ISO 20022, the universal language of the financial world.

Written by: Deep Tide TechFlow

This round of the bull market has risen to a point that feels a bit uncomfortable. It has just been awarded the title of "Meme Bull Market," and not long after, the market is filled with a chorus of wails—yes, the old players who chased after memes have been trapped again. The most painful part is not being trapped by chasing memes, but rather having sold off long-held, stagnant old coins to chase memes, only to see those old coins start to surge.

XRP, XLM, HBAR, XVG… Recently, the names appearing on the exchange's gainers list every day are familiar yet strange to the old investors. In less than a month, XRP skyrocketed by 400%, surpassing SOL in market capitalization, and old group friends are all exclaiming: What year is this?

The "old junk" that has always been subjected to FUD suddenly surged, and while it seems like a bit of sector rotation, at its core, it may still be the market's renewed "value discovery" for these assets.

The positive impact of Trump's election on cryptocurrencies goes without saying, as evidenced by Bitcoin's crazy surge. Just one month after the election, Bitcoin successfully broke through the $100,000 mark. Trump's repeated friendly statements towards crypto have also led Wall Street to reassess the broader "payment attributes" of cryptocurrencies. For example, the recent surges in XRP, XLM, and others are mostly linked to the payment sector and share a commonality: they belong to the "ISO 20022" concept.

ISO 20022, the universal language of the financial world

Is ISO 20022 a new narrative that has suddenly emerged? Not at all; in fact, ISO 20022 has had its early form since 2004, long before the first Bitcoin was mined.

ISO 20022 (full name: Financial Services - Universal Financial Industry message scheme) is an international financial communication standard developed by ISO (International Organization for Standardization) Technical Committee TC68 (Financial Services). After years of development, it has become the unified standard for global financial messaging, covering multiple financial fields such as payments, securities, trade, cards, and foreign exchange.

From a technical perspective, ISO 20022 is:

A globally unified financial communication standard

A set of standardized data formats and rules

A framework for financial message transmission

For example, you might understand it better with this analogy.

Suppose you want to transfer $1,000 to a friend abroad; this money has to go through several layers of processing:

Your bank sends the payment instruction in its own format

SWIFT translates this instruction into its own format

The intermediary bank may process it using another format

Finally, the receiving bank has to translate it into a format it can understand

It's like playing a game of telephone; with each transfer, some information may be lost. Some important information (like payment purpose, invoice number) might even disappear during the conversion process. What seems like a simple cross-border payment actually goes through countless rounds of "translation"—because each financial institution speaks its own "dialect."

Thus, ISO 20022 can be understood as "global financial Mandarin." Just as Mandarin allows people from different regions to communicate with each other, ISO 20022 enables different financial institutions around the world to exchange information in the same way.

With ISO 20022, all financial institutions speak the same "language," and the payment information included in the communication is richer (expanded from the original 140 characters to 9,000 characters), the data structure is more standardized (like everyone using the same template), and processing is smarter (machines can read and process it directly). Previous cross-border transfers were like sending telegrams in Morse code; now it’s like sending a structured email that can include attachments and be automatically categorized.

Cryptocurrencies Actively Embracing ISO 20022

If a cryptocurrency meets the ISO 20022 standard, it will be assigned an official ISO code. Financial institutions can easily use cryptocurrencies for cross-border payments. Additionally, regulators may adopt a more lenient approach towards ISO 20022 tokens; tokens that meet ISO standards may see widespread use, effectively being "incorporated" into the global financial payment system, gaining legitimate payment purposes.

