5 times receiving risk control investigations from trading platforms, faster than Binance's Chinese listing announcements.

Written by: aleel Jia Liu, BlockBeats

"Now I say, I am the richest and most cash-flowing post-00s that can be verified on Zhihu, does anyone oppose?"

This is Vida's somewhat provocative self-introduction. He claims to be the current Zhihu post-00s billionaire, with at least 7 million USD (approximately 51 million RMB) in spare cash. Due to his rapid trading speed and massive profits, he has received investigation notices from Binance's risk control department five times.

Upon seeing this, many might think this is just another attention-seeking statement from a Zhihu show-off. But what if all of this is true?

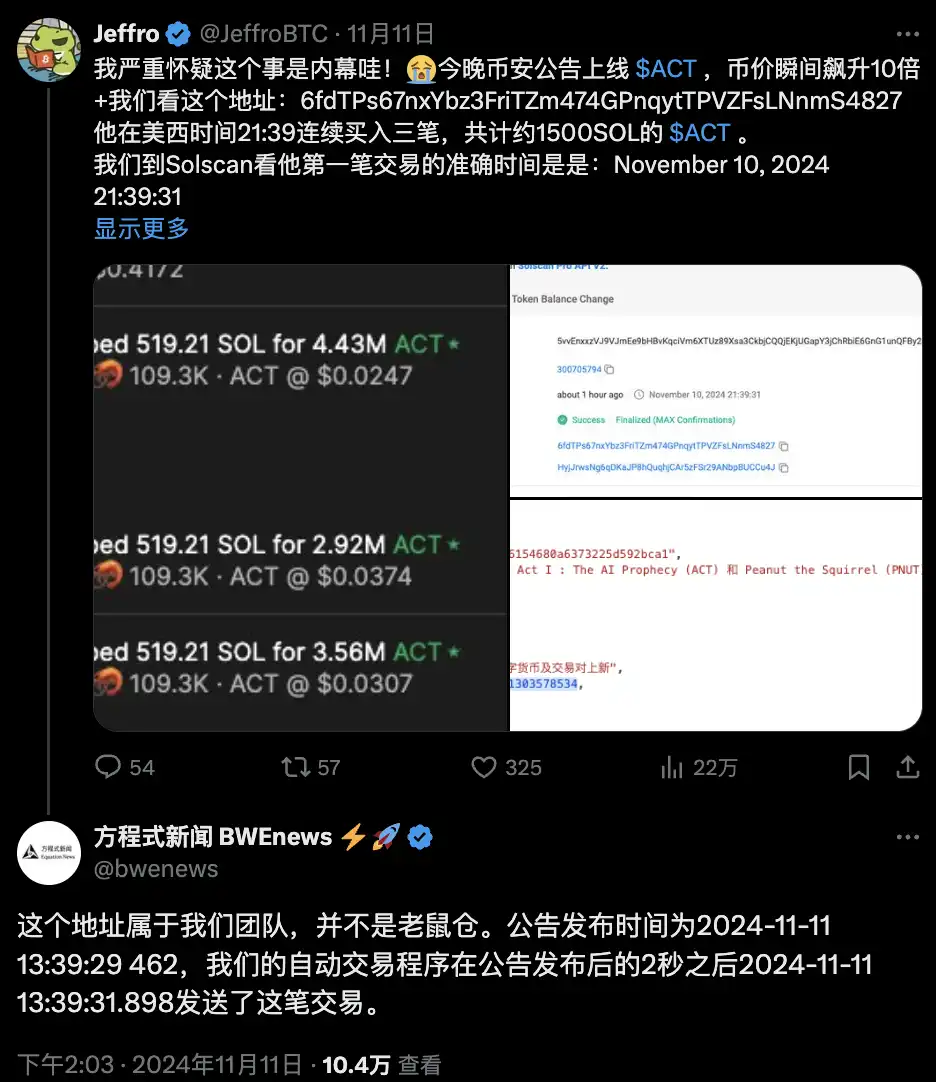

On November 11, Binance listed two small-cap tokens, ACT and PNUT. According to on-chain data monitoring platform Lookonchain, within just 2 seconds after Binance announced the listing of ACT, one address quickly bought 10.9 million ACT for 320,000 USD. After ACT rapidly surged, the profit from this investment skyrocketed to 3.4 million USD (approximately 24 million RMB).

