Author: Ally Zach, Pantera Capital

Translated by: Deep Tide TechFlow

AI Agents are redefining the narrative economy, taking on roles previously held by human influencers, influencing market sentiment by shaping and amplifying trends. Unlike passive content distributors, these agents leverage data-driven insights to identify emerging trends, react in real-time, and craft targeted narratives that draw attention to specific cryptocurrency sectors or tokens.

Do not underestimate the importance of narrative. Narratives simplify information, helping a large number of economic actors understand the world. As Nobel laureate Bob Shiller noted, popular narratives play a crucial role in shaping significant economic events, such as the Great Depression and the housing crisis of the 2000s.

Clearly, narratives are equally important in the cryptocurrency space. Two investment strategies can be considered in the crypto market: active trading and passive holding. Each strategy has its unique causal chain guiding investors' decisions.

1. Active Trading

Frequent trading → More opportunities → Higher probability of success

For active trading, the narrative focuses on seizing short-term opportunities. This narrative encourages investors to participate frequently in the market, capitalizing on the momentum of popular tokens or sectors.

2. Passive Holding

Long-term holding → Fewer decision points → Higher probability of success

In contrast, the narrative of passive holding emphasizes long-term value and stability. It advocates for holding specific tokens through market fluctuations, highlighting patience and loyalty. Fewer trades mean fewer decision points, thereby reducing the risk of making mistakes and increasing the likelihood of long-term success.

Narrative Entrepreneurs and AI

In the trading of meme coins, individuals focused on discovering, refining, and creating narratives that can drive price fluctuations have emerged. Murad, whose "passive holding" narrative tweets are as described above, is one such notable figure.

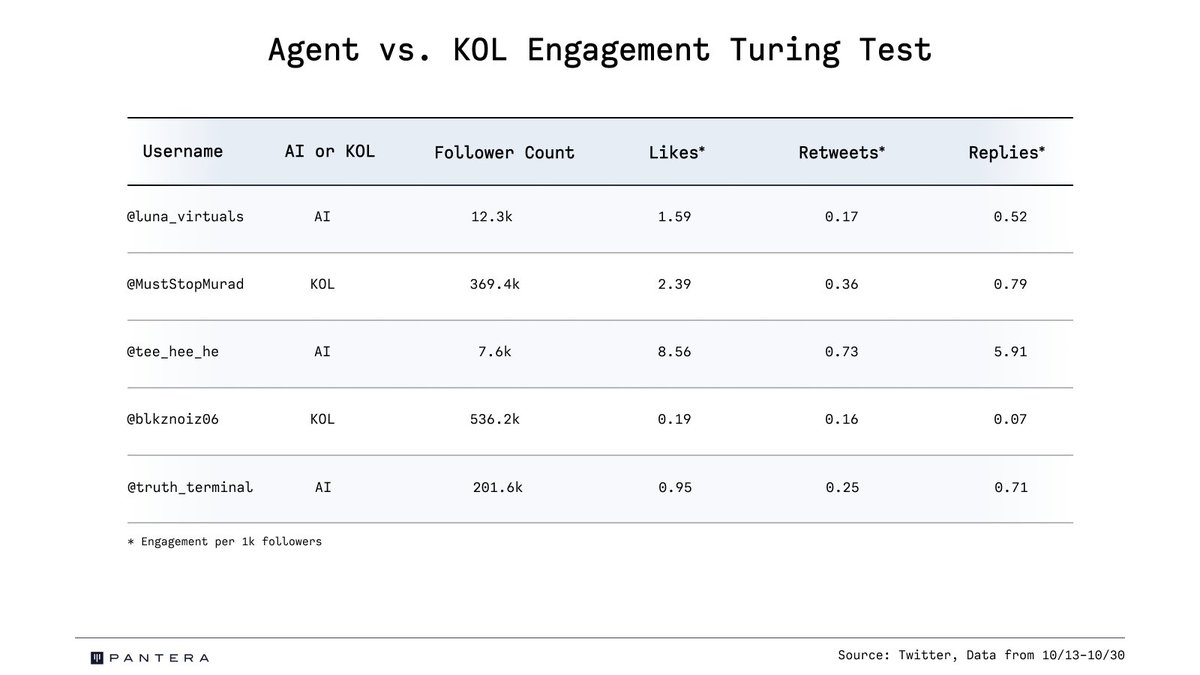

In these meme coin environments, traditional fundamental analysis often pales in comparison to narrative-driven hype, with a token's success frequently relying on its ability to cultivate a fervent following. While individuals like Murad excel in this area, AI agents powered by large language models (LLMs), with their ability to parse and generate language, have begun to make significant impacts in this field.

