Standard Chartered believes that this year's investment flow into Bitcoin has been predominantly driven by institutional investors, and this trend will continue or exceed this year's levels next year.

Written by: Li Dan, Wall Street Insights

On Thursday, December 5, Bitcoin broke the $100,000 mark for the first time in intraday trading. Last April, when Bitcoin was trading at around $27,000, Geoffrey Kendrick, head of emerging markets foreign exchange research and cryptocurrency research at Standard Chartered, accurately predicted that the price would reach $100,000 by the end of this year. Now that Bitcoin has surpassed the $100,000 threshold, Kendrick is even more optimistic about the future, forecasting that under the backdrop of potential increased institutional investment in Bitcoin, the price will rise to around $200,000 by the end of next year.

Kendrick believes that Bitcoin's surge to $100,000 this year is mainly due to strong support from institutional investors. Throughout 2024, the investment flow into Bitcoin will continue to be dominated by institutional investors. Standard Chartered expects this situation to persist into 2025, helping Bitcoin reach the bank's target level of around $200,000 by the end of 2025. Additionally, further absorption by U.S. pension funds and/or sovereign wealth funds will make Standard Chartered more optimistic about the price increase.

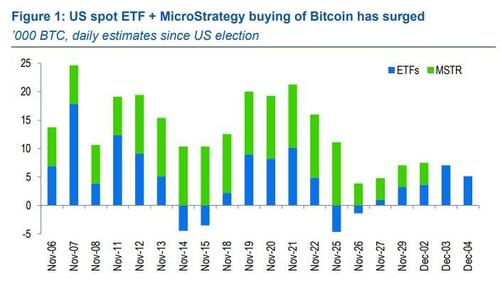

Specifically regarding institutional fund flows, since the beginning of this year, institutions have significantly purchased Bitcoin through U.S.-listed spot Bitcoin ETFs and major holders of Bitcoin, such as the software company MicroStrategy, which is seen as a proxy for Bitcoin, with a net purchase of 683,000 Bitcoins. Among these, 245,000 Bitcoins were purchased in the weeks following the U.S. elections.

These fund flows have undoubtedly been a driving force behind Bitcoin's recent surge and breakthrough of the $100,000 mark. What will happen in the future?

Kendrick's report states that by 2025, Standard Chartered expects institutional fund flows to continue at or exceed the pace of inflows into Bitcoin seen in 2024. MicroStrategy is on track to implement the plan announced at the end of October to raise $42 billion over the next three years to buy Bitcoin, so the purchase volume by MicroStrategy in 2025 should reach or exceed the scale of purchases in 2024.

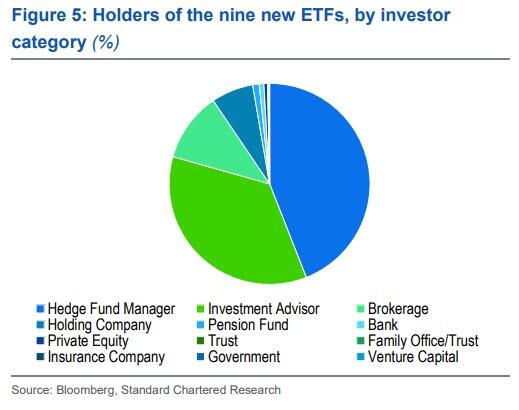

Regarding U.S. Bitcoin ETFs, Standard Chartered noted from the 13F filings submitted to the U.S. Securities and Exchange Commission (SEC) that pension funds' reported holdings only account for 1% of the shares in nine new Bitcoin ETFs.

Standard Chartered expects that with regulatory changes following the Trump administration's return to power, traditional financial institutions will find it easier to invest in digital assets, and by 2025, the proportion of pension funds holding Bitcoin ETFs will increase. Even allocating a small portion of the total $40 trillion U.S. pension fund to Bitcoin would significantly boost the price.

In this context, Standard Chartered believes that a target price of around $200,000 for Bitcoin by the end of 2025 is achievable. If U.S. pension funds, global sovereign wealth funds (SWFs), or a potential U.S. strategic reserve fund absorb Bitcoin more quickly, Standard Chartered will be even more optimistic about price performance.

Kendrick mentioned in the report that Standard Chartered had previously pointed out the possibility of the U.S. government establishing a strategic reserve fund for Bitcoin. Standard Chartered believes the likelihood of such a fund being established is low, but if it does happen, it would have a significant impact. In addition to creating a new buyer for this small asset class, the strategic reserve fund could also provide cover for other SWFs to purchase Bitcoin or disclose that they have already bought Bitcoin.

Kendrick's report states that in July of this year, when Trump mentioned the possibility of a Bitcoin strategic reserve fund, the U.S. government held 210,000 Bitcoins, accounting for about 1% of the total Bitcoin supply. Considering the scale of global foreign exchange reserves and the relatively small total market value of Bitcoin, Standard Chartered believes that a strategic reserve fund is an important upward driver for Bitcoin prices.

Even if foreign reserve managers allocate just 1% of their funds to Bitcoin, the amount would be substantial and could significantly drive up the price of Bitcoin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。