Author: Xiyou, ChainCatcher

Editor: Nianqing, ChainCatcher

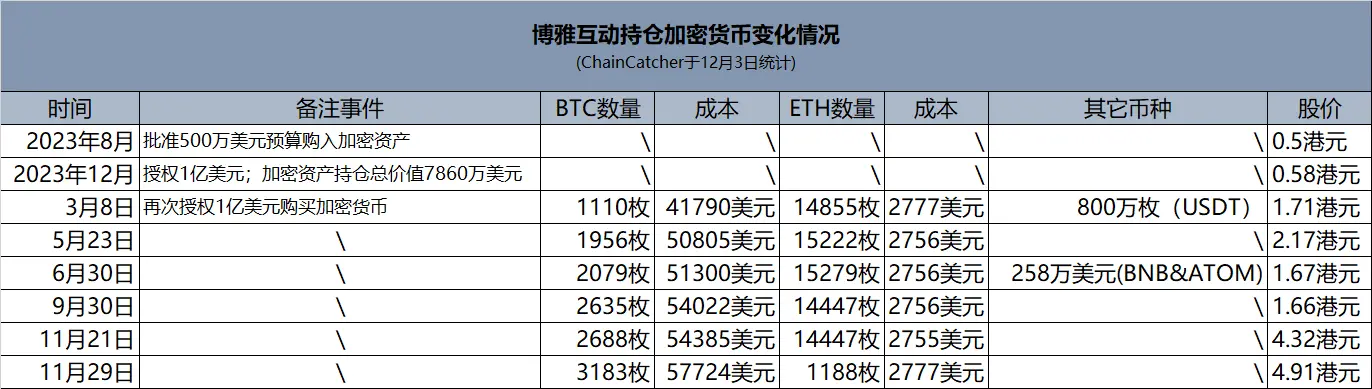

On December 5, Bitcoin surged past the $100,000 mark, setting a new historical record with a peak of $104,088. Meanwhile, the stock price of Boyaa Interactive (stock code: 00434.HK) in the Hong Kong stock market soared, with an intraday increase of nearly 30%, reaching a high of HKD 6.43, the highest since July 2015.

As of the close of the Hong Kong stock market, Boyaa Interactive was quoted at HKD 6.2, marking a cumulative increase of 173.63% over the past month. The total value of the cryptocurrency assets held by Boyaa Interactive has approached $340 million. At the same time, the company's total market capitalization reached HKD 4.279 billion (approximately $556 million). The value of Boyaa Interactive's cryptocurrency holdings is gradually approaching its total market capitalization, with the gap between the two narrowing.

Currently, Boyaa Interactive's cryptocurrency portfolio includes 3,183 Bitcoins, valued at approximately $331 million; 1,188 Ethereum, valued at $4.3 million; in addition, the company has invested $2.58 million in tokens such as ATOM and BNB.

At present, the value of the Bitcoins held by Boyaa Interactive is as high as approximately $331 million, and the unrealized profit from Bitcoin alone is close to $150 million. According to the Bitcoin Treasuries data platform, Boyaa Interactive currently ranks eleventh among publicly listed companies globally in terms of Bitcoin holdings, making it the only Asian company in the Top 15 Bitcoin holdings of listed companies, often referred to as the Asian version of "MicroStrategy."

With Bitcoin breaking the $100,000 mark, Boyaa Interactive has undoubtedly become one of the biggest beneficiaries of Bitcoin's rise. This Hong Kong-listed company, primarily focused on online board games (with major products including Texas Hold'em, Dou Di Zhu, Chinese Chess, and Sichuan Mahjong), has achieved a dual leap in stock price and cryptocurrency assets through continuous accumulation of crypto assets and extensive layout in the Web3 field in recent years.