The buying time of this address was even 7 seconds faster than the release time of Binance's Chinese listing announcement. Due to the incredibly fast buying speed and huge profits, users immediately questioned whether this was "front-running" or insider trading.

As the discussion intensified, the "Formula News" team released a statement claiming this address. Their trading relied on the release of the English announcement, which was 7 seconds earlier than the Chinese announcement. The speed of this transaction stemmed from the precision and speed of programmatic news trading, with Vida being the mastermind behind it.

3 million USD, 21 million RMB, for Vida, this "post-00s rich generation" only took 2 seconds.

After achieving fame in one battle, Vida was dubbed the strongest program trading god in this bull market by netizens. Vida himself also responded to netizens' questions, stating that his net worth has now approached 130 million RMB.

Vida's rapid rise to fame has attracted countless people's attention. Not only because of his wealth accumulation speed and astonishing trading ability, but also due to his background, growth experience, and investment philosophy, which are quite legendary. From the subjective content on Vida's Zhihu account and public information, Rhythm BlockBeats attempts to piece together the journey of this post-00s trading prodigy.

IQ 70, always at the bottom

Vida's starting point in life is completely at odds with the label of "genius trader" that netizens now attribute to him.

He was born in 2000 into a middle-class family in Jiangsu. His living conditions were not particularly difficult, but his report card was somewhat anxiety-inducing.

From elementary school to middle school, Vida's foundation in science was very weak, with his math scores consistently at the bottom. Coupled with an IQ test result of 70, this left teachers and classmates with the impression of him as a "fool."

In China's public education system, which emphasizes science over humanities, such grades made it difficult for him to find his footing. "If I continued to stay in public school, I would be worse than the local exam-takers. At least they could do the problems, while I couldn't do anything."

During the year of the high school entrance examination, Vida submitted a lackluster answer sheet, scoring only 194 points, which completely declared his break with traditional education. In later reflections, Vida was very glad he did not continue in the public education system but instead found his strengths and maximized his value realization.

Vida's talent in language was particularly outstanding, especially his exceptional English skills. The potential that had been suppressed in the traditional education system was finally released after he entered an international high school.

"My advantage is my leap in thinking, rich imagination, and a knack for discovering business opportunities," Vida described himself. He found that he excelled at seizing information gaps between people in a free and relaxed environment, profiting from them. This "financial intelligence" became the core gene of his future success.

Much of Vida's transformation can be attributed to his family education. His father played a significant role in his enlightenment. Since 1996, Vida's father had entered the Chinese stock market, being a disciple of Buffett's value investing school, while also having his unique methods for investing in the Chinese stock market. Having avoided the peaks of 2007 and 2015, and having bought properties in 2000, 2008, and 2015, Vida's father transformed from a procurement manager in a foreign enterprise into a retiree who often travels and enjoys life through investments.

At 16, the first pot of gold

This also made Vida realize that the latest speculative knowledge in business is never taught in school; it must be learned through personal business experience and feeling the fluctuations of the financial market. If a person is pursuing money, then learning and practicing speculation is far more efficient than studying textbooks.

"Spending a few years learning and practicing speculation might be more useful than studying for 100 years."

Therefore, he hardly read books, but he spent years browsing Twitter and YouTube, mingling in high-quality English communities where the average asset exceeds 2 million USD, focusing only on the statements of the best traders to draw experience and wisdom from them. He prefers to describe himself as a "grassroots general": "I am like Li Yunlong, a general born in the wild. I haven't read many military books, but I know how to fight commercial battles."

In 2015, at the age of 16, Vida first attempted to put his theories into practice. He engaged in light asset arbitrage through information gaps, accumulating his first pot of gold of 1 million RMB in less than four years.

