Convertible bonds may currently be the only liquidation risk for MicroStrategy.

Written by: Willy Woo

Translated by: Shaofaye123, Foresight News

About MicroStrategy MSTR Convertible Bond Risks

Currently, the only liquidation risk I can see is from the convertible bonds it has issued:

- If convertible bond buyers do not convert to stock before maturity, MSTR will have to sell BTC to repay the debt holders.

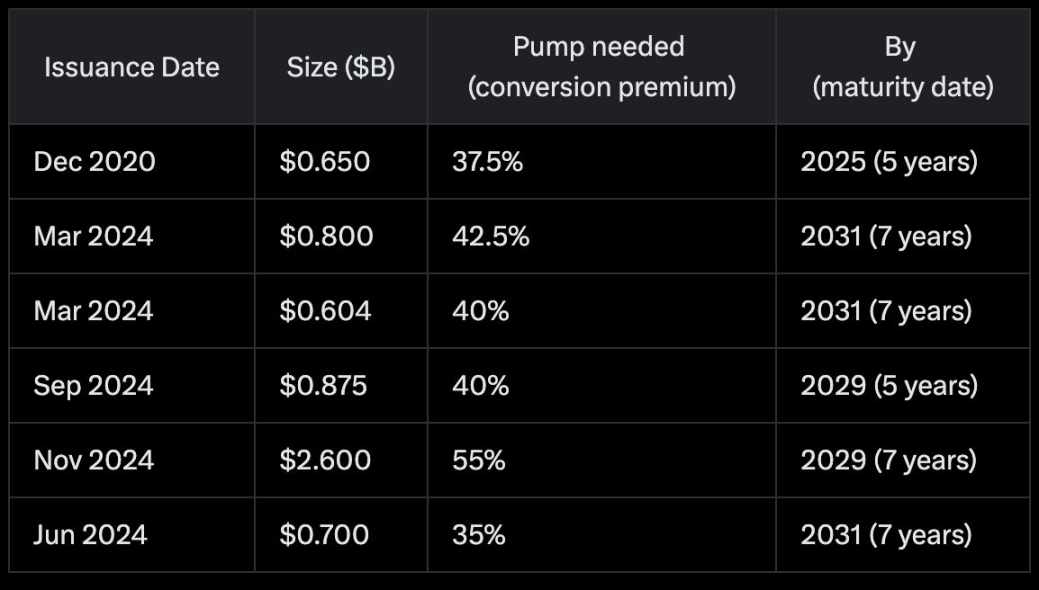

- This situation will occur if MSTR does not exceed a 40% increase within 5-7 years (varies by bond, see table below). Essentially, either MSTR fails to correlate with BTC, or BTC fails.

There are also other risks to varying degrees:

- Competitive risk, where other companies copy and replicate, reducing MSTR's premium relative to net asset value;

- Risk of SEC intervention in future purchases, reducing MSTR's premium relative to net asset value;

- Custodial risks from Fidelity and Coinbase;

- Risk of U.S. nationalization (seizure of BTC);

- Key person risk with Saylor;

- MSTR operational risk;

Lastly, please note the convertible note table; while it provides a rough concept, it is not accurate due to my use of Grok AI.

Other Questions About MSTR

Question 1: Why doesn't MSTR have self-custody rights?

Willy Woo: As of now, the exact custodial arrangements have not been disclosed. To our knowledge, MSTR may have co-signatory rights in a multi-signature arrangement. This is a prudent handling method.

Question 2: Will MSTU and MSTX be liquidated and harm MSTR?

(Note: MSTU: Invests in T-Rex 2X Long MSTR Daily Target ETF; MSTX: Invests in Defiance Daily Target 2X Long. These two MSTR ETFs have accumulated over $600 million and $400 million in assets, respectively.)

Willy Woo: MSTU/MSTX = higher risk. The 2x leverage is achieved through a paper bet on MSTR, with liquidation levels close to immediate liquidation levels (furthermore, there are no claims on real BTC).

Note: Derivative positions will devalue BTC.

Additionally, due to the impact of volatility, holding long-term will not achieve 2x (losses are more expensive than gains).

Question 3: What if a large number of stockholders sell their shares simultaneously due to external events (stock market downturn)?

Willy Woo: This is only a short-term impact; in the long run, the market always implies increased returns, so it is not a real risk. Debt holders can convert for up to 5-7 years after purchasing the notes. As long as Bitcoin is 40% higher than the initial price within 1-2 macro cycles, there will be no issues.

Question 4: Are there leveraged ETFs that gain risk exposure through options rather than swaps?

Willy Woo: The volatility arbitrage trading departments of TradFi hedge funds do this day in and day out. $70 million is very little; based on the mispricing of volatility in the options market, this amount is sufficient to support the trading volume of any given day.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。