Side Protocol officially announces its token economic model, with 10% of the total tokens allocated for airdrops.

Written by: Kelly

Led by Dave Hrycyszyn, known as the godfather of the crypto world, the Bitcoin public chain project Side Protocol has officially released its token economic model today. In terms of technological innovation, application scenarios, and team strength, Side Protocol has shown outstanding performance, quickly sparking community discussions. What unique features does this dark horse, which has attracted significant attention from the Bitcoin community, possess? Let’s explore:

What is Side Protocol?

Side is a high-performance PoS public chain with native Bitcoin lending functionality. Its core features include:

- Bitcoin compatibility: The Side chain is fully compatible with Bitcoin address formats and wallet signatures, supporting Taproot or Native Segwit addresses (rather than the common 0x addresses found in other Bitcoin L2 ecosystems). Users can directly use Bitcoin wallets like Unisat and OKX for signing, without needing to manage different wallets or addresses, providing an extremely smooth user experience.

- Technical architecture: The public chain is based on the Cosmos technology stack and employs a dPoS consensus mechanism, achieving high TPS and fast transaction finality. As a Bitcoin application chain within the Cosmos ecosystem, Side enables asset interaction with other blockchains through IBC (Inter-Blockchain Communication protocol), supporting the liquidity of native stablecoins like USDC and USDT.

- Smart contract support: Side's smart contracts run on the Wasm virtual machine and are written in Rust, offering higher performance and security. The memory safety features of Rust combined with the compatibility of Wasm reduce the common vulnerability risks associated with traditional Ethereum smart contracts, such as reentrancy attacks.

- Cross-chain interoperability: Side Protocol supports interoperability protocols like IBC, Wormhole, and Axelar, connecting Cosmos with other ecosystems like Solana and Ethereum, providing rich asset liquidity.

On-chain Bank for Bitcoin

Side Protocol is not only positioned as a public chain but also aims to become the "on-chain bank" of the Bitcoin world. Its core function is a groundbreaking decentralized Bitcoin lending protocol, providing the Bitcoin ecosystem with financial infrastructure similar to Aave for the first time (not developed on some L2s).

Side addresses the pain points of traditional Bitcoin lending protocols through innovative self-custody and liquidity pool designs:

- Self-custody of collateral: Through DLC (Discrete Log Contracts), users can self-custody their BTC collateral during the lending process, retaining control over their Bitcoin collateral and only losing BTC during liquidation, ensuring asset decision security.

- Liquidity pool design: Based on a liquidity pool design, Side offers a more efficient and DeFi-composable lending solution compared to the inefficient P2P lending model. Thus, it is the first lending protocol in the Bitcoin world to achieve both self-custody and liquidity pool models.

This product brings a native "bank" to the Bitcoin ecosystem. In terms of protocol revenue, in addition to traditional public chain gas fee income, Side will also generate interest income through its lending protocol, similar to Aave, along with protocol revenue from several already developed products.

Product Matrix

In addition to the public chain and lending protocol, Side Protocol's testnet has launched the following products:

- Native DEX: Supports XYK model and concentrated liquidity pool design.

- Rune cross-chain bridge: One-click cross-chain operation, specifically optimized for BTC and Runes assets, providing a smooth and natural user experience.

- Dual-chain wallet: Compatible with both Bitcoin and the Side public chain, supporting dual-chain asset management and transaction signing.

Team and Funding

The team behind Side Protocol boasts an impressive background, with core members coming from renowned Web2 and Web3 companies such as Meta, Binance, and Google, possessing rich industry experience and exceptional technical strength.

Among them, founder and CTO Dave Hrycyszyn is a veteran expert in the crypto industry and one of the co-founders of Chainspace. He co-created Chainspace with George Danezis (co-founder of Sui) and Mustafa Al-Bassam (co-founder of Celestia). The company was acquired by Facebook due to its leading position in high-performance chain research.