Since Boyaa Interactive officially announced its entry into the cryptocurrency field in August 2023, the company has approved a total of $200 million in funds for purchasing cryptocurrencies. Based on the current valuation of cryptocurrencies, this investment has realized an unrealized profit of nearly $200 million, with a return rate of up to 100%. During this period, Boyaa Interactive's stock price has also surged from a previous low of HKD 0.5 to the current high of HKD 6.43, an increase of nearly 13 times.

In an interview with ChainCatcher, Boyaa Interactive stated that the cryptocurrency assets held have brought significant changes to the company in the capital market. In the past, Boyaa Interactive may not have been very prominent in the capital market, but since holding cryptocurrency assets, the market value of Boyaa Group has increased more than tenfold within the year, attracting attention from global investors.

In addition to directly investing in cryptocurrency assets, Boyaa Interactive is actively exploring the transformation of Web2 games to Web3, aiming to create new games that align with Web3 technology and concepts. Besides its own business transformation, the company is also leveraging its years of accumulated experience in game development and operation, combined with advanced Web3 technology, to invest in and incubate more high-quality Web3 projects.

"Dual Flight of Coins and Stocks": Cryptocurrency Holdings "Earned" Approximately $150 Million, Stock Price Increased Over Tenfold This Year

On December 5, Boyaa Interactive's stock price strongly broke through to HKD 6.43, a price that not only refreshed its highest record in nearly nine years but also marked an important milestone in the company's development. Since Boyaa Interactive officially announced its entry into the cryptocurrency market with Bitcoin, Ethereum, and other assets in August 2023, its stock price has soared from a previous low of HKD 0.5 to the current high of HKD 6.43, achieving an astonishing increase of nearly 13 times, truly realizing a "dual flight" of cryptocurrency assets and stock market success.

As early as November 21, Boyaa Interactive publicly released its "Q3 2024 Performance Report," showing that as of September 30, Boyaa Interactive held 2,635 BTC, with an average cost of $54,022 per coin; at the same time, it held 15,388 ETH, with an average cost of $2,756 per coin. Based on the market price at that time, the total unrealized profit from the cryptocurrency assets held by Boyaa Interactive in September had exceeded $134 million. After the report was released, Boyaa Interactive's stock price rose sharply for three consecutive days, soaring from HKD 3.79 to a peak of HKD 5.25, with a cumulative increase of 72%.

This series of successes is inseparable from Boyaa Interactive's forward-looking layout in cryptocurrency assets and its decisive entry into the crypto field. Looking back, we can clearly see how Boyaa Interactive's stock price has steadily climbed alongside its layout in the cryptocurrency field.

Founded in 2004, Boyaa Interactive primarily operates online board games and was listed on the Hong Kong Stock Exchange in 2013. However, in the face of tightening regulations in the domestic gaming industry and declining performance in 2018, Boyaa Interactive began to seek a transformation path, increasing its investment in overseas markets and focusing on two major strategies: "international expansion + esports event layout." However, since announcing its entry into the cryptocurrency field, the stock price has embarked on a soaring journey.

In August 2023, Boyaa Interactive announced that its board of directors had approved a budget of $5 million for purchasing Bitcoin, Ethereum, and other cryptocurrency assets, and planned to enter the Web3 field. This was the company's first public announcement of its entry into the emerging Web3 field, while its stock price was around HKD 0.5.

In December of the same year, the Boyaa Interactive shareholders' meeting voted to authorize the board of directors to purchase cryptocurrency totaling no more than $100 million within 12 months, with $45 million allocated to BTC and ETH each, and no more than $10 million for USDT and USDC stablecoins. As of December 31, 2023, Boyaa Interactive's total cryptocurrency assets amounted to $78.6 million.

Boyaa Interactive believes that since October 2022, the Hong Kong government has introduced a series of favorable regulatory policies for cryptocurrency trading to promote the development of the Web3 industry. Web3 is the future trend of finance and business, aligning with the company's internet gaming business philosophy, both emphasizing the importance of community, users, and virtual assets. Therefore, the company plans to fully transform its strategy to Web3, integrating existing games with Web3 technology to create a Web3 listed company.