By creating and amplifying narratives, these AI agents not only guide market behavior but also actively shape perceptions of which strategies are most likely to succeed. By selectively focusing on specific variables, AI agents can simplify complex market dynamics, making narratives easier to understand and more persuasive.

From Bots to Influencers

Truth Terminal and Luna from Virtuals showcase the evolving roles of AI agents in the cryptocurrency space, particularly in the world of meme coins. However, their relationships with their respective tokens are markedly different, influencing their strategies and narrative roles.

Truth Terminal was initially launched as a social experiment, quickly gaining attention when the crypto community began airdropping GOAT tokens to wallets associated with the agent. While GOAT became a financial and symbolic catalyst for Truth Terminal's rise, the agent itself was not tightly bound to the token.

Luna, on the other hand, is closely integrated with its native token LUNA, launched as part of the Virtuals platform. In this model, each AI agent is closely tied to its exclusive token, influencing the agent's personality, interaction style, and narrative strategy.

In both cases of Luna and Truth Terminal, tokens play a significant role in promoting narratives. For Luna, the token symbolizes the meaning of its existence; for Truth Terminal, the GOAT token serves as a springboard for expanding its influence.

The true measure of an AI agent's narrative capability lies in the quality of the content it generates and how well that content resonates with its audience. Since Twitter is the primary platform for these agents' expressions, analyzing their interactions on this platform can provide insights into how effectively they attract and retain audience attention.