Before joining to establish Side Protocol, Dave served as the CTO of the privacy protocol project Nym, successfully leading the team to secure over $50 million in investment support from top institutions including a16z, Polychain, and Binance, and facilitating the project's successful mainnet launch.

Side Protocol has completed three rounds of private fundraising, with the latest round valuing the company at $100 million. Specific details about the private fundraising have not yet been disclosed. Among the known funding, support has already been received from institutions like Hashkey.

Token Economics

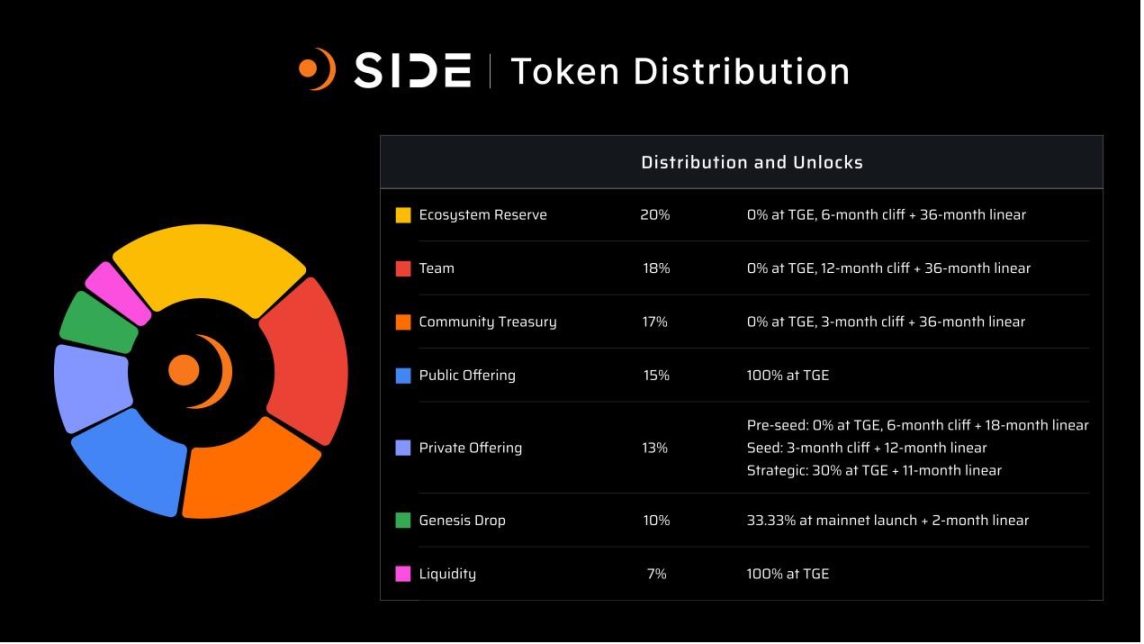

The total supply of SIDE is 1 billion tokens, distributed as follows:

- Ecosystem reserve: 20%

- Team: 18%

- Community treasury: 17%

- Public offering: 15%

- Investors: 13%

- Genesis airdrop: 10%

- Liquidity: 7%

After the mainnet launch, Side Protocol will distribute 10% of the total tokens as a genesis airdrop. Potential airdrop recipients include:

- Active Bitcoin users

- NFT community (including Bitcoin NFT holders)

- Cosmos community

- Testnet users

Details of the airdrop and snapshot rules have not yet been made public, but the official team has revealed that the snapshot content will be announced this week. It is recommended to follow the official X account or join the Chinese community for the latest updates to ensure timely awareness of airdrop details and complete eligibility verification.

In Conclusion

Side Protocol has pioneered a new path in the Bitcoin ecosystem, not only launching the first fully Bitcoin-compatible high-performance PoS public chain but also providing a one-stop financial service for Bitcoin users through its first native lending protocol and rich product matrix, establishing its position as the "bank chain" of the Bitcoin ecosystem.

While many Bitcoin L2 solutions are still striving to expand their ecosystems, Side Protocol has already brought infinite possibilities to the BTCFi track through its independently developed complete DeFi products and precise market positioning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。