Regarding investment in cryptocurrency assets, Boyaa Interactive expressed a very optimistic view of their long-term development, believing they have anti-inflation capabilities and can provide opportunities for asset appreciation. Therefore, the company allocates some idle funds to purchase cryptocurrencies as part of its asset allocation strategy to balance risk and return, while also providing important support for the expansion and operation of Web3 games.

On March 8 of this year, Boyaa Interactive announced that it would again authorize the board of directors to continue purchasing cryptocurrency totaling no more than $100 million. By this time, Boyaa had cumulatively authorized $200 million in funds for purchasing cryptocurrency assets. At the time of the announcement, the company had successfully purchased 1,110 BTC (average purchase price $41,790), 14,855 ETH (average price approximately $2,777), and about 8 million USDT, spending a total of approximately $100 million. Based on the market prices of cryptocurrency assets at that time, Boyaa Interactive's cryptocurrency holdings realized an unrealized profit of nearly $45 million.

At the same time, Boyaa Interactive released its 2023 annual performance report, showing that the company's annual revenue was approximately $395 million, achieving a steady growth of 5.1% compared to the previous year (2022 was $375 million). Driven by the dual growth of unrealized profits from cryptocurrency assets and business revenue, Boyaa Interactive's stock price strongly broke through the HKD 2 mark in March, with a monthly increase of up to 124%.

Since then, Boyaa Interactive has continued to increase its investment in Bitcoin, making it a key strategy for the group, and has announced the increase in BTC holdings in multiple financial reports.

By the end of the first half of this year (June), Boyaa Interactive stated that the value of its cryptocurrency holdings was approximately HKD 1.688 billion, with profits from the appreciation of cryptocurrency assets amounting to approximately HKD 245.7 million, accounting for 87% of net profit. The semi-annual report showed that the digital assets held by the company accounted for as much as 75% of its total assets, with a proportion exceeding 90% in current assets.

As of June 30, the company held approximately 2,079 Bitcoins (average cost approximately $51,300 per coin), approximately 15,279 Ethereum (average cost approximately $2,756 per coin), and also purchased a total of $2.58 million in ATOM and BNB tokens.

In just the second quarter, Boyaa Interactive increased its holdings by 885 Bitcoins and 424 Ethereum.

When the "Q3 2024 Performance Report" was released on November 21, Boyaa Group had already held 2,688 BTC (average cost $54,385 per coin) and 14,447 ETH (average cost $2,755 per coin).

On November 29, Boyaa Group announced again that between November 19 and November 28, it would exchange its holdings of 14,200 ETH for 515 BTC, with a total exchange value of $49.48 million, using ETH with an original purchase cost of approximately $39.45 million. After the exchange, Boyaa Group cumulatively held approximately 3,183 BTC (average holding cost approximately $57,724 per coin) and 1,188 ETH (holding cost $2,777).

Regarding this exchange decision, Boyaa Interactive explained to ChainCatcher its reasoning: "The group is committed to increasing its Bitcoin reserves. Over the past year, the investment return rate of Ethereum has significantly lagged behind that of Bitcoin, prompting us to reassess our investment layout in Ethereum. The previous investment in Ethereum was somewhat hasty, with returns not as good as Bitcoin. In the future, we are optimistic about Bitcoin's strong development and believe it will continue to lead the cryptocurrency industry. Therefore, we decisively exchanged our holdings to focus more on Bitcoin as a core asset."

Based on the recent high price of Bitcoin at $104,088, the BTC currently held by Boyaa Interactive is valued at approximately $331 million, with unrealized profits close to $150 million.

As of December 5, Boyaa Interactive has cumulatively approved approximately $200 million in funds specifically for purchasing cryptocurrencies, currently holding 3,183 Bitcoins (valued at approximately $331 million), 1,188 Ethereum (valued at $4.3 million), along with previously purchased ATOM and BNB tokens totaling $2.58 million, bringing the total value of held cryptocurrency assets close to $340 million. Based on the previously disclosed cost of $200 million for purchasing funds, the unrealized profits from Boyaa Interactive's cryptocurrency holdings have already exceeded $140 million.