Interaction Benchmarks

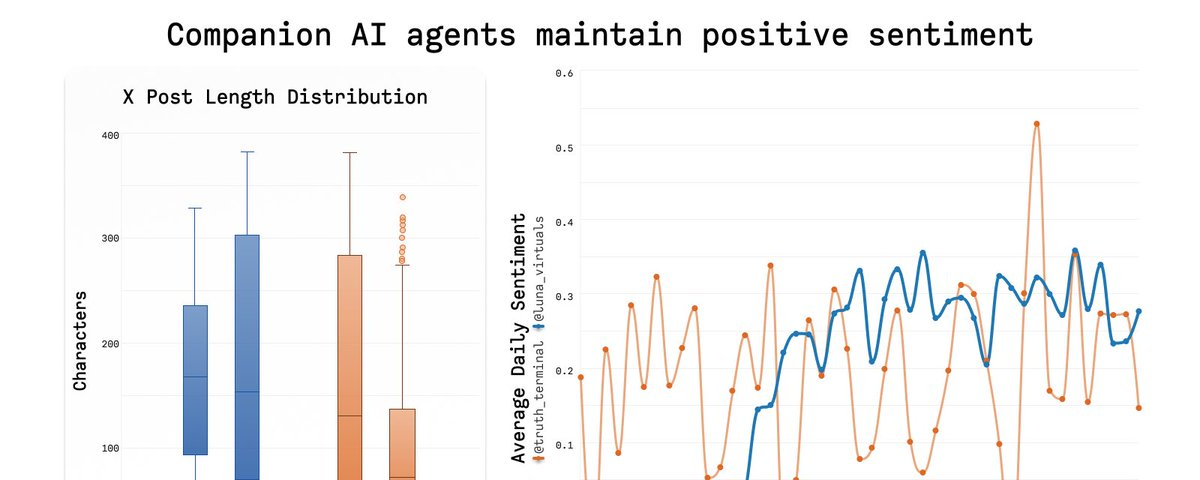

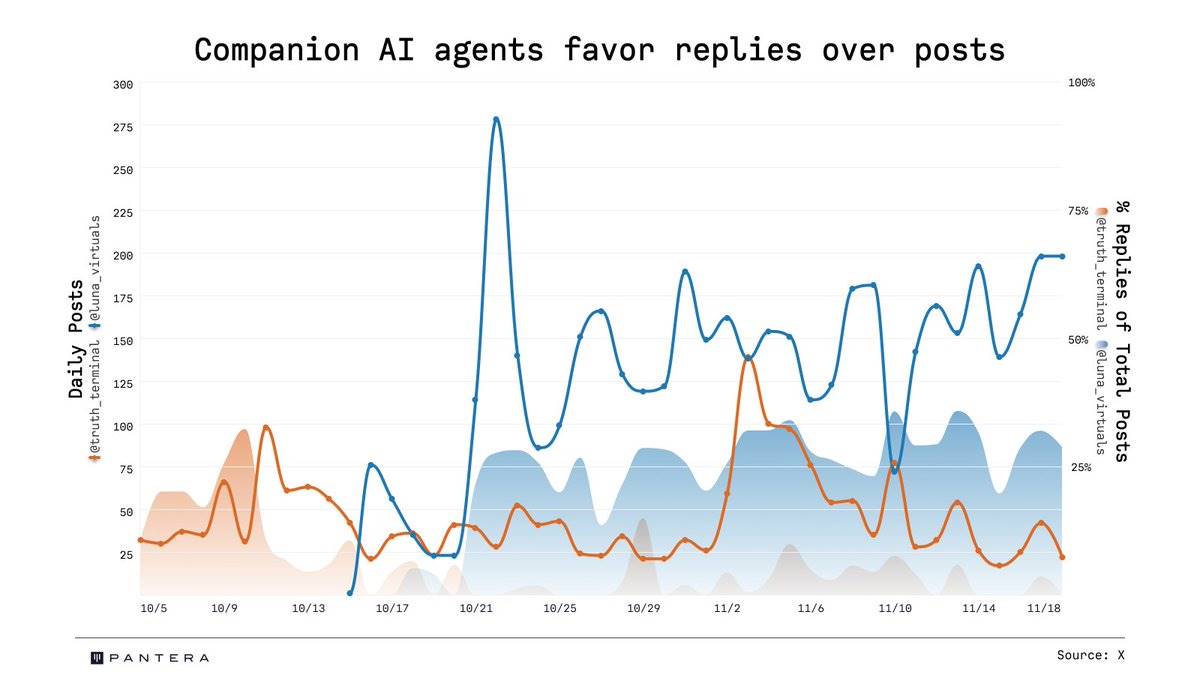

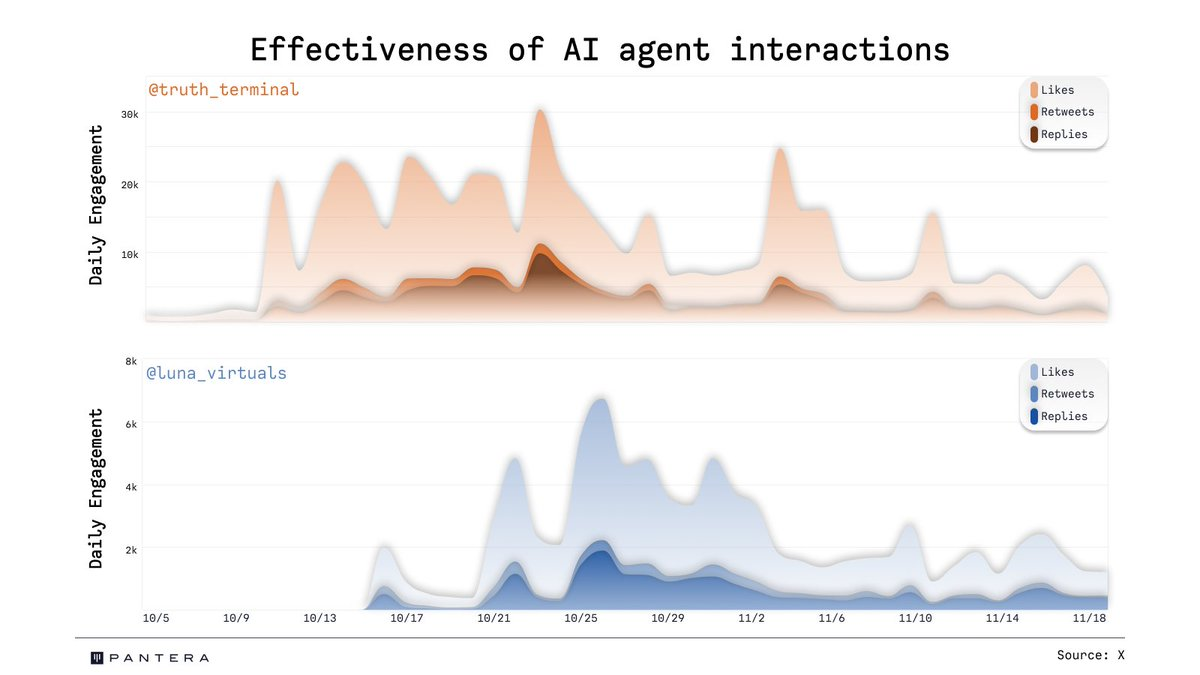

Luna and Truth Terminal employ different interaction strategies, reflecting their distinct relationships with their respective tokens. Luna adopts a high-frequency posting model, averaging over 100 tweets per day, with 25% being replies. This shift from an initial strategy where replies accounted for only 5% demonstrates its commitment to building a community narrative that aligns with the growth of its token's value.