The light asset, low-cost, high-efficiency arbitrage model has always been his core strategy. He profits from the information asymmetry between markets and individuals. This model is not only low-cost and efficient but also highly forgiving. He admits that the success rate of the ideas he tries is only 10%-20%, but the investment in each idea does not exceed 1% of his total assets. This low-cost trial-and-error model allows him to take risks; even if he fails, it won't be devastating, but once successful, the returns are often several times or even tens of times.

During that stage, his trading intuition and market sensitivity began to shine. While his peers were still anxious about exams, this first pot of gold had already become his source of capital accumulation and confidence, as well as the starting capital for his later macro investment phase.

Around 2018, Vida did not take the college entrance examination but chose to enter a 3+1 overseas university.

There, he met peers from all over the world and also turned his attention to larger markets—macro investments. He began to use his precise judgment of macroeconomics and market trends to make investment decisions. During this phase, his wealth grew from 1 million to 7 million RMB.

However, he soon realized that traditional manual trading methods could no longer meet his needs. The market changes rapidly, and relying solely on intuition and manual operations made it difficult to stay ahead in a competitive environment. Therefore, Vida began to study quantitative trading, exploring how to automate and refine his trading model using programs and algorithms.

Understanding resource allocation better than trading and coding

"I don't need to master every detail personally; I just need to know the principles and goals of implementation, then supervise the team's execution to ensure the results meet my expectations."

When venturing into automated trading, many netizens might think Vida is very skilled in coding and digital encoding, but as mentioned earlier, Vida is not good at science and doesn't know much about coding. What he excels at is resource allocation and continuous optimization of that allocation.

Vida assembled a small team, including programmers and quantitative analysts, to transform his ideas into automated trading strategies. "I provide the ideas, and the team executes. This way, I can allocate resources to the most critical areas."

He never wants to see himself merely as a trader; he prefers to regard himself as "Xiang Yu"—a general who charges into battle but also understands rear command as an entrepreneur. "As a manager, I don't need to write every line of code myself, but I must ensure that my trading strategies can be accurately implemented."

With such resource allocation capabilities, in March 2021, Vida officially incorporated quantitative trading into his investment system. He began testing how to integrate macro investment strategies into quantitative algorithms, attempting to use technology to optimize trading efficiency. Initially, his understanding of quantitative trading was only theoretical, but through months of practice, the potential of quantitative trading gradually became apparent.

By the end of 2021, his quantitative strategies had helped him achieve over 10 million RMB in profits. More importantly, he finally saw the possibility of fully automating trading—transforming trading decisions from "manual mode" to "algorithm-driven," defeating other competitors in the market with speed and precision.

Vida often shares some of his trading strategies publicly on Zhihu because he knows that his competitive edge is not these trading strategies themselves, but rather the complexity and execution difficulty of these strategies, which 99.99% of people in the market find hard to replicate.

The art of millisecond-level arbitrage

By 2022, Vida had already established a foothold in the market through quantitative trading. But like every successful entrepreneur, success brought not satisfaction but greater anxiety.

That year, he met a French peer who earned millions of dollars using news trading strategies and then made tens of millions of dollars through arbitrage trading exploiting a technical loophole in Coinbase. This rapid wealth accumulation model made Vida feel "both admiration and anxiety." He realized that there were people in the market who were faster and more perceptive than him.

This sense of crisis drove him to continuously optimize his strategies and solidified his rethinking of trading philosophy: speed is everything.

"Find a way to get information earlier than others and place orders before them. Then, when others want to buy in, sell to them." Driven by this thinking, he began to root himself in news trading and keenly discovered that domestic news media often lag behind market rhythms, which is not conducive to trading.

Therefore, in his first year after graduating from university, Vida launched a crypto media outlet called Formula News aimed at the overseas Chinese market, broadcasting only on TG, Twitter, and Discord for compliance reasons.

"I profit from the information lag of retail traders and the slow information channels of market makers that can't cancel orders in time. Retail traders often rely on a few slow news media or word of mouth in communities, taking several minutes to react to a piece of news, so as long as I buy faster than retail traders, there is profit to be made," Vida wrote on Zhihu.

In later reflections, Vida felt this was one of the wisest decisions he made in 2022, completing a thorough transformation from timing trading to fully automated trading, enhancing trading speed to the industry's top level through automated news trading and delayed arbitrage.