It is worth noting that in all the announcement documents related to cryptocurrencies released by Boyaa Interactive, one name consistently stands out in the signature section at the bottom right—Dai Zhikang, who is not only the chairman of Boyaa Interactive but also an executive director. Dai Zhikang is no stranger to the cryptocurrency industry, as he was an important investor during the early days of Huobi. It is said that he participated in the investment when Huobi first launched in 2014, and this investment reportedly yielded over $1 billion.

In an interview with ChainCatcher, Boyaa Interactive candidly stated that it was under the active leadership and promotion of Chairman Dai that Boyaa Interactive officially began its layout for cryptocurrency asset reserves, the development of Web3 game products, and the comprehensive development of the Web3 ecosystem in 2023.

Regarding the purchased cryptocurrencies, Boyaa Interactive emphasized to ChainCatcher that security is always the top priority for the company. All cryptocurrencies are securely stored in authorized platform accounts and professional wallets within the company. The company implements strict management systems, employing multi-signature accounts, decentralized custody, and continuous monitoring of asset security.

Boyaa Interactive has clearly stated in multiple announcements that purchasing and holding cryptocurrencies is not only a crucial cornerstone for deepening its Web3 game layout and promoting operational innovation but also one of the core strategies for actively entering the Web3 field.

Regarding the previously invested BNB and ATOM cryptocurrencies, Boyaa Interactive explained to ChainCatcher that this decision was primarily based on the company's business development needs rather than purely for investment appreciation purposes. Specifically, a certain amount of cryptocurrency is needed to build the gaming ecosystem, not for appreciation considerations, and these currencies occupy a very small proportion in the investment portfolio. As for future cryptocurrency choices, Boyaa Interactive clearly stated that there are currently no plans to introduce other currencies. In the future, there are also no considerations to include non-Bitcoin currencies in the investment portfolio.

BTC Holdings Ranked First Among Asian Listed Companies, Known as Asia's "MicroStrategy"

Since the official approval of Bitcoin spot ETFs, Bitcoin has become the preferred asset for listed companies to diversify investment risks and protect shareholder rights. Many listed companies have joined the rush to purchase Bitcoin, and as BTC prices continue to rise and break new highs, these companies have not only reaped substantial profit returns but also achieved a dual leap in stock value and book assets. Today, Bitcoin has become a new engine driving the stock price growth of listed companies.

According to Michael Saylor, founder of MicroStrategy, as of December 1, 60 listed companies have purchased Bitcoin through stock issuance financing, with a total Bitcoin holding of 522,565 coins. Among them, Boyaa Interactive leads in Asia with a holding of 3,183 Bitcoins, earning the title of Asia's "MicroStrategy."

According to statistics from ChainCatcher, as of December 3, the top fifteen listed companies globally hold a total of 511,655 BTC, accounting for over 97% of the total holdings of listed companies. In this list, MicroStrategy ranks first with 402,100 coins, while Boyaa Interactive ranks eleventh with 3,183 BTC, becoming the only Asian listed company on the list.

In this global "listed company BTC accumulation craze," the American company MicroStrategy has undoubtedly played a leading role. Since founder Michael Saylor announced the launch of the "BTC accumulation strategy" in August 2020, the company has continuously bought BTC, when the price of Bitcoin was still below $12,000. Now, MicroStrategy's layout in the Bitcoin market has begun to show results, with significant growth in both the quantity and value of its Bitcoin holdings.

From August 2020 to now, the price of Bitcoin has skyrocketed from about $10,000 to a peak of $100,000. During this period, MicroStrategy's stock price has also seen astonishing growth, rising from around $14 to a peak of $421, an increase of over 26 times, making it one of the best-performing stocks in the U.S. market during the same period, earning the title of "King of Coins" in the U.S. stock market.