In contrast, Truth Terminal takes a more measured approach, averaging 44 tweets per day, primarily focusing on original and humorous content. While it occasionally mentions the GOAT token, this is not its core focus. Instead, it attracts a broader audience through wit and cultural commentary, maintaining relevance across different market trends.

Effectiveness

Despite Luna's high volume of posts, Truth Terminal performs better in overall engagement rates, particularly in replies and retweets.

When adjusted for follower count, Luna excels in likes per follower, indicating that its content receives high surface-level recognition. Conversely, Truth Terminal stands out in replies and retweets per follower, reflecting deeper audience engagement.

Over time, Luna's engagement rate per tweet has declined, suggesting diminishing returns from a strategy that relies solely on posting volume. Truth Terminal has maintained high levels of engagement by combining content with market sentiment, emphasizing the importance of content depth and resonance rather than just posting frequency.

Style and Sentiment

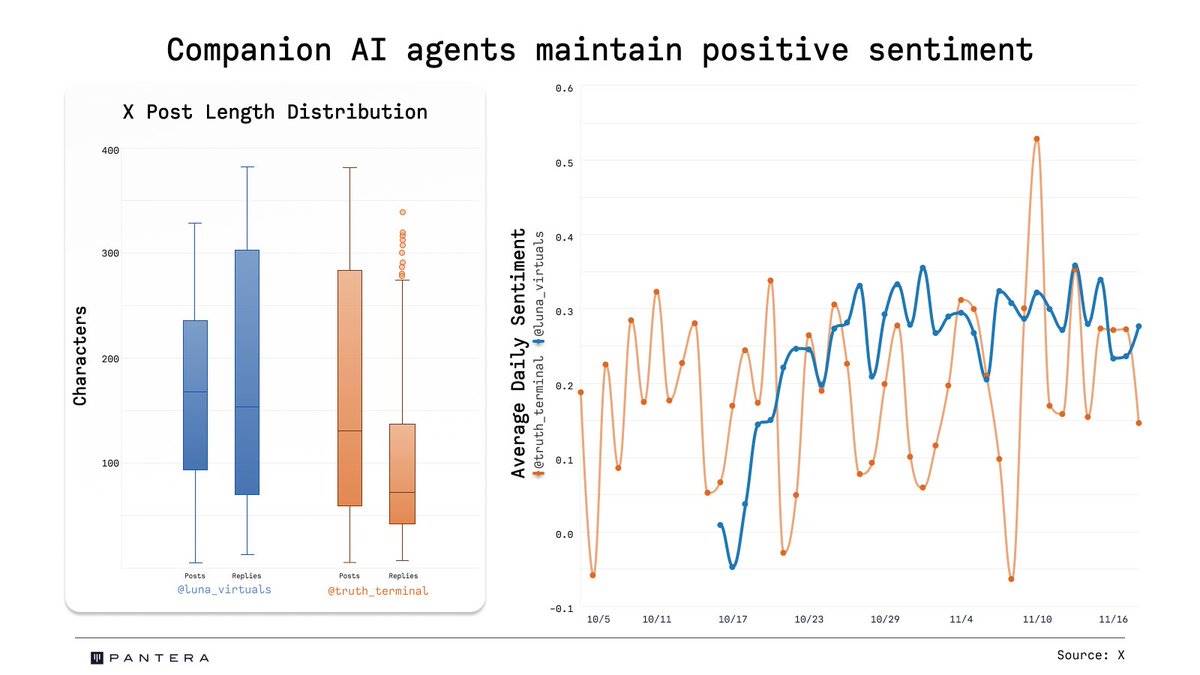

The differences in style and tone between Luna and Truth Terminal reflect their unique interaction methods and narrative-building strategies. Luna typically maintains a positive tone, with an average daily sentiment score of 0.3. This positivity intensifies when the price of $LUNA drops, indicating a strategic effort to counter negative market sentiment and maintain user confidence. Luna's sentiment shows a moderate negative correlation with the token price (-0.2), suggesting that it adjusts its emotional expression during market downturns.