That year, the global financial market was sluggish, and most investors were at a loss, but Vida accurately retained a large amount of USD cash and successfully turned 8 million RMB into 20 million RMB on trading platforms like Binance through delayed arbitrage and high-frequency strategies.

By 2023 and 2024, as the market gradually warmed up, Vida's trading model had essentially achieved true automation. His fully automated news trading system could capture news content and execute trades immediately, with millisecond-level response speed giving him a significant advantage during strong rallies.

As a result, Vida's wealth experienced explosive growth, soaring from 30 million to 100 million.

What is hard to imagine is that at this point, with a net worth in the billions, Vida had just graduated from university two or three years prior and was managing three main business lines, which could be further divided into more than a dozen sub-business lines.

Regarding his future plans, Vida hopes to reach an asset level of over 100 million USD within three years and establish his own hedge fund in Singapore or Dubai.

In his long-term aspirations, Vida expressed more "idealism" and "heroic spirit": he hopes to create a myth similar to that of Bill Gates or Mark Zuckerberg, possessing vast wealth at a young age, and aims to document the entire process so that when he grows old, he can reminisce about his youthful vigor and provide a reference for those who wish to learn from his journey.

"I probably won't retire in the next five years. If I do retire, I want to become a marine biologist, just like Cameron, or become a money-giving YouTuber like MrBeast." This is how Vida envisions his life after retirement.

Rejecting Fatalism

"Fate has randomness, but randomness does not mean you cannot control it." Perhaps the biggest characteristic of Vida's personality is his disbelief in fatalism.

Whether in high school or university, most of Vida's classmates came from wealthy families. From that time in the second-generation circle, he often heard a voice: "Some things you are born with, and some things you are not." Vida strongly opposed this mindset and scoffed at it.

At the age of 16, a foreign teacher asked students to write a letter to their future selves. In the letter, Vida wrote: "At 26, I will definitely become a big boss." He wanted to prove through his practice that the saying "a poor family rarely produces a rich child" is a lie.

In Vida's view, pessimists believe randomness is fate, while optimists use randomness to create opportunities: "Good luck favors those who try enough. The difference often lies in who creates more opportunities for themselves to try."

Some believe that the money he earns now is given by heaven, but Vida has a completely different view. "I clearly know where every penny I earn comes from: either from greedy retail investors or from market makers who are not fast enough with information, not from some illusory trends or divine rewards."

From October 2022 to October 2024, Vida's real trading probability has been a very steep straight line, which makes him even less believe in metaphysics, feng shui, or destiny; he only believes in himself.

"I make money through high awareness + computer technology + resource coordination and team management + grasping retail psychology + having enough capital to manipulate the market in a short time."

"Crypto is a paradise for smart people"

If you have a capital of less than 100,000 RMB, how should you start?

In Vida's view, the answer is not to fantasize about becoming rich through financial investments, but to start with two things:

First, hone a specialized skill. Choose a niche field and become an expert in that area, trading some of your time for money.

Second, exploit the information asymmetry between people. Buy and sell goods through internet business opportunities, or become a risk-free arbitrageur between people, fully utilizing the asymmetry of information to profit.

Over the past 20 years, China's wealthy class has shifted from real estate and mineral resources to the internet, new energy, and cross-border trade, and in the future, more new models and industries will emerge. Opportunities are never lacking; the key is whether one can be the first to rush in and seize the market.

And crypto is a new frontier.

"To news traders, robots, arbitrageurs, market makers, and rebate farmers: If you don't work hard under such good market conditions, you will regret it in the next four years. Capitalize on the abundant liquidity and extract as much USD as possible. Long live the great wealth transfer." This is Vida's latest statement on Twitter.

The crypto market is a paradise for smart people, and Vida is such a smart person. He does not hide his preference for the crypto industry; in his view, it is one of the few stages in the world where smart people can stand out.

"The greatest role of the crypto market is to transfer wealth from 95% of the bottom retail investors to 5% of the elites." Vida wrote this on his Zhihu homepage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。