As of December 4, data disclosed that MicroStrategy and its subsidiaries hold approximately 402,100 Bitcoins, with a cumulative purchase cost of about $23.4 billion, and an average purchase cost of about $58,263 per Bitcoin. Based on the current price of $100,000, the latest market value of these Bitcoins is as high as $41.326 billion. Additionally, the company revealed that MicroStrategy's total return on Bitcoin has reached 63.3% since the beginning of the year.

Motivated by the dual growth of stock value and book assets achieved through the accumulation strategy, many listed companies have followed suit, incorporating Bitcoin into their strategic reserves. Recently, Microsoft plans to decide at its shareholder meeting on December 10 whether to officially include Bitcoin on its balance sheet.

In the Asian market, Boyaa Interactive in the Hong Kong stock market has demonstrated strength comparable to MicroStrategy in its layout and determination in the cryptocurrency field. Since announcing its entry into the cryptocurrency field in August 2023, Boyaa Interactive has been aggressively increasing its Bitcoin holdings, having invested a total of $200 million in purchasing cryptocurrency assets, becoming one of the fastest-growing companies in terms of BTC holdings among Asian listed companies.

Although Boyaa Interactive is not the first company in the Hong Kong stock market to venture into cryptocurrencies, as several listed companies have announced their entry into cryptocurrency investments, its monetization has been the most outstanding.

Meitu Group began purchasing BTC and ETH as early as 2021, and its semi-annual report for June 30, 2024, shows that Meitu Group holds 31,000 ETH and 940.49 BTC, with the Ethereum holdings valued at $105.2 million (costing about $50.5 million) and Bitcoin holdings valued at $57.95 million (costing about $49.5 million).

On March 26 of this year, YING Universe announced plans to invest $100 million in cryptocurrencies over the next five years, but as of December 3, its cryptocurrency asset holdings have not been publicly disclosed. LanKong Interactive (08267) revealed in its 2024 mid-term performance report that the company holds a total of 142.8539 Bitcoins and 848.386 Ethereum, with a total value of about $880,000. Additionally, Guofu Innovation (00290) purchased Bitcoin worth HKD 36 million (excluding transaction costs) between March and August of this year.

However, in terms of current cryptocurrency asset holdings, Boyaa Interactive's BTC holdings have become a leader among Hong Kong-listed companies, regarded by investors as the Eastern "MicroStrategy."

Boyaa Interactive is also taking action to align with MicroStrategy, continuously expanding its Bitcoin reserves as a key strategy for the group, and its Bitcoin holdings continue to increase. On November 29, Boyaa Interactive added 515 Bitcoins to its holdings, and in the future, it does not rule out continuing to purchase Bitcoin through fundraising methods (such as issuing shares in the secondary market), mirroring MicroStrategy's bold approach.

In the latest Q3 financial report, Boyaa Interactive announced that it would use MicroStrategy's Bitcoin growth rate as a key performance indicator to measure the ratio of the total amount of Bitcoin held by the group to the total number of shares issued over time.

In terms of both strength and determination to hold Bitcoin, Boyaa Interactive is actively benchmarking against the U.S. giant MicroStrategy.

In an interview with ChainCatcher, Boyaa Interactive clearly stated its position on its BTC holdings and future purchasing plans: "The group currently has no plans to sell Bitcoin and firmly believes that cryptocurrencies will become mainstream assets in the future. The group will continue to expand the scale of cryptocurrency purchases, using profits from traditional gaming business to increase holdings, which is the group's long-term strategy." Boyaa Interactive also added that although it is one of the companies with a significant amount of Bitcoin holdings among Asian listed companies, it is still insignificant on a global scale. Therefore, the group does not rule out the possibility of financing to maintain its leading position in this field.

Boyaa Interactive previously revealed that the appreciation gains obtained through purchasing cryptocurrency assets may be returned to shareholders in the form of dividends, sharing the benefits.