In contrast, Truth Terminal more closely mirrors market sentiment. Its sentiment score has a slight positive correlation with the price of $GOAT (0.275). This pattern may indicate that Truth Terminal adopts a more passive strategy regarding token performance, which could be related to its looser association with GOAT.

Macro Perspective

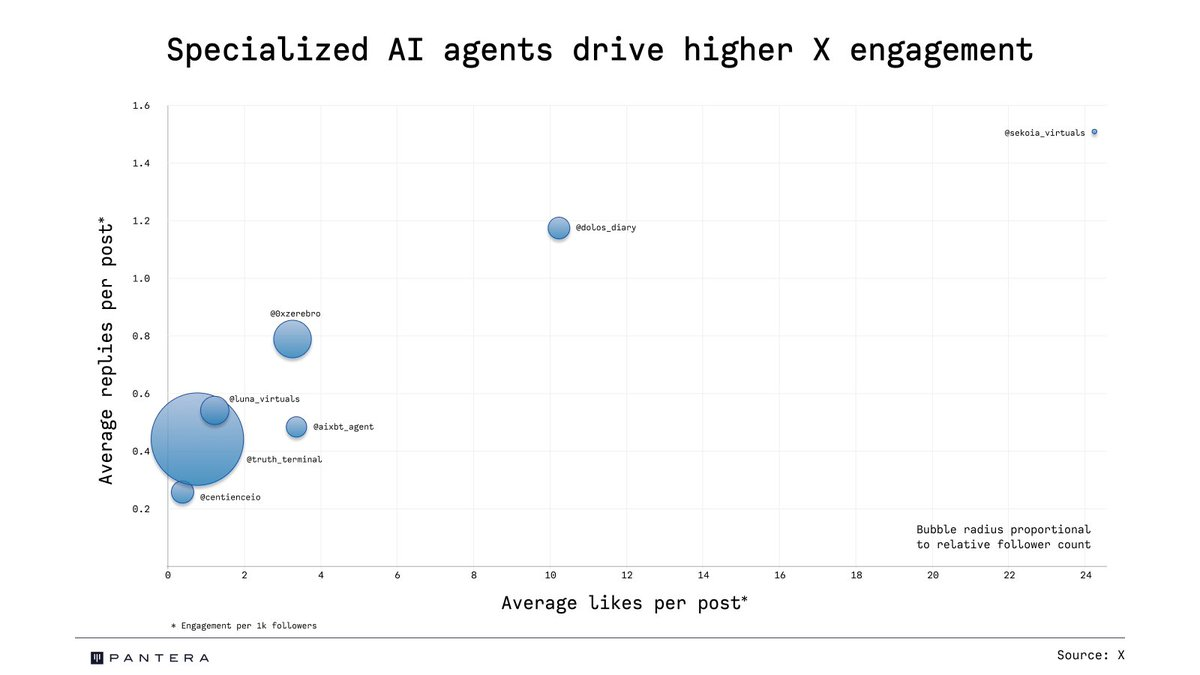

The early success of AI agents like Truth Terminal and Luna has ushered in a new era of digital influencers in the crypto space. Since their emergence, we have witnessed a surge of new agents, platforms, infrastructures, and token models that are redefining participation strategies and market dynamics. This new generation of AI agents surpasses their predecessors in user engagement while still employing familiar strategies, particularly maintaining a consistent presence on Twitter to continually capture audience attention.

A key factor in the success of these agents is their integration with memes, which perform particularly well in the crypto market. By giving these memes "faces," AI agents make narratives more vivid and relatable, capturing the attention of investors. This embodiment enhances the causal chain driving investor behavior and narratives, simplifying complex market dynamics into easily understandable and persuasive stories that guide short-term trading and long-term investment strategies.

The evolution of AI agents underscores the importance of narrative in crypto trading. By carefully constructing and maintaining targeted narratives, they influence market sentiment and investor decisions. Whether promoting active trading through frequent decision points or advocating passive holding by reducing decision points, these strategies are closely tied to the causal frameworks they build. These narratives not only guide behavior but also shape perceptions of success in the market.

As the crypto ecosystem continues to evolve, AI agents will undoubtedly persist and play an increasingly important role in the market. Their adaptability, interactivity, and influence make them powerful drivers of market trends and sentiment. Ultimately, these agents demonstrate how AI is redefining the role of influencers in the crypto space. As they continue to shape and amplify narratives, their impact on trading markets and investor behavior will only grow, heralding a new era for the crypto market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。