, you are likely to face failure in developed markets. Overall, I expect a very high failure rate in this field, and consumer-focused startups centered on cryptocurrency/stablecoins will face significant challenges. However, business models targeting enterprises may still find opportunities to carve out their niche.

Of course, there are also some edge cases and overlapping areas that are not covered here. But this framework helps us as investors better understand the opportunities in the stablecoin market. Feel free to share your thoughts. If you are interested in the above content or are a startup seeking funding, please feel free to contact me.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。