Creating a New Business Model of "Web2 Games + Web3 Integration" and Building a Web3 Ecosystem Through Investment Layout

Boyaa Interactive's layout in the Web3 field goes far beyond merely purchasing cryptocurrencies and developing Web3 games. The company is also actively participating in investments and has laid out multiple Web3 projects, aiming to build a comprehensive and complete Web3 ecosystem, thus becoming a truly Web3-listed company.

Since March of this year, Boyaa Interactive has publicly announced a total of seven Web3 investment projects, with a cumulative investment amount of approximately $14.57 million. These investment projects cover a wide range of key areas, including Web3 gaming e-sports platforms, game development, asset data services, venture capital funds, and Bitcoin ecological funds.

Among them, in March, the Web3 gaming e-sports platform DegenVerse announced that it received $2.6 million in Pre-Seed round financing with the participation of Boyaa Interactive and launched the Degen Game card battle e-sports game.

In April, the company invested in three Web3 projects, including injecting $1 million into the Web3 venture capital firm Pacific Waterdrip (Waterdrip Capital) and establishing strategic cooperation with it in Web3 game development and the Bitcoin ecosystem; investing $1.25 million in the Web3 asset data platform RootData, which provides users with efficient access to accurate information on Web3 projects; and investing $500,000 in the Web3 venture fund AWAKENING VENTURES.

In June, the Web3 gaming entertainment social ecosystem Skytopia announced that it received $2.4 million in seed round financing with the participation of Boyaa Interactive. However, it is important to note that Boyaa Interactive has not publicly disclosed any investment in DegenVerse and Skytopia games.

In July, the company announced a $1 million investment in the Bitcoin ecological fund UTXO Venture and established strategic cooperation with it in the Bitcoin ecosystem.

In September, Boyaa Interactive invested 100 BTC (valued at approximately $5.819 million) in the Web3 game developer MTT ESports and acquired a 25% stake in the company.

Clearly, Boyaa Interactive's investment layout in the Web3 field is extensive and in-depth, encompassing multiple Web3 venture capital funds, game developers, asset data platforms, and more. It also leverages the bridging role of Web3 venture capital funds to reach and invest in more Web3 projects, successfully creating a comprehensive, multi-layered, and closely connected Web3 ecosystem.

Regarding this layout, Boyaa Interactive explained to ChainCatcher: Web3, as an emerging industry, contains infinite opportunities, and the company hopes to work together with high-quality Web3 projects for mutual development. In the future, it will continue to explore more high-quality projects and opportunities.

When selecting Web3 investment targets, Boyaa Interactive places particular emphasis on the project's technological innovation and market potential, conducting in-depth assessments of the project team's strength and experience to ensure they possess the solid capability to achieve project goals. At the same time, the company will also evaluate the project's alignment with the group's strategy to ensure that each investment can accurately support the overall strategic goals of the group.

Regarding future strategies for Web3 layout, Boyaa Interactive stated to ChainCatcher that it is optimistic about the development prospects of the Web3 field, believing it will fundamentally change the traditional internet landscape. Currently, the company has established three core strategies: first, to ensure the steady growth of traditional gaming business, continuously enriching game content and gameplay, and improving functional design to enhance user experience; second, to hold and continuously expand cryptocurrency reserves in the long term; and third, to increase research and development efforts for Web3 game products and strengthen infrastructure construction.

As early as March of this year, Boyaa Interactive announced that it had formed a professional Web3 research and operation team focused on the development, operation, and expansion of Web3 games; as well as related Web3 infrastructure development, including but not limited to Web3 wallets, DeFi infrastructure, etc. The company is also continuously introducing and cultivating professional talents in the Web3 industry and cryptocurrency asset field to promote the realization of strategic goals for business development in the Web3 field.

According to individuals who attended Boyaa Interactive's shareholder meeting in April this year, Boyaa Interactive stated that it would continue to operate its existing 67 traditional online and mobile game products and plans to gradually upgrade these products to add Web3 features and transition to Web3 game products, as permitted by law and technology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。