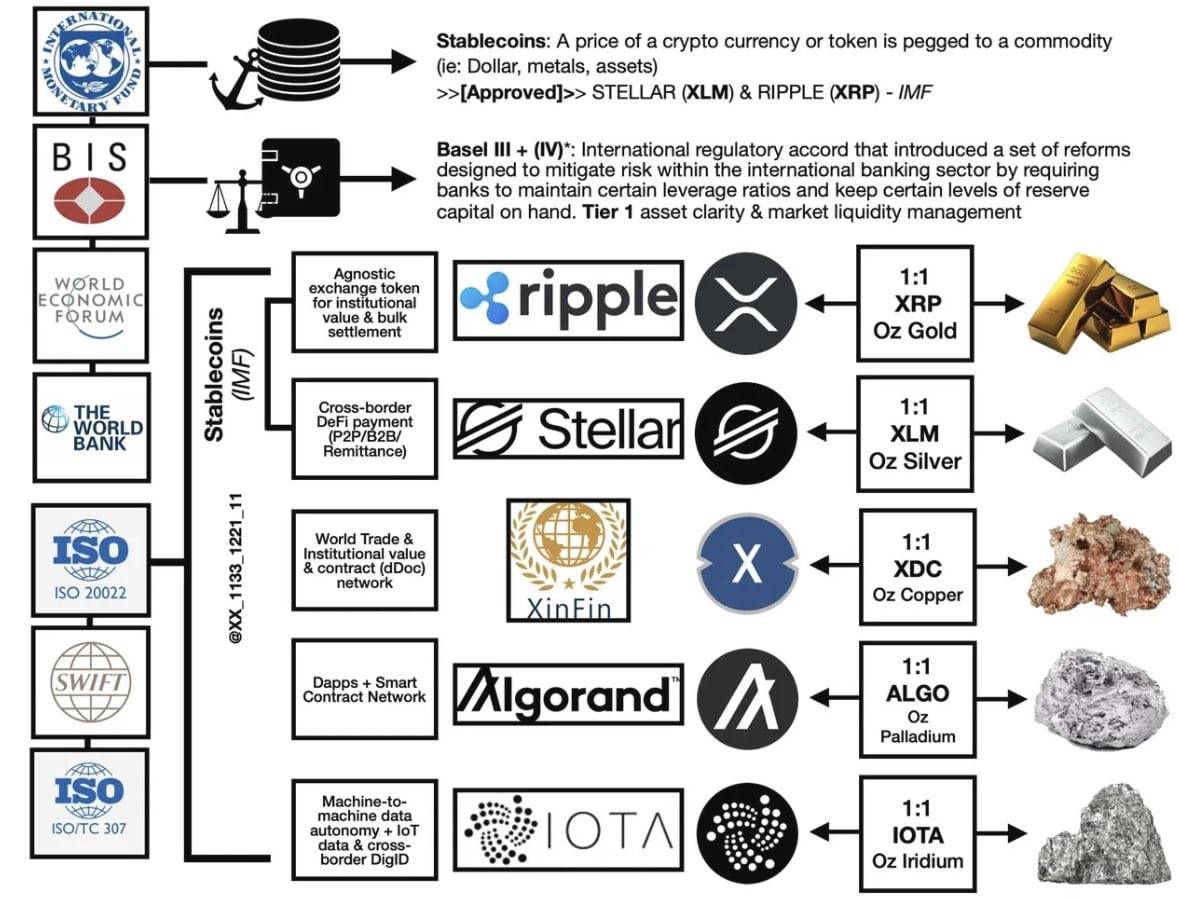

Note: A widely circulated diagram on Twitter, for reference only.

So, which ISO 20022 concept tokens are currently recognized by the market?

- XRP (Ripple)

Official Certification Status: The only cryptocurrency project officially certified by ISO 20022.

Specific Implementations:

RippleNet fully integrates the ISO 20022 message standard

Provides a real-time gross settlement (RTGS) system

Supports end-to-end tracking of cross-border payments

Established partnerships with over 200 financial institutions

Major Collaborations:

Interoperability testing with SWIFT

Collaborating with multiple central banks on CBDC projects

Establishing direct payment channels with major banks

- XLM (Stellar)

Official Certification Status: Non-official certified member, but technically supports the standard.

Specific Implementations:

Uses message formats compatible with ISO 20022

Provides cross-border payment and remittance services

Supports asset tokenization

Major Collaborations:

Strategic partnership with MoneyGram

Collaborating with over 350 banks in countries like Argentina

Partnering with Circle to issue USDC

- ADA (Cardano)

Official Certification Status: Non-official certified member.

Specific Implementations:

Supports ISO 20022 through the Atala PRISM identity solution

Implements standards through an academic research-driven approach

Supports smart contracts and tokenized assets

Major Collaborations:

Collaborating with the Ethiopian Ministry of Education

Establishing government-level partnerships with several African countries

Working with financial institutions to develop identity verification solutions

- QNT (Quant)

Official Certification Status: Non-official certified member.

Specific Implementations:

Achieves ISO 20022 compatibility through the Overledger platform

Provides cross-chain interoperability solutions

Supports multi-chain CBDC implementation

Major Collaborations:

Strategic partnership with LCX exchange

Participating in CBDC project development

Collaborating with enterprises and financial institutions to achieve blockchain interoperability

- ALGO (Algorand)

Official Certification Status: Non-official certified member.

Specific Implementations:

Supports ISO 20022 standard message transmission

Provides high-performance first-layer blockchain solutions

Supports smart contracts and asset tokenization

Major Collaborations:

Collaborating with multiple CBDC projects

Establishing payment network partnerships with financial institutions

Supporting stablecoin issuance and cross-border payments

- HBAR (Hedera)

Official Certification Status: Non-official certified member.

Specific Implementations:

Uses ISO 20022 compatible message formats

Provides high-throughput distributed ledger technology

Supports smart contracts and token services

Major Features:

Outstanding performance in implementing ISO 20022 standards

Provides enterprise-level solutions

Supports cross-border payments and settlements

- IOTA (MIOTA)

Official Certification Status: Non-official certified member.

Specific Implementations:

Supports ISO 20022 through Tangle technology

Focuses on IoT payments and data transmission

Provides zero-fee transactions

Major Collaborations:

Collaborating with EU institutions

Participating in smart city projects

Developing IoT payment solutions

- XDC (XDC Network)

Official Certification Status: Non-official certified member.

Specific Implementations:

Supports ISO 20022 standards for trade finance

Provides enterprise-level blockchain solutions

Supports smart contracts and tokenization

Major Collaborations:

Collaborating with trade finance platforms

Supporting supply chain finance

Establishing partnerships with financial institutions

Is "legitimacy" really important?

There have always been two different voices in the discussion about ISO 20022. Some insist that only the officially certified XRP is the sole concept coin of ISO 20022; while others point out that ISO 20022 is essentially an open technical standard, and there is no so-called "official certification" mechanism. Projects like Ripple, Stellar, and Cardano are merely supporting this standard at different technical levels—much like HTTP does for the internet.

What deserves more attention is the actual implementation of the projects. The officially certified Ripple has indeed made substantial progress in the field of cross-border payments, and similarly, Stellar's collaboration with MoneyGram, as well as Cardano's projects in Africa, can also be seen as achievements from a practical application perspective. From this angle, whether a project is truly "officially certified" seems to have no necessary connection to its market potential.

Therefore, rather than getting caught up in whether a project has received the so-called "official certification," it is more worthwhile to spend time understanding what problems the project is actually solving, whether the solutions are truly feasible, and whether it has a competitive advantage in the current market environment.

After all, when facing a long-term narrative, if one invests money with the mindset of making a quick profit from short-term speculation, the outcome is more likely to be punishment from the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。